Because I joined the equities business a year before the 2000 dotcom bust, I've always been a little wary of stocks as a source of long-term wealth. It was crazy to witness so many people go from having millions to zero in a matter of months. Where does all the wealth go?

The irony about my suspicion is that I firmly believe the only way for someone to reach “next level wealth” is if you build enough equity in your own business. Unless you make Managing Director at a major financial firm, Partner at a big law firm, get hired as a Senior VP at a large tech company, or work as a janitor for San Francisco's public transportation system, it's very hard to get really rich through a day job.

Therefore, the best way to reach next level wealth is to not only build a business, but to make your business LAST for as long as possible.

Making Your Business Last Forever

Netflix killed Blockbuster. Amazon killed Circuit City and a bunch of other businesses. Redfin is slowly squeezing real estate commissions to death thank goodness. Every single business has a life cycle. If you don't constantly reinvent your business, you will die. If you believe your business will die despite your best efforts, you should sell.

Part of the reason why I like converting long term profits in the stock market into real assets is because I'm always paranoid that nothing lasts forever. Instead of seeing my profits turn into losses, like I've seen so many times in the past, I might as well lock in some profits and convert them into something that will last e.g. a new $55,000 master bathroom from a DJIA investment made in 2012.

I know my master bathroom will last for at least 30 years. Sadly, the same cannot be said for most businesses, which is partly why index investing is the predominant way to go. Besides, there's no point investing money if you don't one day take profits to use for a better life.

I'm not sure how the online publishing business will evolve over the next 10 years. My business could very well die a sad death. The only thing I can consistently work on is building a strong brand that will allow me to pivot to something new when the time comes. Financial Samurai drinking water anyone?

Let's say everybody stops reading independent personal finance sites that are written by financially independent authors who spent their career in the finance industry. Instead, people decide it's more beneficial to get financial advice from entertainers due to their good looks. Well crap! I'm SOL since I'm not much of a self-promoter. What is a blogger supposed to do?

If my business or your business is faced with a structural decline, we must CHANGE the composition of our respective businesses. But instead of converting profits into a bathroom that produces no income, a business should consider buying income producing assets.

The only income producing asset I know of that has a high degree of certainty for lasting a long time is real estate. Let's do a mental exercise.

Business Conglomerate

There's no restriction as to what type of business you must operate, especially if you run a privately held business. See this comment from an entrepreneur reader:

My growing company was recently valued at $3m but my business partner and I each making over $500k a year (and I’m only working an easy 20-30 hours a week). Why would I ever sell?! In reality my equity will end up being sold to some valued employees. I don’t see selling to an outside party. Plus we own the commercial building (in a separate real co and renting it to our operating co) and are building a nice asset (equity just passed 50% of value).

Thanks FS – I agree (DON’T SELL YOUR CASH COWS!!)

Do you see the nugget of wisdom in this comment? The reader structured his business into two separate entities: 1) a real estate company that owns the commercial building, and 2) his operating business that pays rent to his real estate company! This way, he recycles all his profits within his business empire while taking advantage of tax shields through non-cash depreciation expense. Further, he rests easy knowing the landlord will never kick him out, unless he turns schizophrenic.

Let's see how this business works with some numbers.

Real Estate Company Rental Revenue: $120,000

Real Estate Company Commercial Building Value: $2,000,000

Annual Non-Cash Depreciation Expense: $51,000

Operating Expense: $20,000

Operating Profit Before Taxes: $49,000

The actual cash flow from Real Co. is $100,000

Operating Company Revenue: $1,500,000

Office Rent: $120,000

Operating Expenses: $380,000

Operating Profit Before Taxes (distribution to two partners): $1,000,000

Plus $100,000 in net rental income = $1,100,000

Because this entrepreneur's business needs to rent office space anyway, they decided to buy a commercial office building in order to charge their operating company rent.

If you own commercial buildings in superstar cities like San Francisco or New York City, there may come a time when the value of your real estate holdings SURPASSES the value of your operating company itself! Let's look at a real example in San Francisco below: Lombardi Sports.

The owners of Lombardi Sports bought a 50,000 square foot building in the prime Russian Hill neighborhood to house their store in 1993 for several million bucks. They had a great run, but selling sporting goods in person slowly started to lose its edge due to the rise of e-commerce. As a result, the owners decided to sell the building to an investor.

“After a while it got to the point where there were more lucrative things for the family to pursue,” said Steve Lombardi Jr. “We were working twice as hard for half the money. This was not a whimsical decision; our family has been in business in San Francisco since the early 20th century.”

I heard the sale of the building was for more than $25 million in 2014. Not bad at all, especially since Sports Authority went bankrupt in 2016. Instead of completely getting squeezed, the owners were able to capitalize on their business's most valuable asset: real estate.

I'm sure the owners liked the idea of owning their building in order to control costs and have maximum stability, just like a homeowner does. But I don't think they forecasted their real estate holding would become a gold mine. Wholefoods plans to move into the space and charge $10 for an organic apple in the near future.

Buy Lasting Assets

Although I run an online media company, I'm considering buying real estate with the company's retained earnings. First I'll start with an office building since I need somewhere to type my magic. Then I'll rent out the remaining 98% of space since I don't need that much space to type my magic!

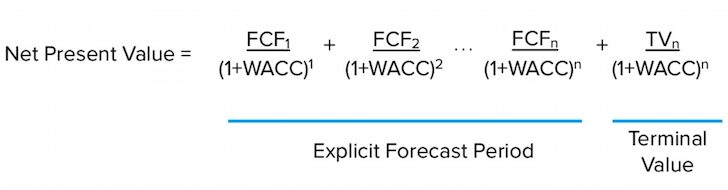

Slowly but surely I'll buy more and more real estate to build a rental property empire under Financial Samurai Incorporated. Perhaps one day, rental income might equal online media income (doubt it). But given the disconnect in valuations (SF real estate valuations are much higher than online media valuations), I might be able to raise my final company valuation multiple if I ever sell. Talk about forward thinking!

By actively turning online media funny money into real assets, I'm basically ensuring my company will be worth at least the value of the company's real estate holdings (book value). I've also elongated the lifespan of my company forever. If real estate inflation continues to grow the way it has in San Francisco over the next 30 years, I will create some serious next level wealth for my children.

Plan. Execute. Predict. Diversify. Don't stay complacent because things are always changing.

My favorite asset is real estate. Buy real estate as much as possible so you can make your fortune last.

Best Private Real Estate Investing Platforms

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages over $3.3 billion for 400,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

Suggestions For Starting A Business

Start your own website. Every business needs their own website. Here's a step-by-step tutorial showing you how. Not a day goes by where I'm not thankful for starting Financial Samurai in 2009. I ever would have imagined being able to engineer my layoff from a well-paying job in 2012 to just write and be absolutely free. You just never know what might happen if you try. Back when I started, I had to hire someone for $1,500 to launch FS. Now you can launch in under 30 minutes for less than $50.

For further suggestions on saving money and growing wealth, check out my Top Financial Products page.

In addition, if you enjoyed this article and want to get more personal finance insights and tips, please sign up for the free Financial Samurai newsletter. You’ll get access to exclusive content only available to subscribers.

Hi Sam,

A couple of points:

-Small/Mid business owners would be doubling up on risk. For instance if the business fails to cover costs the RE income would likely fall. Commercial RE is valued on income so valuation would likely fall.

-A business buying its own premisies may be more suitable for those establishments which rely on proximity or location (hotel, pub, day care) rattler than say an online business like Amazon.

-Investing in someone another business property would give diversification for free.

-High growth (or high risk), capital hungry businesses may be better placed renting or investing in their own operations.

I love the idea of buying the business premises but evaluation may find other alternatives depending on circumstances.

One of the first people I ever worked for told me that his greatest business decision was buying the land his company was housed on. He had a very successful business for decades, but made the killing when he sold the land and retired.

Sometimes this happens accidentally. My company makes tractors, so they acquired an enormous test field outside a city in the 1950s where they could drive them around and see how they performed.

Fast forward to the early 2000s, and the city has expanded so much, the location is now smack in the middle of a ritzy suburb. We’ve been cashing in by selling off small plots to build McMansions ever since. Cha ching!

Hi Sam,

Long time reader of yours now, and I’m also a neighbor on Taraval street. Maybe we can grab coffee sometimes.

I believe in R.E investing, and a huge chunk of my income from my business, I pour back into RE properties in SF and then rent them. That way, if one day business goes down at least I can collect rent. Most of my properties are near colleges, so the rental market is much more stable, and the students will only stay for a max of four years.

As far as diversifying, what are your thoughts of only investing in the Bay Area? People always say don’t put all your eggs in one basket, but they also say to stick to what you know.

Nothing lasts forever but the earth and sky . . . dust in the wind . . . oh, wait, forever is until July, when we get more Game of Thrones.

Tough question, especially as I see a LOT of economic issues in the next decade. Perhaps the key question is how you expose yourself to wealth?

Eye opening Post! Most people think of renting a space for their business but don’t consider buying. Really something to think about. Thanks!

The business property LLC tactic is very common and has been used for decades.

As mentioned above your depreciation calculation is not correct.

A couple things to note.

Be careful what amount you charge your company rent. If it’s excessive the US treas may come a calling. You need to stay close to market rates for the area.

When and if you ever sell the property , all the years of depreciation you took on your tax return (it lowered your taxable income) will have To be re-captured in the tax year you sold prop. on your personal return. I.E. if you were taking a 50k depreciation per yr for the 20years you owned the property then sell it , that 1 million is now added back to your gain on the property and now you have to pay tax on that 1mm in addition to any gain made in value on the property.The gain/profit (if there is one) on property would be less any capital improvements, and depreciation made over the time of ownership. The tax rate on the recaptured money is fed rate of 25%. (250,000) The tax rate on the remaining profit is your current cap gains rates. So you essentially have 2 tax rates on the sale, plus state tax if applicable.

Keep in mind, commercial property can be expensive when it comes to capital improvements such as roofs, electrical and heating systems. Our new roof cost 400k! If you plan on owning for a long time you WILL need to replace at some point.

And you still have to have a written lease with both your entities ,,, so don’t get in a fight with yourself over the terms.

Hi Waldo,

Isn’t there a rule/exception where, if you buy a more expensive building, you don’t have to pay the depreciation/gain/taxes? As long as you keep “rolling up”, you can defer “forever”?

Thanks.

Jeff,

Yes, you can defer taxes using a tax strategy called a 1031 exchange. Another strategy is a monetized installment sale.

Brian, CPA, CFP

I’ve heard pretty much every restaurant uses this same strategy. Margins are very tight in food and so they basically scrape by to build equity in the real estate where they house their restaurant. The most famous example is McDonalds, but all sorts of mom and pop local restaurants I believe employ this same strategy as well.

I think the real genius aspect which I’m not sure the small local restaurant uses is buying the real estate through a separate company, as with this strategy you can gain tax benefits (as well as potentially lawsuit shields).

Some more things to think about…

I wonder though Sam why you don’t take the operating profits from the business and distribute them to yourself and then buy real estate or other assets? I presume for tax reasons?

I do. I bought a fixer upper in 2014 and spent ~$200,000 remodeling the place from my distributions. Most recently, I spent about $15,000 on a hot tub.

But if I have my company own the asset directly, the real estate becomes a 100% business expense in some way. And since I own the company, the building is still mine.

Reading Sam’s post and the replies does create a bias for action. Did benefit from building equity via stock options and investments. Have thought to diversify into real estate but current prices feel like buying at a top, and yet, it has been that way for 3 years with prices continuing to rise. Am looking at reits as one option to get started, though seems many here prefer the real stuff vs paper real estate.

Recycling my active business income into passive real estate income was one of the best decisions of my life.

After five years of scaling my financial advisory business, I began to deploy virtually all the profits into small multi family properties. It helped that I continued to live lean like I was in start up mode.

The true test of this strategy was during the financial crisis. As my business revenue plunged 50%, the real estate portfolio held steady and continued to grow.

Today,the real estate is bigger than my current business and I continue to buy more. Throw in the tax benefits of offsetting active income with passive income, and you end up with a solid wealth accumulation and preservation strategy.

I’ve worked with many business owners over the years. The most successful ones owned the real estate and paid themselves rents. If they didn’t own the real estate as part of their commercial operations, they owned commercial or multi family properties on the side.

On the other hand, the business owners that had all their capital tied up in their business with a plan to cash out in retirement tended go do worse. Some did extremely well, but many ended up selling out at a low price or simply closing due to obsolescence.

Nice post!

I think it’s a great rule of thumb to re-invest all that excess of cash into more assets such as real estate and some stock just to create more value over long periods of time. I’m pretty sure we’re not Warren Buffet, but who cares if you can get a 7% return Yoy with stocks just by following index funds. Real estate is more troublesome, but with higher returns, I assume it comes greater responsibility :)

The biggest trick right now I think is to get online and to build a better brand, just as you mentioned, because the costs are so low and the profit margin can be so large.

Sam-I am posting (from a beach chair in the sun while vacation) because of the statement in your newsletter about your surprise at the lack on comments on this article and an earlier one. I did have an “a ha” moment after reading this article, but have only commented online a handful of times in my lifetime. Your earlier posts led me to invest $13k thus far in RealtyShares debt notes. I haven’t done equity yet because of the tax filing implications, including on any investment outside of my state of residence.

I plan to retire in 5 years from two government jobs with great pensions and health benefits and pursue move wealth building avenues you’ve discussed. I am trying to determine the single most advantageous thing to do during those five years. I had settled upon getting a better hold on my current investments thru Personal Capital, so that I am comfortable taking more risk, but I understand your push to do more.

If you’re only 5 years away from retirement, then I wouldn’t take more risk, especially where we are in the cycle. I’m actively trying to de-risk and reinvest in lower valuation assets, hence my heartland of America push. I hope there’s still upside in the stock market and coastal real estate market, but I’m not counting on it.

Enjoy vacation!

The problem with real estate is its poor liquidity. If you always long stocks and hope you would profit when they go up is not a viable strategy, simply because hope is not a viable and smart strategy. Pun intended.

Definitely like the idea of converting stocks into real assets. It can mean actively being involved VS the passive investments, but at least it’s something tangible. Perhaps a long-term goal…I’m thinking vacation property and otherwise rental for the remainder.

>>Netflix killed Blockbuster

Sam, I have strong opinions on this one topic. I do not believe Netflix killed Blockbuster. Blockbuster killed Blockbuster (and I was SO happy when they did). Blockbuster ran a terrible, non-customer friendly business for a long time. The screwed customers over (over and over again). I have no doubt had Blockbuster built a STRONG customer-friendly BRAND over their lifetime, they would have had way more time to pivot with Netflix started, and their loyal following would have followed them in droves. Instead unhappy customers fled Blockbuster just as soon as they could.

It’s been a number of years, and I still have hard feelings about how Blockbuster ran their business.

I love it. Diversifying the business this way sounds great. How much would an office building in San Francisco cost? It must be sky high at this point. This might be more doable in Portland. I’ll check around. Thanks for the idea.

I think a blog is somewhat unique in that there are little to no costs of operating and little in ways of growth opportunities by injecting cash. It’s a far more organic process. By that I mean, would investing your retained earnings back into your blog provide the necessary returns compared to simply buying real estate?

I can’t imagine there is much you can do to increase readership now, I’m pretty sure most people interested in personal finance blogs know about FS. You could always try and break foreign markets and translate your blog into new languages!

Often, blog growth is organic, you’re right. And unlike a service-based industry, it doesn’t really cost any more for a blog to serve a larger “customer” base. But I disagree that there’s little Sam could do to increase readership. I’m sure there are millions of people who would find the content on FS very interesting but have never been exposed to it – or any personal finance blogs at all. I didn’t know there was such a thing as a personal finance blog until I did. Also, Sam could plow some earnings into advertising or getting his articles featured on major news sites (I’ve seen a few references in the comments lately to people having seen his articles on Yahoo) and thereby gain exposure to new audiences. He could go on the talk show / radio show / “professional” media circuit and gain exposure (I’m not sure if that costs money or not).

Indeed. There’s plenty of things to do to grow your site with paid marketing. Facebook advertising is one. If you can spend $1 to make $1.10, you should do so all day long. I’m just not that interested. It’s fun to do things organically, especially when there are some occassional lucky breaks that can blow away paid marketing initiatives.

I have done some podcast interviews before. Here’s a fun one I recently did:

One step closer towards dominating the Utah personal finance market! :)

Hi Sam,

In your chart you have a $100,000. a year depreciation expense on a 2 million dollar building. I believe the actual depreciation is closer to 51k per year. The depreciation is spread out over a 39 year period. 2000000 divided by 39 equals $51,282.05.

Thanks, Bill

Good call Bill. I’ve amended. Thanks. The point is the same though regarding the beauty of setting up a Real Estate Co. or buying real estate to change the composition of your business.

To be more accurate, you can only depreciate the building but not the land. So if the building is worth $1M and the land is worth $1M, then you depreciate the $1M over 39 years for ~$25K depreciation per year.

-Brian, CPA, CFP

Reinvesting retained earnings is the key to getting compound interest working for you in your business. The biggest mistakes in investing happen when you move outside areas you understand. Sam, you’ve clearly done very well out of property through the years and understand it. Individual stocks can provide fantastic opportunities but there is the possibility of some being wiped out. Very good companies should, over time though, more than compensate for the odd lousy investment. We’ve had a look at a handful of companies on our website where the business is paying more in annual dividends than the original investment – those are the investments to try and find!

Now that’s some creative thinking! Makes complete sense to consider buying the asset to make even more money. And, of course, that give you another stream of revenue to help spread the risk a little more.

Love articles like this. Thanks, Sam!!

— Jim

You know for retired guy who is supposed to be taking it easy you sure do work hard. I love the hustle though. Super motivating as always.

My desire to get some rental properties is growing stronger with every visit here.

It’s a great article and I really like your approach. It also can be thought further: The office needs to be cleaned. Why not do it by your own cleaning company? You have a big extra space? That probably means that the company who rents it has many employees. How about a small canteen or at least a snack bar? I think the options are endless.

I worked at Blockbuster Video (store manager) as my first job after graduating college. Glad I shifted out of it after a few years. :)

I held and grew my last company for 18 years before deciding to sell it. We were a managed cloud hosting provider with thousands of clients in 72 countries. Dozens of staff all working remote across 6 states. It was great. BUT, I saw the writing on the wall with Azure and AWS. Found a larger company that wanted to get into cloud (good timing – right when I wanted out) so agreed to be acquired. So glad I did! For many reasons, not just financial.

My “business” now is managing our finances and a small bit of blogging and coaching. FI/ER is nice. :) I expect this “business” to last forever – if I manage things well enough.

“The reader structured his business into two separate entities: 1) a real estate company that owns the commercial building, and 2) his operating business that pays rent to his real estate company”

Sam this is what the owner does at my company. And I’ve been told by my boss, that it’s one of the most common ways he’s seen people make bank.

Our main office, with huge warehousing space (5 loading docks) is owned by the owner. But separate from the company. The company pays the other company. Not sure if it’s directly to him, or another holding-type company. He makes $20K/month this way from the “rent” he charges himself, practically.

So even if sales and margins are flat, he makes good money. And like you’ve mentioned, he doesn’t have to worry about the renter going AWOL since he’s his own renter. It’s genius.

Thanks for bringing this up!

Happy to see you use my previous comment for part of this article Sam. Our “business conglomerate” is working well and I sure love being my own landlord! We also have a tenant who occupies 25% of the building. They are a great tenant and I haven’t had a single issue with them since we bought the place 4 years ago. I do have my cleaning service look after their space (in reality just to make sure it stays clean and she tells me they are quite neat anyway).

Continue to enjoy your site and great articles.

Chris