If you want to leave your heirs as much money as possible, you should probably die in a state with no estate tax or inheritance tax. If you can't die in a state with no estate tax or no inheritance tax, then at least die in one that has a very high estate threshold before these taxes kick in!

Although taxes are astronomically high in California, one positive is that it has no estate tax upon death. As it turns out, the majority of U.S. states do not collect an estate tax. This is good because there is already a federal estate tax that tops out at 40%.

Let's take a look at the list of states with no estate tax, also sometimes known as the death tax. We'll also look at states that have no estate tax and no income tax.

Finally, I'll highlight my top five states to have legal residence in when you die based on the combination of low taxes, natural beauty, and opportunity for your heirs. After all, you want to think about those who carry your proud name long after you're gone.

No matter where you die, it's a good idea to get an affordable term life insurance policy. This way, your beneficiaries are protected as they receive tax-free death benefits.

Check out Policygenius to shop around for a term life insurance policy. Both my wife and I got matching 20-yera term policies during the pandemic, which provided us tremendous relief and security.

List Of States With No Estate Tax Or Death Tax

Here is the list of states that do not impose a state estate tax or a state inheritance tax as of 2023. The list is based off online checking with the various state tax rules. If I'm missing a state or included a state that shouldn't be there, please let me know.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Delaware

- Florida

- Georgia

- Idaho

- Indiana

- Kansas

- Louisiana

- Michigan

- Mississippi

- Missouri

- Montana

- Nevada

- New Hampshire

- New Mexico

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- West Virginia

- Wisconsin

- Wyoming

Where Are The Best States To Retire?

Unfortunately, the most attractive state, which is missing from the list is Hawaii! Hawaii has an estate tax rate starting at 10% and tops out at 20%. At least state estate tax rates are lower than federal estate tax rates. 20% is the highest state estate tax rate for all states who do impose estate taxes.

With our definite plans to relocate to Hawaii and live out our remaining years, having to potentially pay both a federal estate tax and a state estate tax is a real downer. Too many people live in one of the worst states for work and lifestyle. I hope when they retire, they can relocate to one of the best states.

The other notable state that has an estate tax is New York. At least it has the highest exemption amount for all the estates at $6.58 million for 2023. $6.58 million is huge compared to Massachusetts and Oregon, that have exemption amounts of only $1 million.

Below is a chart that gives you an idea what the exclusion amount is by states who do have a state estate tax. Several of the 2021 exclusion amounts are higher today.

States With No Income Tax Or Estate Tax

If you want to pay the least amount of taxes, you should reside in a state that not only has no state income taxes, but also no state estate taxes as well. Estate tax is based on your legal state of residence, not where you die.

The states with this powerful tax combination of no state estate tax and no income tax are: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming.

Washington doesn't have an inheritance tax or state income tax, but it does have an estate tax.

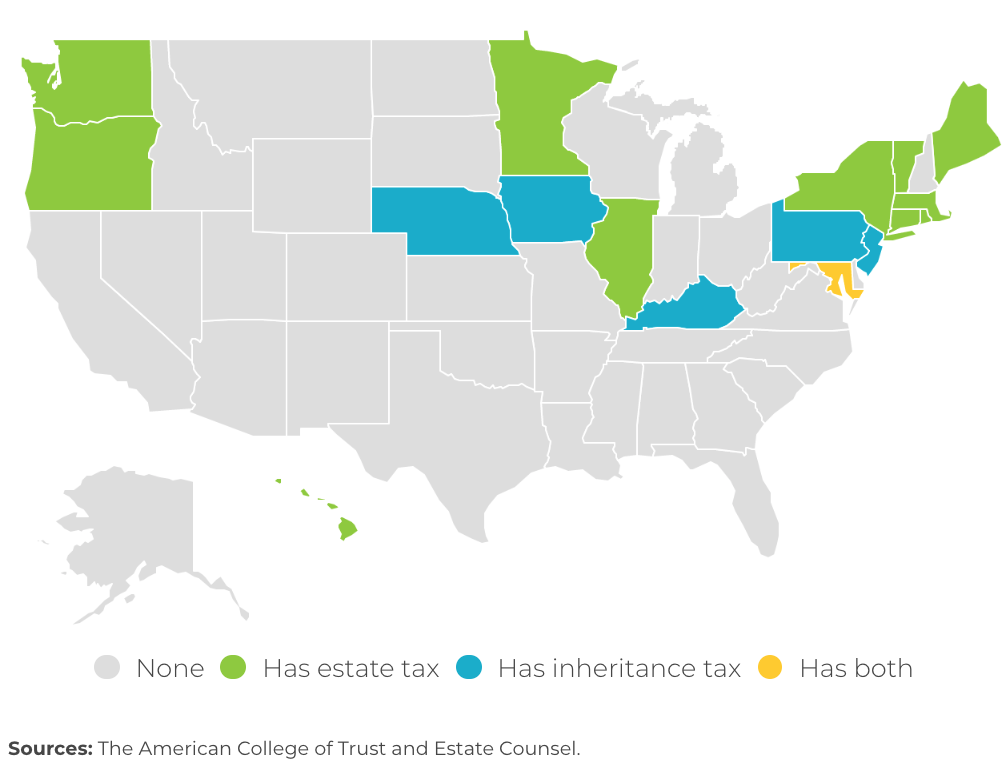

What's the difference between an inheritance tax and an estate tax? Not much, but there is a fine difference with regards to who pays the tax.

The Difference Between An Inheritance Tax And An Estate Tax

An inheritance tax is based on the value of a specific bequest – literally each inheritance. An estate tax is based on the overall value of the deceased person's estate, all gifts made to all beneficiaries.

A decedent's estate is responsible for paying the estate tax, whereas the beneficiary is liable for the inheritance tax. Often, however, the estate will pick up the tab.

Among the states that impose inheritance taxes, most exempt immediate family members. Spouses are exempt from these taxes and some exempt the deceased's children as well. Charitable organizations that inherit are also usually exempt.

If you don't want to pay an inheritance tax, avoid inheriting anything if you reside in the following states: Iowa, Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania. The inheritance tax ranges from 0% to 18%. Check with your local state for the exact rate.

Maryland is the worst because it has an inheritance tax and an estate tax. At least the state tax exemption amount is relatively high at $5 million..

Related: Best States To Retire

The Best States To Reside In And Leave An Estate

If you plan to die very rich, it's a good idea to reside in any of the states that don't have a state estate tax. But I'd like to subjectively highlight my top five states out of all the states without a state estate tax.

- Alaska – A beautiful state that not only has no state income tax and no state estate tax, but residents also often get an annual oil tax credit. Denali National Park is wonderful. The freshwater fish are amazing to eat. The biggest bummer about Alaska, however, is the long winters.

- California – Say what you will about this expensive state, it really has it all in terms of lifestyle. You can live in the mountains, on the beach, in wine country, or in the middle of nowhere. The weather is generally great and the employment opportunities for your heirs are abundant. Finally, the University of California school system is highly ranked. But the income required to own a median-priced home in many California states are among the highest.

- Montana – Perhaps there is no more beautiful state than Montana. Yellow Stone National Park is amazing. If you love to hike, fish, horseback ride, and ski, Montana is the state for you. The cost of living is relatively inexpensive.

- Virginia – There are plenty of job opportunities for your heirs up in Northern Virginia, near Washington D.C. The four seasons are beautiful, although the summers can get extremely humid. The cost of living is high in Northern Virginia, but reasonable based on incomes. Virginia is also home to the greatest public university in America, The College of William & Mary, as well as some other fine schools such as the University of Virginia, James Madison University, and Virginia Tech. Virginia has a rich history.

- Wyoming – Wyoming is like Montana with all its natural beauty. The combination of no state income taxes and no state estate taxes is wonderful. Unfortunately, Jackson Hole has already become a tax-haven for the ultra-wealthy.

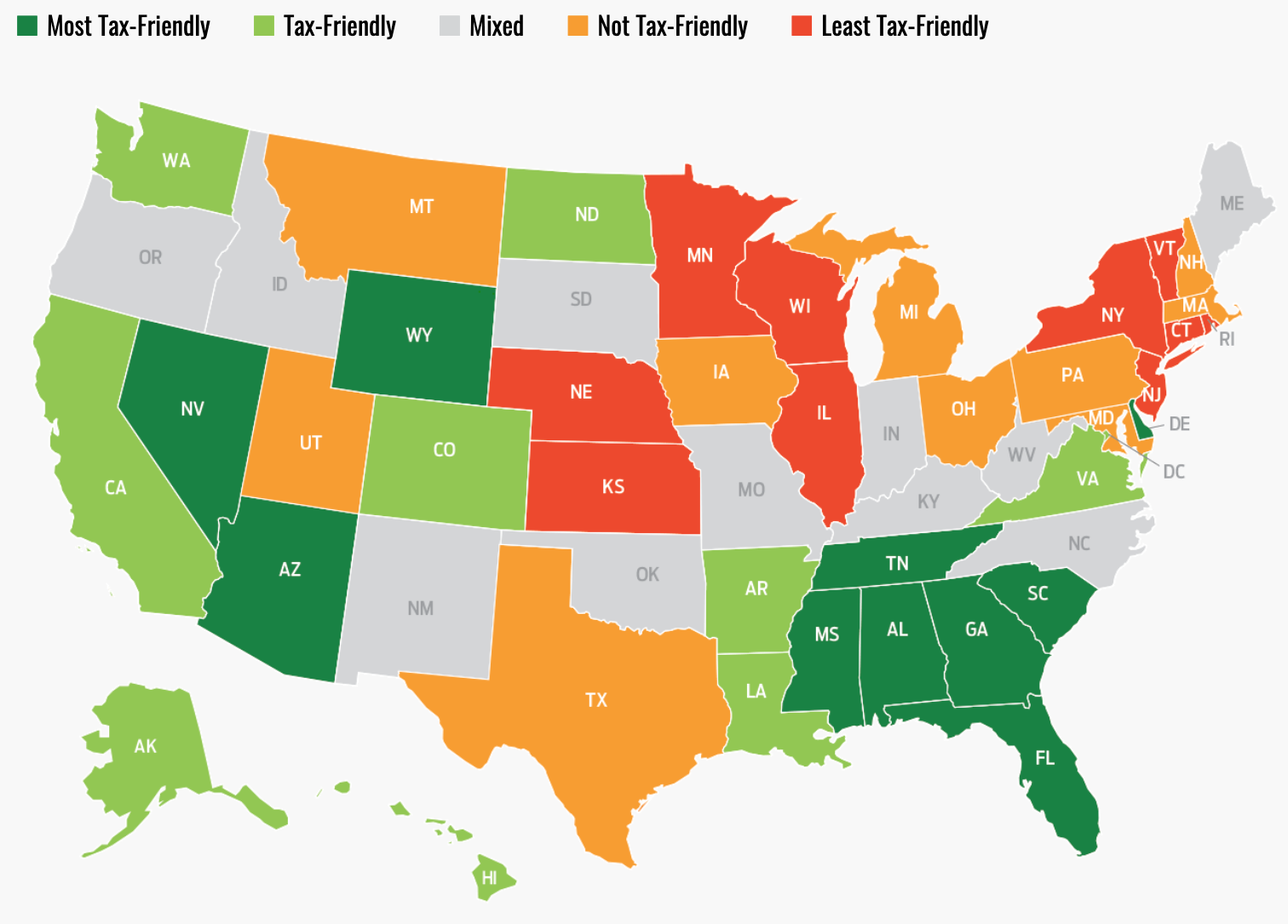

Most Tax-Friendly States For The Middle Class

Below is a good map from Kiplinger that highlights the least and most tax-friendly states for the middle class who won't need to worry about estate tax issues on the federal level.

Paying an estate tax is probably unlikely for most middle class Americans, except for potentially in Rhode Island, Oregon, and Massachusetts where the state exemption amount is only $1 million.

The state that stands out the most on map is Texas, labeled as not tax-friendly. This is strange given Texas has no state income tax and no state estate tax. However, Texas does have the sixth highest property tax rate in in the U.S. at 1.83%. Compared to the national average of 1.08%, Texas's property tax rate is high.

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions (cities, counties, special-purpose districts and transit authorities) also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent.

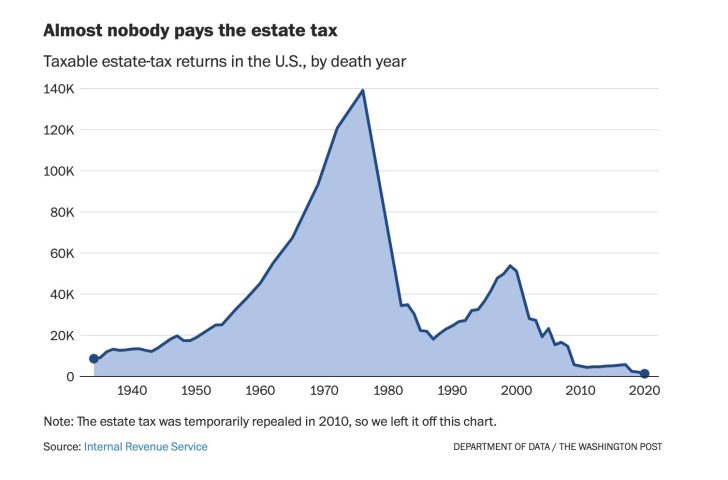

The Number Of Households That Pays Estate Taxes

Below is a chart from the IRS that shows the massive number of households that pay estate taxes since the mid 1970s. Almost no household pays the estate tax (death tax) anymore, which is great!

Invest In Real Estate In Tax-Friendly States

If you're a real estate investor, it's good to pay attention to state tax laws. Now, more than ever, people will be strategically relocating to different states for a better qualify of life. More companies are allowing employees to work from home post-pandemic.

Maryland, with its estate tax and inheritance tax, will see the biggest fallout from wealthy people looking to find a higher quality of life. You can be more strategic by investing in states with no inheritance tax or estate tax through private real estate investments.

Check out platforms such as Fundrise and CrowdStreet, two of the largest and oldest real estate investment platforms today. Fundrise offers diversified funds that predominantly invest in residential and industrial properties in the Sunbelt. The Sunbelt have lower valuations and higher rental yields.

CrowdStreet is for accredited investors looking to invest in individual deals across the country. CrowdStreet screens each sponsor and deal before showing the opportunities on its platform. It's then up to you to do further screening and build your select portfolio of real estate assets in tax-friendly states.

I've personally invested $954,000 in private real estate funds and deals since 2016. My goal is to diversify away from my expensive San Francisco physical real estate holdings and earn more passive income.

Relocating To A Tax-Friendly State Before I Die

Although I'm personally looking to relocate to Hawaii, I may have to relocate again to another state and set up residency before I die. I had never thought about having to move again until I researched the various states with estate taxes. I'm sure many of you may now be thinking the same thing.

Besides moving, the obvious way to reduce estate taxes is to know the federal and state estate tax exemption amounts and spend your assets down to the respective thresholds. Take advantage of the annual gift tax exclusion amount by giving the maximum to as many people as possible.

Estimate Your Future Wealth

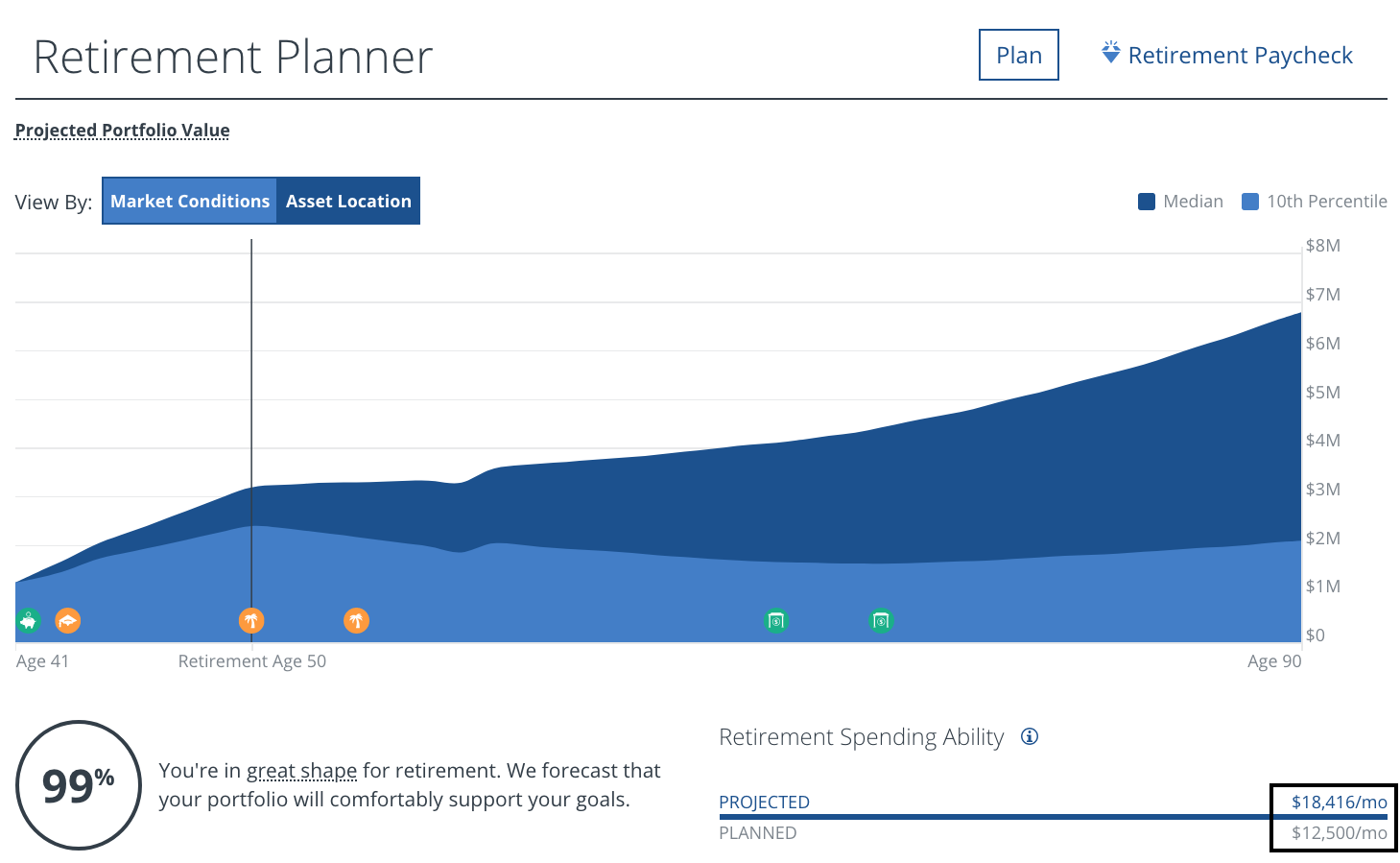

Reduce your estate tax bill by running your numbers through a retirement planning calculator by Empower. This way, you get to see what your potential investment portfolio size and cash flow is in the future. Empower has the best free financial tools on the web. I've been using it since 2012 to track my net worth and calculate my retirement cash flow.

In the calculation example below, this person will only have a projected portfolio value of $6.8 million at age 90 with roughly $6,000 a month in extra cash flow.

If the federal estate tax exemption amount stays as it is, this person won't have to pay any federal estate tax. However, if this person lives in Connecticut, Maryland, Hawaii, New York, Oregon, Massachusetts, Rhode Island, Vermont, Washington, D.C., Illinois, Minnesota, and Maine, he will have to pay state estate taxes.

Please be aware that the retirement planner you choose may only take into consideration your public investment portfolios. Many estates not only have stock and bond investments, but real estate investments, private equity investments, and business equity as well.

States are always changing their tax laws, so please consult with your local accountant or estate planning attorney. Not only will some states abolish their estate tax or create a new estate tax, but some states will also change the estate threshold amount, tax rates, and beneficiary rules.

Related posts:

The Best States To Buy Real Estate

A Capital Gains Tax Hike Should Alter Your Earning And Spending Plans

Surviving Off $400,000 Deemed Rich Enough For Higher Taxes Under Biden

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

New York gets a bad rap as the “Vampire” state (a play on the previous Empire state slogan), but there is plenty to love about NY state, especially if you are a military or a federal/state government retiree. Both my wife and I fall into this category and we pay absolutely zero NY state taxes!

There is no state tax on:

– Military retired pay

– State / Federal pensions

– Social Security

We share our time between two homes, one in a Catskill ski town and the other on beautiful Lake George in the Adirondacks. New York State rocks and summers this far north avoids the blistering heat the rest of the country has to endure each summer.

Additionally those of us that served in the military get a huge tax break on both real estate and school taxes on our primary home. My break lowers my $24,000 yearly tax bill to $11,000 on our Lake George home. Incredibly, the taxes on our ski town house (1 mile from the ski area) are only $3,000.

Both of the homes, worth a combined $3M, are in trust for our two children and with the high exemption for estate taxes, New York was a great choice for us when we retired from our careers in Washington DC.

What are your thoughts on the chance that the estate tax threshold will drastically be reduced in 2025?

Since you like to analyze data – what is the perfect place to retire in the US? All things considered: cost of living, health care costs, income tax, real estate tax, etc.?

Nevada DOES have an estate/inheritance tax. They follow the federal limits which are about $12.4 million excluded. Above that and you DO pay an estate / inheritance tax.

Thanks. If so, then the estate threshold is $13.6 million per person for 2024. As a result, less than 1% of people living in Nevada will pay a state and inheritance tax.

I know you can’t cover everything and all the nuances in one article, but it’s worth noting that Pennsylvania’s inheritance tax has basically no exemption for small estates. Everyone pays it. 0% on assets left to your spouse or minor child, 4.5% to direct descendants and lineal heirs, 12% to siblings; 15% to everyone else. Pennsylvania is telling me that I have to get married to my partner of 20 years (who is legally unrelated and would owe 15%), or leave the state. I suppose this is in some ways a method to recapture the tax the state “loses” by not taxing social security benefits. Nevertheless, we’re leaving.

So the Federal exemption will not apply to PA?

Too bad the politicians ruined beautiful California created by mother nature.

Although I don’t agree with your top 5, thanks for writing an interesting article! In my opinion, there is no way California deserves a top 5 ranking given high cost of living and likeliness of high state income / investment taxes for heirs. Hard to argue with Virginia based on your data but Alaska, Wyoming, and Montana? They are all beautiful, great for COVID-19 quarantine, but otherwise very remote and cold for most. I would suggest AZ, FL, TN, and NV instead with easier travel via major airports, warmer weather, and more to do beyond nature related activities.

Sure, that’s the great thing about America. We are free to move to wherever we want to save on taxes and pass away!

California is a conundrum, but not if you actually live here. There’s a reason why the population is massive and why some of the great new century companies are here. The quality of life and the opportunity to build your fortune is pretty high.

Florida and Nevada are definitely good for taxes.

Many companies and people are leaving California in droves. They ruled the state fir the middle class and the weathy don’t want just give away all their income. California needs so much work i don’t know if anything can fix it.

It’s overplayed by the media.

Check out:

Reasons Why People Are Migrating To California From The Midwest Or The South For A Better Life

Real Estate Outperformance Examples In SF During The Pandemic

IN AZ consider the water issues – you can go online and check the water reports for each state. CA NM and AZ have serious water issues especially in the next coming years. Some communities will end up as ghosts towns especially AZ. Have lived in all 3 and by far the worst for future needs is AZ and NM = lots of drought, very high temperatures, high electrical bills and lack of rain. Something to consider.

I was from NH. The high property tax rate doesn’t scare me because it’s far offset by the cost of housing. Utilities will run more because as you said it’s cold as heck there.

I have a pension coming. I’m looking to move to Nevada from CA to avoid state tax on my pension. I think I will keep my CA home though when I need to get away from the oppressive summer heat in Nevada.

Why is NH not on your “most powerful” list? It has no income tax, no sales tax and according to your article no estate tax.

NH is there.

The problem with NH is that it gets cold as hell and the property tax rate is the 3rd highest in America as of this year.

There is also a 5% tax on dividends and interest.

NH also has a small business tax which makes living there while running a solo biz useless. Tops in country for taxes.

I’ve lived in quite a few states around the country. There is generally a trade off between taxes and quality of services, medical care, schools, colleges, etc. That may not be a concern for those looking to retire or pass on their estate to their kids or grandkids though.

There are still probate fees in many of these states. The last time I looked Delaware charged 1.5 percent. It’s also more complex then just inheritance taxes. Consider the case of Delaware and Pennsylvania. In PA you pay taxes when you contribute to a 401k and don’t pay them when you withdrawal. In Delaware it’s the opposite. But PA has an inheritance tax and Delaware does not. So is the focus what you leave or while you are retired?

No probate court fees hopefully if you’ve set up a revocable trust. The expensive probate fees is one of the main reasons for everyone to set up a revocable trust, not just the wealthy.

Hey Sam, nice article! Just a note on the info for Connecticut as a CT resident, the State estate tax exemption increased from $3.6 million in 2019 to $5.1 million for 2020 and is scheduled to keep scaling in over next few years to eventually match the Federal exemption. In addition, there’s a cap on the total amount of estate tax owed. You have to dig around a bit for the info but it’s out there.

I find it interesting that you’ve chosen to label estate taxes “death taxes” and not “anti-fedudalism taxes.” It’s no coincidence that the fall in generational economic mobility alligns with the repeal of so many so-called “death taxes” the past 30 years.

Where one person sees the government grabbing money from dead people’s hands another can see the government stepping in to avoid a new caste system or nobility class.

So it’s government’s role to confiscate one’s assets when they die and transfer that wealth as they see fit? Just disregard the layers of taxes that were paid over decades attaining / growing those assets – and the taxes that would be paid by the inheritor for future earnings associated with the same? Well, I guess that’s one approach.

Well Chris, when you’re dead there are lots of things you no longer have control over anymore unfortunately. You say people should have the right to pass down what they’ve earned and been taxed on but what if that wealth was just passed down from a previous generation? I guess it’s important to make sure that Bezos’ great great great great great granddaughter never has to work a day in her life because he paid his fare share of taxes.

It’s a bit disingenuous to think that folks who earn vast amounts of wealth due to the systems that taxation provides for (schools, government, police, etc.) should not repay some of that upon their death. Yes, they are taxed throughout life, but again, these same taxes often add to their wealth in ways too numerous to enumerate on a post.

I find it absurd that anyone with less than $3 million of wealth defends the taxation of anyone with more. It’s not that I begrudge their wealth and it’s not that I do no want to have more; it’s that equity must at some point be somewhat equitable or the backs of those whom it is earned from become too beaten to continue to prop up the system.

So by your logic EVERYONE should pay death taxes with no exclusion. Still sound fair for the government to rob your kids?

Californian here. Although we don’t have an estate tax, if you die without funding your wealth into a trust, CA can still take it if your surviving family doesn’t handle probate properly. For that, they’re going to need to spend thousands on a lawyer.

Hey Sam – hope you and yours remain healthy and well. Off topic, but as we’re hearing more about many companies (and Bay Area ones in particular) talking about more remote work post-covid, wondering what you think the impact may (or may not) be on RE prices there, increasing geo-arbitrage (and the impact of that on RE prices elsewhere) etc? Also interesting to think about given the varying income tax levels by state (and additional debt burden by many states with high income taxes). I’d find getting your perspective interesting in case you’re looking for ideas on future posts :)

I unfortunately experienced this situation last year when my father passed. He was a resident of CT but had a property in FL and he was in the process of transferring residency. Because he was unable to complete that residency claim before his death, his estate incurred a 6 figure estate tax bill from the state of CT. My father was a civic-minded person and dutifully paid high income and property taxes his whole life in CT understanding the value of the social contract and that much of those taxes went to safety and schools. To me, the heartburn comes when you see a state like my native state of CT continuously run up deficits and bolster entitlement programs that kick the can down the road for future generations. Simultaneously, politicians pick on high earners and corporations as not paying their fair share which is laughable when the state has a progressive tax system. So what you get is high earners who have the freedom to move fleeing the state and taking their money with them. It is common in the Northeast for high net worth individuals to relocate to low tax states like Florida or the Carolinas or the Southwest after years of seeing states take their taxes and spend recklessly. The state has even seen blue chip companies with generations of history embedded in CT flee because of the constant scapegoating. Now there is a hallowing out of the tax base while the debt that has been racked up is coming due. It boggles my mind why states that enact an estate tax don’t seem to understand that the people their tax targets encourages them to employ legal maneuvers to avoid the tax including packing up and taking all their taxable activity elsewhere.

That’s exactly correct. As much as my spouse and I would like to stay in our home in MA, the confiscatory estate tax provides a strong incentive to leave. This makes no sense. As reasonably well-off retirees, we should be encouraged to stay. We use very little resources and pay considerable income and property taxes. If anything, they should provide a bonus to those that stay. Why encourage all your retirees to leave?

Thank you so much for providing this article, I hadn’t considered any of these things in choosing where to retire.

Fellow William and Mary (and VA Tech) alum here! Virginia is a fantastic state to live in and retire in– I am working hard on that now. I do love my chosen field, though, and will probably work part-time so will truly only be semi-retired. There will be an inheritance for my heirs, I am certain, but it may not be out of the six figures range (I chose a moderately lucrative-paying profession), but even so, this helps very much. I wish you well. Robin

Go Tribe! I miss Virginia and would love to spend a weekend in my old high school neighborhood and spend another week down in Williamsburg. So many good memories. It’s also fun to go back to where you were a poor student with money to spend. No more need to ration what to get at Paul’s Deli!

Nothing like a late-night stromboli from Paul’s during exam week. I miss Williamsburg, too. Stay well!

I believe TN has no estate tax. It also has no income tax. The Hall tax which taxes investment is also set to phase out completely in a couple of years. It does have a higher sale tax but you have to buy a lot of items to come out behind.

Awesome, thanks for pointing that out.

I was about to write a comment saying, “you’re not quite right, TN does have an income tax on investment income (but not wages).”

But this tax is being phased out, and will be repealed on January 1, 2021. So you are actually correct!

Yeah, that was the Hall Tax I was referring to. I can’t wait for that to be repealed :) But it has been phasing out by 1% each year since the legislation passed it several years ago. I forgot when it got to 0, but looks like you answered that 1/1/21.

I suspect that the incredible loss of revenue due to Covid will reverse this phaseout. Sales taxes cannot realistically go much higher in this state and God forbid anyone support an income tax (ambivalent myself).

I pay quite bit in Hall tax and do not mind as it from income earned without labor. Seems like it should be more similar to the state sales tax as that is so regressive and at least most folks who pay Hall can afford it.

Wow thanks for raising awareness on this. I had NO idea that some states have their own estate and inheritance taxes. Yikes! Glad to learn that California has no estate or death tax. Will definitely reference this list if I ever relocate down the road.

Yes, very surprised and glad California has no state estate taxes as well given our property ownership here. I don’t plan to sell any property ever.. but we’ll see. I should probably do a most on how to successfully move assets to another state or not have one state tax your estate if you have assets in that one state.

Unfortunately, my country doesn’t have something like this. Actually, you pay taxes for everything: real estate, savings, inheritance, dividends etc.

Come on Sam, don’t you know from working at GS that no one pays these taxes? Used to work in PWM at GS; nobody paid anything

Oh yeah? Please share some tips on how your PWM clients avoided estate taxes besides giving money away and setting up a GRAT.

My clients were institutional money managers, not individual folks.

thx

Hey Sam,

Great article, love the hustle and work you put into all that you do (particularly the website + podcast)!

Have you considered moving to Mexico as an expat for retirement? Or another foreign country?

Mexico has Hawaii-like beaches, great food, much cheaper all around, beautiful scenery (beaches, jungles, desert, big cities, whatever you want), friendly people, Mayan ruins, etc.

Hundreds of thousands of Americans live in Mexico.

I love Mexico, especially for the scuba diving! Amazing.

However, I have family in Hawaii and I’m guessing the education system I’m looking at in Honolulu is better for my children. That said, we are considering homeschooling forever.

Great information Thanks for reseach.

Hey Sam, great article, thanks for taking the time to put it together. Can you elaborate on why Texas is marked as “not tax friendly” on the Kiplinger chart you included here? Thank kind of perplexes me. A year ago we moved from Orange County California to Fort Worth Texas primarily for tax reasons and because it’s cheaper for me to run a business and have a warehouse here. In California, we were paying 60k per year in California income taxes plus 8k a year in property taxes. Since we moved to texas, we pay $0 in state income taxes and about 22k a year in property taxes (which sucks but we bought a 5500 sq ft house so we shot ourselves in the foot on property taxes). So we paid a total of 68k a year in California taxes VS paying 22k a year in Texas taxes. That’s a savings of 46k a year which is pretty substantial for us. Anyway, we really love Texas and are super happy with the move. I pay my employees out here the same wages I paid in California but I get way higher quality people because the pay is good. The weather isn’t quite as nice as California but we still travel a lot so we don’t miss it too much. I honestly think a lot more small biz owners will make the move. My warehouse rent is half what it cost in California. Anyway, thanks again for the article! Your free content is always much appreciated ;)

Great point about Texas!

The chart pertains more to the middle class American who would not face high marginal income tax rates in higher tax states due to lower marginal income tax rates and higher standard deduction rates. The chart is not as relevant for families with large estates.

The main issue with Texas is the much higher property tax rate, despite the much cheaper homes compared to California.

I’ll clarify this in the post. Thanks.

How is life in Forth Worth?

I’ve thought about the move to Wyoming and even investigated the tax situation and my professional licensing (Colorado Vs Wyoming). The border of Wyoming is a short 40 min drive. Homes are more affordable and much more space with less traffic.

However, the last time I went to Wyoming for one of our kids soccer games, we experienced all four seasons (sun, wind, rain/hail and snow) in a 2 hour window. True story.

I live in Wyoming (Jackson, not a billionaire though). It is great not having to file state taxes. You do need to set up a revocable trust to avoid probate. Sounds like you are considering Cheyenne. I like Cheyenne, but before you take the plunge, you need to understand that it is not Denver. It can be pretty bleak even compared to Fort Collins. I love the weather volatility here but do not be fooled. Life is not easy in Wyoming, even in Jackson (unless you are one of the billionaires). My wife would love to buy a second home in Southern California but I won’t let her for fear that the Socialists over there will come knocking one day. Also, keep in mind, that the budget situation in Wyoming is really bad right now. The schools are still remarkably good for such a rural state but I do worry about the long-term.

Nice piece. FWIW, we long ago accepted the inevitability that our estate would likely have to pay the WA estate tax (with a probably exclusion of around $2.5M by the time we go). In other words, we’ve thought about gaming it at the end, but probably won’t unless we have a burning urge to move when the time comes.

In the case of WA, we think paying the estate tax really is a small price to pay for the years of no income tax and hard to beat quality of life (and I spent many elementary school years growing up on Maui, I love Hawaii too, but it’s on our annual visit list, not retirement list).

Agree. You guys are really lucky for not having to pay income taxes. If California did that, we’d go broke, but maybe not as it would attract millions more people and companies here.

At least there’s Prop 13 for property taxes.

Given that I now got all my immediate family living here in the Bay Area I may never leave. Since none of us were born in this country; we could technically leave but it is too hard to uproot oneself and look for community later in life.

Glad to know CA is on the list although I do plan on spending most of my money before I’m dead