The best online financial advisors can help you minimize investment costs, maximize returns, give you confidence about your financial future, and ultimately let you retire earlier. The best online financial advisors are rated based on the following criteria:

- Platform

- Technology

- Ease Of Use

- Cost

- Accessibility

Picking stocks is a losing proposition in the long term because most people are not professional investors and most professional investors UNDERPERFORM the S&P 500 index. Therefore, it's best for individual investors to stick to low cost index funds and ETFs instead. The other key is to consistently dollar cost average every paycheck or every month into an investment account to build great wealth over time.

Instead of paying a hefty 1.5% – 3% of your assets in fees each year to traditional financial advisory firms such as Merrill Lynch and Raymond James, take a look at digital wealth managers. The following are the top three online financial advisor firms for investors to leverage today.

The Best Online Financial Advisors For 2020

Personal Capital #1

Personal Capital – Personal Capital has the best free financial tools for investors and people who are most serious about planning for a healthy retirement. You can easily x-ray your portfolio for excessive fees, get a snapshot of your asset allocation by portfolio, track your net worth and plan for your retirement. Personal Capital is free and was founded in 2009 by the ex-CEO of Paypal and Intuit.

Once you've started using their free financial tools, there is an option to have Personal Capital invest your money for you for 0.8% a year if you so choose. They use a fantastic digital + human model to provide financial advice and services. They are based in the San Francisco Bay Area.

Read the full Personal Capital review here.

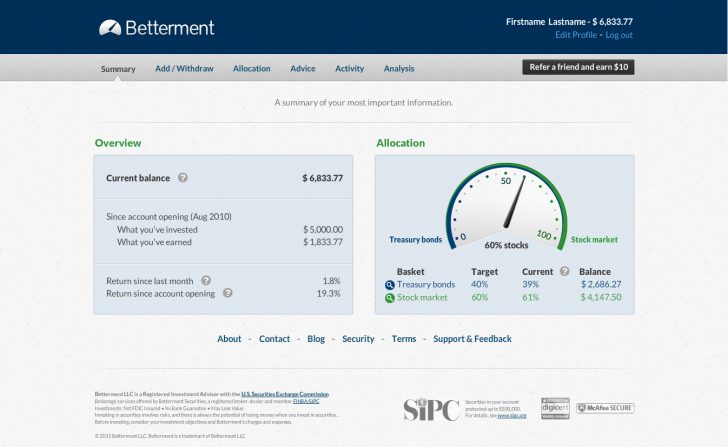

Betterment #2

Betterment was founded in 2008 and is one of the largest online-investment advisor with over $10 billion in assets under management (AUM). In March, 2016 Betterment raised $100 million in a Series E round venture funding led by Kinnevik, a Swedish investment firm. With over $200 million in total funding since inception, it’s clear Betterment is here to stay for the long term. Clients pay as little as 0.15% for Betterment to manage their money.

Read the full Betterment review here.

Wealthfront #3

Wealthfront – Based in the San Francisco Bay Area, Wealthfront is the original robo-advisor and launched in 2011. Its board includes Dr. Burton Malkiel, professor of economics, emeritus and senior economist at Princeton University. He is most known for authoring the classic finance book, A Random Walk Down Wall Street, now in its 12th edition. Wealthfront charges just 0.25% to manage your money, with the first $15,000 free using my link.

Sign up for Wealthfront for free and have them construct a model portfolio for you. They recently raised $75 million in Series E funding in 1Q2019 for a total of $200M.

Read the full Wealthfront review here.

Read the full Wealthfront review here.

About the Author: Sam has been investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out it by spending the next thirteen years after college working at Goldman Sachs and Credit Suisse Group. During this time Sam earned his MBA from UC Berkeley with a focus on finance and real estate. In 2012 Sam was able to retire at the age of 34 largely due investments that today generate roughly $220,000 a year in passive income.

FinancialSamurai.com was started in 2009 and is one of the most trusted personal finance sites on the internet with over 1 million organic pageviews a month and growing. Financial Samurai has been featured in leading publications such as The Wall Street Journal, Bloomberg, and The LA Times.