Robo advisors make money by charging fees based on your assets managed. The fees are much lower than traditional wealth advisors. But there are fees all the same. Let's take a look at the latest robe advisor fees and investment minimums from the top platforms.

Robo advisory firms have exploded in popularity due to a strong stock market, technological innovation, the difficulty of active managers in beating the S&P 500, and low fees.

Robo advisors have also started to combined human advice with algorithmic advice to provide better service along with lower fees. Traditional wealth advisers charge 1% – 3%, which is highway robbery given how low interest rates are today.

Out of all the hybrid robo-avisors, Personal Capital is my favorite since they pioneered hybrid robo advice in 2009. They have years head start compared to everyone else, and they build their company from the ground up solely with the hybrid robo-adviser customer in mind.

I've met Bill Harris, the founding CEO over 30 times given I live in San Francisco, and I've gone through my own free investment analysis with one of their advisors to understand more about their product.

Robo Advisor Fees And Investment Minimums

Below is the latest robo-advisor management fee and account minimum comparison chart. It's important to realize not all robo-advisors are created equal.

The new comers to the robo-advisory service are Fidelity, Vanguard, Schwab, and E-Trade. Personal Capital, Wealthfront, and Betterment are the pioneers. However, Wealthfront has chosen to remain purely robo unlike its competitors.

What Is A Robo Advisor?

A robo advisor is an online wealth management service that provides automated, algorithm-based portfolio management advice without the use of human financial planners. Robo advisor fees are always much lower than traditional wealth advisors. Robo advisor investment minimums are also way lower than traditional wealth advisor minimums as well.

What's interesting about robo advisors is that they use the same software as traditional advisors. But usually only offer portfolio management and do not get involved in the more personal aspects of wealth management, such as taxes and retirement or estate planning.

If you like low account minimums and are comfortable investing yourself, robo advisors are a great solution.

The biggest difference is the distribution channel: previously, investors would have to go through a human financial advisor to get the kind of portfolio management services robo-advisors now offer, and those services would be bundled with additional services.

By deploying sophisticated algorithms based on Modern Portfolio Theory, robo-advisors are able to provide customized investment portfolios for each individual based on the responses they provide in a short questionnaire upon signup.

The idea is that excessive fees at traditional wealth advisors rob investors of their retirement money or cause people to have to work longer – robo advisors are designed to help investors avoid excessive fees.

Based on my research, two robo-advisors stand out above all else. They are Personal Capital and Betterment. Robo advisor fees have come way down due to these two platforms. I've met with many employees of both firms since 2011, and I'm regularly provided with updates. Here are the company details for each firm.

Personal Capital Overview

Total Equity Funding: $215.3M in 8 Rounds from 11 Investors as of 2021.

Headquarters: Redwood City, California with offices in Denver and San Francisco.

Description: Personal Capital is the leading digital wealth management firm.

Founders: Bill Harris, Louie Gasparini, Rob Foregger.

Categories: Financial Services, Wealth Management, Finance, FinTech.

Sign up link: Personal Capital

Company Details

Founded: July 1, 2009

Contact: press@personalcapital.com | (855) 855-8005

Employees: ~500 as of 2021

Personal Capital is an online investment advisory platform that provides its clients with electronically facilitated wealth management services, objective advice, and strategies. Its fees are based on a client's percentage of assets managed by the platform. It includes wealth management, trade costs, and custody.

Personal Capital summarizes its users’ bank accounts, credit cards, mortgages, and other financial details together in one place. The platform also highlights its users’ long-term fiscal health over month-to-month spending with tools such as a visual graph of their investment allocation and a 401(k)-fee analyzer.

Personal Capital is a hybrid robo-advisor which uses both human advisors and sophisticated algorithms to help people manage their money. See my full Personal Capital review here.

Personal Capital Management

Bill Harris is now solely Chairman, while Jay Shah got promoted to CEO on April 24, 2017. Mike Arnsby was added as CFO in 2016. Mike helped take Yodlee public in 2015.

Personal Capital Funding History

Personal Capital's had eight rounds of funding, totaling $215.3M as of 2021. They were purchased by Empower in 2020 for $850 million with $150 million in incentives.

Personal Capital Latest News 2021

I had lunch with Mark Goines, Vice Chairman and Eric Weiss, Chief Marketing Officer in San Francisco to get an update about their operations as of 2H2018. Personal Capital has grown to over 400 employees with a new office in Atlanta, Georgia.

They also run roughly $15 billion in client assets under management, while tracking over $900 billion in assets from users who use their free financial app.

I highly recommend everybody sign up to track their net worth, analyze their investments, and plan their retirement cash flow. The firm is clearly doing well and will be around for a long time to come. Here is some key information.

* Lower minimum. For those who want to use Personal Capital to manage their money, you used to need at least $100,000 in investable assets to become a client. Personal Capital has now lowered the minimum asset hurdle to $25,000. This is great news for the millions of people out there who need low cost digital financial advice with the guidance of a human advisor.

It's clear to me that Personal Capital is in strong financial health, and here to stay. They've got a great suite of free financial tools everybody can use to keep track of their net worth, management their cash flow, x-ray their portfolios for excessive fees, and plan for their retirement.

Wealthfront Company Update

Total Equity Funding: $204.5 million in 6 rounds from 52 investors as of 2021.

Most Recent Funding: $75 million Series E round led by Tiger Global Management on January 4, 2018.

Headquarters: 900 Middlefield Rd, Redwood City, CA 94063

Description: Wealthfront is one of the largest and fastest growing digital wealth advisors (robo-advisor), with over $10.5 billion in assets under management.

Founders: Dan Carroll, Andy Rachleff.

Categories: Fintech, Financial Services, Wealth Management.

Founded: 2008, but since 2011 in its current form.

Contact: support@wealthfront.com

Employees: ~200

Sign up link with 15K managed for free: Wealthfront

Wealthfront Company Details

Wealthfront is an automated investment service firm that builds and manages personalized, globally-diversified investment portfolios. It provides data-driven, actionable recommendations to improve net-of-fee, after-tax, risk-adjusted returns.

With an annual advisory fee of 0.25%, users can monitor their real-time investment performance, review recent transactions, receive financial advice, and manage their deposits.

View my comprehensive Wealthfront review here. Wealthfront has been pretty quiet in the news for the past several years. However, Wealthfront is also a great contributor to lowering robo advisor fees and investment minimums.

Wealthfront Funding Details

Given private companies generally raise new money every 18-24 months, it would come as no surprise if Wealthfront raises a new round of equity or debt round in 2019.

Management Profiles

Latest News About Wealthfront

The firm continues to remain one of the leading digital wealth advisors today. They've grown their assets under management to over $15 billion as of 2021. In the past, you'd need $1,000,000 to start investing. Now you can start investing with just $500.

The long time CEO, Adam Nash, stepped down on October 31, 2016 and was replaced by co-founder and long-time board member, Andy Rachleff. Rachleff served as CEO for three years before handing the reigns over to Nash, a veteran of tech firms including Apple, eBay, and LinkedIn.

“At the beginning of 2014, I was convinced that I needed to hand over my company and serve as a board member and an advisor. I was an investor, after all, not a CEO,” Rachleff continued. “What I didn't realize at the time is that I'm no longer just an investor, board member or advisor. I am a founder.”

The key for Wealthfront is to accelerate its assets under management growth by partnering up with larger financial institutions. They are very focused on the Business 2 Consumer route, which is great for everyday people. However, to really grow assets, they've got to tie up with institutions..

Below is an example of a model portfolio they would create using low cost index funds for a person with a high risk tolerance. Every portfolio is built with Vanguard ETFs because they are best in class and have the lowest fees. All you've got to do is fill out a six question questionnaire and you'll get your own model portfolio to review.

Betterment Overview

Robo advisor, Betterment is the best pure robo-advisor/digital wealth manager in the new decade.

The company was founded in 2008. It is the largest pure online-investment advisor with over $40 billion in assets under management (AUM). With over $200 million in total funding since inception, it’s clear Betterment is here to stay for the long term.

Betterment invests in a portfolio of passive index-tracking equity and fixed income exchange-traded funds (ETFs) to help build your retirement nest egg. Too many people are cashed up because they either don’t know what to invest in or feel the cost of investing is just way too high.

Betterment is solving both problems and also lowering robo advisor fees as well. Betterment offers both taxable and tax-advantaged investment accounts, including traditional and Roth individual retirement accounts (IRAs).

Betterment’s core portfolio optimization incorporates insights of Modern Portfolio Theory, the Black-Litterman model, and Behavioral Asset Management. Modern Portfolio Theory (MPT) relies on diversification and asset allocation to attempt maximum portfolio return for an amount of given risk. Black-Litterman enables passive asset allocation by using world market capitalizations to attempt to estimate expected returns.

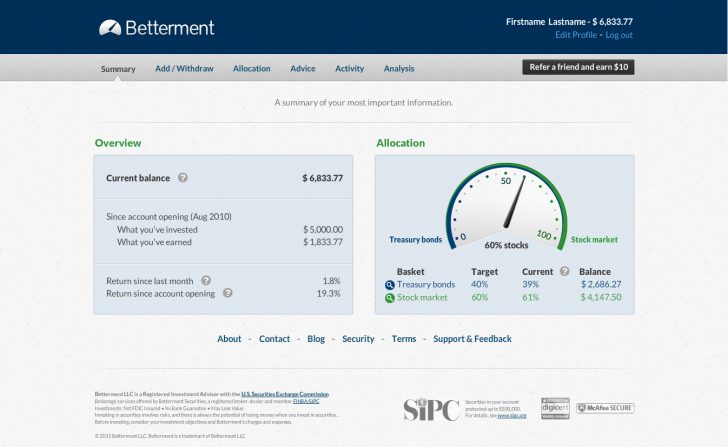

Below is a snapshot of what your account might look like if you invest with Betterment.

Account Types Available To Open With Betterment

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trusts

- Non-Profit

- Individual

- Joint

Great Features

- Tax-loss harvesting – to help you reduce your taxable income

- Automatic Portfolio Rebalancing – so your asset allocation is always congruent with your risk tolerance –

- Automatic Deposits – Weekly, Every Other Week, Monthly

- Android and iOS Mobile App – you can always check your portfolio on the go

- Customer Service M – F, 6am – 5pm PST

- RetireGuide Calculator – to help you plan for your future retirement money needs.

- Tax-Coordinated Portfolio – to help you reduce your tax liability

Robo Advisors Are The Future

Robo advisor fees and investment minimums are coming down. As a result, professional money management is more accessible than ever before.

Each robo advisor has a custodian bank that acts as the safeguard for your money in case the robo advisor were to go out of business. The custodian bank will be responsible for transferring your investments to a new bank or liquidating your assets in an orderly fashion and returning your money.

For example, the custodian bank for Personal Capital is Pershing Advisor Solutions, a Bank of New York Mellon Company with over a trillion dollars in global client assets.

Robo advisors offer a low cost way to automatically invest in the stock and bond market. Given the S&P 500 has historically returned ~8-9% a year and the aggregate bond market has returned historically ~4-5% a year, it's a good idea to invest regularly for the long term. Inflation is too powerful of a force to combat.

Gone are the days of being too intimidated to start because you don't have $250,000 minimum, don't want to pay up to 3% a year in fees, and don't know what to invest in. With a firm like Personal Capital or Betterment, all you've got to do is sign up for free and they'll invest for you in a risk-adjusted manner. I really like Betterment better than Wealthfront by the way.

Be A Long-Term Investor

Just remember to never confuse brains with a bull market. There will be ups and downs in the cycle. But if you invest throughout the downtimes, I believe there's a great chance that you'll end up with a very health retirement nut.

At the very least, sign up for Personal Capital's free financial tools to run your finances through their sophisticated retirement planner which uses real data you've inputed from your linked accounts. Not only can you check to see whether your retirement is on track, you can also x-ray your portfolio for excess fees, manage your cash flow, and a whole lot more, all for free.

About the Author:

Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate.

FinancialSamurai.com was started in 2009 and is one of the most trusted personal finance sites today with over 1 million pageviews a month. Financial Samurai has been featured in top publications such as the LA Times, The Chicago Tribune, Bloomberg and The Wall Street Journal.