Let's take a look at the latest mortgages by interest rate. By understanding the composition of mortgages, we're better able to understand how a rise in interest rates will affect the housing market and the consumer.

Since November 2018, the vast majority of homeowners with a mortgage have refinanced and taken advantage of lower rates. I've drummed this refinancing message since 2009.

In fact, 90%+ of mortgages in America carry an interest rate of less than 5%. Therefore, anybody who is worried about a housing market collapse due to higher mortgage rates shouldn't be. 40% of homeowners don't have a mortgage either.

Most existing homeowners don't care that mortgage interest rates are trending higher because their monthly mortgage payments remain unchanged.

Further, unless mortgage holders with mortgage rates over 5% are struggling financially, they likely also don't care either. For if they cared, they would have already refinanced to a much lower rate!

ARMs Are A Small Percentage Of Mortgages

Only about 5% of homeowners with mortgages have an adjustable-rate mortgage as we learned in a previous post. Therefore, this means that 95% of homeowners with 30-year fixed and 15-year fixed mortgages are also unaffected. Just know the percentage of mortgages with ARMs is increasing. The percentage is now closer to 10% given the rise in mortgage rates.

If you are an ARM holder, you might be a bit nervous. However, chances are good that by the time your introductory fixed-rate expires, mortgages rates will have come back down again. After all, we're in a 40+-year downward interest rate channel. Inflation is proving to be transitory after all.

Number Of Mortgages By Interest Rate

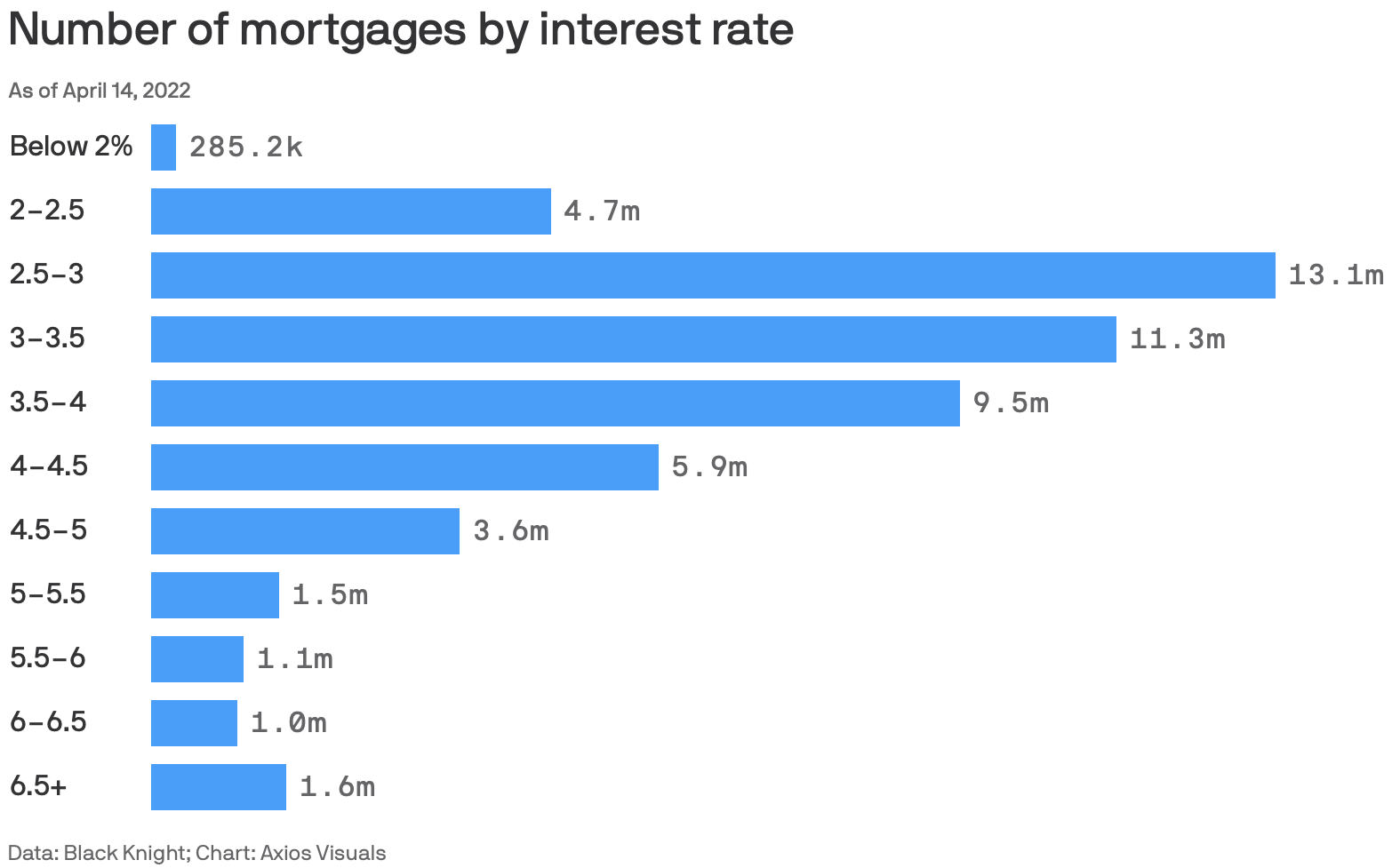

Here's a great chart by Black Knight and Axios Visuals highlighting the number of mortgages by interest rate. Notice how the vast majority of mortgage holders have mortgage rates below 4%.

The total number of mortgages in this chart is 53.585 million mortgages. Therefore, let me break down the percentage of mortgages at various interest rates.

Percentage Of Mortgages At Different Interest Rates

Seeing the percentages is more insightful than just seeing absolute numbers. So here are the percentages of mortgages at different mortgage interest rates.

Mortgage interest rate below 2%: 0.53%

Mortgage interest rate 2% – 2.5%: 8.8%

Mortgage interest rate 2.5% – 3%: 24.5%

Mortgage interest rate 3% – 3.5%: 21.1%

Mortgage interest rate 3.5% – 4%: 17.7%

Mortgage interest rate 4% – 4.5%: 11%

Mortgage interest rate 4.5% – 5%: 6.7%

Mortgage interest rate 5% – 5.5%: 2.8%

Mortgage interest rate 5.5% – 6%: 2%

Mortgage interest rate 6% – 6.5%: 1.9%

Mortgage interest rate 6.5%+: 2.9%

There is also a large percentage of the homeownership population that has no mortgage. The latest estimate is roughly 40% of Americans own their homes free and clear. They've discovered the triple benefit of paying off a mortgage early.

Mortgage Percentage Analysis

9.6% of all mortgage holders have a mortgage rate above 5%. The 4.8% of mortgage holders with over a 6% mortgage rate seem to be getting ripped off. The issue must either be bad credit or 30-year fixed-rate mortgages that were taken out 15+ years ago and were never refinanced because they couldn't or couldn't be bothered.

63.3% of mortgage holders have a mortgage interest rate of between 2.5% and 4%. This is the sweet spot where most Americans reside.

I'm thoroughly impressed by the 0.53% of American mortgage holders who have a mortgage rate of under 2%. I'd be even more impressed if most are 30-year fixed-rate mortgages, but I doubt it. Perhaps these mortgage holders paid points to get their mortgage rates so low.

I'm part of the 8.8% of mortgage holders who have a mortgage rate between 2% and 2.5%. Although my primary mortgage is a 7/1 ARM taken out in the late summer of 2020, there weren't any fees (baked into the rate).

I have no regrets taking out an ARM in a rising mortgage rate environment. By the time my ARM resets in 2027, I'm confident rats will be lower. If not, I will have paid off a lot of the mortgage by then.

Expect Homeownership Tenure To Increase With Rising Rates

Before mortgage rates began to rise in 4Q2021, the average homeownership tenure was already increasing. With an increase in mortgage rates, expect the average homeownership tenure to continue to increase as homeowners rationally decide to hold onto their low fixed-rate mortgages for longer.

The utilitarian value of a home has gone way up as more people are spending more time working from home since the pandemic began. Further, more people are recognizing the value of owning real estate for wealth creation, passive income, retirement income, and stability. As a result, more capital will invest in real estate over time.

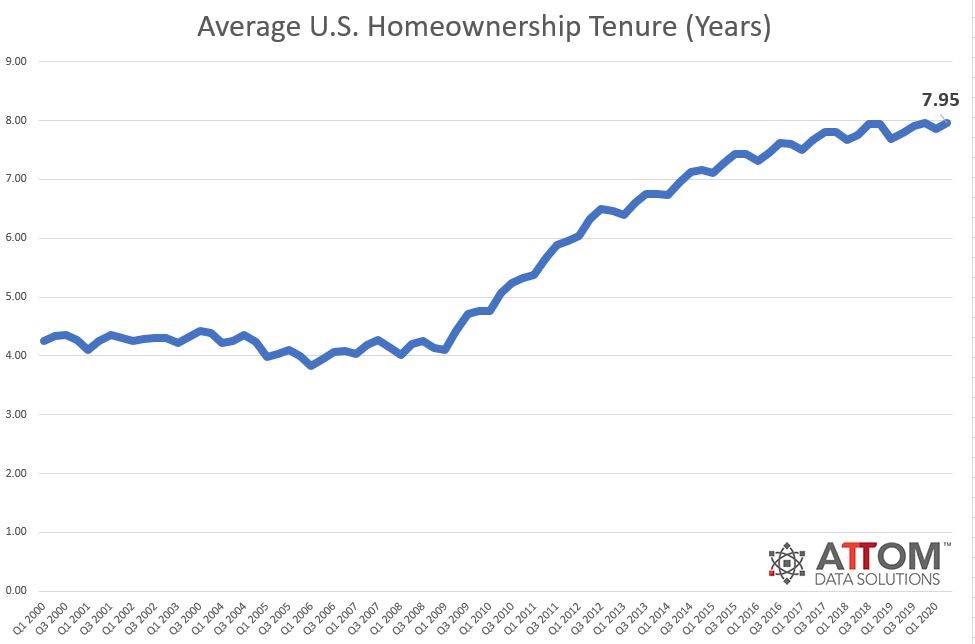

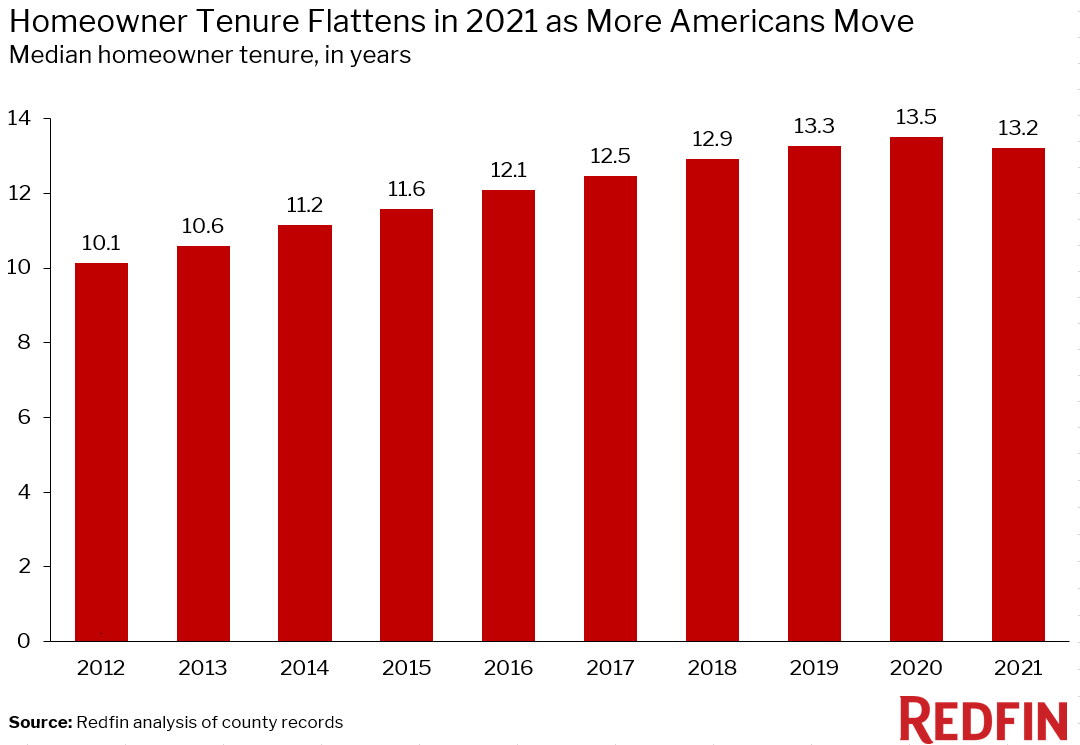

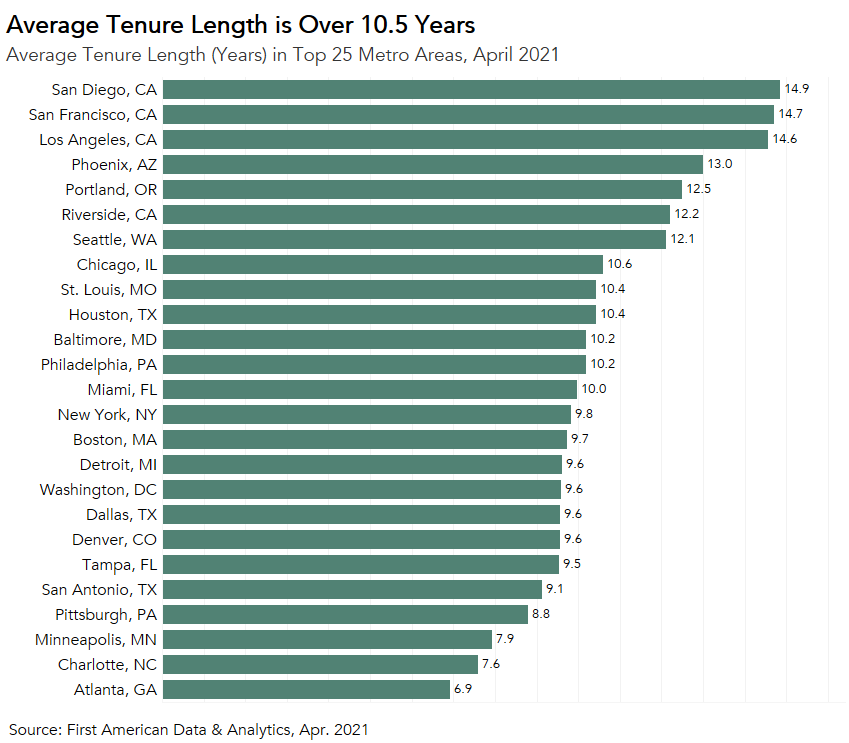

It doesn't seem like anybody knows the exact average homeownership duration in America. But here is some information by ATTOM Data Solutions, Redfin, and First American Data & Analytics. The main takeaway is the trend of increasing average homeownership tenure.

Average U.S. Homeownership Tenure Over Time

According to ATTOM Data Solutions, the average U.S. homeownership tenure is about eight years. The tenure took a dramatic increase post the global financial crisis in 2009.

According to Redfin, the average U .S. homeowner tenure is about 13.2 years. It has risen from about 10.1 years in 2012.

To get more granular, here is the average homeownership tenure in various major cities in America. It goes from as low as 6.9 years in Atlanta, Georgia to as high as 14 years in cities such as Los Angeles, San Francisco, and San Diego.

Homeowners Will Rationally Stay Put For Longer

If you are a homeowner with a mortgage, just ask yourself whether you plan to live in your home for longer now that mortgage rates are higher. Instead of moving to a bigger house after rates have jumped, maybe you'll just wait things out until mortgage rates go back down. Or, you might use this opportunity to hunt for better deals.

Personally, I bought my “forever home” in 2020. The plan was to raise my kids in it for at least 10 years in the house. Ideally, I wouldn't mind raising them until 2037, when my youngest may go to college. Moving is a pain in the ass. So is paying commissions, taxes, and transfer fees to sell a home.

Therefore, I plan to follow through on my plans to own my home for at least 10 years. If I'm much wealthier by 2030, then I might buy a nicer home. Then I'd rent out our current primary residence to build more passive income.

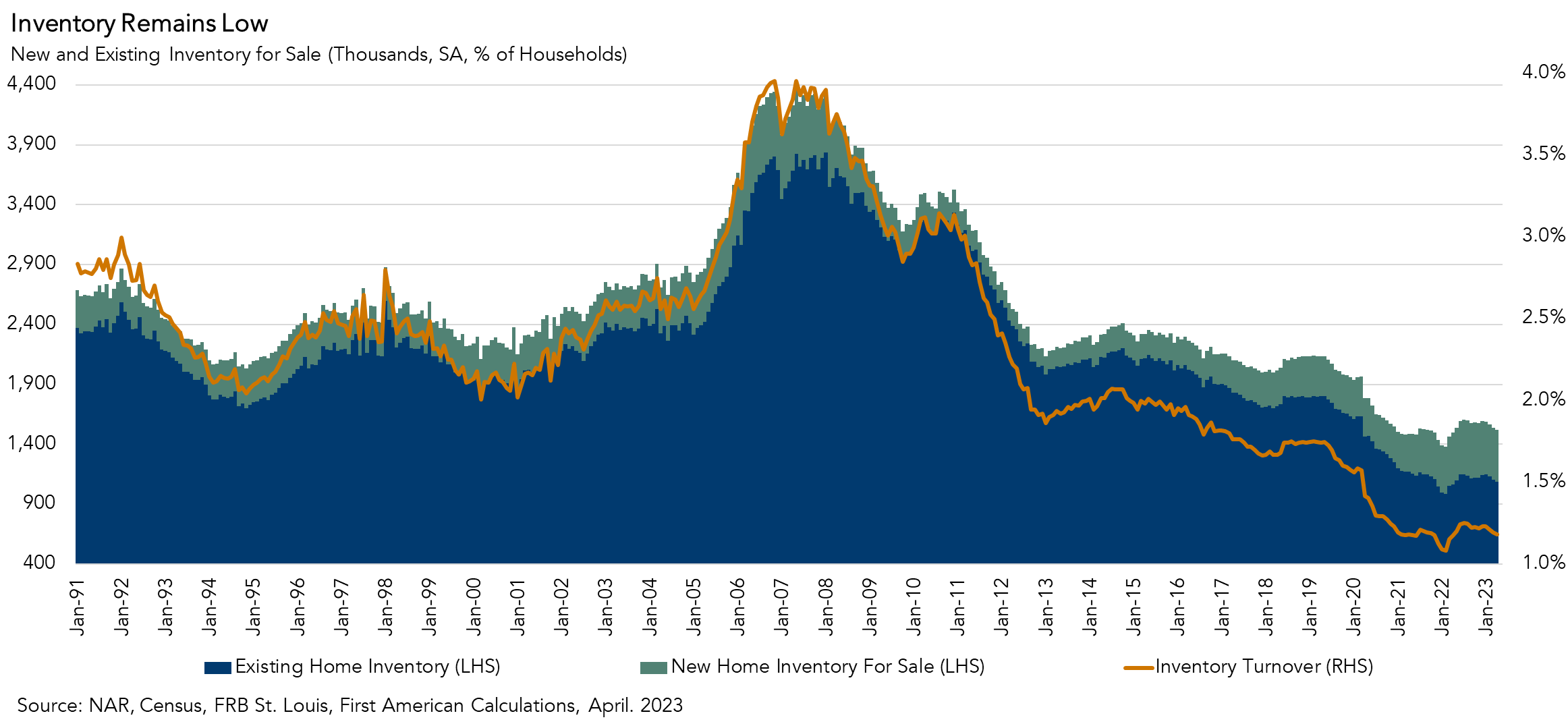

Higher Homeowership Tenure Means Lower Supply

One of the reasons why I forecast 4.5% home price appreciation in 2024 is due to continued low supply. Although higher mortgage rates decrease affordability for buyers, thereby putting downward pressure on home prices, I suspect lower supply than expected will act as a counterbalance and keep prices elevated.

As you can see from this one chart from Altos Research, single-family home inventory is extremely low. Originally, it looked as if inventory might rise to about 600,000 – 800,000. There is growing pent-up demand and I think there will be a return of bidding wars.

But with rising mortgage rates, I suspect it no longer will over the next couple of years. More homeowners will stay put or landgrab.

Is there no wonder why investors continue to buy single-family homes? Single-family homes benefit from positive demographic trends and are also in chronic undersupply.

Existing Homeownership Affordability Is High

According to Fannie Mae's most recent national housing survey, 92% of homeowners say that their current home is affordable. In addition, 91% of lower-income homeowners say the same thing, up from just 79% at the end of 2017. Not bad at all.

As a result, only the most financially secure homeowners or those who absolutely need to move will likely be moving in this higher interest rate environment.

For those who have the financial means, I would try and find bargains and rent out your low mortgage rate house. Rents continue to be strong, so you may want to capture market forces.

Invest In Real Estate More Surgically

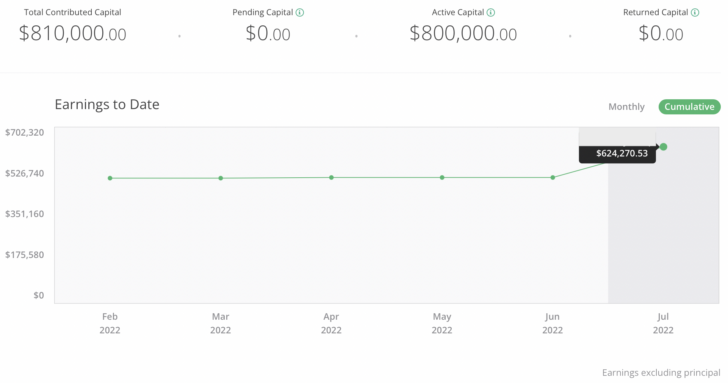

The combination of rising rents and rising capital values is a very powerful wealth-builder. I encourage readers to invest in real estate to build more wealth for the long term.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. It was a great way to diversify away from expensive coastal city real estate.

Best Private Real Estate Investing Platforms

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages over $3.3 billion for 400,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai was started in 2009 and is one of the largest independently-owned personal finance sites today.

Even the highest interest rate in your article is below the inflation rate. Seems like a great time to have debt (if you can service it, and elevated inflation persists for a while).

Interesting point. I’ve been considering buying a condo because rent here in Austin, Texas is insane and getting insaner. I’m not looking for a home-run ROI, I just want to have SOME equity since I’m already paying more than $1,500/mo on a 1-bedroom apartment. It’s been hard to justify buying a ~$400,000 2BR condo, but I might reconsider with this new perspective that interest rates are lower than inflation

I am curious to see if there will be a spike in foreclosures the next few years if inflation continues on its current trend. One thing I don’t hear a lot about are the large principles that have been take out over the past year or so as home prices have increased significantly. I understand that mortgage interest rates are low, however if you have to take a out a larger loan, that still makes for a larger monthly principle payment, which may have been affordable at the time of the loan but now that other monthly expenses such as groceries, gas, etc… have gone up, will people still be able to cover the monthly payment. Believe I hard Americans took on a record amount of debt both auto and real estate last year?

Inflation will decrease the # of foreclosures as it increases the equity in homes (people sell before foreclosure) and increases people’s pay (even if dropping in real dollars).

The debt is a record in nominal, not in a real terms, and consumer debt in as a whole adjusted for population and inflation, even with the huge runup in vehicle and home prices, is WAYY below 2007 – like 50% lower.

As the pandemic hit and prices appreciated my current home is now worth three times what I paid for it 6 years ago. We re-financed it for 15 years back in October for 2.1%. Rather than kicking myself for not buying more property before things got crazy a light bulb went off…We decided to move a little further away from the beach (3 miles vs. .04 miles) by plopping 20% cash deposit on a pre-construction home in a gated community. It will be completed in about a year.

I am a bit apprehensive about the rising interest rates although we can put down an additional 20% (about 40% of the purchase price total in cash) once it is all said and done. Not knowing what the interest rates will be in a year is nerve wrecking…Currently planning on signing up with the builder’s lender to lock-in a rate for a year (hoping to lock around 5.5 %).

Never thought I’d leave my beach home or buy at what seems to be the height of the market with double the interest rates…but it feels like the right move. Wether I do long term rental or vacation rental (lots of wear and tear and paying a property manager 20%) for my current beach house is the big question I have…What would you do?

Either way I should be able to cover mortgage and expenses for my current home and have a nice chunk of cash flow to put towards the new home’s mortgage. I believe I can probably net out paying just a bit more out of pocket each month to cover both mortgages by renting my current home and moving into the new home. Hoping the timing is right and it all works out!

Looking for advice… I bought a home with a friend from college Jan 2021 for $325k in Phoenix. I live in the home with 4 other roommates and they cover the entire mortgage. Our neighbors just sold their house across the street with the same layout as ours for $510k. When next January comes around, since that’s when we could sell for tax free capital gains, we are not sure if we want to sell or rent it out for $1k cash flow total. It would be nice to have $500 cash flow for myself but it would also be nice to have $100k in the bank to use on other investments such as crypto, AirBnb, etc…

Makes sense why people wouldn’t move, unless more retirees are selling their homes and moving to those city-center senior living that’s being built everywhere. That will help supply hopefully.

I’m also glad to see many HOAs following the lead of Canada and taking it one step further, making it very difficult or impossible for foreign or US investors from buying single family homes just to rent out. They make a very good point that people who are going to buy and live in the home will take better care of it and integrate into the community. It’s not all about greed.

wsj.com/articles/homeowner-groups-seek-to-stop-investors-from-buying-houses-to-rent-11650274203

We plan to upgrade to the forever home in the next couple of years. Hopefully, the interest rates will have come down by then. I don’t plan to rent when we move. Instead, I plan to sell my current house and use all the equity to build more passive income. I’ll use my Veterans loan to purchase the next house. No down payments for Veterans!!

But wouldn’t using the equity to pay for the new home be another way to produce passive income in the form of no mortgage payment.

Be careful with that move. In theory it makes sense….VA loan might be 3%ish … average REAL SP 500 returns are 7%…no brainer right?

BUTTTT sequence risk could bite you HARD. We haven’t had a recession in a long time….imagine if you buy a house THEN a recession hits. You now pay 3% interest to LOSE 30% on the equity you took out AND there is some potential you home may drop in value a bit.

I am not saying dont do it….I get it…there is upside to be had…no risk no reward…..but maybe only take 40-60% of your equity out….lessen the risk so if we hit a recession and you income is at risk, your home value is at risk and your portfolio value is at risk for a period of time…you have a nice margin of error or buffer to protect you.

Four years left on a 10 year 2.75%. House worth 1.1M. Want to upgrade but timing is wonky and would be at a cost of probably 2M. Also, not sure if I ever want to be a landlord in Cali due to the crazy eviction moratoriums and squatter’s protection. Seems risky renting property in Cali.

Great post thanks Sam! Definitely interesting that almost 10% of all mortgages have an interest rate of over 5%, a lot higher than I’d have guessed!

In my view I think house price changes will vary by area. Desirable locations or those where the average house price to average income ratio is lower, I think house prices will increase or at worst plateau. However, I think there will be areas where house prices will decrease due to lack of demand driven by affordability or desire to live there.

Know you’re in the San Francisco area. Do you think affordability & the movement to more home working so less requirement to be in a HCOL area will negatively impact property prices?

Maybe. So far, prices are up over 20% since the pandemic began. Not crazy amounts like in the Sunbelt.

I think the farther away and more affordable areas from downtown SF will continue to do well. Lots of parks, beaches, and amenities on the western side of SF.

See: https://www.financialsamurai.com/the-best-near-term-real-estate-investment-opportunity/

How about where you live?

Thanks. 20% is still quite the increase in two years! Will have a read.

I’m in the UK and some areas are starting to show signs of prices plateauing or even starting to go down. Think a lot of that has been down to people getting greedy and putting their houses on the market for way over market value and now having to reduce the price to more realistic levels to get some interest. Still up a lot since the start of the pandemic though.

Our intention to sell our current home not long after we retire in a few years. It has a great location if you work in the city, being right near the train and only 20 minutes from Grand Central Station during peak. But it is full of stairs, has a steep driveway, and the front steps look like someplace the Aztecs used to do sacrifices on top of. Bad for people getting older in a place where snow and ice are not uncommon.

The point being, even with lots of expectations for the next place, it seems to be doable with what we can get for the current place. Since my inclination would be to pay cash, if interest rates were high, wouldn’t that be a good thing for us in terms of getting a better purchase price?

“has a steep driveway, and the front steps look like someplace the Aztecs used to do sacrifices on top of” haha.

I hear you on steps and getting old not being a great combo.

Yes, all cash buyers will have the upper hand in this market for sure.

Are you planning on prolonging your homeownership tenure? In 2021 we refinanced to a 10 year FRM at 2.45%. We are putting extra cash on the deathbpledge monthly. We plan on paying it off in 30 months. No plans to sell this house until 2029 when our kids graduate HS. We will evaluate selling at that time.

Does anybody plan to rent out their homes with their low mortgage rates and try to buy more property? We are living in the house. Once our kids graduate HS we may rent it, but that is years away. It would currently rent for $4,000 monthly. We speculate it would rent for $5,000 by the time we contemplate renting or selling. $60,000 yearly income Stream with low risk and tax incentives sure lols enticing.

Anything about the mortgage percentages by interest rate numbers that surprise you? Yes. There are a whole lot of people with historically low rates. Looks like an incentive for people to stay in their current housing situation.

I don’t have plans to buy more physical property right now. But what I do have plans for is paying down my mortgage! It’s a fixed rate mortgage set to be done in January 2023, but I plan to beat that and have it fully paid down before the end of this year. I’m targeting somewhere in Q3 2022. It’s been a long time coming and I’ll miss the tax write off, but I’ll enjoy the happiness of paying it off so much more!

It is interesting that SD, LA, SF tenure is nearly twice the national average and is likely to grow as more homeowners are “trapped” by 1) low interest rates (we did a no cost refi 30 year fixed last year at 2.75%), 2) lower property taxes, 3) SALT deduction limits that make higher interest and tax payments less advantageous, 3) record high home prices. Remote work also puts less pressure on many people to relocate to change jobs.

I am not sure if tenure includes rental properties, but with increasing rents it would be foolish to ever sell CA real estate in these metro areas unless you really needed the cash. Mortgage debt is also a great hedge against inflation.

5% mortgages are still low by historical standards, so I don’t see that causing prices to drop. We might just no longer see as many big bids over asking and more normal buying experiences without as many investors buying properties trying to leverage lower rates. Rental property mortgage rates are typically ~0.5-0.75% higher than primary homeowner mortgages. At higher interest rates little guy investors putting only 20-25% down for a rental property may have cash feeds for years before the property is cash flow positive at higher interest rates, and that’s assuming they aren’t paying property managers another 10-20% of the rental income.

CA FS readers may want to consider/plan for a post-retirement move where the new Prop 19 law allows owners to transfer their low property taxes to another home that they purchase in CA starting at age 55. Only bad news there is I think you have to sell the property to transfer the property taxes. Still a great option for empty nesters looking to downsize, upgrade to an ocean view, or relocate to a more retirement friendly community.

This has been a prolific week of FS posts. Go Bears!

Prop 13 is also a big factor I’m sure.

Go Bears, indeed!

Prop 19 has to be same or lesser value home. Only enticing if a lateral move.

Prop 19 is pretty new and I am not a real estate professional, but I believe there is still a pretty good property tax reduction to be had if you are moving to a more expensive property. Only the difference in value is assessed at the full rate. See #5 in the FAQ

https://www.boe.ca.gov/prop19/#FAQs

I was referring to keeping the transferable base rate after 55. Has to be same price or cheaper. Up to 110% if building and taking extended period.

We saw the writing on the wall and bought a new primary residence in December, locking in the last of the low rates. Now we rent out our previous home that was refinanced at a low rate in 2020. Considering the recent changes in rates and tight rental market, we feel incredibly lucky with our timing and situation.

Nice job locking in a low rate. However, you must also prepare for a potential softening in property prices. Everything is yin yang in finance. So I hope you also got a good deal on a home.

December is my favorite month to buy property, so I hope so!

The house appraised significantly over the purchase price. I felt like it was a good deal. Selling right before Christmas is tough and the real estate agent made some mistakes in the listing. They had the square footage shy by about 600 sf. Also, the true selling point of the house is the spectacular view. Bizarrely, for the open house the agent had all the windows facing the lake and mountains closed. I’ll never understand that but it worked in our favor. The house definitely needs updating, but the location is stellar. I’m curious what your thoughts are on buying a fixer versus pristine home.

Got to love bad-timed listings and bad realtors!

I’m very much in favor of buying fixers before you’re 40. But after 40, it gets tougher due to time and energy.

Regarding the .53% of people with mortgage rates under 2%, there are many Veterans who benefitted from government programs, federal and state, that provided very low interest rates with zero or minimum down. And rightfully so. Many of those vets were either in Iraq or Afghanistan during the years 2003 and 2018 and I suspect that accounts for many of those sub 2% mortgages.

That would be great if so! The more assistance we can give our veterans the better.

Related post: https://www.financialsamurai.com/why-are-there-homeless-veterans-in-america/

Been a long-time lurker and really enjoy reading your blog. What’s your view on buying a primary residence in this current market? I live in the SF Bay Area and I’m struggling to justify/afford buying a modest 3bed/2bath home anywhere. I have only been able to save enough for a down payment last year (bad timing with the market). I’m particularly interested in an area where my kid can be in a K-5 bilingual program, but it looks more and more that I will have to rent for 10+ years to live in the Bay Area or move out of state.

Howdy!

My view is that there is a growing probability that bargain-hunting for homes over the next four months could prove to be wise. The froth has been taken out of the housing market. There are more deals to be had today.

Less bidding wars means more opportunities, especially for mispriced properties by non-local agents. Love those!

At the same time we are in an upward interest rate cycle for the next 1-2 years. So there’s no rush to buy. Prices could easily flat-line or go down by 5% during this time period.

So be patient and picky. Be a super negotiator! If you miss one, another will always come up.

Yup, I’m starting to see some price reductions in my area (East Bay suburbs). I’m keeping a closer eye out for bargains as buyers become more picky.

Sam, thoughts on new construction pricing over the next 1-2 years? You think prices could also be impacted and negotiating new co structuring pricing could return like the old days? I’ve never purchased a used home. Prefer starting new.

Thanks for sharing your view! I’m trying to be patient yet curious how all the money printing/inflation will impact real estate pricing in the next few years? I watched Ray Dalio’s Changing World Order and got me wondering how might this impact housing (along with the international buyers you nicely wrote about). Flat-line or 5% decrease in housing still keeps the home values pretty sky high for my budget. At least for now, I’m renting and investing the remaining amount into the typical portfolio of index/eREITs/etc.

I have 9 years left on a 10/1 IO arm @ 2.375%. Had a 7y IO arm that I refinanced in 2021. I’ve paid no principal but my house has doubled in value. A lot can happen in 9 years.

I’ve got a interest only mortgage. When I retire, plan to pay it off. I realize that numbers wise, it may not be the smartest move but all personal finance is indeed personal and I prefer to own it free and clear near when the regular paycheck ends.

Yes I am nervous with my the fixed rate period over for my 5/1 ARM loan. 3% now, we’ll see come January 18 what it changes to.

I think most ARMs resetting now would be in the mid 3% range….still better than fixed. 5-10 yr ARMs IMO are the way to go here, especially since the spread is higher than normal. I’m surprised they’ve only increased to 8% of new mortgages…would expect that to go up to 25%+