Ever wonder how geopolitical risk affect stock prices? With the recent threat of Russia invading Ukraine, geopolitical risk is heightened and stocks tend to sell off. But how much do stocks decline when there's war, terrorist attacks, bombings, airstrikes, attacks, and invasions?

Let's take a look at research by LPL, S&P, and CFRA regarding how stocks performs when there is geopolitical risk.

Geopolitical Risk And Stock Returns

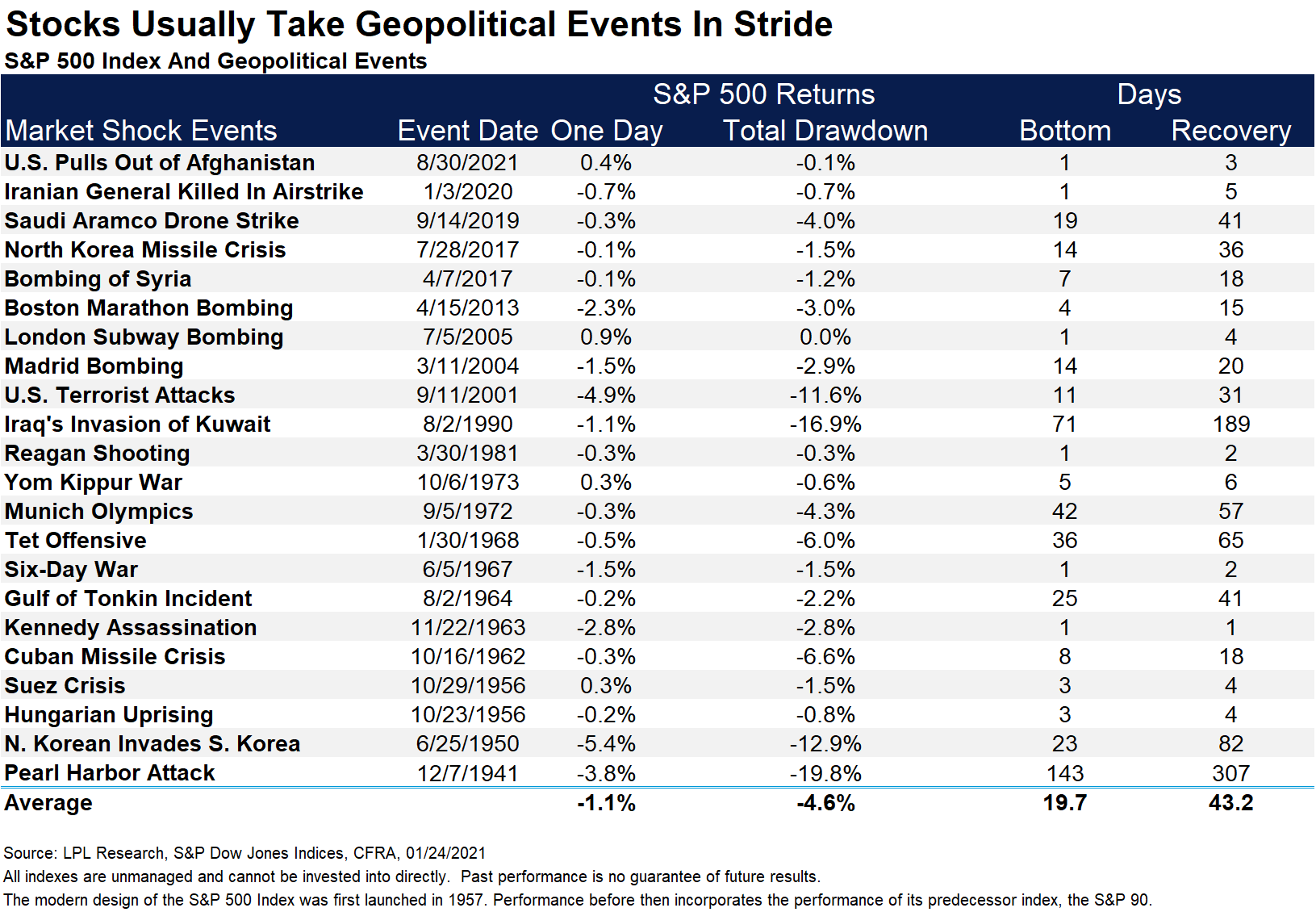

Below is a history of previous geopolitical events and what happened to the S&P 500 returns after. After a geopolitical event occurs, the average decline in the S&P 500 was -4.6% over 20 days.

After hitting bottom, the average time it took the S&P 500 to recover back to even was 43.2 days. Therefore, geopolitical risks basically disrupt stocks for about two months. Then, stocks tend to climb upward again.

The Worst And Best Types Of Geopolitical Events For Stocks

The worst geopolitical events are usually terrorist attacks, invasions, and surprise attacks. Such events have caused the S&P 500 to decline between 10% – 20% each time. Therefore, if Russia invades the Ukraine, expect a 10% or greater decline in the S&P 500.

The most benign geopolitical events include air and drone strikes, random bombings, and political shootings. The Hungarian Uprising, Madrid Bombing, London Subway Bombing, Boston Marathon Bombing, Regan Shooting, and Air Strikes all resulted in low single-digit S&P 500 declines.

In a sinister way, people with a lot of cash on the sideline want the worst type of geopolitical risk possible. This way, they can deploy their cash during a correction and profit.

How To Invest When There Is Geopolitical Risk

Given the data about how stocks get affected by geopolitical events, it is generalyl wise to dollar-cost average down when stocks are selling off due to a geopolitical event. Over the long run, stocks tend to recover all its losses and move on to new highs.

For the Russian invasion of Ukraine, I'd assign a 12% chance of a light-scaled invasion (border crossed, no mass death and destruction). If so, we could see a 10% correction in the S&P 500. If so, I'll be buying aggressively.

With an 88% chance of no invasion, just more saber-rattling, and weeks more of uncertainty, we may have another 3% downside as we re-test Oct 2021 and Jan 2022 lows. I will be nibbling with my new monthly influx of cash.

Below is a great chart of how the U.S. stock market tends to grind through difficult times. Over time, the S&P 500 has continued to reach new highs after all sorts of negative events. Therefore, the key is to buy the corrections and hold for the long term.

Interest Rates Tend To Decline When There Is Geopolitical Upheaval

The greater the geopolitical upheaval, the more interest rates tend to decline. The reason is because investors flee to the safety of U.S. treasury bonds. As bonds get bid up, interest rates go down. As a result, mortgage rates go down as well.

Therefore, in addition to bonds performing well, real estate also tends to perform well when there is geopolitical problems. Real estate is often considered a safe-haven investment. Investors want to own hard assets that tend to hold its value during times of uncertainty.

Besides real estate, investors tend to buy up precious metals, art, wine, and collectibles. In an inflationary environment, like we see post pandemic, real assets also tend to do very well. For example, high inflation acts as a tailwind for rent and property price growth.

Further, as a real estate investor, you should be thrilled with high inflation, rising rents, rising property prices, and very negative mortgage rates.

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth and generate passive income.

The combination of rising rents and rising capital values is a very powerful wealth-builder. Real estate is a great hedge against geopolitical risk. At the same time, real estate is also a beneficiary of geopolitical upheaval because interest rates go down and investors want to own hard assets.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have more capital, you can build you own diversified real estate portfolio.

Build More Passive Income Streams

I've personally invested $810,000 in real estate crowdfunding to diversify my expensive San Francisco real estate holdings. Further, as a father of two young children, I'm trying to earn as much passive income as possible.

Investing in private real estate is a great way to move money into the background so you can focus more on living your best life. Even when there is geopolitical risk, you won't worry so much.

Real estate currently accounts for roughly 50% of my net worth and generates over $180,000 in net rental income. Equities accounts for 35% of my net worth and generates almost $20,000 a year in dividend income. I mainly invest in growth stocks, which do terrible when there is geopolitical upheaval.

Financial Samurai began in 2009 and is one of the largest independently-owned personal finance sites with over 1 million organic visitors a month. I worked at Goldman and Credit Suisse for 13 years, received my MBA from Berkeley, and have written over 2,000 personal finance articles. Sign up for my free weekly newsletter for more insights.