For most people, an adjustable rate mortgage is better than a 30-year fixed-rate mortgage. With an adjustable-rate mortgage, you will likely save more money during the duration of your ownership. Even in a rising interest rate environment, an ARM will likely still save you money in the end because rates will eventually go back down.

I've been taking out an adjustable-rate mortgage since 2005. I will continue to do so because they are more efficient. Over the years, I've saved over $300,000 in mortgage interest expense as a result.

For those of you smartly looking to refinance, do a cash-out refinance, or purchase a new property, I'm here to argue why an adjustable-rate mortgage is better than a 30-year fixed-rate mortgage (FRM).

With ~95% of mortgage holders owning 30-year fixed-rate mortgages, I know I'm part of a small minority. However, if you spend several minutes to read about my logic on why ARMs are better, you might just save more money going forward too.

Why An Adjustable-Rate Mortgage Is Better Than A FRM

The main reason why an adjustable-rate mortgage is better is because it will likely save you money over the long run. I will back this up with logic, examples, and truth.

You know what sells? Fear.

For decades, lenders have used fear to get homeowners or potential homeowners into 30-year fixed-rate mortgages instead of adjustable-rate mortgages.

Lenders like to tell borrowers that if they don't get a 30-year fixed mortgage, they'll potentially face financial hardship when their ARM resets to a higher rate.

By pushing peace of mind, especially to first-time homebuyers, lenders get to earn more money off larger loans with longer durations that charge higher mortgage interest rates.

The thing is, lenders who push 30-year fixed-rate mortgages are either focused on their bottom line, not providing you the entire truth, or are simply ignorant about economics.

Here are the reasons why an adjustable-rate mortgage is better than a fixed-rate mortgage to save you money.

1) The long-term interest rate trend is down.

Interest rates have been coming down since the 1980s as the Federal Reserve has become more efficient in managing economic cycles.

The US has also become the world standard for sovereign assets through the purchase of US Treasury bonds. No country comes close to being as stable and as sovereign as US.

If countries like China would open up their capital account and let its citizens buy foreign assets, we would see a flood of capital head our way. I firmly expect foreigners to buy up U.S. real estate once the borders open and COVID subsides.

Of course, there is no guarantee that interest rates will stay down forever, as we saw in 2022. But in order for interest rates to start a permanent upward trend, a combination of the following would need to occur:

How Mortgages Rates Could Go Up

- The U.S. would have to completely lose its superpower status, causing foreigners to dump Treasuries in lieu of another international safe haven.

- The Fed would have to start printing endless amounts of money to stoke inflation or expectations of greater inflation. Ah hah! This happened in 2020 and 2021 to combat the global pandemic. As a result, inflation rates rose to 40-year highs. However, inflation is beginning to roll over again as of mid-2022.

- The Fed Governors all turn out to be the dumbest, most inept people on Earth. Ah hah! Actually, if we understand how rich central bankers think, there are as fallible as the rest of us. They care about their legacy and they will sometimes tighten or loosen too much, creating big boom bust cycles. Let’s hope the governors are logical enough not to ruin the world.

- Our government would have to blow up our budget, which is possible if we decide to have medicare for all, free tuition, and wipe out all student loan debt without significantly raising taxes. Funny enough, President Biden announced his student loan forgiveness program, which will likely result in higher college tuition and a slight uptick in inflation.

- Employment growth would need to be so strong that it causes the natural rate of unemployment to fall to ~2%, which would, in turn, cause inflationary pressure.

- Globalization declines and Nationalism rises.

- The internet regresses and information flow slows

Permanently Higher Interest Rates Is Unlikely

Taking out a 30-year fixed-rate mortgage means you are betting against a 40+-year trend of declining rates and rising economic and intellectual progress. It is not a wise bet.

Yes, the Fed started another rate-hike cycle in 2022. Yes mortgage rates are way up. However, mortgage rates don’t go up forever and tend to revert back to its downward trend. Further, by the time your ARM adjusts, interest rates will probably revert back to its downward long-term trend.

Take a look at this historical chart below. Notice how the 10-year bond yield, the main determinant of mortgage rates, goes up less than half as much as the Fed Funds Rate. I expect things to be no different during this current rate-hike cycle.

What's sad is despite the long-term downward trend in mortgage rates, the percentage of mortgages that are adjustable rate mortgages is still in the single digits only. In other words, millions of homeowners have been paying way more in mortgage interest than they needed to for decades. See the chart below.

A general upward sloping of the yield curve.

Due to the time value of money and inflation, the longer you borrow the higher your interest rate.

If you borrow money from me today to pay me back tomorrow, I won't charge you interest. But, if you want to borrow money from me today, to pay back over the next 30 years, I'm going to charge you an interest rate above inflation to counteract inflation, make some money, and bake in some risk of default.

In other words, if you borrow at a 30-year fixed rate, you are borrowing at the most expensive part of the yield curve. When the yield curve inverted, as it was in 2018 and portions of 2020, your best value is to borrow at the deepest point of the inversion.

Take a look at the troughs of the yield curves in 2020. Where I circled is the duration where you should borrow to get the best value. However, basically, any duration between 3-10 years offers great value compared to borrowing at a higher rate with only a 3-month term.

In 2H2022, the yield curve inverted, making an argument a recession is coming or is deepening. As a mortgage borrower, you get better value taking out a 30-year fixed-rate mortgage compared to taking out a one, two, or three-year ARM. However, it is unlikely the yield curve will stay inverted for more than a couple of years, which means there will be better value taking out an ARM again. I’d buy short-term Treasuries when the yield curve is inverted.

The thing is, the average 30-year fixed rate mortgage reached about 6.5% in 2H2022, which is 2% higher than the average 7/1 ARM. Hence, locking in a 6.5% 30-year fixed rate mortgage when mortgage rates are likely going to come down within a couple years is suboptimal.

Match the average length of stay.

Some of you might be thinking that taking out a 5-10/1 ARM is too risky. You plan to live in the property for much longer. If you think you're going to live in your house for much longer than 20 years, the data shows otherwise.

The average duration one lives in and owns a home is about 11 years as of 2022. Therefore, taking out a 30-year fixed rate mortgage makes little sense. Not only will you be paying a higher interest rate, but you'll also likely sell your home or maybe even pay off your mortgage in under 10 years.

A 19-year overestimation of ownership is a serious miscalculation based on the data at hand. Even if you end up owning your home for longer than a 10/1 ARM, you still have plenty of time to pay down more debt before the interest rate resets, refinance your mortgage, or set aside more money for potentially higher monthly payments.

If you plan to live in your house for 10 years, taking out a 10/1 ARM is the most ideal loan duration. A 10/1 ARM is usually between 0.25% – 0.5% cheaper than a 30-year fixed-rate mortgage.

Here's what I did with some of my mortgages since 2003:

A) Took out a $435,000 mortgage in 2003, refinanced it multiple times to a lower rate, and paid it off in 2015

B) I then took out a $1,220,000 mortgage in 2005, refinanced it multiple times to a lower rate, and paid it off in 2017 by selling the property.

C) I then took out a $568,000 mortgage in 2007, got a free loan modification in 2010, and will pay off the remaining balance by 2023.

D) Took out a $990,000 mortgage in 2014, refinanced it in 2019, and will pay it off in 2027.

Based on my small sample set, I have an average mortgage duration of 13 years. The durations would be shorter if I had not refinanced all the mortgages and/or purchased cheaper homes. San Francisco is expensive!

Adjustable-rate mortgages have an interest rate cap.

I'm not sure whether it's due to misinformation or fear-mongering by your lender or the media, but some people think that once the fixed period of the ARM is over that your interest rate will skyrocket. This just isn't true.

There is a cap on the annual interest rate increase for the first year. Another cap usually for the second year, and a lifetime interest rate cap. Unless your lender is trying to swindle you, there is no endless increase in interest rate increases. Please double check by asking.

For example, I got a 5/1 ARM in 2014 for 2.5%. In 2019, the most it could reset to was 4.5% for one year. The ARM could reset by another 2% in the second year all the way up to a maximum of 7.5%. You can read more about how high an ARM interest rate can reset here.

Don't Forget Principal Gets Paid Down

But after five years, through normal and extra principal pay down, my mortgage was only about $704,000. Therefore, despite the interest rate increase to 4.5% for 1.5 months, my monthly payment hardly changed. After I refinanced my mortgage, my monthly payment went down from about $3,800 to $2,800.

Please know that an ARM doesn't automatically reset higher either. The ARM rate is tied to an index + a margin. The index is usually the London Interbank Offer Rate (LIBOR). If LIBOR is lower during the year of the reset versus the year you took out your ARM, then your interest rate will actually be lower.

In my case, the Fed started raising rates since 2015, so I got caught in the upside since LIBOR follows the Fed Funds rate. However, the Fed cut its Fed Funds rate to 0% – 0.25%. If I took out a 5/1 ARM in 2010 and it reset in 2015, I would have paid the same interest rate for the first year. Good thing most of us with a high loan-to-value (LTV) ratio have the option to refinance when Treasury bond yields are low.

See: The Anatomy Of An Adjustable Rate Mortgage

Heads you win, tails you also win with an ARM.

Let's say you get completely unlucky after your 10/1 ARM expires and your mortgage rate goes up 2%. Further, you can't refinance to a lower mortgage rate because Treasury bond yields are high. This could actually be fantastic news.

Things don't happen in a vacuum. The 10-year Treasury yield is a reflection of inflation and demand expectations. If the 10-year yield, and therefore mortgage rates are rising, that means inflation is elevated or expectations for inflation are also rising.

Inflation increases in a strong economy due to a stronger labor market, rising wages, and higher demand for goods and services. When these things happen, the price of real estate also rises.

So what if inflation rises from 2% to 5%, causing your mortgage to reset from 3% to 6%? If your home is now inflating by 5%, and you have an 80% loan-to-value ratio, your cash on cash return has now gone up by 25%.

Given the cost of ownership is largely fixed, real estate is not only an inflation hedge, but it is also an inflation play. In an extreme circumstance where there is hyperinflation, you need to own real assets such as real estate. Cash will rapidly lose its purchasing power when inflation is high. Real estate is also a hedge against so many bad things in life.

Financial discipline is why an ARM is better than a 30-year fixed-rate mortgage.

When you have 30 years to pay something off, the natural tendency is to pay it no attention. But when you have an adjustable-rate mortgage, you are more aware and more motivated to pay down some debt before the fixed rate period is over.

Think of an ARM like a personal finance trainer. The trainer motivates you to stay on top of your finances and pay extra principal every month. Think of a 30-year fixed mortgage as your neighborhood gym. You hardly ever go, even though you know you should.

Building wealth is much easier when you have a target. An ARM gives you a great timeline target to reduce debt and build equity. The key to paying off debt and achieving financial freedom is discipline. An adjustable-rate mortgage is better than a 30-year fixed-rate mortgage because it will keep your ocused.

Related: A 15-Year Mortgage Is Probably Best For Veteran Homeowners

You're not a helpless infant, you're a Financial Samurai.

Before your adjustable-rate mortgage resets, you can do a number of things:

A) Pay down more principal to lower your future mortgage payments

B) Refinance your mortgage to a lower rate than the reset rate

D) Sell your property

E) Generate income from the property by renting out a room, a floor, or the entire property

F) Generate more income from your job or a side-hustle to pay for higher payments if worse comes to worst

G) Do nothing as the ARM resets to save time and potentially refinance fees

You have plenty of time and plenty of options to make a positive financial move before your ARM resets to a higher rate. If you just pay your mortgage payments as usual and pay no extra principal, you will have paid down roughly 11% of principal after five years.

Therefore, even if there is a rate increase, the monthly payment increase won't be as bad as you think. I have no regrets taking out an ARM in 2020 before mortgage rates started moving higher.

Why An Adjustable-Rate Mortgage Is Better: Peace Of Mind

The more uncertainty and fear there is in the market, usually, the lower mortgage interest rates will go. Investors tend to seek the safety of US Treasury bonds. The lower interest rates go, the higher demand there is for real estate. The higher the demand there is for real estate, the more equity you will build as prices rise.

Don't listen to mortgage officers who push a 30-year fixed mortgage on you for peace of mind purposes. You know why an adjustable-rate mortgage is better. You should actually have less peace of mind knowing that you're paying a higher interest rate than you need to.

Have an ARM that closely matches your duration of homeownership. It should make you feel great knowing that you're paying the lowest interest rate possible to own an asset that provides utility. Over time, your home will likely appreciate as well.

If you really appreciate peace of mind, then quantify it.

Let's say a 30-year fixed loan is currently around 4% vs. 2.625% for a 5/1 arm. Let's say you borrow $1 million. $1 million X 1.375% (difference in the rate) = $13,750 more in interest expense you will have to pay every year for the length of ownership.

If you own the home for seven years, that's $96,250 more in interest expense you would have paid for the comfort of having a 30-year fixed rate mortgage. Assuming interest rates stay the same over a 30-year period and you own the home for 30 years, you will have paid more than $300,000 more in interest than necessary.

In this example, is your peace of mind worth $96,250 – $300,000? Perhaps, but only if you've never read this post. And you can't handle the reality of economics. Or you don't know your options and don't believe in yourself.

After reading this article, I hope you agree why an adjustable-rate mortgage is better than a 30-year fixed-rate mortgage. The next step is to refinance your mortgage and take advantage of all-time low mortgage rates.

Build More Wealth Through Real Estate

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile. Real estate also provides utility and generates income. It doesn't lose 20%+ of its value overnight as do some stocks which miss earnings.

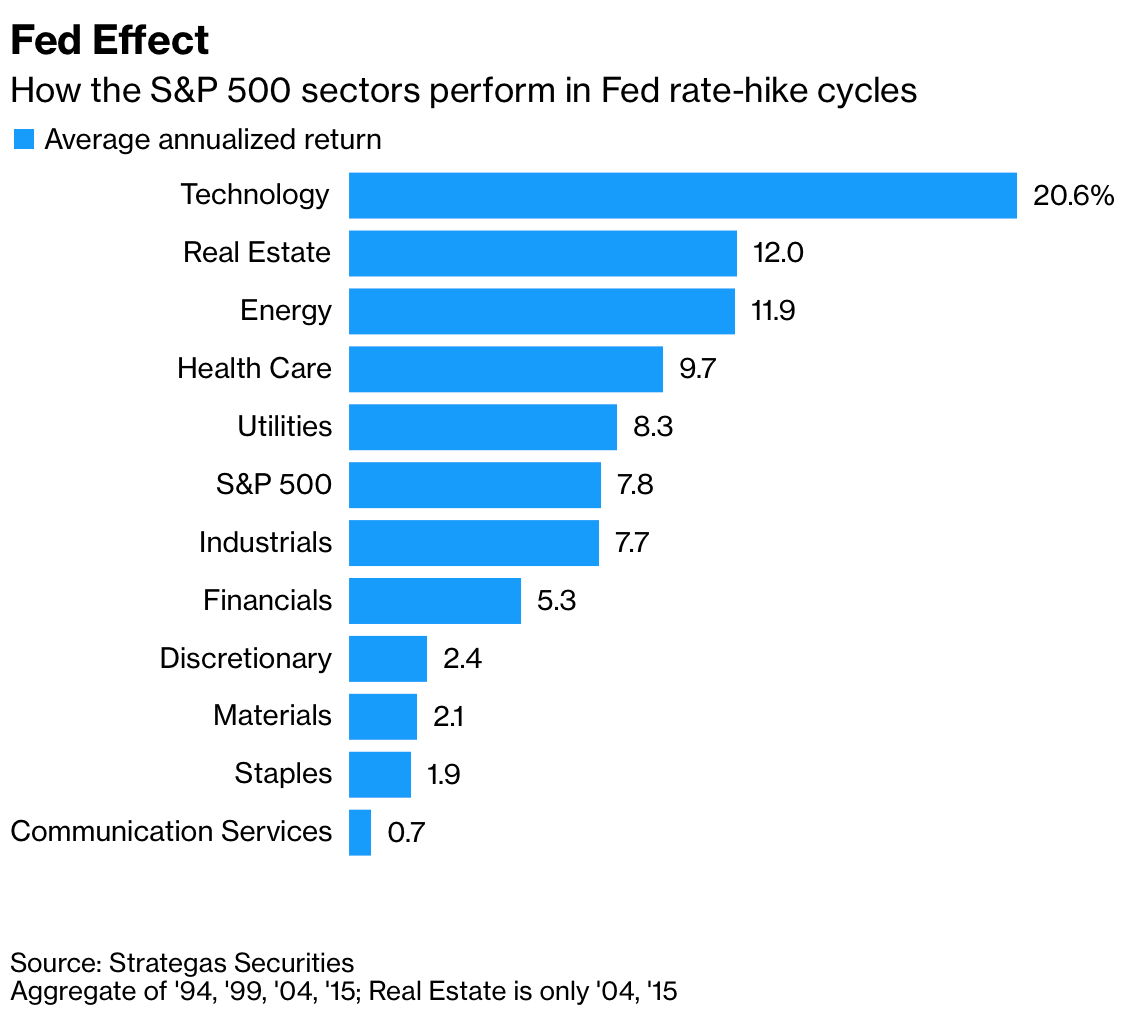

Interestingly, real estate is also one of the best performers in a rising interest rate environment. The reason why is because real estate rides the inflation wave and landlords can capture rising rents. For example, rents in the Sunbelt are surging as more people rent instead of buy.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: My favorite platform for all investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. Demographic trends are positive for 18-hour cities. If you have a lot more capital, you can build you own diversified real estate portfolio.

I've personally invested $810,000 in private real estate so far to diversify my holdings and earn more income passively. Thanks to my investments, I've received over $624,000 in distributions since 2017 and counting.

Why An Adjustable-Rate Mortgage Is Better Than A 30-Year Fixed-Rate Mortgage is a FS original post.

I’m a long-time reader of your site, and of course this was the first place I came when I started to consider an ARM for our next home purchase. I’m looking to shave down the current high interest rate as much as possible.

In today’s rising interest rate environment, it seems a 3/1 ARM wouldn’t be a bad idea. I expect interest rates to go down within 3-5 years, if not sooner.

Thanks for your detailed analysis and explanation of the benefits of the ARM.

Jess

Hi Jess, glad you found value in this post when making a mortgage decision. I think there is an 85% chance mortgage rates will be lower within 12 months.

See: The Most Bullish Economic Indicator Yet

Post-Mortem Analysis of A Bullish Thesis

Hi Sam,

I live in San Jose and have been thinking about ARM after reading your post. I talked to a few banks like Wells Fargo and BofA and they all said that their ARM products are actually more expensive/higher rates than 30 yr fixed. Any pointers on which institutions I should reach out to for better deals?

Evan,

Hi Sam, do you feel this article is still relevant after the last Libor hikes? Would you still advise towards a 10/1 ARM today?

Yes, if you have to get a mortgage. Match duration with likely ownership duration.

Speaking of 10/1 ARM, I got quoted a great rate around 3.5%. See: https://www.financialsamurai.com/well-qualified-borrowers-paying-much-lower-mortgage-rates/

Inflation and rates will fade down by 2023.

Hey Sam, long time reader here, thanks for your excellent posts! As a few others have asked, does your preference for ARMs over 30 year fixed rate mortgages still hold true today? A couple of your qualifiers for an upward trend in interest rates seem to be starting to occur, do you have any new thoughts on this topic?

I think taking out an ARM will still save you money in this rising interest-rate environment. The long-term trends down. Let’s say you take out a 7/1 ARM. In 7 years, There’s a high chance that interest rate trends will revert back to normal, which is downward.

Further, you can always refinance beforehand. And depending on how long you’re on the property, you might sell or leave before the adjustment. Finally, taking out an ARM guarantees you will be paying a lower rate than a 30 year fixed rate mortgage during the fixed duration.

What are your thoughts on ARMs vs 30 year fixed with the rates going up? I refinanced to a 5/6 ARM last year and am wondering now if I would have been better off with a 30 year fixed…

I second this question :)

I like your suggestion to match financing to your average length of stay in a home. First time home buyers tend to stay in their house for even less time than the average home buyer. I’ve recommended first time buyers consider how much square footage and what kind of location they need in the next 5-7 years in order to get the most from their home. Combining an appropriate time horizon for financing using an ARM with a matching time horizon for the type of property could really benefit homeowners!

30 year fixed: 2.875%; no cost

10/6 ARM: 2.49%; no cost

5/6: 2.49%; with a buy down of $635

7/6: 2.49%; with a credit of $305

$450k home @ 5% down

$427.5k mortgage * .385% = $1,645.88 in savings.

I get it’s not $1,645.88 per year (I’m paying off principal).

Why would I do 5/6 or 7/6 ARMs? It seems like 10/6 ARM is the one to go with.

Any advice is greatly appreciated! I don’t expect this townhome to be a forever home for me.

Thanks for this article financial samurai! It’s hard to find articles that are pro ARM (so much fear selling going on for fixed rates).

Is so the 10/6 ARM and lock in 10 years. The extra years is worth something. I still don’t think rates are going up much, even with inflation.

10 year bond yield actually declining now again.

Related post: Income And Net Worth Recommended To Buy A Home At Different Price Points

When I look at rates today, the 30 year fixed is much more competitive than a 5/1, 7/1, or 10/1 ARM… am I missing something? My thought is with the shape of the current yield curve, 7/1 and 10/1 ARMs don’t make much sense for lenders to pursue given the steepness in those sections of the curve.

For reference on a 750k home with 20% down, I’m seeing ~3% on 30yr fixed and 3.875% on 7/1 ARM when I compare rates on Costcofinance.com or bankrate.com. So 30yr fixed clearly the winner…

Any help/guidance would be appreciated!

You’re actually seeing a mortgage market anomaly that needs to be taken advantage of right now with a 30-year fixed or a 15-year fixed rate mortgage.

Usually, the 30-year and 15-year fixed rate mortgage is more expensive. However, banks are getting more bullish (see XLF performance doing great) and are willing to lock in and lend at longer terms.

I’d check out Credible for a no-obligation mortgage rate quote. I’ve found them to be pretty competitive.

Hi Sam,

Your posts are very insightful and I always enjoy reading them. Agreed with your points about ARMs and we have always had success with ARMs since 2006. We are refinancing now. Two options: 1.75% for 7/6 ARM, or 2.625% 30-year fixed. With the anticipated rising interest rate, we are debating for the first time whether it’s still a good idea to go with an ARM. Would really appreciate your thoughts.

Information:

Primary residence in SoCal. Expecting to have ~$500k gain in 5-7 years.

We will likely move in 5-7years, considering whether to pay agent commission to sell then and save on capital gain taxes, and invest the profit into something else, or convert it to rental but lose the $500k tax exempt gain.

If we hold the property beyond the ARM period, we will have to refinance again because the ARM terms are 3% margin + SOFR, adjusted every 6 months. The initial reset can go as high as 6.75% (though not likely). Subsequent adjustments are capped at 1% each time. Interest rate during life of the loan is capped at 6.75%.

Related questions we are researching:

Is it truly a great strategy to buy and hold? If so, does it apply to primary residence converted to rental, even if we lose tax exempt on the gain (have to hold it long term to recoup the tax savings).

Or is it better to alway buy primary residence to get more favorable financing, live in it for a few years, then rent it out for 2-3 years, then sell when we can still qualify for the tax exemption? In this strategy, we will likely always have 1 rental, but can’t really accumulate properties.

Thank you so much in advance!!

If others have experience with similar situation, I’d appreciate it if you can share as well. Thank you!

I’m generally in agreement with 80% of what Sam writes but tend take on a little more risk than what he prescribes. However, with regard to my mortgage, I’ve refinanced multiples times with a “safe” 30 year fixed for the last 25 years while Sam has stuck with those “risky” ARMs.

I finally caved on my most recent refi and went with Sam’s thinking…sort of. On my $1M mortgage, given a choice between a 30 year fixed at 3.0% and a 10-yr ARM at 3.0% Interest Only, I went with the second option. I’m increasing my monthly cash flow (which is the point of an ARM) while locking in for 10 years. I’m also strategically maintaining my mortgage balance at $1M over the next 10 years to maximize my interest deduction. I am grandfathered into the $1M limit.

Would you take a mortgage if you had “enough” money? We, family of four, got suddenly “extra” ~$10M. We have always had zero debt but we are also renting. Now we suddenly have about $5M cash and $5M in a single company stock. My one year plan is the following:

1. Buy a ~$2M house for cash

2. Put $5M into SP500 index fund

3. Keep $1M in cash and short term US bonds

4. Keep $1M in the company stock

(yeah that adds up to $9M, but I will need to pay long term capital gains and California income tax on the $4M company stock I will be selling…)

(I also have ~$0.5M in 401k, 90% in stock index funds)

In theory taking a mortgage and putting the money into SP500 would make sense.

Would you buy the house for cash or not?

I’m 47, so is my wife. I make about $300k/year and plan to work at least until I’m 55, although I might change my mind earlier… (My wife is not working)

Frank

I retired in my early 40s back in 2013. My wife continues to work even though she doesn’t need to. If a bank is willing to lend me money for 3% for 30 years (even lower for an ARM) to buy a house (or for any other purpose for that matter), I’m borrowing as much as I can as soon as I can.

If you can’t invest the proceeds and generate an annual return > 3% over 30 years, you’re doing something wrong.

As a point of reference, my house is worth $1.8M, and I just refinanced my $1.06M mortgage at 3%. I would have borrowed more, but I was limited by the reluctance of that bank to lend more than 60%LTV. However, I liked the other terms.

In general, I am highly leveraged because I own a lot of investment property with 65% LTV at rates around 4% on 5 Year ARMs. You’ll never get better financing terms than on your primary residence.

I totally agree with your points about “why an adjustable rate mortgage is better than a 30-year fixed-rate mortgage.” Our most preferred option is the 15 year fixed-rate mortgage though.

According to your chart, it has had the lowest interest rate over the last 18 months or so. It also “helps” people borrow less money overall since the monthly payments are higher (versus a 30 year fixed) and the overall interest paid is significantly less.

Personally, we have paid off 15 year fixed loans multiple times in under 6 years each. Now that we’ve paid off our “forever” home before age 35, we plan to remain debt free from here on out. While taking on significant debt/mortgages can be a great strategy to building wealth, it doesn’t align with our risk adverse and debt adverse personalities.

From here on out we plan to supercharge our already strong savings/investments. We also started a blog to document our journey. It only took about 7+ years of convincing from Sam. Better late than never I guess.

You make quite a few valid points. However, whenever I have shopped the discount for and arm was always negligible over a fixed. Perhaps it was just the timing, but I never felt like the ARM was worth it at all.

I just refinanced my primary mortgage taking it from a 30 year 3.625 to 2.25 at 15 years with no points. The lender covered all closing costs and pre-funded my escrow account for 6 months so the loan was free and I go about 8K in escrow costs. However, I had to bring 186K to closing to pay down my principe to 741K to make the loan conforming, getting it below a Jumbo that banks are not touching. I feel I did great on the loan but that was a ton of cash to come out of pocket. What are your thoughts? Would the cash have been put to better uses in other areas?

2.25% is a great rate for a 15 year. Not only did you pay down more debt, you got a lower rate. Seems like a win-win. I’ve never regretted paying down mortgage debt.

See: No Mortgage, More Courage

In case others are curious about latest rates, WF quote on a new purchase:

25% down, 30 year fixed at 3%

20% down, 10 year ARM at 2.625%

20% down, 7 year ARM at 2.375%

Love the fixed pricing but would be nice to keep an extra 5% in my pocket by selecting an ARM product. Decisions…

Sam’s list of ‘what would have to happen’ for rates to rise certainly reads differently in COVID times. Looks like we are on track to check most of those boxes soon. Possibly I need to cowgirl up on the fixed.

I remember in 1999 when my home loan ARM went from 12% to 24% overnight because of the Asian crisis. Just as I purchased my first home. That really left a scar when we lost the house.

Fixed rate mortgages are amazing and let me sleep, rather than trying to squeeze a few bips extra.

Interesting that these low interest rates have really created a housing bubble in the first world. My latest 2000 square foot home was bought for $160k in 2007, due to weak real estate market and weaker currency it would currently cost around $70k to buy. The developed world has pushed its population out of home ownership or into a crisis if rates were ever to rise a full 1% from 2% to 3%…

Short memories.

Thank you for this very informative article! I looked into 7/1 ARM(3%) vs 30-fixed(3.25%) on a cash-out refinance primary home conforming loan and I went with 7/1 ARM. I’m hoping 7 years give enough time for the real estate market to stable before we have to refinance again. Question now is whether it makes sense to do a planned renovation the house we live in or use that cash to invest in a new investment property :)

I applied to refinance to 15 years (from 30) with 1.55 points leading to a 2.375% int rate and 2.66% APR with a new lender. My current lender now got back to me and wants to offer a 2.5% int rate with 0 points. However, with the COVID situation they have to keep the rate floating until 15 days before closing. Since it is floating, they are offering a 1.25% price protection as well, until it is locked. Very confused on what I should do. Should I stay with the former lender (2.375% with 1.55 points)? TIA!!!

It doesn’t seem right to pay 1.55 points in this market.

2.5% with 0 points sounds good. I don’t see mortgage rates rising.. they’ve since come down since March 18. There are no guarantees, but I’d role the dice and pressure them to give you credit if the rate goes up.

With the new $1 trillion spending plan, should we assume that interest rates will continue to stay flat or even decrease for the next 10 years?

Sorry, to add onto this question, but now, with Democrats $3 trillion spending that was approved by the house and POTUS mentioned he would sign it, the next step would be to get it approved in Congress. I was wondering if your thoughts have changed about getting a fixed rate vs a 30 year ARM now that there is tons of stimulus in the economy. I heard from multiple sources that there is the possibility of inflation in the future. I know it won’t be in the next couple years but I know inflation is possible after that.

No excess inflation. Too much slack in the economy with up to 50 million unemployed by year end.

Great article, I took you advice a got a 10/1 ARM last year at 3.0% . Now rate are going down, would you switch to a no cost 5/1 ARM at 2.875% and if not want percentage would you be comfortable at switching from 10/1 ARM to 5/1 ARM. Thanks Jim

The gap isn’t large enough since you are losing 5 years of duration too.

At 2.5% or lower no cost is when I’d look to refinance for you.

Refinancing is great. I’ve done it many times.

But it’s not free.

First it’s a lot of work if you’re wealthy, lots of docs. Time wasted. particularly if you make high income/hour.

Second: what if you can refi. That you won’t be approved. Banks are not lending, your situation has changed etc…

To me that is the biggest problem with renting or refinancing: that circumstances may not allow it.

I’ve known RE investors to go under exactly because the banks will not lend you an umbrella when it rains.

Now, to me, that’s stressful.

Just FYI the market for mortages is so crazy, my college got a 30 year fixes rate mortage for a primary residence for 1.3% here in good old Germany, Europe…. so yes fixed can be a smart choice. If she would go for 10 years fixed would be below 1%…

Sam,

I have quite a few rentals 20+ houses. I plan on using them or 1031’s into bigger ones possibly. For an investment house that I wont’ “move” out of would it make sense to have a 15 or 30 year fixed?

Thank you!

+1 on this question. Does it make sense to have a rental on an arm versus a 30 year fixed?

Same factors. Depends on how long you play to pay it off / own the rental. Rentals just have higher mortgage rates than primary mortgages.

Interesting perspectives. Currently have a 30y fixed at 3.125%. Haven’t talked to anyone of rates for refi yet but wonder value proposition. 15y fixes wouldn’t work for me due to lower amortization period equaling higher monthly payment. ARM for 10/1 seems reasonable but not sure what the IR would be. I will be doing the numbers but gut tells me that a drop would need to be significant to justify a refi especially if there are costs associated to the process. Curious to get someone’s perspective on my situation. As FYI we make bi-weekly payments for last 5 years so have shorten loan duration already.

Actually rates for 30 year vs 10/1 ARM vs 5/1 ARM are all about the same. Might vary by a couple basis points but right around 3.3%. So I would go with the 30 year fixed in today’s market. I would opt for an ARM if it was meaningfully lower (more than 0.1 point).

If they are for you, unfortunately, your lender is not treating you as a prime customer. I would shop around. It makes me wonder how many other borrowers are getting taken advantage of. This gives me motivation to keep Sharing to help other people.

As of yesterday, I was being quoted 2.75 for 10yr ARM with hsbc. 2.75 for 7yr with Wells Fargo, which can drop 25bps to 2.5% with a funds xfer.

Don’t buy too much house. Don’t buy in a depressed area (location, location, location). That’s what can kill you with an ARM. If you don’t believe me, read “The Big Short” by Michael Lewis.

I am refinancing from a 30yr. fixed at 3.75% to a 10/arm and was offered a 3% rate at bofa with no points, which seems solid. Anyone seeing better rates out there?

Yes, being quoted 2.375% from Citi with asset transfer right now. Keep shopping around, make the lenders compete for your business.

Thanks, I actually check with citi and got offered 2.625% for a 10/1 arm with an asset transfer. Going back to BofA to try to negotiate!

Received a quote for 2.625% on a 5/1 ARM. I currently have a 7/1 ARM (6 years left) at 3.00% (done with a re-cast no cost). I’d save $450 per month in interest if I refinanced. Does this seem like a slam dunk?

Best ARM article I have ever read.

Outstanding commentary!

I have taken your exact position when I was planning to refinance 6 months ago, and this is what I found out: Unless your mortgage is large enough and rate differential between fixed and ARM is significant, the risks if refinancing in the future far outweighs the benefits for me:

– Higher origination fees for ARM and .25-.375 % benefit. When I refinanced 6 months ago, rates for 7/1 and 30 years were almost the same as 30 years fixed across major lenders.

– Here is the biggest trick lenders use: Index used for calculation of rates after the the fixed rate period was WS Prime Rate not LIBOR. I couldn’t find any ARM’s based on LIBOR. Prime rate at the time was 5.5% and variable rate after fixed period was Prime Rate + 2%. All things equal, my monthly interest expense would increase by 2.5 times (due to a whopping 7.5% interest) if rates stayed the same. Even if rates went down to 0, I would still pay more interest than a 30 years fixed at reset.

– I would have barely saved few grand after refinancing costs while taking the risk of paying 10K more interest every year after rate reset. It was like no gain and a huge risk after the fixed rate period.

– If I wanted to refinance after the fixed rate period and If I am not employed or financially viable in lender’s eye – that would be a death financial death warrant for me.

-I decided to get a fixed rate mortgage at 3.5% and am pretty happy with my decision. I would have dome otherwise only of the ARM rate was 2.75% and I had ample cash on the side to pay off my mortgage at rate reset if I had to.

Regards

Murat

Sounds good to me. You’ve run the numbers and you got to do what’s best for your financial situation.

I hope everybody runs the numbers with various options before making a decision.

I took out a 5/1 ARM in 2014 that reset to around 5.5% last year. I know that the smart financial play is to refinance but the property is non-conventional and most banks are unwilling to finance such a property. As a first-time buyer, I basically went with the only option presented as feasible by the mortgage broker. Do you have any advice or recommendations for companies specializing in non-conventional loans? Thanks for all of the great advice!

Thanks for educating us about ARM’s. I’m not sure what type of mortgage I will go for (a lot of the first-time homeowner programs require a 30 yr mortgage) but I’m glad to know of the options that might benefit me even if I don’t/can’t go with it right now.

Sam, in this scenario, will it still be advisable to refinance with ARM instead of 30yr fixed rate?

* Refinancing current primary home.

* Plan is to rent out primary home after a year or so.

* Paying off mortgage sooner is not feasible.

My concern is that once my ARM rate expires, I wouldn’t be able to refinance to a good rate since I’ll be refinancing a rental property at that point.

It seems you already have your answer!

Not so great advice. Problem with that, it is over-financises our life. It makes one make additional financial decisions, which only takes one to wipe out any prospective gains. Transactional costs are high.

Also, when looking at the the terms: APR for the ARM loans are always higher.

Individuals cannot follow optimized approach to finances like corporations do.

Beauty of 30year fixed or 15 year fixed (with optimal rate) is that it IS: get and forget.

Inflation will take care of the payment over time.

If you move – keep the home and turn into rental.

Treat whatever “extra’ you might pay on fixed mortgage as insurance.

You are a banker’s FAVORITE type of client. Pay unnecessarily more for unneeded insurance and peace of mind due to ignorance.

It is amazing that you choose to ignore all the facts in this article.

You are why bankers and money managers are so rich.

Let’s brake down his 7 year example:

Once you sell, you incur 5%-6% selling fee 50k-60k

Every time you open a loan 1%-2% cost – 20k on 1mln dollar loan

So, your 96k savings is reduced by 70k-80k

Author does not price risk of interest rates increase.

In any financial calculation, risk price must be added: cost * P(occurance).

Calculation above assumes P = 0, which is absolutely incorrect. In fact, rates have a fairly good change to increase.

Even bankers when advertising ARM loans quote APR which are “realistic” APRs.

You are forced to refinance every 5 years -> fees + time spent.

You face risks of increased payments, increased rates -> these risks are no ZERO and one would be stupid to call them zeros.

Yeah, don’t get him started on car loans…

Car loans?

Thanks, Sam, for making your posts relevant to the times. I had already decided that my next loan would be an ARM when I read one of your previous posts explaining how ARMs work. It’s nice that you don’t shy away from topics you’ve already written about in the past since it allows newer readers to get exposure to the topic. Keep up the great work!

No problem! I endeavor to write about evergreen topics and timely topics whenever there is something important, or There’s a money saving or money making opportunity. The money saving opportunity is absolutely right now to refinance a mortgage.

Sam when you refinance do you stay with the same mortgage term, e.g. if you already had a loan for 10 out of 30 years, you refinance into a 20 year loan and compare the savings in interest? It gets even more confusing when you have prepaid some principal and shortened your mortgage term that way.

I tend to refinance back to a 30-year amortizing period but then pay down extra principal over the years to stay on track. This way, the monthly payments are lower and I pay down earlier. Best of both worlds.

Sam,

You actually changed my mind on this. I always thought ARM”s were a way banks could screw you. I never thought to run the numbers. I’ve only had 2 mortgages in my life. Payed the first one off in seven years, the second in 4. I definitely would’ve saved money on a ARM. I learned something new today. Thank you.

No problem! Thanks for sharing your mortgage durations. I hope all the readers can share their mortgage relations before selling the property or paying it off as well.

I got a variable interest rate HELOC back in 2014…. The original rate was 3.25%…. It rose the in 2018-2019 to over 5% and just recently dropped to 4.75%… lagging far behind what rates are currently on FIXED 20-30 years… I decided to refinance and roll it into my mortgage at a 20 year fixed 3.29% rate. Not a fan of playing the ARM and variable rate game. I do agree whole heartedly with ALWAYS choosing a no cost refinance. I’ve refinanced my current home twice now at no cost. Original rate was 5%.. then down to 3.95% soon after closing in 2011… and then most recently to a 20 year at 3.29%. And if something crazy happens like we enter a negative rate environment in the next 5 years.. i can refi again to a 15 year at no cost to below 3% without doing any number crunching first to see if i’ll lose money on that prior refinance.

Hey, HELOC is tied to a different number than a fixed rate mortgage. Just in case anyone was confused on that point. You’re better off with a low rate mortgage assuming you want to carry debt on your real estate.

HELOC rates should be falling again soon, especially if the FED lowers rates in March. I will most likely open a $100K HELOC credit line in the next few months… with a fixed-rate option, rather than dip into my cash. I’m hoping to get a fixed-rate HELOC at sub-4% soon.. they seem be trending that way.

Will be nice having a $100K credit line for the next decade in case I need it for home repairs and remodeling. I didn’t want to take cash out from my house, while I’m waiting on contractors and such for a remodel. This way I only tap the equity when I am cutting a check to the contractor.

I also don’t want to gamble with my equity on margin in the stock market.. so fixed-rate HELOC market is what I’m interested in going forward.

Not a bad idea. Always nice to have the option to tap the equity if one really needs it.

There is no no-cost refinance. Costs are rolled into higher interest rate.

In reality it’s not really true though Surge… Let’s say you refinanced last year and locked in at a rate of 3.29% for a 20 year and paid points to get that rate. Now something unforeseen like the Corona virus hits 6 months later… and you can get that SAME 3.29% rate without paying any points.

Who was smarter? the guy who paid points to get the lower rate last year… or the guy who waited and did a no-cost refinance at 3.29%?

The only time paying points makes sense is if you absolutely know for sure rates will never go lower anytime in the near future. Otherwise, you can keep no-cost refinancing to get a lower rate. True, you will never get the ROCK bottom rate some lucky guy that TIMED the market and got a points-purchased loan during the corona virus… But that’s gambling…. not investing.

I just no-cost refinanced… If rates drop another .25% .. I can refinance again at sub-3% rate… The guy that paid points can’t do that without losing money!

Guy who waited is not smarter. Just luckier. Nobody has knowledge to surely predict the rates. He just made the right bet by waiting.

Yes, if apr (which includes the cost) is lower, then it is lower.

And yes, points is generally a losing game, 5-7 year breakeven point typically

Just trying to make the point that a no-cost mortgage is effectively no-cost if paying for a refinance with closing costs and locking in the absolute lowest rate is based purely on luck…. then the smart move is to always choose a no-cost refinance.. since assuming you locked in the lowest possible rate and paying for that rate with closing costs is purely luck.

Yes, I agree. One should not pay points/costs when refi, given the fact that breakeven point is typically 7 years (good chance to refi).

Great post, but nothing feels secure like 30 years of fixed payments even if the interest rate is 0.75% higher. Life is full of unknowns and with the house being most peoples biggest purchase, it’s good to know if you can count on at least the mortgage not changing 5 to 10 years out.

I would hate to see an increase in my rate 5 years later and be kicking myself that I did not lock in 30 years of an all time low rate.

Moving every x years is normal for some people but if you hate moving like me, there is no guarantee that it will happen. Especially if you really like your home.

Also, when I was looking for a house, many banks would not offer a 30 year fixed and only offered 7/1 and 5/1s. We were right on the edge of comfortable for them with our jumbo loan and debt:income ratio. The cynic in me thinks that this means banks think they will get a better deal if they can get you to buy into the variable rate. 30 year fixed are too “boring” for them.

You know what feels better. 50k of compounding investments in my pocket that I did not pay in interest to the bank.

Sure, for you, the price of security feels better by walking on a 30 year fixed rate mortgage. To me, I feel bad paying that extra premium for security when I know I probably will not need it. So it’s kind of like insurance.

How long have you had your mortgage for? And do you have any other mortgage examples and can share their duration so far? Thanks

One mortgage for over a year but just refinanced. Wife swears this is the dream house and does not want to ever move.

Sounds great! I would try and pay it off before 30 years though. That will also feel great.

Hi Sam,

Enjoyed the post but not sure I agree. Here are a few thoughts:

1. Peace of mind is great – your numbers ($1 million loan and interest rate spread between a 30 year mortgage and 5/1 arm) likely exaggerates your case. Most people do not have $1 million loans and with the flat yield curve I doubt the spread is that high.

2. I had a 7/1 ARM that went from 3.5% to 5.25% last year. The cap was at 2% so it wasn’t a great result. I refinanced but there were closing costs – a no cost loan means a higher rate so you pay for the refinance one way or another.

3. Life can get in the way of timing your hold period with the adjustment date on the ARM. A loss of a job, a bad economy where you lose a lot of the equity on your property, etc., can make it a whole lot more difficult to refinance when you need to. My refinance became very challenging because the property had been converted from a home to a rental and I retired at 43 so my W-2 income was no longer helping. I did refinance eventually but not without some extra effort.

Your analysis is very logical in a perfect world. I like to reduce my risk and one way I have done it in the past is locking in already low interest rates for a long period of time.

I’m on a 7-year ARM adjusting in 2023. I’d like to do a 10-year ARM at 2.5% if possible and pay that bad boy off before the 10 years are up (wishful thinking).

I prefer to ask my mortgage broker to give me four financing options. I plug those into my spreadsheet to calculate the lowest loan constant. I purchase the loan product with the lowest loan constant which gives me the most flexibility if my cash flow is down at any point. Even though I chose the lowest loan constant, I can always mimic the payments of one of the other three loan options for a quicker payoff. In the real world paying down a 30 year fixed loan using 15 year fixed payments, it will take me an extra ~8 months to pay off loan compared to purchasing the 15 year fixed loan from the start. I am ok with these extra 8 payments in order to have the flexibility to pay the 30 year fixed payment when cash flow is tight.

The bank is transferring risk to the borrower with a 15 year fixed. They want the borrower to pay the highest loan constant. I will be taking the bank’s approach when I start private lending.

Very logical and reasonable to ask for options and then run the numbers.

That is what I always do and my conclusion is always the same, and adjustable rate mortgage has a much higher chance of saving me money.

Got my 30 yr fixed at 3.375%. Unless I get an ARM at 2.375% it might not be worth refinancing for me.

Also my rental pays my mortgage so it is not a bad deal

I like this blog for personal finance advice, and I respect Sam, but I would definitely not take the advice of a financial blogger about predicting the direction of interest rates. Anyone can read a trend line, but literally no one can predict the direction of long or short term rates over probably any period of time. The only way to protect yourself against falling or rising rates is to purchase a hedging product, and that’s essentially what all these different mortgage products do. You’d think by reading this post, anyone who buys an interest rate hedging product is a moron. I’d rather not bet on that as there are billions of dollars going into those products every day. It’s true that for the past 10 number of years, it’s been smart to be in an ARM, it’s also true that you should have been 100% in equities, but anyone who has read a prospectus know that past performance is no indicator of future returns. People need to internalize that what’s happened in the past literally has no bearing on what could happen tomorrow, let alone the next 10 or 20 years. You have to make plans that match your financial goals and your risk tolerance. There is clearly a place for 30-year fixed rate mortgage, especially at these rates, it’s not a scam. For me, I plan on keeping my primary residence as a rental in the future. Once I move out, I would not have the advantage of getting the same rate as if it were my primary residence. So there are other considerations. And I will say this, when everyone thinks something won’t ever happen, that’s usually when it happens.

Sounds good to me. That’s why it’s a free market and you’re free to get a 30 year fixed if you want and short treasuries.

What are some specific things you think will happen that will cause interest rates to go up? Getting the reasoning out there is important to challenge the mind and take proper action.

Thx

I’m not an economist, but I am typically very skeptical of “consensus” views. There is inflation for one. I know people think inflation is dead and will never come back, but that seems far fetched to me. Remember that less than a year and half ago the 10-year broke 3% and everyone freaked out. I don’t think it’s crazy to say if Trump is re-elected, finds a way to keep juicing an economy that is at (or past) full employment, that you may be sowing the seeds for massive inflation sometime in the future. That will absolutely will drive rates up. Here’s another thing to think about, people think this bond bull market (and this bull market has been going on for far far longer than the bull market in equities we’re seeing right now) will never end. I just can’t see how that can possibly be true! All good things…

Every event that Sam identifies is happening/reasonably could happen because of Trump’s disastrous policies:

“The U.S. would have to completely lose its superpower status, causing foreigners to dump Treasuries in lieu of another international safe haven” – we’re a global laughingstock and international leaders are worried about the credibility of the United States as a partner/ally.

“The Fed would have to start printing endless amounts of money to stoke inflation or expectations of greater inflation” – Trump has literally attacked his own selected Fed Chair for not doing this; it’s likely he’ll push to appoint more free-money Fed members.

“The Fed Governors all turn out to be the dumbest, most inept people on Earth” – have you seen the rest of the people Trump has appointed?

“Our government would have to blow up our budget, which is possible if we decide to have medicare for all, free tuition, and wipe out all student loan debt without significantly raising taxes” — actually, Trump pushed the deficit over $1 trillion with a tax cut to big business/the rich that did nothing to stimulate the economy (forgiving student loan debt/universal healthcare would arguably do far more to actually stimulate economic growth than Trump’s tax cut did, as it would most benefit consumer spending)

“Employment growth would need to be so strong that it causes the natural rate of unemployment to fall 1-2%, which would, in turn, cause inflationary pressure” – if there’s anything nice to say about Trump, it’s that the economy and employment has continued the growth Obama’s administration began.

“Globalization declines and Nationalism rises” Trump literally started a DOJ program to denaturalize citizens today; nationalist hate groups like in Charlottesville are spreading in the US and globally.

“The internet regresses and information flow slows” – this is literally happening with Facebook/Twitter and propaganda/disinformation campaigns/Russian bots.

Therefore, how are you positioning your investments? What are you short and what are you investing in?

It’s important to take action based on what you believe in, otherwise, it’s just talk And your finances don’t improve.

I just refinanced to a lower, 30 year, fixed rate mortgage (3.75%, down from 4.5% in 2018), and continue to max out my/my spouse’s 401ks into an 80/20 stocks-bonds mix. No secret sauce, no shorts — just staying the course, with a comfortably low mortgage that won’t spike up and massively increase the cost of owning the home I plan to stay in for the next 20+ years or more.

In the wise words of John Bogle: Don’t just do something, sit there.

Cool. 3.75% is better than 4.5%.

Just one thing mortgage rates are not spiking up. They are actually spiking down.

In the course of the (hopefully) 30+ years I live in this house, it is far more likely that mortgage rates increase over 3.75% than decrease any appreciable amount (particularly given that 3.75% is near historical lows).

That’s why you get a fixed rate mortgage for a primary residence you plan to stay in — ARMs adjust and could mean much higher payments down the line. Fixed rates mean you (basically, except for taxes) know exactly what your housing cost is for the upcoming decades.

Sounds good, but I hope you don’t take 30 years to pay off your mortgage, especially if rates keep going down.

Why wouldn’t I take 30 years to pay it off, if (a) I can get a better return on money spent paying it down early by investing, (b) can accomplish other financial goals (saving for college for kids, etc.) with that money, and (c) am financially in a position where I itemize meaning the interest deductions have some value to me for tax planning purposes?

I value liquidity. I wanna build up a large retirement nest egg/taxable account before I go and pay off my mortgage. So for the next 10 years, I couldn’t really see paying down early a 3.75% mortgage when I could bank the money for liquidity/other goals instead.

Besides the real time events of a market meltdown, check out this post: The Need For Liquidity Is Overrated If You Are Financially Competent

Nobody knows.

This is why there is a premium on stability (fixed rate). Lenders also have higher risk with 30year mortgage, thus they charge premium.

ARMs are very risky. If rates increase (does not mean they will, but if) -> a lot of people will default with ARMs

And rates are more likely to increase off of near-historical all-time lows than get much lower over the course of any 5/7 year ARM.

Will they? I don’t know. But it’s a lot easier to see them going higher than a historical low than it is to see them set a new historical low. And as this is my primary residence, I want to fix/set the cost so I can plan around it going into the future.

I’m currently in a 30 year fixed rate at 3.25%. I refinanced almost 4 years ago. Not sure what the best strategy is moving forward. Do I just keep that rate or do I try to get a 7/1 adjustable? I dont plan on moving or selling this house in the short term, or possibly ever. I don’t want to pay it off aggressively, I like the lower payment but could always change. I have about half of this house already paid off from large downpayment so any suggestions?

Stay with the 30-year fixed. Great rate and you possibly never plan to move. Who knows what rates are going to be in 10 years.

Thank you Sam! I remember you mentioned about ARM in one of the other articles. When it comes time to finance our new home we’ve taken out a 7 year ARM. Although our rate isn’t nearly as low as yours, it’s still a lot better than taking out a fix 30 year or a fix 15 year (lower rate but required payment much higher) loan. We have the best of both worlds with lower rate and flexibility with no pre-payment penalty! Great insight!

Thanks for the insights. Couldn’t agree more. I have been refinancing – because we have moved to another house – from a 4.3% 10 year (3 years remaining) to a 1.3% also for 10 years.

I just don’t understand that people want to take out a 30 year fixed… It SO much more money… But then again.. You will only know for sure in 30 years ;)

FC

1.3% for 10 years. Really?

Has to be a typo. Probably 2.3%.

Can you go into more detail on how you are “pay down more debt before the interest rate resets” Since ARMs amortize on the same schedule as a 30 year, isn’t the debt the same?

I think what he’s saying is that if the ARM rate is lower than the fixed rate, and if you took that dollar savings and paid it down on the mortgage, you could pay down the balance faster before the interest rate resets. If you do that, then the interest rate reset only applies to the balance of the loan, which would be smaller than what it would be under the fixed-rate mortgage plan.

How should a potential borrower think about APR and fees? It seems that the spread between 30yrs and ARMs are such that the APRs are the same or even in favor of a fixed rate mortgage. Wouldn’t I end up paying more fees in an ARM since the APR is higher and I’d have to get another loan sooner?

I’ve seen the same thing – shouldn’t we care more about actual APR than advertised interest rate?

The APR for an ARM bakes in a calculated rate increase after the adjustment period.

Yes, APR is the main item to look at it.

What the author proposes (constant refinance) will incur additional refinance fees and expose borrowers to unplanned interest rate risks (which should also be expressed as NPV) + health bills for stress :).

You are basically playing a financial roulette with this.

If ones time frame horizon is well cut to 5 years -> of course 5/1 is good.

For long term players – not so. Takes 1 wrong move in interest rates to wipe out any gains or even cause a default.

Hi Sam,

Doing a quick search of rates it looks like a 15 year fixed rate is lower than a 7/1 or a 5/1. Why not just get the 15?

Also, when you say “no cost” refi, do you really mean no out of pocket with fees just wrapped into the refi?

Thanks

15 fixed has a lower rate but it requires you to pay a fix high payment compare to a 30 year fix or an ARM. So if you have a 15 year fix in case of job loose and other misfortune, you have no flexibility and are stuck paying the high monthly payment (unless you the rates are favorable at the time to refinance, but you still pay extra cost to do that).

ARM monthly payment for the duration of the ARM is calculated like a 30 year, so you have lower required monthly payment

A 15 year is amortized over 15 years resulting in a higher monthly payment which some may not be able to afford from a cash flow standpoint. So while the interest rate may be lower the almost double monthly payment (due to being amortized over half the time period) proves to be a deterrent.

” Interest rates have been coming down since the 1980s as the Federal Reserve has become more efficient in managing economic cycles.”

So the government has been good at what ?

How about getting a 30 year mortgage and aggressively paying it off ?

My 5/1 ARM (currenly at 3%) is set for a rate change in 12 months. I locked the loan in Dec 2015. My loan contract it will rise to the 2.25% + LIBOR rate. Does that means the LIBOR was 0.75% when I got this loan or is there some other discount for new loans. From your chart, it seems LIBOR much higher than what it was in Dec 2015. So how did my rate get figured out? Could my rate go up even if people with new 5/1 ARMs are getting lower than me?

Yes your lender. But yes, LIBOR was probably 0.75% when you took out the loan, and went up a lot given the Fed raised the Fed Funds rate a lot.

If your margin is 2%, then your 5/1 ARM will reset to 4.25%.

You should definitely be able to get a 5/1 ARM for under 3% now.

See: https://www.financialsamurai.com/how-much-can-an-adjustable-rate-mortgage-arm-go-up-after-the-fixed-period-is-over/

I just called Wells Fargo and their new rate for 5/1 ARM is 3.125% so more than I am paying now. As is typical, they won’t say anything about the future rate a year from now when the introduction period on my ARM is done. So definitely staying put now

What’s your analysis of the ALL – IN – ONE Loan?

I’d really like to, but I just closed on a house less than 8 months ago. For fun, I just looked at what I’d potentially qualify for and it looks like the lowest 30-year refi rate I could get is 3.25% which is 0.625% lower than what I currently have. The lowest 7/1 ARM is also around 3.25% – so in this case, I guess a 30-yr refi would make more sense.

Shoot, even in a no-cost refi…do you think it’s worth it to do it to shave off 0.625%? I’ll end up saving around $250…

Hmm…that’s actually a good chunk of change. But would banks typically do a refi for a loan that’s just been given?

Yes, refinancing to save 0.625% is huge, especially if all the costs are baked in. That’s a no brainer IMO.

Why not spend some time to save $21,000 in interest over 7 years?

Dang, I just filed my taxes too so I’m sick and tired of gathering and looking at documents but $21k over 7 years is a lot of money.

SIGH. Back to saving more money I guess…lol

Thanks for sharing the benefits of adjustable rate mortgage. What you argue makes sense and it really doesn’t look like taking out a 30-year fixed rate at 0.5% higher rate is a waste of money.

It’s my pleasure to visit this blog first time.

Thanks

“Taking out a 30-year fixed-rate mortgage means you are betting against a ~40-year trend of declining rates. It is not a wise bet.”

In terms of financial and economical growth, I cant imagine the next 40 years look anything like the last. The inventive growth, access to information and tools that simply did not exist have changed the game forever. I would be cautious of projecting anything too far into the future based on the last 40-years.

It’s like playing checkers with your child. For the first 10 years you can beat the heck out of them, then one day, they win, and the next, and the next. And eventually you realize they can outplay you and win every time.

Look at what the Chinese cutoff in spending on US construction and condo unit purchasing has done in California over the last 14 months. Giant, multi-billion dollar projects have been at a standstill for over a year. Numerous, huge developments have had to convert condos to apartments as there aren’t enough buyers.

The tide is changing and I wouldn’t predict the tide based on the last 6 hours nor the government on the last 40-years.

But for sake of the topic, we secured a fixed, 15-year mortgage at 2.5% during the dip last year.

Excellent comments.

Thanks

15 years at 2.5% is a great rate. Nice job! I am 10 years into a 15 year fixed rate of 3.5%. We also pay bi-weekly to save a little interest. I ran an amortization schedule over the remaining 5 years to see the total interest we will pay. It equates to an average remaining rate of ~1.8% per year, before considering the impact of a mortgage interest deduction which would imply an average annual effective rate of less than 1.4%.

It is nice when you pay down a lot of interest as you get closer to the end of your mortgage term. I’ve set aside money in savings bonds and CDs to pay off the remaining balance at any point over the next 5 years should something unforeseen come along. I’d rather do this than outright pay off the loan sooner because I am earning more in interest than I am paying on the loan.

I hear you. We are sitting on enough cash to pay the remaining balance off, but the interest we are earning, even in just a high-yield online account, is nearly covering the interest being paid on the loan. So for the sake of a couple hundred dollars a month, we are just making the standard payment and staying liquid.

So if there is some political shakeup or unsubstantiated economic growth or some virus infects the earth and things begin to crash we will have the cash to take advantage of opportunities that may arise quickly. I know we could always get a HELOC or refi, but this way we could make the move instantly and not worry about any delay.

Are you buying stocks now with your cash?

I have, but the market keeps going down. And we could easily see another 10% correction, wiping out all of 2019 gains.

I have started getting in this week. (We had to wait for a couple transfers that took longer than I was expecting.)

Long-term planning that there will be a recovery in travel stocks. The sector has been hit so hard that it might not be a quick turnaround as I originally thought, but we have plenty of time.

Figured I would close the loop on this one–What a ride!

We got in a little too early, obviously, but we averaged down a few times, waited for the pendulum to swing the other way and we got out. We made some quick money and confirmed that neither one of us really like intense roller coasters.

…Back to our conservative 401K approach and hoarding cash.