After 11 Fed rate hikes since 2022, interest rates keep rising. Let's discuss where to invest in a rising interest rate environment today and over the next year.

Nobody knows whether rates will continue to move higher from current levels. However, it's good to layout a what if scenario so we can be better positioned.

Rising interest rates do the following:

- Makes mortgages more expensive. You should check the latest mortgage rates now with Credible. They have the largest network of mortgage companies who compete for your business. When banks compete, you win!

- Makes car loans more expensive. One shouldn't be borrowing money to buy a depreciating asset anyway, so all is good.

- Increases credit card interest rates to even more egregious levels. Nobody better have revolving credit card debt unless they are a financial masochist.

- Increases student loan interest rates, depending on what type of government subsidies you receive.

- Makes the stock market less attractive given the opportunity cost to own securities has increased. One of the main reasons why I aggressively invested in equities in 2012 was because the S&P 500 dividend yield was greater than the 10-year yield.

- Cools off the housing market as homebuyers are now hit with an increase in prices from a year ago and rising mortgage payments. That said, I still expect home prices to rebound in 2024 as rates decline.

- Slows down consumption growth, which is the main driver for GDP growth in the Y = G + I + C + NI equation.

- Theoretically increases your savings rates and CD rates, but banks will move like molasses to adjust so don't bet on anything great for a while.

- Leveraged buyouts will decrease at the margin due to more expensive debt financing.

- Makes bonds look more attractive given higher yields.

- Strengthens the US Dollar vs a basket of major foreign currencies.

- Makes you reflect on what's next.

It's important to realize that a rising interest rate environment often reflects underlying strength in the economy as the demand for money increases. Money demand increases due to better employment levels, higher wages, positive growth expectations and a host of other factors. It's the short term adjustment, which which can be tricky to maneuver.

Check Your Finances In A Rising Interest Rate Environment

Large market drops are a great time to assess whether you are currently comfortable with your net worth allocation. I recommend you sign up for a free online tool like Empower to get a bird's eye view of your money.

If you have 100% of your net worth invested in equities, you may be too exposed. When you invest in a rising interest rate environment, be aware that riskier assets like stocks tend to be more volatile.

If you can stomach 2%+ declines in your net worth a day then having 100% of your net worth invested in equities is fine as well. I personally can't tolerate much more than a $25,000 decline in my stock portfolio a day based on my assets and retirement situation.

I personally dislike volatility. As a result, I've diversified my net worth into real estate and CDs as they at least provide an illusion of stability.

You can't really tell what your real level of risk tolerance is until AFTER you start losing money. All those folks who think they are Warren Buffet because they've never had any significant money invested during a bear market have a fun surprise coming because large corrections are commonplace.

OK, so hopefully everybody has done a top down analysis of their net worth allocation or will do so by the end of this post to decide whether they are comfortable with their existing exposure. If you don't you could seriously wake one fine day and wonder where the hell are your money went. Let's see what we should do with our money going forward in case rates continue to rise.

Where To Invest In A Rising Interest Rate Environment?

1) Accumulate More Cash.

We are in a time period where bonds are selling off due to fears the Fed will start tapering off its bond buying program. As a result, interest rates are rising. When interest rates rise too fast, equities start selling off as well due to fears of slowing consumption, higher opportunity costs, and all the other reasons discussed above.

In other words, we are in this negative cycle loop until we find a happy ground. Relatively speaking, cash becomes that much more valuable as other asset classes decline. It's good to have a healthy cash hoard to start legging back into equities and bonds once you've found your risk tolerance.

Money market funds are yielding ~5% and Treasury bonds are yielding between 5% – 5.5%. Take advantage of hiring rates by saving more money! I'm happily saving more aggressively today.

2) Invest In Shorter Term Duration and Floating Rate Funds.

To reduce your portfolio's sensitivity to rising interest rates you want to lower the average duration of your holdings. The Vanguard Short-Term Bond Fund (VCSH) is one example. Pull up the chart and you'll see much more stability.

When you want to invest in a rising interest rate environment, consider a bond fund with coupon rates that float with the market rate. Luckily, there's an ETF for such a fund called the iShares Floating Rate Fund (FLOT). Treasury Inflation Protected Securities (TIPS) are another way to invest.

Just know that bond funds have gotten crushed since 2020. Buying now is much more attractive, but bond values could go down if rates continue to go up.

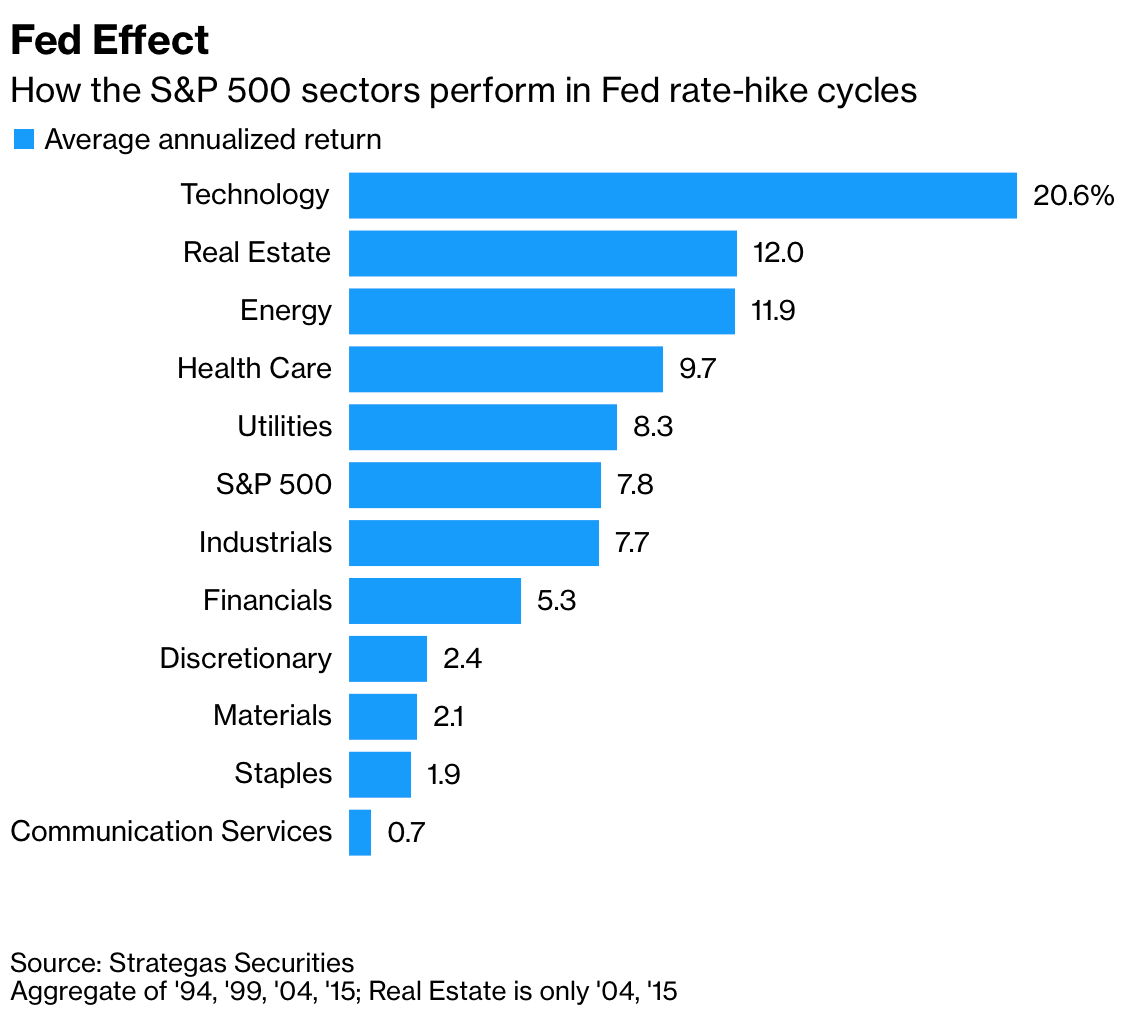

3) Invest In Technology, Real Estate, Energy and Health Care.

Many studies have analyzed the 13 rising-rate environments over the past 64 years. Tech and health care gained an average of 20% and 13% respectively during the 12-month period following the first rate hike of each cycle.

This compares favorably to an average 6.2% gain in the entire S&P 500. The past is no guarantee of the future, but there's something to be said about history. You can easily buy the PowerShares QQQ and the Vanguard Health Care (VHT) ETFs.

I want to invest in private growth companies in the artificial intelligence space. To do so, I'm investing in the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

In addition, I like investing in private real estate funds that invest in single-family homes for rental income. Single-family homes are the best real estate asset class given positive demographic trends and the permanence of working from home. Fundrise, with over $3.5 billion in assets under management, specializes in such investments in the Sunbelt where valuations are cheaper.

Additional Ways To Invest When Interest Rates Are Rising

1) Reduce Exposure To Communication Services, Staples, Materials, Discretionary Banks and Materials.

On the flip side of the study, communication services, staples, materials, and discretionary don't do well in a rising interest rate environment. For financials, the idea is that financials get squeezed a little bit as borrowing costs rise and lending costs don't rise quick enough.

Material stocks are commodities that fall out of favor in a growth environment. Again, what's very interesting to note is that the S&P 500 did gain 6.2% in a rising interest rate environment because rising interest rates are a reflection of increased demand in the economy.

2) Structured Notes That Provide Downside Protection.

In How To Invest In The Stock Markets At Record Highs Without Getting Your Face Ripped Off I talk about common index based structured notes everyone with enough capital can invest in.

The ones I like to invest in are S&P500 Buffer Notes that commonly provide a 10% downside buffer in exchange for locking up your money over a certain period of time and perhaps giving up some dividend income. These Buffer Notes also provide guaranteed minimum upside if the note closes above the index entry price on closing day.

3) More Of What You Know

If the fundamental story of the company you own has not changed, then during the short-term adjust period of rising interest rate volatility you should consider investing more in your existing holdings.

In fact, you should run screens like a maniac trying to figure out which stocks or funds look attractive. Try and come up with your own price target entry point based on valuations and variables and leg in. Over the long run, the markets trend up and to the right. It all depends on how long you plan to hold on.

Personally, I like to continue buying the dip in an S&P 500 ETF. You won't get really rich buying index funds. But you will gradually get richer over time based on historical returns.

Focus On Your Financial Goals

The most important point is to be congruent with your financial goals. There are a lot of delusional people out there who think just because they've made 15% in the stock markets this year they can extrapolate 15% a year for decades. This is way too optimistic. It's much better to be conservative and have lots of money left over than come up short with much less time on your hands.

It's important to run different portfolio scenarios to see whether you are on target. I ran my own 401(k) through three different portfolios and I've come up with $1.15 million, $2.4 million, and $6.8 million after 30 years. I can now adjust my spending habits accordingly.

My goal is to protect the financial nut I've built over the past 13 years because it spits out around six figures a year in passive income. Run real numbers so you don't just randomly guess at your future.

I'm personally legging into the markets as stocks fall because I've had 65% of my rollover IRA sitting in cash for the past month. I'm adding to my positions in technology, which is a sector that has historically done well in a rising interest rate environment and a sector that I know.

Furthermore, I'm increasing my exposure to bonds such as the Templeton Global Bond Fund given I've got less than 3% of my net worth in bonds. With the 10-year bond yield close to 3% again, bonds look relatively attractive.

A rising interest rate environment makes generating passive income easier. Let's enjoy it while it lasts!

Related posts:

Can Your Finances Withstand A Fed Rate Hike?

How To Invest And Profit In An Inflationary Environment

Should I Buy A Home When Interest Rates Are Rising?

Track Your Finances For Free

The best way to become financially independent and protect yourself is to get a handle on your finances by signing up with Empower. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize.

Before Empower, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances. Now, I can just log into Empower to see how my stock accounts are doing and how my net worth is progressing. I can also see how much I’m spending every month.

The best tool is their Portfolio Fee Analyzer which runs your investment portfolio through its software to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was paying! They also recently launched the best Retirement Planning Calculator around.

It uses your real data to run thousands of algorithms to see what your probability is for retirement success. Once you register, simply click the Advisor Tolls and Investing tab on the top right and then click Retirement Planner.

There's no better free tool online to help you track your net worth, minimize investment expenses, and manage your wealth. Why gamble with your future?

About The Author

Sam worked in finance for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too.

Sam started Financial Samurai in 2009 and has grown it to be one of the largest independently owned personal finance sites in the world. You can sign up for his free private newsletter here.

To all those who don’t understand savers… Savers are not greedy for wanting reasonable interest rates. The rate of inflation is much higher than the rate of interest. This ultimately means that the money they worked hard to save, is worth less and less. If I was a big time saver, I too would want higher interest rates so that my money wasn’t being devalued. I don’t think that is selfish.

Where to invest with rising rates.

My investment focus has always been heavy in real estate, for good or bad.

with that perspective I have been focused on apartments in the last few year.n for many of the reasons you outlined above, higher home costs higher interest rates for buyers SHOULD allow apartment occupancy to remain high as well as Rents.

If you cannot buy apartments consider REIT funds that focus on the apartment sector.

I’m a fan of short term bonds and floating rate funds right now. You can get some yield on these funds while still being able to take advantage of rate changes.

I’d love to get more insights about this perspective as seeing markets get crushed doesn’t make me salivate at all! Are you not concerned your portfolio will get crushed? Or is it the case where the portfolio is not large enough that the declines does not worry you? What percentage of your net worth is in stocks? Thanks

100% of my net worth is in stocks. All my non-retirement account financials are currently posted on my site. Later this year I’ll probably add those too in the interest of full transparency.

I’m a strict value investor who aims to hold onto his stocks for the long run. Of course I don’t like seeing my portfolio value go down, but I recognize now that market dips are just buying opportunities. Lots of great, but previously overvalued, stocks are moving towards fair value or even under valued.

Plus, all of my stocks pay dividends and have a history of increasing their dividends over time. The market price of the stock will fluctuate up and down as bubbles form and burst, but so long as the fundamentals of the stock are sound two important things will occur. First, dividends will continue to be paid and increased every year. Second, the long term trajectory of the stock price will be upwards.

Given that I try my best to select stocks with strong fundamentals why should I be overly concerned about market corrections? The fundamentals weren’t there to support most of the current valuations anyway so the market had to come down eventually. I knew this was coming, I just didn’t know when.

What I find much worse than a market correction is when a company’s underlying fundamentals take a turn for the worse. That’s when I start thinking about cutting my losses. Market corrections are when I’m tempted to scrape up every penny I can find and shove them into brokerage account.

That’s a good attitude. If you can stomach the volatility then by all means be all-in on stocks.

How do you decide how much cash to keep in order to invest in market corrections though if you are 100% in? Is it basically your excess disposable income?

I rebalance my net worth bc I don’t keep more than 35% in stocks.

(Reuters) – The possibility of rising interest rates rocked the U.S. municipal bond market on Thursday, with prices plunging in secondary trade, investors selling off the debt, money pouring out of mutual funds and issuers postponing nearly $2 billion in new sales.

Interest rates have been so low for so long it doesn’t seem real that they are finally rising again. It might take a while but I look forward to earning more interest in my money market accounts and perhaps invest in CDs someday again if the rates become favorable.

I bet banks are going to be super slow to raise savings rates at all. But they will be super fast to raise lending rates :)

I’ve been debating whether to sell a house I inherited and put the money into a CD (no mortgage) or rent it. More stocks and bonds might be an option, but I think I have enough in the market. Besides, it’s so crazy now, I’m not comfortable risking the cash. The house is in Phoenix, but it’s not a good neighborhood–it’s not horrible, it’s okay, crime not that bad, just a little run down. The neighborhood has been improving, and the sales prices of the houses in the area have come up to a median sales price of $110,000. Grand Canyon University, a private Christian university, is only about a mile away, and they’ve been working on improving the area, luring business, etc. Rents in the area run from $750 to $1000 per month. My house would probably only get $750 to $800– it’s an original from 1969 with good bones–roof and AC new, and it’s in good condition because after my parents moved out, family lived there. I’ve had a renter for a couple of years, but she’s a friend of mind. Just not sure I can get decent renters, especially since I’m competing with houses that have been flipped. But selling and putting the funds in the bank won’t even keep up with inflation. I’m torn. Any advice?

Depends how old you are and how much tolerance you have for being a landlord. What is the gross and net rental yield.

Income generating assets is huge right now b/c interest rates are so low and savings/CD rates will lag higher for a while.

My advice is to hold on until you can’t take it, work to raise the rents and keep your property in good shape.

Thanks for the info. Ran the numbers. Gross rental yield is 7.5 to 8%. Net rental yield is 5 – 5.5%. We’re in our mid-50’s. We can do many things ourselves–painting, minor plumbing and repairs. But do we want to? I’d really like to get rid of it, but on the other hand, it’s a decent income–if we get decent renters–and the depreciation write-off is a nice bonus. My husband would like to keep it, and since he’s the one that does most of the physical labor–on weekends–suppose it’s up to him. I’m stuck with the paperwork. If we did sell, I guess I’d put the $$ in short term, low-risk bonds. Maybe we’ll put it up for sale and just roll with it–whatever happens, happens. If we can’t sell it, we’ll rent it.

I’m using dips like these to try and load up on additional shares of what I already own. I’ve been waiting for a pullback like this for a few months & will be buying if anything falls into a range I’m comfortable buying at.

Interest rates have started to increase, but the market is reacting to the Fed decreasing the artificial support in the market(in the future). I guess the market does not believe the economy is improving!

My asset allocation has always included healthcare, biotech, technology for a combination of growth and stability.

The market is schizophrenic. It will eventually find a balance and start resuming its trend due to an improving economy. We’ve just be used to the juice so long it takes a while to get weened.

Although it is difficult temporarily, you have to think long term. CEOs are forced to think quarterly, yet the really good ones think long term. Investors react almost daily, but the smart ones think long term. I guess the market needs a12 step program! :)

Thanks from me also. I really appreciate all the investment information you put out there. The rental home stuff is really useful too. Keep up the good work and thanks again.

No problem Phillip. Glad you find the content useful. Good luck on your financial journey. Knowledge really is power.

Thanks for the information! I enjoy learning more about financial portfolios. Sucks interest rates are rising. They couldn’t have waited a few months until we bought a house!

You should have sent an e-mail to Bernanke to tell him to hold off on pulling the rug away until later this year!

Great point Sam on this being a good time to look over your asset allocation and what you’re comfortable with. I personally took some gains several weeks ago and sitting still in cash with that and will determine when the best time will be to get back in. These are definitely some interesting times and I think we’re going to see some more of the same uncertainty for a bit – though I am still generally bullish in regards to the year as a whole.

I would agree that having a diversified portfolio that matches your risk tolerance is extremely important in all markets, not just one with rising rates. If you’re going to freak out because of daily market drops, you either have a misunderstanding of how the stock market works or you’re far too heavily invested in stocks, or both. Personally, I have a long-term view with my portfolio and really don’t spend time worrying much about the short-term environment. I think that trying to time the market ups and downs is much more likely to hurt you than help you. So in a rising interest rate environment, I just keep on doing the same things I’ve been doing for years. Over the long term I firmly believe that I will be better off for it.