As a private equity and real estate investor over the past 20 years, I've noticed an increase in unplanned capital calls at the end of 2023 and in early 2024. These surprise capital calls are considered unplanned when the amount called and the frequency of the capital calls are higher than usual.

This increase in surprise capital calls temporarily put me in a liquidity crunch at the end of 2023. I received two, 10% capital calls from funds where I committed $200,000 each in December. Usually, these funds have capital calls equal to 3% – 5% of one's committed capital. That was $40,000 in cash I had to come up with within three weeks.

Then I got another unplanned 5% capital call from a venture debt fund where I made a $300,000 capital commitment. Already scrambling to come up with $40,000, I had to come up with another $15,000.

Neither of these funds had capital calls for the majority of 2023. Why were they suddenly asking for capital calls before year end? The winter holidays are supposed to be slow. I have some answers.

Why The Sudden Increase In Unplanned Capital Calls From Private Funds

Here are the three main reasons for a surge in unplanned capital calls from private funds.

1) Increased cost of debt to service commercial real estate projects

If you invest in private real estate deals, you have seen how the unfortunate increase in Fed rate hikes have hurt returns. After 11 Fed rate hikes since 1Q 2022, the cost of debt grew to its highest level in 17 years.

Here's what CrowdStreet, a leading private real estate platform, had to say about a rise in unplanned capital calls.

“Real estate sponsors today rely on capital calls to make up for unforeseen costs to service debt obligations on past deals. Not only are these costs unexpected, but they are far higher than what sponsors had initially budgeted for in many cases.

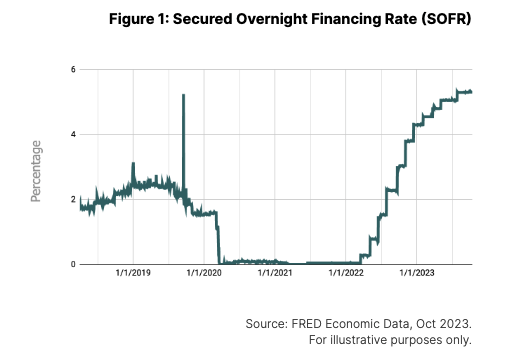

Here’s why. The floating rate index, called the Secured Overnight Financing Rate (SOFR), is a critical benchmark that variable or floating rate loans are priced off of.

Most ground-up development or value-added CRE projects are financed with variable or floating rate debt. Our investment team at CrowdStreet also regularly utilizes this rate as a benchmark to analyze deals.”

Big jump in the SOFR since 2022

Typically, the higher the rate, the higher the cost of debt that is underwritten into deals.

As you can see from the chart above, the floating rate index jumped from 0.05% in March 2022, when the Fed first raised interest rates, to 5.31% in October 2023. As a result, this has dramatically increased the total cost of acquiring and servicing debt.

Higher interest rate spreads

Sponsors must also account for lender spreads to get to a deal's all-in or total interest rate. The all-in interest rate is the additional margin over the variable rate paid to the lender. Lender spreads have increased with the interest rate hikes because banks are accounting for higher risk on their loans.

As a result, there's been a double increase in cost – higher rates plus higher spreads.

Lower borrowing limits

Typical lending rules also limit how much money sponsors can borrow when they refinance a deal.

CrowdStreet explains, “For example, a few years ago sponsors could typically borrow 65-80% of the property's value (known as the loan-to-value or LTV ratio). Today, however, lenders may only finance 45-60% LTV on the same deals. And that is if sponsors can even find a lender willing to provide financing given more challenging capital market conditions.

As a result of the extra costs and reduced availability of debt financing, sponsors are often issuing capital calls to their investors to cover operating losses. The capital calls are also used to fill gaps in their deals' capital structures that would previously have been filled with debt.”

The positive is that interest rates are finally coming down, which should boost real estate valuations in 2024 and beyond. Hence, as an investor, you want to be dollar-cost averaging when prices are depressed.

2) More attractive deals means more unplanned capital calls

Private company valuations declined by 30% – 70% from 1Q 2022 through 4Q 2023. As a result, venture capital, private equity, and venture debt general partners found more attractive deals. The more attractive deals they find, the more unplanned capital calls occur.

As a limited partner, you actually want to see an increase in the number of capital calls when valuations are depressed. Buy low, sell high right? The capital you committed to these private funds is meant to be invested.

Despite funds sometimes taking years to deploy 100% of your capital commitment, a slow deployment helps private fund investors dollar-cost average through good times and bad times.

For example, I committed $140,000 in a venture fund that launched in 2019. Five years later, I've still got 20% of my committed capital left unfunded.

In other words, the fund was investing in companies at reasonable valuations for two years until valuations peaked in late 2021/early 2022 (OK). The fund then invested in deals at peak valuations for one year (bad). Then the fund invested in deals at depressed valuations for a couple of years since (good).

Investing in private funds forces you to stay disciplined and invest through boom-bust cycles. Investing in multiple vintages then helps you diversify even more.

3) To help pay management fees during slow periods

One of the negatives of investing in private funds are the higher fees. Some of the top venture funds charge a 3% management and up to 35% of profits. But these funds still are able to raise billions of capital due to their strong historical track records.

During a weak environment for private investing, there are fewer liquidity events. Liquidity events include acquisitions and IPOs. As a result, general partners are not getting paid “carry,” which is a percentage of profits on the investments they make when there are liquidity events. Instead, all GPs make is their management fee.

By issuing a capital call, the GPs can use some of the capital call money to pay themselves a fee. However, wise GPs usually don't just issue a capital call to pay for fees. The unplanned capital calls are for fees that are usually mixed in to mainly fund a new investment.

Example of a surprise capital call to help pay management fees

Below is a capital call I received for $15,000, or 5% of my capital commitment of $300,000. Part of the capital call includes another $723 to pay the Q3 and Q4 managements fees.

Within the capital call, I had an income distribution of $2,597 (credit to me) from a previous investment the fund made. Therefore, my net capital call was only $13,126.

If management only issued a capital call to pay for fees, we limited partners might complain. However, by making this capital call a mixture of fees, income distribution, and a new investment, the GPs are able to keep their LPs happy in a slower environment.

What If You Can't Pay Your Capital Call?

As a private fund investor, you must carefully plan your future expected capital calls. Good planning means also being prepared for unexpected capital calls so you never find yourself in a liquidity crunch.

If you are unable to pay your capital calls, you will likely be given a grace period of one month to pay. General partners know, especially with unplanned capital calls, that limited partners can sometimes experience liquidity issues.

However, if you aren't able to fund your capital call after two months, you will likely not be invited back for future fund raises. The investment firm will also have to spend extra manpower to adjust your future investment distributions and redo agreement paperwork.

There are big consequences if you don't meet your capital call at all. One of them is forfeiting the capital you've already committed to the fund to date. Imagine already committing 60% of the capital promised, and losing 100% of it because you didn't fund a 10% capital call. That's no good.

Do your best to meet your capital commitments

If you've been able to invest with a top private investment firm, your goal should be to invest in as many of their funds as possible over time. A lot of these firms are invite-only because there's too much demand. Most of their capital raising comes from institutions or ultra-high net worth individuals.

A surge in unplanned capital calls usually doesn't last for more than six-to-twelve months. Do your best to survive the sudden increase in demand for your committed money, which should probably have been earmarked already.

Look on the bright side as your funds are finding more attractive deals. Sell other assets to fund your capital calls if you have to. If you gain a reputation for being unable to meet your capital calls, you might not get invited back for future funds.

Invest In Venture Capital And Real Estate Without Capital Calls

If liquidity is important to you, consider investing in open-ended private funds instead. Open-ended venture capital and real estate funds don't have capital calls. Instead, you invest based on the money you have at the time. In addition, you can request a withdrawal and typically get your money back within one quarter.

Private Real Estate Investing

To invest in private real estate without capital calls, check out Fundrise. Fundrise manages over $3.3 billion that primary invest in the Sunbelt region. Valuations are lower and yields are higher in the Sunbelt compared to the coasts. The spreading out of America due to work-from-home and technology is a long-term trend.

The investment minimum with Fundrise is also only $10, making it possible for both brand new and experienced investors to participate. I expect the real estate market to rebound as mortgage rates come down. With stocks at or near record-highs, real estate prices should catch up.

Private Growth Company Investing

To invest in private growth companies without capital calls, check out Fundrise's venture capital product. Fundrise invests in private companies in the artificial intelligence, prop tech, financial tech, and datacenter space. Private companies are staying private for longer, meaning more gains are accruing to private investors.

Fundrise's investment minimum is also only $10 and you can see what it invests in before making a commitment. Knowing what a venture capital fund is investing in helps investors make more optimal decisions. With traditional venture capital funds, you commit capital and then hope the general partners make winning investments.

We're at the start of the artificial intelligence revolution. I'm investing in AI now because I don't want my kids asking me 20 years from now why I didn't when I had a chance. You can listen to my conversation with Ben Miller, CEO and Co-Founder of Fundrise about venture capital below.

Financial Samurai is an investor in Fundrise and Fundrise is a long-time sponsor of Financial Samurai.