This post will discuss the latest Federal Poverty Levels (FPL) by household size.

Although America is one of the richest countries in the world and making over ~$38,000 a year puts you in the top 1% of earnings globally, there is still poverty in America. It's a shame really, given how rich our nation is.

Every January, the United States Department of Health and Human Services publishes its annual Federal Poverty Level (FPL) guidelines. The annual adjustments reflect changes to the Consumer Price Index (CPI), which is the main measure for inflation.

Just like how the government updates its Social Security cost of living adjustments every year or two and updates the maximum contribution one can make to their 401(k) and IRA, so does the government adjust the FPL due to inflation.

Knowing the Federal Poverty Level is important because the FPL determines what type of subsidies Americans get get from the government. Even if you are nowhere close the Federal Poverty Level, it's always a good idea to know what they are just in case your finances change.

For example, there is trend towards Financial Independence Early Retirement, where people retire much earlier than the normal 60+ age. To provide for decades left of life without a job is not easy, especially given the high cost of healthcare.

Thankfully, the government subsidizes healthcare for citizens who make up to 400% of FPL. If you know the FPL figures, you can then make a more informed decision about when to retire early.

Federal Poverty Levels (FPL) By Household Size 2021

There are roughly 31 federal programs that use the latest FPL guidelines to determine eligibility requirements and assistance. Additionally, many state and local programs use them as well.

The most important subsidy, again, is for healthcare under the Affordable Care Act. So long as you make less than 400% of FPL for your household size, you are eligible for subsidies.

Healthcare subsidies are huge because healthcare costs so much. My family of four pay $2,380 a month in healthcare premiums. None of us have any preexisting conditions. We are also all in shape. Yet, because we make more than 400% of FPL, we get zero subsidies and have to pay more to subsidies those who make less.

The 2021 Federal Poverty Level (FPL) guidelines are dependent on the number of people in your household and where you live. Alaska and Hawaii differ from the other 48 states + DC. Take a look at the latest FPL guidelines below.

Here is the Federal Poverty Levels (FPL) by household size for Hawaii. The Federal Poverty Levels by household size should continue to go up each year due to inflation.

Federal Programs That Use The FPL

In addition to the Affordable Care Act, here are other federal government programs that use the Federal Poverty Levels to help determine subsidies.

- Head Start

- Medicare: Prescription Drug Coverage

- Medicaid

- Children’s Health Insurance Program (CHIP)

- Community Service Block Grant

- Low-Income Home Energy Assistance Program (LIHEAP)

- Supplemental Nutrition Assistance Program (SNAP)

- National School Lunch Program

- School Breakfast Program

The Ideal FPL Income Level

If you have children and want to take advantage of government subsidies, you want to earn no more than 400% of FPL. For a family of four, the income limit to qualify for subsidies would therefore be $26,200 X 4 = $104,800.

That's right, if a family of four can earn up to $104,800 a year and still get financial help! If this family lived in a low cost city like Des Moines, Iowa, that would really living well.

These subsidies are one of the reason why I'm investing in real estate in the heartland of America. There is a multi-decade demographic shift inland due to lower cost of living. Valuations are lower, cap rates are higher, and potential growth is higher.

To make math easier, here are the various income figures by household size for the 2019 FPL levels. The sweet spot income level looks to be around 300% up to 400% of FPL to live comfortably and earn subsidies.

FPL And The Affordable Care Act

Healthcare is by far the most important subsidy for most Americans. An estimated 60% of bankruptcies in America blame the cost of healthcare as one of their reasons for financial ruin.

To qualify for various healthcare subsidies (get a credit), you must earn the following percentages of FPL and no more:

- 138% = maximum income eligibility for Medicaid and CHIP in states that expanded Medicaid as part of the Affordable Care Act implementation (some states may vary)

- 100% – 250% = eligibility range for cost sharing reduction subsidies on “Silver” plans bought on the Health Insurance Marketplace

- 100% – 400% = eligibility range for the ACA Premium Tax Credits on Health Insurance Marketplace plans

The income used is the Modified Adjusted Gross Income (MAGI) figure for your household, which includes your income and your spouses income if applicable.

Getting healthcare under the ACA is inexpensive. Just know that you might not get the best quality service from your healthcare provider or insurance provider due to the subsidies. You may also have a high deductible, depending on if you get a bronze, silver, gold, or platinum plan.

We decided to get the second best platinum healthcare plan possible because we have two kids under three years old and didn't want to mess around. A Bronze plan probably would save us $600+ a month.

Grow Your Income And Wealth

Hopefully, if you are at or near Federal Poverty Levels you won't stay there for long. If you work 40 hours a week at a minimum wage job, you will already be making greater than FPL. However, I understand that not everybody is able-bodied to be able to work that many hours for 50 weeks a year.

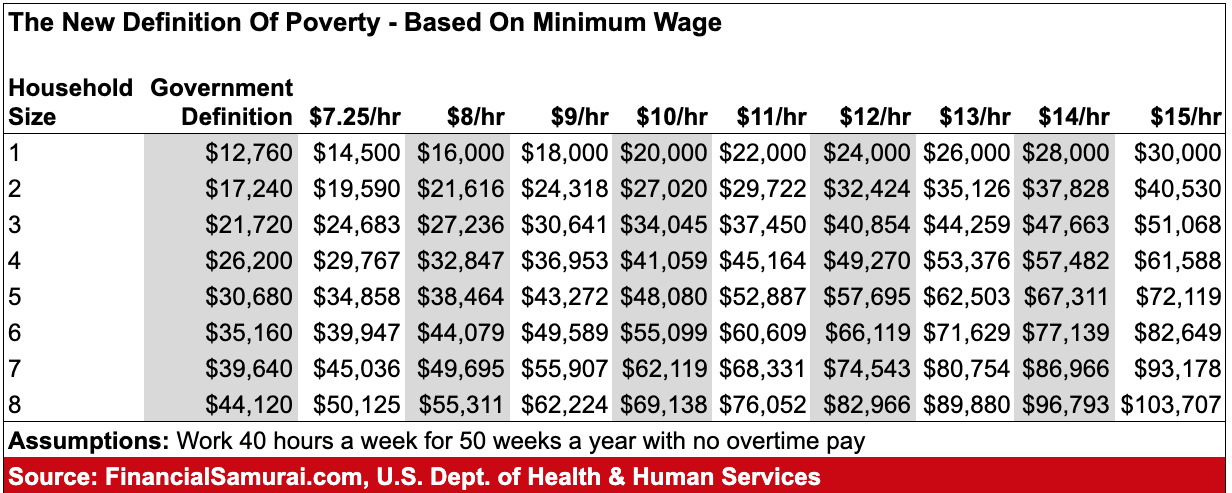

The row under Household Size 1 shows how much a person would make working a minimum wage job at $7.25 – $15/hour. At every wage level, the person makes more than the current government definition of FPL for one person: $12,760.

The best way to grow your wealth is to increase your skills, work longer hours, find side hustles, save aggressively, and invest aggressively to build passive income streams. Having only one job in this internet day is not good enough.

Once you start building your wealth, make sure you keep track of your money. I recommend using a free financial tool like Personal Capital. You can analyze your investments for excess fees, track your cash flow, and plan for your retirement.