Although COVID has been bad for many of us in so many ways, the pandemic did one good thing. The pandemic helped protect American homebuyers from a resurgence in foreign real estate investors. In a big way, the pandemic has throttled the demand from foreign real estate investors to buy American homes.

Before the pandemic hit, 2020 was shaping up to be another solid year. There were growing talks that capital restrictions out of China would ease. Foreigners wanted U.S. assets, and they wanted them bad, partially thanks to a tremendous current account surplus.

Currently, mainland Chinese residents can convert up to US$50,000 per year on foreign currencies for travel, overseas study or work, but not for buying overseas property, securities or life insurance policies.

But before 2018, Chinese foreign buyers were buying United States property in droves. It was easier for citizens to pull resources to buy U.S. property. Then, the Chinese government started cracking down.

International Demand For U.S. Real Estate Is Increasing

Once lockdowns and travel restrictions were in place in the United States and many foreign countries, it became very difficult for foreigners to transact. As a result, COVID gave U.S. buyers the opportunity to buy up our own real estate with less competition. And as a result, Americans who bought homes are much richer today!

With the Ukrainian Russian war, a terrible Chinese economy, and war in the Middle East, the demand by foreigners to buy American real estate has now increased even further. International capital is now also looking for a safe haven in U.S. real estate.

One of the easiest ways both international and domestic investor can gain U.S. real estate exposure is through real estate ETFs like VNQ, or through private real estate funds like the ones offered by Fundrise.

The combination of increased international demand and declining mortgage rates will likely push U.S. real estate higher in 2024 and beyond.

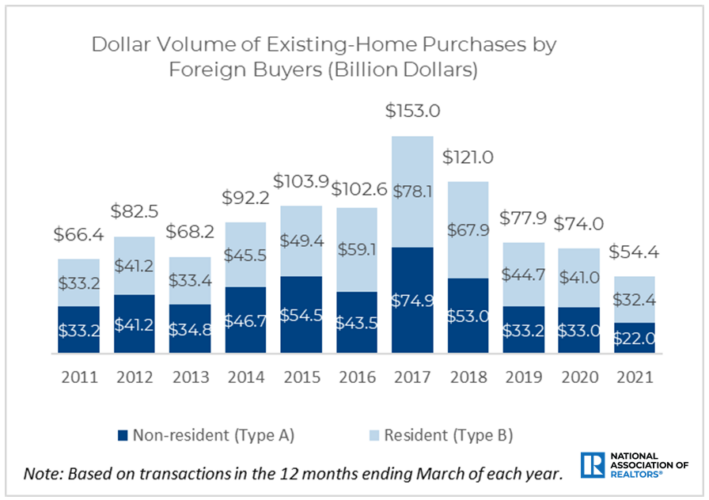

Dollar Volume Of Existing Home Purchases By Foreign Real Estate Investors

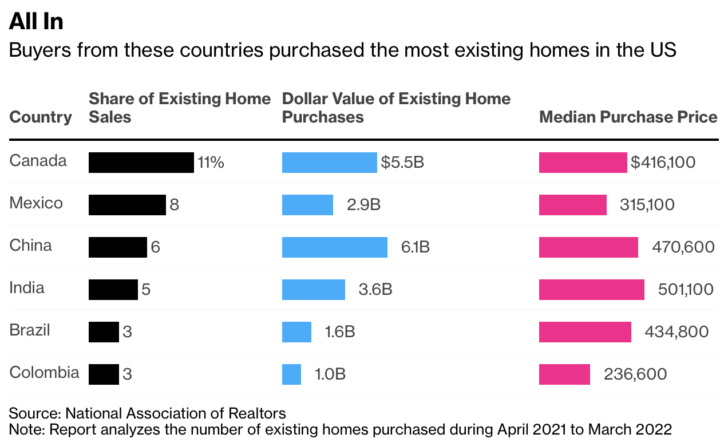

Below is an interesting chart from the National Association of Realtors that shows the dollar volume of existing-home purchases by foreign buyers. The dollar volume peaked in 2017 at $153 billion, and bottomed in 2021.

2017 so happened to be the year China’s authorities began capping overseas withdrawals using Chinese bank cards at Rmb100,000 per year in a move designed to prevent money laundering and terrorist financing, the foreign exchange regulator said.

China sought to limit foreign exchange purchases by its citizens in an effort to conserve forex reserves. The measure plugged one of the few remaining ways Chinese citizens were getting money out of the country by broadening the Rmb100,000 ($15,400) limit from a single account to a single individual. Previously, the annual limit of Rmb100,000 for overseas withdrawals was set for a single bank card.

But today, things are a little different. There is excess financial liquidity in the Chinese financial system. Further, China's strict capital controls are overly strengthening the Yuan currency, which hurts its exporters.

Therefore, Chinese authorities may be considering loosening rules on overseas investments to ease pressure on the Yuan and the country's exporters.

Pent-up Foreign Demand For U.S. Real Estate Is Building

I'm mainly talking about China because I'm on the west coast. Foreign real estate money from Asia generally buys up more west coast real estate. However, in reality, China only accounts for about 6% of the total foreign volume of U.S. real estate purchases.

The top-five foreign buyers of U.S. real estate include Canada, China, Mexico, India, and the United Kingdom. Together, these five countries account for 29% of the $54.4 billion dollar volume of foreign buyer residential purchases from April 2020 to March 2021. And pent-up demand for U.S. real estate from all these countries has been building.

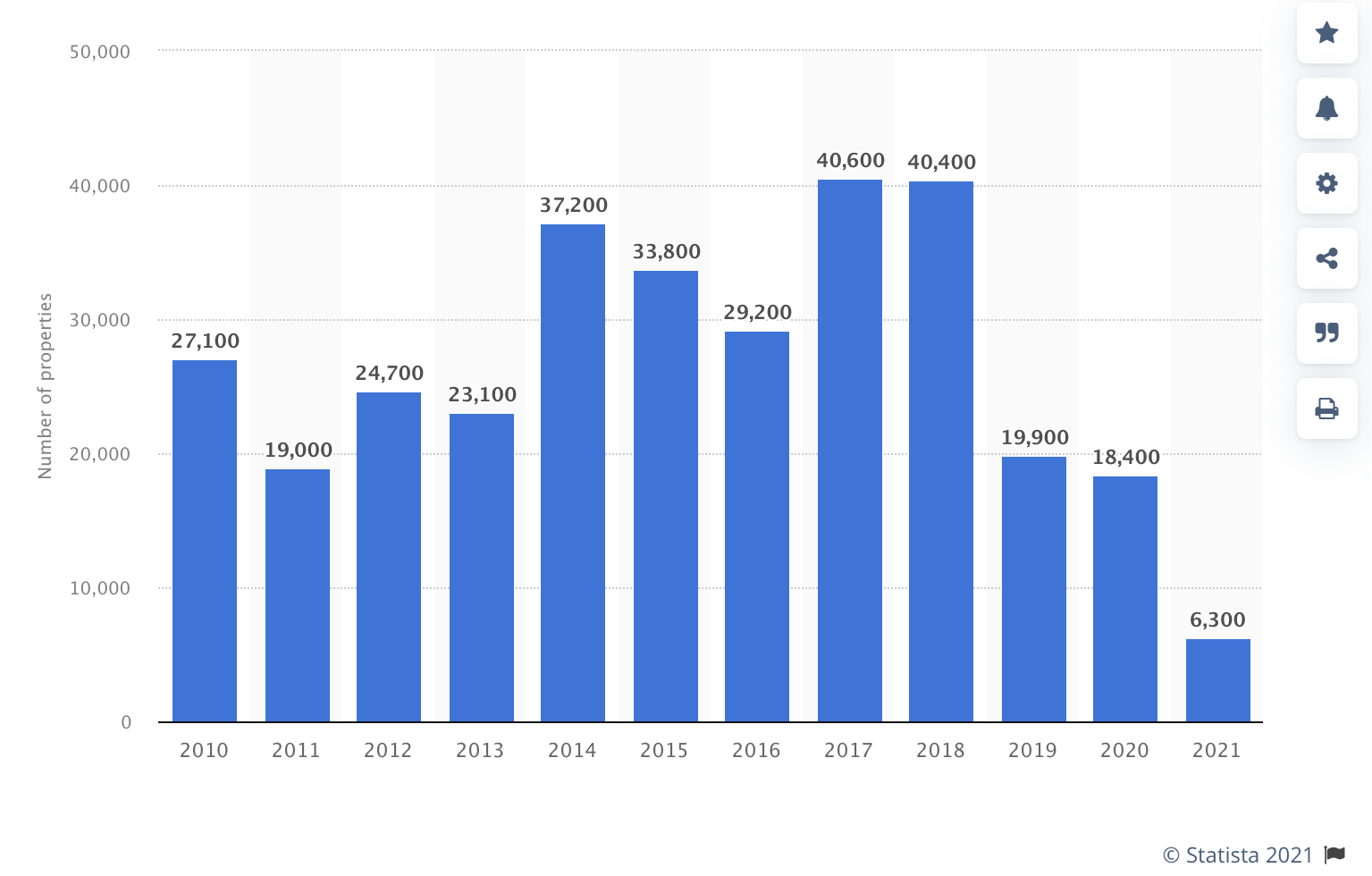

To get a better idea of how stricter capital controls and COVID impacted Chinese buying of U.S. real estate, take a look at the chart below. It shows the total number of residential properties bought by Chinese buyers in the U.S. from 2010 – 2021.

Once all the data is compiled, the 2021 count will likely be just 1/3rd of its 2017-2018 highs. If you look at the data from Canada, India, Mexico, and the UK, the drop-off in buying U.S. properties actually looks even steeper.

A Discussion On The Ground In Beijing

I recently talked to an old friend of mine in Beijing the other day. We had met in 1997 when I was an exchange student at Beijing Normal University. He agrees there is growing pent-up demand for capital to leave China. More people are getting fed up with the restrictions.

When the Chinese government started cracking down on companies like Alibaba, the desire for investors to diversify out of China increased. Further, once the China Evergrande debt debacle news started spooking the markets, the demand to buy foreign assets ticked up further.

The dream of foreigners sending their kids to the United States for a better education and a better life has not abated. Instead, it has only grown given how well the U.S. economy has performed during the pandemic. The S&P 500 is one of the top-performing indices in the world since 2020.

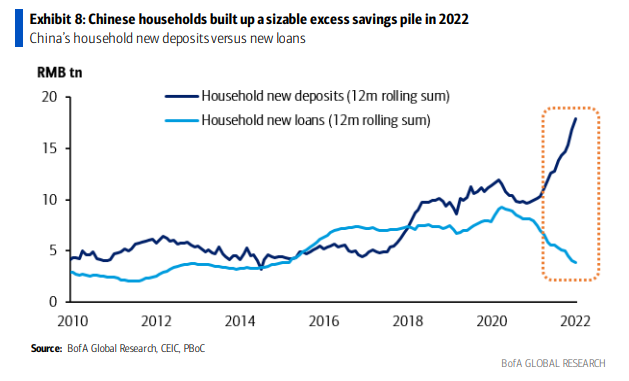

The Chinese Are Cashed Up And Ready To Buy

If capital controls are loosened in China, I see no reason why demand for U.S. residential properties by foreigners won't surpass their 2017 – 2018 highs. We're talking about pent-up demand for over 70,000 U.S. residential properties by Chinese foreign buyers alone from 2019, 2020, 2021, and 2022.

Take a look at how much cash mainland Chinese citizens have. One estimate says mainland Chinese households have over $150 billion in pent-up savings ready to be unleashed. We saw how Americans splurged aggressively in 2021 and 2022. China is just a couple years behind.

Millionaire Migration To More Free Countries

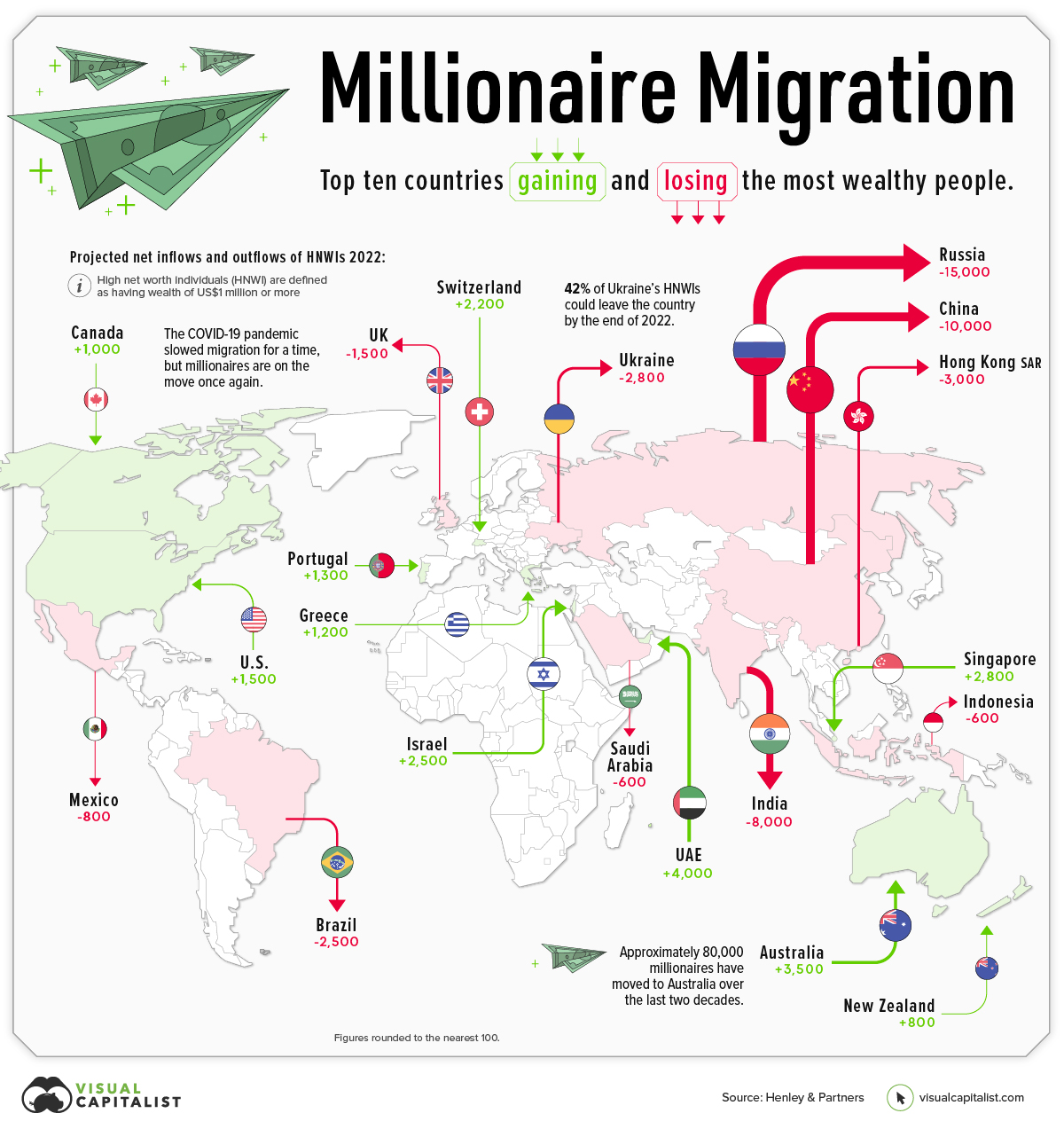

Even if you are a multi-millionaire or billionaire in China, life hasn't been so good during the pandemic. China's Zero COVID policy has created nightmare lockdown scenarios where residents aren't allowed to leave their houses for months.

Any wealthy rational Chinese person would want to get their capital out of the country for a better life. Now that the Chinese government has finally dropped the Zero COVID policy in 2023, there is a surge in interest in U.S. real estate from the Zillow of China's website according to cNBC.

Take a look at this millionaire migration chart that shows which countries are losing the most number of millionaires. You'll also see countries like the U.S., Canada, Portugal, Greece, Israel, Singapore, Australia, and New Zealand are gaining the most number of millionaires.

Logically speaking, countries with more freedoms and more access to vaccines are more desirable. Therefore, those with means are more willing and able to migrate.

How Much Pent-up Total Foreign Demand Is There For U.S. Housing?

Nobody really knows how much pent-up total foreign demand there is for U.S. real estate. However, we can make an educated guess.

If we average the total dollar volume of existing-home purchases by foreigners in 2017 and 2018, we get $132 billion per year. If we then subtract $132 billion by the actual dollar volume for 2019, 2020, and 2021, we get about $205 billion. Foreigner real estate buyer data for 2023 is not out yet, but it was likely at least $25 billion below trend.

Therefore, we can estimate there is about $230 billion in pent-up total foreign demand for existing U.S. homes. But the figure could be much higher since foreigners have also gotten wealthier over the past several years.

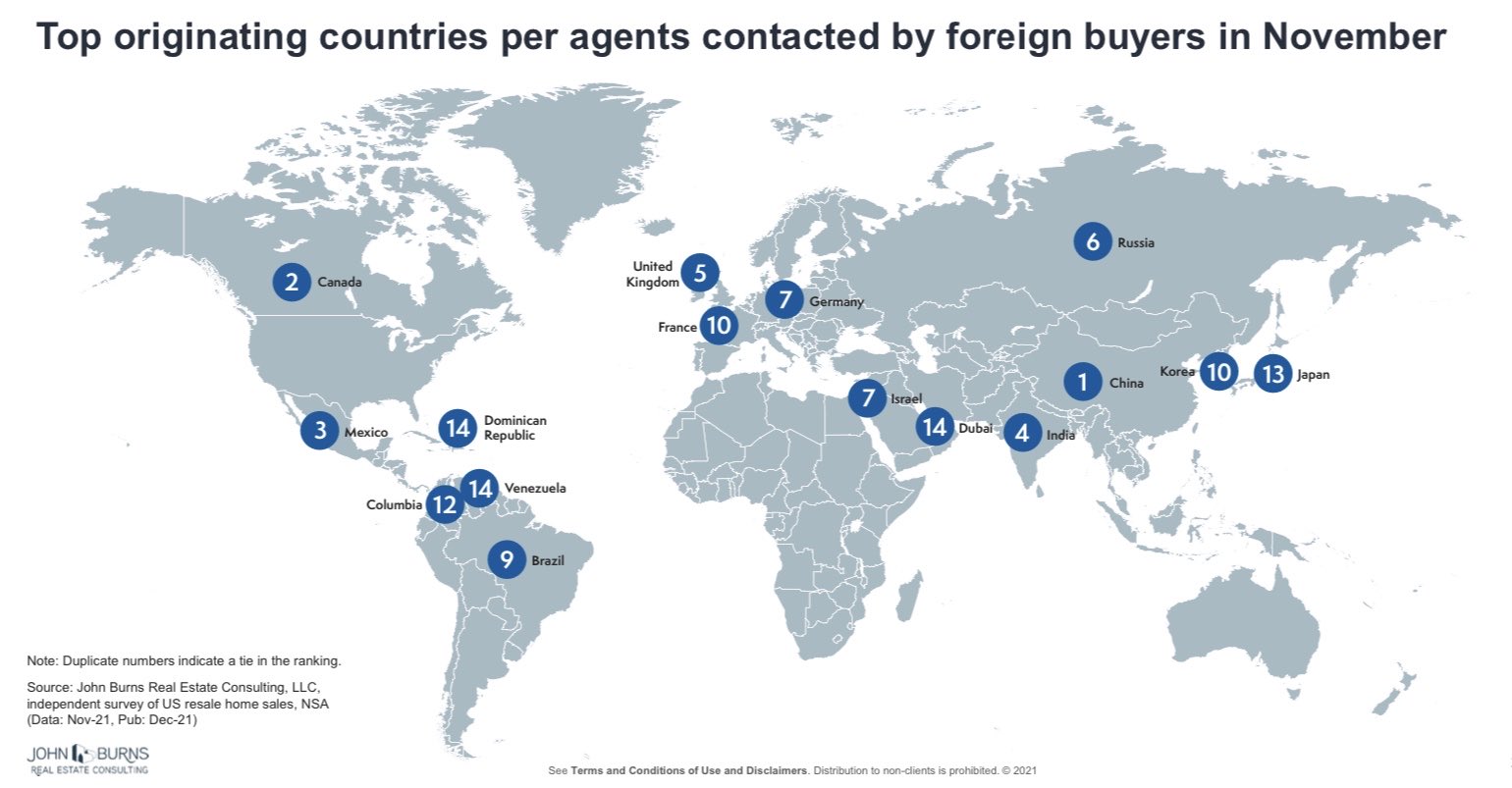

Check out this great graphic by John Burns Real Estate Consulting. It shows the top originating countries per agents contacted by foreign buyers in November 2021. As you can see, China, Canada, Mexico, India, and the UK are in the top 5. Indian buyers are seldom talked about. But they could be a huge source of foreign real estate demand in the future.

Foreign Real Estate Demand Is Even Hungrier Than Domestic

If you are an American who wants to buy an existing home, this $205 billion pent-up foreign demand figure should make you nervous. You think that competition from U.S. institutional real estate investors is currently fierce. At least we can all invest with U.S. institutional real estate investors to also profit.

However, with foreign real estate investors, it's really us versus them. Foreign real estate demand is so much hungrier than U.S. domestic demand. Not only does foreign money want to make a profit because it clearly sees how much cheaper U.S. real estate is compared to every other developed nation, foreign money is also seeking security.

The more foreigners fear capital confiscation back home, the more foreigners want to diversify their assets outside their respective countries. Despite our country's problems, America is one of the most fair and justice countries in the world. At the end of the day, we need to feel secure financially to feel rich.

Back in 2016, I distinctly remember trying to compete against foreign buyers for San Francisco real estate. It was not pleasant. One buyer bought a neighborhood home for $2.3 million in cash for his 21-year-old daughter. The daughter was going to the Academy of Arts.

She and her boyfriend drove around in matching Porsche 911 Turbos. They constantly woke up our baby boy from his midday naps in 2017 because they enjoyed gunning their engines. It was so damn annoying. Since 2018, the home has actually sat empty.

Foreign Real Estate Buyers Will First Affect The Coasts

The recovery of foreign demand for U.S. real estate will be a big deal. I expect dollar volume figures to rebound over the coming years. The shelter we've received from foreign investors thanks to the pandemic is waning. Cash-rich foreigners will be coming back.

If it ever gets as easy to buy United States real estate as it is to buy Canadian real estate, I expect U.S. home prices to rise by an additional 35%+ for this reason alone.

It is odd the Canadian government has encouraged foreigners to buy up Canadian real estate to extreme levels at the expense of its local citizens. Local jobs clearly can't afford some of the median home prices in some Canadian cities.

If foreign relations improve and/or if wealthy foreigners can do a better job of affecting foreign buying rules of U.S. real estate in their favor, U.S. real estate has tremendous upside. Therefore, if you are an American, you should probably buy your piece of America before a foreigner does.

And where is international money going to buy U.S. real estate first? The coasts because they are easier places to visit and do due diligence.

The Russians and Europeans will buy up U.S. East Coast real estate. Asians will buy up West Coast Real Estate, and likely San Francisco real estate. Canadians will tend to buy in the north and all over America.

Increase Foreign Demand For U.S. Real Estate Due To Geopolitical Unrest

Due to the unfortunate war in Ukraine by the Russians, there will likely be more investors from Russia and Eastern Europe looking to move money out of their country. The Russian stock market collapsed. Therefore, other citizens of countries without smooth-working democracies may also want to move their capital out.

The obvious destination is buying U.S. assets like real estate on the east coast. The war reminds the world about the importance of stable governments. In fact, right now is shaping up to be an ideal environment for real estate investors. Inflation is high, mortgage rates are coming, property prices are fading, and investors increasingly want to own stable assets.

Foreign real estate investors are coming, whether you like it or not. Instead of suffering, position yourself for the impending tsunami of capital.

Real Estate Investing Suggestion

Owning coastal city real estate to prepare for foreign real estate demand is a smart move. I suggest also strategically investing in fast-growing cities via real estate crowdfunding. It's a hands-off, passive way to participate in the real estate boom while providing diversification.

Take a look at my favorite real estate crowdfunding platform, Fundrise. Fundrise offers all investors to diversify into real estate through private funds that primarily invest in single family and multi-family properties in the Sunbelt.

Another private real estate platform to consider is CrowdStreet. Crowdstreet is a marketplace that mainly sources individual commercial real estate deals from various sponsors around the country. This way, you have more customization to build your own select private real estate portfolio.

However, you must diversify your portfolio and do your due diligence on all the sponsors. Look up their track record, their management, and whether they have had any blowups before. Although CrowdStreet screens the deals, you have to do your screening as well.

According to Census data, 10 of the nation’s 15 fastest growing cities are in the Sunbelt. Sunbelt cities have population growth averaging nearly 9.5% since 2010, compared with 1.8% and 3.0% in the Northeast and Midwest.

Foreigners Are Coming, Get Ahead Of Them

Even a CNBC report mentioned how Chinese buyers are aggressively looking to buy Texas real estate. This is a first I've ever heard of such savviness.

Fundrise has been around since 2012 with now over 500,000 investors and $3.5+ billion under management. For most people, investing in a diversified fund is the easiest way to gain real estate exposure.

Below is my private real estate investment dashboard where I've invested $954,000 since 2016. I've also received over $624,000 in distributions so far. Click the image to learn more.

For more nuanced personal finance content, join 55,000+ others and sign up for my free weekly newsletter. Foreign real estate investors are coming in 2024 and beyond.

I would like to learn more and find a foreign real-estate investor, I have a few major projects ranging for 600,000- 3,000,000 in NY and Florida Not sure if you could help

I am interested in Chinese buyers of real estate.

Sam, your doing a slight bit of exaggeration in this article.

The ~60% majority of these “foreigners” are what the realtors association classifies as “Type B” i.e. people with green cards or some other status that live in the USA 6+ months per year have kids that go to the same neighborhood school and behave the same as U.S. citizens.

Only ~40% are true off-shore “Type B” investors dumping capital into the USA, which granted is still alot.

Due to the capital restrictions you noted for China, my strong suspicion is that in California and New York, these are mostly Chinese-American doctors, engineers, lawyers, earning their money in san francisco or NYC, etc and buying up homes nearby. Likely similar for Indian-Americans in NJ as well. These two immigrant origin countries both have above U.S. median levels of wealth and so can easily own multiple homes and indians remain #1 in per capita household income. Mexicans in Texas are likely in a similar boat in that a majority of them probably are physically in the USA, I grew up with many white collar professionals kids whose family immigrated from Monterrey and Juarez when the drug wars started getting bad in the 90s and 2000s. These 3 groups also happen to be just the largest total share of green card applicants and holders in the USA so the data tracks.

In the link below from the realtors association, I couldn’t find the true breakdown for my hypothesis above for “Type A” foreign capital foreigners. My suspicion is that Florida, and Miami in particular is likely being used by Latin American upper class as a place to dump and shield assets. If I earned my money in Argentina, i would 100% be doing this as soon as I get each paycheck since I don’t trust my government. If China does loosen capital flight (which I don’t think will happen and its been pretty darn tight since 2015), I do expect a wave of investments in U.S. real estate though, most of their elite’s children still go to grad school here and its already easy to have family members move $10k in a suitcase in cash each semester when he visits your daughter to help pay their mortgage.

https://cdn.nar.realtor//sites/default/files/documents/2022-international-transactions-in-us-residential-real-estate-07-18-2022.pdf

And how much Caribbean property is owned by US residents ?

Just like Canadian, don’t buy what I want, but don’t stop me buying in other people’s backyard!!!

Never FOMO into buying a home.

I did exactly this in 2011 on the tail end of the housing crisis. Never say never.

I did so as well in 4Q2023. I found a forever home that I had an opportunity to buy for 14% less. It’s not a massive discount, but I couldn’t believe it.

I think the best time to own the nicest house you can afford is when your kids are at home.

And now, I’ve got to go back to work part time to afford it. But that’s life!

https://www.financialsamurai.com/no-longer-financially-independent-blew-up-my-passive-income/

ZIRP is coming to an end- and it going to get ugly. The Fed is making it very clear that there is inflation is a problem and that they are serious about getting it under control. People can make copes about foreign investors coming to the rescue of RE bag holders- but c’mon… now is absolutely a terrible time to buy a HOOM.

Also- normal people can’t afford to buy a house anymore. I wouldn’t dismiss the idea of a republican congress and a President DeSantis banning Chinese from laundering money here with HOOMs. Think double digit mortgage rates won’t happen? Taylor rule implies we’ll need to get Fed Funds rate to about 2% above the Fed’s inflation ta eh etc for long term equilibrium. Overweighting your portfolio towards RE may have paid off in the past, but as John Bogle said, “Winners rotate.” U3 is what- 3%? NAIRU is like 6%. Get ready for Volcker-style disinflation brah. JPow is a goy. Haven’t had one of those in a while lol.

As for people staying in their HOOM forever- I agree. People never get divorced, have kids, or die. BOOMERS certainly never die.

SF SFH are down to 2014 levels on Xillow (sic). Even lower when adjusted for inflation. You’re catching a falling knife loading up on HOOMs bro.

Love these comments from renters who missed the boat and always wishing doom. Yet, commenters like these are the ones who keep on losing.

You know the real estate market correction won’t be so bad when you have this type of commentary. Because it shows people still want to buy.

A 10% decline in real estate prices should be expected after such a strong run, especially since 2020.

Yeah Real Estate has already dropped 17% in my area from its peak in May 2022. The world has not ended and life goes on.

Interestingly real estate is cyclical and rises in spring and falls in winter, so this 17% drop coincided with the usual cyclic drop in winter. Will be interesting to see what happens this spring. Alot of buyers are pent up and are also begining to accept the reality of current interest rates. My best guess is real estate will be -15 to +8% by the end of 2023!

Great post. I was struck by two things regarding the Millionaire Migration chart and the absolute number of US properties bought by Chinese buyers. 1st: the Millionaire Migration chart clearly shows that Millionaires are moving to countries with freedom and peace. This is natural, but it shows how having entire countries run by the whims of aging egotistical authoritarian leaders without term limits (ie Russia and China) is just insane! Those leaders may have done some good initially building up those countries but have now grown old, senile, and hardheaded and have decided to run those countries into the ground and will damed if anyone tells them to do otherwise. The brain drain and entrepreneur loss that comes with Millionaire migration is devastating for long term growth. But I say, great! Those countries run by insane leaders deserve to wither away… Also surprising to me on that list is the large increase in millionaires to Australia, I guess people want space and land as well freedom.

2nd point on the absolute number of properties bought by Chinese buyers, I was struck by how low that number seemed 40,000 at peak and only 6,300 in 2021? I know these are estimates but seems relatively low. Regarding Canada I think you should update your post Sam because Canada recently banned foreign buyers from buying property for 2 years! Quite an interesting policy. Given the demand maybe we should institute a fee on high net worth foreign buyers of US property and funds could go to augment property tax revenues and prevent property tax increases?

Right, the two year ban on foreigners not being able to buy in Canada now is a major point. That should help deter some demand here instead. That was the first thought that came to mind when I saw that announced.

Are you a foreign real estate investor who wants to loose 20% of their principal in the next year? Buy U.S. real estate now! All foreigners are welcome.

How long you been renting? Keep it loose baby!

Housing prices barely dropped 20% in 2007-2009 when the cause of the great crisis WAS housing, when no one put money down and credit scores were horrible. Why would it drop just as much when 25% have been all cash, the rest have averaged 30% down, and credit scores have averaged 770 of those who took out a mortgage? A market here or there could drop that much but extremely unlikely they’ll drop nationwide by more than 5% this year IMO. And if mortgage rates continue to decline, I actually believe will increase in the 2H23.

Not to mention 95% of mortgage holders own 30-year fixed-rate mortgages, and 95% of mortgages have mortgage rates below 5%.

Golden handcuffs is owning a home with a sub 3% mortgage. Why would you ever sell at a discount? Just own it forever and rent it out.

But I’m still sticking to my -8% 2023 housing price forecast. There has to be some deflation after so much excess since 2020.

“Golden handcuffs is owning a home with a sub 3% mortgage. Why would you ever sell at a discount? Just own it forever and rent it out.”

When looking to upgrade and needing the equity for a down payment without the need to go beyond a tax advantaged 750K mortgage in a HCOL area. For example, hard to save up 750K – 1.25M for a 1.5M – 2M home for HENRYs (>400K income). Plus, can only write off 750K in mortgage interest across all properties, right? Minus, the property tax, is the income really worth it when factoring in the headache of being a landlord? Even the depreciation gets recaptured when deciding to (not) sell at a discount down the road, right?

Could you see a scenario where it would make sense to go beyond a 750K mortgage, up to say 1.5M if it allowed for keeping an existing home? Would seemingly be hard to justify paying that much mortgage interest that can’t be written off to generate say $3,500/mo in rental income.

I’m not selling my HCOL home, just keep collecting rental checks.

5 years +.

Would get more activity if US Government allowed unvaccinated Canadians across the border. I know 2 people in my city of 50,000 that would buy Arizona real estate.

Intersting point. I think that’s going to happen, the relaxing of COVID rules entering America for foreigners. You’re seeing that at the Australian Open now with Novak Djokovic being let in versus last year.

Interesting article Sam! You make a compelling case for why foreign buying might drive up real estate prices in America.

There is one aspect that has been left out though. Especially when comparing with recent years, it has a significant contribution to a proper assessment of future trends.

And they is… exchange rate. Over the past 12 months the dollar had been gaining strength against many currencies. That might dampen demand sufficiently, especially in USD terms, even if foreigners might feel incentivized to invest the same (all other things being equal) amount of their own currency.

Good point. Or, a strong dollar might attract even more foreign demand as foreigners. Believe a strong dollar will continue to get stronger, more sovereign, and more powerful overtime.

Rightly or wrongly, Capital tends to Chase good performance.

Conversely, the strong dollar prompted us to buy now affordable European property. Our luxury Italian condo cost less than our stateside cabin.

Very true. But because of the USD, demand for U.S. real estate by the global trumps U.S. demand for foreign real estate.

We already live in one of the best countries on earth with the most opportunity.

Sam,

Long time listener….There are other trends in the bay area that are going to be counter acting. Something that came with the pandemic – the time it took to get a greencard. Look at the current wait. Much of the demand for housing is driven by immigration in the tech sectors. Many H1-B candidates are giving up because the ability to get a green card is beyond their lifetime. Why buy a house if you can’t stay.

-Steve

Great counterpoint and something to dig deeper into. Do you know the percentage of total demand of U.S. housing from greencard / Hw-B candidates?

Sam,Its great that foreigners or any above average means person or persons can afford/scoop up speculative value property.What could possibly go wrong with that scenario?,love the mass exodus from CA btw.I was born and raised in Orange County .CA is an awesome place, just needs less people, and of course lower home values to attract the blue collar people that came there in droves from the 30’s to the ’70’s.Like my single parent grandmother of 3 (not counting the stillborn).

Theres no shortage of tech people…look at the layoffs.Just a whole lot of blue collar mechanics/operators/lineman/wireman/plumbers/pipefitters/laborors. etc.not being filled.

I enjoy most of your writings as you understand that sometimes you have to swim against the tide of society.And I resonate with that completely.

But you’re so out of touch(or at least in your writings) with the average person(meaning say mean average wages).

Get your hands dirty, make some callouses, how bout a bit of garden work under your nails.Fix

or maintain any small machine you might own.Do your own oil changes.Then pass that to your children.

Then you can tell me your a man…

Fascinating comment Dave. Not sure how you went from the topic of foreign real estate investors coming for U.S. property to the definition of manhood.

Did someone insult you recently or have you been reflecting on your life as a blue collar worker? If so, I say feel proud of the life that you’ve lived and the career that you accomplished! Don’t let anybody tell you that you are not a man for providing for your family.

Remember, just because someone’s reality is different from your reality doesn’t make their reality any less real. This is why interacting with different types of people, traveling, speaking multiple languages, and reading different points of view are important for more harmony.

Chin up David! You did the best that you could. And if you didn’t, you’ve always got today to try harder. Here is a regret minimization framework to help you move forward.

Sam,

thanks for the reply,and I apologize for being insulting. The obtuse point I was trying to make,is there needs to be a great re-set in home prices.Much as there needed to be a great re-set in interest rates.

Both are a plus for everyone with a long term big picture view.Not so good of course for anybody in either market who thought “buy high and sell higher”.

It’s already happening in treasuries, will it happen in R.E? Only time will tell.

As far as myself, no need to feel sorry, Ive done quite well in my trade, wish I found it a few years earlier after I quit commercial fishing in Alaska.

I cant speak for the rest of the country, but theres no reason you cant pull down low 6 figures at least here.

Your content and perspective are invaluable, but teach kids how and why to work!

Sounds good and will do. Maybe I have a blind spot that I’m not aware of, where I gave off the impression that I’m soft or not teaching my kids. I’ll ask around.

You’ll enjoy this post: https://www.financialsamurai.com/rich-spoiled-clueless-work-minimum-wage-job-at-least-twice/

David, I also sense your sadness of life gone by full of regret. If only the definition of being a man was so easy.

You may have missed out on building wealth for you and your family by overly focusing on oil changes instead of increasing your education and focusing leverage, but your children don’t have to.

I suggest teaching your children to leverage knowledge into wealth so they can one day be free and have other people change their oil. Your chance for happiness and freedom may be over, but that doesn’t mean theirs is.

If it’s not clear, this post’s message is to help American real estate investors think about the demand side of the real estate equation. There are plenty who are on the sidelines waiting to get a deal. But what’s not talked about is the potential demand from foreign investors now that the world is opening up.

Best of luck to you and I’m sorry life has been so hard.

“You may have missed out on building wealth for you and your family by overly focusing on oil changes instead of increasing your education and focusing leverage, but your children don’t have to.”

Yup – Too many folks try to be the jack of all trades and brag about all the small repairs they can fix and how much money they are “saving” are meanwhile stuck in terrible jobs, that if they had invested the same effort, could be making 250k+/yr in corp America, saving at a bare minimum 10% of that year. I decided at 28 y/o to go all in all finance for my time investment (except personal finance), and have gone from $60k/yr to $600k/yr+ (lumpy now with stock comp – could be $400k one year or $1m+ the next).

That is a very,very narrow definition of what a man is. Maybe the definition of blue-collar man, but blue-collar men don’t tend to do well financially. I grew up in a working class blue-collar household and knew I did not want to stay barely scraping by pay-check to paycheck and that my family would not have to either.

Sorry David for your loss and struggle. As a clinical psychologist, whenever a man discusses what it means to be a man on an unrelated topic, it has always signifies abuse and lack of love from parents and friends.

I think it’s good to be aware of one situation, as well as the potential influx of foreign capital.

Julie,

Tnx for the big fuzzy group hug.Makes me all misty eyed..

You and others are doing a good job of projecting something that not there.Or atleast i wasnt trying to imply.

Im doing fine,pretty much pulled off the near impossible in 15 yrs(well 2024).House is payed for,live well below my means,save most of the rest.Make time to enjoy this beautiful!

Perhaps re read my post,not sure how you and others got off the rails.

There are many ways to success and or hapiness/fulfillment.Theres a blogger for every flavor,and this one is one of the best imo.

As Sam stated more or less,everyone lives there own reality

What are you talking about? Your comment went off on a random tangent with no context. I don’t think you’ve read Sam’s work long enough to know that he does get his hands dirty plenty. He pulls weeds, fixes leaks, paints walls, etc.

Sam,

I appreciate your deep dive into the topic. Given the demographic problem that China is facing as a result of decades of their “one child policy” (which is likely to get much worse), it seems odd that they would ease up on restrictions now. Any thoughts?

Social unrest. The people were going to have a mass revolt if they weren’t set free.

Got it. Makes sense. Thank you

House prices and rents skyrocketed in Singapore thanks to all the rich Chinese escaping lockdowns. Their top destination would be the US if the US-China relationship didn’t experience a free fall that continues. Without a meaningful shift of the government policy, it’s hard to see massive Chinese buyers back to the US like prepandemic. Yes American people are friendly, but foreign buyers want to buy in someplace where they can freely go back and forth, do business and benefit from the education and healthcare resources. With the geopolitical tension growing instead of reducing, hard to see much change.

As of Indian buyers – India is the fastest growing economy in the world now. Money are going there for profit, not the other way around.

As of Russians – they are of much smaller pool as there isn’t a meaningful emerging (upper) middle class there like in China and India. The oligards are being targeted. So sorry, not a real threat either.

I think desirable US RE will hold its value while the inflated places will go back to where it should be. Foreign buyers’ influence will not be any threat to this trajectory.

Agree 100%.

“As of Indian buyers – India is the fastest growing economy in the world now. Money are going there for profit, not the other way around.”

Think about this – that’s exactly why Indians will begin buying more property here in the US. As India begins to develop a larger upper class, partly due to FDI, those newly wealthy Indians will begin to want to diversify their assets out of their own country.

I think the biggest issue with foreigners buying property is FX – the dollar has pulled back in the last 5 weeks or so pretty well, but was on a record tear for most of 2020-2021. For institutional money, not an issue but for a typical wealthy individual buyer, makes a big difference. I actually considered buying a place in Scotland to take advantage of the pound dropping to 1.05 briefly last year.

Sam – Are you still of the belief that June ‘23 through February ‘24 is the projected sweet spot for purchase or upgrade? V could an unexpected influx of foreign money change this projection?

Yes, I think this is a good date range to go looking for deals.

But plummeting mortgage rates and an influx of foreign buyers might accelerate the time from to buy in 1H2023. Just know there is ALWAYS a deal out there. Bargain hard.

Sam, I would be interested in your thoughts on how the impending water shortage will affect real estate prices in California, Arizona, Nevada, Utah, Colorado, etc.? Reports are out that we are going to have to cut Colorado River water use by 25-50% if we want to continue to generate power and have a reliable water source. California has proposed mitigation efforts, however, these are huge projects that will take 10+ years to implement. Other than cutting water output to farmland areas, there doesn’t appear to be any quick fixes, and relying on the states to come to any type of reduction agreement seems unlikely.

Good question! Water shortage is definitely a long term issue. But so far, the water shortage hasn’t negatively affected the mass population yet. I believe capitalism will help solve the problem somehow.

We also just had a massive amount of rain in California over the past 30 days. Here’s a post that you might be interested in about how climate change affect real estate prices. I will revisit it an update it with more thoughts.

https://www.financialsamurai.com/how-climate-change-may-affect-real-estate-values/

A great point to bring up Carmen. As a homeowner in the heartland as Sam calls it- we have never been more relieved to live here until now due to water issues! We live by the great lakes so water won’t be an issue for farmers, etc. We own property in Florida and we worry about hurricanes. My sister lives in AZ and they are worried about water. There are neighborhoods that have to truck in water and pay over $1000 per month! It’s only going to get worse. You don’t realize how important water is!!

Anyone else see the irony? The very countries and people that the Americans hate, (racist attacks against American-Chinese are through the roof), are the ones buying in America.

Are people attacking us? I think we need to differentiate between the government and the people. Everybody knows that America is one of the best countries in the world.

I know several Asian people that refuse to go into SF for fear of attack

Oh wow really? Where do they live? Must be tough to always live in fear.

Los Gatos, Saratoga, San Jose, Palo Alto, Los Altos – I could go on but you live in SF so are probably not aware of this phenomenon. Mostly elderly folks, many at my golf club. The external view of SF all the way down the Peninsula is very negative. I think we’re the only family I know that still goes there for dinner 1-2x / year. The potential for randon violence is a big deterrent although when we went for dinner in Dec it had been remarkably cleaned up from the prior year.

Gotcha. Living in fear must be difficult. I’m sorry this is happening to you and others. Hopefully everything will work out.

Keep the faith! And stay safe!

It’s never pleasant to hear negative opinions regarding safety about where one lives. That said the exodus from SF and negative press driven by homeless/crime/violence against AAPI should work to your advantage as prices have fallen farther faster there than anywhere else in the Bay Area, so your move up property should only get cheaper. Stay Safe (for real)!

That’s really funny. Based on 2-3 incidents that the media blows up. This is not an issue in SF. Of course, crime in general can be a concern in certain areas of any major city.

I know several white people who stay at home all day because they are afraid of getting hit by a car.

Nice insights.

That’s mentally ill people… weak minded people doing those attacks. It’s not some conspiracy hate-filled thing. It’s easily manipulated failures in our society that were pushing Asian people on subway tracks or knocking them out on the street.

The media actually broadcasting the attacks across the papers and airwaves just added fuel to the crazy fire of copycats. It’s really not a systemic real issue of actual organized hate…. Normal civilized people, who hold some prejudices, don’t act on them in such a violent way anymore unless pushed to the brink.

Was Huu Can Tran who just shot up a ballroom in Monterey, CA racist against his own race?

Please stop with the “americans hate” nonsense. Disenfranchised, angry, unstable, mentally ill people commit these crimes. Deep rooted hate is more based on fear of the unknown. You can’t extract that from the population at large. All you can do is keep better track of the potential crazy people and deny them access to weapons the best you can, while offering them better mental health services. Right now we are failing at that.

Really sad. Fewer and fewer Americans can buy homes…. but foreigners face no barriers to purchasing property here.

Yes, Sam, i know, it’s all about the financial opportunity! Except it’s not. There are things/ideas beyond $$$.

Just sayin’. :(

Foreigners do you have capital barriers. We should be thankful we were able to buy property with less foreign competition for almost 3 years.

Now we should be thankful we can buy property at a discount before the foreigners come in droves by the end of this year.

I totally remember pre pandemic how crazy open houses were with foreign buyers. They would arrive in mini vans full almost like sight seeing. It was nuts. And then that all disappeared. I haven’t been to many open houses recently so I don’t know what it’s like now but I can imagine things will get crazy again now that things are opening up.

I am very thankful the pandemic rattled real estate demand by foreigners. My neighborhood, corners started buying up about 20% of the properties, crowding us out.

Fascinating insights regarding search demand for U.S. properties going up in China!

I hope I can buy some property at the disco this year as well. Mortgage rates coming down is a good sign for affordability.

Very interesting perspectives from someone else in the Bay Area. I’m new to the area, but not to real estate growing up with my parents owning and operating small businesses for most of their life. The residential prices for real estate here are flat out insane–as an investment, even more insane. I could build a hotel in a good location elsewhere in the country and operate that for 5 years and have a much higher return on the investment. In fact, almost any well-run small business can have that type of a return. But it requires work–not at all unlike managing a bunch of rental properties, but your appreciation isn’t determined by some sort of market value, but by the goodwill you’re generating in the business. Just another perspective.

Hey Sam,

I have read several of your insightful posts. Thank you for sharing.

Living in SF, I am sort of paralyzed by oblivion of the opportunities in real estate to build passive income (it seems as though the high costs would impede any hope for cash flow or growth given the increase in real estate prices).

I’ve been holding on to more cash than I should – any ideas on markets or even areas around the Bay or CA (eg. Sacramento) for that mater that offer prospects of real estate passive income and growth – max property value should be $1M. Is a multi-unit better than a single family (obviously, I would need to rent it out to meet the PMI & taxes).

Or are there better avenues to build wealth – goal is freedom to live a simple life. Would be great to get a coffee if you’re up for it. Cheers!

Sam,

Why do you believe that, before Trudeau changed the rules, it was easier to buy Canadian real estate than US real estate? Here’s the excerpt from your post that I am referring to: “If it ever gets as easy to buy United States real estate as it is to buy Canadian real estate”

It was more of an observation regarding the completely out of whack home prices compared to median income in Canada versus the United States. I did not understand how the Canadian government could let foreigners buy so many homes, leave them empty, and make prices so unaffordable for local Canadians.

The reality is anyone may buy and own property in the United States, regardless of citizenship. There are no laws or restrictions that prevent an individual of any foreign citizenship from owning or buying a home in the U.S. But we don’t have an affordability problem as bad as Canada’s, yet.

Those who say RE is priced to high need to consider much of the so called appreciation was really just money printing. When you double the money supply, of course prices go up. In terms of interest rates, as long as the US government remains in debt, interest rates are capped at 3%

I think you are naive, and drastically under estimate the amount of offshore money involved in this. And when it gets to London, NYC, Des Moines, Calgary, it is no longer ‘foreign’, been washed white as… The US is now far and away the largest launderer, and US/Can is the destination for most of it (NZ and London can only absorb so much). It runs to trillions, and no way Biden of Delaware, or Trump of real estate scams, have any intent of having any intent. Would you buy Chinese real estate now? Do you really think Chinese oligarchs are too simple to figure out a way around purchaseable regulators? How about a nice condo development in Minsk? Almaty seem likely to preserve equity? I’ll take Alberta for 500mil, Alex.

Love the cynicism!

“Would you buy Chinese real estate now?”

No. Because we’re talking about foreigners buying up USA real estate, not the other way around.

You can short the U.S. housing market if you want to, but I wouldn’t!

I agree. I have been screaming about foreigners coming to buy US properties and that it should not be permitted.

It went down significantly, as a percentage, during the Trump administration.

I think it’s quite hypocritical and unethical to preach about affordable housing and a lack of inventory in this country while letting wealthy foreigners buy US properties.

Not that the Democratic party cares one bit about this issue.

Well apparently if you buy foreign real estate the country can easily take it back. Russian real estate in Italy is apparently being taken back from rich Russians. What’s to keep the US from taking back Chinese real estate from rich foreign Chinese if we go to war ever with them? That’s a steep and real risk!

I’m with you 100% on this John! Very hypocritical to preach about lack of supply and affordable housing when foreigners buy up houses, and some don’t even live in them full time!

I would support some sort of law/rule about not having houses empty long term to prevent ghost neighborhoods and provide local housing, but that will never happen. The local governments love it! They collect full RE taxes but no kids to educate, minimal services to provide, likely don’t vote, etc.

Does anyone remember the late 80’s when all the complaints were about the Japanese buying up all the real estate?

Now its the Chinese. Next it will be ????

Overall it is great that foreigners want to invest in America.

I think lot of these investors are small time and just trying to park assets out of country and into a stable environment.

There will be a lot of tax lien sales in the future….LOL

In the past, I used to bid on these and a good percent were always foreigners who just don’t pay the tax man.

Remember, you really own nothing. You just rent from the tax man.

I do remember. So the question is, will you let foreign investors punish your or will you take advantage of foreign investors why getting long before they do?

What have you ended up going?

Its so upsetting that the USA government allows this in times of a “housing crisis”. And don’t think that China doesn’t buy real estate in NYC, they in fact buy ALOT in nyc. My parents neighborhood alone has seen a huge influx in foreign investors in the last 20 years and they knock down our single family homes to house 20 people or 4 families in a “two family house”. Also, I read an article recently that new real estate went up in I think Texas and the next day, most of the homes that were built were bought up by Chinese investors! The government really needs to stop them especially when you have millions of homeless and millions more Americans looking for housing. This is a real huge problem. Not only that, it will start taking a toll on the nature we have here in America. We are literally building foreigners houses and knocking down our own nature to do so and nobody sees a huge problem with this in government? When the foreign investors move into the coasts then the American home buyer goes deeper into the usa to look to build more cities and house themselves. This country has lost all control.

I think the US knows they can just steal it all back if we go to war with the Chinese. That’s what appears to be happening with rich Russians who bought foreign real estate.

Having lived in Switzerland, I learned that for any job opening, if there is an candidate that is native Swiss they will beat out any candidate that is a foreigner. Similarly Switzerland massively restricts foreign ownership of real estate.

I did a quick Google search for other countries that do the same: Mexico, Hong Kong, Guernsey, Malaysia, Thailand, Australia, Philippines, Singapore, and Prince Edward Island.

Nothing is more quintessential American culture than the highest level of capitalism and may the richest individual anywhere buy a home in the U.S. if they so desire.

As a result of this phenomenon, there are a few residential neighborhoods here in San Francisco that look like ghost towns. I’ve jogged few a through and it’s eerie when all the houses on the block look completely and permanently unoccupied. Imagine paying all cash for a $2-5M home and then not even living in it or renting it.

Which neighborhoods are you referring to? I am unaware. Didn’t realize you live in SF! What do you do here?

I work in a high technology sector (remote since March 2020) and pondering moving toward bizdev / buy / sell / VC. Recently, I’ve spent a lot of time assessing and evaluating what I value most and what I see myself doing the next 5-10 years. Life is a journey, I suppose? :)

I’ve run through Monterey Heights and the surrounding neighborhoods and seen streets that seem to have several homes that look permanently and eerily unoccupied. It feels different compared to the mansions in Pacific Heights that seem to be unoccupied during stretches but then occupied by their owners (as they may have multiple residences). This is because I notice in Pac Heights that they still have various services including cleaning and security that frequently come in and out of many of the homes there.

Which neighborhood do you think has the highest % of foreign buyers and do they mostly occupy / rent the homes?

I live in Lower Pacific Heights and there are a lot of houses that seem to be unoccupied for a few years.

Uhhhh ohhhh what you heard about Switzerland giving preference to native employees over foreigners is not true at all. Some serious BS.

25.1% of the Swiss population do not own a Swiss passport and most of them make a very fine living in Switzerland.

This article is exactly why I text and email FS to all my friends. Dude is a freaking savant. A tennis and softball playing savant.

Much like George Constanza ( my spirit animal), my gut tells me it’s good that foreign money wants to buy domestic real estate. It’s desirable. But it drives prices up.

In the meantime we have purchased LUCID stock in ROTH IRAs and custodial ROTH IRAs. We are preparing to funnel money into fundrise accounts. Lastly we are looking at Crowdstreet. The rest of our money in equities we are letting ride.

LUCID has been very good so far. We are looking at a long term holding. If and when we derisk from

LUCID is is earmarked for fundrise and Crowdstreet long term.

Be water,

dunning freaking kruger

Good luck! Only time will tell whether foreigners will come rushing in. But based on my experience, it is inevitability IMO.

I generally try to financially insulate myself to the maximum extent possible from cryptocurrency and from China (to name two things I avoid as much as the global economy will permit).

I don’t see them as being worth the risk. I may miss some great opportunities, but experience has shown me that there are always others.

Keeping your wealth where the rule of law generally prevails is worth a lot more than a quick potential profit.

Well, If you believe the rule of law holds the best in the United States, then you can see how attractive US assets are to foreigners.

In south florida you have the Venezuelans (most are already here) , Brazillians, Russians, and a little from everywhere since Miami has that allure.

The condo market in south florida is crazy. The skylines of Miami and Ft. Lauderdale are almost unrecognizable today versus 15 years ago. The building of condo’s stretches for 30+ miles from south beach to Boca Raton along the beach.

“Miami-Dade County’s total home sales surged 142.4% year-over-year, from 4,766 to 11,553. Miami single-family home transactions rose 66.9%, from 2,688 to 4,486. Miami single-family homes have now posted year-over-year sales gains in eight of the last nine quarters, a span of two-plus years. Miami’s existing condo sales increased 240.1%, from 2,078 to 7,067. Miami single-family home median prices rose 31.6% year-over-year, from $380,000 to $500,000.”

From local RE Investment Group October newsletter

Jeff, lucky for us local that have been invested in south Florida real estate since 1988. Is about time that truth is out. We lived in paradise.

You might be right but I have doubts that Chinese investors could have the same influence here as in Canada. Actually, Chinese investors is a misnomer maybe as most of those people are corrupt party officials who came into easy money and contribute zero to the communities where they park their money.

First, Canada is the ideal ground for RE speculation. There is no capital gains if you live for some time in the house and CRA has turned a blind eye to Chinese investors for fears of racist bias as documented by Ian Young , Canadian journalist. Most investors in Canada own $5million dollar homes while declaring no income and even claiming government benefits.

Second, there is zero reporting required by Canadian banks, you can transfer millions, no questions asked. Canada is a paradise for money laundering.

Third, Canada gives easy 10 year tourist visas which is akin to getting permanent residence. I also don’t think it’s going too far in claiming that part of Canadian government structures , especially in BC are captured by Chinese money.

In the US it’s going to be harder in my opinion.

Big transaction are reported by banks to the financial crime unit and they do investigate.

It’s harder to transfer money. Plus, you would have to pay taxes on your worldwide income, it’s harder to own a 5 million dollar home here and declare no income like in Canada, IRS has a long arm and is no joke. Imagine Chinese millionaires declaring their worldwide income to Uncle Sam? They are the kind of people who don’t like paying taxes.

Then, getting residency in the US is much harder.

If you have money, you would have to invest I think about 1 million and create a certain amount of jobs for some years, quite complicated.

Then the most important, while Chinese investors pay cash, the money is usually borrowed in China.

My opinion is that with real estate about to go south in China, things will get dicey.

They might need to sell rather than buy more.

Plus, unless our government and the Fed have decided to let inflation rip and destroy the dollar and social fabric, interest rates might rise and that could spell the end of the RE mania.

I sold my house last month and I am renting now.

I have seen this movie before. But I could be wrong.

You don’t think U.S. politicians could be as swayed by money and influence as Canadian politicians? Money and power are extremely intoxicating. It really takes a special person to go into politics AND not be influenced by money.

The human condition is on the real estate investor’s side. Hence, I plan to just stay long.

If you have a family, how do they fell about selling and moving?

You obviously haven’t been to queens, ny in recent years. Come to visit, you will feel like you are in China. My parents neighborhood is unrecognizable anymore with all the foreign money that has poured into the neighborhood. And every single week, my parents have real estate people (Chinese real estate people) leaving notices on their doorstep. Don’t think that “Chinese don’t have the purchasing power of canada” because they definitely do! Look into how much farmland the Chinese own too here in America. Even your wonderful Smithfield pork products are now in the hands of China. Amc? Not American anymore either! The Waldorf Astoria? Not American anymore either.

Your perspective and emphasis on Chinese residents without regard to whether they are US citizens warrants some concern regarding your motive. Hopefully it is not racial. My US citizen Asian wife was recently screamed at and told by a fellow Costco customer to “go back to China where you belong!”. We were sickened by the hateful racially motivated experience. Hence I raise the question regarding your motive…. BTW Americans have long been buying real estate in Europe and Mexico.

Hi Sam !

Some potential foreigner here in Canada (me!). But actually, I’m not looking to buy a property in the USA.

I think you are wrong at looking at foreign buying for real estate price increase. There may be some of it, but I think it’s a relatively small portion of the buyers.

The real problem, in my opinion, is interest rates. Rates are near zero actually. That’s true that 30-years mortgage are closer to 3%, but it’s possible to get a variable rate for around 1% right now. So it essentially mean you can borrow capital for free.

It’s not an option I would take for myself, but when it comes to bidding up price, we have to remember that it’s always the highest bidder that gets the house. That mean those who are ready to take the more risk, like undertaking a variable-rate mortgage, are likely to buy real estate. As prices go up, their gain becomes even higher and this become a self-reinforcing loop.

I’ve heard many stories in Canada of people buying 10 houses or more in recent years. As long as rates go down and rents go up, they are fine. Whether they will still be fine if rates go up is another story. And the question of whether rates will go up again one day could be another separate discussion…

But my point here is that interest rates are to blame here. I don’t think foreign buyers are a problem at all. They are just the perfect scapegoats for politicians to deflect blame on and distract from their irresponsible monetary policies…

Hope my point of view make sense and can be of any help !

Sounds good to me. What is your current real estate holdings now and your prediction on mortgage rates going forward?

I always think about the marginal buyer bc it is the marginal buyer that pays the price that dictates the market. And only a tiny portion of the total housing stock trades.

Just own my home. No investment property. I thought real estate was too expensive in Canada and that the stock market was a better opportunity to invest. I was right about the stock market, but wrong about Canadian real estate. It keeps going higher and higher !

My view on interest rates is Central Banks will try to raise them (Canada, April 2022; USA, late 2022). But eventually, that will trigger either a crash, a recession or a significant slowdown in the economy. Most likely the latter.

The threshold will be when variable rates (actually 0.25%) exceed the 10-year bonds (actually 1.6%). Pushing variable rates further (above 1.6% or whatever the rate is at that time) would eventually lead to a recession. Banks will prefer to keep cash at the Fed than issuing new mortgages and loans. So, Central Banks will have to back down and lower rates again to 0.25% and provide more stimulus for the economy.

I don’t think Fed funds rates (variable rates) can go higher than 2%. That would be my absolute maximum target. I’m pretty sure they will be at zero again by 2030.

That’s very far from now. Many things can happen since then and prove me wrong. But it’s basically the path rates have followed in Japan after 1987 and in Europe after 2012.

I think USA/Canada is next in this zero-rates trend…

From Calgary, Alberta where I’ve also lived in Vancouver BC for over 8 yrs. I was jockeying between Vancouver and here in last 11 years.

I agree the low interest rates on mortgages, has contributed to home buying Vancouver. Vancouver has a vacancy home tax rate now. I can’t remember the penalty…not living there for past 6 months or something. PLEASE remember Canadians buy up property too in B.C. …as someone knowing employees owning vacation/2nd property in B.C. While yes, some wealthy mainland Chinese like Vancouver/Canada for its clean air, rule to law, food /health security there are also CAnadians who invest in real estate. By the way, Toronto and around that city is also a magnet.

Being a province hit by struggling oil and gas economy, our real estate is alot cheaper than those 2 other big cities…so more Canadians and probably foreign investors. We are only 100 km. east of Banff National Park and Rocky Mtns.

And I think you are wrong! Even 20 years ago in queens, ny, foreign investors have gobbled up the housing market! And this was when rates were at about I think 6 percent to 8 percent. Foreign investors don’t care about the rates. Even in recent years, Canada has risen the rates on foreign investors looking to curb it and it did very little to help it. The problem is with American policies. In my opinion, I think a house should be kept on the market for an American to buy it and give it from 3-5 months for Americans to buy the house, then after 6 months of being on the market, then it should open up to foreign investors. I even cringe at American home investors as well buying up real estate when the homeless crisis is so ridiculously high and when Americans can’t even afford houses. It is proven that wealth is built by home ownership. You can’t have a wealthy nation of renters. It is no good. Also, renters don’t care about how their property looks either and if you are renting from a foreign investor, good luck with finding out who really owns that property. Want to sue the home owner for something? Good luck with that one too!

See my comment on “type A” vs “type B” foreigners defined by the realtors board, majority of real estate sold to “foreigners” are sold to people with green cards or legal visas that live and work in the communities they bought houses in.

I suspect in Queens in particular its mostly the type of chinese doctors, lawyers, restaurant owners etc. that actually live in queens, some of them may have even grown up there in flushing in the 1990s and 2000s and themselves are now priced out. Maybe some of them also buy 2nd or 3rd homes with money funneled from their uncle in China or Taiwan or something, but that’s no different than say another American who works in NYC buying a 2nd home in Florida with money from their rich uncle in Canada.

Sam,

I appreciate how you call balls and strikes as they truly are. While the press is saying the real estate market is overheated, you lay out ample evidence that we may still see even more appreciation.

If my Chinese classmates at my MBA were right, I believe smuggling money out of China if you’re wealthy is something of a national pastime. China just ousted the US for the top spot as far as global wealth, so it’ll be interesting to see how this plays out and how the US government reacts!

To be clear, I do believe U.S. property prices must slow down. However, the foreign real estate buyer is the X Factor NOBODY is talking about.

And if there really is $200B worth of pent up demand looking at buying real estate in the greatest country, then perhaps the party goes on for much longer than people expect.

Foreign buyers have been relatively quiet for 2-3 years. But I believe they will return.

I was looking for a home 967tree4. The real estate selling agent asked the other couples if they lived in Hawaii.

“No, we are visiting from China.”

This was Jan 2020.

Very few signs of life on beachfront houses on Kailua beach. And the signs are minimal- a light left on, a towel on a chair.

Less than 5 times have I seen anyone in a house on Kailua beach that you can view from the public beach.

I think the congress should pass a non citizen property tax surcharge of .5-1%. This would most likely reduce demand considerably from foreign investors. This may lower housing costs a bit for Americans do to lower demand. The government should work to help Americans have financial stability first and foremost. Vote for me :).

Would never work. They would have to pass legislation to require a foreign investor to live in the property for at least two years and pay income tax as well if it was to have any impact.

A property tax surcharge would just trickle down to the renter of the property. So if you want to have working Americans pay even higher rent, this would accomplish it.

Then when local governments get a taste of the surcharge they will see it as a “solution” to their terrible spending and pension decisions and decide everyone should pay it. Look at the history of how the income tax began in the US. Just 1 percent tax on the wealthiest was the pitch to get the common person to support the new tax. Now look at who pays most of the income taxes, it’s not the rich.

I’m a lot of areas local governments are already charging a property tax surcharge on everyone. They do this by calling them “special assessments” because the State “caps” the property tax percentage. They just call it something else and charge whatever extra tax on your property they want.

vacant owners already pay more than 1% in property taxes and that doesn’t dissuade them from buying 2M properties in SF. Appreciation is significantly higher, and the risk remains very low.

I AGREE 100% with this. I will be holding at least for 4 years. And just later see what really happened to the market.

I’m a foreign investor in US residential real estate through URF.AX. It invests in NYC and NJ. I bought in because it trades at a huge discount. It’s been selling off property in recent years trying to get its leverage down….

Long time reader first time commenting. Sam, did you read the article in the New York Times about the crazy real estate market in the US specifically in Austin. If you haven’t it’s called “Will real estate ever be normal again?”. I think it will add an additional perspective to your as always interesting viewpoints. Love so much about your site and your influence on my financial decisions. I use Personal Capital, I have invested in Fundrise and I am actively trying to build my passive income. Keep up all the great work you do. Looking forward to the book.

I was born and raised in China, but have been in the US for 10 years. Initially for school and then grew some roots here. Have to admit that we do have passions of owing land/houses due to scarcity of these in China. Although people talk about avoiding bias, but my recent behavior seems to be pretty consistent with how other people view about “Chinese Investment Philosophy”. I have been doubling S&P 500 return for a few years, but recently dumped some stocks to get a rental property. Money from the stock money seems “not real” to me even though I have been doing good there.

Are you talking about Chinese who don’t live in the US? Also there is no capital restriction in Hong Kong. My wife’s family is able to wire money to the US from HK without any restrictions.

I once had a Chinese owner as a next-door neighbor. I never saw the owner.

Great article and I agree that foreign buyers are coming for the US coastal cities! Any predictions on how this will spill over and impact heartland real estate?

The China buyers are also getting something of value that Americans no longer appreciate: birthright citizenship for children born on U.S. soil. Come visit, pregnant relatives!

Additionally, real estate is a great protection against the coming Inflation Typhoon. Kidding, it is already here! Never mind the Yuan, U.S. currency value is being destroyed. This is why all those scary articles about Blackrock Investments, purchasing unbuilt housing developments in bulk, were fashionable earlier in 2021. There is so much money sloshing around in Pension funds and Sovereign and Institutional entities, they have to put it somewhere to protect the purchasing power. “May you live in interesting times!”

Long live TINA! (There Is No Alternative)

We definitely take for granted being born I’ll be able to live in the United States, that’s for sure. It’s hard to know how good you have it until you live abroad.

Would consider following those above our pay grade. If companies are pulling out of China, that indicates restrictions will remain in place or even worsen. China is also headed toward a war footing in regards to Taiwan. Capital controls tend to increase during such periods.

On the west coast in Silicon Valley, foreign buyers were buying home unseen and we are taking $3-$6M range. Not sure if it’s gone done. The other thing I want to ask is in this data what is a company registered in US but owned by a foreigner or owned by us based family of foreigners buy the properties on their behalf. Wonder how much of that is happening that maybe hiding the foreign money that could be still moving into the country.

What years are you talking about?

Has your position changed on Alibaba since your last post where you picked up some stock? I am riding that pony with you (that is if your still in :)

I plan to hold for 2-3 years. Remind me then!

Oh God ! Some “paper handers” here …. Haha !

This is a permanent holding for me. Waiting for the first dividend declaration someday in the coming century …

Ah I didn’t now about the capital tightening that took place in China. That makes a lot of sense now because the amount of real estate Chinese investors were buying in SF was insane before. I remember going to open houses and there would almost always be a van full of foreigners that would show up to view the properties. And when asking the realtors about offer dates and interest they would often say there were expecting X number of overseas offers.

The country is also trying for a Zero COVID objective, which means stricter lockdowns. At this point, seems like we should all just get used to living with the virus.

The lack of freedom in China and the desire for more freedom is likely very high, especially those with capital to invest.

Hi Sam, first thank for all great articles Can you advise what is the best instrument to invest in USA properties if she/he can not afford to buy a house. I see that only REITs can be used for the moment but we know that they are volatile as stocks.

Besides publicly-traded REITs and real estate ETFs like VNQ, there are privately traded REITs with low minimums. For example, Fundrise, one of the largest real estate crowdfunding platforms, recently lowered its minimum investment to only $10. That’s pretty huge for the average retail investor who wants real estate exposure.

I want to allocate my capital to trends. And real estate is an obvious, positive long-term trend IMO.