Let's look at the banks with the highest savings rate so motivated savers can make the most money on their risk-free asset.

Due to the coronavirus pandemic, the Federal Reserve cut the Fed Funds rate to 0% – 0.25% on June 12, 2020. The 10-year bond yield was also below 0.7%. By mid November 2022, after multiple rate increases, the Fed Funds rate (FFR) rose to 3.75% – 4.0%. And the 10-year bond yield was around 3.88%. Now in 2025, the Federal funds rate has gone from a range of 4.25% – 4.50% to 4.00% – 4.25% and the 10-year bond yield is around 4.01%. That's quite a difference within the span of five years

I've monitored bank rates for many years in both strong markets and weak. Being aware of what's happening with interest rates is important for every serious investor. If you're looking for an easy, low-risk way to invest your cash, CIT Bank consistently ranks as the bank with the highest online savings rate.

We will also look at other banks with the highest savings rate post rate cut.

Banks With The Highest Savings Rate

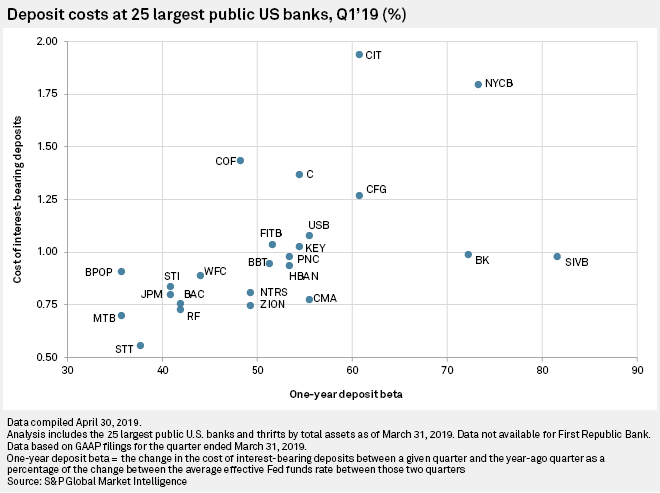

S&P Global Market Intelligence put together a very insightful chart of a couple dozen banks and ranked them by Cost of Interest-Bearing Deposits (savings rate) and One-year Deposit Beta (how often the rate changes).

As you can see from the historic chart below, CIT Bank has the highest cost of deposits, which means it is paying the highest savings rate. I believe this to be true because I've been monitoring CIT Bank's online savings rates since 2015. They have consistently been higher than most other banks out there.

The banks with the highest savings rates are:

- CIT

- NYCB

- Capital One Financial

- Citigroup

- CFG

- USB

- FITB

- KEY

- BK

- Silicon Valley BAnk

- PNC

- BBT

- Wells Fargo Corp

- BPOP

- JPM

- NTRS

- CMA

- ZION

- Bank of America

- RF

- MTB

- STT

CIT Bank is an online-only bank, which means it can afford to pay depositors higher rates because it doesn't have all the operating costs such as rent and teller salaries to pay for.

Given CIT Bank is and historically has been the highest savings rate payer, let me share with you a deep-dive review of the bank. For reference, we use CIT Bank for some of our cash savings and short-term CDs.

Here is a review of our favorite direct bank with consistently the highest savings rate.

CIT Bank Review: Highest Savings Rate

CIT Bank is an online-only bank that offers a variety of account options, including savings, CDs, mortgages, business accounts, and more. You can link multiple accounts and deposit checks online through the bank's web app. There are also no hidden monthly fees.

Like all registered banks, all accounts are FDIC insured up to $250,000 per person or $500,000 per couple. As a result, you can rest easy knowing your money is backed by the U.S. government.

Main CIT Bank Features

| CIT Bank Bank | Features |

|---|---|

| Banking Account Types | Savings Accounts, Money Market Accounts, CDs, eChecking |

| Other Account Types | Mortgages, Small Business Accounts, Custodial Accounts |

| Minimum Required Deposit to Open Account | $100 (Savings accounts); $1000 (CD accounts) |

| Number of Branches | Internet Only |

| ATM Network Size | No dedicated CIT ATMs |

| Remote Deposit | Yes |

| App Availability | iOS, Android, and Mobile Optimized Website |

| Customer Service Types | Phone, Email, and Mail |

| Customer Service Hours | Mon – Fri: 9am – 9pm (ET) Sat: 10am – 6pm (ET) |

| Member FDIC | FDIC Certificate #58978 |

CIT Bank’s Online Banking offers real-time access to your account so you can manage all of your banking activity online.

This includes making transfers to and from other banks and other accounts that you have with CIT Bank. You can also view and download current and previous statements as needed.

Interest is compounded daily and credited monthly on all banking products.

CIT Bank also has a mobile banking app for Apple and Android that allows you to do all of the functions that you can do with Online Banking. This includes checking your account balances and transaction history, transferring money, and depositing checks.

You can access your account online or via the CIT Bank mobile app 24 hours a day, 7 days a week.

Finally, CIT Bank has a series of calculators that help you with CD laddering, building emergency savings, college savings, retirement planning, traditional and Roth IRAs, the payoff of your mortgage payoff, and various other financial functions.

For the best retirement planner, I would check out Empower's free tools. It is an award winning app with a tremendous amount of features.

CIT Premier High Yield Savings Accounts

CIT Bank has several different savings account product lines: Platinum Savings, Savings Connect, Money Market, and Savings Builder. At the time of writing, Platinum Savings is offering the highest rate that is multiple times higher than the national average.

Platinum Savings: Highest Savings Rate

CIT Bank is consistently one of the banks with the highest savings rate. Platinum Savings is currently our favorite savings account for those who plan to have a $5,000 balance or greater. There are no monthly service fees to worry about and you can get started with just $100 as your minimum opening deposit. You get easy access to your funds, deposit checks remotely, and quickly transfer money using their mobile app. Simply maintain a $5,000 balance or greater to earn the maximum APY.

If you plan to have less than a $5,000 balance, Savings Connect is your next best option. It's also high-yielding and there's no minimum balance required to get the full APY. Simply open an account with a low $100 minimum opening deposit.

CIT Bank Money Market Accounts

The CIT Bank Money Market is an easy way to keep your cash safe and secure while also earning a higher interest rate. Conveniently access your cash whenever you need it. And relax knowing that interest accrues automatically.

You can use this account for deposits, withdrawals, and transfers. Federal banking regulations limit transfers and withdrawals from money market accounts to six withdrawals per statement cycle. So this account is best used for parking cash for your emergency fund or long-term savings.

The minimum to open an account is $100.

CIT Bank Certificates of Deposit

CIT Bank also offers many types of Certificates of Deposits including term CDs and no-penalty 11-month CDs.

Here are some of the CD types they currently offer:

1) Term CD: These are standard certificates of deposit, with terms ranging from six months to five years. The minimum deposit for opening a Term CD is $1,000. Recently, the most competitive offerings are the 13-month, 18-month, and 6-month CDs.

Common CD terms include:

- 6-month CD

- 1-year CD

- 13-month CD

- 18-month CD

- 2-year CD

- 3-year CD

- 4-year CD

- 5-year CD

2) Jumbo CD: These CDs have a minimum deposit requirement of $100,000. You can choose either two-, three-, or five-year terms. Rates vary by term. Lately their jumbo rates have not been competitive to other banks.

Each of the CD options offers daily compounding. They also feature automatic renewal at the conclusion of the term unless you opt to withdraw the funds.

3) No-Penalty CDs: This CD comes with CIT Bank’s early withdrawal advantage feature. It allows you to access your funds early.

You can withdraw the total balance, including interest earned, without penalty, beginning seven days after the funds have been received. This CD is a minimum opening deposit of $1,000 with a term of 11 months. Click here to open a no-penalty 11-month CD.

Check the latest CD rates and compare them to the latest savings rate by clicking the button below.

CIT Bank Early Withdrawal Penalties on CDs

CIT Bank’s early withdrawal penalties for CDs are as follows:

- Terms up to 1 year – 3 months interest on the amount withdrawn

- Terms more than 1 year up to 3 years – 6 months interest on the amount withdrawn

- Terms more than 3 years – 12 months interest on the amount withdrawn

No Hidden Fees

If you open an account with CIT Bank, rest assured it will not charge you any fees. The only issue is that since CIT Bank is 100% online, there no dedicated ATM machines. However, they offer features like $30 in other bank's ATM fees reimbursed per month with their e-checking accounts. And CIT Bank doesn't charge any ATM fees of their own when you use another bank's ATM.

- Monthly Service Fee – Free

- Online Transfer Fee – Free

- Mail Check Fee – Free

- Incoming Wire Transfer Fee – Free

- Outgoing Wire Transfer Fee – Free (with a daily balance over $25,000, otherwise $10 each)

- Account Closure Fee – Free

How To Open An Account with CIT Bank

You can open an account with CIT Bank online in about 10 minutes. Here is the information you'll need:

- Social Security Number

- Driver’s license or state ID number

- The account information of the bank you wish to link to your CIT account

- Basic information

The minimum for a savings account is $100. The minimum deposit for CDs is $1,000 and up, depending on which type you open. Again, take advantage of their savings accounts because of the higher interest rates and no lock-up period.

To verify all your accounts are in order, CIT bank will make two small test deposits to your account. You must then verify the deposit amounts before you can officially link your account. Once this has been accomplished, you can transfer money between accounts.

You can make your initial deposit via an electronic funds transfer (EFT), or you can mail a check to CIT Bank. EFT is the way most people do it because every bank should have the capability to do so online.

CIT Bank Bank Pros And Cons

Pros:

- Among Highest Savings Rates in Nation

- Quick and easy to open accounts in minutes

- No Monthly Account Fees

- Savings, Money Market, CDs, eChecking, Home loans, and Self-Directed Investing

- Member FDIC

Cons:

- Online Only

- No Dedicated ATM Network

- No IRAs

CIT Bank Final Verdict: Highest Savings Rate

CIT Bank is one of the premier online banks today with consistently one of the highest savings rate. They are a reputable bank that has been around since 2000 and I highly recommend you put your spare cash to work with them.

Since the Fed started raising rates in 2022, CDs and high-yield savings accounts became attractive again. It's a good idea to have at least 5% of your net worth and 10% of your investable assets in cash. Rates have come back and you want to have liquidity and a buffer just in case the economy turns south.

Sign open up a CIT Bank savings account today.

About the Author: Sam worked in investment banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate six-figures a year in passive income. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.

Disclosures: For a complete list of CIT account details and fees, see Personal Account disclosures. Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of day account balance. Interest Rates for the Savings Connect Account are variable and may change at any time without notice. The minimum to open a Savings Connect account is $100. Fees could reduce earnings on the account. With a No-Penalty CD, you may withdraw the total balance and interest earned, without penalty, beginning 7 days after funds have been received for your CD. No withdrawals are permitted during the first 6 days following the receipt of funds. 13-Month CD, $1,000 minimum deposit is required to open the account. A penalty may be imposed for early withdrawal of principal, and any early withdrawal (principal or interest) will reduce earnings. Upon maturity, the 13-Month CD will be automatically renewed as a 1-Year Term CD at the then-published APY.