Dear Financial Samurai,

Has the government shutdown impacted you in any meaningful way? For me, the only disappointment so far is that I still have to file my taxes before the October 15 extension deadline. Ugh.

From what I understand, furloughed federal employees can’t work during the shutdown, but once the government reopens they receive full back pay. In that sense, a shutdown can feel like an extended, paid vacation that doesn’t count against their actual vacation days. A couple of my friends who work in government jobs are honestly pretty happy about the arrangement.

The tougher situation is for “essential” workers—like air traffic controllers, border agents, and military personnel—who still have to report for duty without pay until the funding issue is resolved. They’ll eventually get their back pay too, but in the meantime they’re working for free.

Given the Trump administration’s preference for a leaner federal government, I imagine they’re not in a hurry to resolve the standoff quickly. Meanwhile, the stock market has shrugged off the drama, powering to fresh record highs.

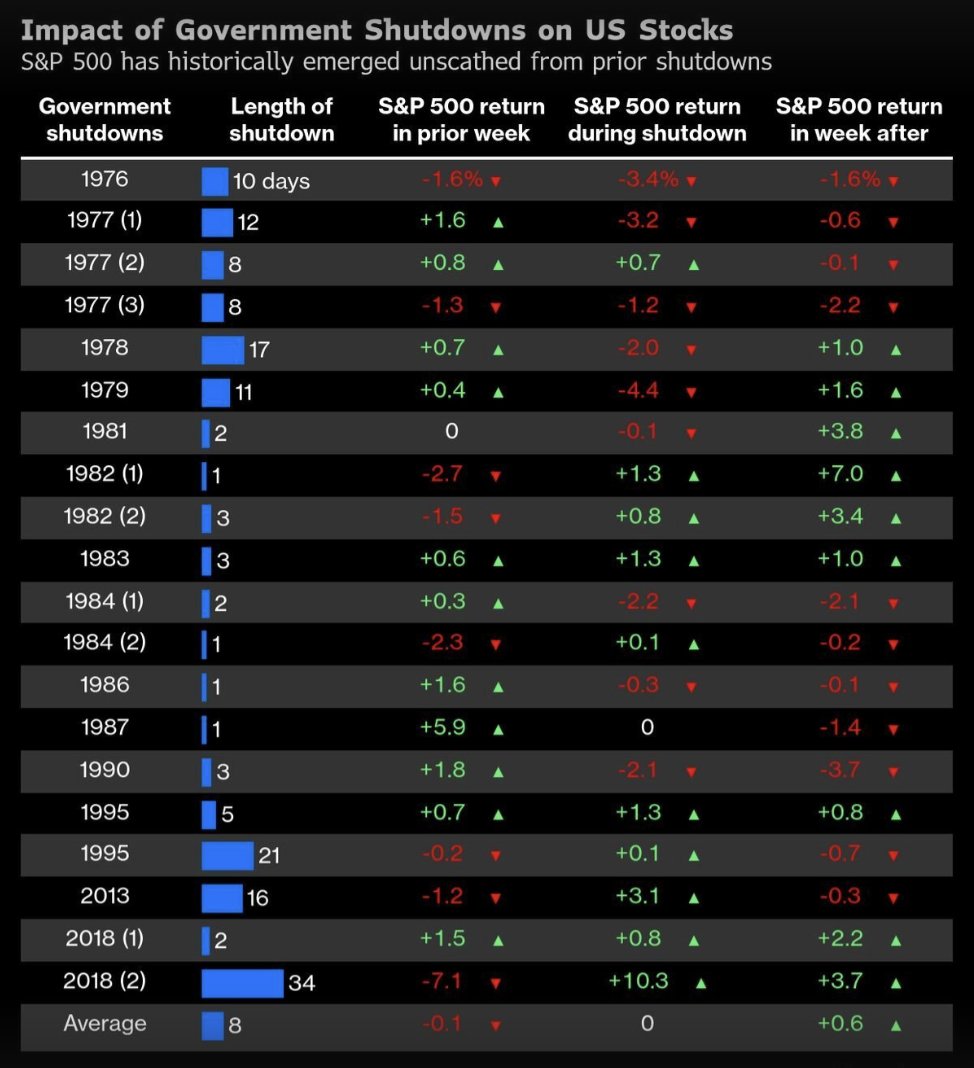

Here’s a chart I came across showing how government shutdowns have historically affected U.S. stocks. The takeaway? The impact hasn’t been all that bad.

U.S. Holdings of Equities at All-Time Highs

Here’s another fascinating chart showing that U.S. households are essentially all-in on equities. The concentration risk is enormous – higher than during the 2000 dot-com bubble. When the next inevitable correction comes, it could be spectacular.

That said, given how much investors have already made, and with valuations clearly stretched, none of us should be shocked if we see a 10%+ pullback at some point. Frankly, the amount of wealth created since 2022 feels almost comically absurd.

My hope is that you’re putting at least some of those paper gains to work – whether by upgrading your lifestyle a bit, buying yourself more freedom, or shoring up your financial resilience for the next downturn. Please do some YOLOing for me. This way, if stocks do correct, at least you'll feel good knowing you got something out of the bull run.

The Practice of Identity Diversification

With equity valuations stretched, investment diversification feels more important than ever. Personally, I’m leaning harder into private real estate right now. The valuation gap between commercial real estate and stocks is enormous. Add in the likelihood of another Fed rate cut this month—and perhaps one more by year-end—and we could see further downward pressure on the long end of the yield curve, translating into lower mortgage rates.

But beyond financial assets, I’ve been thinking a lot about something I call “Identity Diversification.” This idea has been simmering in my head since 2020. Just as it’s advantageous to own more stocks during a bull market and more bonds during a bear market, imagine being able to lean into different aspects of your identity depending on the political or social climate.

If you’re not financially independent yet, you’re still trading time for money. That means navigating shifting work environments and power structures. Identity Diversification can make it easier to adapt—helping you blend in when necessary, or even ingratiate yourself with decision-makers who hold the keys to your next opportunity.

Check out the full post: Identity Diversification May Be Just As Important As Investment Diversification.

How Long To Hold Onto Your Mortgage

Finally, I wanted to tackle a long-standing debate of when to pay off your mortgage. I organically paid off my vacation property mortgage in 2022 and another mortgage earlier this year with the sale of a rental property. And each time I pay off a mortgage, I have zero regrets, despite being able to make more elsewhere. It just feels so darn good!

But feelings only get you so far when it comes to making optimal financial decisions. So in a new post, I draw upon my experience to come up with some new guidelines on when to pay it off.

Check out: The Ideal Length Of Time To Hold Onto A Mortgage

More Posts You May Enjoy

Being Truly FIRE IS Terrible For Entrepreneurship – For those who have the entrepreneurial itch, try to give it a go before you are financially set. Otherwise, I'm afraid it may be too hard to stay disciplined to grind when you don't need to.

How The Irrevocable Life Insurance Trust Can Save Your Estate Millions – For those of you fortunate to die with way more wealth than the estate tax threshold.

We’re heading down to San Diego this Thursday and Friday to take the kids to LegoLand and SeaWorld. I’m debating whether it’s worth buying the special fast passes at $99 per person to skip lines that could be 30 minutes or longer.

My gut says yes, but if you’ve been, I’d love to hear your thoughts and experiences.

To Your Financial Freedom,

Sam

Support & Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population—and break free sooner.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Everything is written based on firsthand experience and expertise.