The SF Bay Area real estate market has done phenomenally well since 2012, ever since Facebook went IPO. Tech IPOs will continue to inject a tremendous amount of liquidity into the San Francisco Bay Area economy.

In 2019, a new wave of private companies IPOed. They include Uber, Lyft, Airbnb, Slack, Pinterest, and maybe Palantir. Post-pandemic, there are even more tech IPOs on the horizon. The pipeline is full and endless.

Many renters fear these IPOs will unleash billions of dollars of liquidity into the SF Bay Area real estate market and drive up prices.

Tech IPOs May Drive Up SF Bay Area Real Estate Prices

Real estate agents are chomping at the bit, talking about the real estate market as much as you can.

“You better buy now before the lockup periods are over!”

“You better prepare your home to sell as this is the time you've been waiting fore!”

“You better sell now before everybody else decides to sell, causing a surge in inventory and price weakness!”

In other words, if you're a real estate agent, it's always a good time to buy or sell property.

There is a lot of cheerleading and fluff pieces out there about demand surging post all these IPOs. But I've come to a different conclusion as a San Francisco resident since 2001, and a San Francisco property owner since 2003.

Let's do some analysis as to how much demand there really will be for SF Bay Area housing. The demand for big city living is back now that so many have gotten vaccinated. Personally, I would be buying SF Bay Area real estate in 2021 and beyond.

How Tech IPOs Will Affect SF Bay Area Real Estate Prices

Let’s make some simplifying and generous assumptions to make the math easy and put a ceiling on the number of eligible home buyers.

* The wealth threshold an employee will use is to have $1M in cash *after* taxes so they can use some of their cash to make a sizable down payment, ending up with a loan they can afford as well as a chunk of savings in addition. (E.g. $500k down payment on a $1.2M condo) Anyone back this up based on small condo / home prices we might expect the “average” employee to seek? This is one assumption that may not be generous enough.

* Vast majority are not highly-comped execs

* Average employee has been with the company ~2 years

* Does not already have large cash reserves

* Option strike price of effectively zero (definitely false)

Employees cannot early-exercise their options, which means they must exercise at the time of sale, incurring ordinary income gains. At that level, let’s include 50% in taxes so they need $2M in options.

Tech IPO Valuations

Let’s say the company IPOs at a $20B valuation (Lyft is IPOing at roughly $10 billion). To get $2M in proceeds the employee must liquidate 0.01% (1bp) ownership in the company.

Now let’s go back to our assumptions. If they’ve been there 2 years at IPO time and they want the money within a year of IPO, they’ll only have vested 3/4 of their initial 4-year grant, which means they must have been granted 1.33bp ownership.

The strike price is also not zero; considering rocketship growth it may be 10-20% of the FMV at IPO. So now they need a 1.5bp grant.

Employee option pool sizes at this stage are typically between 15-18%. And of course they’re not distributed evenly. At a $20B company there are probably no more than 1000 employees who could end up owning 1.5bp (that totals 15% and assumes uniform distribution). The real number is probably more like 500.

So at a $20 billion valuation post IPO, if it holds in time for employees to sell usually 6 months after the lockup period is over, the IPO may yield 500 eligible buyers.

The Number Of Techies Willing To Buy Real Estate

Now multiply these 500 people by how many will ACTUALLY enter the market with this money in the ensuing year. If 50% want to buy property, that's 250 eligible buyers. If 20% want to buy property, that's only 100 eligible buyers.

The intent to buy percentage is certainly not 70% – 100% want to buy property since some already have property, don't want the hassle of owning property, think property prices are too expensive, or want to take their gains and move away from the Bay Area.

A total of $100B in valuation with the same math would roughly equate to about 500 buyers if we use a 20% intent to buy percentage, or 1,250 buyers using a 50% intent to buy percentage.

This is a full order of magnitude, and then some, less than the projected number the media is throwing out about 10,000+ new millionaires. The NY Times even published a quote saying they believe the average home price will be $5 million soon. Nonsense.

Total New Demand From Tech IPOs

If we add up the total projected public values of Uber, Lyft, Airbnb, Palantir, Pinterest, Slack, and several more, we're talking about a total public value of roughly $200B from 2019 – 2020. Uber, alone, is estimated to be worth around $100-$120B.

Therefore, one can make an educated guess there will be anywhere from 1,000 – 2,500 new buyers resulting from all these IPOs over a 1-2 year period.

These 1,000 – 2,500 new buyers with $1 million in cash after tax are therefore looking for properties worth between $1 million – $4.5 million based on a 20% – 100% downpayment.

We've read some hyperboles about how there will be 10,000+ new real estate buyers after this batch of tech IPOs. We've also read articles quoting people who believe the average SF Bay Area home price will rocket to $5 million. Such data is nonsense in my opinion.

Perhaps in several decades average SF Bay Area prices really will be $5 million, but definitely not within the next 5- 10 years.

How Will SF Bay Area Home Prices Be Affected

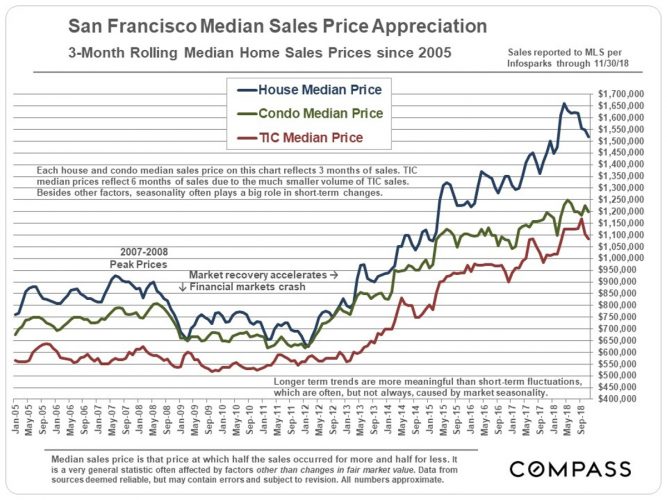

The SF Bay Area real estate market finally cooled off in 2018. Inventory has risen and the median home price has fallen. Real estate prices have outpaced wage growth for so long that this slowing was bound to happen.

The S&P 500 closed down 6.4% in 2018 due to fear of slowing earnings growth, which is happening in 2019. Some tech companies like Nvidia, Facebook, and Apple lost 20% – 40% of their value, so investors are on edge.

Check out these price and inventory charts by Compass, the largest real estate broker in San Francisco and from Realtor for the inventory data.

At any given time, there are 7,792 homes for sale in March 2019 in San Francisco, up from 6,233 a year before according to Zillow.

In the San Jose area, there were 3,011 homes for sale in March 2019, up from 2,102 the year before. That's an almost 50% YoY increase inventory folks.

Tech IPOs Should Boost Demand

One can conclude that an incremental 1,000 – 2,500 new buyers over the next two years will be significant. Further, probably only around 30% of the existing inventory is attractive to such buyers.

However, the default assumption everyone has is that the tech IPOs will bring in huge demand and drive up prices. What people are UNDERESTIMATING is that amount of pent up SUPPLY that is waiting to be unleashed that may very well overwhelm the incremental demand.

2019 marks the 10th year of a bull market. Real estate prices are up 80% – 100%+ since 2012. The SF Bay Area population is aging. Meanwhile, the area is becoming congested and unaffordable.

Further, there is a demographic trend away from the SF Bay Area to the heartland of America because costs are much lower. It's due to outrageous prices, congestion, homogeneity, and technology that is making people vote with their feet.

Google, for example, announced in February 2019 they are spending $13 billion to expand into the heartland. If Google, one of the wealthiest companies on Earth is finding it cost ineffective to pay their engineers $500,000 because it costs $3.3 million to buy a median priced home in Palo Alto, you know other companies are expanding into the heartland as well.

Further, one can reasonably a recession to hit by 2021 if history is any guide. The recession likely won't be as bad as what we experienced between 2008-2010, but still, going in reverse is not great for home prices.

Control Your Buying Emotions

I foresee a continued increase in inventory of homes over the next few years because homeowners are finally looking to cash out. They witnessed the decline in 2018, and now are seeing the tech IPOs as another chance to sell at all-time highs. The housing market is hot, but please buy responsibly.

Despite there being 50,000 – 70,000 employees at these upcoming tech IPO companies, there are 7 million people in the SF Bay Area. Even if just 20% of them own homes, that's 1.4 million homeowners who may be itching to sell.

This surge in inventory will more than negate the uptick in demand. We'll likely see a price surge in 1H2019, as we normally see a seasonal uptick. But over the next 2-3 years, we could see prices soften for another 5% downside. We're already down about 5% from all-time highs.

Don't believe the hype folks! There is always two sides to the equation, and the media and real estate agents are only making you focus on the demand side. Keep your head on straight.

Just like there is FOMO for buying, there is FOMO for selling. It is much more stressful to sell a property than to buy a property. If you don't find a buyer, then you are stuck with a stale fish property. If you don't buy a particular property, there's always another one.

Buy Property To Live Life First, Invest Second

At the end of the day, you should buy a property to live in and enjoy life first. Do the math. Run the numbers. If you foresee owning your home for at least five years and the cost makes sense after putting at least 20% down, then go ahead and buy.

If you want to invest in real estate once you own your primary residence, it's much better to invest outside of the SF Bay Area where cap rates (net rental yields) are 3-5X higher, and valuations are 50% – 80% lower.

Check out the best real estate crowdfunding platform Fundrise. They have a variety of eREITs, commercial real estate, and multi-family real estate projects you can invest in outside the SF Bay Area for as little as $1,000. All their investments have been pre-vetted.

I truly believe investing in non-coastal city real estate is going to be a multi-decade trend. Thanks to telecommuting, video chat, the internet, mobile phones, and new work tools, both companies and employees are moving to cheaper areas of the country.

Investing in real estate is the most logical way to invest in this trend. Thankfully, since the passage of the JOBS Act in 2012, we're now able to do so more easily with the likes of Fundrise, my favorite real estate crowdfunding platform. They are the most innovative platform with the largest variety.

I personally sold one SF rental and reinvested $550,000 of the proceeds into real estate crowdfunding to potentially earn higher returns much more passively. Being a landlord in SF can really stink sometimes!

About the Author: Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.