Ever since 2012, I've invested in equity structured notes to provide for some downside protection. Structured notes have sometimes gotten a bad reputation because they may be complex and expensive. However, just because you don't understand something doesn't mean you should burn it at the stake.

If a structured note can give you the courage to invest when you are too afraid to, then a structured not could be very good fr you in the long run. Over the years, I know so many people just let their cash pile up in their savings account because they were too worried about losing money.

In hindsight, I didn't need downside protection since the S&P 500 has performed very well since I left work. However, because I didn't have a steady paycheck, I lacked the courage to invest significant sums of money in the stock market. If it weren't for equity structured notes, I may have just kept the funds in cash or bought even more real estate instead.

For downside protection, an investor in a particular structured note usually has to give up something. That something is usually dividends or capped upside. As a result, these notes tend to underperform during a bull market. But not this one.

Let me share a structured note that just matured as a case study. You can then tell me how bad it really is. With stocks melting down in 2022, equity structured notes have outperformed.

The Upside Of Investing In A Structured Note

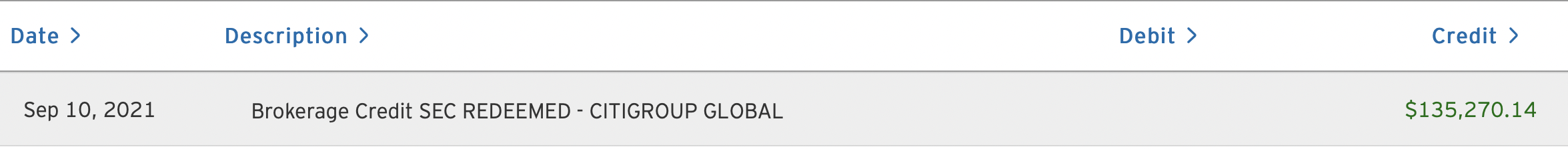

On September 10, 2021, $135,270.14 hit my checking account. It turns out a 5-year S&P 500 structured note I bought in September 2016 came due.

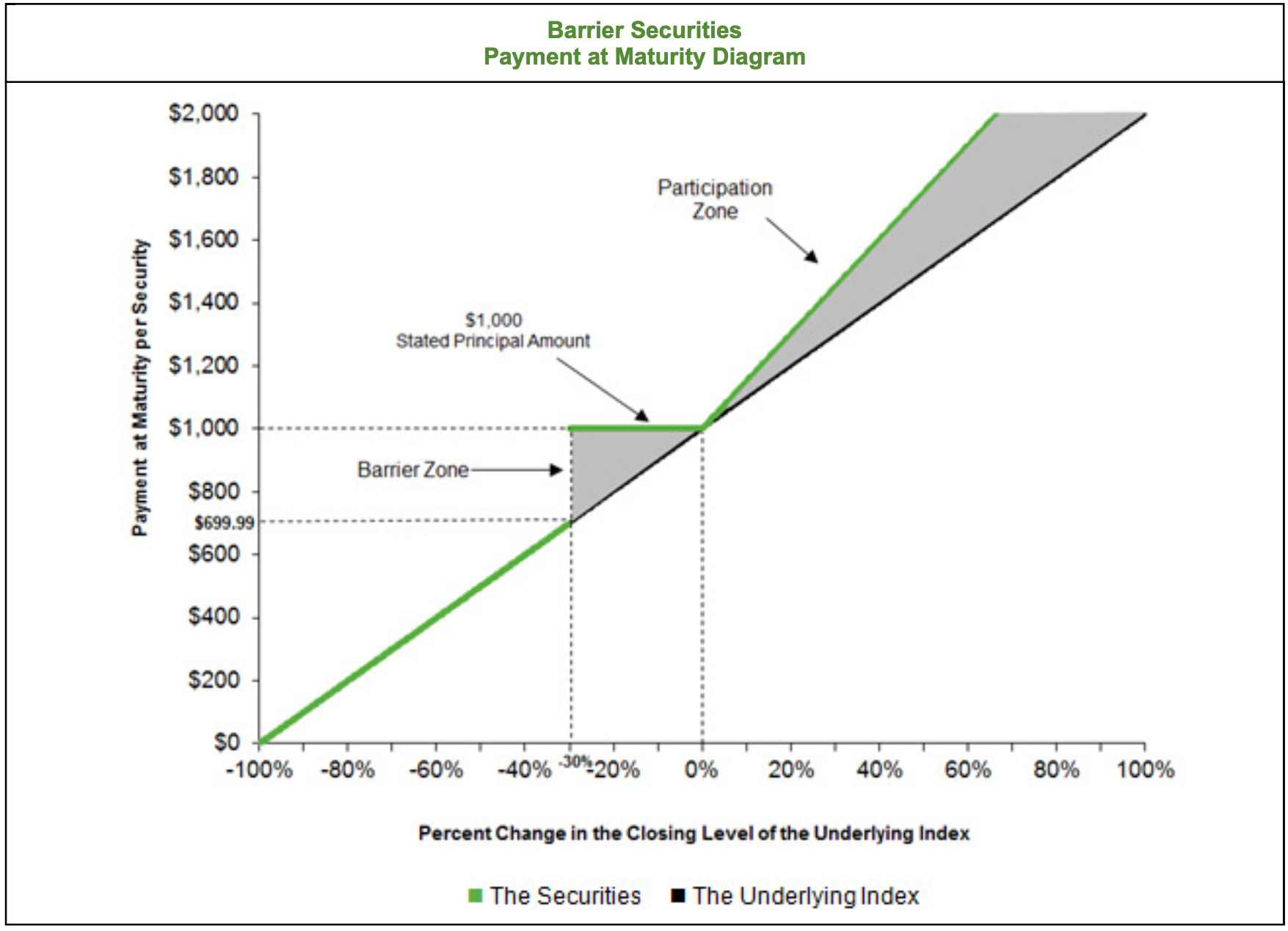

Given five years was so long ago, I didn't remember the details of this note. So I asked my private client manager at Citibank to remind me. He got back to me with the original prospectus and said it was an S&P 500 barrier note with the following terms:

- Barrier level: 70%

- Leverage factor: 150%

- Investor must forgo all dividends

In other words, this S&P 500 structure note would provide 30% downside protection if I gave up dividends. So long as the S&P 500 was down 30% or less, I would get 100% of my money back upon maturity in five years. If the S&P 500 closed down worse than 30% in five years, I would get the exact same downside loss.

On the flip side, I would get a 50% boost to my overall return after five years if the S&P 500 ends up positive. In other words, if the S&P 500 closed up 50% in five years, I would get a 75% return. Not bad!

Below is a chart that highlights how this structured note worked.

With these types of conditions, I understand why I invested in the note. Unfortunately, I only invested $52,000. Still, the investment was better than buying an expensive new car I didn't need.

The note's 5-year IRR equaled 21% compared to a ~16% IRR if I had invested directly in an S&P 500 index fund. In other words, if I had invested $52,000 in an S&P 500 index fund on September 10, 2016, I would have ~$102,000 today. Due to investing in the structured note, I made about $33,270 more ($135,270.14).

The positive of investing in a structured note is not only getting downside protection but sometimes, getting extra upside participation as well.

More importantly, this structured note gave me the confidence to put $52,000 of capital to work. I remember back in September 2016 I was feeling just so-so about the stock market. We went through a correction in late 2015 and another one in early 2016. These corrections felt like mini tremors before a potentially big one hits.

Further, my wife had also left her full-time job 1.5 years earlier. Therefore, my household was really without any steady income or traditional work benefits.

However, due to the attractive conditions this note provided, I felt like it was worth the risk. At 39 years old, I was too young to not stay invested. Further, Financial Samurai was growing.

In retrospect, I wish I had invested a lot more!

First Downside To Investing In A Structured Note: Mental Burden

After investigating the origin of this structured note payout, I came to realize there are several downsides.

I now have $135,270 more in cash to deal with. Should I use the proceeds to pay down mortgage debt? That always sounds like the responsible thing to do. I have more mortgage debt now given I bought a home in 2020.

Should I re-invest some of the proceeds back into the S&P 500 without any downside hedge (naked long)? It's good to stick to my desired equities allocation as a percentage of net worth. But valuations are so expensive and we haven't had a big correction in a long time.

Or maybe I should invest more in real estate crowdfunding to earn more passive income. After all, this structured note provided zero dividends. Therefore, investing in real assets may not only help dampen volatility, but it should also boost retirement income by potentially $3,000 – $10,000 a year.

Thinking about what to do with the money is a mental burden, which is one of the reasons why I enjoy investing for the long term. Private investments with 5-10-year lockups are ideal. Although, once I reach 60 years old I will likely reduce my exposure to private investments given I might die before the investments exit.

Second Downside To Investing In A Structured Note: Tax Liability

Figuring out what to do with the cash is one thing. However, perhaps the biggest downside to investing in a structured note is a new tax liability every time a note matures.

I've discussed in the past about the importance of accurately tracking your passive income for better tax management. However, once again, I've failed to take into account this liquidity injection.

I knew in the back of my mind something was coming. But I didn't get the amount right. Further, I thought this note was only purchased in my rollover IRA.

As a result, my upcoming tax bill will equal $135,270 – $52,000 = $83,270 X 15% = $12,490.5 federal. Then I've got to pay long-term capital gains tax for California. Bummer. I just got finished doing my 2021 taxes in 2022 and it is a lot!

Third Downside To Investing In A Structured Note: No Control Over Exit

When you invest in stocks or real estate, you can control when you invest and when you sell. When you invest in a structured note, you must concurrently decide when to sell and when to exit sometime in the future.

In 2016, I felt there was a decent chance the S&P 500 would be higher in five years. However, what if the S&P 500 was up 100% in five years. But the day before the note was to mature, the S&P 500 crashed by 51%. I would have ended up losing money during this long duration!

If it was up to me, I would happily let this structured note ride for another five years. Sure, there will probably be multiple corrections during this time. However, I like its incentives. In addition, once the money is locked up in a long-term investment that has early withdrawal penalties, the stress of managing the money disappears.

At the very least, I would have liked for the note to have matured in 2022, the year I plan to re-retire and make less money. 2021 should end up being a financially great year because the economy will have rebounded strongly from a depressed 2020.

A Complicated Net Worth Needs To Be Managed

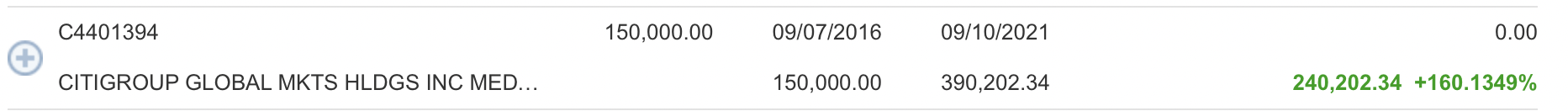

After doing the final edit on this post, I realized I actually did end up betting big on this note through my rollover IRA. All this time, I was playing Monday-morning quarterback wondering why I didn't invest more. Having investment systems work!

When this note matured in my taxable portfolio, the proceeds eventually hit my checking account. As a result, it was easy to tell that something had exited – like an automatic reminder.

However, when a note exits my rollover IRA, the proceeds just sit there and my portfolio balance looks the same. Therefore, even though I remembered a note was exiting in September 2021, I confused the note that exited in my taxable portfolio with the one I held in my IRA.

Upon checking my rollover IRA realized gains/loss tab, I noticed the following. $150,000 invested on 9/07/2016 and $390,202.34 exited on 9/10/2021. Gains $240,202.34, +160%. I had strategically invested the most in a tax-efficient account. Thank goodness! Having to pay taxes on $240,000 in long-term capital gains would have been a real butt-kicking!

I've now got to figure out how to reinvest $390,202 in proceeds with stock market valuations at nose-bleed levels. But in reality, I've got to figure out how to reinvest $525,472 given I've got to add the proceeds from my taxable portfolio.

Luckily, there is no taxable event with the $390,202 in proceeds. Otherwise, paying taxes on the entire $323,472 in profits from both investments would be very painful.

The key lesson here is to take advantage of rollover IRAs, Roth IRAs, and backdoor IRAs. If you like to trade, invest in structured notes, or invest in private investments, IRAs are your friend.

Just make sure to invest responsibly. It can sometimes feel easier to swing for the fences with your tax-advantageous accounts because you can't access them without penalty until you're much older.

With your taxable portfolios, you should hold your positions for as long as possible. Your taxable portfolios should also be one of your main sources of passive income.

We've been in a bull market for so long that we've become accustomed to just buying and holding. So long as you hold, you don't have to pay capital gains taxes. The only tax you will have to pay is on the dividends if any.

On the bright side, maybe this payout is a good thing. After a 160% increase in five years, perhaps it's time to take some chips off the table. Using the money to pay down mortgage debt to lock in a guaranteed return sounds like the most responsible thing to do.

Where To Invest In Structured Notes

If you want to invest in structured notes, check with the financial institution where you have your brokerage account. Most large institutions like Citibank, JP Morgan Chase, Goldman, offer structured notes.

It also helps to have a financial advisor look for appropriate notes for you. I've got very little time to look for new notes. I just tell my private client manager to highlight ones that have attractive terms. From there, I make a decision.

Before investing in any structured note, you must know how it works. The prospectus should go through various scenarios. If you don't fully understand how the note works, don't invest in it.

Finally, structured notes also cost money to buy. The cost usually hovers around 1% of the purchase amount versus free if you buy a stock or ETF.

Continue To Track Your Liquidity Events

As an investor in long-term investments, it's best to put them all in a spreadsheet. One column should show when you invested and another column should have the exit date. You can also put calendar reminds to alert you to when an investment will mature. This way, you can better plan your life.

At the end of the day, you invest to potentially make more money to save time. If you know a couple of investments are exiting one year, you can plan to spend less time making money and more time doing something more meaningful.

To track my complicated net worth with over 30 financial accounts, I use Personal Capital. Personal Capital lists all my accounts I've linked up on my dashboard so I always know what's happening.

Ideally, I will reinvest the proceeds into another structured note with similar terms. This money comes out of my equity exposure. Unfortunately, I haven't been able to find similar ones for the past several years. Therefore, I'm going to patiently bide my time until better opportunities come along.

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth.

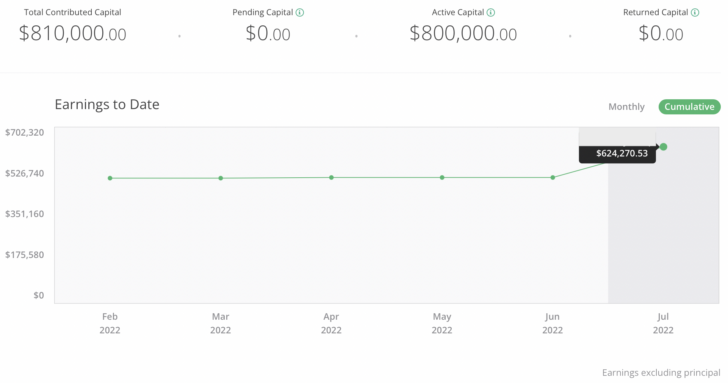

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Invest In Private Growth Companies

In addition, consider investing in private growth companies through a fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

One of the most interesting funds I'm allocating new capital toward is the Innovation Fund. The Innovation fund invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much.

Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments. It's almost like investment arbitrage.

Related posts:

Understanding Structured Notes As A Derivative Investment

After doing a post on the minimum portfolio amount to start feeling financially free, I realized my structured note investment really helped buffer my rollover IRA's decline in March 2020 as well.

If you’re interested in more nuanced investing content, join 60,000+ others and sign up for my free weekly newsletter. I’ve been writing about achieving financial independence since 2009.

I purchased one myself a few years and it matured. I think my return was about an average of 4.5%. Does not sound great but this was used as substitute for a portion of my fixed income portfolio. So all in all, it probably did as good or a little better than what i would have expected investing in fixed income funds/etfs. People cannot compare these to equities and would recommend this as a replacement/alternative to a part of one’s fixed income allocation.

Sam, always love your posts, and how they challenge me to THINK! Have you ever researched or considered an Alternative that invests in Structured notes from the debt side, like what Yield Street offers? It looks to me to be even more insulated from the machinations of the Market, which as a 6 year retiree, I’m interested in. I have 75-80% of my portfolio in plain, low expense Equity ETF’s (e.g. VOO, VO, VB…), but am living off of my portfolio for another 5-6 years until my wife and I file for Social Security, so not being tied to a variable underlying asset class like stocks is appealing to me.

Just wondered if you’d ever considered YieldStreet, or the debt side of Structured Notes

Yes, I did a YieldStreet review earlier. Your firm has really done well over the past several years when I first spoke to the founder.

I haven’t gotten into the nitty-gritty of debt structured notes yet. Part of the reason is because debt is lower on the capital stack, so it’s less risky. Therefore, I don’t need the downside hedge as much as I would with equities.

Sam,

Good read. Not every one knows about these or has heard of them. Financial Advisor got me into one back in 18′. Barclays Buffered Note 5yrs (Tied to Euro Stoxx 50) w/ 30% Buffer and 1.7 Upside Leverage Factor (i.e 10% Return on the Index = Principal Payment + 17%). Good way to hedge the down side. Watch fees. Also, I think you can participate w/o a $250K Min at some smaller brokerages.

1.7 participation is nice! I haven’t checked the Euro Stoxx 50 in a while, but sounds like your investment is paying off.

Oook, sigh….more to learn. How do I go about investing in a structured note?

Ask the private client group or your wealth manager where most of your assets are if they have such offerings. You usually need a minimum level with the bank. Maybe $250,000 or more.

Hi Sam,

Well done with this investment ! The S&P500 have done amazingly since 2016, so I can imagine a structured note on the S&P500 can do very well during that time.

Structured notes are complex investment instruments, but they are easy to build when you know how they work. They consists of a mix of options and cash (bonds). The option part provides the upside potential of the structured note (70% of the note), while the bond portion of the note provide the guaranteed capital needed at the end of the term (30% in your example).

Obviously, there are hefty fees embed in these types of products (maybe 2%, 3% or more, but certainly higher than 1%). So, creating one by yourself could be interesting.

However, I think those products worked well when interest rates were at least 2%-3%. Now that interest rates are so low (0% to 1%), I think these products are far less attractive, for clients as well as for bankers. This may explain why your manager was not able to provide an interesting proposal recently.

Personally, I never invested in options or structured notes. I prefer the simplicity of owning stocks or bonds directly. I also prefer stocks or bonds over ETF because I like to know exactly what I’m invested in. And, what is nice with stocks is that there are always “deals” in some areas of the market, no matter how “high” the market is.

Recently, I’ve increased my holdings in foods, staples, utilities and commodities. I think inflation can be a bigger problem for the economy in the years to come. Those type of companies are likely to benefit from inflation and it’s not the type of expenses customers are likely to reduce. Also, they are not too expensive compared to other parts of the markets. Some are even at 5-year lows !

If you are interested, here are examples of some of the purchases I’ve made recently :

– Food : Pepsi (PEP), Coca-Cola (KO), Saputo (SAP.to, SAPIF)

– Consumer Staples : Procter & Gamble (PG)

– Utilities : Verizon (VZ), TC Energy (TRP)

– Commodities : Barrick Gold (GOLD), Suncor (SU)

There is no need to invest specifically in these companies. But it may give you investing ideas for your own portfolio.

As for the taxable account liquidity, I would pay down debt. I think having the lowest amount of debt is the way to go. If you don’t like to have a lower debt level or if you find a better deal in the future, the bank will always be there to lend you back that money in the future.

Hope my thoughts on this subject can be helpful !

I could definitely create the structured note myself, but I would have to stay on top of it. One of the other benefits about a five-year structure note is that it just forces me to hold for five years and not so bad in opportune times. I don’t even think about it until the investment is over.

For example, during the 32% March 2020 selloff, It didn’t even occur to me to sell this note. It was just shelved away. And if I did manage to find it and sell it, I would incur some type of liquidity discount.

I’m going to have to think about low interest rates as the reason for why these notes are less attractive. If they are still going to charge a 1% fee or higher, it would actually be more attractive for them give an interest rates are lower. Can you elaborate your point of view?

I’ll look more into the consumer staples names. Thanks for sharing!

I’m not an expert with structured notes. I just know on which principle they are built. But my reasoning was that they use the bond portion of the note to generate their fees. If the bonds provide 2-3% interest, this mean they can guarantee the principal without clients noticing the fees (0% return in the worst case).

If they charge a 3% fees and the interest rate on bonds is only 1%, then they have to promise ~88% of the capital after five years (loss of 2% per year), or lower substantially the option portion of the note in order to fund the guaranteed portion of the note, which would mean less interesting proposition for clients on the potential payoff.

Maybe it’s more complicated than that. I’ve never tried to build one myself. It could be an interesting exercice to try.

I put my kids college fund in a structured note 5 years before she went to college. If I remember correctly I got 100 percent downside protection. My upside was capped at 50 percent and I forgo any dividends. Unfortunately the note was compromised strictly with telecom stocks. After 5 years my total return was 2 percent. In the meantime the S&P nearly doubled.

I’m still a believer in structured notes. I just picked the wrong one. Also, I didn’t want to lose any money and that was accomplished. Schwab doesn’t offer any structured notes so in order to invest in them I’m gonna have to find a financial advisor like you pointed out. As I plan my future retirement structured notes will give me the peace of mind to invest money I know I’ll need in the future with limited downside risk.

Thanks, Bill

Thanks for sharing your example. Sorry you didn’t make a lot of money from your structured note. The more downside protection there is, generally the less upside.

But it’s good you didn’t lose money. And the money was there earmarked for your daughters education. And it’s also easy to look back in hindsight and wish we should have invested this way or that way.

If there was a massive and extended bear market, you would have felt much better about it.

Wow what a great investment, those are hard to come by. I can see how it’s so easy to forget when they are going to mature. And some even can pay out early if I remember right depending no the terms of the deal. That can definitely make it hard to accurately estimate how much passive income you could get each year.

I’ve held a few structured notes before but not that many. And I definitely don’t know off the top of my head when the rest of mine are coming due. I should probably check into that! The vast majority of my portfolio is all in ETFs now for the ease of trading.