This week's newsletter is brought to you by Fundrise, my favorite private real estate investment company with over $3.3 billion invested in the heartland. With interest rate cuts on the horizon and likely more volatility in stocks, real estate could be one of the strongest asset classes over the next four and a half years.

The Financial Samurai Newsletter For July 21, 2024: The Return Of Saber-Rattling

While contemplating how a Trump presidency will affect our finances, I recalled the amount of “saber-rattling” that occurred during his first term. It seemed like not a month would go by without him making threats to some country on Twitter about something.

Just after a bunch of Silicon Valley venture capitalists threw their money behind Trump, he said in an interview with Bloomberg, when asked whether he would defend Taiwan against an invasion by China, “I think Taiwan should pay us for defense. You know, we're no different than an insurance company. Taiwan doesn't give us anything.”

These remarks caused a huge sell-off in chipmakers as well as technology stocks for the entire week. The fear is that if China invades Taiwan, it will control Taiwan Semiconductor and the entire chip supply chain, thereby controlling a huge portion of technology. China's hostile takeover of the chip industry is unlikely to happen, but even a 1% increase in the chance that it does is enough to roil markets.

As investors, we should brace for more volatility over the next four and a half years, given Trump is likely to be the next president after the failed assassination attempt. There will be a return of nationalism, protectionism, and nativism, which means higher tariffs, trade wars, and stronger anti-immigration policies.

As a result, I find myself rewinding time back to 2016, when I argued we should be investing in heartland real estate once more. The demographic shift to lower-cost areas of the country accelerated during the pandemic. Then demand unwound from 2022 to 2024 with higher mortgage rates and supply. But if Trump wins again, I expect capital to flow to the heartland once more.

Here's my new post on What A Trump Presidency Means For Your Finances. If you see any similar posts with thoughtful analysis, please send them over as I'd like to know if I'm missing anything. For some reason, I haven't found anything else on the web that scratches beyond the surface yet.

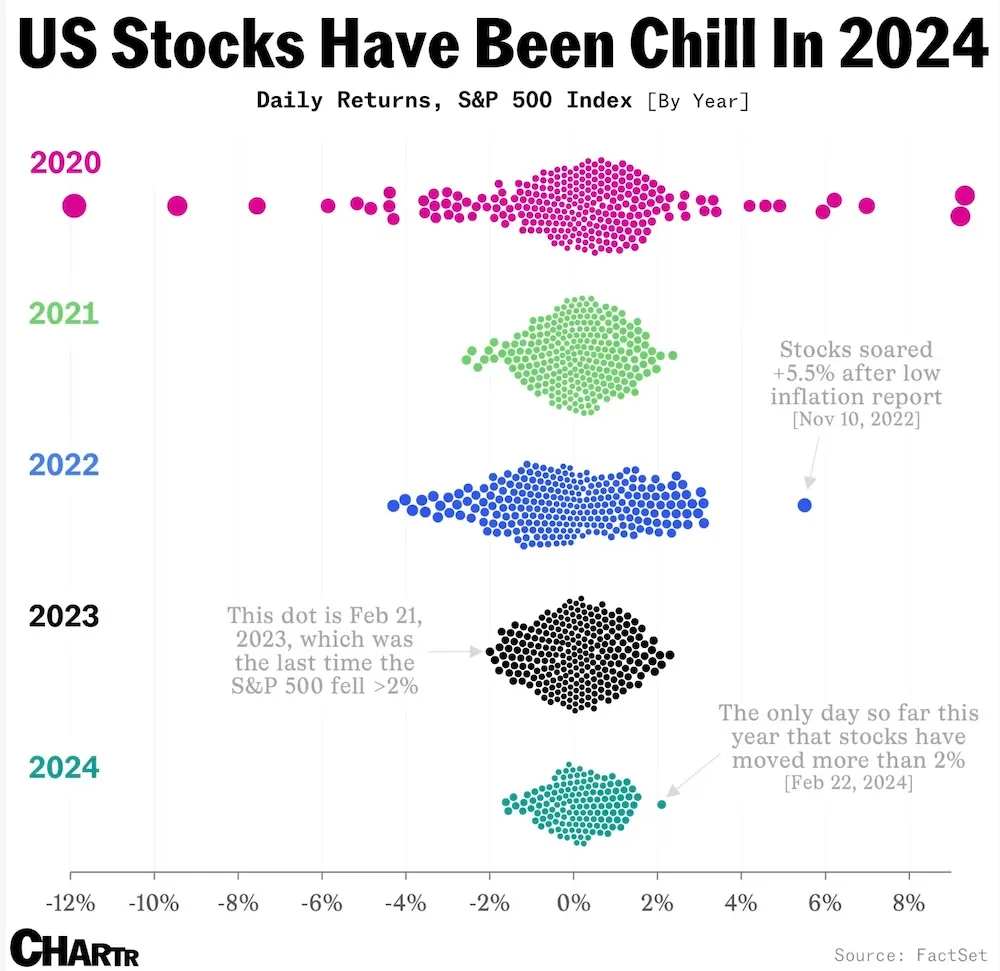

Newsletter Chart Of The Week – Low Volatility Stocks

This chart reminds me of why I love real estate during volatile times. As stocks imploded in March 2020 by 30%+, real estate held strong. There's a good chance investors will focus on investing in less volatile, income-generating assets like real estate once more in 2025 and beyond.

The more money you have, usually, the more disturbing the volatility becomes. As a result, your desire to preserve capital and generate cash flow increases.

Paying For College And Coast FIRE

I did a video interview (scroll to the bottom) on the dangers of following the Coast FIRE strategy if you want to retire early. In the video, I argue that Coast FIRE leads to complacency, which can also lead to delusion if you're not careful.

However, what I realized afterward is that using the Coast FIRE strategy is actually perfect for helping you decide when to stop saving and investing for college.

Since 2017, I've been saving aggressively in both my kids' 529 plans because I know college will keep getting more expensive each year. I don't want them to be saddled with student loans, angry at the world for why they are having a difficult time launching into adulthood.

However, starting in 2024, I was forced to hit the brakes because I ran out of money. And instead of feeling bad for not contributing to their 529 plans, I felt relief.

The lack of money forced me to figure out how much college savings is enough. By connecting the dots with Coast FIRE, I've found a solution for all parents who want to be able to fully fund their children's college education.

My new article, “When To Stop Contributing To A 529 Plan To Fully Fund College,” became the most-read article of the week. This shows me that parents everywhere are trying to find answers to a big problem that is stressing out their finances.

Good Luck Achieving FIRE Before 40 With Kids

After considering how much we need to save for college, I was reminded that it's nearly impossible to achieve financial independence and retire early before 40 with kids. If you're saving $250,000, $500,000, or $1,000,000+ for your children's college educations, that's money you're not saving for retirement.

But it's not just the money going to your children's future that makes FIRE difficult for parents; it's more the time and energy required to take care of kids. With less time and energy, it's extremely difficult to do more work to make more money.

As I've written in previous articles, I'm struggling to keep up with the rising costs of tuition, health care, and to a lesser extent, housing since I own my primary residence outright. If you are a parent, these are the three inflationary items that cost the most and have been rising the fastest.

So if you don't have kids and want to FIRE, don't waste your energy doing frivolous things that don't increase your wealth. And if you are parents who want to achieve FIRE, I'd give yourself some grace and extend the target date for when you want to retire. It's not worth being miserable and overly stressed in your quest to escape the corporate grind. Your kids will sense all your negativity, to their detriment.

Read: Not Having Kids Is Your FIRE Super Power: Don't Blow It!

To Your Financial Freedom,

Sam

Newsletter Recommendations

If you believe Trump will win and heartland real estate will benefit as a result, check out Fundrise. Fundrise has methodically been investing in heartland residential and industrial real estate over the past 15 months to take advantage of deals. The Fed is set to cut interest rates in September, and pent-up demand may get unleashed onto real estate as a result. After a strong run in stocks, I suspect investors will look for lagging investments like real estate.

The Financial Samurai newsletter is free newsletter read by over 60,000 people each week. You can sign up here to help you achieve financial freedom sooner, rather than later.