A good credit score and a clean credit report is essential for accessing credit. Without a good credit score and a clean credit report, lenders will charge higher rates with more onerous terms. This post will review the historical average credit score over time.

Getting a mortgage and a car loan are the two largest loans for the average U.S. consumer. However, having a good credit score and a clean credit report is also essential if you want to be competitive renting an apartment in a strong market.

As a landlord since 2005 in San Francisco, a tenant must have a good credit score and clean credit report because there's simply too much demand.

Let's first go over the fundamentals of a credit score.

The Fundamentals Of A Credit Score

Your credit score ranges between 300 – 850. Therefore, the average credit score should be somewhere around 575-600 if the scores are equally distributed. But they are not.

If your score is between a 300 – 579, you're probably never going to get credit due to some type of non-payment you made in the past. Things such as a foreclosure or bankruptcy likely drops you down to this range for around 5-7 years.

If your score is between 580-669, your rating is fair, but you're still considered a subprime borrower.

Subprime borrower are two nasty words you don't want to be identified with by a lender. You can get some credit, but you're going to pay an extremely high interest rate.

It's only after you get over 720 are you considered an attractive borrower. At usually 720 and above, you will get some of the best rates and terms.

Take a look at the FICO score ranges by Experian and their beliefs on each score range and its impact on your loan terms.

How To Improve Your Credit Score

Here are all the factors that affect your credit score.

- Payment history for loans and credit cards, including the number and severity of late payments

- Credit utilization rate

- Type, number and age of credit accounts

- Total debt

- Public records such as a bankruptcy

- How many new credit accounts you've recently opened

- Number of inquiries for your credit report

The most important factors in your FICO score are your payment history on loans and credit cards, total debt, and the length of credit history.

Therefore, to improve your credit score, you simply need to always pay on time, take out credit for as long as possible, and limit the amount of credit to probably no more than 3-5X your average annual income.

Not considered in your FICO score analysis is your race, color, religion, national origin, sex or marital status, salary or occupation, or where you live. It's the same law when you are deciding on a prospective tenant.

See: How To Increase Your Credit Score Over 800

Historical Average Credit Score Over Time

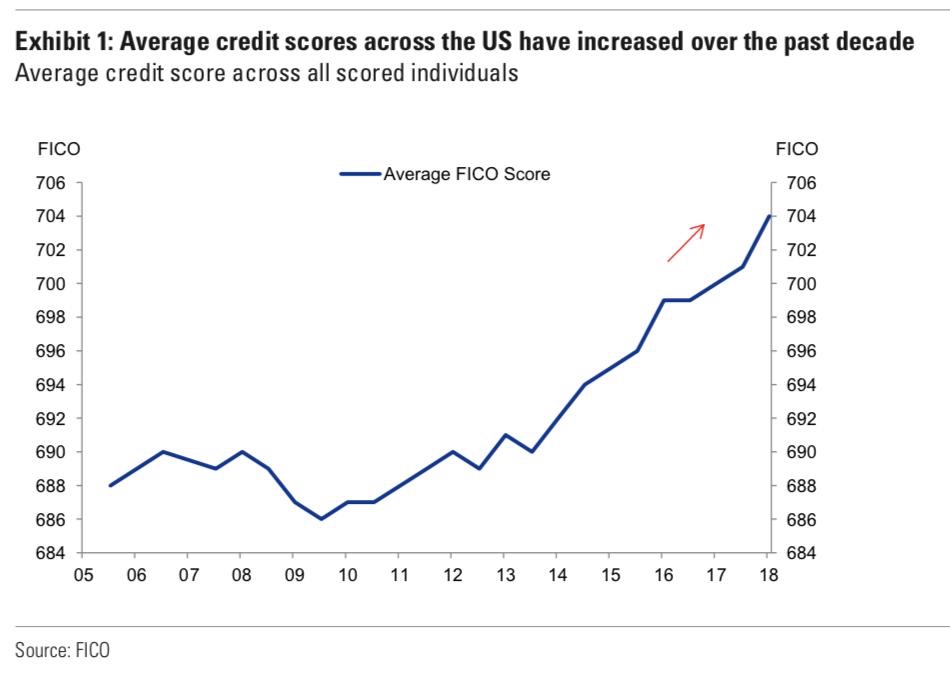

Now that we know some credit score fundamentals, take a look at the historical average credit score over time according to Fair Isaac Corporation (FICO).

The average U.S. credit score has steadily improved since the financial crisis when it was around 686. As of end-2019, the average U.S. credit score is closer to 704. In 2021, the average U.S. credit score is now closer to 710.

In other words, the average U.S. credit score is now in the “very good” to “excellent” range, which is a very strong indicator for the economy. After the global financial crisis in 2008 – 2009, lenders really tightened up their lending standards. Only the people with the highest credit scores could borrow money. Therefore, millions more Americans worked on improving their credit scores over the years.

With declining mortgage rates, rising credit scores, and a large amount of net worth gains since 2009, the U.S. economy will be able to withstand a recession much better than in the past.

Only the most creditworthy borrowers were able to get mortgages post the financial crisis. Today, new mortgage borrowers are more financially responsible than historical mortgage borrowers. Therefore, the U.S. economy looks to be in great shape.

Borrow Responsibly To Invest

Despite the improvement in credit scores over time, it's still important to always borrow responsibility.

When it comes to buying property, always put down at least 20% and have at least a 5%-10% buffer in case something happens. Leverage is great when asset prices are rising, but terrible when asset prices are falling.

Two things I recommend everyone do:

1) Check the latest mortgage rates online. Us Credible, my favorite mortgage marketplace where prequalified lenders compete for your business. You can get competitive, real quotes in under three minutes for free. Interest are at all-time lows. Take advantage!

2) Diversify your investments. If you are looking to buy real estate as an investment, I suggest checking out Fundrise, the leading real estate crowdfunding platform first. Instead of spending big money on one piece of real estate, you can diversify your holdings across the country for much less. The platform is free to sign up and explore.

I've personally invested $810,000 in real estate crowdfunding after selling my expensive SF rental property for 30X annual gross rent. I'm bullish on real estate for the coming years. With inflation on the horizon post pandemic, I want to ride the wave with real estate.

The average credit score in America should continue to improve, which bodes well for the housing market and other asset classes.

About the Author: Sam worked in investing banking for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.