To come up with a proper 2022 housing market forecast, it's important to first forecast where the 10-year bond yield is heading. The 10-year bond yield is the most important indicator for mortgage rates, not the Fed Funds rate. And mortgage rates, along with new household formation, job and income growth are the biggest factors for housing price growth.

I believe we are in a permanently low interest rate environment. Therefore, even with the Fed expected to raise the Fed Funds rate six times in 2022, I still believe the 10-year bond rate won't rise much above 3%. (As of Dec 5, 2022, this has so far been wrong with the 10-year bond yield rising to a high of 4.3%.)

Instead, the yield curve will likely get flatter as the short end goes up and the long end barely moves higher, if at all. For 2022, I forecast the 10-year bond yield will hover between 2% – 3% for the vast majority of the time. As a result, I predict the average mortgage rate will only increase by about 1%. We're talking about 4.75% for the average 30-year fixed-rate mortgage for 2022.

If you have a choice between believing the seven Board of Governors of the Federal Reserve System or the $46+ trillion U.S. bond market, go with the latter. The Board of Governors are nominated officials who make mistakes just as much as anyone.

They are sometimes too ahead of the curve or too behind the curve, which ultimately helps create boom and bust cycles. Part of the reason why inflation and risk assets are so elevated is that the Fed was too accommodating for too long.

Real Estate Background

To better understand where I'm coming from, here's a brief background about my real estate interests.

I own four properties in San Francisco, one property in Lake Tahoe, have partial ownership of a property in Honolulu, and own 18 private real estate syndication deals through funds and individual investments mostly across the heartland. Real estate accounts for about 65% of our passive investment income.

I'm clearly biased towards real estate with tremendous skin in the game. But it is due to this skin in the game that I try to be as accurate as possible with my forecasting. I wish I was paid to make forecasts where whatever I say doesn't impact our finances. But I'm not. A lot is at stake for our family and our livelihood.

Since 2009, I have also consistently taken action based on my beliefs. Pontificating is nice. But it is taking action based on your beliefs that will help you build and protect your wealth.

2022 Housing Market Forecast: Another Boom Year

I am 90% certain the U.S. housing market will show another positive year in 2022. The question is, by how much?

If we are talking about the median-priced home, which curiously ranges from about $360,000 – $400,000, depending on the source, I expect an 8% – 10% increase. This is down from an 17%-19% increase in 2021, also depending on the source.

In other words, by the end of 2022, the median-priced home in the U.S. will likely be somewhere around $390,000 – $440,000. This price range is still relatively affordable compared to an estimated 2022 median household income of roughly $73,000.

The reasons for another strong housing market in 2022 include:

1) Low and negative real mortgage rates.

As predicted above, mortgage rates won't go up more than 1% in 2022 on average. In other words, your typical 3.125% 30-year fixed mortgage may go up to 4.125% – 4.5% in 2022 at most, which is still dirt cheap.

Even if inflation declines to 4.3% in 2022 from 7% in 2021, mortgage rates would still be negative. Therefore, there will still be a huge incentive to borrow as much money as responsibly possible to buy assets such as real estate.

2) A permanently higher demand curve.

The demand curve has shifted up. Therefore, demand is higher at all price points. The reason why the demand curve has shifted up is that there's no going back to the way things were for millions of employees. Work from home and a hybrid work from home model are here to stay for good.

Further, the adoption of real estate as an investment is growing. No longer are people happy to just own their primary residence. Instead, people are now wanting to own multiple homes for passive income and profit.

Finally, the millennial generation is some ~72 million strong. This generation will be buying homes in droves for the next couple of decades.

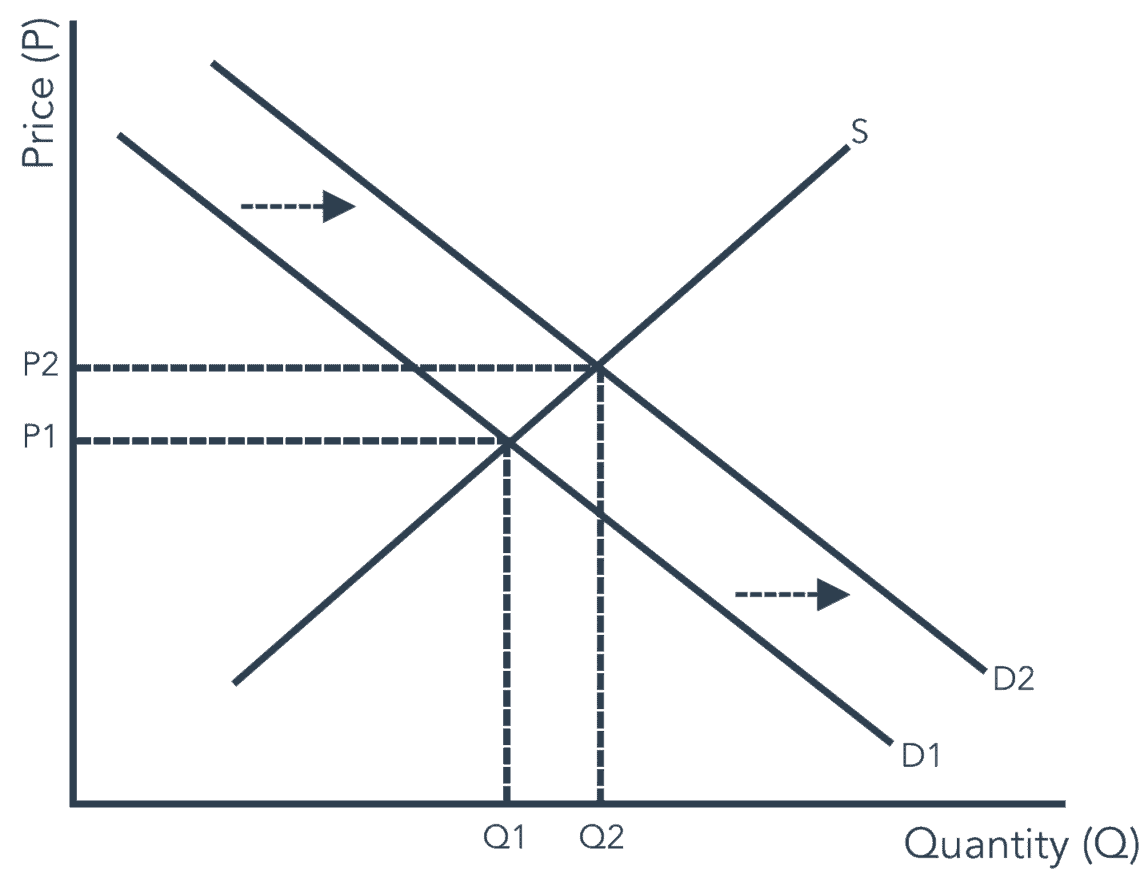

Below is the classic supply and demand curve. Notice when the demand curve shifts up (D1 to D2), price also increases (P1 to P2). I believe the demand curve will continue to shift up as the adoption of real estate as a viable investment grows.

3) Increased demand from domestic institutional investors.

Given we are in a low-interest-rate environment, more capital will be chasing higher-yielding real estate. Further, there is growing access to institutional real estate funds for retail investors through real estate crowdfunding platforms and other private syndication platforms.

Investors now account for roughly a quarter of all resale and new transactions. In some areas, the percentage of transactions made up of institutional investors is up to 40%. I expect this percentage to grow, even if Zillow did blow themselves up due to bad pricing estimates.

My favorite private real estate investing platform is Fundrise. Fundrise is vertically integrated and invests in single-family and multi-family rental properties in the Sunbelt. The Sunbelt is benefiting from strong demographics given valuations are lower and rent yields are higher. It is the long-term trend I'm most excited about. For most investors, investing in a diversified real estate fund is the way to go.

4) Increased demand from foreign investors.

The biggest X factor nobody is talking about is what happens if foreign real estate demand comes back with a vengeance? Pre-pandemic, I witnessed foreign demand beat out many competitive home bidding situations here in San Francisco. Wealthy foreigners would simply buy homes and leave them empty for years to park cash. The disinterest on renting out their homes for income is a testament to how attractive U.S. assets are to foreigners.

The one good thing about the pandemic is that it has throttled foreign institutional demand since early 2020. By my calculations, there is roughly $200 billion of pent-up foreign demand for U.S. property. As borders slowly open up, I expect a tidal wave of capital to hit our shores.

5) A revaluation of U.S. property on the world stage.

Anybody who has ever researched overseas real estate markets knows how cheap U.S. real estate is for a developed country. The funny thing is, foreign investors know this, but we don't. Most Americans don't appreciate how good we've got it because most Americans have not lived overseas.

But I'm telling you as someone who grew up in six different countries, worked in international equities for 13 years, and traveled to over 60 countries so far, U.S. real estate is cheap.

A simple comparison to the Canadian housing market demonstrates the U.S. housing market has ~70% upside if valuations increase to similar levels. And the income upside in the U.S. is much greater.

8) Strong stock market gains.

Compare your 401(k) balance from January 1, 2019, to now. Now compare your taxable portfolios from three years ago to now. You are likely up well over 50% in such a short time frame. This is an anomaly.

Anybody who has invested through the 1997 Asian Crisis, the 2000 dotcom bubble, and the 2008-2009 Global Financial Crisis knows to always convert some of your funny money gains into real assets.

One of the best performing stock markets in the world since early 2020 has been the S&P 500. The reasons are due to strong corporate profits, quicker access to vaccines, more innovation, stable government, and a generous Federal Reserve.

World investors see the performance of the U.S. stock market as an indicator for where to park money and provide a better life for their children. Unfortunately, 2022 has turned out to be a terrible year for the stock market. 2023 S&P 500 forecasts don't look much better.

9) Strong job and wage growth.

It's an employee's market, partially thanks to a high quit rate and strong government benefits. Millions of Americans have used the past two years to figure out what they really want to do. And the common consensus is that we all want better pay, better flexibility, and more perks.

In 2H2021, we saw the investment banks raise first-year analyst salaries from $85,000 to $100,000 – $110,000. This causes a cascade effect for the tech, management consulting, and other industries who also have to raise wages to compete for talent. But it is actually earners on the lower end of the wage scale who are seeing the highest increase in salaries.

Below is wage growth tracked by Goldman Sachs. Notice how U.S. wage growth is much stronger than Euro Area and Australia. U.S. wage growth is also the highest since 2007.

10) Rising building costs.

Unless there is no other choice, nobody will sell you a home at a price that is less than its cost to build. And building costs are going up.

Although inflation is expected to come down in 2022, supply chain disruptions will likely still persist for housing material. For example, lumber prices plummeted by 70% from their peak only to surge 80%+ higher out of the blue. Labor costs are also rising. As a result, the cost to build a house is increasing. Home builders will be forced to raise prices to protect their margins.

As someone who has spent the last two years remodeling a home, it is clear to me input costs are going up. Perhaps more importantly, the time it takes to build is also going up. As a result, my asking price, if I were to ever resell, will go up as well. Multiply my experience by thousands of homeowners who are experiencing the same difficulties.

11) Declining supply/inventory.

The combination of rising demand and declining supply will cause home prices to increase further. Take a look at the green line in the chart below. Existing home inventory is at its lowest level in 30 years. Further, the median ownership tenure has risen from about 4.5 years before the Global Financial Crisis to over 10 years today.

Homeowners are rationally not selling their homes. Why would they if prices are expected to continue to go up in a low-interest rate, high inflationary environment? The other major problem is having to buy in a strong market after selling a home. It's easier to just hold if you can.

The Greatest Housing Market Opportunity: Big Cities On The Coasts

For the past two years, real estate in the Midwest and the South have strongly outperformed real estate on the more expensive coasts. I expect the outperformance to narrow and even flip in certain markets.

Housing markets that have gone up the most, but also have the most upcoming supply are most at risk of a slowdown. Housing markets that have gone up the least and also have the least upcoming supply are the most attractive. These housing markets tend to be in already built-out cities such as San Francisco, New York City, Seattle, and Boston.

As foreign investors come flooding back to the United States, I predict they will first buy up coastal city real estate. To them, coastal city real estate is already a bargain. Investors from Asia will buy up the west coast. Investors from Europe and Russia will buy up the east coast. Canadians will continue to buy everywhere. Central and South American investors will focus on the south and the coasts.

Although there will be continued migration to lower-cost areas of the country, the most hungry people will continue to migrate towards big cities. Big cities are where high-paying job opportunities are the greatest. Further, big cities are where you can network the most.

As people get on with their lives, the allure of big-city living will continue to be the most attractive option for the highly motivated. Once people make their money, they can then relocate to save money. However, oftentimes, the people who make their money end up making so much money they end up staying because the cost of living is no longer a problem.

2022 Housing Forecast Confidence Levels

When making forecasts, there are no guarantees. However, let me share with you my confidence levels at various price increases:

Negative appreciation: 10% confidence

Positive appreciation: 90% confidence

5%+ appreciation: 80% confidence

8%+ appreciation: 70% confidence

10%+ appreciation: 60% confidence

+15+%: 30% confidence

We could certainly see high teens price appreciation again in housing. This could happen if mortgage rates plummet by 30%+, foreign demand comes in higher than expected, favorable real estate tax laws are passed (e.g. raising SALT cap), and the stock market falters or explodes higher.

However, my base case housing market forecast for 2022 is another 8% – 10% price increase. Conversely, I only expect a ~5% increase in the S&P 500 in 2022. As a result, real estate will be one of the strongest asset classes in 2022. From a cash-on-cash return perspective, I'm not sure real estate can be beat.

If you are long real estate, then you should hold onto your properties to capture another great year of upside. As a renter, you should consider getting neutral real estate by owning your primary residence. Just make sure you see yourself living in it for at least five years. If you only own your primary residence, then you may want to surgically invest in more real estate online.

Thanks to just inflation, the house you find expensive today will probably seem reasonable three years from now. And in 10+ years, you will likely kick yourself for not buying it today.

Related: Forecast For Stocks And Real Estate In 2H 2022

How I Plan To Invest In Real Estate In 2022

Because I already leveraged up to buy a home in 2020, I cannot afford to buy another home without selling assets. My next home purchase will likely be five years from now in Honolulu if all goes according to plan.

However, given my positive outlook on the housing market, I will be investing money in single-family real estate funds and continuing to build my position in VNQ, the Vanguard real estate index ETF. I'm also going to look at individual real estate opportunities in the south.

Further, I find Redfin stock to be intriguing after a 55%+ sell-off from its peak in February 2021. It has a superior user interface and better price estimates. It didn't go heavy into iBuying like Zillow, but Redfin's stock has gotten almost equally as punished. Too bad Redfin stock is now down 85% from its peak!

It is largely because I expect real estate to do well again in 2022 that I feel comfortable taking things down a notch. If my tenants move, I've got rent upside of 15%-25%. Further, distributions from several of my commercial real estate investments should increase in 2022.

The downside scenario for real estate is that mortgage rates shoot up by 1%+, a damaging new law is passed, and we enter into a recession. In such a scenario, the median U.S. real estate price might decline by up to 10%. But I only see a 10% chance of this happening.

If there is a 10% dip in real estate prices, I expect investors to aggressively buy the dip. I certainly will be!

Related posts:

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. Therefore, if you want to dampen volatility, diversify your investments, and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth.

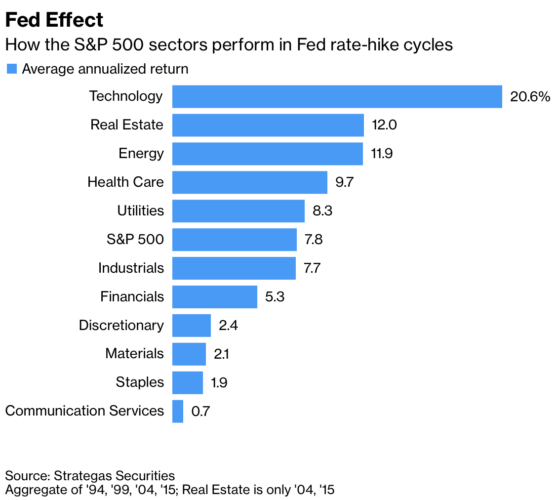

The combination of rising rents and rising capital values is a very powerful wealth-builder. Real estate is also the second-best performing sector in a rate-hike environment.

My favorite real estate investing platform is Fundrise. With over $3.5 billion in assets under management and over 400,000 investors, Fundrise is the leading, vertically integrated real estate platform today. Investors can invest in their diversified real estate funds with as little as $10.

Fundrise primarily focuses on single-family, multi-family, and build-to-rent properties in the Sunbelt. With lower valuations, higher yields, and strong demographic shifts, Fundrise investments are in the sweet spot of a positive long-term trend. Come check out what they have to offer.

For more real estate insights, join 50,000+ others and sign up for my free weekly newsletter. I’ve been writing about real estate investing since 2009. 2022 Housing Market Forecast is a FS original post.

Art by Colleen Kong-Savage.

3/22/2022 – “I still believe the 10-year bond rate won’t rise much above 2%.”

4/11/2022 – 10 Year bond yield is @ 2.755%

Any revisions to your 2022 Housing Market forecast?

The 10-year bond yield to 2.75% by April 11 is much quicker and higher than I had expected. However, there are tons of signs that inflation is rolling over and will roll over by summer’s end.

Here are several anecdotes that inflation is beginning to roll over.

* Used-car prices have declined for three consecutive months for the first time since May-June 2021.

* Container shipping rates from China continue to decline, despite the entire city of Shanghai supposedly on lockdown until May.

* Lumber prices continue to head down since mid-Feb 2022.

* The Dow Jones Transportation Average has significantly underperformed the DJIA over the past month.

* Trucking spot rates are down 25% since mid-February as trucking supply builds.

* U.S. pending home sales are down.

Given the significant jump in the 10-year bond yield to 2.75% from 1.6% at the beginning of the year, demand for most things should continue to slow. The jump is the largest since 1981.

We could see a scenario where the reported inflation figures peak this summer as consumers slow their roll. Boom bust cycles can happen quickly.

The good news out of all of this is the Fed may not have to hike as aggressively or as often over the next 12-24 months. The bond market and capitalists looking to capture excess margins are presently doing the work for the Fed.

I’m going to keep my median house price appreciation forecast at 8% – 10% for the year. But clearly, demand is slowing and the froth is coming out of the market.

Interest rates are currently hitting 5.35% 30 year on 750+ credit score. Anticipating 6% + by May 1st, by our regions largest lenders.

First time reader here – great stuff!

Curious on your thoughts with my situation: Wife and I have owned our primary SFH in Arizona since 2015. We have about $300-350k in equity and have decided we want to buy and move into a new construction home. Prices are inflated but we are “done” living in this house and our young kids are about to start school. We plan to purchase in the next few months and will likely close in Q1 2023.

Up until now we had planned to sell our current house and use the equity to fund the (much more expensive) new home. But given the outlook on real estate, especially here in a suburb of Phoenix, I am wondering if renting it – AirBNB or longterm – would be worth exploring more.

Would likely be able to rent this house for $1k/month over the mortgage amount (which includes taxes/insurance/HOA/etc). BUT, my biggest hesitation is that this house is 26 years old and has an original roof (tile), original two AC units, and a pool that is becoming dated and will need some TLC in the coming years.

We are less than 1 mile from a very booming suburb downtown area that has seen tons of growth and commercial investment in the past 5 years and the plans are for this to continue. This area should continue to flourish with time, which is why I am hesitant to walk away.

But with the age of the house and repairs that are upcoming, should I take the equity now and think more about a rental later on if the opportunity presents itself? It would be cleaner just to walk…. but I know I am going to kick myself for not hanging onto this house.

I am so torn on what to do.

Thanks for any insight/opinions you are willing to share!

In general, you want to hold onto your real estate for as long as possible, until you can no longer take it anymore.

But living a free life is important. If your real estate starts feeling like a bear, then sell it. And if you do, you should reinvest the proceeds so you don’t kick yourself too hard! Click the link for reinvesting ideas after a home sale.

hello Sam,

Interesting article since i was trying to get insight into the housing market this year. We are located in MI and owe a single family house currently. after 3 years my elder one will start college and we plan to move to suburbs of Atlanta due to weather reasons. Its been on my mind for years. Wondering if we should buy a house before hand or wait for another 3 years. My husband doesnt want to purchase before we sell this one and kido moves out which is another 3 years. While i would like to grab something sooner and may be even start living there with younger one a bit sooner. Both of us have remote jobs now

If you buy now, would you rent it out until three years? A lot can change in three years (tastes, life, economy, etc).

So I’d rather stay more flexible and invest in online real estate or stocks, and then buy what you really want to live in when the time comes.

Hi there,

All good advice but here’s what is causing me to pause before buying another house after selling my primary residence in the East Bay in October 2021: CLIMATE CHANGE. Fires, droughts, severe storms, etc. have already impacted all of us, and there’s clearly more and likely worse coming in the not-so-distant future. Isn’t there evidence that at some point many properties will simply be too risky and undesirable to resell at a profit? Will banks lend money against homes that may eventually be practically uninsurable? The past doesn’t always predict the future and I feel this is especially true for real estate since we are only just starting to feel the true impact of climate change.

As long as folks like Obama are buying beachfront properties on Islands and flying everywhere on private jets and massive yachts, you are probably OK. Watch what people in power do – not what they say.

Sam this was a great article with a lot of insight. I was wondering what you think I should do as a first time home buyer? I’m single, 34 years old, make around 70k a year, and live in Las Vegas. The reason why I haven’t bought a home before is because I’ve been waiting for prices to drop (which I was wrong) and because I live in a great place now with rent that only cost me $375 a month (which allows me to save tremendously). Right now, I’m debating on waiting and keep saving, buy a house for around $375k, or a condo around $225. I was wondering what you would do if you were in my shoes? Any advice would be greatly appreciated!

Thank you for everything you do for your readers!

Jazz, buy the $375K home. Owning a home is the very best no-brainer investment anyone, especially younger people (at 34 you are in this category!), can make. There’s really no downside because it’s an investment in the roof over one’s head, which one must have and pay for in any case. It’s paying yourself for your own investment, instead of paying rent to pay for someone else’s investment. Not to mention, fixed rates around 3 percent for 30 years is a no-brainer in a 10% inflationary environment.

Real estate is forced savings, a tax write off, and eventually should you upsize, or relocate, keep it as an investment and never sell it.

I’m 50, have owned 30+ homes, but the part I’d do over is “KEEP” the homes I bought in my 20’s and 30’s… a few of those are worth a fortune now.

I hear you on shoulda keeping homes. I sold one home in 2017. But I couldn’t take the maintenance and tenants anymore as a new dad. At least I reinvested 100% of the proceeds.

Although social media blows things out of proportion, it’s no question that California has epic government incompetence, from woke school boards to homeless policy to mismanaged pension funds and beyond. Nonetheless, I have hope that we’re turning the corner. In particular, it seems there’s a younger generation, multi-racial and pragmatic, that is slowly making inroads and defining a “third way” that meets the demands of “equity” without killing entrepreneurship. Examples include the YIMBY movement or the rise of post-Trump Asian-American Republicans in Orange County that are more focused on fiscal sanity than 20 year old culture wars.

For these reasons and more, I’m bullish on California real estate long term. Am I just engaged in wishful thinking here? What’s your view on the soft cultural/political factors affecting the real estate market here and ultimately, our quality of life?

The richer you are, as a state, the less efficient and judicious you are with your funds.

Here in San Francisco, there is a big backlash against the district attorney who doesn’t seem to be tough enough on crime. And he is probably going to be gone after June.

Everything ebbs and flows. And long-term, everything comes to be rational. So when things get too bad, people vote for change.

I’m bullish things will get better in California. As a result, I plan to hold onto my San Francisco real estate. It’s still a great place to live and make a lot of money.

Sam – Great article. Definitly looking like another strong year for the housing market. What are your thoughts on the broader real estate market in 2022? My investments this year, outside of my IRA, will be in bonds and real estate. I prefer the liquid route, so looking to diversify through a variety of REIT’s that look attractive from a dividend and growth propective. Seems like the “safer” route for returns this year given the headwind for equities.

Can you elaborate what you mean by “ What are your thoughts on the broader real estate market in 2022”?

REITs can be more volatile than stocks during a downturn. See: https://www.financialsamurai.com/how-does-real-estate-get-impacted-by-a-decline-in-stock-prices/

Commercial and industrial.

We currently have an net worth allocation of 30% cash, 25% stocks, 15% bonds, 25% real estate, 5% business. Most of our equity exposure is through our IRA. Taking the wait and see approach with equities this year but looking to increase our bond and real estate exposure by roughly 10%. The eREIT route is interesting, we’d like some liquidity though so not sure this is the right path for us at the mement. Haven’t done a ton of reseach yet but it appears that REIT’s had a very strong 2021, which would coincide with your article that they trade similar to stocks with the similar volatility. That being said, I know you see some growth in the market in 2022, albeit not what we saw in 2021, but still some growth. Would you consider a diversified portfolio of REIT’s a good investment strategy in 2022 for someone mainly looking for passive income with some growth upside or would you take the wait and see approach similar to what we’re doing with equities?

I don’t have that much experience in real estate investing.

I’m looking at REITs right now. But I am embarrassed by such a myriad of articles in their favor. It seems suspicious to me.

But I think for individuals, the affordability of buying fast-growing stocks under $50 is an advantage.

I’ll subscribe to this thread to keep up with your response.

Sam, you’re a champ. This is an intensely well researched article per usual. Do you have a forecast for commercial real estate? Yesterday I closed on a 765k retail strip center in Fort Worth Texas. I’ll be using half of it as a warehouse for my company so risk is low (I won’t have to rent warehouse space anymore). I’ve noticed that commercial real estate prices in Texas extremely lagged residential with regard to 2021 appreciation. I expect to see around a 10% appreciation in commercial in DFW this year. For those interested in commercial, get yourself an owner occupied loan – I grabbed a 25 yr loan w 20% down at 3.19% which is WAY below investor rates. Thanks Sam, great article per usual. I tell everyone about your site, you’ve helped me a lot and your posts are always entertaining and informative.

Hi Jon, I do think commercial real estate lags and should catch up in 2022 and beyond. In 2020, a lot of commercial real estate held onto their distributions due to the unknown. In 2021, things got better and I suspect things will continue to get better in 2022.

GL and thanks for sharing my work!

Sam

We are buying up San Francisco multi family properties and single-family homes. Many of my contacts overseas are trying to buy SF property there. Vancouver is too expensive now with high foreigner tax too.

San Francisco has a lot more high-paying jobs and is a wonderful city. It continues to rise as a premier international city.

Nice. I think you are going to clean up when you look at your purchases 5-10 years from now. The flood of foreign capital from Asia will come. Best to buy up real estate before they do.

I’m sure you’ve seen the news here in San Francisco about the burglaries and looting. Personally, I’ve been in 2 hit and runs while my vehicle was parked in the last 5 months. The Target I visit has basic items now locked down. An impediment to U.S. real estate demand may eventually be the effects of increased crime and even perhaps homelessness. I’ve personally never witnessed such levels of homelessness in Europe and Australia.

In addition, many commercial leases downtown have been abandoned, some at a significant loss. Covid19 has forever altered the business landscape with remote work becoming more mainstream. Indeed, the last minute cancellation of the in-person JPMorgan conference held in SF was guised as a Covid19 concern, but also likely due to the concerns described above. My colleagues in the conference business confirm.

I would not argue that we are at a tipping point in large metro real estate, but I foresee a pullback in large U.S. metros if crime and remote work continues along this path.

Sorry to hear. Overall crime is down, especially the more violent crimes. Do you live in a rougher part of the city? Hopefully you have been able to see huge equity in compensation gains?

I am pleased that prices went up about 12% in 2021 in SF (not 20% like the MLS median price data says). With so much wealth from the big tech companies, I expect prices to continue to go up.

I’m not sure people really understand the magnitude of wealth creation here in the bay area since the pandemic began. When I was renting in San Francisco, I definitely focused on the negatives. But if you zoom out, the amount of wealth creation here is just ridiculous.

And given rents lag due to leases, I expect rent to really catch up this year and next year.

Fortunately, I have been able to reap significant equity gains. Although for me they are paper gains aside from dividends as I am investing for the long haul. I absolutely agree that people can barely comprehend the magnitude of wealth creation in the Bay Area. I find that some folks are shocked and / or upset when they learn how much people are making or how much wealth people have. Because of recent massive asset gains, the gap between the wealthy and the poor is becoming more and more extreme in larger cities like SF and NY and partially illustrated by what I believe is increased rate of crime. I was parked in Mission and near Lake Merritt during the hit and runs, which I wouldn’t consider the roughest parts of the Bay. I believe the rising wealth inequality in the US (and perhaps elsewhere) may reach some sort of tipping point during my lifetime.

Mission and Lake Merritt, especially at night have more crime. Social media has helped to amplify voices, no matter who you are.

Several of us are trying to use the negative media as a bargaining chip to try and get better property price deals. The return to big city living I think is going to be huge. And I think foreigners are going to buy up coastal city real estate in droves in 2022. $200+ billion in pent-up demand thanks to the pandemic throttle.

In the long run, everything tends to be rational. Therefore, so long as you are happy with your wealth and living situation, that’s all that matters.

Glad you crushed it in 2021! And if you have any predictions for the real estate in stock market, happy to hear them.

I’m not yet invested in RE, so I don’t have specific price predictions. I believe the exodus to cheaper metros and potentially a relatively better “quality of life” will continue along this trend with remote work enduring indefinitely. My own firm has hinted at return to work for about a year, but each new variant and subsequent spike keeps delaying it.

Regarding size and style, I believe younger generations don’t want or need as much space as older generations and I believe younger generations seem to prefer the unique designs and architecture of an older home compared to cutout McMansions. My own father advises against this preference as older homes require more work (and thus more money). These are the only home trends I have Sam! :)

Eventually, I would like to buy a smaller home (or multiunit) with classic architecture in a larger metro as I’m still in the growth phase of my career. Someday, when the price and situation is right.

I believe migration will continue as well. However, employees need to be where their managers are.. those who control their destiny.

The ability to get paid and promoted faster when you build a strong relationship with people in charge cannot be underestimated.

Play for income increases, less for cost savings, if people want to boost their wealth quicker.

As someone who worked in a field role for many years far away from HQ and management, I learned this lesson the hard way and I will never forget it. Hence, why during my ambitious 30s I will always live in a HCOL metro near HQ / offices.

My main concern is the irrationality in the house buying markets. I’m in SD, we’ve been looking to buy our primary residence. In December we put in offers on 2 places – both were priced above comparable sales of the last 3 months- both had over 20 offers – and one went 30% over ask and the other went 40% over ask. $900k-$1.4m range homes (middle to upper middle class neighborhoods).

Logic has completely gone out the window. When I worked in a RE office 10 years ago buyers would walk away from a property over $5k difference. What I’m seeing now is such a dearth of inventory that people aren’t batting an eye at paying $200-350k over ask for listings that are priced in line with comparables.

While this may be explained by the basic laws of supply and demand, the irrational exuberance has me at least somewhat worried for the 3-5 year outlook of this market.

My other concern involves the investors in the area buying $1.3m-$2m homes and trying (unsuccessfully) to rent these homes out for the mortgage payment, while market rents are significantly less (trying to rent a property for $7.5k that would rent around $4-4.5k). These investors either are banking on huge rental appreciation or home price appreciation, or both.

I would consider both these examples to be risky behaviors that I have not seen in my local market before. While I’m bullish on housing long term, this behavior is very unsettling.

Regarding another tale of unsettling real estate behavior – I agree with Sam’s extensive commentary that there is a lot of wealth out of there and generated recently (see: tech, crypto, NFTs, etc.). However, I know of someone who bought a home taking on a loan of ~$700k (prop tax north of $10k annually) who informed me they got the loan because their student loan payments were halted, thus increasing their income to debt ratio (artificially). If student loan repayments are resumed, we may get a real picture of what this market is like and if my friend is not a one off, it would represent a real liquidity concern in the housing market.

I imagine a lot of folks are going to have to face capital gains at some point if they sell in the future, as the RE gains many are making are well over the 250/500 exemption. My home purchase in JAN 2021 for $1.3 is estimated by Redfin at $1.85 and inventory has dimenished to very little, making the first part of this year primed for further gains.

Where did you buy? I suspect more people will just hold their real estate for longer. Why cell if it continues to go up? Real estate is fast becoming an investable assets for retirement.

Back in 2006, the average Homeownership 10 year was about 4.5 years. Now the average Homeownership Tenure is about 11 years.

In coastal San Diego. I’d consider selling to get slightly closer to our jobs and we have the ability/means to upgrade price wise. The problem with little inventory (like when we bought) is that it’s hard to get exactly what you want. Fortunately, we got into contract before prices exploded higher. No complaints if we do stay put.

Here is my financial predictions Sam and my course of action(s)

-Make the Big 6 (Google, Apple, Amazon, Microsoft, FB And Nvidia) close to 45-50% of my portfolio. It is along with Tesla (so maybe big 7) a “risk or reward” strategy but even if the pundits are right and Amazon goes to 4500, the strategy worked as don’t see the others garnering any less than 8-10% increases.

-Drive the rest of the market with sustainable type dividends as say that because dividends need to be watched because 5% today can be 1.25% tomorrow. My dividends are what drive my future purchases as my reinvestments. However, this year being 65 will use them for living expenses shortly.

-Real prediction 10-12% stock market overall gain and as high as 15% with right equities. “Weed and Pull” the dogs cannot be over stated.

-Real Estate; have one rental and looking for my primary residence to buy when right situation. Been renting this year after house sold but skeptical right now on inflated properties that need tons of love and repairs.

-Art-explored your suggestion and gentleman actually called me from New York and used your name! Just have to figure out the hows and whys. Seemed like a great diversity to RE and stocks.

-debt-does it pay to payoff a 2.5% loan of only 149k left and have all the rent as total cash flow. According to my man Sam this is negative interest loan! Please advise Sam, but think I know answer.

-Tzedakah Or GIVING-big in our household and will continue to be!

Thank you and hope this is a good overview. We are self made couple after many years of “living under our means”.

Happy 2022 to your family and yourself!

PS Sam-nothing wrong as goal to get to the FU money level as striving for that.

Thanks Sam! As usual, very insightful coverage.

You asked for

“I especially want to hear from people who are bearish on the housing market. Bearish viewpoints are especially helpful in highlighting things bullish people have not thought about before.”

For the last few months I’ve been watching the YouTube videos by Reventure Consulting (Nick Gerli):

https://www.youtube.com/c/ReventureConsulting/featured

I finds Nick’s analyses convincing. Perhaps because I too have a bearish outlook.

Realizing that it would not be practical for you to watch too many of Nick’s videos, perhaps you could watch some, and let us know your thoughts.

Sounds good! Can you tell me three reasons why you are so bearish? And what is your current position in stocks in real estate and how did you invest in 2021? Thanks

Here’s my forecast.

1. Real Estate continues to move higher with the biggest growth coming from the Sunbelt (my opinion is clouded by comments from Fundrise. Thank you for turning me onto to them)

2. Equites trading in a range with limited upside and downside as much as 20%. While the weighted indexes have continued to set new highs, if you look under the hood, breadth has been weakening for a while + you could make the case that we topped a while ago. The one thing that would change my opinion is if breadth strengthens dramatically. Given that we’ve run so far already while also facing potential headwinds (rising rates), I think it’s unlikely.

I agree with you about real estate. This feels like it did early in the cycle of the from 2002-2007’. Hopefully we just don’t go parabolic again

I just stumbled across this website and post while trying to decide whether to buy. I recently relocated to a coastal city in south FL and am debating buying. The dilemma is that on the one hand, rental prices are astronomical. On the other hand, I really don’t see myself staying here for longer than 2-3 years as we want the kids to be closer to family up north as they get older. I’m curious why you caution against buying if you don’t intend to live there for more than 5 years? Does renting the property after living in it for 2-3 years have little upside? Never bought a house before so I’m admittedly a little clueless on this from, hence the questions!

Sure. Mainly transaction costs and the possibility prices could go down in a shorter time frame.

See: https://www.financialsamurai.com/the-median-homeownership-duration-is-too-short-to-build-real-wealth/

Regarding FundRise. Don’t know if this has been covered in previous articles or posts, FundRise seems to be shifting business to an interval fund and away from efunds. There are advantages and disadvantages to an interval fund. An interval fund must maintain liquid assets sufficient to meet repurchase offers or requests. That reduces the amount of money in the fund that is invested thus reducing potential growth. On the plus side (and important for me given my age) liquidity is easier. Maybe a post re: their interval fund +/- would be useful. Thanks for your excellent post on real estate in 2022.

Sam,

Since you asked for RE opinions, you probably are already aware WSPB now BTB are not so bullish on RE. They expect RE to be taxed to raise revenue and also to put downward pressure on RE to make it more affordable to the middle class to cap social unrest. They also view potential higher returns elsewhere such as crypto and indexes (S&P 20%+ last decade) for example.

What are WSPB and BTB here?

Wondering the same thing on what WSPB/BTB is.

To his comments though, RE taxes will go up some (although less than they could), but Rents are going up more and incomes are rising to support higher spend on housing. Plus people are spending more time than ever inside. Who knows with Crypto – it could go up 30%+ or down 50% next year. I guess its possible the S&P could gain 20% again in 2022, but given its expensive by every metric (P/E, Shiller Index, dividend yield, etc), unless earnings really outperform that seems unlikely.

I posted a link, but not sure if that is allowed.

It is Wallstreetplayboys, now Bulltiedbull.

They have a substack.

Hi Sam,

Thanks so much for your terrific blog—I’ve learned a ton reading your pieces.

I was really interested to see you being more bullish again on coastal cities, given

your focus on Heartland and “18-hour cities” over the last couple of years. (We live in

SoCal, with ties to both NY and the Midwest.)

Hoping I could get your thoughts on a couple of things. First, given the recovery in

NYC (per NYT piece yesterday on Chelsea, rents are rising rapidly but sale prices are moving more slowly, with seeming upside), would it make sense to purchase a small co-op in a desirable area rather than continuing to rent? Thinking of my parents, who may be priced out of their rental once their 2-year lease is up in 2023. (We could put 50% down, maybe more.)

Second, given your experience with your Lake Tahoe rental, I’m assuming you’d argue against

purchasing a mountain vacation rental (likely Mammoth)? Sounds like you are glad to have the Tahoe place now but that it’s been a bumpy road—and I know that, unlike NY, CA mountain property values are high now. We have some capital making almost no interest in a savings account; we already follow your principles on savings goals, proportion of net worth in primary home, etc. (And are looking at crowdfunding real estate.)

I’d appreciate any thoughts you might have. And again—thank you so much for all your writings and insights. Hope you and your family have a wonderful 2022!

Hi Rusty,

I’m a buyer of Manhattan property. I’m a seller of vacation properties. They just won’t be used as much as you think. Instead of being locked down in one place, utilize Airbnb and lots of platforms to experience new and fun places. There are better ways to make money than through a vacation property.

And boy, 16 feet of snow in Lake Tahoe in Dec 2021 is a record!

Sam

Wifey and I currently own two vacation properties in Colorado and Arizona and both delivered sizeable value gains and revenue since 2013. These properties will serve as our retirement homes (winter in AZ and summer in CO) and we only paid 20% down and allowed the tenants to pay most of mortgage. CO has been fully paid since 2018 and AZ is 50% paid. If invested for the long term and selected wisely, vacation homes can delivery tremendous profit while and freedom in retirement.

This year, we decided to rent our place in AZ (Scottsdale) full time and the tenant paid in full – $100K for a 3 bedroom/2 bath. Check out Scottsdale for great rental opportunities. The town serves as both a vacation destination and superb full time living.

Our portfolio of vacation homes generated 450k gross and 250k net income this year, self managed on top of our W2 jobs. 900k invested since 2012 has grown to 2.7 million current market value with annual cash yield of over 20%. This might trail FANG/S&P stocks somewhat in same horizon, but has been a great investment and lifestyle business. We use them and one will become a reconstructed retirement home.

Fantastic work Ryan! What locations?

Amen on the AirBnB! I find myself sooo happy I don’t own a vacation home every time I stay in a vacation rental. Enjoy it, then walk away…

Hi Sam,

Great post as always. Love the clarity of your hypothesis, in particular.

Re Manhattan real estate, do you have any personal opinion on the impact of climate change (ex. more & more snow storms/hurricanes paralyzing life/commerce in Manhattan, and rising sea levels) on Manhattan real estate in future? has that ever made you cautious on Manhattan RE?

I am evaluating options to buy a 1-2 bed, new build, either in the Chelsea, Kips bay or Carnegie hill area, but wife is dragging feet over the long term future of Manhattan real estate price in light of climate change impacts.

Both of us live in the Bay Area, and love NYC otherwise (always wanted to buy a property there and believe this may be the best time to get in). Currently own a couple of SFH in Austin and Tahoe in addition to our primary in the bay area.

Thanks in advance for your insights!

I’m not too worried about climate change for Manhattan, but it is tough to live in Manhattan after living in California for so long. I think Manhattan is the best place to live for about six months a year.

I really think the Russians and the Europeans are coming in 2022 and beyond to buy of Manhattan real estate again.

Just be careful about the tax component of owning Manhattan real estate. There is a certain amount of time you have to live in Manhattan or not live in Manhattan to avoid or to pay local taxes. Double check!

Was unaware of the local taxes related to physical residency, will def check. Thanks again for the insights!

Here’s a relevant article that popped up about climate change and Manhattan!

https://www.yahoo.com/news/climate-change-will-bring-more-hurricanes-to-new-york-other-mid-latitude-cities-study-finds-184919327.html

Bought my Ski in Ski out Colorado condo in 2017. I’m still working full time, but I still manage 30 days on the snow. Covid has interrupted my plans a bit, but it is still working out pretty good so far. My HOA is paid plus I make a little profit in the rental pool. We also enjoy the Summers there as well. Plan to retire in 4 years and plan on spending a whole lot more time out there then. I have a 10/1 ARM that I am on track to pay off in under 15 years total. Just hoping this poor Nation can hold up and people can learn to get along. Primary residence in South Florida which I don’t plan to sell. Thanks for the years of wisdom that you share with all of us. And wishing you a great year.

Sam, thanks so much for your reply—super helpful!

All makes sense. Heard more about rental increases these last two days that makes me think that buying a small place in Manhattan would be a better, safer bet for my folks than continuing to rent.

Appreciate your point about vacation properties, too. We used to have a cabin in the Sierras—just for us, not a rental—and loved it, but it wasn’t practical financially. And to your point, even we didn’t use it enough. We’re outdoors folks and camp and backpack a lot—much cheaper! But do miss having a dedicated place.

Thanks everyone else for your thoughts, too. Great to hear all the perspectives. Oh—and I just put some money into Fundrise today!

Thanks again, Sam, and happy new year! Look forward to your book.

Hi Sam,

I was wondering what Fundrise fund are you currently invested in? Is there one that you’d recommend specifically?

The main one available is the Interval Fund. However, I am the Heartland eREIT… which kinda ridiculously, went up 41% in 2021. I don’t expect that to happen again. See: Focus On Trends: Why I Invest In The Heartland Of America

Sam – I have a question about funding platforms like FundRise. I currently own 8 investment properties, my primary, and a vacation home. I have done well on all of my properties but the #1 reason was because I was extremely picky about each of the properties, bought properties at prices that were attractive on a relative value basis in each market, and watched rehab costs (all of.my properties were full rehabs except the vacation home) like a hawk. I don’t think platforms like FundRise are incentivized to be carefull about purchase price or rehab costs if most of the return to principals are based on fees (i.e. deal size and volume). In fact, I would not be surprised if pricipals were front running their own deals (buying properties for themselves and then selling to.the platform at a mark up) and skimming / getting kickbacks on rehab and maintenance expenses. How do we know that orgs like FundRise are not doing these things? Not to brag but my annualized returns for 10 yers on my BRRR smokes that of the dunding platorms, and i suspect the reasons are those which i have highlighted. Thanks!

I like your skepticism! Institutional investors have an incentive to do well and provide solid returns to attract more capital. If they don’t do well relative to their peers, they won’t be able to grow as much. That’s just business and capitalism.

The other thing is, not everybody has a desire, time, or patience to manage multiple physical rental properties. My limit is three rentals managed by me, and then one vacation property managed by a property manager. I really don’t have the desire to own another Physical rental property over the next 3 to 5 years. I want to spend more time with my children. Therefore, I want to surgically invest in online real estate that is 100% passive. The returns may be lower, but saving time is so important to me now.

What is your property ownership limit? And how much exposure are you talking about? Let’s say you have $12 million in real estate exposure. A 10% increase is still pretty good as that’s $1.2 million. To earn it totally passive is even better.

More than 90% of my real estate exposure is still in Physical real estate. But I wanna make it more like 60%, 40% over the next 10 years.

Here is the 3Q2021 Fundrise report. Returns have been solid. But of course, no fire guarantees.

“In other words, by the end of 2022, the median-priced home in the U.S. will likely be somewhere around $390,000 – $440,000. This price range is still relatively affordable compared to an estimated 2022 median household income of roughly $73,000.”

Hey, Sam. Is it relatively affordable though according to your 3x-5x income recommendation? 73K x 3-5 = a 219K to 365K purchase price. Additionally, households making 73K would need to somehow save 78K to 88K (or more than a full year’s income) to come up with a 20% down payment on a median priced home. Wouldn’t this mean based on your recommendation of purchasing a home for no more than 3-5x income, the average household will not be able to purchase an average home based on your recommended formula?

Yes, based on a 3 to 5 times multiple, it’s not as affordable. However, the median family is not buying the median home. For example, the median price for a single-family home in San Francisco is about $1.9 million. What’s the median household income here is about $100,000. The people who are buying $1.9 million homes turn over $350,000 a year.

What is your view on the housing market in 2022? And what is your real estate situation? I’m hoping more people can share their opinions and not just me. Thanks!

Your analysis seems rational otherwise. I’m close to payoff on primary residence and would love to keep the current residence and purchase another, but I’m one of those people that could never rent my house out to strangers if ever planing to stay in it again myself. That said, would love to keep a home in NorCal (near family/jobs) and have another in SoCal (more desirable), or possibly out of state to ultimately save on taxes as primary residence. Will never give up stake in Cali real estate though no matter how bad the state is governed. The state probably has many more years before it’s policies make it uninhabitable. Just can’t get past the renting thing though and not sure if owning two properties w/o renting one would ever be optimal even if one is paid off.

Thanks Sam, good article. IN case of fundrise are you targeting anything specific fund or long-term growth fund is what you talking about?

“Housing markets that have gone up the most, but also have the most upcoming supply are most at risk of a slowdown. Housing markets that have gone up the least and also have the least upcoming supply are the most attractive. These housing markets tend to be in already built-out cities such as San Francisco, New York City, Seattle, and Boston.”

and also,

“However, given my positive outlook on the housing market, I will be investing money in single-family real estate funds and continuing to build my position in VNQ, the Vanguard real estate index ETF. ”

I don’t understand if investing in housing market is a good or not as good investment.

can you clarify?

Sorry, I don’t know what you mean. Could you clarify? Feel free to share what your thoughts are about the housing market as well. Thanks!

may be is because I’m my language is Spanish, but it seem to me, that both sentences are incongruous.

¿Did I explained my self?

Not sure. But bottom line is that I’m bullish on real estate in 2022. Sorry if my message was not clear in this article.

For 2022, I will work on my clarity and messaging as I want to include as many people as possible.

I want to start with Fundrise,

any recommendation?

How should I analize the properties?

Consider I’m living in México, don’t know well the country.

This is a great article. I’ve started to invest in real estate after reading your blogs. Regarding Fundrise investing, would you mind sharing what fund do you invest in specific, or simply let Fundrise decide? Thank you very much.

Great article Sam, your analysis is always well thought out.

I agree in the short term (2022) we will see prices continue to rise, for the reasons you listed.

What do you think about the effects of the following on RE prices & rents in the long term (5 to 10 years+)?

-zoning changes: allowing for things like “tiny homes” and higher-density housing (multifamily & apartments) in neighborhoods that were traditionally single-family homes. (do you think this will realistically happen, and if so, what would the effect be on prices & rents?) What about affordable housing? (in Massachusetts, 40B basically allows you to build without as much restriction as long as 25% of the units are for low-income earners).

-multigenerational househoulds: as baby boomers age, they may see the benefits of moving in with kids (or kids moving in with them) to share expenses, look after them, help look after their grandkids, etc., especially if inflation continues to be worse than we think. (As Baby Boomers pass away, their houses will also go on the market, increasing supply.)

-legislation: what if cities/towns, states, or even the fed pass a law to restrict or prevent foreign/remote/institutional investment in local real estate? For example, you have to be an owner-occupant to buy, or you face a huge RE surcharge (by way of not getting a large residential exemption if you don’t live in the building – this would be easy to do at the local leve, at least in Massachusetts – there is a provision in state law for a residential exemption that businesses and non-owner occupied houses don’t get). This would even make people think twice about buying a second home out of town if the penalty is large enough.

-automation/AI/technological advances: this will probably increase productivity and GDP, but it might lead to high unemployment and low wages for a time. Even a temporary decrease in wages could tank the RE market temporarily.

Hi Jon,

Thanks for all your questions. Will probably require a post to address them all. What are your thoughts on the questions you’ve asked? I’m hoping more people can share their thoughts so we can all learn together.

Zoning changes: Slow to enact. But will cause more price and rent increases long term due to more restrictions and more density.

Multi-Gen households: Net negative. But demand should mop up supply. Hold inherited property to build real estate portfolio and passive income.

Legislation: Bullish. Look at the Canadian government allowing foreigners to buy up real estate and make prices less affordable for locals. There are some dealings we don’t know about. And we can count on similar dealings in the U.S.

Automation: Bullish due to more productivity, more output, more profits.

I’d love a guest post from you about these topics! What is your current real estate situation so I understand where you’re coming from?

Thanks!

Sam

Thanks for your quick reply Sam!

I “co-own” an investment rental property (3 family) with my siblings. I am on the board of assessors in my town (in MA). Residential real estate here is up 15%+ in just the last year, and an industrial building assessed by the town for $9M just sold for $50M. Needless to say, I am long on the real estate market locally (and nationwide, on average).

I think the zoning changes could decrease prices over time if tiny homes are allowed and people decide to warm up to them (or if they are forced to, due to high prices for larger homes). Mobile homes could also help solve some of the problem. Otherwise, zoning changes is a tossup.

I think Boomers aging will be a big factor. Many Gen X/Millennial kids won’t be able to pay holding costs for inherited homes (appreciation is awesome, but it doesn’t give cash flow, and if your income is too low, you can’t refinance, so you might need to sell the inherited home or your original home). Even if they can pay, they might not want to be landlords.

As people’s attitudes shift concerning multi-generational housing, you will see less new household formation. Combined with tighter borders (due to Covid, politics, etc.), we will see less population growth due to constraints on immigration. Also, birth rates are low compared to historical rates, leading to even less growth in the very long term. People will live with roommates/siblings if needed to save cash. I think you will see LOTS of people adding an in-law unit to their homes to accomodate aging parents (even at a cost of $100K, which you would spend anyway in 1 year at assisted living facilities in some states).

At the federal level, I don’t see them restricting foreign investment – there are too many powerful lobbyists with vested interests (realtors, mortgage brokers, banks, etc.) who want higher RE prices to allow that to happen.

At the state level, the big guys (CA, NY, etc.) won’t restrict foreign investment either. A few states might do it as a “selling point” (move here guys, we don’t sell out to foreigners!), but most states won’t do this either.

At the local level, if people get fed up with foreign/institutional investors, they might decide to enact an exemption for owner-occupied residential properties. These exemptions would slowly creep up over time as homeowners realize they can shift tax burden from themselves to commercial/industrial properties and multifamily/apartments (bad news for businesses and renters, though).

For automation: I’m not sure on this one. If someone finds a way to speed up/automate home building, that will help some of the supply-side problem and ease prices (there was an article, I forget where, about 3D printed modular homes). However, that would be offset by higher wages for some folks due to GDP/productivity increases.

The Black Swan event is health, in my opinion. A bad virus (think Spanish Flu or Bubonic Plague level) could cause a hit to population & housing, while a breakthrough in healthcare could increase lifespans, population, and RE.

I definitely want to discuss and think through this more with you – I like the idea of collaborating for a guest post!

“…If you have a choice between believing the seven Board of Governors of the Federal Reserve System or the $46+ trillion U.S. bond market, go with the latter…”

Fed owns already 30% of government debt and was the major buyer of almost all US debt in last two years.

Also Fed bought more TIPS than there were issued in 2021, so the idea that treasury yields are indicative of anything should be taken with a big grain of salt.

There is zero price discovery in the bond market and they have been nationalized for the time being. Wake me up when the Fed stops buying and starts unwinding their $9 trillion balance sheet.

Sounds good. What are your views on the real estate market for 2022 and how are you positioning your investments?

I sold my house and am renting.

If prices continue increasing at this pace, my fear is the disintegration of our social fabric and social unrest.

Policy makers will have to do smth to stop inflation eventually and if history is any guide, that involves raising interest rates.

But there is no guarantee, they might choose to do nothing and sit tight and assess.

Gotcha. When did you sell and how did you reinvest the proceeds? And is there any rent pressure?

Since most Americans own and most politicians own real estate, I’m not sure whether there will be as great of a social unrest as we might believe.

sold about 3 months ago. money sitting in cash in various accounts at the fdic limit. yeah, kinds sucks to rent but the capital gain can pay my rent for a very long time almost the length of a 30y mortgage.

I could be wrong, its a bet, rents have been going up but if they continue on this trajectory smth will break and if they dont smth will break too, but time will tell, I might live to regret my decision.

That’s pretty good! You captured a lot of the gains. The main thing is that you are happy with your living situation and choice.

I just can’t that against the housing market by renting long-term. I could reduce my real estate exposure to be less long, but I don’t want to be short.

Bingo. And no chance it happens. That BS is impossible to unwind without cataclysm. Same goes for interest rates to any serious degree. Based on the cooked CPI alone, rates should be north of 9%. Imagine what that would do to every single market!

What makes you think the Fed will start unwinding anything? LOL The feds dropping their net purchases to zero and beginning to raise rates is already priced into the US Bond prices.

Only risk I see to Treasury prices significantly in 2022 is if bond investors think 6-10% inflation is here to stay for a long time. Right now, every bond investor I chat with still believes it will be temporary, even if longer than they expected 6 months ago. Either way, I expect RE to do well. Interest rates on mortgages went from 6% to 18% from 1975 to the early 80s and RRE doubled in that time due to rising inflation and wages.

” I will be investing money in single-family real estate funds and continuing to build my position in VNQ, the Vanguard real estate index ETF ”

————

I’m invested in VNQ as well but is considering unloading.

It is up only an underwhelming ~28% in the last 15 years (from ~$84 to $115). Not only that, the dividend yield also seems to be treading lower and lower … from $3.33/share in 2020 to $2.96/share in 2021.

Any hope that the dividend rate would go back up at all?

What is attracting you to VNQ?

Get the harpoons ready boys, let’s go whale fishing!

Whale season?

As an economist, I’ve long believed that the “real” inflation is well above the “official” inflation, and this visible hike in prices and related panic was a long time coming.

I also agree with Sam that there is no way Fed will increase the interest rates fast enough and high enough to combat the “real” inflation, which means, that investing with borrowed money will continue to be attractive for the foreseeable future. Think of it this way, as a borrower-investor, your incentives are aligned with the US policy makers sitting on trillions of dollars of debt.

I also agree that US real estate is cheap compared to global real estate. Most other countries have long abandoned the “American dream” idea of everyone owning a home as being some kind of birthright, and consider home ownership a real privilege. Unlike in America, in most parts of the world, real estate is considered an inter generational investment and the prices reflect the inter generational value of the asset (and are thus fundamentally higher).

If it weren’t for the taxes on capital gain unless you do a 1031 conversation, I’d go all in on real

Estate investment. I wonder what Sam and others have to say about the money being “stuck” in real estate investment forever (unless paying massive capital gain tax).

Did you include dividend returns in your overall returns?

I’m attracted by the dividend, capital appreciation, and the passiveness. I want more exposure to a sector I’m bullish on. I expect dividend to improve in 2022.

What are your views on the real estate market for 2022 and how are you positioning your investments?

Wow Sam thanks for these thorough predictions! These type of posts are where you really shine. You clearly know real estate and I love how you explain everything in a way that’s easy to understand. I’m long real estate and am hopeful for a positive year in 2022! HNY!

I’m a real estate agent on Maui, and this is the best most accurate real estate assessment I’ve read so far.

Sam addresses the “sky is falling” articles with facts such as:

-supply/demand deficits will continue

-migration to a work at home from anywhere environment

-low mortgage rates, not Fed rates, to continue.

I could go on, just read the article!

What about property taxes going up and what about rent control in smaller towns (I live in Yuba City, Ca)

Rent control is great for the overall rental market. Restricts the supply of properties for rent, thereby boosting overall rents.

Classic rent control case studies in SF and Manhattan, two of the most expensive cities to rent. As a landlord, you want more rent control, provided you can lock in a market rent and have normal turnover of 2-5 years.

Great article! How do you structure the business side for your properties (ie are each in a separate LLC) and curious for your reasoning? Thanks in advance!

Great question, would love to hear on this. Do you have an LLC to rent out all the places ? I act as my own property manager and currently house hacking to build up my real-estate portfolio.

Be careful! A word of caution if the property is not owned free and clear, the bank can call the note if not already in an LLC. Check w/the financial institution if you are still making payments.

Get the harpoons ready boys! Let’s go whale fishing!

Thanks Katherine! What are your views on the real estate market for 2022 and how are you positioning your investments?

I think getting an umbrella policy to protect you from liability is a wise decision. An LLC for each property is not necessary IMO. You’ve get rental insurance, landlord insurance, and liability insurance.

Thanks Sam! I currently have 2 long term rentals and a short term rental under an umbrella policy. I’m looking to get another short term rental in 2022 and debating putting it under the umbrella or a LLC.