If you don't want to work all your life you need retirement savings. If you want to retire before the traditional age of 65, then you need a ton of after-tax retirement savings to generate enough passive income. Let's take a look at the average retirement savings for Americans.

Unfortunately, the average American retirement savings is way too low to live even a comfortable traditional retirement savings lifestyle.

According to a 2018 study by Northwestern Mutual, 21% of Americans have no retirement savings and an additional 10% have less than $5,000 in savings. A third of Baby Boomers currently in, or approaching, retirement age have between nothing and $25,000 set aside.

Can you imagine being close to retirement age and only having $25,000 set aside? What are Americans thinking?! The average Social Security payment is only about $1,4,61 a month, hardly enough to live a comfortable retirement lifestyle.

As a personal finance expert since 2009, I strongly recommend all Americans max out their 401(k) and/or IRA each year and save and invest an additional 20% of their left over cash flow. It's important to only depend on yourself when it comes to your financial future.

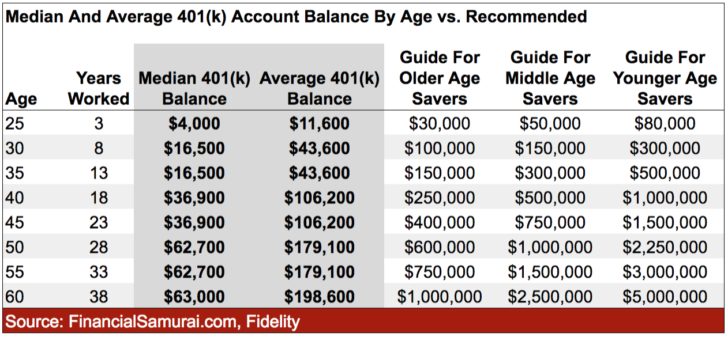

The Average Retirement Account By Age

Following are the mean and median retirement accounts for people who have retirement savings. That's right. There's actually a group of people who don't have any retirement savings at all.

According to the Transamerica Center for Retirement Studies, the median retirement savings by age in the U.S. is:

- Americans in their 20s: $16,000

- Americans in their 30s: $45,000

- Americans in their 40s: $63,000

- Americans in their 50s: $117,000

- Americans in their 60s: $172,000

In other words, the average retirement savings for Americans is not very high. If you retire in your 60s with only $172,000, expect the money to run out within 10 years if you don't have Social Security benefits.

For households older than 65 years, retirement accounts begin to decline as these individuals leave the workforce and begin spending their savings. Makes sense.

When accounting for people who have no retirement savings the picture looks considerably worse. Following are the median retirement accounts when including the figures for people with no retirement savings.

• Age 32 – 37: $480

• Age 38 – 43: $4,200

• Age 44 – 49: $6,200

• Age 50 – 55: $8,000

• Age 56 – 61: $17,000

If you have any of these amounts by age for your retirement account, you are in a world of hurt. There is no way you will ever retire and lead a comfortable lifestyle when you get older.

The average retirement savings for Americans needs to improve drastically as a whole.

Recommended Retirement Savings By Age

The average savings rate in America is only about 6%. This is actually up from about 2% during the financial crisis. Americans need to save 20% or more each year to take care of their retirement.

Your 20s: You’re in the accumulation phase of your life. You’re looking for a good job that will hopefully pay you a reasonable salary. Not everybody is going to find their dream job right away. In fact, most of you will likely switch jobs several times before settling on something more meaningful. Maybe you are in debt from student loans or a fancy car.

Whatever the case, never forget to save at least 10-25% of your after tax, after 401k contribution income while working and paying off your debt. Shoot to have up to 1.5X your expenses covered in savings.

Your 30s: You’re still in the accumulation phase, but hopefully you’ve found what you want to do for a living. Perhaps grad school took you out of the workforce for 1-2 years, or perhaps you got married and want to stay at home. Whatever the case may be, by the time you are 31, you need to have at least one years worth of living expenses covered.

If you’ve saved 25% of your after tax income for four years, you will reach one year of coverage. If you saved 50% of your after tax income a year for five years, you will have reached five years of coverage and so forth. You should have 2X – 6X your expenses covered in savings.

Welcome To Middle Age

Your 40s: You’re beginning to tire of doing the same old thing. Your soul is itching to take a leap of faith. But wait, you’ve got dependents counting on you to bring home the bacon! What are you going to do? The fact that you’ve accumulated 3-10X worth of living expenses in your 40’s means that you are coming ever close to being financially free.

You’ve hopefully built up some passive income streams a long the way, and your capital accumulation of 3-10X your annual expenses is also spitting out some income. You should have 4X – 10X your expenses covered in savings.

Your 50s: You’ve accumulated 7-13X your annual living expenses as you can see the light at the end of the traditional retirement tunnel! After going through your mid-life crisis of buying a Porsche 911 or 100 pairs of Manolo’s, you’re back on track to save more than ever before!

You are 100% in tune with your spending habits, therefore, you raise your savings rate by another 10% to supercharge your final lap.

Your 60s: Congrats! You’ve accumulated 10-20X+ your annual living expenses and no longer have to work! Maybe your knees don’t work either, but that’s another matter! Your nut has grown large enough where it’s providing you hundreds, if not thousands of dollars of income from interest or dividends each month.

Full Social Security benefits kick in at age 70 now (from 67), but that’s OK, since you never expected it to be there when you retired. You’re also living debt free since you no longer have a mortgage. Social Security is a bonus of an extra $1,500 a month. You’re budgeting a couple thousand a month for health care as you plan to live until 100.

Invest Your Retirement Savings Wisely

Not only should you building a healthy pre-tax retirement portfolio from your 401(k) and IRA, you also need to be building a healthy after-tax retirement portfolio as well.

There are plenty of various investments that generate passive income. Dividend stocks, public REITS, and real estate crowdfunding are my favorite types of passive income streams.

Check out Fundrise for free, the best real estate crowdfunding platform in my opinion. They allow you to invest in commercial real estate projects around the country that were once reserved for ultra high net worth individuals or institutions.

Your goal should be to build enough passive income to cover at least your basic living expenses. Once you do that, you can breathe easier and do whatever you want.

Recommendation To Build Wealth

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms.

I’ve been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.