You would think there would be no mortgage refinance fees in a no-cost refinance. However, there are plenty of mortgage refinance fees to be aware of! They just aren't apparent in the fee document.

Please remember nothing is ever free when it comes to a mortgage refinance. The costs are baked in somewhere because banks and lenders are for-profit companies.

In this article, I'll share with you all the mortgage refinance fees you actually don't have to pay if you do a no-cost refinance. Let me explain each one in detail based on a previous refinance of my primary residence. The reality is, the are mortgage refinances fees. They are just in the form of a higher interest rate.

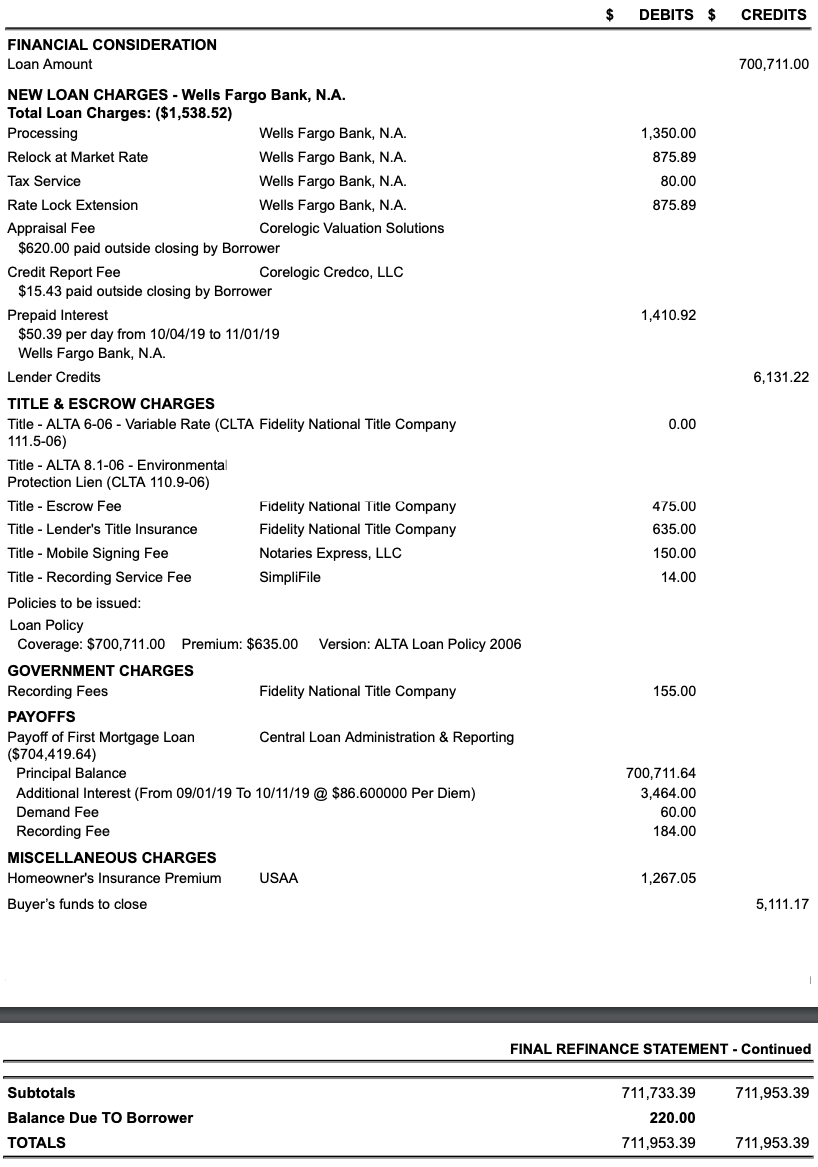

One of my rental property mortgages is a 7/1 ARM at 2.625%. The loan amount is $700,711 and the new monthly payment is $2,814.41. Not only did this mortgage refinance cost me nothing, I was paid a $220 credit.

The only downside to my mortgage refinance was that it took a little over four months to complete. It was a real PITA, but I'm happy to have got it done. Over the next seven years, my cash flow will increase by ~$91,000 and my interest expense will decline by ~$95,000 had I not refinanced.

Common Mortgage Refinance Fees In A No-Cost Refinance

Although my mortgage refinance was considered a “no-cost refinance,” there are still plenty of mortgage refinance fees the lender ends up paying at closing. These mortgage refinances fees are very similar to a regular-cost refinance.

Just know that if you go the “no-cost refinance” route, you end up paying a slightly higher mortgage rate or get less credits back because lenders have to make money too. In other words, instead of getting 2.625% for my 7/1 ARM, I may have been able to get 2.5% if I was willing to pay $5,000+ in fees.

But I like the no-cost refinance route because you're automatically saving money each month. If you decide to sell a property soon after refinancing, you won't feel like a dummy for paying those fees. With a no-cost refinance, there is simply no need to stress about holding the mortgage long enough to break even.

Let me share all the mortgage refinance fees using the final fee schedule of my $700,711 mortgage refinance as an example. Review the final refinance statement and I'll go through each fee one-by-one.

Mortgage Refinance Fee Statement

New Loan Charges For Mortgage Refinance Fees

New loan charges are also called loan origination charges. These are charges made by the lender you plan to refinance with. In this case, the lender is Wells Fargo.

Processing fee: This is an unavoidable fee to pay someone to process your loan.

Relock at Market Rate: This fee is a rate extension fee. When you refinance, you will initially lock on a certain rate. After a particular period of time is over, usually 45 – 60 days, if the loan is not completed by then, the lender will file an extension. Unfortunately, you end up paying the fee for the bank's own inefficiency.

Tax Service: A random tax included in the refinance.

Rate Lock Extension: Because my mortgage took four months and one week to complete, Wells Fargo had to file another rate lock extension. Lenders could take much longer to refinance than they initial guide.

Appraisal Fee: A lender usually hires an independent appraiser to verify the value of your home. A qualified applicant needs to have at least 20% equity in their home. Example: f you want to refinance $800,000, your house best be worth at least $1,000,000. Appraisal fees generally range from $600 – $800.

Credit Report Fee: This fee is sometimes not covered directly by the lender during a “no-cost refinance.” Pulling your credit is a must. As of 2022, the average credit score for a qualified mortgage applicant is a healthy 760.

Not A Refinance Fee

Prepaid Interest: Prepaid interest is not an extra expense. It is the mortgage interest expense you would have paid anyway had you not refinanced your mortgage. Given a refinance can take anywhere from 1 – 4 months, you need to pay the mortgage interest owed to the original lender before closing.

Title & Escrow Charges For Mortgage Refinance Fees

Every mortgage refinance goes through a title company to make sure everything is legitimate.

Title – Escrow Fee: The fee you pay your title company for opening up the escrow account. The title company keeps track of the various stages of the transaction, ensures both sides abide by the contract, holds the money, and releases the money once conditions are met.

Title – Lender's Title Insurance: The lender and ultimately you pay for title insurance. This type of insurance is to ensure that you get a clean title upon purchase and that there are no liens or other owners against your property.

Title – Mobile Signing Fee: Mobile notary who comes to your house, office, or wherever you want to meet to sign the final documents. The notary will take your thumb print and sign a book that verifies s/he saw you sign all the required documents. You will be sent a final refinance statement within a couple days of closing.

Title – Recording Service Fee: This fee is to record the official owner and lender in the city records.

Government Charges

Recording Fees – The government charges your title company a fee to have an official record of your homeownership and lender in the city records.

Payoffs

Payoff of First Mortgage – Principal Balance – This is the balance of the first mortgage you plan to refinance.

Additional Interest – This is the mortgage interest owed based off your first mortgage's interest rate. The additional interest is usually due to a mortgage rate extension. A mortgage is paid in arrears e.g. Feb 1 payment is for January mortgage.

Demand Fee – A random fee that has no purpose

Recording Fee – The borrower's portion of the city recording fee.

Miscellaneous Mortgage Refinance Fees

Homeowner's Insurance Premium – The refinancer must pay the full year's hownerhomer's insurance premium in order to successfully complete their refinance.

Lots Of Mortgage Refinance Fees!

As you can see from the final refinance statement, there are a lot of mortgage refinance fees, even in a no-cost refinance. The only fees that could possibly be reduced or eliminated are the Rate Lock Extension fee, the mobile signing fee, and the appraisal fee.

The Rate Lock Extension fee should not be born by the borrower if the bank's underwriting department is backed up. The Mobile Signing Fee can be eliminated if you go to the title company's office. Finally, you might be able to convince your lender to skip the appraisal if you've had one done with the past 6-12 months.

You'll notice on the Final Refinance Statement that there's a Lenders Credit of $6,131.22. That credit covers all my fees plus gives me a $220 balance due.

Still Have To Come Up With Cash To Refinance

You'll also notice a final credit at the very bottom for $5,111.17. That was actually a check I had to come up with at closing. In other words, even though I completed a “no-cost refinance,” I still had to come up with thousands of dollars.

How come? The $5,111.17 was necessary for the following reasons:

- Having to pay the entire year's homeowner's insurance premium of $1,267.05.

- Having to pay $3,844.12 in mortgage interest at 4.5% from 9/1/19 – 10/11/19. The statement says I only owed $3,464, which is why I have a $220 balance due.

Therefore, the $5,111.17 check I wrote is money I owed anyway. I had previously elected to pay my annual homeowner's insurance premium in monthly installments at no extra charge. But in order to refinance, the law requires the annual homeowner's insurance premium to be paid in full.

With money all paid up until 10/11/19, the next mortgage payment came due on 12/1/2019.

Avoid Big Financial Moves During The Refinance Period

During your refinance period, don't make any sudden and large financial changes. If you do, you run the risk of delaying your refinance as the lender requests more paperwork. Big financial moves during the refinance period may also ultimately lead to a rejection of your application.

Here are some big financial moves you should not make during the refinance period:

- Big purchases like a car or another property

- Big deposits or withdrawals

- Credit inquiries

- Experience a large change in your income

- Change jobs

- Lose your job

- Changes to your revocable trust

Expect every single financial move to be scrutinized during the normal refinance window. If you end up having to extend your rate lock, then you need to be extra careful.

With each extension, you have to send new bank statements and brokerage statements because they expire after two months. After sending new statements, you will often be asked to explain in writing a number of transactions.

For example, after the second rate extension, the mortgage lender asked me to explain 36 transactions that occurred in my checking account and savings account. That took a while!

These transactions included credits from my various real estate crowdfunding investments, capital calls for a couple private equity and venture debt funds, expense reimbursement checks, and more.

When To Refinance Your Mortgage

Despite the time it takes to refinance a mortgage nowadays, refinancing a mortgage to increase your cash flow and reduce your mortgage interest payment is great over the long run.

I recommend refinancing if you can save at least 0.25% on interest and break even within 12-18 months. If you go the no-cost refinance route like I did, then your breakeven is immediate, even if the interest rate is slightly higher.

If you're looking for some competitive mortgage rate, you can get free mortgage rate quotes online with Credible. Credible has a platform of multiple lenders that compete for your business. The more quotes you get, the more confidence you know you're getting the lowest rate possible, no matter the environment.

Diversify Your Investments Into Real Estate

In addition to refinancing your primary residence, you should get truly long real estate by buying more than one property. The combination of rising rents and rising capital values is a very powerful wealth-builder.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $954,000 with real estate crowdfunding platforms. Now, I'm earning over $100,000 a year in passive real estate income.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for all investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and primarily invests in the Sunbelt region where valuations are lower and yields are higher. The real estate company manages over $3.5 billion and has over 500,000 investors. For most people, investing in a diversified private fund is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

All The Mortgage Refinance Fees In A No-Cost Refinance is a FS original post. FS began in 2009 and is one of the largest personal finance sites in the world today.

Great article and discussion!

I think it’s worth pointing out that if you’re already many years into a mortgage, you’ll want to think twice about refinancing due to the way amortization works over the life of the loan. While your payment stays the same, the percentage that goes toward principal continuously increases over the life of the loan. So in that case, it’s really not as simple as a breakeven analysis and you really will need to look at those amortization tables unfortunately to compare how much principal will be paid off on your current loan payment vs the newly refinanced loan payments.

You’re right. A good goal is to just continue to pay the same amount you were paying before we financing, or pay down a chunk of principle to get your timetable back in line.

I would argue that the further you are into your mortgage, the more advantageous it is to refinance and reset your clock. You’ll end up wealthier by stretching the debt, as long as your investments can beat your interest rate over the life of your loan. With mortgage rates as low as they are right now, mortgage debt is very good debt.

So far, that certainly has been the case. Although there is a priceless and amazing feeling about paying off mortgage debt completely. I’ve never regretted it and I have paid off to Mortgages before.

If you don’t want to reset the amortization clock, you just keep paying the prior monthly. You’ll actually reduce the time to payoff compared to the prior mortgage.

So with the lower rate, say 1/4pt on a 1.2M mortgage, you’re spending on order of $400/month on interest that can either shorten the loan as I describe above, or give up ability to direct into a higher earning asset class.

Either way, if its a low or zero cost close, there’s not much downside. Just hassle.

Hi,

I just finished my BOA refi for $548K, 7/1 ARM Jumbo at 3.375% with $800 lender credit. (I am in dispute with them as I swore I had $2500 lender credit in some of the paperwork).

Question- I realize you got relationship credit but your rate still looks much lower than mine. Did you buy a point as well? Any comments on my rate package? I shopped hard to get this with a run off with Wells and I have perfect credit.

Started in Aug last year and they finished in Dec 7.

$800 lender credit only? Or no-cost + $800 credit back?

The bigger your loan, the more they can profit, and the more credits you may get. How big is your mortgage?

Honestly, I think 3.375% is not that good of a deal for a 7/1 ARM. However, if it’s free + credit and it is lower than your previous mortgage, you still win!

I am at a loss trying to understand why you are able to get that rate on a 7/1 arm. I followed your articles earlier and had 5 lenders compete through lending tree. This resulted in the 3.3% rate and 3.1% roughly if I did relationship to move assets. Even other readers in this post are quoting at best 3.1 % on the ARM. I had 1.2M property and a $540K loan with perfect credit. Is the $200k difference with your loan the difference? I am assuming all of this is no points for apples to apples. Why such a wide variety between what you get and others?

Without knowing your entire financial picture and your timing, I’m not sure. I was a ruthless negotiator who cancelled on one lender 2 months in b/c they didn’t honor their agreement, have a larger loan, and moved $1 million to another bank.

Did you move $1 million+ as well?

You should try Credible as well. I like them better than LendingTree because the lenders only get paid when you choose them versus lenders on LT who pay for leads, not final business.

I agree that this is a great time to refinance your mortgage. I was able to obtain a mortgage re-financing on my primary home that was 0.75% lower than the existing mortgage. Best of all, not only did the lender cover all re-financing costs, they threw in a few extra thousands. I walked away from the closing with the same principal outstanding, a lower interest rate, a lower monthly mortgage payment, and a check for thousands (including a smile on my face).

Not only is it a good time to refi. In my opinion, it is also a great time to borrow to invest in rental properties.

Who did you refinance with?

Bank of America

Congrats! A 0.75% lower interest rate is huge, especially if it was a no-cost refinance. It’s like found money, being able to refinance and save while your property appreciates.

I’m not so sure about now being the best time to borrow to invest in rental properties. It’s a case by case situation, and it’s less of a good time in the coasts where cap rates are low.

But the Midwest seems more interesting, despite lack of capital appreciation.

Several houses ago, I refinanced with my lender with no closing costs. With my current house, 5/1 ARM @ 3%, I have one year to go, so will have to consider options.

Question – if I can’t get a good rate, and my rate increase isn’t too bad, should I consider just paying a lump sum into the loan so my monthly payment status the same?

You should read this post: https://www.financialsamurai.com/how-much-can-an-adjustable-rate-mortgage-arm-go-up-after-the-fixed-period-is-over/

I faced the same dilemma. 3% is good. I’d inquire now what you can get, and if it’s not good enough then just wait until about 4 months before the reset date and aggressively look.

I don’t think rates will spike up next year.. but nobody knows the future.

Back to our discussion on ARM rates a month ago. So I’m at 3% now, and 5/1 ARM is set for a rate change in 13 months. I checked and the it would be calculated at 2.25% + LIBOR rate. No mention of any discount for good credit. I locked this loan on Dec 14, 2015, when the LIBOR rate was 1.11. Since 2.25 + 1.11 = 3.36, they must have discounted my rate by 0.25 and rounded down to 3.0.

Right now, it seems the LIBOR rate is 1.8. So that would mean 2.25 + 1.8 hopefully minus 0.25 = 3.75.

But that doesn’t make sense. Today, it seems like interest rates are lower than they were in Dec 2015. Wells Fargo’s Today’s Rates says 5/1 ARM is 2 7/8. Yet LIBOR rate is higher. So I’m a bit confused on this unless banks are offering a bigger discount at the beginning (which I don’t think they would since as you wrote on another article, banks want you to go for the 30 year).

Anyhows, I still have 13 months to think about it but just trying to understand this better.

How do you figure out if you will break even within 12-18 months?

Sure.

Cost to refinance divided by the monthly interest cost savings should equal less than 12-18 months.

e.g. $3,000 / $200 = 15. Not bad.

But if you can do a no-cost refi, it’s immediate savings from the first month.

great article! Being in mortgages for most of my 35 year career I most often ran amortization schedules to show what the old mortgage vs new mortgage would be in terms of savings and cost recovery time. Interestingly, I was able to tell people SAVE YOUR MONEY since their situation and timeline would have made it a waste of money to refinance.

Sure. Hopefully now readers are armed with more information to make a better choice.

I guess there’s no such thing a “Free Refinance”! Thanks for the breakdown, Sam. All of these complications are part of the reason I’m not pulling the trigger on a house, which I bet you’d encourage since I’m in the Midwest.

The loan industry as a whole is regulated by laws. Many of those fees can be traced back to a governmental regulation – these regulations are to minimize loan sharks.

Although each of the fee is regulated by law, the banker can set the fee at any amount as long as they can justified the “loan shark” level fee with the actual operating expenses.

Everything in the financial world is negotiable with leverage regardless regulation or not – money is the most effective tool.

The average U.S. mortgage debt per borrower for 2019 was between $200K and 300K.

You were able to close on the loan with “A No-Cost Refinance” because you have come with the “$700,711” leverage.

What is your thought on the chance of an average American pull off “A No-Cost Refinance” with a competitive rate?

Congrats on the refinance! It’s super helpful given that we are also thinking of refinance. I guess you took advantage of the assets under management program to lower down your rate :)

Anyway, great rate!

Yep, I took advantage of relationship pricing. At the time, it was a PITA and nerve-wracking b/c I just wanted to transfer over exactly $1M, and the market was going down at one point. But now that $1M has about a $70K buffer now, so I’m feeling good!

See: https://www.financialsamurai.com/the-difficulties-of-relationship-pricing-when-refinancing-a-mortgage/

You got a deal. My home is in SF. I just finished a refi. I didn’t cash out, but I did add a large HELOC at a reasonable rate. My two most recent refinances have required two appraisals, even though my LTV is under 50%.

What was your rate and duration?

5/1 2.75 jumbo I/O. I could have gotten and eighth lower, but I waited too long, thinking a Fed rate cut would drive rates lower. The opposite happened.

That’s a good rate. Can’t complain about that one.

Holy moly that’s a lot of fees! Good to understand what they’re all for and try to knock off the ones that aren’t always required like the appraisal fee if you’ve already had one done recently. It’s pretty crazy how long it can take to refinance these days, especially compared to before the financial crisis. Banks are incredibly nit picky and I feel like they tend to ask the same questions over and over again because they can’t keep track themselves of all the various due diligence checks they have to go through. Glad you were able to get yours done even though it took 4 months!

Do you know if you can use Credible for refinancing investment properties? (Single family homes specifically)

Yes, Credible offers Primary, Second Home, and Investment Property mortgages. They also do Student Loans and Personal Loans.

I’m excited to partner with them this year. They are offering a great service to borrowers.

Sam, I agree that explaining transactions is a pain. I always have multiple bank accounts and usually have the lender only look at the primary account which would fund the closing. Learnt that lesson during my last property purchase.

I just refinanced; and after asking the loan officer 5+ times what all the fees were, I still didn’t completely understand. I understand now.

This is a Top 5 post. Thank you.

Cool. Glad you can use this post as reference.

Demand Fee = “Because we can” Fee. *sigh*

Yeah, some of those fees are head scratchers. But, someone has gotta make some money. If we all win, then that’s good.

What’s your new principal balance? Are the fees just being capitalized?

Or is the new balance the same? $700,711?

I decided to refinance $700,711 with the plan to pay it off right before the ARM resets in 7 years.

Could you perhaps expand as to why the Lender provided you with a credit? From a prior article, you had to move assets to get that credit. Is there any other reason why a lender would provide a credit for thousands of dollars?

Sure. B/c the lender wanted my mortgage refinance business and wanted my asset management business.

The lender still makes money off my refinance b/c they earn a spread between what I’m paying (2.625%) and their cost of deposits or cost to lend (less than 2.625%).

Very good points. Just finished my refi with Citi. Took 134 days start to finish, got a 30 year fixed for 3.3% on a Jumbo, cost about 3k out of pocket, which most were prepaid interest. They had to extend our lock, at their cost.

Just completed a investment loan in heartland America on a 30 year fixed at 4%, no points, minimal closing costs, 25% down. Rates are great, take advantage of them!

Wow, 134 days is long! Citibank, my main bank, failed me. So I took my business elsewhere.

Here’s what happened: https://www.financialsamurai.com/how-to-fail-at-getting-the-lowest-mortgage-interest-rate-possible/

Funny- we had the reverse happen. Wells Fargo was my bank, and they failed me, so I flipped to Citi! I’m guessing it’s just who you get at the time and how busy they are. They have since followed up, not sure if they are more upset about missing the refi or the 300k I pulled from them?

Preface – I do closings for a living. I see most lenders who are doing repeat business with an existing client for a Refi cover their closing costs besides prepaids and escrow funds like this one.

Why did you go into an ARM when you could have locked in a similarly low fixed rate of around 3.5% that you can hold long term? I’m assuming a 15 year – I didn’t see your term since it wasn’t the actual closing disclosure. We’re about at the floor and from what I saw from my adjustable HELOC last year – rates can only go up which is a risk with this ARM of up to 9.625%. You’ll save money now, but the Fed raising rates would concern me. I’m sure you done plenty of analysis and will be monitoring for your rate for go above 3.5%, but that jumped out to me.

Also, most closings don’t include a mobile notary fee. Wells just pushed that onto you because they didn’t want to eat the signing service fee. Typically the signing fee is inclusive of the title fee.

Sure. 2.625% is less than 3.5%. Why pay more interest when you don’t have to?

Homeowners who took out 30-year fixed mortgages since the late 1980s have spent way more on interest than they needed to as rates have steadily declined since.

Good for banks and their profits, bad for consumers, who own their homes an average of 9 years. Mine is a 7/1 ARM.

My lender quoted me 3.675 on a 30 yr fixed and I am currently at 3.975. He quoted a 7/1 ARM at 3.175. Both no points.

I asked him about fees and be said “5k to 6k.”

I used a mortgage calculator and it looks like refinancing would only save ~$5k in interest over the life of the loan and increase cash flow by a couple hundred bucks.

Doesn’t seem worth it. Maybe I am missing someone. Any advice?

What’s the breakeven period? Ask what the rate would be for a no-cost refinance. If you have a huge loan, $5K-6K might be reasonable w/ a short breakeven. If you have a small loan, then it’s probably not worth it.

12-18 month break even period.

BE would be 10 months on the 30 yr fixed option if we paid down to an 80% LTV ($48k required) based a 2 year old appraisal. For some reason we don’t have PMI. Savings = $511 a month and $37k on interest (but I think that is mostly as a result of the $48k paydown).

We could continue paying the same amount after refinancing and just accelerate the mortgage payoff unless for some reason we needed that $500 – or we could put it in the market with our other savings.

One thing he said to me that I like is that for the 7/1 ARM I’d be saving $414 a month at an 85% LTV (where he thinks we are). That’d be $35k savings over seven years. He said I’d have to earn $50k to save $35k – which is a great way to think about it. So whether I invest or pay down mortgage, I came by that $35k more easily than by earning and saving because of taxes. I like that a lot.

I took advantage of the last years great rates due to one your posts last year. Only took a quick phone call to my mortgage broker and 30 days to go from a 3.75% 30 yr to 2.875% 15 yr. You are 100% right that the fees are ridiculous, but I estimated saving 75 K in interest, and knock 5 years off on paying off the house was worth $5,000 in fees. I am like you and highly recommend people take this opportunity to look at their mortgage and shop around!

Congrats! Feels so good to pay LESS to live over time, not more.

Very unlike tuition and healthcare costs.

I am a young professional and based on your real estate investment experience. Do you recommend people get a 30 year investor loan or do you usually get an ARM and then refinance again in the future?

I’ve always gotten an ARM. Here’s a good post to read:

https://www.financialsamurai.com/30-year-fixed-mortgage-loan-vs-adjustable-rate-mortgage-arm-the-choice-is-obvious/

I’ll write a follow up.