There are some people who think that achieving financial independence before 60 is only for people with high incomes. I strongly disagree. You can still achieve financial independence sooner on a modest income.

A modest income is defined as +/- 25% of the median household income in America, which is roughly $75,000. In other words, a modest household income today ranges between $63,750 – $93,750.

A large part of achieving financial independence is having a strong money mindset. If you believe you deserve to be rich, you will likely put yourself in a position to get richer.

If you believe you don't deserve more wealth despite people dumber and less talented than you making way more money, then less is what you'll likely get.

The other part of achieving financial independence is having congruency between your beliefs and your actions. The more you believe, the more you need to take action. Otherwise, you might look back on your life, full of regret.

Anybody who has played competitive sports knows having a healthy mindset is more than half the battle to winning. And maybe that's the problem? Not enough people are put in competitive positions to test their mettle.

You Can Make Excuses Or You Can Take Action

The disgruntled will say how it's not fair other people are able to escape the rat race early with their six-figure salaries. Instead of seeing the various wealth target figures by age in Buy This, Not That as a motivator, some will just throw their hands up in the air and just give up.

The reality is nothing good comes easy! You're either going to complain about why life is not fair or you're going to do something to better your situation. Always choose the latter.

In a world where depending on only yourself for retirement is the way to go, having a weak money mindset can be devastating for your financial future. When it comes to achieving financial independence, the percentages often matter more than the absolute numbers.

However, the larger numbers always seem to mesmerize some folks into not being able to focus on the percentages. To minimize envy, please think about saving rate percentages, investment return percentages, and risk-appropriate asset allocation percentages on your journey to financial independence.

Achieving Financial Independence On A Modest Income

Imagine being 22 years old and finally landing your first job in finance at a top investment bank. You thought you were going to be rich, but nope! The bank sends you an offer letter in the mail for $40,000 a year.

What the heck? $40,000 in Manhattan was like earning $16,500 in Austin, Texas. Here are the cost of living salary equivalents to $40,000 for other major cities in America:

$26,330 – Washington DC Area

$31,893 – San Francisco

$25,554 – Seattle

$24,255 – San Diego, CA

$24,349 – Los Angeles, CA

$20,394 – Chicago, IL

$19,100 – Miami, Florida

$18,766 – Philadelphia, PA

$16,600 – Phoenix, Arizona

$16,100 – Houston, TX

Working Long Days For Not A Lot Of Money

OK, $40,000 was an OK salary back in 1999/2000 when I first started working. But not so much when it cost $1,000 to rent a room in Manhattan, the most expensive city in America. Watered-down beers were still $6 at local dive bars.

A regular day for me would start at 5:30 am and end at 7:30 pm. I'd then have to work another 5-8 hours on the weekend. When you add up all the hours a week, a $40,000 a year salary equated to earning only about $9/hour, or $4/hour above minimum wage at the time.

After only two weeks on the job, I realized I couldn't last working such long hours for decades. Therefore, I logically decided to save as much money as possible to give my future self options.

I knew achieving financial independence wasn't going to be easy. But I had to try in order to give myself opportunities when I was older.

One of the biggest mistakes I see young people make is not properly forecasting their misery. They think they will have the same enthusiasm for their job as when they first start in their 20s. This is seldom ever the case!

The Question That Changed My Financial Trajectory

The question I asked myself was, what are the things I'm willing to sacrifice today to have a better life in the future? At the time, my answer was almost everything.

The more you want something, the more you are willing to sacrifice. If you don't sacrifice by working longer hours, starting a side hustle for extra income, and continuing your education, you're probably happy just the way things are. And that's great!

For me, I had won the lottery getting a good job from a non-target school. Therefore, I tried my hardest not to screw things up.

$40,000 Salary Budget Breakdown

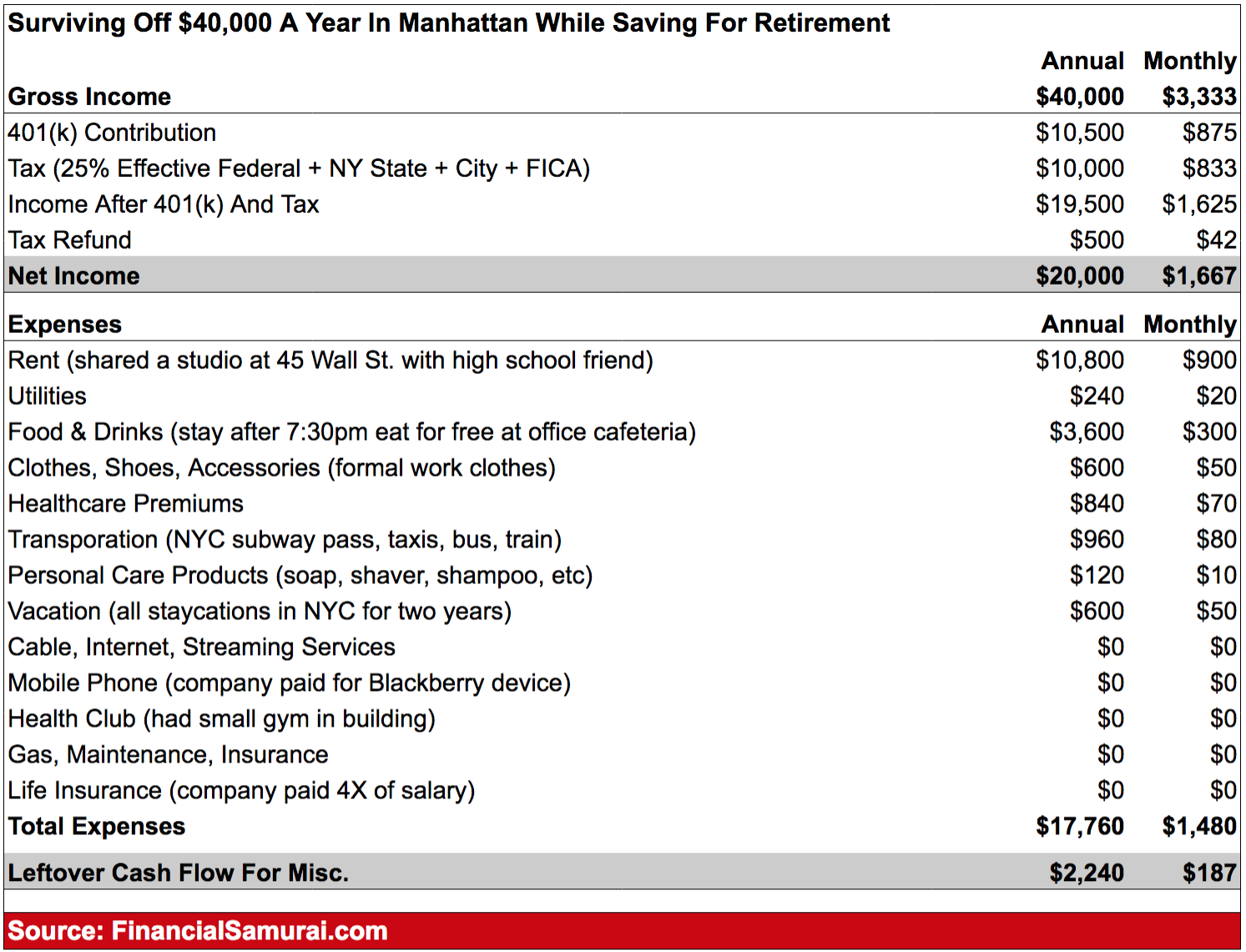

Below is my detailed budget breakdown when I was earning $40,000 a year living in Manhattan. Essentially, I was living paycheck-to-paycheck for two years.

Take a look and I'll explain more below on my path to achieving financial independence on a modest income.

Saving For Retirement Starting At An Early Age

Back in 2000, the maximum you could contribute to your 401(k) was $10,500 a year. After several months of working, I got educated about the importance of retirement savings so I elected to deduct 30% from each paycheck to go to my 401(k). Once the maximum was hit, the contribution stopped.

By taking money off the top first, it was easier to adjust to a $28,000 gross salary. It also felt good that I didn't have to pay a 28% marginal federal tax rate on the $10,500 either.

With $10,500 a year in pre-tax savings and another ~$2,200 a year left in after-tax savings, I was saving a blended ~31% of my gross income.

The retirement savings mistake I made back then was not also contributing $2,000 a year to an Roth IRA. I'll always regret not contributing to a Roth IRA as well. However, I did end up using all my after-tax cash flow to invest in stocks, one of which did very well.

Run The Numbers

Was I going to achieve financial independence while making only $40,000 a year? It was hard to see. At the time, $40,000 really did not feel like a lot of money. But I had hope my income would grow as I gained more experience.

I did the math and knew that if I kept on saving at least $12,000 a year for the next 10 years, by the time I turned 32, I should have at least $177,000 with a 7% compound rate of return.

If I could boost my annual savings to $20,000 a year by living frugally and earning more income, in 10 years at a 8% rate of return, I could actually accumulate $313,000.

In another 10 years, with increased savings to $40,000 a year and 8% annual returns, the $177,000 would turn into $1,007,000. If I had accumulated $313,000 the first 10 years, it would turn into $1,301,563 ten years later! Ah, to become a millionaire by 42 would be great. So that's what I shot for.

Only in retrospect did I realize the minimum investment portfolio balance to start feeling financially independent was about $300,000. Once you hit the $300,000 amount, your annual returns could provide enough to pay for basic living expenses.

The more pro forma calculations you can run, the more motivated you will become to achieve more wealth. You will find various ways to earn more, save more, and invest better.

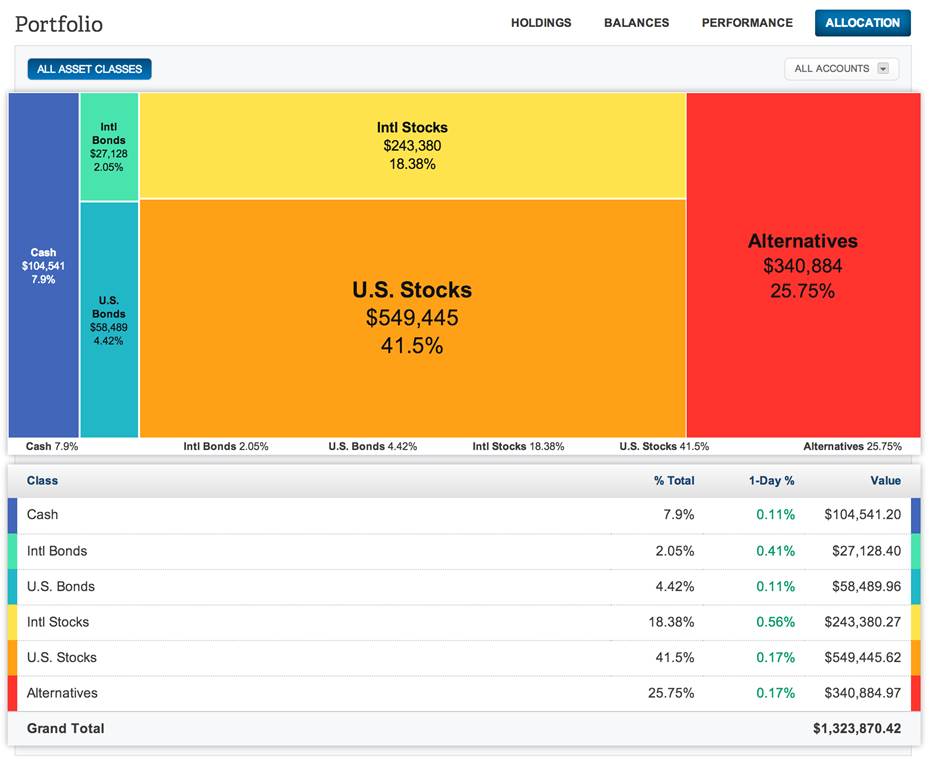

Today, I just use free technology to track all my accounts in one place. The more you can stay on top of your money, the better you can optimize it.

Housing Costs ($920/month)

While many of my fellow financial analysts decided to rent a one bedroom for $2,100+/month (with the help of their parents) or split a two bedroom for $1,300/month each in a nice part of Manhattan, I decided to split a studio with my high school buddy down in the dead zone.

Our studio was at 45 Wall Street, a 10 minute walk to 1 New York Plaza where I had to get in by 5:30 am every morning. The traders and sales-traders would arrive by 6:30am. Therefore, I had to prepare as much printed research material about what went on overnight by the time they got in. Oh, how I remember the stress fixing photocopy machines!

By living close by to work, I not only was able to save time, but transportation money as well. I sometimes fantasized by taking a nap back home during my lunch break but that never happened.

Even during the depths of winter, our utility cost never got much higher than $40. When you're living in a small space, it's so much cheaper to heat. Besides, we were hardly ever home.

We didn't have time to watch cable TV. There was no such thing as WiFi or streaming services back then as well. All I did was come home to a mattress on the ground and pass out. Drastically minimizing housing costs, makes saving for retirement much easier.

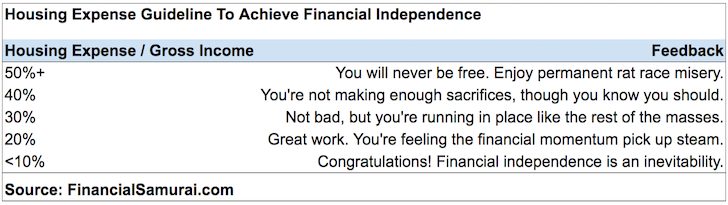

Getting your housing costs down is one of the most important steps to helping you achieve financial independence. If you can keep your housing expenses to 10 percent or less of your gross income, financial independence is an inevitability.

Food & Drinks ($300/month)

A great way to incentivize worker bees is to offer free cafeteria access once you work past a certain hour. Because I didn't have a lot of leftover cash flow, I would always stay until 7:30 pm and gorge myself with whatever was on the menu that day at 85 Broad Street.

After filling myself up, I'd “steal” some fruits and mini cereal boxes to feed myself free breakfast the next day. There was always random free food in the office I could eat. It was part of the culture that if an employee closed a deal or got a big trade to buy lunch for their team or the floor.

Despite the ubiquitous free food that got me fat, I still had a ~$300/month food and beverage bill because I'd occasionally go out with colleagues. When you go out with friends and colleagues, it's customary to buy at least a round of drinks. I didn't want to be seen as a cheapskate, even though I had a thin financial cushion.

Back then, stepping outside your apartment in Manhattan would cost you at least $50.

Related: The One Ingredient Necessary For Achieving Financial Independence

Vacation & Entertainment ($600/year)

Given I was working so much, I didn't take any vacations my first year because there was so much to do and learn. If I got an entire weekend off, that counted as my vacation. Only after the second year did I fly back to Hawaii to see family.

During my weekends off, I'd go watch a movie in the theatre, go out for dinner, catch an occasional cheap ticket play, or go to some free event in Central Park. There are lots of relatively inexpensive or free things to do in a big city.

My firm did have the occasional analyst appreciation outing where they'd take us to watch the Yankees or take us to some restaurant close by. But there was never anything fancy or special.

Yes, sacrificing vacation time was not great. However, I believed I could one day have all the vacation time in the world if I worked hard until 40.

A Simple Life Was Just Fine

Even though my budget looks pretty boring and maybe even a little sad, I was simply too busy at work to spend money on anything else. To pay up for a nicer apartment felt stupid because I was hardly there.

To go clubbing or get bottle service at a fancy lounge with my fellow analysts would only limit my options in the future. I went clubbing maybe once a month or two, not every weekend.

Yes, I wanted to go to the Hamptons during the summer and go on European vacations like my colleagues. But I wanted to reach at least a 50% saving rate before I partook in such festivities. At a 50% saving rate, every year I saved meant one year of freedom covered!

I had my whole life ahead of me to enjoy. There was no rush. Besides, college was kind of like a four-year vacation with all the partying and studying abroad. So I didn't mind grinding hard while I still had the energy. Further, many of my analyst classmates had family money.

My main focus in my 20s was achieving financial independence at a young age. I treated my investments as expenses so I could take care of my future self. Work was too miserable, which ironically propelled me to focus on my finances more than my peers.

$40,000 Was Just OK For Manhattan

If you want to adjust the $40,000 into today's dollars, you can increase the salary and all other city salary equivalents by about 50%.

But $60,000 a year in Manhattan today (= ~$30,000 in Austin, Texas) is still relatively modest as well. After all, the median household income for the entire country is about $75,000 today.

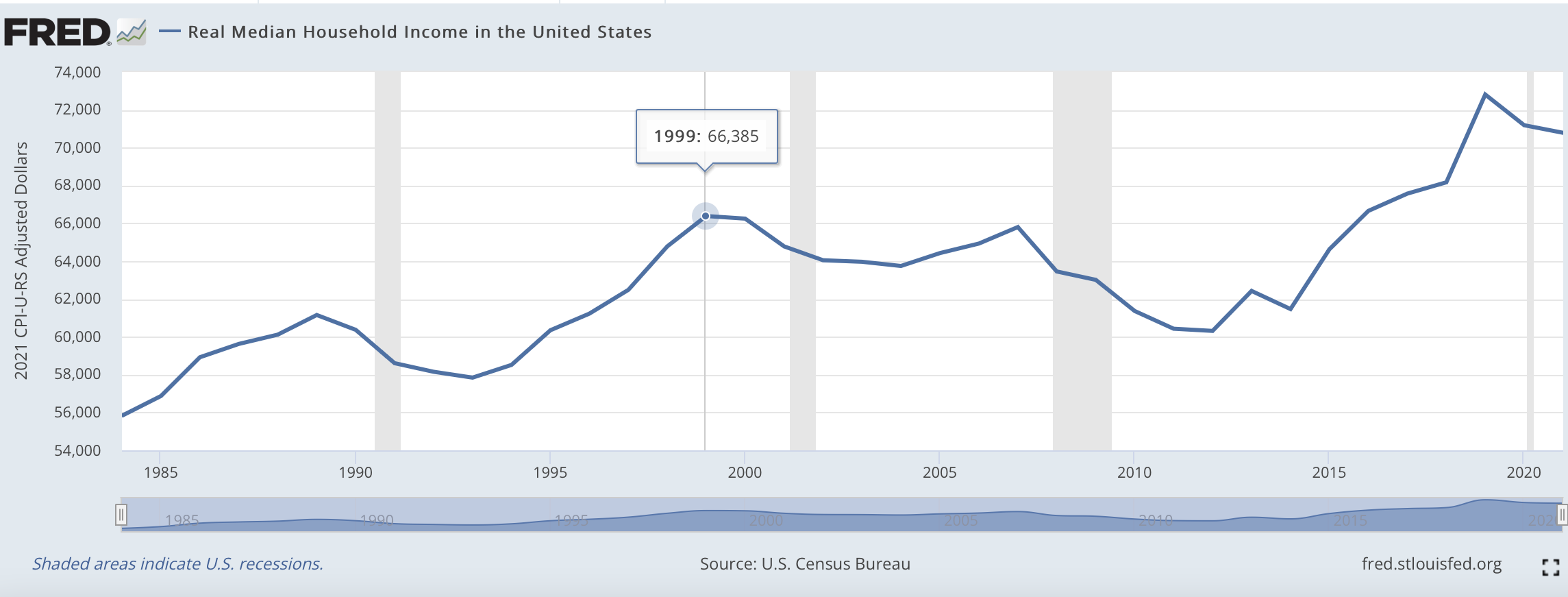

See median income chart below by the St. Louis Fed. Elevated inflation is also requiring more people to make more just to run in place.

I knew the rough times wouldn't last forever because there was upward mobility. I just needed to survive in the industry for 10 years. If so, I would make more in finance than in most occupations.

So long as I could stay frugal while I made more, financial independence was an inevitability. There really is no sacrifice saving and investing in your 20s when the ultimate reward is 1,000X.

According to eFinancialCareers, my old firm now pays $110,000 base salaries for first-year analysts when I only made $40,000 ($60,000 inflation adjusted). The young guns have it good nowadays!

Advice For Modest Income Earners Wanting FIRE

If you want to achieve financial independence and have a modest income, here is my advice.

1) Live in a crap box.

Be honest. If you have an entire room to yourself, you are living large. In US colleges, most students have dorm mates. In China, each college dorm room has bunk beds for 4 to 8 people. If you are a family of three living in a two bedroom apartment or larger with more than one bathroom, life is pretty comfortable.

There is no reason why you shouldn't continue living like a college student until you can save at least 30% of your income. Housing continues to be the greatest expense most people face.

The more humble the place you live in, the more motivated you are to go outside and network and make more money. Here is my housing expense guideline for financial freedom.

Even after I got a raise and promotion at a new firm in San Francisco two years later, I decided to share a two-bedroom apartment with two other people. My rent in San Francisco was only $800, or $120 less a month than my rent in Manhattan. By keeping my living expenses low, I was able to boost my saving rate by another 10%+.

See: Lean FIRE

2) Work so much you don't have time to spend money.

Your 20s are for learning, your 30s and older are for earning. There is so much to soak in that if you're working 40 hours a week or less before the age of 40, you're leaving a lot on the table. People everywhere around the world are outworking you because they are hungry to improve their quality of life.

Don't believe me? Go to any major city in a developing country and witness their work hours for yourself. Taiwan is already a developed country, and only in 2016 did they put into law to limit work days from six days a week (48 hours) to five days a week.

Yes, you will likely have to suffer more than the average worker in order to make more money. But you know that because you are rational. Decide to either suffer earlier or later.

3) Don't confuse yourself with someone else.

This is a common phenomenon I don't get. If you only work 40 hours a week, how can you compare your salary to someone working 60 hours a week? You can't. If you are 30 years old, how can you compare your net worth to someone who is 45 years old? Of course not.

If you work at a nonprofit, why are you comparing your income to someone working in the private sector? Nope. If you dropped out of college, it's not rational to compare yourself to someone with a graduate degree.

If you are a new Financial Samurai reader, you can't compare yourself to those who have been reading FS since 2009. It's not possible since long-time readers have been able to benefit tremendously from the bull market and reading so much about money.

The same thing goes for comparing yourself with someone who has been reading personal finance books for a decade when you've never read a personal finance book in your life. The voracious personal finance book reader is likely much wealthier.

If you must compare, then compare yourself to people with similar backgrounds. Just know that comparison tends to lead to misery. If you want to aspire, eliminate the jealousy and learn from others who are doing things differently.

4) Max out all pre-tax retirement accounts.

You will adjust to your lower gross income because you will find a way to make things work. We get in trouble when we decide our lifestyle expenses first, and then figure out how much we can save after.

If you max out your 401(k), then you'll always know that you're building at least that much for your retirement. You will mostly likely be a 401(k) millionaire by the time you reach 60.

Please also keep maxing out your Roth IRA or traditional IRA if possible. Then work to contribute another 20% to your taxable accounts as your income grows. In 10 years, I promise you will be happy you did.

5) Ask yourself what's wrong with making more?

Unless you are a terrible employee with low self-esteem and a severe disability, your earnings trajectory should be up and to the right along with inflation. With more experience and a stronger network, your income growth should continue.

If you can't make more from your job, find another job. Don't be stuck doing something that's not rewarding. If you can't make more by finding another job, freelance after work. The freelance industry is booming now. If you can't make more money freelancing after work, start your own online business.

If you can't start your own online business, be a rideshare driver. Don't be too proud to get your hands dirty. If you can't be a rideshare driver, be a Tasker. If you get shut out at the thousands of online gig jobs you can do, start coaching or tutoring.

We all have something we are good at. Maybe you can provide private sports or music lessons. Or perhaps you can do some freelance writing or editing. We've all taken music, sports, and English before.

Personally, I used to coach private tennis lessons. I still occasionally do private 1X1 personal finance consulting if there's a good fit. I also make money from my severance negotiate ebook as well as potentially royalties from a traditionally published book.

Don't think the only way to make money is through your day job. That is so pre-2000 thinking. Today, there is literally an endless amount of ways to make money thanks to the internet.

Keep Fighting For Financial Independence

Achieving financial freedom is tougher with a lower salary no doubt. But the good thing about having a modest income is that you have more upside! This is where having an abundance mindset really helps.

If you can control lifestyle inflation while continuing to save and invest, you'll do just fine. It's those who keep spending at the pace of their income increase that tend to get in trouble.

Instead of complaining about higher income folks achieving financial independence sooner than you, expend your energy trying to improve your own situation. Don't let your fixed mindset keep your income static forever. For things to change, you have to change!

Remember to focus on the percentages. Improving your percentages is what will help you achieve financial independence the most.

The amount of income opportunities out there are endless. Take advantage!

Achieve Financial Independence Through Real Estate

Real estate is my favorite way to achieving financial freedom. It is a tangible asset that is less volatile, provides utility, and generates income. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my favorite real estate crowdfunding platform, Fundrise. Fundrise manages over $3.3 billion in assets invested in the Sunbelt. I strongly believe in the long-term demographic trend of Americans moving to lower-cost areas of the country due to technology and work from home.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio.

Investing in a fund that focuses on Sunbelt single-family and multi-family homes takes advantage of this long-term trend. Valuations are cheaper, net rental yields are higher, and there is more upside compared to more expensive coastal cities.

I've personally invested $954,000 in heartland real estate since 2016. I plan to keep on building my sticky and defensive real estate portfolio for decades to come. During times of volatility in the stock market, real estate tends to significantly outperform. .

Helping You Achieve Financial Independence: Empower

Achieving financial independence takes discipline. Sign up for Empower, the web’s #1 free wealth management tool to get a clear overview of your investments. Not only will you see how your net worth is allocated, you can also get a better handle on your retirement cash flow needs and more.

The more you can stay on top of your finances, the better you can optimize your wealth. I used to use an Excel spreadsheet to track every line item each month, but now, Personal Capital will automatically track my wealth for me.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. If you would like an unfair competitive advantage in building wealth, pick up a hard copy of my instant WSJ bestseller, Buy This, Not That.

It truly is incredible how a strong mindset can make such a significant difference in so many aspects of life. Although I’m not a true athlete, I’ve seen this so often in sports. Athletes with a strong mental game beat out a physically better opponents with weaker mental games all the time.

Believing one can do something along with feeling worthy enough for a desired goal is so powerful. I’ve self sabotaged myself into failure so many times. At least I’ve come to recognize this most of the time and try to proactively reset my mindset for better results. There are still times when I don’t catch myself fast enough, but I’ve gotten better at it. Thanks for the reminder on the importance of a strong headspace!

Hi Sam,

Thanks for sharing the in depth breakdown of costs and savings for a modest income.

I think people just end up being too busy to spend time properly allocating money for savings. I think banking and institutions should be doing more to empower the working class.

I do see some startups trying to fill the gap. One of it is called digit(.io) that uses AI to set aside intelligent portions based on income and spending. Although there are some aspects about the company that I’m not quite thrilled about, I think this is the type of step banking institutions need to take.

-AJ

16 years ago, I was living in NYC on $45,000 a year. I spent $5,000 year in transit costs, with no commuting benefit from my employer. I had $1500 a month in rent, so $18,000 a year in rent. $200 a month was for school loans. The rest, plus about $5,000 a year more, went to living. I spent a lot of money living in NYC, and that means drinking and eating out. It was a lot of fun, and after 2 years, and then $10,000 in debt, I knew it was unsustainable.

Fortunately for me, I then got a job working a short walk from my apartment, so my transit costs went to $0. My rent did not change, but my income went up to $55,000 per year. I woke up then, and then started paying back my school loans. Sadly, I spent the income from selling my car. I spent an award from the Air Force for saving the service $500,000; of which they gave me $10,000. That was all gone, but I started over from $-15,000, and am far positive now. It’s tough to live like that in the City. You walk out of your apartment, and money just flies out of your pockets. It’s amazing.

Going back to many of your other points, though, I would not trade that money for anything in the world. That time for me, while expensive in many ways, filled me with memories that make it easier for me to be as frugal as I was after that. Also keep in mind, I was living on $20,000 a year for the 4 years preceding it while a LT in the Air Force. Military did not pay well in those days, and I doubt they do now. I saved nothing in those days, but I did learn to enjoy what I have.

Hello Sam,

Thanks for a great blog! I work for a company In NYC that offers 401k with no match but instead offers a pension plan( this is presented as a great benefit by HR but the perception is that the salaries are on the lower end because of this). I did not budget better and only recently enrolled in the 401k, whi has proven to be a great decision. I would like to know your opinion on such pension plans or if you have written about it. I wonder about this since I am considering a move but want to better understand the pension implications of such a move.

Thanks much for the post, Sam. I understand why some people might be upset. They click the headline of the article only to find out that 1) the subject of the article (you) did not achieve financial independence on a modest income (at least not on $40k in NYC); and 2) the budget is 17-18 years old.

All this said, I do think this is a helpful post. Dollar figures aside, it shows the activities you did and did not do to ensure you saved a healthy amount. You can use a higher or lower salary, do it in 2000 or 2018 dollars, but the lifestyle you had (or did not have) back when you were starting out will produce results no matter what. I think a lot of people fixate too much on the dollar side and not on the fundamental activities. If you try to Uber less to save money (focusing on dollars), you might find yourself giving in at times when it’s inconvenient to take the train. If instead you rediscover the awe of walking in NYC (focusing on the activity), you’ll find yourself walking through rain and snow and not even thinking about hailing a ride.

I live in NYC and my net cash expenses are about $30k/year (excluding taxes, of course). I know this is higher than the ~$18k/year on your budget even after adjusting for inflation, but I simply don’t go the same lengths you went. I live in a studio by myself, travel monthly to Miami and about four times a year to South America to see friends and family, and donate over 10% of my budget to charity. I could probably slash my expenses by a third if I removed some of these nice-to-haves. I’m 25 and make about ~$280k/year all-in, so my income is a little less relevant to this specific article, but I identify with the mindset and lifestyle.

Thanks for reading.

$280K/year is a great income! Wow, what do you do for a living at 25?

I wonder if folks realize that even $55K in today’s dollars still equates to only about $27K if you are living in a city like Austin, Texas.

Yes, people get hung up with the numbers. But what can I say but the truth. That’s what I got paid my first year, and that budget was as close to what I can remember. Sharing a studio for two years and eating free cafeteria after 7:30pm to save money on food and breakfast was real.

I work in private equity. The all-in figure includes some $40k in investment income. There are several folks at bigger funds with similar experience making twice what I make.

Inspiring story! Sometimes I think that life is really unfair as success always comes to those who are already capable and rags-to-riches stories are too rare and are just due to pure luck. I agree that we should accept who we are and try our best to improve our situations. Complaining instead of acting on it could result to nothing, right? The life of a modest income earner could be boring but we could find simple ways of making it more enjoyable.

Wow I can relate to this post since your savings and expense rate is similar to mine when I first started working. I find it so helpful to read others financial outlook and their story. But my starting salary wasn’t even $40,000. It was $25,000! Pretty much poverty wages, and for a design studio. (Sadly being a designer is a notoriously under paid profession) I lived with my family in our small apartment to this day to save money. Also ate cheap and opened a small side hustle to help increase my income but not by a lot. I’ll admit it was pretty miserable for the first couple of years lol.

I was born and raised in NYC so I knew how expensive it was already. My family was just blue collar folks/ immigrants. And I also went to FIT to persue design major. But I knew I didn’t want student loans after hearing how long my art teacher was still paying off her debt (she was in her forties!!) I didnt want that hanging over me when I graduated nor can my parents afford it. Luckily if you’re a resident in NYC, state tuition was $6000-$8000 per year in 2000. My parent were able to help me pay for college and I graduted debt free. I realized now how lucky I am, cause I didn’t realize the magnitude of student debt crisis at the time. I thought it was just commen sense.

Though I never got the full college experience or lived in a dorm. But looking at my bank account with over 200k saved I can dance a jig seeing I don’t have to worry about loans, and living like a broke college student for years helped accelerate my savings rate.

This is an interesting topic because it covers so many aspects. I think the summary is suck it up and work harder. Everyone can be wealthy if they choose but the road isn’t just going to jump out at you. The important thing was to create a budget. This was probably your best asset. Having free food was a nice bonus too. I look back to my college days and my path to where I am today. I ended up in the construction management field but didn’t start here. I enrolled in college as a history major thinking that I would be a teacher. Summers off and easy life I suppose. However half way through the first year of college in 2002 I found myself bored. While I love history I just started seeing the limits for my future. I would no doubt graduate and then find a small school somewhere and teach out my days. I started thinking of all the things in life that I wanted to do and tried to imagine how on a teachers salary. So halfway through my freshman year I decided to chart a new path. I told my parents I was going to switch to engineering which my college didn’t offer. So I elected to transfer to a community college for 2 years and pick up an associates degree in engineering. I did this while knocking out technical skills and prerequisite classes for engineering. After graduating I had offers for $30-50k (2005), however I decided to keep going for my Civil Engineering BS. So I switched to another school and got my civil degree. The first year of history major was about $15k total. The 2 years of community college was about $7k total. Then my engineering college (out of state) ran me about $23k/year. This doesn’t include living and board and food etc. all in all I left college with about $75k in loans. My first job provided a salary of $51k and a company matching 401k up to 6% also a matching ESOP match of 3%. I started to aggressively save and pay down the student loans from day one. I also had to buy a new car as my high school car died on month one of real life. So much for my plan of 300,000 miles. So add in a car loan of another $23k (didn’t know the 1/10th rule at the time). So month 2 I’m down $100k in loans. Still despite now living in DC (read expensive) I manage to push on. I can’t say that I followed the samurai way in the early days exactly but I pushed hard on loans. I took on roommates and house hacked my way through them. In 2017 I paid off all loans prior to buying a new house. All the while i busted my ass at work and took on extra assignments. I learned as much as I could in my 20’s and pushed for advancement. I put on several titles and raises. In the span of 2008 to 2014 I grew my base salary to over $150k. $101k increase in 8 years. Now with 2 kids, wife, house, and all the life that comes with it – I still aggressively save. Mistakes are learned along the way. I don’t live like a refugee and often think I should but you need to balance life and savings. I trade longer work years for memories in my 20’s and 30’s. But I still push to save save save. Max 401k, invest DCA until it hurts. Max HSA. Maintain an emergency fund. Try and focus on picking up side projects where possible and make as many home repairs on my own as possible. You can YOUTube everything these days. I think what I learned in my early career was to save as much as you can and even if you can’t Max 401k push more than you feel comfortable eventually you will Max. Also 40hour work weeks are not for successful people. Some get lucky but most need to earn their dinner. Stay focused on the future but remember to enjoy the journey. Good luck to all, no matter what hand you are dealt you need to play it out.

Nice job on this one. I like how you can put yourself back in the early-career mindset (which is hard to do). I’m amazing at how cheaply you lived in NYC!

Thanks for sharing your story Sam!! Really impressive that you knew the power of saving at an early age. I, on the other hand, didn’t really care a whole lot about saving throughout my 20s. And that really hurt me living in a expensive city like SF. I got into credit card debt and student loans and didn’t get out of it until my early 30s.

I think for living on a modest income in an expensive city, you have to prioritize your spending. You have to play to long game and know that limited in your expenses and thus live off that and invest your money into your retirement accounts, stash some for an emergency fund and try to fight off debt. You need to plan it out and hopefully you will execute it successfully by saving a lot.

Thanks Kris. It’s weird, b/c if I had a relaxing job out of college, I wouldn’t have been so motivated to save and invest aggressively.

As a teacher in the midwest, this article really resonates with me. I’ve never made a lot of money and yet my wife and I have managed to pay down all of our debt and now are working on knocking out the mortgage. We also continue to save/invest and have been cash flowing my grad degree and an adoption.

Many things are possible with the proper mindset and the willingness to eat s#*t for a while.

You adopted AND you are a teacher?! Clint, you are my hero. Seriously. God bless you.

I welcome you to share your story via a guest post one day.

Related: Adopting From Foster Care: Clearing Misconceptions About Foster Children

Wow!!! A guest post on Financial Samurai. It would be an honor. I think I’ll head over to that link you shared. Once I get some time to jot down my story I’ll email it to you. If you like it then feel free to share, if not that’s fine to:)

Thanks, again Sam. Btw I think you are pretty awesome. 5.0 ranked USTA…did the kids you coach even realize what an accomplishment that is!!!???

Great post Sam, I think many lower income households have prioritized things like internet, cable, cell phones and automobiles not realizing that these things are eating up between 10% and 25% of their incomes. I still spend more on these things than I would like, but I’m fully aware of the impact they have on my savings.

Thanks. And cars. Spending too much on a car is probably the #1 personal finance killer for most Americans.

See: The 1/10th Rule For Car Buying Everyone Must Follow

How do you spend so little on health insurance? It’s $500/month for me in Mississippi whether I use Obamacare or get private through BCBS. it’s insane. If you make $1200 a year the “Affordable” Care Act charges $500/month for a crappy insurance plan with a rarely accepted company in the network or if you have no income you can’t get insurance. An apartment is about $1200+ a month. And, it’s hard to find a job that pays more than 40k a year here if you can get that! Even with a graduate degree.

what? For real? That… is scary. Then what do people do?

In most part of the world with 40K$ you live like a king.

No real need to live in Manhattan (or London or Paris) and starve yourself (unless you really need to)

Step one for frugality and FIRE should always be living in a low cost area otherwise you are not frugal but just reach enough to afford that lifestyle

Love this article! At 53, my wife and I find ourselves often reflecting on the “good old days” when life was much “simpler.” We sometimes stress about money, when we clearly have an abundance of it, and then we catch ourselves. Having some means actually creates problems – just ask any lottery winner. This is in sharp contrast to how we started with zero – and those were just awesome days. Life was simple, we didn’t own anything to speak of, drove cheap cars, etc. Sure, we are doing very well now, and are grateful for it, but we always know that we could survive just fine with nothing. We realize this even more when we talk with our 14-year old daughter – she is very content and expensive things don’t tug at her. She really is living without any worries except to learn, grow, etc. That is why continuous learning is so imporant – it really gets to the meaning of life – that is where the fun and wonder is. The good life, in addition to good health, is often lived by just having a roof over your head, a comfortable pair of jeans, some friends and family, and a beater car that you don’t have to worry about dinging up. Health matters most above all else. Too often success causes us to forget that reality. They say that money, like alcohol, amplfies who you really are. If you are a happy and content person, you will be the same regardless of having $1 or $1M. If you are mean and cold-hearted, then money will make you more of that (think Scrooge!). Great article and awesome posts!

Well said! Thanks

You got it. Why can’t young people live like a college student for a while longer. If you’re not making much, then just keep the same student lifestyle. Most people ramp up their lifestyle too quickly when they make more money. You’ve got to prioritize saving first. I shared an apartment until I got married. I worked a ton of hours when I was young and dumb too…

I have been always been frugal and in many ways smart with my money, so reading your blog has been super fun for me in the past few days after I discovered it. I listened to the episode of Bigger Pockets Money where you shared your story.

My “dilemma” when it comes to FI and the extreme savings rate is the fact we have four kids and I stay home at the moment. I am not complaining or whining about it as it is our choice and I feel strongly about being home with them during their early years. I often think “man if we had two incomes, we could save so much”. My point being, I think you are so right, many people are too comfortable in their lives to make sacrifices to get long-term benefits for their hard work.

I know I will evenly go back to work and make a good salary with my nursing degree, so I have shifted my mindset a bit to think of this stage of my life as a stage in FI where I can choose to stay home (thanks to smart financial choices) and still save a large amount of my husband income’s as an engineer. Of course, compound interest etc are not in my favor when it comes to that but neither can you stop your kids growing up.

Four kids is a blessing. Seriously, I think many folks would give up FI to have one kid, let alone 4 kids. Congrats! Maybe they will give back financially and help support you guys when they are adults.

#5 screams at me. I had terrible self esteem and was just grateful to have a job that I missed career growth by not changing jobs. Now it’s too late to move.

Thanks, Sam for sharing your early start story in depth with the numbers. I’ve been a silent reader for a few months and finally decided to post here. I wanted to ask some follow-up questions, if you don’t mind? Because you worked in finance and dressing the part is important, what choices did you make in order to keep the clothing budget down to $600 for the year? Even though it was 1999/2000, spending just $600 on formal attire including clothes and shoes while working in the finance field seems low. Also, how did your clothing budget change as you got promoted through the years? Did you dress the part according to your title? Professional clothing can eat away at a budget if not managed properly, especially with the expectations to maintain images in certain fields such as finance. Appreciate any tips you can share on this topic.

I had a discount suite I bought in Taiwan during a summer job in college for $200. It was actually a sweet suite that i STILL have today made by Versace. There were always these discounts in Taipei on cool clothing for some reason. So I tried not to get too fat and stuck with the suite for a long time. Waist did get really snug.

I also bought a discount suit and socks from Century 21 downtown. It is a discount store. The suit was by Hugo Boss, and I still have the jacket, but not the pants b/c I wore a hole through the bottom lol. The suit was about $200 as well.

Key: STAY FIT! If you comb your hair, stay fit, and smile, that’s like 90% of looking good right there. Just don’t get a green or brown suit.

When I made more money, I would get tailor made blazers from Hong Kong for about $300-$400. They fit like a glove and chose the material. I’d match the blazers with khakis ($40-$60) or finer pants (up to $100). Again, if you can stay the same shape and size, clothing is easy and affordable.

Sam Dogen,

I just read the equivalent article at

https://www.marketwatch.com/story/tips-from-a-guy-who-managed-to-live-in-manhattan-on-a-40000-salary-and-still-max-out-his-401k-contributions-2018-11-12

They said:

Dogen has learned through living it. He “retired” at age 34 with about $2 million in after-tax investments producing about $80,000 in passive income.

Would you mind sharing how you did that on a $40,000 salary???? I am currently 60 and don’t have half that and I have been I think very frugal for many years!

Interesting it got picked up.

Sure, what happened was my salary increased, but my frugality stayed the same.

You can see my housing situation progression in this post: Housing Expense Guideline For Financial Freedom

This post also talks about my net worth path: The First Million Might Be The Easiest

I’ve basically invested almost all of my savings every single paycheck, every single bonus. I think of everybody aggressively save and invest the majority of their money for 15 or 20 years, they’ll be able to do very well financially as well.

This is great! Thanks for sharing your story and inspiring others to work hard and save. Starting early makes such a powerful difference whenit comes to saving and planning for the future. You surely made the most of the opportunities you had and didn’t let anything go to waste. Love your hustle and determination!

Sam i like how you redid this one, This part hits me the most, i was here at 20 and spent all my money and time having fun instead of investing in myself, now being a father at 39, i mean trying to find the road to financial freedom, is a long road but it is something it can be made.

“2) Work so much you don’t have time to spend money. Your 20s are for learning, your 30s and older are for earning. There is so much to soak in that if you’re working 40 hours a week or less before the age of 40, you’re leaving a lot on the table. People everywhere around the world are outworking you because they are hungry to improve their quality of life.”

keep up the good worked, i like also how you touch the Rich uncles article… looking in to that.

I went to school in Manhattan, and still live in Manhattan. I graduated in 2013 from one of the best fashion schools in the country, and know classmates that were offered $35K salary in that field. Yup, you read that right: $35K in 2013 for working in fashion (similar hours as your field except there is no such thing as a cafeteria in our buildings). I wasn’t offered much more, only $42.5K in 2014 (continued to bartend after college bc I had $600 in student loans each month and couldn’t accept a job with too low of pay). If I didn’t live with my boyfriend who paid 70% of the rent, I would not have been able to live in any part of the 5 boroughs without the possibility of putting my safety at severe risk. I remember crying multiple times a month because after $800 rent, $600+ student loans, $115 for subway, $60 for utilities, 401K which I contributed only 3% bc that’s what my company matched, groceries, clothes (hi, its fashion) I would have MAYBE about $100 left over for ‘fun’. In NYC, that’s not even enough to take my boyfriend out for dinner! Luckily things have changed for me for many reasons…but not many of my friends. I know people who have been out of college for 5+ years, have made MILLIONS upon millions for major fashion brands and still only get paid $60K.

My point is this: I would have been so happy to earn $40K back in 1999 in Manhattan. Like others said, thats $60K in today’s money. Again, people 5+ years out of college make that in my industry TODAY.

I don’t think this article is relevant anymore. I would love to read how someone makes $40K today, with student loans, gets no help from their parents, live in Manhattan AND saves.

Thanks for your feedback. I was hoping more folks could focus on the takeaways of the post, and not zero in on the $40K income as the barometer, and instead, focus on what a modest income is depending on location – perhaps $30K – $60. But I understand everybody’s interpretation of an article is different.

May I ask you some questions?

* How much did it cost to attend your fashion school a year, and over 4 years?

* When you went into fashion school, how much did earning an income play a part in learning fashion? e.g. did you know what the average salaries were upon graduating from your fashion school?

* The only four people I know who went to FIT in NYC were all from wealthy families because it cost so much to go to FIT and live in Manhattan. Money, to them, wasn’t a big priority. They just wanted to follow their passions without focusing on a return.

* What are some of the things you are doing outside of your day job to boost earnings etc?

I didn’t really have the option to go to an expensive private school because my family were just middle class earning government employees. I knew what they made, and paying private school tuition would be tough for them and for me.

I’d love to hear more detail about your story and profile your story too. I have one reader who says she makes $60K/year and almost out her 401(k). I’ll see if I can share her story in the future and how she manages her expenses.

Thanks,

Sam

Only my rich friends spent $100,000+ to get a fashion degree when I went to college between 2002/2006 as well.

If you are middle-class or poor, you study something that pays the most amount of money and hopefully you’re interested in it as well. You don’t have the luxury to be at English major, or a history major, and definitely not a fashion major!

What’s the full story Fashion101? It’s great to pursue your dreams and your passions, but in all of history, the middle class pursued jobs to survive.

Fashion degree graduate bemoaning a sub standard income. What did you expect? You lived your best years in college. Welcome to the graduate program – school of hard knocks.

Perhaps you should go back to your college program as a guest speaker and tell all those wide eyed, bushy tailed college kids to grow up and get a real degree. Unless they’re expecting to receive a handout from Bank of Dad/Mom/Spouse.

I get that you did what you can to save money, because for you that was a huge priority. FYI, NONE (yes, really) of my friends companies contribute anything to their 401K. A few do not have a 401K because their companies do not even have them set up. Instead they just put money in a savings account when they can. I worked for a unicorn of a company that did offer and match 3% 401K.

I went to FIT, I do not even remember exactly how much my tuition was, but somewhere around $12K a year, not including rent. FIT only guarantees out of state students to live in dorms freshman year. Following years you get put into a lottery and I did not get picked any years so I lived downtown in a loft with 5 (6 girls all together) other girls from FIT. Rent was $1200 that was paid for by my parents since I was still in school. (Part of this is being paid back by me, too).

My classmates and I always say we felt a little duped when we graduated. Many companies look specifically for Parson graduates (that is a private fashion school and yes, MANY are from wealthy families). We were told entry salaries were between 45-55K. In reality many people were getting offered 35-39K.

I personally bartended throughout college which allowed me to save some money. The supplies for my degree weren’t $100 books but rather $50 books + leather, fabrics, and other various pricey materials.

I guess just in reading through the comments, people seem to understand this as a recent/current scenario. I just looked at 45 Wall street and a studio today is $3346 according to Streeteasy. I understand you did a lot of things differently in order to max out your 401K savings each paycheck, but FOR ME it just wasn’t relatable. I don’t say this to discount or minimize your effort at all, because obviously did relate to others!

Ah, I think I remembered wrong about my rich friends all attending FIT. I think they were mostly or all at Parsons School Of Design Instead. A tennis doubles buddy’s daughter went there, and they are wealthy (he was an MD at GS for 8 years or so).

FIT for $12K a year sounds like good value actually compared to $47K at Parsons!

Hopefully you can help spread the word to other FIT students about the real world salaries post graduation. I think they would LOVE to hear from a graduate about life after FIT.

I oftentimes hear people bemoaning that they were “told” they could make X amount of $ by attending a particular school, usually by school personnel themselves. Now they feel duped when that salary doesn’t materialize. Excuse me, but the school personnel are salespeople, who only desire is to get you to put your money into their pockets. Perhaps if people spent some time on the Web actually researching salaries, which is quite easy to do, they wouldn’t be duped so easily.

My first love when I started school in the 1970s was history and I planned on being a teacher. After screwing around my first two years I decided to take a few years off working before going back. By then I realized I wanted to make $ (hard work does that to you) and I switched to a business degree, allowing me to have a successful career in IT sales. I didn’t depend upon others to tell me what I could make in a particular field; I looked myself during a time that the resources of today were not as readily available.

Bottom line – either get a degree in something marketable and lucrative, or resign yourself to getting a degree in “what you love” and making less.

Awesome motivation from this article Sam. To realize a measure of financial independence living in NYC on 40k is huge. What was nice about the budget is that it reflects balance. It’s not like this guy lived under a rock for years and only clipped coupons.

He took vacations, ate out and lived a modest life while building a financial future.

Very inspirational

Thanks for the insight. I believe it can be done. It’s just how you manage your money. I remember one of my older colleagues once told me…the organization can control what they pay you but they can’t control what you do with your money!

I seen your logo on BP right after reading this article. Will check it out later!

Edit: The Bigger Pockets Podcast Interview

40K in 2000 is more like 60K today.

The max contribution to 401K has grown faster than inflation by several thousand.

Knowing both these facts, you would not be able to max your 401K today if you did the same things.

Can we get a reader story using today’s dollars who is able to save a decent bit on a 60K budget? Or does that undermine your point (because 60K is too much)?

Saving (much) on a 40K salary today isn’t happening.

Sure, happy to do so. I actually have three readers who emailed in saying they earn between $55,000-$60,000 today and max out their 401(k). I’ll ask them to share their budget and write a post. Not only are they maxing out 401K, they also have a lot more in after tax savings than I did because they do not live in Manhattan. It’s pretty awesome.

I wonder if people know that the median income in America went nowhere from about 2000 until 2016. Check it out: https://www.financialsamurai.com/the-median-net-worth-of-us-households-over-time-has-gone-nowhere/

Even if you exclude income going nowhere for 16 years, and assumed a 2% annual raise, $40,000 in 2000 is about $56,000 today.

What’s your story and what are the things where are making it difficult for you? I love to share your numbers and situation as well. Sometimes people who are struggling just need to see examples of people who are able to make it through.

40K with 2% raises for 18 years is $57,316. How are you doing your math?

I made about 80K out of college (in the Northeast) and make 400K now (in the Valley). My family has a lot less wealth and I love sending them to this site to share a mindset with them. This post seems cognitively hard to digest.

Got it. I use 17 years bc there was no raise until 2001 and 2018 isn’t over yet. Maybe I should use 16 years compounding instead.

That’s great you made so much out of college. What year did you graduate and are you saying that you struggled to max out your 401(k) on $80,000 a year? What was your living situation like in your overall budget? I you would be a great example to go through On why it’s so hard to save even with a high salary.

I think people also need to realize that we went through a couple downturns since 2000 which resulted in many people losing their jobs, never making what they used to make, or not seeing raises for many many years. Where are you not working from 2000 to 2003? I know so many people who got crushed during the 2008 to 2010 financial crisis.

Check out: https://www.financialsamurai.com/scraping-by-on-500000-a-year-high-income-earners-struggling/

I’ve never saved less than 40% of my income. My commentary on this post has nothing to do with my own finances but empathy for others who make less than 40K and might be discouraged because they don’t grok the time value of money enough.

Got it. Congratulations to you and your success.

Empathy is good, but unfortunately, empathy doesn’t help as much as straight talk and action points. It’s like the woman in the Thousand Oaks tragic mass shooting who said she doesn’t want thoughts and prayers and wanted gun control.

As an empathetic person, I’d love for you to write a guest post sharing your empathy and suggested action points to help others. Let’s do it. Shoot me and e-mail and we can help others.

One of the funny things I’ve noticed is that people always say other people are suffering, or we need more empathy for others, yet the person saying this is not suffering and doing great. They’re also doing nothing to help other people.

Why is this?

Andy, are you talking to me? Because you know nothing about my life. I grew up with a single mother making < $20K and pay for her entire life now, as well as donate a sizable amount to others.

My point about having empathy for people on this post is to imagine someone making 40K and living in Manhattan today reading it. They may see they're far off from this budget and just give up. When the reality is, it's not possible to have this budget anymore because this was 18 years ago. Adjusting for inflation it's a lot easier to do, and also a lot less of an interesting story to save 15K (10K adjusted for inflation) when making 60K (40K adjusted for inflation).

I look forward to a post about a single person (or household) making 55-60K and managing to save a good chunk while living anywhere close to NYC. That'll be motivating and straight talk with action points that people can actually be guided by.

“saying razors” ? not familiar with this?

Don’t understand why guys come to your free blog with a chip on their shoulder. All these keyboard warriors out to eviscerate your blog. Gee whiz, the budget is what the budget is.

Kudos to you Sam for your grit, tenacity and entrepreneurial spirit. You would’ve succeeded anywhere because you had the right mental attitude. That’s my biggest takeaway from this blog entry as well as many others.

That was well said! Thanks Sam ! I appreciate everything you share with us!

“Seeing raises.” Voice dictation typo.

Anthony, Why do you have such a defeatist attitude? In the post, it talks about what the present value of $40,000 is today.

If you make $40,000 today, yes it’s gonna be hard to max out your for 1K at $18,500 for 2018. But maybe $10,500 like Sam did is possible. The budget is the budget.

I think you’ll find more happiness if you look at the bright side of things and adopt a positive can-do attitude. It makes me sad when you’ve already given up before even trying.

I look forward to your guest post.

Apparently I’m doing an incredibly poor job communicating. I’m not a defeatist at all. I haven’t given up on anything. I’m quite comfortable in my own skin and budget. I make $400K+/year. However, I watch people in my own family making far less than $40K in the NYC area. And, I do not feel it’d be appropriate to share this post with them because it’s simply not possible anymore. It’d be discouraging to someone who’s trying to see how far off they are to read something unattainable. It’s not inspirational or a motivation.

You remedy this by either adjusting the values for inflation (accurately not 40K=> 52K but more like 40K=>60K) or writing a story from the perspective of a budget of 55-60K today.

Anthony, don’t you know, Thou shalt not question Sam? Otherwise, his pets shall descend on you, much like those creepy winged monkeys in the Wizard of Oz.

Don’t worry, your comments make a very good point, which is that this was quite some time ago. Rents, consumer price index, incomes, etc have changed since then in a way that makes it somewhat dishonest to present the article in a light suggesting the same could be done today. In fact, it’s probably quite discouraging to people in similar situations (FI anytime soon on 40k/yr can look like a stretch in many parts of the world, not just Manhattan).

While I think we all agree on the lessons and points behind the story, I don’t really agree that anyone not doing the same now is simply “bitching and moaning about how unfair life is”. Things change and in the last 10-20 years, they have generally not made life easier for people earning in the lower ranges.

If you maxed out your 401k at 19000 or w.e it is now in 2019, would that not make your taxable income only 21k? I dont think the govt would take 10k from this. Therefore your numbers may not be as bad. I recall that when I made only 32k after college, I was taxed 8k and got back almost 3k in April.

Indeed! $19,000 in taxable income if you maxed out the 401(k) in 2019.

And given you have a $12,000 standard deduction, your taxable income is $7,000. We’re talking a 10% marginal federal income tax rate, or a $700 federal income tax bill.

Not bad!

I graduated in 1997, with a starting salary of $45k in a low cost of living area. Back then, I was saving $1,000 a month in investment accounts. I had no student loans and my parents turned over $18k they had leftover. I did stop for 4 years for my PhD, but there was no tuition and I got a small stipend. I’ve always been a big saver / investor. I guess I’m trying to figure out why I’m not on FIRE now, though I do enjoy my job and now have 3 young kids.

Quite impressive with your new found levels of frugality and the saving mindset. I’m in agreement on always being hungry to grow your income and not adjusting to your increased earnings when you do manage to augment it. By converting those extra hours when you’re young into more income and flat consumption, there’s a high probability of reaching financial independence at any income level.

You found clever ways to manage your expenses and knew your career would take off and quickly lead to higher returns. Having that certainty can make the short-term sacrifices seem easy and worthwhile as your savings grows.

Try to live with your parents as long as you possibly can, try to have a roommate as long as you possibly can and try to avoid having a car as long as you possibly can and get good at cooking! :-)

Great example, thanks for sharing, Sam! My son’s just started corporate work in London for roughly that salary. He’s set himself up very similarly, so this is possible in a HCOL area today: he rents 1 room in a flat share, an eight minute walk from work, maxes out employer match in the company’s dc pension scheme and is now looking at tax-advantaged options for after-tax investing. He’s 21, and I think if you’re lucky enough to be able to start your career that young and get the financial basics right, there’s quite a high probability that you’ll convert that ‘more’ in work effort and ‘less’ in consumption in more and better options later-on in life – and that’s a great return to aim for, I think.

You had no student loans, so that helped as well. With loans, thinking your retirement contributions would have dropped.

Thanks for bringing this up. Very true. One of my missions is to educate people on not spending a fortune on a college education. It makes no sense to spend tens of thousands of dollars a year on an education that is rapidly declining in value because the Internet offers everything for free.

Check out: Public Or Private School? It Depends On Your Fear And Guilt Tolerance

I didn’t have the courage to attend an expensive private school or did I have the smarts to get scholarships. My parents weren’t rich either, so I went to The College of William & Mary for $2,800/year in tuition.

Also see: Would You Accept $1,000,000 For The Privilege Of Going To Public School?

What’s your educational situation?

I had about $78k in student loans and $13k in a car when I graduated. Luckily now 3 years later I have about $11k left total and also managed to put away about $13k in retirement while I was at it making about 58K a year in Pittsburgh. After this is paid off I’m going to be maxing out all retirement funds and saving aggressively to get myself back on track. Wish I would have listened to my parents on the loans, but really they will only have put me 3 years behind.

Congratulations..

The College of William & Mary for $2,800/year in tuition ? Only 2800 – how did you pay such a low amount ?

Everybody back then who was in-state was allowed to pay in-state tuition. The discrimination is between out of state students.

https://www.wm.edu/offices/financialoperations/sa/tuition/historical-tuition-data/history/index.php

That is amazing Sam that you recognized the power of saving at such an early age. I am sure it was so easy to get caught up in the lifestyle when everyone around you in the financial district was living it up.

Incredible you were able to split a studio with someone. That certainly makes for close quarters but as you said this is common in other parts of the world.

What you sacrificed back then set you up for an amazing lifestyle now. Would be interesting to see how your colleagues measured (the ones that did succumb to the lifestyle in their 20s).

did you invest in mutual funds or single stocks?

Wow, that’s impressive. When we start new employees where I work (near DC) we start them at around $47,000 – $50,000k generally. Most of my coworkers think it’s impossible for them to get by but I know better. They just have to “live like a resident” as the White Coat Investor would say.

Yes in my state of IN I made about $20,000 a year, I declined to pay high rents and slashed costs any way I could, drove a sensible used car, and was taking medical and psych classes, and finishing an internship, and managed to save almost 10,000 over a period of two years.

Now I have started to balance my real estate risks with US and Foreign mutual funds(low cost). I am hoping that real estate’s low correlation with my mutual funds, not to mention being a solid rent-able asset, will give me a solidly diversified retirement investment, and of course, income now so I can eventually move to part time work.

My secret? Slash overhead like a fortune 500 company freaking out near the end of their fiscal quarter. Rent: too expensive. Food? MCD dollar menu for lunches($2 for total bill) and Top Ramen. Recreation? cheap land line internet. Cable? nope. Power savings? heat my sleeping area only, and keep everyhing else warm enough that the pipes don’t freeze. Before living in current dwelling saved on rent by living in a car…….In short I live like a miser today so I can have a future tomorrow, there is a reason Warren Buffet doesn’t drive around in a limousine.

My boss makes far more than I do(I make $9.75 after my raises from $8.50, he makes about $18 an hour, and with overtime he gets about a thousand dollars a week, and his wife makes about the same. He is just getting out of a bankruptcy, paying a high 1000 a month rent, has not contributed to his 401(k), has no IRA, is behind on his new credit cards, spends money on expensive furniture, is currently getting a $1000 advance from his boss to pay down his credit card debt, and goes to concerts. He also owns no real investment assets.

I make far less than my boss, it is with frugality that I manage to put away almost 50 percent of my income, and have almost no debts, interest, or rents to pay.

Often times its not how much you make but how well you spend it. At the age of 23 I am escaping the poverty level, and at the age of 30 I can begin soaking up passive income and half retire to a four day work week, and by age 35 I can probably move to a two day workweek, though I probably will just keep building my assets so that I can completely retire around 50.

Yep. I tell people I lived like a broke college student until yesterday to start saving. I went from saving $25 a month to saving $1100 per month. It took years to do this. It wasn’t luck, but hard work and sacrifice. I’ve learned that living on the cheap can make great things happen.

Thanks,

Miriam