Are you trying to determine your level of financial satisfaction or dissatisfaction? After all, if you're more satisfied financially, you should also be happier and less stressed. Good news! The FS Wealth Reality Ratio (FSWRR) will help you quantify your feelings and reveal the unhappiest cities in America!

The core attribute about the FS Wealth Reality Ratio is about managing expectations. After all, happiness equals reality minus expectations. The higher your expectations, the lower your happiness. The better the reality compared to expectations, the higher your happiness.

If you go to Harvard and end up doing the exact same work as a non-Harvard graduate does, you might feel a little disappointed. But if you go to Podunk U and end up getting paid the same as your Harvard co-worker, you are probably thrilled!

I didn't go to Podunk U, but I did go to The College of William & Mary for only $2,800 a year in tuition from 1995 – 1999. Comparable private universities cost about $22,000 a year at the time.

Therefore, any job I got that paid more than my $4/hour McDonald's job in high school would be a blessing. And boy did it feel good not to have high expectations placed upon my shoulders.

The Financial Samurai Wealth Reality Ratio (FSWRR)

As a Financial Samurai, always think in derivatives. Try to think about what's behind and beyond the numbers. When you start thinking in derivatives, you will find many more answers and solutions to common problems.

In my article about the net worth amount required to be considered wealthy in various cities, I introduced you to the Financial Samurai Wealth Reality Ratio (FSWRR). The higher the ratio, the unhappier you likely are and vice versa. Below is the ratio's formula.

FSWRR = Minimum Net Worth Required To Be Considered Wealthy / Median Home Price

For example, if you believe you need a net worth of $50 million to be happy in a city that has a median home price of only $500,000, psychologically there's likely something wrong with you.

A 100:1 FS Wealth Reality Ratio is extreme. Your expectations about how much happiness money can bring you is way too high. Further, you'll likely never going to achieve that level of net worth.

Source Of The Data

The data about the minimum net worth required to be considered wealthy comes from Charles Schwab's annual Modern Wealth Survey. Your individual opinion matters. However, having a larger survey is more impactful for statistical significance and overall research purposes.

The median home price comes from Zillow, Redfin, St. Louis Fed, US Department of Housing And Development, and the National Association Of Realtors. These figures are more objective. Although interestingly, nobody really can say with certainty what the median home price is in America.

By analyzing mass data, we can identify which city residents are happiest (most satisfied) and unhappiest (least satisfied).

Why The Median Home Price Is Used

The median home price is used in the denominator because it is a reflection of the cost of living in your city and its resident's earning potential. The median home price also reflects the cost of local goods and services, economic environment, and desirability of your city.

The reason why the median home price in Hawaii is ~$780,000 – $1.1 million in 2024, depending on which analysis, is because Hawaii is heaven on Earth. In contrast, West Virginia's median home price was only ~$135,675 in 2022 mainly because there is less economic opportunity. Hawaii is an international tourist attraction while West Virginia is not.

Another reason why I use the median home price of your city in the ratio is because of the importance of housing. Once you have your housing costs relatively fixed, living the life you want usually becomes much easier. After all, the housing expenditure is usually the largest necessity expense, followed by food, clothing, and transportation.

Stabilizing your housing costs is why I highly recommend everyone get neutral property by owning their primary residence as soon as you know where you want to be living for at least five years. Riding the inflation wave is much better than getting pounded by it.

With housing security for your children, you also won't feel as much anxiety. And one of the best reasons to have money is to worry less about money and survival.

The Higher The FS Wealth Reality Ratio The Unhappier You Are

The reason why the higher the Financial Samurai Wealth Reality Ratio, the unhappier you are is due to expectations. Schwab's Modern Wealth Survey is based on what people THINK is the minimum net worth required to feel wealthy in their respective cities. The survey is not based on what people already have.

We know this to be the case because not everybody surveyed in San Francisco in 2022 has a net worth of $5.1 million, a top 2% net worth (top 1% net worth is over $11 million). The participants collectively think $5.1 million is what is needed to feel wealthy. One report by the Legislative Analyst's Office in 2019 had the the average net worth per resident in San Francisco at $450,000.

If you have a Wealth Reality Ratio of 8, that means you believe you need a net worth 8X greater than the median home price in your city to feel wealthy. Cleary, trying to build more wealth will take longer and be more difficult than trying to build less wealth.

Therefore, you will feel more stressed, tired, anxious, and demoralized the longer you have to work and take risks to achieve what you think you'll need to feel wealthy.

Conversely, if your Wealth Reality Ratio is only a 3, then you feel you only need a net worth 3X greater than the median home price of your city to feel wealthy. Thanks to your lower expectations, you don't have to work as long and take as many risks to get to your aspirational wealth number.

You can FIRE if you want to because you're more easily satisfied with what you have.

The Unhappiest Cities In America By Wealth Reality Ratio

Based on the logic that a higher Wealth Reality Ratio means more struggle and less happiness, below are the latest 12 cities ranked from most satisfied financially to least satisfied financially.

Some thoughts and possibilities based on the ranking:

- Cities with higher median home prices tend to have more financially satisfied residents.

- Coastal city residents are more financially happy than non-coastal city residents.

- West coast living may have an edge over east coast living.

- There is likely more wealth inequality in Houston and Dallas between the very rich and the middle class perhaps due to the oil industry.

- LA / San Diego may have the best combination of financial satisfaction with upward mobility, great weather, and a nice lifestyle.

- Move to Houston, Dallas, Chicago, or Atlanta for retirement if you already have a $2+ million net worth given the low cost of living.

- Boston residents are some of the most financially satisfied residents despite high home prices. But I don't know why given the weather is rough for a third of the year and the Warriors won the 2022 NBA final.

- High property taxes might be a big variable for why Houston, Dallas, and Chicago have the least financially satisfied people.

- San Francisco and Seattle have the highest wealth-creation potential, which is also partly why their residents are the most financially happy.

- There is a correlation with cities with the highest satisfaction and states with the highest life expectancies. And given we all want to live longer, this is a huge breakthrough!

One important point to highlight is that happiness is also relative. Given America is the best country in the world with the most amount of opportunity, being ranked the unhappiest city in America is still likely better than most other cities in the world! It’s like only eating salmon filets at the buffet because they ran out of prime rib.

See: Why The Smartest Countries In The World Are Not The Happiest

More Examples Of Why A Higher Wealth Reality Ratio Is Worse For Happiness

There has been debate about whether a lower ratio signifies more happiness or not. Hence, let's use more examples as to why a higher FSWRR number leads to decreased levels of happiness.

- It is more painful to run 20 miles than it is to run 3 miles and win the same medal. In this case, the medal is the denominator equal to the median price of a home.

- People are less happy if they must work for 40 years versus working 20 years before being able to retire to do what they love. In this case, retirement is the denominator given we all have a limited number of years to live.

- There is more heartbreak if it takes you 7 years to have a baby than 1 year. In this case, starting a family is the denominator and we all run out of time.

- You're more frustrated if it takes you 10 years to write the next great personal finance book versus 2 years. In this case, being a published author is the denominator.

- The longer you live in your mom's basement after high school or college, the more embarrassed you might feel. In this case, your pride is the denominator.

- The longer the airplane delay compared to the duration of your flight, the more agitated you are. A three-hour delay for a one-hour flight is brutal. However, a one-hour delay on a 12-hour international flight is no big deal. In this case, getting to where you want to go is the denominator.

Key Variable For Happiness

What's the key variable in all these examples? It's TIME!

The expenditure of time is also a key variable for my FS SEER ratio, which helps quantify your risk tolerance. The less time you are willing to spend to make up for your losses, the more conservative your investments.

Usually, the longer it takes for you to get what you want, the less happy you are. Due to a lack of discipline and patience, many folks prematurely give up before the going gets good. This giving up part and never reaching your goals is the biggest risk to happiness. The secret to your success is unwavering commitment and consistency!

However, for those of you who learn to appreciate the journey and who can survive a difficult path, the rewards are often much greater. We appreciate things more when we need to struggle hard to achieve them.

Therefore, the key to happiness is to have realistic expectations. Having too high expectations will lead to misery, since you'll likely never achieve your goals. Having too low expectations will lead to indifference because you didn't struggle hard or long enough.

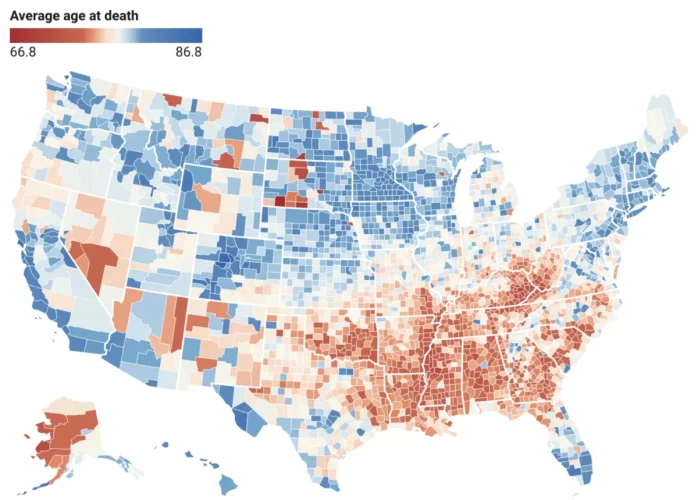

Happiness, Wealth, and Life Expectancy

There is also a strong correlation with wealth and life expectancy. The richer you are, the longer you tend to live.

Notice how cities with the lowest FS Wealth Realty Ratio also are based in states with the highest life expectancies. Is that a coincidence? Of course not.Happiness and money are intertwined!

The richer and happier you are, the longer your life expectancy and vice versa.

The Ideal Wealth Reality Ratio

The lower your FSWRR the better, up to a point. This means your expectations for how much money you will need to be happy is lower. In return, your wants will be more easily satisfied.

Think back to when you were in high school or college. Although you were poor, you might have been much happier because so many things don't require needing lots of money. I remember having $200 a month to spend in Beijing, China while studying abroad in 1997 and was thrilled to explore a new country!

However, the ratio likely can't be much below 1X the value of the median home price in your city. This is because if your entire net worth is equal to the median home price, then you will need to continue working in order to generate income.

You can't withdraw principal from your home without incurring debt. Nor do you have another net worth asset that you can use to generate passive income. If 100% of your net worth is tied up in the value of your home, you're also at the mercy of the housing market.

At a FSWRR of 1X, you will need to survive off Social Security, rent out rooms in your house, or the generosity of others. Or you will need to own a home that is priced much lower than the median price for your city.

If you are lucky enough to have a pension, it may be worth much more than you think. The value of a pension while you are alive will most likely boost your FSWRR far above 1.

A Net Worth Equal To Two To Five Times The Median Home Price

It is my opinion the ideal wealth reality ratio is somewhere between 2 – 5. Let's say your net worth is already there. Here are a couple examples that make sense.

At a FSWRR of 2, you could have a paid off home worth $400,000 and have $400,000 in investments generating $12,000 – $20,000 a year. Your total net worth is $800,000. In addition, you could also be collecting another $15,000 – $20,000 a year in Social Security and live a comfortable lifestyle.

At a FSWRR of 5, your net worth is $2,500,000 if the median price of a home in your city is $500,000. You could afford to rent a nice home for $50,000 a year if you wish. Your $2,500,000 net worth could generate $75,000 – $125,000 of passive income a year alone.

Personally, I'm a little more ambitious and greedy, which is why shooting for a FS Wealth Reality Ratio of 5 feels appropriate for me. After about a 5, I'm happy to start decumulating my wealth in order to not die with too much.

To get specific, if the median home price in San Francisco is $1.8 million in 2023, having a $9 million net worth is more or less good enough. And having a net worth of $5.4 million (FSWRR 3) is pretty good too.

How To Use The FS Wealth Reality Ratio For Your City

Let's say you don't live in one of the cities above. How can you use the FS Wealth Reality Ratio to help you ascertain how much net worth you should accumulate to feel wealthy?

Financial Samurai reader Mapuana asks,

Just curious if you have any idea how Hawaii fits into this? Having been raised there and left for several reasons, cost being one of them. I just wondered how it fit.

Step one is to find the median home price in Hawaii = $835,000 (Zillow estimate 2023). Then multiply by the multiple range of other comparable cities. The range is 3X – 10X for the 12 largest cities in America. Therefore, Hawaiian residents would need between $2,505,000 to $8,350,000 to feel wealthy.

However, given Hawaii is the best place on Earth, one could argue a multiple below 3 works. Hawaii weather is amazing. The beaches and mountains are free. Overall, Hawaiian residents live longer and are less stressed.

Therefore, I would say most Hawaiian residents need at most $2,505,000 to feel wealthy (FSWRR 3). But a Wealth Reality Ratio of 2 equaling $1,670,000 is probably plenty for most residents.

Related: The Cities That Have The Highest Income

How To Use The FS Wealth Reality Ratio To Determine Your Financial Satisfaction

To quantify your financial feelings, come up with a minimum net worth you think is required to be wealthy and divide it by your city's median home price.

Let's say I'm delusional and think I need $50 million to feel wealthy even though I live in a $1 million house and spend less than $200,000 a year. My Wealth Reality Ratio would equal 50. I'm likely never going to be satisfied with my wealth.

Instead, I should probably shoot for a minimum net worth of between $5 – 10 million, a level many people believe is enough to have generational wealth. And if I already have a minimum net worth of between $5 – $10 million, then I need to learn to be more appreciative of what I have.

- 1 – 3 Wealth Reality Ratio means you are extremely satisfied financially.

- 3.1 – 5 Wealth Reality Ratio means you are satisfied financially.

- 5.1 – 10 Wealth Reality Ratio means you are slightly dissatisfied with your finances.

- 10.1 – 20 Wealth Reality Ratio between means you are dissatisfied with your finances.

- 20+ Wealth Reality Ratio means you are highly dissatisfied with your finances or are very money hungry

You May Want To Invest In The Unhappiest Cities

The unhappiest cities also have some of the highest cap rates and lowest valuations. These two factors along with positive demographic trends are why I've been investing in heartland real estate since 2016.

The Wealth Reality Ratio actually makes me even more bullish on investing in cities such as Houston and Dallas because it shows its residents are hungry for more wealth! And when you are hungry for more money, you will work hard to make more either at your job or by growing your business. More profits means more income and higher home prices.

The only problem now is rising supply and declining demand after an increase in mortgage rates. But trying to find single-family or multi-family deals in places like Houston and Dallas over the next 12 months seems attractive.

You can search for individual deals in Houston, Dallas, and other high Wealth Reality Ratio cities on various private real estate investment platforms. Or you can invest in a private fund that invests mainly in the Sunbelt through Fundrise.

The great thing about investing in private real estate is to invest anywhere without having to move. Further, you will earn income or distributions passively as you diversify your real estate holdings.

Keep Your Wealth Expectations Reasonable

When I graduated college, all I hoped for was a $30,000 a year job. When I got a $40,000 a year job at Goldman Sachs in 1999, I was thrilled! However, I soon found out that $40,000 didn't go very far living in Manhattan. Hourly, I was making minimum wage. Therefore, I wanted more.

Every time I made more money, I was happier for about three months at most. Then it was back to my steady state of happiness. Finally, in 2012, I decided I had enough and retired.

Despite losing 80% of my income for the first year, I was happier because I was free. Being able to drive to the park and read a book instead of going in to the office at 6 am made up for my lost income.

When I left work in 2012, I was happy with my net worth. If I wasn't, I would have kept on working. I expected my net worth to grow fairly conservatively, in the 4% – 5% range a year.

However, the subsequent 10-year bull run provided greater growth. This upside surprise has provided for greater happiness.

Keep Low Expectations For Your Endeavors Too

Today, I continue to try and keep my expectations measured.

For example, before starting to write Buy This, Not That in 2020, I told myself I just wanted to finish. The book was a bucket list item to help regular FS readers build more wealth and make my family proud.

It was hard enough juggling kids, Financial Samurai, and book writing during a pandemic. We had pulled our son from preschool for 18 months. Expecting BTNT to also be a bestseller would take away from my joy of writing.

However, once I finished writing the book in 2022 and received the advanced physical copies in my hand, my expectations went way up! It was a beautiful book that provides a wealth a knowledge.

Then I started thinking, why can't this be an international bestseller? It rocks! The foreign rights in the Arab nations, China, Taiwan, Hong Kong, and Macau have already been negotiated.

As my expectations for my book increased, so did my anxiety! It's hilarious how it's so hard to keep our hopes and dreams contained. But we keep fighting because anything is possible!

In the end, Buy This, Not That became an instant Wall Street Journal bestseller. Hooray! But when is it going to get big in France?!

The Desire For More Money Needs To Be Carefully Measured

If I had a goal of retiring with $10 million when I was in my 20s or 30s, then I'd certainly be miserable due to the need to work for many more years. Instead, I left when my net worth was about $3 million.

$3 million could generate enough to provide for a basic lifestyle, not a lavish one in San Francisco. I knew what my upside was and decided it wasn't worth it.

After you've got your basics covered, if you live in a developed country, your life is quite similar to much wealthier people. Sure, the super wealthy may have larger homes and fly in luxury all the time. However, the very rich revert to their steady state of happiness too.

I have one friend who is probably worth $200 million and makes $25 million a year. He flew first class to London ($20,000+) to go watch the Wimbledon tennis tournament. Front row tickets cost anywhere between $10,000 – $20,000 a day, depending on the round. I'm sure he's having a lot of fun.

But I'm also having a lot of fun playing with my kids and watching Wimbledon on my relatively inexpensive 4K TV! Besides, flying is a PITA!

We should try to be more satisfied with what we have. Wanting less is the easy path to feeling wealthy. Always think about how much of your life energy is getting sucked away by spending time earning incrementally more money that you don't need.

Ask yourself whether the marginal effort is worth it. If it's not, then please have the courage to accept enough!

Invest In Real Estate More Surgically

Real estate is ny favorite asset class to build wealth. If you don't want to buy physical investment properties, consider diversifying into private real estate online. Here are my two favorite platforms.

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages over $3.3 billion for 500,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

I've invested $954,000 in real estate crowdfunding so far. My goal is to diversify my expensive SF real estateholdings and earn more 100% passive income. I plan to continue dollar-cost investing into private real estate for the next decade. Both platforms are long-time sponsor of Financial Samurai and Financial Samurai currently has investments with Fundrise.

Reader Questions

Readers, what do you think about my Wealth Ratio? Can you argue how a higher Wealth Ratio is actually a reflection of happier people? What is your Wealth Ratio and do you agree with the various levels? Which cities are the unhappiest and happiest in your opinion?

See: Solving The Happiness Conundrum for more on getting happier. I also wrote about how it's exciting to live in a big city despite the higher costs. Go to big cities to make your fortune and then leave if you've accumulated enough.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. To get my posts in your inbox as soon as they are published, sign up here.

‘$3 million could generate enough to provide for a basic lifestyle, not a lavish one in San Francisco.’

What? How is 3 million a basic lifestyle? I enjoy these articles and the blog but sometimes the author seems so out of touch with reality.

Sure. $3 million generates $120,000 a year at a 4% rate of return. $110,000 is actually the cut off considered low income for a family of four in San Francisco. This assume you don’t want to spend down the $3 million too soon before you die. Bear markets like in 2022 do happen every 5-10 years.

How big is your family, where do you live, and how much do you spend?

See: Why Some Households Need To Earn $300,000 A Year To Live A Middle-Class Lifestyle

I understand the point of the article that people who live cheaply despite solid NW could be fueled by greed. Yet, this point of view contradicts several other articles you wrote. Depending on location, our WRR could be either 15 or 30 and we do not intend to lower it to feel happier. We practice what is called stealth wealth and do not intend to move to a bigger house to feel better. What is the point of being house rich and cash poor? For us living a comfortable lifestyle on $100K is what we desire despite being 1%. We live in a LCOL area and in an unlikely case we move it will be another LCOL place far from traffic, crime, and high taxes.

I think you can make you formula even better by including another variable. What is you take the current formula and subtract passive income / total income. This would improve the score of those who rely mostly on passive income which I think would be a factor in happiness. The best you can increase your score by is 1 if all of your income is passive. That would keep the final result in line with you chart.

Sure, please provide an example of the new formula, the results, and what it means. Cheers

Since this is a “FINANCIAL” blog, hence, it is understandable for the discussion of money on happiness.

Unfortunately, happiness is the “shiny object” that each and every one of us will chase to the last moment of our lives.

The bulk load of our happiness is already determined within the genetic makeup at the start of our births.

The remaining portion of our happiness is determined with the time we devoted to chase after the “shiny object or objects”…money, love, power, sex and hotdog.

Choose your “shiny object” wisely!

I live in San Francisco and am really happy here. Although the crime rate has been increasing, the weather, diversity, food, and people are hard to beat. I also love being next to the ocean. Being land locked would definitely decrease my happiness level, so I feel very fortunate to see the ocean everyday. Location makes a big impact on happiness!

The way I interpret the data…if we all need somewhere to live… having our home considered in our net worth is irrelevant (unless you need to leverage it or to your heirs when you die) So, subtract the median home value from net worth to feel rich and you will see that all the numbers are around 2-3 million. Most people would agree that feeling wealthy in your town means you can eat out whenever/wherever you choose.. vacation 3-4+ wks per year, afford your desired schools not have a real budget, etc etc. But in most cities, unless you are 3* Michelin dining or doing bottle service at the club, the expenses for entertainment and enjoyment are the same. Vacation expenses are similar for everyone.. so what differs…childcare, private school, fuel, taxes, insurance… maybe expensive weekend excursions because they are more convenient or accessible due to better weather in Cali.

So I wouldn’t read into the ratio to believe that you need more to be financially satisfied in Houston vice SF. We all want to have the same luxury experience as consumers and it pretty much costs the same for luxury toys, food, vacations no matter where you live in the states. If you took the 2-3M and turned it into income….paid your local expenses, the disposal income would be very similar in each city I bet… w/o doing the math

Lastly…these median home values and their differences are almost solely related to scarcity of available land. If you were to build a house in SF, you probably would have to find a 2+M dollar teardown… in TX.. they just plowed out a chunk of farmer field and you can plunk down your 4k sqft house all in at 700k or whatever. Scarcity has driven the values insane in Cali…but increased ability to work remotely may have some consequences for future price growth in Cali.. we shall see.

love your site

This is what I’ve been saying as well!

If you have SUSTAINABLE wealth, then you can be happy wherever you live. As you stated, your money actually goes farther in cities that aren’t as expensive. Some expensive cities do have the nicer amenities. For example, San Francisco has the Warriors and Hawaii is….Hawaii. Other than those extras, it’s all a wash.

However, If your wealth is less sustainable (i.e., you’re treading water just to keep your current station in life), then you’re probably not going to be happy no matter where you live.

My current ratio based on the formula is 9.9. I’m not 100% happy with my financial situation, but I would say I’m about 85 – 90% happy.

We’re starting at different points.

If you believe you need a 9.9 ratio, I’m saying you will likely be dissatisfied.

If you just discover this ratio and plug-in the numbers while you’re happy, you’ll likely be even more happy.

Nice article.. liked what you say. Just one point i dont agree with..”America is the best country in the world.” I know its a relative thing and you may be biased to say that since you are an american, but i would expect neutral practical views from a blogger like you. I have travelled to 45 countries, worked in 5, and lived most part of my life in 3 countries and after my own experiences and also from knowing from many other globe trotters i can surely vouch that america is not the best country by far, maybe for people whose objectives are only to earn the maximum wealth on the planet , it might offer the best opportunities. I think the latest 2022 survey from Internations should also offer some insight with a deep dive on this topic. Cheers!

Don’t leave us hanging. Which country is best in your opinion?

I’ve traveled to 60 countries and lived in eight. I enjoy France, Netherlands, Spain, and Malaysia.

So America is not the best country in the world, just the one that offers the best opportunities?

That’s pretty damn good in my book.

At the same time, desire is the source of all progress. The key is balancing this desire to fit our needs and our ego to reach fulfillment.

In practice, I wonder if the Wealth Ratio reflects real experiences. I live in Houston with a modest teacher’s salary and own a home in the city and a vacation (and eventual retirement) home two hours north in Nacogdoches. I’m in my late 30s and can afford two homes on a single salary. If I lived in San Francisco, this would be impossible. I spend several weeks in the Bay Area each year visiting family. As much as I love the natural beauty and weather of the Bay Area, the overall quality of life here I find immeasurably better.

Hi Sam

How difficult it is to purchase your first home in San Francisco? How big a job do you have to have? How much of your income has to be earmarked for home purchase? How many sacrifices do you have to make? How many long hours do you have to make? How many delays in family time? Marriage? Having kids? Just to purchase your first home…not your “dream home”

Just to buy that 1.7 million dollar “average median home”

Now in Dallas were the most “miserable” home owners in the USA only have to spend 300 k for there home they get to put down a reasonable down payment and come home to there free income tax State home and talk to their wife, play with there kids, discuss future interests including investment real estate, or possibly other niche business ideas because they aren’t on the Coaster’s tread mill….

I will illustrate why the

ratio doesn’t work for me through a couple of personal examples. I have built a small niche business in southern California over the last 30 years. Five years ago I decided to move out of California and relocate to eastern Tennessee. At that time I owed approximately 1.2 million on a nice middle class home and a small warehouse. Moving to Tennessee I bought a fixer upper farmhouse on 5 acres and a warehouse on 7 acres that was about 3000 sq feet more than the one in California. I paid for them with the equity from my properties sold in California, therefore having no debt. (Saving $8500 a month)

In addition Tennessee is a no state income tax state (saving $4000 a month)

Lastly moving my small business to Tennessee saved me a lot of money in freight costs. I sell on my website and various other sites and always sell “free freight”. The product I sell is heavy (60 lb boxes) and my cost savings are substantial as I am within 8 hr drive to 70% of the population of the USA ( Cost savings $6000 a month)

I know Sam you’re going to say that “this doesn’t really pertain to your ratio”…. I can assure you that I am not unhappy about saving $18500 a month ( this was 5 years ago) with that money I invested in other cash flow properties that had I stayed in the “High Lifestyle Taxed “ state of California I would have never been able to buy!

I also live in east Tennessee. Don’t tell anyone how good it is! LoL.

I live in Dallas and really enjoy your articles, especially this one. Thank you the effort made to create it. I am in my early 60’s and own a home here and a home on the coast in Florida, both 2x the medium. Both of them have recently been paid off, with the one in Florida generating enough income through short term rentals to cover all expenses and then some. The feeling of wealth was achieved with lower expenses, and a continuation of the same income working from home as much or little as I like. Of course, like you, I like working and see it as satisfying “purpose”.

Wonderful article, as always.

One thing that grabbed me was that you pointed out that less satisfaction may be showing up in areas with higher property taxes (Texas). I agree, I think that having a lower and stable property tax is a big deal (Prop 13).

I love that you quoted the Buddha. I’ve also noticed that asset attainment has always let me down if I expected too much from its attainment. It wold seem that I’m happy and content or I’m not, period

Hi Sam,

Thanks for this article. I always enjoy ways to try and place a qualifiable metric on things such as financial happiness and satisfaction.

That being said, I don’t think the inputs chosen provide for a realistic view of financial satisfaction and happiness. In order to more accurately capture this you would need to look at other factors in costs such as transportation, food, entertainment, healthcare, state taxes for high earners, etc.

I quick look at a cost of living calculator shows that I would need to make approximately 80% more in San Francisco to maintain the standard of living that I have in Dallas. My wife and I both work remotely and could choose to live anywhere. Based on our desire to live in a big city that has direct flights to almost everywhere in the world while simultaneously not (from our perspective) overpaying in taxes, gas, food, entertainment, etc. the way we would in cities such as SF, Seattle, Boston, and LA, we chose to move to Dallas. Our decision to live in Dallas vs these other cities that are placed higher on the list by the ratio has allowed us to have much larger house and will allow us to retire years earlier than if we lived in SF based on the calculations I have run.

True, but the elephant in the room is, in the 5 cities you mentioned, the other 4 you avoid are in somewhat rational states (I am personally a moderate) – Dallas is obviously deep red and not the most tolerant city. Simple formulas only go so far; not totally apples:apples comparison when decision is only formula-based. Even Sam gives Hawaii bonus points, in his case for climate, beaches, mountains, stress-levels and life expectancy.

Jeff,

Thanks for the reply. I am a moderate myself. A couple points to think about based on what you said:

1st- Your stated is “Dallas is obviously deep red”-Voting data for Dallas states otherwise (69% voted blue for President in 2020, the mayor is blue). I’d be interested to see statistics or indexes measuring the tolerance of a city. My personal experience since moving here is that it is a diverse city with various thriving communities. All of this considered, none of it factors into a financial happiness and satisfaction measurement.

2nd-You mention “rational states”. That is a relative term, and I’m inferring that you are talking about social/cultural issues. I won’t comment on social/cultural policies on a personal finance blog. The arguments I’m making come from Sam’s conclusion that the ratio shows people in Dallas to be unhappier due to financial circumstances, not social or political conditions.

3rd-100% agree that simple formulas only go so far, and you will never hear me argue that Dallas is a good place to live because of the weather. California, Denver, Seattle have far superior climates in my opinion. BUT, that does not mean that they are financially better places to live.

Buddhism and Hinduism both preach disentanglement from material aspects, yet capitalism is all about money, money and money. Modern society, unfortunately, has no place for spirituality.

Excellent post and newsletter Sam!

I began my pursuit of more at 18, it ended at 49 in critical condition from a massive heart attack that 75% of my heart no longer functioned, consequently, I was put on the heart transplant list.

Over the next six months I had a medical miracle, my heart healed itself. The cardiologists could not explain it.

Any way Budda is right, life is about our attachments.

God Bless,

MP

This is accurate. I live in Scottsdale, went to decent schools. Not fabulous, but decent. Make decent money. Don’t have many wants. But I still worry about money and making sure my kids have, not everything, but have. My father was a doctor in Hawaii, we had, not everything, but we had enough.

A few years ago, I realized that I will probably not come near what my dad made as a cardiologist., even with a JD. But, does it matter? We have a nice life, are pretty happy, but Scottsdale is expensive. At least housing for us is reasonably affordable, we got into our house when the market was way down, in 2015. We couldn’t afford our house now. We have access to decent schooling through the city and carefully picked our neighborhood to get access to the better schools.

I have a great job with decent comp, RSUs that will vest one day, which is interesting. I worked in non-profit healthcare for most of my career, and I was able to tap into the recent expansion of the Federal Public Student Loan Forgiveness program because I made the requisite ten years of loan payments while working in the sector and got my federal student loans paid off by the feds.

Are we Happy? Maybe. I long ago learned not to compete with others who make more and who have.

Happiness is relative, though, right?

I am nowhere near the figure you identified for Phoenix needed to be happy.

But…

My job has access to amazing health, affordable care with has been a game changer for my four year old with Type 1 Diabetes. Happiness.

I have some fun toys.

I did tap into my creative side, I wrote a book that was a dad tribute/Hawaii tribute. I had no intention of ever monetizing it, it was really one of the ways that helped dealing with my dad’s death. It really produces milk money at this point, but it was such an amazing project.

My Happiness has definitely changed with my journey of mindfulness, meditation, Tae Kwon Do, happiness now is really joy, joy of the mundane, joy of watching kids grow up. I never saw this coming. I think Happiness in America has been defined as NBA-star level happiness, which isn’t really accurate.

I would say we have Happiness even though we may never get to $2.7Million….

Agree with many of your points. My number is like a 6 but generally happy because I know I will always have a roof over my head and not worry about life’s expenses.

What is name of the book?

Good plug for Fundrise. I am a Groundfloor equity owner and investor. Passive real estate investing is a strong model for the future.

I always enjoys your books and articles. Yes, desire is the cause of all suffering in Buddhism, which is why I am no longer attached to as many material things.

I like that you simplified the analysis using home price, but I have a quick question. Why did the half of the cities on your list all have declines in population from 2020 to 2021? I would think that the happiest cities would have more people moving to them. Common sense tells me I would leave a city that makes me unhappy and move to a city that may potentially give me more happiness.

https://www.census.gov/newsroom/press-releases/2022/population-estimates-counties-decrease.html

Here’s another ratio to consider:

Annual income generated by net worth (1/3 divided between US Stock/Int’l Stock/bonds ) / Annual Cost of living. Aka AIGNWACL ;)

The FSWRR (FS Minimum Net Worth Required To Be Considered Wealthy / Median Home Price) is a great idea and generates a lot of worthwhile discussion – thanks for the post!

For example, to SF and Chicago:

San Fran => 5.1M (net worth) | 1.7M (median home price) | 3.0 (FS ratio)

Chicago => 2.5M (net worth) | .32M (median home price) | 7.8 (FS ratio)

Now look at this with AIGNWACL :)

San Fran => 5.1M*(1.47%+1.07%+3.74%)/3 (~$106,760 Annual passive income) | 12*(4,792.07+4182+200) (~$110,088 Annual expenses family of 4) | 106,760/110,088 = .97 ratio

Chicago = > 2.5M/2*.013+2.5M/2*.011 (~$52,333 Annual passive income)/ 12 * (3,725.42+1618+200) (~$66,521 Annual expenses family of 4) | 52,333/66,521 = .78 ratio

Not as easy to measure (as the FSWRR) and people already mentioned this, in effect. Also,

The ratios would therefore change based on interest rates, dividend rates, monthly rental payment cost, inflation/deflation, lifestyle, etc.

I guess this measures how financially stable someone would feel in a certain city, living off of passive income. Chicago you’d need more just to break even.

Data from :

smartasset.com/mortgage/what-is-the-true-cost-of-living-in-chicago

smartasset.com/mortgage/what-is-the-cost-of-living-in-san-francisco

numbeo.com/cost-of-living/in/Chicago

numbeo.com/cost-of-living/in/San-Francisco

morningstar.com/funds/xnas/vtsmx/quote => 1.47%

morningstar.com/funds/xnas/vbisx/quote => 1.07%

morningstar.com/funds/xnas/vgtsx/quote => 3.74%

duckduckgo.com/?q=2500000*(.0147%2B.0107%2B.0374)%2F3&t=ffab&ia=calculator

duckduckgo.com/?q=5100000*(.0147%2B.0107%2B.0374)%2F3&t=ffab&ia=calculator

Chicago has very high wealth and racial inequality as well. Despite the social engineering through high property taxes and lip service from our politicians many neighborhoods are barely recovering from their pre 2007 prices. See WSJ article below on homes prices by zip code in Chicago.

wsj.com/amp/articles/housing-boom-fails-to-lift-all-homes-above-previous-cycles-peak-11654335001

I love Chicago during the summer. But I do not like the combination of tough winters and the highest property taxes in the nation. That’s a bummer. We joke about the sun tax here in California.

It is impressive the underperformance of Chicago and Illinois property prices since 2007.

Sam – in your email newsletter today about this you mentioned your number is $8.5m – $3.5m for a house and $5m invested to generate between $150,000 and $250,000 per year in passive income. Presumably that is after tax income. Where would you get that sort of return, and maintain it with inflation over time? I live in the Bay Area, too.

Re the SF ratio of 3.0, I’m not sure that ratio works as well here as it would in other parts of the country where the standard deviation of average home values is lower. Said another way, while the average home price here is $1.7m, the variability is enormous. Where I live homes in our neighborhood vary all over the place, from about $1.5m to well over $3m. From the street it’s sometimes hard to tell the difference, because you can’t see much of the house.

In other parts of the country I think the spread is not as dramatic, and therefore the amount that people say they need to feel happy would point to a more uniform index.

Interesting concept but what i found being married is that feeling wealthy and net worth needed is a compromise. My wife grew up somewhat poorer than i did so that played into her “number “ that wasn’t based on any mathematics, but just a feeling of what wealthy was for her. For reference it was about double what we needed based on the 4% rule. We ended up compromising somewhere in the middle as was miserable at work and she agreed that it was ok to risk a little on her “number” to contribute to my happiness. So far its worked out

Yes! LOVE = happiness no doubt. The more love we have in our lives and the more people who love us, the better.

Sam –

Some more perspective on Houston. What is considered as wealthy standard house generally is bigger than the west coast, comes with a huge backyard and pool. On top of it – due to the lack of good public schools, attractive areas are concentrated ; hence a house within the city area with those qualities won’t be under a million. Plus, most of the private school surroundings are super rich areas 9mainly O&G and/or medical professionals concentrations: making it hard for people to afford a nice house + private school fees).

First, props to Sam for this article, clearly well thought out. I do agree with some of the other commenters that there are multiple variables in play. Personal example. Thanks to Sam I refinanced to a 2% mortgage. Rates are now 2.5X higher. So someone buying now at the same price point will naturally feel poorer due to a higher payment. That isn’t reflected in the data as it is only based on housing price. Maybe add in a modifier of Equity % for each city.

The most important thing I took from this article is: I gotta start moving to West Virginia! $135k for a home is a STEAL!

Its a beautiful area. We stay there when we do cross country road trips. What we would struggle with moving there is the political environment. I think its pretty conservative which doesn’t work great for us personally. Its def worth considering though. World According to Briggs(YouTube) brings WV up all the time, Pennsylvania too.

FSWRR – it changes during the journey to wealth.

Sam, I posted a similar response on the other article. I think some of the inverted-ratio thinking comes from the way that the ratio changes as one progresses during wealth-building. If one’s NW grows faster than their primary house, then the ratio will increase – and that’s good. It’s not as simple as smaller FSWRR is good and larger is bad. It depends.

Here are the two perspectives: pre-wealth and post-wealth

*pre-wealth: the person here will find a low FSWRR Ratio less of a challenge because by the time they can afford the median house, they are a big percentage of the way to reaching wealth. (the road is long, but look how far we’ve come already)

*post-wealth: by the person reaches a net worth to be considered wealthy, their primary residence should become a smaller percentage of their NW. This person will be happy with a high FSWRR Ratio, because their house represents a small, and shrinking, percentage of their net worth (the road was was long, and we’re happy the non-house assets are outperforming the house)

So, the FSWRR Ratio flips during the journey. At the beginning, it’s good to have a lower FSWRR for the median homeowner, since the house acts like a booster on the road to wealth. At the end, it’s good to have a higher FSWRR because the house becomes a less significant portion of net worth.

Examples:

* In the 1X example, you mentioned living off of social security. Not ideal – so lower isn’t better for the older investor with FSWRR=1, but could be inspiring for the younger investor who is considered wealthy by the time they can afford the median house in their city FSWRR=1.

* Sam, you also cited striving for a higher FSWRR (5), with enough wealth to think about decumulating.

* Ideally, over time, the FSWRR will increase, as non-residential investments out-perform the appreciation of the primary house.

I agree that the FSWRR is dynamic. And we also must be dynamic with our withdrawal rates in retirement and in our thoughts and actions.

We just look at things differently.

The survey is asking what people THINK they need to feel wealthy, who are not yet wealthy. It doesn’t mostly survey wealthy people who are already past the minimum threshold for wealth what they think.

A FSWRR decreasing over time is actually quite nice too. Because it can result from one thinking they require a lower net worth to be satisfied. It can also come from people spending down their wealth and helping others.

Remind us where you are on your financial journey?

Hey Sam,

Thank you for the clarifications. This has been a good topic and discussion.

On our journey, we are in the decumulation phase. I was able to retire a few months ago, which was earlier than I had planned – thanks to you and Personal Capital. You’re making a difference in people’s lives.

At the market peak a few months ago, our FSWRR reached 7.0, but now we are down to 5.3 because equities dropped and real estate popped. It’s not a big deal, and I’m happy with the current FSWRR.

Good points here as, for us, a higher ratio is fine. We bought our house in 2011, investing a ton in the stock market, and the median prices in our market have been skyrocketing. Does that make me happy? Yes and no. Yes, because I can sell for significantly higher. No, because so much of our market is unaffordable if we want to move to another part of the city. In addition, my kids can barely afford anything here now.

Yeah, The unaffordability for our children is a tough one. That’s one of the reasons why I invested in multiple properties over the years so that when they are in this one is, they can have an affordable place to stay if I want.

See: https://www.financialsamurai.com/a-real-estate-goal-every-investor-with-kids-should-consider/

Thank you Sam!!!

Good article. Long-time reader.

This point is not the strongest you’ve made:

“There is likely more wealth inequality in Houston and Dallas between the very rich and the middle class perhaps due to the oil industry.”

The oil industry, although very well-paying, is not nearly as “top-heavy” as Tech (or Entertainment or Finance). Texas has a high gini coefficient – but California is higher.

Sounds good. Why do you think Houston and Dallas residents feel they need so much higher a net worth to feel rich then? Do you live in Houston or Dallas? All local perspectives welcome! And if you have the gini coefficient data between Texas and California, I’d love to see it as well.

Thanks!

Not local to TX, but I know Oil & Gas (and the areas that produce it).

Gini Data: https://en.wikipedia.org/wiki/List_of_U.S._states_and_territories_by_income_inequality

After a bit more thought I interpreted the data differently – what do you think?

I believe Houston/Dallas residents need ~$2.3MM ($2.6-$0.3MM) above the cost of their residence to feel rich.

SF residents need $3.4MM above the cost of their residence to feel rich.

After removing domicile costs it actually seems fairly close to me – mostly accounting for the remaining variables in cost of living between CA & TX.

I’ve lived in SF and Texas. The standard of living is much higher in Texas (at least with respect to housing). In SF, you can live in a “dump” and you are grateful because you own a home at all. Home ownership by itself is not a sign of wealth in Texas (unlike SF). It is more the norm for any middle class family.

So, to feel wealthy in Texas, you need a very large home. Otherwise you have the same thing as everyone else. Outside of Austin maybe, that means 7,000 sq. ft. or more (there are exceptions of course in swanky neighborhoods in Dallas and Houston). That will run $2 mill or more in a good neighborhood. So 3X the median house in Texas isn’t wealthy by any means. Not when the expectation is so much higher for a “nice” home.

I remember the first time my parents visited me in SF (they live in Texas). They were disgusted by “how I was living.” Even though I was paying 3X a month to what they were for housing! Of course, they grew up on the east coast and my “starter” home was nicer than what they could afford in NYC. As you said, we all get very comfortable very quick when we raise the standard of living.

Personally, I think comparing SF to Texas is apples and oranges. You simply can’t use housing as a metric. The value system is very different. Folks that are happy in Texas put no value on the parks, weather, culture, etc. They just think SF is a dump (which it largely is sadly these days–at least downtown). SF people think a 7,000 sq. ft. house is just stupid and wasteful. They also put much less value on owning a few acres of land.

$3 mill, for example, in the bank in SF or Texas generates the exact same amount per month. Outside of housing, the cost of living between the two places isn’t really that far off (not for the people reading this blog). The cost of a gallon of gas is trivial once you hit a certain wealth level–as is milk, insurance, clothes, etc.

The key, in my view, is to figure out your housing as you say…but do it early. If you own your home in SF or Texas, then it is basically a wash. Just much harder to pull that off in SF (but certainly not impossible if you start young and make it a priority). You can also get away with a much lesser home in SF and not look weird to your “wealthy” friends. Try living in a 1200 sq. ft. home in Texas and fitting in at the country club!

I don’t think too many people who are wealthy in San Francisco only live in a 1200 square-foot condominium or house.

The key question to test your theory is where do you live now? And where did you go to make the most amount of money?

I want to challenge people to think where it is they can make the most amount of money. There’s too much of an emphasis on housing here. Housing is not the main point of wealth. Housing price is the indicator of opportunity.

I live in Texas now. I make more than I did in SF by a lot, but I had a more traditional job in SF and now I own my own business. My view may be tainted I suppose since I lived in the financial district most of the time in SF where a nice place in a high rise was very expensive. But, I have many friends that live in SF that are wealthy by any metric. Maybe their places are 1500 sq ft and not 1200. Not sure exactly, but they are very small by Texas standards and well over $2 mill at this point. Obviously no land. Okay view at best (usually just the noisy street).

If you need a regular job, you will make more in SF for sure. But, you will lose a big part of the delta to taxes. With that said, I’m glad I worked in SF out of school. I made lots of great connections and got great experience. It was great fun when I was in my 20s. But, once you own your own business, I think the advantages of SF go away very quickly. Obviously that depends on what you do. But, if you personally picked up and moved to Houston tomorrow your FS business wouldn’t likely take any hit at all. You would just get a big increase due to taxes and lower housing costs (if you kept the same standard of living). Of course, that ocean view would be a bit hard to replicate! As would the weather, sushi, etc.

I know people get a little protective of where they live, but I think it is best to just be honest. Housing in SF is crappy for the most part. There is little to no standard because there is no need to have one to sell a property. I have a friend in lower pac heights who lives in a $3 mill dump. Full stop. Place is falling apart, old, gross, on a busy road, etc. It is objectively a dump. I have another friend in Houston in a similar priced house. He bought it five years ago, but it is 12,000 sq ft, over an acre, pool with a lazy river. Over the top for sure, but objectively they are night and day. No reasonable person would argue otherwise.

My friend in SF in lower pac heights has more money. More prestigious career, credentials, etc. The whole package. She is “wealthy” and runs in a “wealthy” circle. She has cramped little house parties with lots of VC types, tech executives, …. Everyone thinks her place is “normal” and “super nice” because of the neighborhood. My friend in Houston would never understand why someone with access to enough money for a $3 mill place would live like that. But, it is totally normal and fine in SF. When my friend in Houston has parties he hires over 10 staff for the evening, excluding valet. He could host 200 people at his place without any issue at all. I think he has a dozen bathrooms or so.

Now, to be clear, I could write 50 pages on why Texas sucks. But, there is no denying the extreme difference in standard of living for housing. Of course, I just visited a friend in London who has a place that would easily sell for $10 mill or more. I would rather stay with my friend in lower pac heights! It is all relative.

My point, poorly made at this point I’m sure, is using median home price as a metric for “wealth” is tricky when comparing Texas to SF. It is better than no metric of course. And your metric is better than any ideas I have. So not knocking the effort (I enjoy the blog very much). It is just that when I read this post it got me thinking about how different the mindset is from SF to Texas. I’ve lived and worked in both (actually jumped back and forth several times over the last two decades). My SF friends would rather live in a shack than live in a mansion in Texas. My Texas friends think my SF friends are idiots for living like animals while having millions in the bank.

I travel so much (mostly overseas) that I don’t overly care where I live at this point in the U.S. The no state income tax is the deciding factor for me in Texas, but I don’t have to deal with the summers. And I get my cultural fix in cities all over the world. If that was not the case, I may too live in a “dumpy” little place in SF. I like the ocean, weather, access to hiking, skiing, etc. But, the housing in SF is garbage. I wish it wasn’t true.

Thoughts on why the median home prices are so low in Houston and Dallas if those cities are so amazing and so much better than SF?

You would think their prices would be much higher due to better weather, culture, food, education, scenery, etc. what are people and the world missing?

And btw, I bought multiple properties in Texas starting in 2016 and have been there multiple times before. The median price difference seemed and still seems too egregious.

It is a bummer so many of your friends lived in dumps, as you say. I’m pretty impressed with the homes my friends live in. Hot tub on roof with bay views is nice! Maybe our friends have different tastes or wealth levels? I love the forever home I bought in 2020. And I definitely enjoy Hawaii even more.

The answer is because nobody chooses to visit Houston or Dallas if they don’t have to. The ability to make a lot of money is not as high for most people there. It’s hot as hell during the summers too.

The cities are fine cities. But if people have money, most aren’t choosing Houston or Dallas over San Francisco. And the 8-10X multiple that is required to feel wealthy is a reflection of the need for more money to make living their less uncomfortable.

To be clear, Houston and Dallas are dumps. They are terrible cities with no natural landscape. Hot as hell and devoid of most culture (there are always exceptions). That is why the median home price is so low (plus cheap labor and abundant land).

“You would think their prices would be much higher due to better weather, culture, food, education, scenery, etc. what are people and the world missing?” You are just being snotty and petty. I never said any of that. Don’t be a child because someone pointed out the standard of living in your city is low. The human feces everywhere in downtown SF is exhibit A that the people of the city are comfortable with a lower standard of living.

I’m simply making an objective point. The house you get in Texas is considerably nicer than what you get in San Francisco. Hot tubs are cool, but I have friends with 1000 sq ft pools in Texas (and built in hot tubs under the waterfall). Tacky? Sure. Of course. But, a little hot tub is a little hot tub compared to a massive pool, hot tub, lazy river, waterfall, deck, etc. It is just a fact. Doesn’t mean you shouldn’t appreciate your hot tub. But there is no value in being delusional either and pretending it is the same thing. It is not.

Also, a new kitchen with new appliances that is clean and nice is better than one slightly updated from the 70s. That is just an objective observation. 12,000 sq. ft. is nicer to live in than 1200 (or 1500)–all things being equal. I can’t change reality. It doesn’t make Texas “better” than CA. It makes it different, which was the point.

My guess is your standard is simply much lower because you are accustomed to SF standards. It isn’t a personal attack. Your standard is 10x that of someone on Malaysia. It is all relative. You say “I’m pretty impressed with the homes my friends live in.” That’s the point. Objectively those houses are much less than what you can get in Texas. The standard would be unacceptable to a Texan. I don’t think that is debatable. A quick review of what 1.7 million gets you in SF will show picture after picture of a dumpy place to live. Why not just call it like it is? Same is true in Hawaii. Most of those houses are dated and dumpy too–even at seven figures.

But, if one places a high value on weather, culture, food, and education, they can make the reasonable judgment call that it is better to live in SF. But, they can’t change the reality that their housing standard of living is much lower. Just like you can’t change that the weather and scenery is better in SF. I just find it fascinating that people in both places are so delusional. SF has crappy houses. Texas has crappy weather and scenery. :). I’ve lived extensively in both.

Grew up in Houston. Live in NorCal. My house in a comparable neighborhood in Houston is nearly the same price ($1.5) however the Houston house would have 2-3x the property taxes.

Houston has some of the nicest people you’ll ever meet, however, the weather is abysmal, hot, humid, torrential storms, cannot plan anything in advance outdoors, literally a miserable climate so you better have that big house because you’ll be inside of it most of the time (with the A/C cranked!).

Don’t even get me started on the mosquitos, cockroaches, etc. Couldn’t pay me to live in that climate again. Not to mention zero options for nearby travel. You can’t drive to Napa, Tahoe, in an hour or two, and the “beach” in Galveston is polar opposite of the Pacific. Comparing Dallas/Houston to Northern CA is certainly apples-to-oranges..

To each their own, but when I see any articles about the exodus to TX I think to myself “Yeah, give them a couple of years in that weather..” There’s no Utopia out there, and certainly CA has its challenges, but I’d take a 100 year old 2 bedroom home here over some 5K sq ft monstrocity in TX.

Anyhow, another 58 degree morning here in July and heading out for a run! Cheers.

I have a theory that simple geography plays a role in the relatively low housing prices as well. In Dallas-Fort Worth, builders are financially incentivized to continue building further and further out on the plain. Not constrained on peninsula like NYC or SF, a lake like Chicago, ocean and mountains like LA. I have no proof of this theory, but its just a thought.

Excellent and very thought provoking article. I live in Dallas and, after seeing this chart initially, it gave me a something isn’t right feeling in my stomach. After mulling over the city ratios for awhile, I think I know what makes me uneasy about this ratio. If I just eyeball the top 12 results, it seems like the ratio is skewed towards the coastal cities with higher home prices.

In attempting to justify my intuition mathmatically,

(looking at just the 12 cities presented)

Get the mean & standard deviation of net worth: Mean: $3,066,667 Std Dev: $794,679

Get the mean & standard deviation of home price: Mean: $696,917 Std Dev: $403,005

Net worth coefficient of variation (CV) is 25.9%. The std dev is 25.9% of the mean.

Home price coefficient of variation (CV) is 57.8%. The std dev is 57.8% of the mean.

Home price CV is 2.2X bigger than the net worth CV.

In my words, the net worth requirements have a much closer range (i.e. less dispersion) compared to median home price; thus, this ratio is biased (i.e. is lower) towards coastal cities with higher home prices. Said another way, because people’s expecations of net worth across the USA are in a well defined range, coastal cities with higher home prices (i.e. higher denominators) have lower ratios.

I’m not a statistican by any means so I would love it if a statistician can jump in here and opine.

“The median home price is used in the denominator because it is a reflection of the cost of living in your city and its resident’s earning potential.”

I don’t think home value is a good approximation for cost of living and maybe not income potential either. Living in Seattle the home prices relative to cost of living (w/o housing) is simply out of whack. Perhaps this is because housing has had such a run up in the last 7 years and the cost of living hasn’t caught up yet.

bestplaces.net/cost_of_living/city/washington/seattle

Median income for Seattle says it increased 124% from 2000-2019. I don’t have a good site to show median home value % change but I know it is much much higher than that. My home has about tripled since I bought in 2013 along with every other house in the area.

Here was the median income change link:

Change in median household income between 2000 and 2019: Seattle, Washington: +124.1% Washington: +71.9%

city-data.com/income/income-Seattle-Washington.html

Hi Travis – Do. you rent or own in Seattle? How long have you been living there?

Maybe the other big variable is whether a city resident has stabilized their living costs by owning or not. That certainly should play a big part in financial satisfaction, especially given the runup in home prices.

We bought back in 2013. Our living costs, relative to inflation, have been slowly creeping up, but I attribute this to having 3 kids during that time.

2013 was a phenomenal time to buy congrats! So that’s very interest that despite you being way in the money now, you still find you don’t yourself as financially satisfied and happy as me or others might think.

Why do you think that is? Maybe the weather or the struggle of raising kids? I know the feeling if so!

I have made millions work at Amazon over the past 10 years. The cost of living hasn’t nearly caught up with the amount of wealth creation in this area.

So Sam the Median home price in Omaha Nebraska is 138 k…in addition Warren Buffet lives there…

So do you think WB thinks about his home value and how somehow equates to his idea of being rich or happy? I don’t. I think he succeeded in a low cost area and never considered it a hindrance to his success, to the contrary more likely a catapult for success. In today’s Covid world the location of your home base is much less reverent…

I think the formula is interesting but needs additional data points…

For instance what is the per capita income in San Francisco vs your last place city Houston?

What is the home ownership percentage?

Happiness is not only based on wealth/home ownership it is so much broader

I personally think your numbers are inversely relateted…lower the median home price automatically equates to higher happiness.

Lower median home price leads to less stress, lower payments, less keeping up with the “Jones’s”

People in lower cost areas don’t envy the “Coasters”..even if they aspire for a “rich” net worth that is a higher multiple than there homes value. That only means that they aspire for bigger things…and I believe that even if they don’t achieve it their baseline happiness level is still higher than the treadmill/ chasing payments Coasters…

I don’t think we can use Warren Buffett as an example. He is clearly an outlier. And I would say plenty of people who had his wealth would not want to live as frugally.

The data is the data though. I didn’t commission the survey or determine median home prices.

Keeping up with the Jones is feeling like you need a net worth 10X greater than the median home price rather than just being happy with a net worth 3X greater. I’m not sure why this logic is so debatable. Want less, be happier.

You left California To Tennessee b/c you wanted less or didn’t feel wealthy enough. Now you feel wealthier, which is one of my bullet points of relocating to be richer and make your money go farther.

But we’re talking about existing residents of these cities and their desires.

Sam, this was an interesting read. I did the calculation for my situation in our city (Columbus, OH) and got 3.1. My spouse and I are in our 60s. We lived in an East coast city early in our marriage and the cost of living was brutal. We were able to move back to the Midwest later and got immediate traction on our finances. We live a simple life and are very happy.

I also wanted to let you know that when you announced about your book, I went right to our library and it was on order. I am the first one in line when it comes in. So far they have ordered 5 copies.

Good to know! I wonder how libraries around the country decide which books to buy and how. Maybe you can ask them when you check my book out. I’m a big fan of the library and happy to have more folks read.

I was thinking of writing a post about how we can all make things for free. Free labor, free products, free healthcare etc.

I’ve been writing for free since 2009 and I’m wondering if I can encourage more people to do their work for free too. Could be good for society!

The terms “starving artist” or “hungry writer” might slowly disappear from our vernacular as we all become one.

Should be a good topic discussion!

Sam, when I read the second part of your reply, I have done this. For many years I sang funerals. Sometimes I would get an honorarium, but not always. I know it might sound morbid to some people, but I felt I brought something valuable to comfort people who were grieving. I was only able to do this b/c my spouse had a good job. I feel what I did was worthwhile in this life, and helped people.

Sam,

Thanks for this post and your excellent blog. I’ve been following along recently and also tracking our real estate bet :)

I live in the Bay Area and I’m constantly hearing from coworkers and friends how hard it is to be financially successful here, so this list is surprising to me. Wouldn’t we want to look at median incomes as well? The median income in the Bay is about 130k, so the median income to median house ratio is 13, which seems unhealthy and where most people cannot afford a good standard of living here. I personally feel the same way, even though our household income is very high. Likely will be moving out soon bc we cannot afford the kind of new house we would like in a good community in the Bay. Hearing the same from others in my circle as well.

Remind me of our bet!

We can look at median income as well or median income of the median household buyer, who makes more than the median overall income.

But introducing a third variable gets complicated. And the median household income implies income levels equal to 20% to 34% of the median home value based on my 30/30/3 home buying rule.

Our bet was related to this! 100 dollars based on whether the median house price in the US declined by more than 1% this year. You are obviously winning so far, but the housing market is starting to show cracks.

I guess you could say those that have enough income to buy a house and then more in the Bay Area have an *easier climb* to the 5.1m rich value and that’s true. However, what percent of Bay Area residents are this fortunate due to high income levels or appreciation? I believe it’s well less than 10%. Would it be more fairer to see how well the median resident can do in cities in terms of affording a median home and then more to calculate happiness levels of the general population?

Also many could afford a house in the Bay but then would not be able to rent it out at cash flow positive or risk tying up their equity and net worth in a single and in my opinion over inflated asset, which is something we are struggling with ourselves at this time.

Ah yes, thanks for the reminder. Let me put it in the calendar on Dec 31. Make sure to ping me.

Prices are definitely softening. Should be able to get 5% discounts now from peak prices. Hard to find 10% though as sellers will just hold on.

The survey results are what they are. The wealth creation potential in SF is the highest. Yet we also don’t need that much more, maybe bc of the weather, food, culture, schools, and entertainment.

Thanks Sam. Will check in end of the year. I was just agreeing with other commenters that your interpretation of the survey results is inverted. Anyway, to be rich is better than to be right! Cheers.

Yes, a couple commenters have said my interpretation of the survey results or the Wealth Reality Ratio is inverted. So I spent some time thinking things through for this article.

Can you explain why you think a 10 Wealth Reality Ratio makes residents happier than a 3? I see your earlier comment on median income. But I’m talking about the ratio itself.

I would be miserable if I felt I needed at least 10X the median home price of SF ($1.7 million) before feeling wealthy. $5 – $10 million is plenty, let alone $17 million.

Sure Sam I can try to explain the thinking here.

Being *rich* in mind is the combination of two things.

1. Have your needs taken care of with a nice home

2. Have leftover wealth to protect from a bad day and enjoy life.

What I think is happening is that in SF those residents have accepted a lower standard of living as acceptable for feeling rich. A rich person in sf therefore has a residence worth 2x the median at 3.4m and an extra 1.7m buffer. Because they understand the realities of a high cost of living.

A person in say Houston can dream bigger and aim for a house that is truly grand at 5x the median value (1.3m) and still have 1m left to cover expenses and for a rainy day. They consider that being rich.

So the person in Houston aspires to a higher standard of living at least in terms of a home than the SF resident. Now whether or not their aspirations are achievable has more to do with incomes and opportunities than housing values.

So to summarize the ratio is inverted bc it shows that people in the bay have accepted a lower standard of living as wealthy and achievable. And therefore it is a less happy place to be to reach that American dream of wealth than Texas, for the median resident.

Thanks for the perspective! Insightful!

I disagree, but insightful.

You’re overemphasizing the joy and value of the house and not looking at the denominator as a variable that reflects existing opportunity to build wealth. Yes, the house itself is a part of feeling wealthy, but it is not the main desire or reason.

Using a 5X multiple on the median house to feel wealthy is extreme for the Houston example. And then to have another 5X leftover to feel wealthy (10X) is another extreme. Why does it require so much more to feel wealthy if residence are satisfied with what they have?

We are talking about minimum net worth to feel wealthy, not maximums.

But I think it’s great our thinking is the exact opposite. Maybe I’m more easily satisfied than you? Can you provide some hints on your existing situation and happiness levels? Are you working/retired, married/divorce, optimist/pessimist, etc?

Thanks!

Sure Sam. Thanks for your blog, its been immensely helpful on our wealth journey.

I am in my 30s married with 2 kids, like you. I’d say I’m a very optimistic and positive person. Others say that as well.

Career has been ramping healthily in the past few years (thanks to the Bay) due to career growth in tech and also probably some salary inflation. Lucky to have been able to achieve a high income and 2M+ NW. We already own a home which is right about the median bay area value.

Next, we want to upgrade to a larger home with a yard and good schools. To do that in the Bay Area costs ~3M. If I were to do that, I’d feel pressured to work at least another decade at least to pay the 18k / month (Yikes!!) in mortgage and property tax.

Also, if there’s any recession or layoff, I’d be screwed. And if I wanted to move, if the value went down I’d sell at a loss and I couldn’t really rent it out and cover my monthly expenses.

So we are considering moving out of the Bay to get a similar home for less than 1M. Could retire now, or even in a few years if I did that, or try startups instead of the few big tech that could pay an income that can support such a large monthly payment.

But also feel very conflicted to leave right as our careers are ramping and (maybe) in a few years it’ll feel cheap here with more career growth. You never know though, tech is crashing again and cheaper and better tech workers in Asia are catching up quickly!

To me, the Bay area feels like one big rat race. If you try the leading tech forum teamblind you can find 50% of highly paid bay area tech residents feel the same and hope to move out in droves. I’d even say it’s the worst place to live financially in the US. A few years back when I made less I felt totally hopeless. So that’s why I think your curve is inverted :)

Got it. Makes sense! And the desire to move out to afford a bigger home is consistent with not feeling financially satisfied living in the Bay Area.