Are you wondering whether to superfund a 529 plan? My wife and I did for both our children when they were born in 2017 and 2019. I'll share with you our reasonings in this post.

If you can superfund a 529 plan, I think you should. It feels good to have your child's education fund squared away for five years until you can contribute again. With the passage of new laws, the flexibility and attractiveness of a 529 plan is even greater. You no longer have to worry about having funds stuck in an overfunded 529 plan anymore.

A 529 plan is a good way to save and invest for your child's education. The after-tax money you put into your child's 529 plan gets to compound tax-free, just like a Roth IRA retirement account. Further, when you use the money to pay for qualified college education expenses like tuition and books, the money is not taxed.

Positive Changes To The 529 Plan

Thanks to the 2017 Tax Cut And Jobs Act, $10,000 a year from the 529 plan can also be used to pay for grade school tuition as well. The added flexibility is nice for parents who are considering sending their kids to private school. Tuition can range from between $10,000 to $60,000 a year.

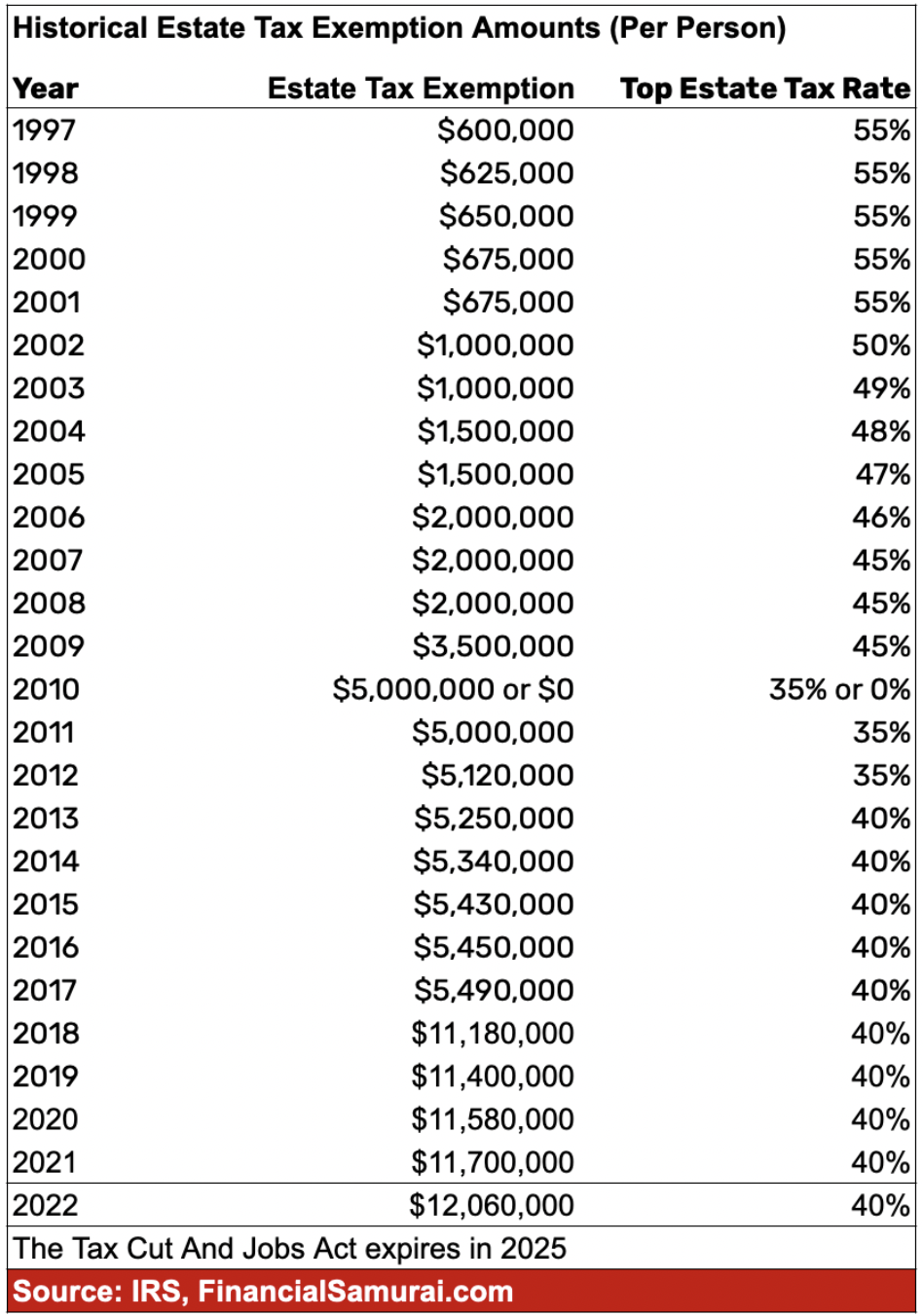

Normally, the maximum each parent is recommended contribute to a 529 plan is based on the maximum gift tax exclusion amount. This amount is $18,000 per parent per year in 2024 versus $10,000 in 1997. The maximum gift tax exclusion amount generally goes up by around $500 every 2-3 years.

Given $18,000 is the gift tax exclusion amount in 2024, can now superfund a 529 plan with $90,000 starting in 2024. That's a lot of money!

The $18,000 per year is not limited by parent. It is limited by person. In other words, if you get two sets of grandparents to also contribute $18,000 each, along with two parents, that's six people who can contribute a total of $108,000 a year!

If this happens, your child will become a 529 plan millionaire in no time. And sadly, with the way college tuition is rising, more college-bound children will need to be 529 plan millionaires.

If You Accidentally Fund More Than The Gift Tax Limit

Just note, if you give more than $18,000 in cash or assets (for example, stocks, land, a new car) in a year to any one person, you're supposed to file a gift tax return. You don't actually have to pay a gift tax since you're still living.

You're also not going to be sent to prison, like the parents who were caught bribing university officials to help their children gain admission. So don't worry.

What Is 529 Plan Superfunding?

Superfunding, or 5-year gift-tax averaging, allows families to front-load large contributions to a 529 plan without having to pay gift taxes, while protecting their lifetime gift and estate tax exemption.

With 529 plan superfunding, individuals may contribute up to $90,000 ($180,000 for couples) per beneficiary if it is treated as if it were spread over a five-year period. This superfunding amounts starts in 2024.

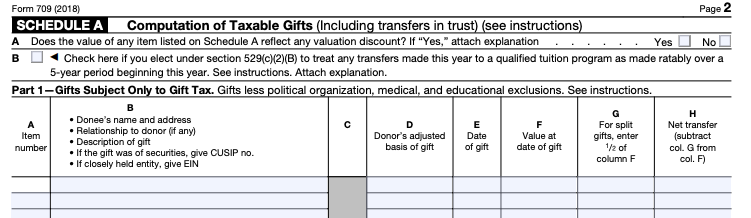

Taxpayers must report 529 plan contributions between $18,000 and $90,000 on IRS Form 709 for each of the 5 years, and check a box to indicate that the contribution is being spread evenly over 5 years.

Why Would You Superfund A 529 Plan?

$85,000 per person to superfund is a lot of money. So why would a parent want to superfund a child's 529 plan instead of spreading it out over a 5-year period?

Here are some reasons:

- You have spare cash and are a busy person who wants to get the 529 plan contributions out of the way. Once you contribute $80,000 you can't contribute without penalty for five years. Superfunding is like saving yourself five years of thinking about saving for your child's education. It's similar to maxing out your 401(k) at the beginning of the year so you don't have to worry about it for the rest of the year.

- You have wealthy grandparents who may be able to make a larger tax-free gift by using up part of their lifetime gift and estate tax exemption.

- There's a bear market and you want to take advantage of depressed prices.

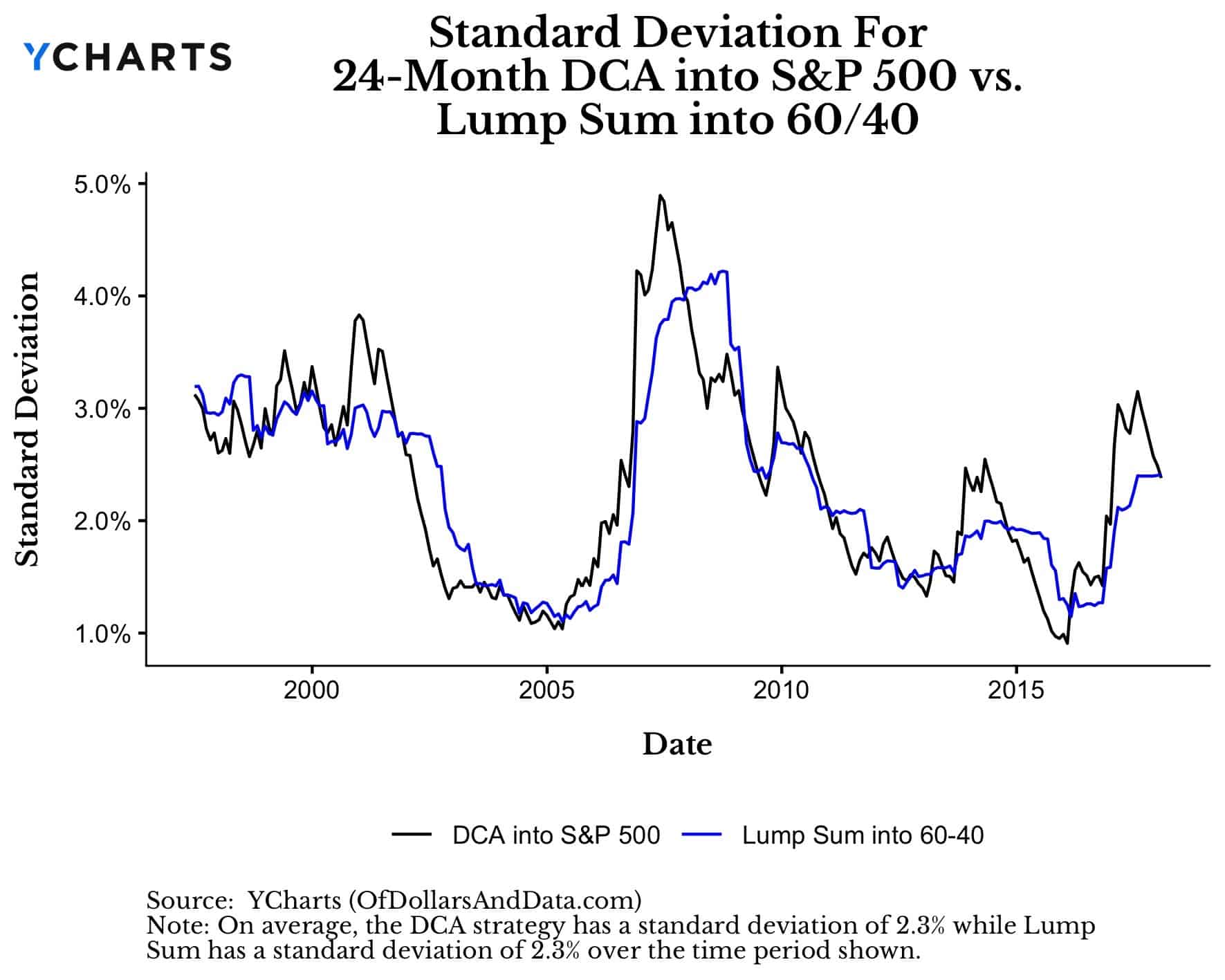

- You believe in lump-sum investing versus dollar cost averaging.

- You have a busy and complicated life and just want to get college savings out of the way.

In a normal upward trending market, superfunding will provide a greater return than dollar cost averaging.

For example, let's say you superfund $90,000 and earn a 7% compound annual return for five years. The account will grow to $120,000+. But if you dollar cost average $18,000 a year and earn a 7% compound annual return for five years, you'll only end up with ~$110,000.

Downsides To Superfunding

Of course, if you decide to superfund your account right before a bear market begins, then obviously you will lose much more than if you decided to contribute $18,000 a year for the next five years.

For example, let's say you superfunded $80,000 in 2022 and the S&P 500 goes down 50% in the first year. You will have lost $40,000 in year one.

Now let's say the S&P 500 climbs back by 10% a year for the next four years. In year five, you will end up with still only $58,000. But if you dollar cost average $16,000 a year, you will lose $8,000 in the first year, but end up with $93,000 in year five. $93,000 versus $58,000 is quite a big difference.

More Downsides To Superfunding A 529 Plan

Another downside to superfunding is that you'll run out of ammo to be able to contribute more when stock prices are depressed. If you do run out of ammo, then it incumbent upon you to lobby a grandparent, a god parent, or a relative to contribute to your child's 529 plan. That's not exactly an easy thing to do.

Another downside to superfunding is if the gift giver dies within the five-year period. For example, heaven forbid a grandparent contributes the maximum $90,000 and dies in the fourth year. If so, only the first $72,000 is considered a completed gift. The remaining $18,000 will be added back to the grandparent’s estate and will be subject to estate taxes.

Good thing the estate tax exemption amount limit is now $13.6 million per person in 2024. A grandparent would need to be extremely wealthy to have to pay taxes on any leftover superfund money after death. This is especially true since two grandparents have an estate tax exemption amount of $27.2 million in 2024.

Of course, the estate tax exemption amount could decline in the future. In 2003, the estate tax exemption was only $1,000,000. Depending on who becomes president, there's a chance that the estate tax exemption would be entirely abolished.

Final Downside To Superfunding

The final downside to superfunding is that the 529 plan might have grown too large by the time the child goes to college. Two parents superfunding $180,000 will grow the 529 plan to over $719,000 in 18 years. This is assuming an 8% compound annual growth rate.

Contributing too much to a 529 plan can be a problem. The money could have been used to pay for a better life for yourself or for someone. As someone who cares enough to read about 529 superfunding, chances are higher that you may die with too much money. Practice consumption smoothing.

If your child decides not to go to college or is brilliant enough to get a full-ride, all that money could have been used to live a better life instead. Thankfully, the beneficiary of the superfund can always be changed. Or you can withdraw the money and pay a 10% penalty on gains as well as capital gains tax.

In fact, a 529 plan is one of the best generational wealth transfer tools. Instead of giving your loved ones just money, it's better to give them the gift of education.

A 529 Plan Is Probably Not Enough To Pay For All Of College

The thing is, after seven years of saving the max in two 529 plans, I don't think a 529 plan is enough to pay for all of college when it comes time.

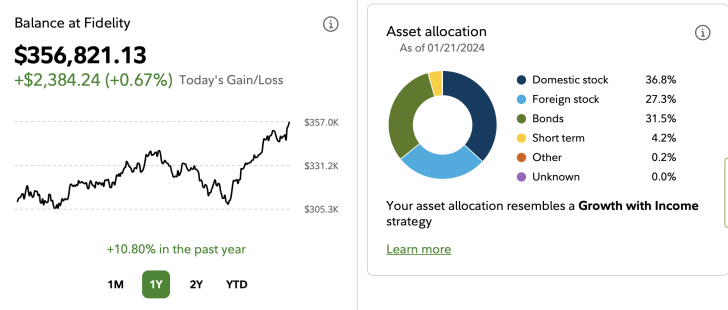

Below is my son's 529 plan balance after superfunding and regular contributions from my parents and wife since 2017. With college expected to cost $750,000 all in when it's time for him to attend, I'm not sure his 529 plan will be enough.

One of my key mistakes with saving and investing in a 529 plan is choosing a target date fund as opposed to investing the entire sum in the S&P 500. With an 18-year investment horizon, investing in the S&P 500 makes a lot more sense.

Alternative To Superfunding: Megafunding!

Individuals are not subject to gift tax or generation-skipping transfer tax (GST) unless the total amount of cash and properties they give away over the course of their lifetime exceeds $13.6 million for 2024.

529 plan aggregate contribution limits range from $235,000 to $529,000, depending on the state. In other words, you cannot contribute millions of dollars to a plan. Otherwise, the 529 plan would be one of the most popular ways wealthy families can pass down tremendous wealth tax-free.

According to the IRS, 529 plan contributions may not exceed the amount necessary to pay for the qualified education expenses of the designated beneficiary. Each state has a maximum aggregate limit for 529 plans. It is based on what the state believes is the full cost of attending an expensive college and graduate school. This amount is including textbooks and room and board.

However, it is possible to fully fund a 529 plan account without having to pay gift taxes. So long as you are under the estate tax exemption limit you should be good.

529 Megafund Example

For example, married grandparents in California who want to fully fund a grandchild’s 529 plan may contribute a lump sum of $529,000. The first $30,000 of the 529 plan contribution will qualify for the annual gift tax exclusion.

The remaining $499,000 must be reported on IRS Form 709 and will count against their lifetime exemption. (There are no joint gift tax returns, so each grandparent will have to file separately).

Please double-check with an estate planning lawyer if you or a grandparent plants to contribute the maximum allowable to a 529 plan in your state. The numbers tend to go up over time to account for inflation.

Also note that due to the passage of the SECURE 2.0 Act. Any leftover 529 funds can be rolled over into a Roth IRA. The limit is $6,500 per year and there is a lifetime cap of $35,000. Further, you need to have the 529 plan be open for 15 or more years to be able to roll over.

Rules To Consider Before Superfunding A 529 Plan

There are no hard and fast rules regarding when you should superfund a 529 plan. However, here are some rules to consider before you do so:

- If the S&P 500 has declined by 20% or more, superfund a 529 plan. The average bear market decline is roughly 35%.

- If the S&P 500 is three years into a bull market or less, superfund a 529 plan. The average bull market lasts around 5 years.

- You have an above average net worth for your age.

- If your child is more than 15 years away from attending college, superfund a 529 plan. The average return for stocks since 1926 is 8% and closer to 10% with dividends reinvested.

- If you are already maxing out your 401(k), IRA, Roth IRA, and SEP IRA plans, superfund a 529 plan.

- If you still have more than six months after you superfund a 529 plan, superfund a 529 plan.

Superfunding A 529 Plan Feels Good

By superfunding a 529 plan, you can then focus on aggressively building up your taxable investment accounts. Your taxable accounts are inn order to generate more passive income. Your passive income is your most valuable asset that will enable you to achieve financial freedom sooner.

If there are two parents, you can always go the hybrid approach. Have one parent superfund and the other parent contribute $18,000 a year instead. This way, you are hedged in case the stock market does take a dive after superfunding. One parent will still be able to contribute $18,000 or more up to a total of $90,000 in a 5-year window.

Just be careful not to overfund your child's 529 plan. Follow my 529 plan savings guide by age. You can throttle your contributions or step up your contributions if needed. A college education is still important, but its value is declining as everything can be learned online for free.

Related: Roth IRA or 529 Plan Contributions For College

Diversify Your Investments Into Real Estate

In addition to superfunding a 529 plan, you should also invest in real estate. Real estate is my favorite asset class to build wealth for ourselves and for our children.

The combination of rising rents and rising capital values is a very powerful wealth-builder. Real estate is also a great way to diversify from your stock holdings.

In 2016, I started investing in heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms.

With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common. As a result, real estate is going to be attractive for a long while.

Take a look at my two favorite real estate crowdfunding platforms.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. Due to strong job growth, there are good demographic trends as well. If you have a lot more capital, you can build you own diversified real estate portfolio.

Since 2016, I've invested $954,000 in private real estate to diversify, invest in the heartland, and earn more 100% passive income. I believe a demographic shift to lower-cost areas of the country thanks to technology is a multi-decade trend.

Both Fundrise and CrowdStreet are affiliate partners of Financial Samurai and Financial Samurai currently has a six-figure investment in a Fundrise fund.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience.

If you superfund a 529 and check the box on tax form 709 to indicate that the contribution is being spread out evenly over 5 years, do you have to file a form 709 again in subsequent years for that superfund contribution?

Thank you so much for your time and thoughts; I greatly appreciate it.

Can you superfund again after initial 5 year super-funding period is up?

Now that its Oct 2021, can I contribute for this year and then do a super funding in Jan ? Thay way I can start with higher amount, rather than wait for 5 Years to add?

If both parents would like to contribute the maximum to a 529 plan for a given year, can the money for both contributions come from the same joint checking account that both parents share?

When I make a contribution to the 529 plan for my child (to Vanguard) from the joint account that my wife and I share, I do not have to indicate anywhere who (e.g. – my wife or I) is making the contribution.

Is it permitted (and not a problem) if my wife and I make a total contribution of $30,000 in 2021 from the same joint account? Or does my wife need to make the contribution from an account where she is the sole owner (she does not have a checking account where she is the sole owner at this time so we are hoping that the contribution for both of us can come from the same joint account)? Thank you very much for any thoughts.

Good question, and I think the answer is yes. It’s not like the IRS checks. And even if they do check, there are two people on the account for the maximum gift tax limit. Of course, feel free to ask your accountant.

At one point I was deciding whether or not to superfund my child’s 529 plan and decided against it (we were well into the longest bull run on record).

My daughter is now 3 1/2 years from college so superfunding probably not as big a bang for the buck and with the current state of the market, I’m not sure which way it will go so it’s not worth the risk and might as well dollar cost average it in.

I was curious, I know if you superfund you are locked in for the next 5 years of giving. What happens if they raise the limits during that time (like they did a couple of years ago from 14 to 15k? Do those who superfunded then make up the missing $1k/yr increase?

One thing that I feel is a bit unfair is how the 529 contributions are set up that penalize a child with a single parent (and the other parent is either not living or really no desire to contribute). That child is handicapped 50% compared to a child with 2 parents that can contribute.

A better way is to designate that a child can receive a max of $30k from parents and it doesn’t matter if there is one parent or 2 in the picture. Gives every kid an even start.

The other parent, if still living and if s/he has the funds, can still gift $15,000 to their child’s 529 plan. You can gift $15,000 to anybody as that is the gift tax exclusion maximum for 2020.

I’m pretty sure as the gift tax exclusion increases, the parent can add to the difference during the 5 years.

Yes, it doesn’t make sense to superfund your daughter’s account now. It does feel good to superfund early on and feel like at least you have part or all of your child’s college education covered and don’t have to think about it again for a while, if ever.

It’s tough to gauge just how much you will need for college. I have two kids, and my state had merit based scholarships they should qualify for. Both or neither may decide to go to college. Both or neither may qualify for other scholarships….

My state allows me to write off donations against my income, saving my 6% in tax. It’s also invested in mutual funds.

Considering everything I aim to cover half of the state school tuition costs for each kid. If scholarships are cut costs or one kid doesn’t go, I may end up with too much still.

What are you going to do when the Bernie bros make college free for all, or College prices get destroyed due to Covid-19? I think we are in for a college cost cutting revolution. As the government backed and made student loans easy for everyone, colleges got greedy and increased prices, it has been a huge scam.

It’s a great point. It is possible that one parent superfunding $75,000 and letting it hopefully compound over the next 18 years is good enough. At a 6% compound annual growth rate, you’ll end up with $214,000.

A parent will simply not have to be a robot and contribute more or throttle back or change investments as the college landscape changes over time.

I took a class on asset protection recently and it was mentioned 529s are worse than investing in a business or real estate. It is likely you would make out better if you bought a rental house and just refinance to pay for the college. I’m not saying this is a good approach or not. Just interesting. Something to consider.

Cool. Did your class tell you why? A lot depends on what you invest in and the performance of the business and real estate.

Definitely think deeper on this topic and challenge your professors on the why.

If a person has enough money to max out all their retirement accounts and superfund a 529 plan they probably could just cash flow college anyways. I’d hedge my bet. I’d put half the money in the 529 and half in a taxable account. Who can predict how a kid will turn out 18 years from now? I would hate to have to much in the 529 and get stuck paying a penalty.

For my kid I bought a structured note when she was 13 for 200k. It offered 100 percent downside protection and unfortunately that’s about all it did. I think I got back 205k. She’s in college now and the total cost is gonna be about 100k.

In hindsight I would’ve done way better splitting the money between a 529 plan and the structured note. I would’ve been hedged against a bear market and made money in a bull market.

Thanks, Bill

Yeah, it’s hard to predict the future, which is why parents should actively reassess their kid’s educational savings progress every year.

I’m not going to mindlessly keep contributing $15K/year if it turns out my kids hate college, are not academic (maybe need to contribute more as a result), or are on some miraculous path towards an academic or athletic scholarship.

I’d rather spend the money on life now.

I think super-funding the 529 plan makes sense if one has the financial means.

How else can you fund your kid’s education in a tax free account?

The only caution I have (and I’m not sure of the answer here) is do you lose your tax deduction in future years by contributing all at once vs. spreading out the contributions over years?

But for those with less means, I would not go too crazy with contributing to the kid’s college fund.

There are a lot of talks about making public colleges free. Other talks have centered around student debt forgiveness.

For those with a baby, the value of a college education might decrease significantly over the next 20 years as the gig economy takes hold and we are all basically self-employed.

No tax deduction for us in California. Only high tax rates, hah.

I’m hoping public colleges will be free in 15+ years. That would be a nice gift, even if the 529 plan does get large. The money can still be used for other qualified expenses besides tuition and gifted to a grandchild or someone else.

A 529 plan is like a 401(k) plan in the sense that it’s like insurance. It’s also out of the way. Feels good to have multiple bases covered.

I think it’s a great option for those who have the funds. A lot depends on market conditions as you explained in your examples though. So one could come out a lot ahead or down depending which way the markets run for five years. I do like the set it and forget it approach though so if I had the means I think I would superfund.

May as well superfund for peace of mind. If you spend all your money on a house in Hawaii and real estate tanks there, at least you’ll have college expense taken care of.

I’ve read that a Roth IRA can be used to fund a child’s education expenses. Do you know whether a Roth 401k can be used in the same way?

That’s true actually. Whether it’s investing money in the stock market or investing in Hawaii real estate or blowing it on a Ferrari, by superfunding each child’s 529 plan, at least the parent knows that if all else fails… there’s still that money for their children.

Check out: Roth IRA or 529 Plan For College

Thanks for the reminder. I’ve been writing so much recently it’s hard to keep track. Sprinting towards the lockdown open finish line!