A golden opportunity to buy real estate during the pandemic is upon us. With mortgage rates falling to near all-time lows, the S&P 500 at all-time highs, and a lot of people still fearful, chances are higher you can get a better real estate deal.

Everyone is spending more time at home now. Therefore, the intrinsic value of a home has gone way up. People are looking to buy larger homes with more amenities. Demand for remodeling is through the roof! Yet, given mortgage rates have collapsed, affordability is up.

With the mass media hyping up the demographic shift away from big cities to small cities, it's time for savvy investor to go the other way and focus on big city real estate again.

That said, secondary cities, also called 18-hour cities are also very attractive given lower valuations, higher net rental yields, and less overall density. Rent prices keep going up in 18-hour cities and rents in 24-hour cities like NYC and SF are rebounding once again.

Let me explain in more detail why I believe now is the time to buy real estate in again for 2021. In 2023, I expect real estate prices to fade given higher mortgage rates. But I think 2023 is another good time to buy real estate.

Why It's Time To Buy Property Again

1) Prices already softened across the country.

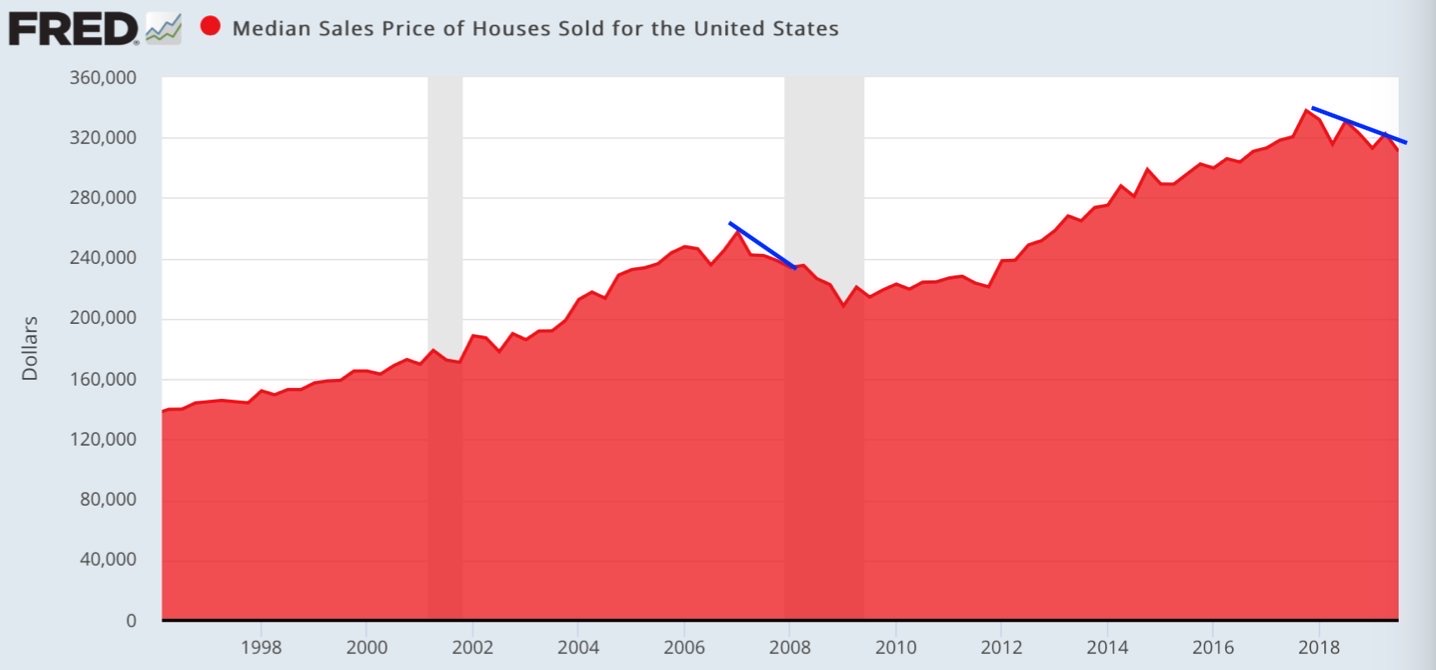

According to the Federal Reserve Economic Data (FRED), the median sales price of houses sold in the United States began softening in 2017. Therefore, we've already had some pricing deflation let out of the system.

If we look what happened after the previous peak in late 2006, we saw the median sales price go from $255,000 down to $210,000 (-17%) over the course of 2.5 years. Some time in 2H2009, home prices bottomed.

Home prices gradually ticked higher from late 2009 until 2012, before exploding ~55% higher from $220,000 to $340,000 in 2H2017.

The median sales price had fallen from $340,000 to roughly $310,000 in 4Q2019, a 9% decline. However, median home sale prices are now at $375,000. Despite the big price increases, I'm still bullish on housing. I don't think there will be a housing market crash for at least three years.

2) Mortgage rates collapsed.

Mortgage rates have declined by over 1% across various mortgage types since their highs in 2018. The average mortgage rate for a 30-year fixed is now below 3%, which is unheard of.

In 2019, I refinanced to a no-cost, 7/1 ARM at 2.625%, which is going to save me over $1,000 a month in cash flow until 2027. In 2020, I got preapproved for a 7/1 ARM jumbo mortgage for only 2.125% with no fees.

Too bad mortgage rates surged higher starting in the second half of 2022. But inflation has peaked and we should expect mortgage rates to fall by 2025. Survive until 2025 and we'll be OK!

3) The stock market is at an all-time high.

The S&P 500 closed 2019 up an incredible 31%. In 2020, the S&P 500 and the NASDAQ went up 15% and 43%, respectively. As a result, stocks investors are extremely wealthy, especially tech investors.

So much wealth has been created in the stock market that it is inevitable some of that wealth will move to real estate, which lagged in 2019. The tradition of turning “funny money” into real assets will continue, especially now. We all want to feel a sense of normalcy. And owning a home or a larger and nicer home helps.

At the same time, we're also looking to invest for a profit. Given real estate prices moves more slowly than stocks, I'm looking to diversify into 18-hour cities across the heartland of America.

The best way that I've found to do so is through CrowdStreet, my favorite platform for accredited investors. CrowdStreet focuses on investment opportunities in 18-hour cities. The platform enables you to invest directly with the sponsors as well. If you have a lot of capital to buy real estate, you can build your own select portfolio with CrowdStreet. It's free to sign up and explore.

Fundrise is my favorite platform for non-accredited investors to buy real estate. Fundrise offers various diversified eFunds/eREITs, which is an easy way to gain real estate exposure across the country. Historical platform returns have been quite steady, in the 9% – 10% range. When stocks do poorly, Fundrise has historically done well. Fundrise is also free to sign up and explore.

4) New President, New Stimulus Money And Goodes

If we know one thing about power-hungry politicians, it's that in order to stay in power, they will do everything possible to help ensure the economy keeps growing. With President Biden in power, he is promising a never-ending amount of stimulus money to keep the economy going.

The stock market and the real estate market tend to get hyped up over all the promises the presidential candidates promise to get elected. The thing is, regardless of who wins, the stock market and real estate market tend to do well.

5) The devil you know is better than the devil you don't.

Once the state income and property tax deduction limit of $10,000 was introduced and the mortgage interest deduction limit was lowered from $1,000,000 to $750,000 for 2018, there was a lot of uncertainty regarding how this would affect a homeowner's tax bill. Now that homeowners have gotten to see what the exact damage is, homeowners and tax experts can now make more calculated homeownership decisions going forward.

In my opinion, the SALT cap limit hasn't hurt as badly as some people feared due to the doubling of the standard deduction and the decline in mortgage rates. I personally haven't noticed any difference and even got a small federal tax refund.

Let's see if President Biden drops the SALT cap deduction limit. If President Biden does, buy real estate for more tax benefits in expensive locations.

6) Rents continue to tick up.

The value of a property is ultimately based on its rental income. Some coastal cities will have lower cap rates due to faster property price appreciation. While heartland cities will have higher cap rates, which offer tremendous value to income-seeking investors.

With the coronavirus pandemic, there is shelter-in-place for millions. However, thanks to stimulus checks, generous unemployment benefits by state, and the Paychecks Protection Program, I'm confident that many Americans will survive the lockdowns and keep paying rent. In some states, you can earn $5,000+ a month in unemployment benefits.

So far, all my tenants have paid on time in the pandemic as all still have their jobs and are working from home. The recovery in big city rents is real and picking up steam in 2021+.

7) The Millennial generation is in its prime buying years.

Buy real estate to take advantage of long-term demographic trends. Millennials are now mostly in their 30s, which means they've had 10+ years to save for a downpayment. They're also at a stage where they are settling down and having children.

There's probably no bigger catalyst to own a property than children. Your nesting instincts go into overdrive as you strive for stability. Further, there is probably no bigger multi-year catalyst to invest in real estate due to demand coming from millennials.

Millennials today account for almost 40% of homebuyers. Supposedly, there are some 88 million millennials now.

Adult Composition of Home Buyer Households

You can see from the chart below by the National Association of Realtors® Home Buyer and Seller Generational Trends study that married couples dominate the home buyer demographic, followed by single females. No surprise, the single male is way behind the single female when it comes to home buying.

I've mentioned this before, but there are now eight males over the age of 25 still living at home with their parents within a six-block area around my house. One of my biggest fears as a dad is raising a son who does not grow up to be an independent man by 25. I cannot be too soft.

Where Millennials Are Buying The Most

Below is another interesting graphic I found that shows where millennials are buying the most homes. They certainly aren't buying as many homes in California or Washington, Hawaii, Florida, New York, New Jersey, Washington D.C. or Boston.

This buying trend gives me confidence that buying property in non-coastal cities is a good long-term trend. I've now got Ogden, Grand Rapids, and Des Moines on the top of my radar when I look at deals on CrowdStreet, my favorite real estate crowdfunding platform for accredited investors.

Just like how stock investors shouldn't fight the Fed, real estate investors shouldn't fight multi-decade demographic trends.

Google is spending $13 billion on real estate in Nevada, Ohio, Texas, and Nebraska in 2019 and beyond. Uber signed a 450,000-square-foot lease within The Epic, a mixed-use development in Dallas, Texas. Their office is set to open in 2022. The trend towards the heartland is as clear as day.

8) Wage growth is reaching new highs.

Real median household income finally broke out to new all-time highs in 2017. The latest data is $68,000 at the end of 2020. Higher real household income growth means more buying power.

When you combine wage growth with lower mortgage rates, it's no wonder why debt as a percentage of household income is close to an all-time low.

9) Hot foreign money may be coming back.

Before 2017, a lot of coastal city buyers had to compete with wealthy foreign money, especially from China. Foreign buyers caused bidding wars and a lot of competition for potential local buyers. The Chinese government has since clamped down on hot money outflow to purchase foreign property. As a result, Chinese buyers of U.S. real estate is down over 50% YoY in 2019.

Now with coronavirus fears, you know that the wealthy Chinese are trying to do everything they can to diversify away from the Chinese economy.

From a foreign capital competition perspective, the time to buy is when their spigots have been shut off. Eventually, foreign money will come flooding into America again, especially if there is a resolution with the trade war. There have been over two years of pent up demand for U.S. property. When the demand is finally unleashed, it will probably result in all-cash bidding wars once again.

Currently, we are only battling domestic institutional real estate investors. But foreign institutional real estate investors are coming once global economies open up.

10) V-shaped economic recovery.

During the 2008-2009 financial crisis, the median home price in America declined by ~17% over a 2.5 year period. I do not believe we will go through a downturn of a similar magnitude because lending standards have been so incredibly tight post the 2008-2009 recession. For example, I got rejected for a refinance back in 2014 because my 1099 income was too abysmal. Yet, I had enough in my investment account with the bank who rejected me to pay off my entire mortgage times two!

Since 2009, only people with excellent credit scores have been able to get mortgages. Negative amortizing liar loans have disappeared. It has also become common practice to buy a home with a 20% or greater downpayment again.

With so much home equity that has been accumulated since 2009 by very creditworthy borrowers, most homeowners should be able to weather a financial crisis much easier than in the past. As a result, buy real estate for further upside appreciation.

The self-inflicted recession of 2020 to combat the coronavirus means that the recovery should be much quicker since we have the power to open up the economy. This recession is very different from the last one, which took years to unwind over-leverage in the system.

11) Conforming loan limits are going up.

The Federal Housing Finance Agency (FHFA) announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2020. In most of the U.S., the 2020 maximum conforming loan limit for one-unit properties will be $510,400, an increase from $484,350 in 2019.

In high-cost areas, the maximum loan limit for mortgages acquired by Fannie Mae and Freddie Mac will be $765,600. Higher conforming loan limits means homebuyers are able to buy more house at the same conforming loan rate.

Further, higher limits signifies the government recognizes real estate prices have room for upside, as their loan limits follow inflation. Therefore, even the government thinks it's time to buy real estate during the pandemic.

With all these reasons, I seriously don't think there will be a housing market crash for years to come. There is simply too much momentum with strong fundamentals.

12) The U.S. Housing Market Is One Of The Cheapest In The World

In a global context, the U.S. housing market is the second-cheapest in the world. Below is the latest chart by Numbeo, ranking the cheapest countries in the world by real estate affordability. The United States comes second, partially thanks to high incomes.

When the pandemic subsidizes, foreign money will be rushing to buy as much U.S. real estate as possible. If you just look at the Canadian housing market, our closest and most relevant neighbor, you'll see how cheap the U.S. housing market is.

If the U.S. housing market turns into the Canadian housing market, prices could easily rise by another 30% – 75%!

Buy Real Estate To Build Wealth

I'm thankful to have sold one of my rental property in 2017. Although paying the commission was painful, the peace of mind I received from not having to manage the property as a first-time dad was priceless. Further, the reinvested proceeds have done well so far with no work needed on my part.

With wages up, mortgage rates down, and stocks strong money is flowing into the real estate market. I want to find the real estate seller who was the Dow Jones seller at under 20,000 and the S&P 500 seller at 2,250. It's time to buy real estate again.

I invest in everything from stocks, bonds, private equity, venture debt, metals & mining, and real estate. I don't play favorites. I'm mainly interested in maximizing my investments to make the most amount of possible with the least amount of stress as possible.

If you don't want to take out a loan to buy real estate, that's understandable. Consider investing in real estate with a real estate crowdfunding platform like Fundrise.

With Fundrise, you can invest in real estate for as little as $500, and you don't need to leverage up at all. This way, you can easily diversify your real estate exposure and earn income passively. Fundrise is open to all investors. For the average investor, investing in a diversified eREIT from Fundrise is a good way to gain exposure to real estate.

If you're an accredited investor, take a look at CrowdStreet a real estate marketplace that primarily focuses on secondary metro markets that are lower cost with higher cap rates and higher growth than the expensive coastal cities.

These cities include Denver, Austin, Memphis, and Charleston. Due to technology and the rise of the freelance economy, I think investing in lower cost growth cities will be a multi-decade trend. If you have a lot of capital, you can build your own select real estate fund with CrowdStreet. CrowdStreet is also free to sign up and explore.

Great post. This, and some of your other work, has impressed upon me that the best opprtunities for real estate lie outside of the coasts and towards the middle of the country.

As for the timing, is it too perfect of a time?

We’ve basically had a 10 year bull market in just about everything so that gives me pause.The Coronavirus has the potential to be a major jolt in terms of economic output. But whether the Coronavirus or some other as-of-yet unforseen catalyst, the odds of a pullback or substantial pullback may be higher or more substantial after such a long-run higher. You mentioned the divergence between the stock market and real estate, but I wonder if real estate is the more telling indicator? Are Tesla and Virgin Galactic signalling that the stock market the one a bit out-of-touch with fundamentals? Thoughts? Always appreciate when others take time to point out flaws in my thinking.

Sam!

It’s been almost a decade (2010), since I I bought my first of 3 rental properties and 1/2 ownership of my office building. I am sitting on the beach drinking Dos X in Cancun as I write this, treating my entire family and parent to a much needed vacation. Thanks in part, to my real estate investments. As much as I I love Real estate, and want to agree with you, I feel like it’s not quite time to buy, just yet.

Yes, rates are unbelievable. There is also some fear in the air of what’s to come (Corona virus, earnings, etc). But prices are still to high. Atleast in my area (Colorado).

When I began purchasing property, prices were on sale. By on sale, I mean 50% off sale! I understand this may have been a once in a generation deal, but it’s hard for me to pull the trigger on property that is selling for 100%+ more than it did just a few years ago. Something just doesn’t sit well, for me.

When we look at Replacenment Cost, or the price to build/rebuild/produce the disparity versus sales price seems astonishing and artificial to me.

I get that everybody is making money right now. I understand it’s been a good ride over the last 10+ years, but prices are inflated and I believe they will come down. The question is when and what will rates look like?

Im sitting on the sideline, with cash. Maybe because I’m ten years older and now in my mid 40s. Perhaps because I have 3 daughters nearing college. Either way, my guess is, 12-24 months and we’ll see a price correction. Anyways, really enjoy and appreciate your work Sam.

Jim

ha ha– this guy was so dead wrong. SF real estate will collapse to nothing –Even more will be defecating on the streets!

I’m sorry if you are losing money in the stock market or whatever. It’s a tough time and I know things can be very nerve-racking. Just know that not everybody can afford to live in San Francisco. So don’t feel bad.

But here are some real time examples of some awesome price performance and sales during the middle of the pandemic.

https://www.financialsamurai.com/real-estate-outperformance-examples-during-a-coronavirus-pandemic/

I do feel fortunate to do well in a pandemic and won’t take it for granted.

GL!

Sam,

What are your thoughts about being a private lender in this lower interest environment? You state that you want to be “overweight” and “maintain overweight” in real estate, but does that only mean physical assets? What do think about private people who lend to buyers of real estate?

Thanks,

MP

I own an apartment outright in SF and have been struggling with whether to sell since ‘17 (which I regret not doing). Any advise on whether to try to do it before the election? Is it more defensive to be liquid in cash or to keep a property I have no debt on, and I rent out? Is there a sell high, buy low opportunity here?

Sorry, without knowing when you bought it, the price you paid, the price you could get, etc, I have no way of providing an informed opinion.

In general, I think the best holding period for real estate is forever. But life happens.

See: Why I Sold My Rental In 2017, Had To Live For Today

This Fred new starts Western region chart sums up my position on the RE market.

The new starts have just started to peak up over 400k. The chart shows a number of years above 500k to call it quits in RE. Enjoy the ride.

As long as you have the money to cover the expenses if something goes wrong it ALWAYS the right time to buy real estate :)

If you wish to invest in real estate then this might be the time for it. As mortgage rates have decreased and prices have decreased, 2020 might be a perfect year to dive into real estate. Thanks for this wonderful article as I have been thinking about taking a plunge in this aspect. This had been insightful.

At a young age I was foolish enough to invest all my spare time, sweat, party money & a lot of knuckle skin & blood into run down rental properties. My at work colleagues & my all-knowing MBA Management type bosses warned me of my impending financial demise (interest rates were @ 18-19%).

So, in ’98 I pissed them all off by retiring very early & they all said I’d be back. To this day I’ve yet to cash in any of my tax deferred retirement savings (at least until RMD clicks in).

As of ’98 I was jobless & ‘at home’ watching our kids grow up & we NEVER missed a game or event they were in. We took them on annual vacations, all over the world. In fact, while visiting family in Australia for 3 weeks, my agent & I did 3 deals over the phone, (@ 2am Aussie time), that paid for our entire vacation. We now spend THE required 12-18 days every year, on Marco Island, to just chill with all our kids & grandkids.

None of our kids graduated with college loans & all owned their own homes (which we built or rehabbed) a couple of years after they graduated. Two are self-employed, all have real estate investments & ALL their homes are within their Italian Mother’s required 6-mile radius.

Pull-backs/recessions/inflation & the absolute insanity of politics has never made a dent in any of our REI values or income streams & everything we own has been free & clear for many many years. My wife GC’d the building of our current home & when the construction loan draws were complete, we paid it off cash, NO mortgage.

Sure, we were crass enough to sell high, raise rents & deal firmly with tenants/evictions & take advantage of EVERY legal tax deduction we could conjure up. But we have also financed & mentored a lot of young kids into their own homes & investment properties. In fact, several young veterans have a home & a couple of rentals ONLY because of us. In fact, one young kid (25yrs old), that we are mentoring & helped finance, now has >40 positive cash-flowing rental units. His 2018 W-2 was $120k, (my wife does his Tax Returns), so you would assume he doesn’t need the demands & aggravation of being a landlord, but like some of us he thrives on it.

Over the last 18 months we have slowed down but still dropped another $500k CASH into new properties with a COCROI of 15-20%. Another project we hope to finalize this month will return $117k, over 10 years, just in interest.

Apart from our Florida home we did buy that Lakehouse, (mentioned above), & we personally did all the re-wiring/re-plumbing & complete rehabbing. That old decrepit 1 bed/1 bath 2 story ‘cottage’ is now 2000 sq. ft with 4 bedroom/2.5 baths. Then my wife designed & we personally built her 23×12 kitchen overlooking the Lake. We are now < mile from several of our friends for the many tranquil sunset Happy Hours, as others fight traffic to rush home from their JOBS !!!

The intricacies & idiosyncrasies of a hard-core real estate portfolio are definitely NOT for everyone, but over the years our Tax advantaged/leveraged Passive income stream has provided an amazing exponential return for our immediate family, both in TIME together & $$$.

Thanks for sharing!

I’m interested to learn more about this! I work full time everyday and have small business on the side. Would like another stream of income. What ways can one find money to purchase and rehab buildings for rent?

you have got to be kidding me with this

I have a home house that is currently vacant. It’s 3 bedrooms, 2 baths, basement and detached garage. I’m thinking of renting since markets are not good now for sellers. Its located in rural VA where they’re are not many Property management companies. I had one years ago that was in town, and it did not work out. Curious if I should look an hour away for property management companies or rent to section 8? I’d like to find a way to make money with it. Interested to know your suggestions. Thanks in advance

My properties in northern VA do very well. Location. Location. Location

That good to know BB! I’m interested in occupying my home with good responsible renters this time. Do you know of any good property managers or realtors that manage in the area? I’m in the outskirts of Richmond, VA but the home is further south.

Prices have only gone up in South Florida. There has been no pause. So I am not sure what down turn you are referring to. It hasn’t been seen in 33486 or 33432.

I agree 100%. The South Florida market and in particular Boca Raton keeps going up an up and up. In my mind the prices are absolutely ridiculous. Complete dumps that should cost no more than $100-$200K are going for $500-$600K. The job market in South Florida can in no way support such real estate costs. There are not that many high paying jobs here.

The city is very well run and EVERYONE wants to live there. Everyone in FL. Everyone in NY and NJ. Everyone everywhere. What do you expect, you live in paradise. Plus, the city hits well above it’s weight class and has given much focus to improving economy/jobs resiliency and improving schools… all A rated for the city, first time ever. Call me biased ..

CD

Hi Sam, Rising Interest rates do not always mean a gangbusters economy. Look back to 1981- 1985 when interest rates were at what would be an unimaginable rate today . When my wife and purchased our first home in Colma/

Broadmoor Village in 1984, we got an adjustable rate of 12% , fixed rates at the time were14%. The economy was not good.

Thanks for your input.

Good article. As others have mentioned, RE is local, so it depends on where you are thinking of buying, down to the neighborhood.

I’ve been investing in RE for over 20 years and I’ve never seen such uncertainty in the future and a dichotomy in economic statistics. RE supply is very low and not really improving. There are a host of reasons, but it is almost impossible to build a SFH now at or below the median home price, so there are few affordable homes and not likely many more coming online soon. However, lending standards are still fairly tight and could be loosened to help those on the edge be able to afford homes. Finally, interest rates are low and will likely stay that way for some time. So, demand is strong, supply is low and rates are low, all of which are good for RE prices.

However, as mentioned above, affordability is a real problem. Even if Millennials that are settling down WANT to buy a house, unless their college debt is forgiven or loan standards loosen or we figure out how to build more affordable housing, they can’t buy. If/when the recession hits, those same Millennials will lose their jobs. Due to automation, some of those jobs won’t come back. I don’t believe the AI horror stories and I think the economy, jobs and people will adapt, but some jobs simply won’t come back.

So, there is little supply, rates and low and there is solid demand. But, prices are at near, all-time highs and most people can’t afford to buy a home. We’re also near a recession. Recessions tend to make people play defense and put off large purchases.

So, my long-winded theory is that we will have a recession coming and that it will cause a mild contraction, or maybe just stagnation, in RE prices. Demand/supply will balance out more. Once we come out of that, I believe it will be a great time to own RE, as the Millennials will be in better financial shape, price/income ratios should be better and the economy will start back on an upswing.

Hey Sam, I think the title should more accurately be “A Golden Opportunity to Buy Non-Coastal Real Estate is Upon Us.” :) I realize that’s a bit less catchy, but I think that’s what this post is saying.

I have a family and am renting a single family home on the peninsula in the bay area. Even with a softening market for home prices (it feels intuitively like prices have come down 5-10%), the total principle, interest, tax, and insurance cost to live in our house would be 2x what we can rent it for. I’m not particularly interested in maintaining the property with my scant free time and love that I can call someone to fix stuff. I’m even more enthusiastic that I can save an additional $4-5k/mo and put that money into other investments that have higher rates of return (namely index funds at the moment, but hopefully heartland real estate and angel investing in the next year or two).

In the past, the benefit of a mortgage to hedge against inflation was a big deal, but I think we’re entering a prolonged period of low growth/low inflation. Would love your thoughts on the topic though!

I love the article, your homework and Optimism !

So many valid points and a majority of negative votes show a lot of concern.

I’m going sit on 70% cash, a 10 % equities 10% cds 10% gold a few nice rentals in SLC and ABQ and a bunch of seasoned low income real estate contracts, in NM. If Yang is correct and AI jobs take overs & cause chaos I’ll stay put here in the Philippines.

Great post, Sam. To clarify your article, you are recommending buying property not in the major coastal cities (Silicon Valley, LA, NYC et al), but in the heartland, correct? You don’t explicitly state it above and wanted to clarify.

Although the Bay Area market has cooled substantially since 2017 (intuitively, -10% feels about right), among moderately sized single family homes above 3 bedrooms at conservative interest rates (~3%), the total principal, interest, tax and insurance cost is hovering around 1.5-2x the yearly cost of renting. I’ve been reading a lot about possible future paths for inflation and have become convinced that inflation and stock returns are likely to be much lower in the next 30 years than in the past 30 years. That means that a mortgage won’t be a big help as an inflation hedge since inflation will be pretty low. And even at a nominal 4% long run return on stocks, there’s a 1% spread between a 3% mortgage interest rate and stock market returns that can be arbitraged.

For context, I currently have a family and rent a home on the peninsula. We have been saving for a down payment for 2 years and could afford to buy, but are increasingly leaning towards not doing it for the reasons above. I AM, however, considering whether to buy a rental home in my home state of Ohio for the reasons you present here.

I think a lot of folks myself included are held back by the fact that they don’t know enough about it. In my case, there are also fears of bad tenants that folks I know have had to deal with. This is why REITs are my happy medium where we earn less, but I have less problems. That being said, I am adding more and more to my REIT investments for the very reasons that you are talking about.

I didn’t read through the massive list of comments but here’s my take.

I live in a military driven town, largest military(navy base) in the country right here. If the military were to disappear the economy of this entire place would collapse. This history lesson is given to explain that even one here is living in a real estate bubble that very rarely bursts. Houses are overpriced and sell fast. Captains wives want southern charm with open floor plans and streets where you can walk to little quaint bistros. That’s what we have.

I live in a 2300sq ft home that just got valued at over 475,000 and my mortgage is killing me. Literally. My husband and I found the absolute sketchiest house on the nicest street in the second nicest neighborhood and completely renovated this 200 yr old house. Now I’m in a nightmare. My goal was to live in it for a few years, then rent it, but keep the house because holding onto property is the easiest form of retirement. My parents have a duplex 3 blocks from here that is paid off, but needs work, but will give me at least $4000 a month in a few years when my dad can’t manage the place anymore.

My problem is my husband. He’s convinced that if we sell this house we will be “free” and everything will be rainbows and stars. I keep telling him that I’m the real world houses like ours are 1/2 the price and that we should just rent the stupid thing and start fresh somewhere cheap like North Carolina or one of the square states.

I’m interested to see if you respond or if you have an opinion about this issue.

Property will stay predictable for the next 20-30 years. Until the memory of the Great recession is gone.

My best guess is a 20% correction on NY, JC, SFBA real estate in the next 2-3 years as people realize either their tech stock isn’t worth as much as they think it is, or that their tech stock is worth a lot and that means a multiple 6 figure state tax bill. The impact of the SALT deduction limit is massive.

Gotcha, so another 20% down from here for the most devastating real estate collapse in the history of America – more so than the 2008-2009 financial crisis.

Can you share your housing situation: renter/owner and for how long? It’s good to understand your background to understand your call. Have you been shorting the stock market and housing market given your view? If so, what have you been short?

thanks!

I think your arguments are a bit confusing, because some of them apply almost exclusively to the Bay Area (e.g. IPO money) and some don’t. I am now selling my longtime residence in a top zip code in LA because of bumping up against the cap gains deadline, but also because renting over 50 miles from home is a hassle, even when it’s high end and you know the people. But I was getting rent of over $7k a month. Imagine now renting in Michigan. You would have to rent and maintain several houses to match that rent. Have you ever lived in a place with winter, and the maintenance issues involved? I think, despite your heartland arguments, there can be good buys in CA and other West Coast, because this is where many of the high paying jobs are. I am selling to a gay couple of new UCLA professors from the east coast because they have $$$ and feel comfortable in CA (they ain’t moving to Ogden). I have downsized into a beach house in Ventura County that I bought during the depths of the recession in 2010. Meanwhile, prices in the rest of the country can seem shockingly cheap, but the salaries are low, property taxes aren’t capped by Prop 13, they have terrible weather, etc. I think you sound a little cocky, perhaps due to your relatively young age. I worked for many very lucrative years in the DVD business, where everyone thought they were a genius when we were just in a lucky moment. Be careful, because, while your research and thinking are quite thorough, you are ignoring the sheer lucky timing component (the Big One didn’t hit SF!) and the sheer other luck component (what if you had a family health issue? If you are not working you give up many perks including disability insurance, perhaps). You should also consider that if you are raising a family you have to be able to support them through thick and thin, so beware of over-extending yourself on risk and stress. When you stop working you face a lot of the problems that older retired people face. You should focus on making sure your family is housed and secure no matter what. Have you already fully funded 529 plans for your kids (I paid for top private schools and just finished paying my kid’s Stanford tuition, with grad school on the horizon, and yes, I feel great about my kid not having debt–but that cost a fortune)? Then you can think about fancy real estate investments (watch the crowdfunders when the cap gains rate is raised to 39%!). Then worry about seeing how many people approve of your blog entry. Just writing this reminds me to re-focus on life and financial priorities, because I have one life to live. Oh, yeah, and my mother is 100, so I also have pre-paid high-end long-term care insurance–do you? Good luck and be wise.

Sorry to write a confusing article. I thought only one point, #8, and a couple anecdotes was related to San Francisco regarding the tech IPO liquidity. The rest affect us all.

But real estate is local. So you need to pay attention to your local economy.

I should have said I was also thinking of your points about record high wages, the ability to even think about monthly rents above $5K, the degree of sensitivity to tax deduction caps (certainly came up with young families looking at my LA house in an excellent elementary school district, and is certainly impacting several East Coast markets), and also the irrelevance of that cap to the vast majority of homes in places like Utah and Michigan because the buyers there will never see those house value numbers that start triggering the caps–when one lives in the Silicon Valley bubble, some things seem almost normal that are amazing to outsiders. My son just moved from Menlo Park, where a Coffeebar breakfast for 2 easily hits $50, standing room only. I believe you should spend some time in these places you are thinking of investing in and consider how different they are from the Bay Area. I know someone who started snapping up cheap tax auctioned houses in rural PA and wanted to rent them. It seems you can’t make enough rent to overcome the damage that can be done to a cheap rental in such an area, so he had to start flipping instead, but all hard to handle from a distance and there’s a reason that winter is not a good real estate season in these places!

Perhaps I can give some perspective on flyover country relative to coastal metropolis living.

I was born and raised in Fairfax County, VA (Washington, DC for those who don’t know). Went to college in VA, Medical School in VA, and then Residency training in San Francisco and Bethesda, MD. I then worked for the first few years of my career in Washington, DC. while I was serving in the U.S. Army at Walter Reed (in return for an Army medical school scholarship).

At age 33 I was free to select my geography for the first time in my adult life. In my particular field, I could make twice as much income, with half the time to equity partnership in flyover country due to supply/demand for physician specialists.

I looked at many locations and settled in Tulsa, OK. I had never been to Oklahoma before the job interview.

From 1997-2007 I lived and raised my children to school age here. At that point, I moved back to Northern Virginia since all of our extended family lived there and we wanted the kids to be around their family. We loved living in Tulsa, however.

After 2 years, we found that life was immeasurably better in Tulsa than DC. Tulsa is a city of about 400,000 with an MSA population of about 1 million. Beautiful. Cosmopolitan. Great people. No traffic. Great schools. Airport easy as pie to park next to terminal 30min before departure with no crowds.

Due to the traffic on I-95 in Virginia, we only saw family on special occasions because no one wanted to sit in an interstate parking lot for an unpredictably long period.

After 2 years back “home”, I got a call from the hospital CEO in Tulsa, and long story short, I returned to my old job in Oklahoma. That was in January 2007 and we have happily lived here since. Like many heartland cities there is a renaissance going on in our downtown that is amazing. Walkable cafes, restaurants, craft breweries, outdoor spaces, etc. that are growing like mad. What was a really good place has become much better.

I also own outright 4 SFH rentals in the best school district in the state. All are less than 10 years old, 3-4 BR/2-3 BA homes in great neighborhoods with high relative rents and attract higher end renters with no drama. I paid on average $150,000 for each home, and the gross rents average $1550/mo for each.

I’ve recently bought land to build a second home in Colorado Springs where my oldest daughter settled. I plan to keep my home in Tulsa for part year living, and also all of my rental properties which are slowly but reliably appreciating. I’m considering committing additional capital to the rental realty market due to the high income it produces here.

Just some thoughts for those who have no experience in this part of the county.

Hold your cash and wait for the crash after the 2020 election, then buy!

I have a lot of respect for the author however, I’m going to very much disagree with him. I’m not declaring to be an expert or I know it all, however I’ve been a student of AI / Robotics mostly about the economics of it for 12 years. Owning a media company has given me the opportunity to interview CEO’s from AI companies along with Robotic Engineers. I could write for a day about it – the short from most major think tanks: As of June 2019 human jobs were 71% Vs. 29% automated. They all agree by 2022 it’s going to be 58% human Vs. 42% automated. There just waiting for a recession. We all know if a major company laid off 20K to automate, it would be bad PR – in a recession, cost cutting measures are expected. I think when it comes to Real Estate … it’s going to be simply supply Vs. demand. If there’s a lack of jobs, millennials will not buy homes. We currently have approx. 64% home ownership in this country .. over half is by boomers. The largest group taking social security is the ones at age 62 it’s 34% – full SS or waiting to age 70 … both are under 10%. I’ve sold my Silicon Valley home before the market went down. I’ve sold all rental property. I’m living in a state that’s cheap. I’m going to sit it out until 2025. This is my prediction when jobs vs. AI will be 50-50. With AI it’s no longer a question of not if but when – it’s now how much pain and who will suffer the most. Recessions are part of the biz cycle, political policy cannot keep the recession at bay much longer. All the articles you read that say AI will destroy i.e. 70 million however it’s going to create 100 million. It’s called disruption, displacement. I recently interviewed a CEO in the hospitality arena – they’ve started however will be very everywhere in Vegas hotels soon. Immigration laws and minimum wage is accelerating it. I told him what he would tell me “the jobs will stay (robots will take them) however the task will change – meaning employees will find other jobs. I asked, so all of those housekeepers etc. in Vegas, will they get jobs at the casino’s in finance? HR? – he admitted it’s a job killer. It’s just my wife and I we’re late 50’s never had kids. I think cash will be king. Anyway, again, lots of respect for the author, I know he’s written about great value in the central part of the company buying RE Crowd funding. In the central part of U.S. & rust belt, lots of those manufacture jobs are going to disappear. It’s a different type of AI – it’s smart AI not dumb like what you see in a car plant with a robot doing one function. Foxconn Apples largest supplier replaced employees with 60,000 robots who can do 20 task. We already have Robotic Bartenders, AI Hotels, Amazon will be launching over 3K AI grocery stores, soon your Amazon delivers will be by drones – testing mini blimps for larger items. The CFO of Ford admitted, they don’t want to sell cars, they want to lease for $1 a mile … says they only make around $30K when they sell. He’s not my favorite however Mark Z of FB commencement speech to Harvard’s graduating class of 2017 – first item, there’s not going to be jobs, went into UBI. I don’t have the answers to everything – I’m lucky my wife & I have done well, we have enough money, I have my own biz and she’s still working. There’s going to be a lot of people in a bad place in the future! Sorry, for the long explanation – but I would not go long term in RE

Jim,

Thanks for your informative and thoughtful comment. Quick question, with the ways things are going with AI and negative interest rate, where should people put their money in?

First, I must apologize, I should of proofed what I wrote … it was a little sloppy. My humble but honest answer is I don’t know. For my wife & I, it’s our age. We’re late 50’s never had kids, did above average in the investment world. Fortunately, I have my own biz and my wife still works. We made the decision, after quarterly results to sell mutual funds that we’ve had with Fidelity for over 25 years. Pulled the plug on the rental property. Even though Google is buying buildings all around us, we decided to sell our home in Silicon Valley … however, we did also want to experience living on the east coast. I’m very concerned for young people these days. I see young adults graduating from law schools paying out over $50K a year while IBM has developed AI technology that will review millions of legal documents in minutes. The biggest cost for a law firm is preparation for trial … the list goes on and on. If I was in the market … I’d probably take a look at where VC’s are putting their money and with which AI companies. Perhaps, Sam can chime in, he perhaps would have a better vision regarding investing. I’d also be curious on his take.

Maybe I’m wrong but when people claim to know that AI currently has 29% automation (in the US) my bs detector goes off. Really 29% not 28%? Not 30%. Big lack on knowledge indicator – excess precision in an very hard to measure area. How would one measure this now to see what the 29% really is?

Going forward looking at all jobs and saying we are going to replace around 20% of jobs with AI in 2.5 years? Really? Have you ever seen IT projects role out? Your AI will replace house cleaners? More challenging the justice AI, and if you are going to replace 1million bed makers and bath tub washers in that time frame there should be solid beta testing now – and maybe a unicorn or two pre selling them. So no dice there.

Maybe in banking? If ATMs didn’t wipe out all the crazy tellers in the last twenty years who would believe they are going to vanish from magical AI in a couple years?

Seems like the same over hype we had with 3D printers, or Y2K stocks. AI will impact jobs but I will bet large sums of money that it will be slower then that, and like every labor saving device of the last 300 years people will find other ways to add value that the AI can’t do.

Maybe I’m wrong and Bloomberg can teach the AI farming and food will be free. Oh no – we’d have to go fishing for fun instead of food. A great human tragedy. :)

In addition to Grand Rapids, in the Midwest I think lakefront property is a great buy now. More people will shy away from the coasts due to climate change and buy lakefront instead. Northern Michigan (Traverse City, Charlevoix, Petoskey etc) is increasingly becoming the new Hamptons.

I can assure you that —-> your northern Michigan crap lakes will not become the “new hamptons”. Not now…not ever.

Well, you’ve obviously never been to Harbor Springs

I have been to Harbor Springs, but the new Hamptons is a bit much. My parents don’t bother going to their admittedly old family lake house in Northern Michigan. I haven’t been in approximately 20 years. I suspect there are too many little lakes to ever make the real estate exclusive, and who wants to live there year-round.

I had the same thought about lakes versus ocean, so I looked at Lake Tahoe. Climate change will impact lakes as well–less snow-melt, algae and invasive plant growth from warming waters and organic pollutants, and humans fighting over the water needed to replenish. On the sad flip side, the bark beetles have killed so many pine trees due to warming that lake views are opening up where they didn’t exist before! Shorter term, there are plenty of people who don’t research these things like I do, so there is surely money to be made. Longer term, I decided not to sink money into that much concentrated risk. Diversify, diversify, diversify, is my advice to myself, because the crystal ball is cloudy.

I believe prices will continue to weaken because we have already had declines in an environment with lower interest rates and declining unemployment. If interest rates begin to increase as well as unemployment we are looking at asset price crashes.

We also had Treasury Secretary Mnuchin and HUD Secretary Carson testify before congress that loans issued by Fannie and Freddie as well as the FHA are actually higher risk then before the crisis. While the negative amortizing loans are a thing of the past; high debt to income is not.

I’d be curious to get your views on real estate crowdfunding vs. traditional REITs as well. Pros and cons, that sort of thing.

Sure, see: Real Estate Crowdfunding vs REITs

Check out my search box on my homepage, or Google “subject/question Financial Samurai” for more.

thanks

Boston / Arizona / Texas areas of investment. Real estate investing is a long game. There is substantial risk depending on how deep you are leveraged. There are a number things to consider. How deep you will be involved in the property management, maintenance , etc. If you can buy a place and make money from day one do it. If you can survive with the place empty for 6 months that’s border line. Real estate ownership should not be taken halfheartedly. There will be ups and downs. Be prepared for them. My experiences have been mostly positive. There are so many balls juggling in the air with real estate ownership. Be prepared. Here is something I learned if I rent to a great tenant and the rents go up in the area it is not worth driving a good tenant out to chase a small profit. Each month a house is empty is an expense that could take months or years to recover.

I’m in a suburb of Boston, and things are still pretty good here.

On the peninsula feels like the entry level market is seeing later stage buyers (feels like more contingent sales now), while the upper middle to high end where mortgages are less of a factor hasn’t moved much since 2015/2016.

As you say – where lending caps move, the prices tend to move. Is there a place that tracks the 75th percentile of mortgage amounts? That would prob help explain a lot of price movement, and give a sense of where it’s headed.

Hi Sam, I am a big fan! Do you have any thoughts on climate change impact on real estate on coastal cities areas? I prefer to invest inland with higher altitude and close to clean source of water… lake Michigan…I think Chicago is under priced, what is your thoughts?

Hi I have a condo in Chicago right near Michigan Ave..got it for a good price 10 years ago..only make $200 cash flow monthly..but it literally rents within a week…should I sell ( I have approx $80 grand in equity), or should I hold on to it ? Your thoughts ?

Hold on. The quality government there will prevent it from becoming the next San Juan or Detroit.

The last to leave gets hurt the most. ‘The Chicago area’s population declined for the fourth year in a row in 2018, according to the latest Census Bureau estimates.’

Sam,

Love all your content. Currently trying to buy a house in Los Alto/Mountain View area. It’s still quite busy as least for good houses. I wonder, you said in a post a while ago how IPO’s wouldn’t lead to increase in prices (https://www.financialsamurai.com/how-new-tech-ipos-could-actually-accelerate-the-decline-in-sf-bay-area-real-estate-prices/). Has you take on this changed or is there something I’m missing?

Thanks

I’m curious what you think of cities like Bend, OR, for real estate buying. It’s not coastal or heartland, but prices have gotten quite high there. It’s no longer just a tourist or logging town and is seeing explosive population growth (from 20,000 in 1990 to about 100,000 today and expected to hit 140,000 in 2040).

I tend to disagree…I can’t see any significant appreciation happening in the San Francisco market for at least a couple years. The highly desirable neighborhoods like Noe Valley will always be very competitive but given the unprecedented increase in prices over the past 10 years, i think prices will remain flat for some time. Those buyers who paid big for condos between 2015-2018 in SOMA or downtown, and need to sell, are going to struggle to break even. (I’m expecting drops of 10-20 per cent in that market.)

To counter balance, rates are going down and there does appear to be an endless supply of trust fund babies who move to this city!

It’s going to be interesting to see how it all unfolds. I’d wait unless there’s a great deal that you can’t refuse.

Further to your post…the heartland may be a good bet!

Hi Sam,

Great article to think about. However, with the looming presidential elections coming it is likely possible housing and the stock market go down. So, even though I see a good time for housing in the next 6 months, I see it getting hammered once we know who will be in power for the next 4 years. I am telling my friends to be cautious and save money right now. Once the elections are done, then make a choice. Nothing is worse then buying at a relative top and then being forced to sell due to job loss or some other reason. Alternatively, if you can buy and hold for a long time, then buying would work, regardless.

Can you elaborate why Trump winning again will hammer the real estate markets? Are you currently a renter or Owner?

I never said Trump winning would hammer the real estate market. I think it is more likely the Dems winning would hammer the real estate and stock market.

I am an owner.

Gotcha, so you are going against the current odds makers.

You should consider making a bet for the Democrats then because you’re getting at least 3 to 1 odds. That’s a much easier way to make money as the payout will be in one year.

Always put your money where your mouth is. That is the best way to win and to lose, but most importantly to learn.

Sam, your responses seem very odd here. All he is saying is that there is significant uncertainty in an election year which is well documented historically and you are saying that Trump will definitely win and that he should bet against him?

Also, the oddsmakers were wrong last time so why would you put any faith in them this time especially this early? Sounds like you need to put your money where your mouth is and place a bet on Trump.

Already have. Happy to make a side bet with you as well. $100 straight up? We can settle by Paypal.

I think it is common practice to make assumptions based on probable outcomes. So first making the assumption against the odds, and then assuming the housing market crash or two derivatives.

But anything can happen and that is the beauty of the market. What are some bets you are making and are you a renter or a homeowner?

Totally agree with Daniel and Justin here. But just a quick 100% political bias-free comment regarding the election odds. Trump clearly has the best odds of being elected president in 2020 right now. But that’s only because he’s the only republican candidate. Using a tennis analogy, he’s got a BYE into the finals, while the dems have a playoff before they can advance.

But don’t conclude that Trump winning the election is the most likely outcome. Polls are all over the place, but most have it near a 50/50 toss up depending on which candidate the dems put forward.

Approval and impeachment polls suggest Trump is a clear underdog at this point. I don’t see why someone would accept an oddsmaker bet that puts him as an even money or better favorite. That’s got to be a -EV bet.

The socialist Dems will be the ones to destroy the economy..

In 2016, I thought stock market would tank after the election and I wrong. What I have learned is that it swings a lot. I have a lot of cash on hand and would like to see what I can do with it.

I’m selling what I can of what I own – my most profitable rental and my current home. But only so I can buy more real estate. Those two properties are in non-declining areas and will give me additional capital to expand what I own at hopefully lower risk for the rentals i acquire

Not sure about the timing, but I heartedly agree about the heartland (drum snare, bad joke)… Anecdotally, I see millennials coming through our SF office, getting “tech” on their resume and then retreating to more affordable markets, particularly when kids come into the picture. Previously, those places included the usual suspects (Sacramento, Portland, Austin, SLC) but any geo arbitrage value in those markets has been soaked up over the past 10 years so some of those kids are “going home.” whether that be Florida or Indiana or…

Re the greater Midwest, Minneapolis has a strong economy and good quality of life despite the intense cold. Indianapolis, Grand Rapids, Columbus and Pittsburgh also stood out in my spreadsheet as places with jobs, affordable housing and a good quality of life (lower crime, decent schools, cultural amenities, etc).

The problem with all these places from an investment standpoint (ironically) is that are very stable. Rents tend to rise slowly and there’s a lot of supply because the Rust Belt has been depopulated. Pittsburgh, for example, is half of its peak population in 1960! Therefore, it only makes sense to me as a long term buy and hold, particularly for undervalued historic and walkable neighborhoods close to amenities that may see more upside, kind of how dilapidated Victorians in San Francisco were relatively cheap in the 80s and 90s.

Sam, maybe I am missing something here – but your points – 2,3,4,7,8,9 all indicate that prices are going UP. How is this a golden opportunity to buy?

Sure, because the prices have been going down since 2017, hence the opportunity.

Ah. Thanks! That may be the case for national prices in general. Here in the Bay area I don’t feel price soften until later 2018. My neighbor who own a small 1200 square feet house in Fremont sold at the peak at more than a million mid 2018. The price does feel softer late 2018 – early 2019. However with record low interest rate and good economy I am afraid price is going to rebound.

Our little family is looking in to a bigger house, but I am afraid price wouldn’t come down much, if at all.

Here’s where you are wrong. Prices are not softening nationwide. The Phoenix metro area is still red hot. Multiple offers within days of listing. Flipping rampant.

You’re a real piece of work. Property “ownership” is a farce. Using it as an investment vehicle to generate passive income while charging absurd prices to renters is ethically gray and morally bankrupt. You are creating nothing of value to any real economic system and you are hoarding money from those who are creating real value through their labor.

Even though I have not taken any risks, I deserve to have affordable or free rent. It is my right as an American and I cannot believe people like you make investments for income when I have expenses to pay!

Spot on! I totally agree. These people are utterly oblivious to the daily plight of ordinary workers and renters who are barely hanging on. It’s a cringe of a read!

I assume this post is sarcasm. If so – it is great. You have spoken the mantra of the Progressive Left. (Gimme gimme gimme)

I am Progressive Left. (Yes, that post was sarcasm).

I believe in paying my taxes, absolutely. People who go to the extremes to lower their tax bills are unpatriotic.

I do not believe in gimme gimme gimme. I do believe that society functions better when governments can give a hand up.

Gov’t CANNOT offer a hand up. All gov’t can do is move $ from one group it dislikes (taxpayer) to another group that votes it in.

You would think living in CA you see that first hand every freakin day of your life.

It’s unbelievable how naive some people are.

And we have a winner! You are 100% spot on. Big government ONLY leads to big oppression. It would be nice if big govt lead to only hands up. Nope nope nope. It leads to hand outs for favored groups. And that money has to come from somewhere. Mainly the pockets of the productive. The problem with big powerful government is that it is run by people. Those people bring all their bias, prejudice, and pettiness with them to work. BTW where on earth did anyone get the idea that shelter was a right? A privilege of living in a generous nation maybe. How quickly thank you becomes you owe me.

New blog idea: Social Justice Samurai. Since it would be hypocritical for any blogger to personally profit from greedy corporate advertisers on this site, you may direct all proceeds to my personal non-profit.

Looking to buy something with my wife and brother, 3 incomes will bring our housing costs down below 10% of each of our monthly!

The power being turned off is helping prices go down! A home we looked at was in escrow and the buyer backed out when the power was turned off.

Luckily for me, I love California with every bone in my body and am not phased by this minor inconvenience.

I am a contractor in the gold country and I have noticed recently that every home we work on is owned by someone with money from the Bay Area. I feel this area will be a great investment for the future.

This blog has helped me so much. Thank you for writing. Cheers!

The millennial stat is surprising. Here in the DMV I just see more apartments being built which indicates more rental demand. If I could go back in time in my 20s, I’d rent for dirt cheap longer and save and invest more.

REITs all the way baby!

BUY BUY BUY!

We’re in a recession really but it hasn’t been announced yet, or some kind of dip. It won’t last forever. I just bought a house that would have cost a lot more in 2016 and even if it goes down a little further, so what. Better to buy now than when they start rising again within 2 years I think. Then there will be the crash around 2025, but I doubt it will wipe away the growth from buying NOW.

Great article, one of your best Mr Samurai

Interesting take on how you see millennials becoming home buyers now.

I have read in the past that this generation has been the one bucking the trend to buying homes and prefer renting. They grew up with the housing crash came online and have that fresh in their mind. Also it seems that this generation prefers mobility and freedom which favors renting.

Who knows. Maybe the nesting instinct does take over as you suggested.

Among my family and friends who are all millenials, almost everyone has bought a house or condo and almost everyone has had their first child by now. You cannot fight the bio clock and once that SO starts nearing mid 30s, you start making moves.

Great timely post.

I am closing, in the next 18 days, on a 1.39 M property in San Ramon, CA. I was able to bargain the price down 3% while comparing 2019 average prices (similar floor-plan and area) and about 5-7% from the 2018 reference point. Similar properties in the area, I see, are listed around 1.45 to 1.5 M.

To negate for the potential downturn, and to down-pay 20%, I withdrew my Roth contributions made over the last decade to lock in some 40% growth in the portfolio.

While I am hoping that prices don’t adjust further, I am sure with a long-term horizon it will not hurt much if it does. Having said that, I have witnessed that the days-on-market for any given property has been on the rise and I have also seen price-cuts on pretty much every other property on the sale.

Do you mind commenting on withdrawing retirement funds to make a down-payment considering we are all sitting on a decade of gains?

As someone who stopped working late 50s and manages my retirement stock funds with advisors handling the “income investment” side, I would say that I sure hope that is not all your retirement savings and also I hope you are in your 20s. And I hope you asked your financial advisor to extrapolate for your future needs, comparing historic market date versus real estate projections, and I hope you can stay employed with matching funds (I had old school matching at my employer and that really adds up). What I learned is that maxing out 401k contributions is NOT enough to fund retirement, and if I had it to do over again I would have saved and invested even more. Plus I bought real estate along the way, but only when I had the down payment in cash and secure

job prospects. Priorities!

Maybe you should work a little overtime or pick up a side gig so you do not have to cry as much.

People who provide housing for

other people who do not want or own or know how to purchase are providing a valuable service.

I own 6 rental houses that I have acquired over the last 35 years of working. They are all paid off. Did I forget to mention that I am a Carpenter who went to work the day after I graduated from high school and saved to purchase each one of the homes.

I did not spend my money on travelling to Europe, purchasing $5. coffee or dining out 5 to 6 nites a week.

Si, if you want your piece of the pie, go get it and stop blaming other people for your short Cummings.

Good Luck. Mike

Im impressed !! What area do you live in ?? You inspire me

these trolls are hilarious

For San Francisco specific, my instinct is that there are a lot of extremely leveraged buyers who are depending on the performance of their tech equity to keep up with their payments and monthly spends. I see a big risk of a rotation between growth and value stocks next year especially as we go into an election year and investors prefer more stability. This will hurt tech stocks and therefore hurt prices in the Bay Area too.

From an investment point of view there are other uncorrelated assets you can go into vs real estate which which I prefer and there factoring in opportunity cost I prefer to wait for that 15 percent decrease in SF house prices which has always come in the past and will come in future. These assets are things like music royalties, litigation finance funds, reinsurance catastrophe funds, managed futures mutual funds etc.

I would love to see Sam write a post on non-correlated investments. I know of a private equity fund that lends against collateralized fine art that is interesting.

Without foreign buyers, do you think new demand is drying up from young buyers unable to purchase because they’re overwhelmed with student loan debt?

May partly depend on where you live but based on observation of the market and stagnant incomes how could it be a good time? Not to mention throwing in all time high student loan debt and car loan debt. Housing prices are quite high and in many neighborhoods have approached the previous bubble levels. I think this is the time to lower overhead and build savings IMHO. I live in a near “average” COLA and decent homes in a neighborhood with good schools are 4-600k. That is too much for people with median incomes, especially if you insist on paying for college and retiring a bit early. I really do feel bad for the average person sometimes. Glad your blog is around to help us strive to meet our full potential.

Interesting comment about “feeling bad” for the average person. I urge you to look at this a bit differently. One can also say we live in unbelievably good times where the options available to the “average person” are more than ever in human history, especially in USA.

You say houses cost more that the average salary. I say poppycock. Expectations of average person in terms of what should be in said house are much more than in past. Dial back expectations or move to LCOL area. If someone really wants a house, they can make it happen.

You say sky high student debt is a problem. I say poppycock. There are ways to achieve an education without taking on all that debt but the minions do not allow themselves to think of those ways – Go into military for a few years and get GI benefits; start freshman classes at local community college, DON”T go to school and instead concentrate on a trade – that degree in Ancient Lesbian Basket Weaving Techniques ain’t gonna do one much good anyway.

Point is – we have to stop looking at glass half empty and start looking at all the options available to us and then ACT on them If not, we fall for the tripe from fake SJW’s like Bernie, Elisabeth Warren or AOC.

Let rich keep getting rich with all the resources they already have. Average people should focusing on adjusting expectations.

While I agree what you said is the right thing what average people should(and can only) do, but in grand schema of things, it is sad for the society.

All the opportunities you talk about require three things, capital + education + relationship. And all three of them are getting harder and harder for average people to obtain.

The most important thing needed is always HARD WORK!!!

Perspective is important. Based on reviewing the comments, most people on this blog are doing well. I dare say though a flippant poppycock, leave town and go somewhere else is shortsighted.

I do hope the four firefighters renting a flat in San Francisco (because the American Dream of home ownership is unaffordable) don’t take to heart your poppycock perspective when you need them. And feel free to substitute firefighters with teachers, nurses etc.,.

please stop saying poppycock. also you misspelled Liz’s name.

Sam, if you’re looking to buy a bigger home for your family, go for it if it makes sense. But if you’re doing it for investment purposes, don’t.

Why would you invest in physical real estate when you have a vastly superior alternative in real estate crowdfunding? Once me and my friend liquidate our business, i plan to use my share of the proceeds to invest in Fundrise. And that’s mainly because of your discussions on the topic. Why put all my assets into a single concentrated–and likely leveraged–bet that I have to manage and can be wiped out in one wildfire or hurricane? Wouldn’t it be better to have a diverse set of professionally managed commercial properties where you have no responsibilities or obligations? You’re going to manage more tenants when you’re trying to spend as much time with your child as possible? I don’t think that’s a good idea.

Unpopular opinion alert: I think real estate crowdfunding has made owning physical real estate (other than your primary home and your business, of applicable) to be obsolete. I can’t think of a single advantage owning a rental property can have over investing in real estate crowdfunding.

Sincerely,

ARB–Angry Retail Banker

>>I think real estate crowdfunding has made owning physical real estate (other than your primary home and your business, of applicable) to be obsolete.

How about tax benefits through depreciation? Does fundrise provide same level of tax benefits?

It depends on how it is set up, but, yes, you can get both depreciation and leverage using crowdfunding platforms.

I think the main benefit to owning your own RE is that you control your own destiny. You decide how/what to improve, what to rent it for and when/how to sell it. Normally, you can also get better returns owning RE directly, but not really as much now.

> I can’t think of a single advantage owning a rental property can have over investing in real estate crowdfunding.

Uhm, leverage?

I wrote a whole response to this, and then the train went into a tunnel and took my comment away :(

I think I’ll turn my response into a blog post about rental properties vs crowdfunding. I can probably write a better quality blog post than a comment typed on my phone while riding the subway.

Still, I hate it when this happens.

Would enjoy that post, can you provide a link when it’s done.

Will do, good sir.

Look forward to the post! Thanks!

The biggest problem with RE crowdfunding is the management company. Some companies don’t screen the projects well enough. They let some shady projects go through and investors pay the price. Some shady developers inflate their numbers. It’s hard for individual investors to do due diligent on these projects. I don’t know how to value these big hotels/apartment buildings and price the local market. I still like RE crowdfunding, but I’ll limit it to 10% of my portfolio.

On equity deals, they’ll send K1 so you get to write off part of the depreciation.

Leverage – yes, that’s the big advantage of owning a rental property. Assuming the value increase, of course.

Also, option to defer tax through 1031 exchange. RE crowdfunding can’t provide that.

Cant disagree with your points. However, where I’m located in a outer ring suburb, in the midwest, I’ve seen prices continue to rise, but at a slower pace, in the last 6 months. My observations are simply based on searching online houses, no realtor data, at median local prices. I’d say the high end prices, which to me in my area are $650k+, havent seen any appreciation over inflation in the past 3-6years.

From my understanding it usually take 1-2 years for housing trends to make it to the midwest, from the coasts. My gut feeling is next summer we’ll see the slow down here…no rocket science from me. Personally, I’d love to gobble up some more low priced single family rentals, in small midwest college towns.

Cheers

At the end of the day this post really revolves around leverage, cost of capital, perceived opportunity cost and inflation. Cost of capital is a no brainer given rates. Leverage has not really changed that much over time (the distortion around risk adjusted returns and no one talking about it….but that is a different conversation). Perceived opportunity costs is a little harder given everyone has been calling for a market top since 2016…..and inflation (ie borrowing fixed today to pay real tomorrow) seems to be dormant. I Think the hardest part about this post is to talk about buying long and renting short….ie you taking on a long term mortgage at great rates and renting out at short term rates. There are lots of examples of buying long and renting short that have not worked well but we all know them……

I’m 62 and plan to work until I’m 70. I’ve been looking at crowdfunding for real estate investments but have heard that exiting from such investments may not always be easy. Often times there are no buyers for the shares you are selling. I guess if it is long term it is not an issue but intermediate it could be. What day you sir?

I saw this post and just felt compelled to respond. I completely disagree with you for several reasons (and I could be completely wrong), but here is my thinking.

I’ve been a value-add real estate investor for more than 15 years. Over the past few years I have been a seller almost exclusively and have sold most of my real estate investments. My reasoning is a combination of what I would describe as anecdotal, other experts and gut feel.

Anecdotal:

In my niche, the number of buyers/investors has probably doubled or more over the past few years. That in turn has driven down cap rates to crazy valuations on assets. In fact, in many cases the value add has all been priced out of the deal. Increasing demand and limited supply drives prices up as we all know. I’m a seller in this market not a buyer. Based on my first-hand experience, I have never seen prices higher over my 15+ years.

Cash on cash returns can be driven up by using a lot of leverage (i.e. debt). The debt availability and leverage keeps getting easier. When you can drive up the loan to value, you can then pay a higher price to achieve the same returns. I believe this excessive leverage is compounding the price increases.

Other Experts:

I believe all asset values are being driven up right now (small business acquisitions, stocks, real estate, etc.). Warren Buffet would say low interest rates drive the value of other assets up. The reasoning is that if your risk free return on treasuries is very low, the price you are willing to pay for other investments increases. In other words, investors are willing to take a lower return on real estate for example, because the return they can get on a risk free investment is so low in comparison. Therefore they will pay a higher price for the asset. Historically, this has proven to be the case.

Gut Feel:

When I look at where prices have gone, generally, over the past 10 years on real estate I feel like we must be somewhere near the top of the market. Rents at least in my area (Denver metro) have increased a crazy amount based on historicals (with the exception of the last year or so). I don’t think ongoing increases in asset prices or rent based on the past decade (ish) are sustainable moving forward, generally.

My caveat would be that all real estate is local. I think specific, opportunistic or niche investments can be successful still, so my thinking is more general in nature.

Your post seems more specific to you buying a primary residence. I don’t pretend to be able to predict the market and where it is going. Real estate prices might be even higher next year!

But I do think that the probability that prices fall over the next few years seems more likely to me than that they rise. I like to find investments where I am highly confident it is more likely to be a “sure thing”. So you should know my bias is equally in managing downside risk with upside opportunity. I don’t think of my real estate investment temperament as speculative in nature.

My 2 cents…

You’re defiantly more of an expert than I am, however your reply made me think of this Financial Times article from a few months back (link is to a public copy). Good read overall, below is what the author said specific to real estate.

https://news-flash.info/profoundly-low-interest-rates-are-here-to-stay/

”Seventh, demand for housing will rise. It is, after all, the main capital asset that most people use. There are two potential outcomes. Where it is possible to build, permanently lower interest rates will trigger an increase in the housing stock. If it is not possible to build, then houses will behave like assets in fixed supply, and soar in price.“

I just bought a vacant duplex in Oakland as a primary residence. I definitely felt that the market was in correction mode especially given that it’s been flat to negative in Oakland. I borrowed for First Republic bank at 3.15% interest for a 30yr and FR paid $6500 in closing costs. I’m pretty happy with the result. I’m expecting prices to stay flat and then go up again given that my area hasn’t seen as much appreciation as Rockridge, Bushrod like Oakland neighborhoods.

Given the current rents in the area I’m predicting a 6.7% cap rate if I rent out at market. That is high as SF is seeing closer to 3%. I’m hoping for appreciation but if that doesn’t come I’m okay with raising rents.

I really hope you are right since I am looking in the Spring.

I’m just worried about a major market correction but I know you cant time these things.

How come you never wanted to be a real estate agent? Seems like you would be great, flexible hours…

Would be interest to see the buying rate for millennials in Hawaii!