Want to earn more money and pay less taxes? We all do. Let's talk about three of my favorite ways to earn more and pay less.

John F. Kennedy once said, “Ask not what your country can do for you, ask what you can do for your country.”

I took his message to heart when I came to America as a teenager. As soon as I started my first job out of college, I was proud to pay taxes to help our country thrive.

Starting around age 26, I began paying more than $100,000 in Federal and State income taxes a year. I distinctly remember coming home after a 14-hour day exhausted and finally analyzing my pay stub.

25 percent of my pay went to Federal taxes. 6 percent went to State taxes. 7.65% went to FICA taxes. After contributing to my 401(k), more than half my gross paycheck was gone.

It's one thing to pay taxes when you've got a pleasant job with relatively comfortable hours. It's another thing to pay lots of taxes when you're often miserable at work. The desire to be so patriotic like JFK said declines.

Making W2 income is the most inefficient way to earn money. High taxes is why some CEOs gladly accept a $1 salary in exchange for earning stock grants that are taxed at long-term capital gains tax rates.

Let's look at my three favorite ways to earn money and pay less taxes.

Best Ways Earn More Money And Pay Less Taxes

One of the easiest ways to pay zero income taxes is to make your income equal to your standard deduction.

Single filers get a standard deduction of $13,850 while married couples get a standard deduction of $27,700 for 2023. The standard deduction should continue to inch up over the years to keep up with inflation.

Unfortunately, not many adults can comfortably live off $12,200 a year. In fact, the Federal Poverty Level (FPL) is $12,140 for one person and $16,460 for a two-person household.

Besides making less money, we all know about the benefits of an HSA plan, contributing to a 401(k), IRA, Roth IRA (not a fan for higher income earners), and opening up a 529 plan for your kid. Letting your investments compound tax-deferred or tax-free is wonderful.

Let's talk about bigger picture ways to pay less taxes that may also provide you a better lifestyle today. After all, we might not live until the age when we can withdraw funds penalty-free from our pre-tax retirement accounts.

1) Generate More Qualified Dividends And Long-Term Capital Gains

Generating more qualified dividend income and long-term capital gains is highly tax advantageous compared to earning more W2 income.

Qualified dividends are those paid by domestic or qualifying foreign companies that have been held for at least 61 days out of the 121-day period beginning 60 days prior to the ex-dividend date.

Long-term capital gains is generated by holding and selling any asset for more than a year.

As you can see from the chart below, once you start making over $44,625 as an individual, you get to pay a 0% long-term capital gains tax rate. 0% tax rate to earn more money sounds good to me!

Long-Term Capital Gains

Impressively, you can actually earn up to around $578,125 a year as an individual in long-term capital gains and still only pay a 15% tax rate for 2023. Even if you make multi-millions in long-term investment income, your maximum tax rate is capped at 20%.

But let's not forget the 3.8% Net Investment Income Tax (NIIT) on income over $200,000 for singles and $250,000 for married couples to help pay for more government waste.

For more info, see short-term and long-term capital gains tax rates by income. If you pay short-term capital gains tax, you are paying your marginal federal income tax rate.

Hence, the best way to earn money and pay less taxes comes from knowing the tax code!

It's logical that long-term capital gains tax rates are lower than Federal income tax rates since the income used to build an after-tax portfolio was already taxed.

The larger you can build your after-tax investment portfolio, the more passive income you will generate. The more passive income you can generate, the more options you will have to become financially free.

Remember, your goal is to try and live your best life now, not when you're too old to move.

2) Own Rental Property

Owning a rental property is like owning a business. All expenses related to running your rental property are deductible from the rental income. Just be careful and remember that deductions start phasing out after you make over a certain income amount.

A key rental property expense is depreciation. Depreciation is a non-cash expense to provide a fair way for the normal depreciation of your property.

There's no escaping property tax, but at least it's a deductible expense. While owning your property, it's worth trying to convince your property assessor that your property is worth as little as possible.

Rental Property Is My Favorite Wealth Builder

One of the good things about owning rental property is that you usually acquire rental property during your higher income tax bracket years. But rental income is generally the lowest during the early years of ownership, hence the lack of taxable rental income.

Once you've retired, you'll probably be in a lower tax bracket and should receive more rental income given your rent will be higher and mortgage interest and amortization will be lower. In other words, rental income becomes more meaningful as you get older, which is exactly what you want.

The only thing about owning rental property is that it scores low on the passive investing scale. The older and richer you get, the less you want to deal with maintenance and tenants. This is where investing in real estate crowdfunding and REITs come in if you continue to want real estate exposure without the hassle.

Check out private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside.

If you want to get more surgical in your private real estate investments, Crowdstreet is a strong solution. I've met the people at Crowdstreet on two separate occasions and came away impressed with their risk-management and product offerings.

Finally, you're always free to “house hop” by buying a fixer, renovating it, living in it for at least two out of the past five years, and then flipping it for a tax-free profit up to $250,000 as an individual or $500,000 as a married couple.

Just know that you might have to prorate the tax-free profit if you make the house a long-term rental.

3) Earn Business Income

Starting your own successful business is harder than just working a day job, but it's one of the most gratifying things you can ever do once you gain inertia. It is also one of the best ways to earn money and pay less taxes.

A lot of your normal living expenses can be considered business expenses. For example, you can have annual board meetings in Hawaii if you want. The flights and accommodations are deductible. Nobody says your annual board meeting has to be held in a place of suffering.

You can also deduct your cell phone bill, laptop, car lease payments, and a bunch of other common things that are required to operate your business. The idea is to deduct the lifestyle expenses that are also required to run your business, so you get a discount.

Before you start a business, you must at least start your own website in this day and age. Over three billion people are online and this figure is only going to grow over time.

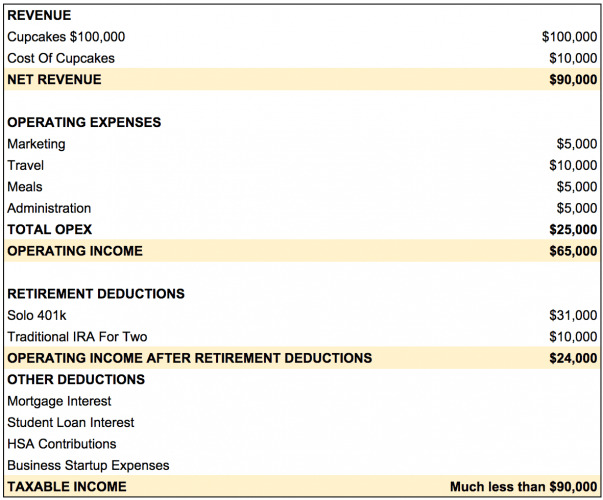

Business Income Analysis

In the above example, your cupcake business generates $100,000 in revenue and $90,000 in gross profits after paying for the ingredients used to make the cupcakes.

$25,000 for normal operating expenses leaves you with an operating profit of $65,000. For simplicity's sake, I've equated $65,000 as one part salary and another part distribution.

Since you want to reduce your taxes, you contribute $31,000 to your Solo 401(k) and $10,000 to two IRAs. Your business's taxable income falls to just $24,000.

Depending on how you structure your business and earnings, you might be able to deduct additional items from your taxable income or salary. The chart above is just a simple illustration.

Related: The Rich Are Paying Their Fair Share Of Taxes

Incorporating A Small Business

You want to incorporate as a C-Corp, LLC, or S-Corp. For most small businesses, I like incorporating as an S-Corp as there may be tax benefits in the way you pay yourself a salary and distributions.

Once you start making an operating profit above ~$200,000, the S-Corp loses its benefit in my opinion because the maximum income for FICA tax is $168,600 for 2024. You don't want to pay yourself much more in distributions than salary to minimize chances of an audit.

Also beware the IRS has an eye for businesses that are perpetually loss-making. They know there are unscrupulous people out there who establish a business for the sole purpose of shielding their income. After several years, your business should start earning a profit or else.

Earn money and pay some taxes so the IRS doesn't come for you too hard.

How A Big Business Pays Less Taxes

Before media company Gawker Global went bankrupt, we learned it had set up a Hungarian subsidiary to help the parent company drastically lower its tax bill. As a result, Gawker Global was paying an effective tax rate of ~4.5% versus a ~30.6% effective tax rate had it not created the subsidiary.

Check out the chart I created below to help illustrate how Gawker Global paid less taxes.

The chart shows the US company earned $1,000,000 in advertising revenue in one year. But because it hired its own Hungarian subsidiary and paid $1,000,000 for editorial, website, and design work, the US company claimed no profit and therefore pays zero taxes.

Meanwhile, the Hungarian subsidiary earned $1,000,000 in revenue and deducted $100,000 in labor expenses of its own for a $900,000 operating profit. Because Hungary only has a 5% corporate tax rate, it only has to pay $45,000 in taxes.

Instead of Gawker Global paying $306,000 in taxes, it ends up paying only $45,000 in taxes. Now that's what I call tax-arbitrage!

I've yet to understand how Amazon was able to pay zero income taxes in 2018 on profits over $11 billion. That is a truly amazing feat that partially shows why Jeff Bezos is one of the richest people in the world.

He must be thinking to himself, only the little people pay taxes!

Reconsider Your Day Job Income

If you are a W2 income earner, the only things you can do to reduce your tax liability are max out your pre-tax retirement accounts, contribute to your HSA if eligible, and see if you can defer bonus income to a potentially lower income year.

Consider earning qualified dividend income, long-term capital gains, rental income, and business income instead. Not only are such income sources more tax efficient, but they might also provide you with a better lifestyle.

Although I still pay over $100,000 in Federal and State income taxes a year, my effective tax rate is lower than while I had a full-time job. Further, I'm having a lot more fun running a lifestyle business than grinding away in the banking world. My patriotism runs high!

At the end of the day, if it means making more money, it's better to pay more taxes than less taxes. But eventually, there's a law of diminishing returns where you'll no longer want to work as hard if your marginal tax rate gets too high.

That day might be coming sooner than we think.

Related Articles:

How To Pay No Capital Gains Tax After Selling Your House For Big Profits

The Only Reasons To Ever Contribute To A Roth IRA

Ranking The Best Passive Income Investments

Long-Term Capital Gains Tax Examples

Readers, what are other best ways to earn money and pay less taxes? Tax professionals, feel free to share your thoughts on our complicated tax system.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Hey Sam,

great post! I found your ideas and strategies in both this article and the one from 2016 about S-Corp salaries and distributions. As I didn’t find Financial Samurai until late 2017 and did not go through your whole archive, I just read the S-Corp article now.

You wrote that you like S-Corps because of the tax benefits, as opposed to C-Corps and LLCs. Is there any chance you would be able to share your opinions on all three, maybe with pros and cons for strategy, in an upcoming post? As someone considering starting his own company, I would be very interested to know your views on all three

Great tips, thanks for sharing.

I have yet to master my taxes as they say. That’s next on the to do list.

Any good book recommendations to help with general tax strategies, etc? I feel like I’ve heard of a couple good ones of the past few years, but never wrote any down.

I love that you’re very savvy with tax laws in order to maximize profit. I think that is really important for long term financial security.

However, it would be interesting to hear your take (perhaps even it’s own blog post) on ideas or ways that you personally think the tax system should be changed in order to be more fair.

For example, I think it’s bullshit that long term capital gains is taxed differently that W2 income. This is essentially a vehicle for the wealthy class to pay fewer taxes than those who are working 40+ hours per week. Personally, I think all income should be treated the same.

Given your expertise, what other examples could you give that you might consider to be more fair?

Good point. I’ve simplified my chart and have assumed operating profits to be the cupcake business’s entire take home salary. In general, the biz owner can max out the employee contribution and contribute about 20-25% of the operating profits.

Related: How Much Can You Contribute To A Solo 401(k)?

If it is luck to have profits well over $200K, there is another lesser known income tax deferral strategy, known as defined benefits plan. It is more complicated to set up but could shelter a much larger amount of taxable income. Many self-employed lawyers and medical doctors have used such a plan for years.

Hey Sam-

Wanted to share a quick comment that is admittedly not relevant to this post. I’ve been following your blog since 2012 and I just hit my first million dollars. I know there have been lots of influences from your posts that have contributed to that milestone and wanted to say thanks. Lots of gratitude and looking forward to the next million (hopefully!).

Right on David. Congrats! The first million is really the hardest….. but when you look back, sometimes you might think it’s the easiest too!

The key once you’ve built a decent nut is to protect it. Hold on. Don’t go backwards!

Thank you! That is tough – to “stay the course”. I am having an overwhelming desire to upgrade my life by moving to a nicer apartment, getting new furniture, travel more, etc. Its all about balance. I am relatively young so most (all) of this $ is in the market. Every single time I think about selling to diversify, I’ve decided to just buy more (like in Q4) and every time that has worked out well (like now). Won’t be so easy to keep on this strategy and also sleep at night!

Enjoyed the post. Do you have a related post on the CEO stock grants at LTCG rates? Work and the IRS sure as heck are considering my stock grants regular income when they best!

It is amazing how advantageous business income is to W2. I have been running my LLC for 11 years, while my husband stayed in traditional employment. He joined me a couple of years ago, and even though we no longer have his multiple six-figure salary, because we now have business and real estate income the tax savings makes up for much, though not all of the salary.

For a entrepreneur, why a s-corp vs a pass through LLC with the new 20% income deductions for pass through entities (under 300k any type of business counts).

Why does Amazon pay zero tax? Capex spend and accelerated depreciation. The business side of Amazon is cloud computing and Amazon Web Services is profitable and growing at a tremendous pace. Amazon’s ecommerce business is loss generating. AWS has been buying a lot of servers and data centers to support the growth, and that capex spend is depreciated on an accelerated basis (more now less later). That’s why they are highly cash and gaap profitable but not from an IRS standpoint.

Good point. And I won’t know for sure until I run the numbers in more detail. But there is an operating profit threshold where one makes more sense than the other.

Do you have experience running an LLC? And comparing your taxes before and after? If so, I’d love to see some numbers from you. Thanks

Pre 2017 tax cut the S-corp made more sense as you split up your income into w-2 salary which is subject to FICA and pass through income which is not (but taxed at ordinary income rates). Single member LLC is all pass through and you pay FICA on all of it.

Post tax cut, 20% of pass through income gets deducted if you make under certain thresholds 300k for joint couples and no threshold limit for many industries. Pass through LLC you get the 20% off on everything and pay FICA on everything with social security up to the cap. S-corp you get 20% off the pass through portion, and pay 80% and your salary portion at regular tax rates plus fica on your salary.

Part of the calc you need to assign value to the social security side of fica. Every year and every dollar you contribute to social security increases your expected payout from it. Then haircut it for what you expect to actually receive as social security is underfunded.

If you make 300k. As a pass through LLC taxpayer, you get to exclude 60k and pay taxes on 240k and fica on 300k with social security capped at around 110-120k. As a s-corp, you can pay a salary of 120k pay the same social security but save on Medicare fica. 180k pass through income and you get to exclude 36k. So 264k at ordinary income for the S-corp vs 240k for the LLC but you save the Medicare portion of fica. LLC comes out ahead.

At lower income levels it’s more mixed and depends on your value of future social security benefits for size contributions. At larger income levels assuming the business qualifies, the pass through exclusion is a no brainier.

Thanks for this data.

Any idea how easy and how much it costs to switch from an S-Corp to an LLC? Could be a big PITA, and I haven’t done my 2018 taxes yet to figure out whether it’s worth it or not.

It’s really not as easy to see the benefits with this 20% deduction. Need to really do the numbers.

Starting a new company and transferring the assets is the easier way. Setting up a new LLC is a lot easier than setting up an S-Corp. LLC allows for non-US investors (limitation of an S-Corp) which is worth it as a longer term option. With the LLC you can change your tax elections. While the company is small, the default election is a disregarded entity (you file the LLC taxes on your own tax returns and save an extra return). As the company and you are looking for external investors you can change the election to a corporate election.

Amazon pays no income tax because they can still use the carry-forward the operating losses from previous years.

The idea that Amazon paid no tax in 2018 made me check the 10-K and found the following:

We have tax benefits relating to excess stock-based compensation deductions and accelerated depreciation deductions that are being utilized to reduce

our U.S. taxable income. The U.S. Tax Act enhanced and extended the option to claim accelerated depreciation deductions by allowing full expensing of

qualified property, primarily equipment, through 2022. Cash taxes paid (net of refunds) were $412 million, $957 million, and $1.2 billion for 2016, 2017,

and 2018. As of December 31, 2018

Any thoughts on muni bond income either through an ETF or individual holdings? Do you bother building that bucket?

I know it is often looked down upon but I have slowly been building my whole life insurance bucket also.

GREAT POST!

I love muni bonds! Almost nonexistent default rate for double AA rated, no taxes, and higher yields now.

What’s not to love? After a ten-year bull market, my portfolio is very defensive now. And I love the peace and mind of knowing that I’m guaranteed to hold onto my wealth.

1099 income generates twice the SS Tax, with a little bit of giveback in credits. This is an important factor when planning income source.

Don’t forget you’ll typically be paying state income tax on those long-term capital gains and qualified dividends. That 15% to 23.8% federal rate can become 30% to 35% depending on where you live!

Good post!! Its amazing the tax breaks you get with a 1099 over a W2 but its more difficult to generate the big $$…

Im also playing “catch up” on my Roth.

It looks like depreciation is much higher in your example than property taxes.

Is it good to try to get a much higher assessment for a rental property and with it a much higher depreciation even if it costs some more property taxes?

The depreciation is based on the price paid for the property not the assessed value.

The way tax laws are structured you really get heavily penalized if you are a W2 Wage earner, especially in the higher income levels.

I have said before that because of our progressive tax system, the last dollar we earn is our least valuable one as it comes in at the highest marginal tax rate which for me means 37 cents is automatically taken out due to good ole Uncle Sam.

Passive income money on the other hand is my favorite kind of money. There is a significant tax arbitrage available between money from active and money from passive income sources (in my instance 37% vs 23.5%)

FYI (sorry if I took your comment too serious).

https://www.vox.com/2019/2/20/18231742/amazon-federal-taxes-zero-corporate-income

Sam, you’ve motivated me to look into potential S-Corp structure for my blog. It’s starting to earn some $, and I’ve never established a legal structure. Great overview (including the embedded link) of the arguments for S-Corp. Time to talk to my CPA…

Your No. 3 reminds me of Rich Dad Poor Dad. I still remember reading about deducting board meetings/vacations in Hawaii from there :) So amazing how much more tax flexibility you have with business income as opposed to W-2 income.

I like real estate crowdfunding and have been happy with my small investment with Fundrise. You have the 20% pass through deduction but you lose the tax benefits of direct ownership which could make it less attractive for some people.

Great analysis. I’m about to get to a spot to max out my 401K. May need to look into the equivalent option for my wife’s business to further reduce the amount of taxes we owe.

As an employee, I’ve never been bothered paying taxes, but I am bothered when those tax dollars appear to be wasted. Not that 100% of it is waste, but the cost of our health care is insane.

That is a very interesting point you make in how capital gains should be taxed at a lower rate. But what is the real difference from income generated with capital gains vs income I earn from my job? Isn’t that the same thing? To me, it seems like we are taxing people with more money less, compared to people who are more well off. I’m just wondering if that is a little lopsided?

Is the hard work I put into my job less valuable than the ultra-rich who are making massive amounts of money from their money?

I don’t have any strong opinions about this (yet), just curious at what you think. :)

The answer is double taxation. The money used to purchase the assets providing the capital gain was already taxed.

It was staggering to me the first time I started paying more than 100K in taxes, because it surpassed more than I ever made as a W-2 employee. I quit my last W-2 job in May 2000. I was making ~$80,000/year. Fortunately, I came across the concept of extreme saving (50%+). It’s hard to start, but is well worth it. It’s got to be an awful feeling for someone to make high six figure income over 20 years and realize they have little-to-nothing to show for it.

Sorry – what do you mean? How can you pay 100K in taxes if you don’t make that much?

Thanks!

He means that he currently pays over $100,000 a year in taxes. However, when he had a desk job and was paid a salary, his salary never surpassed $100k.

I.E. He makes so much money now that the taxes he currently pays are higher than his total salary was when he had a desk job.

Fishyboi, exactly what Joe said. Thanks, Joe!

I’m just starting my journey to (hopefully) create a bit of wealth. Do you mind sharing the area of work you’re in that has led you to a $100k+ tax bill?

Hi Walter. I own a “small” software company where I’m able to net (pay myself) over 500K per year. I also have real estate investments, too, although there are much better tax advantages for that. I max out my SEP every year (2019 is $56,000), but other than that, I pay taxes on the income. That’s why it’s important to save/invest as much as you can. Understand it took almost 20 years to start making this kind of income. I save/invest over 70% of my “take-home” pay.

Brilliant — that’s amazing, congratulations on that hard work paying off for you. I’m in software as well (10 years in building mobile applications independently) but not nearly close to that mark. Thank you for sharing.

Good post and analysis. Wow, paying $100k in taxes in a year…. yikes. My first job out of college paid me $20k a year salary, which I was happy to have. Then many many years later I remember when I started paying more than that per year in Federal taxes alone. I felt happy to be making that much more money, but sad because I work for the government and see how wasteful and inefficient they are with our money.

And this – “It’s logical that long-term capital gains tax rates are lower than Federal income tax rates since the income used to build an after-tax portfolio was already taxed.”

Now that socialism is back in vogue and growing fast in America, I’m not so sure it’s logical to many. We’ll see.

Socialism is back in Vogue, yet Corporate America and it’s minions aren’t paying taxes?

That’s right. Big Corporate America do very nicely under Big Government. And Socialism, a complete fraud and not in any way benign, will still privilege the powerful at the expense of the rest of us.

You may want to update the article and remove the “Option: Lend Back US Parent All Aftertax Profits with Interest”. That would create a deemed dividend to the US parent under SubPart F of the Internal Revenue Code (Section 956). The deemed dividend would be taxed at the US rate (with credits for foreign taxes paid) and you’d destroy the planning you were trying to do. This is why all the tech companies had too much cash overseas that they couldn’t bring back home. Some of this changed with the new tax law but there were some serious law changes to address certain related party transactions.

FS, this information is gold. Once you quit working, one of the biggest ways to keep your net worth is to work your tax situation. Your #1, listed above, is our preferred method.

For married couples, the annual limit for realizing Capital Gains at 0% is $77,200. If you have acquired equity index funds over years of DCA, an example of a 50% cost basis would put withdrawal of $154,400 without paying any Federal Income tax. Set it and forget it, without the hassle of a side-gig, tenants, etc.

Regarding your comment about trying to convince your property assessor the property is worth as little as possible, I’d make an additional suggestion.

Also attempt to convince the assessor to assign as high a percentage of that lowered worth to the physical dwelling as opposed to the land. You can’t depreciate the value of land, but you can on the house itself.

To illustrate my point, let me provide an example.

You purchase a rental property for $500,000 and the assessor agrees with this level. Therefore, your house has taxes levied in accordance with this value. However, you aren’t allowed to depreciate $500,000/27.5 years per year, you must assign a portion of that value to the dwelling and a portion to the land.

If the assessor says the land is worth $150,000 while the dwelling is $350,000, you are only allowed to depreciate $350,000/27.5 = $12,727 per year against your taxable income.

In that case, while you’re negotiating with the assessor, it might also help to have a higher percentage be assigned of the worth to the dwelling value as opposed to the land.

The ability to take depreciation is really key to generating a nice cash flow stream in real estate investments. In Sam’s example, the property owner was able to pocket $23,000 in cash and does not have to pay any taxes because of the depreciation deduction. Isn’t that spectacular. The tax advantages of owning rental properties is one of the main reasons why I own 5 rental properties. I was able to generate $200,000 in net cash into my pocket without having to pay any taxes (coincidentally I just post an article about this).