This Financial Samurai newsletter is proudly sponsored by Fundrise, my favorite platform for private real estate and private company investments. With a minimum investment of just $10, it’s never been easier to gain exposure to high-quality private investments. Personally, I’ve invested over $290,000 with Fundrise to date.

Dear Financial Samurais,

The brazen assassination of the UnitedHealthcare executive got me thinking about making a living off the suffering of others. It also made me wonder: how much money is it acceptable to earn if you don't feel your company or product doesn’t provide a net benefit to society?

This wealth-versus-morality dilemma is something I wrestled with during my time in banking, especially through the global financial crisis. Ultimately, I walked away from finance in 2012, partly because it no longer felt right to work in an industry so heavily vilified—even though I had nothing to do with mortgages.

Perhaps you’ve faced a similar dilemma in your career: making money while questioning the impact of your work. Early on, you might tolerate a job or a company you’re not proud of because you need the money to survive. You start telling yourself things to justify what you do. But over time, as you save and invest enough to gain financial security, the question becomes: when is it time to leave?

The answer is deeply personal. But I believe you’ll know it’s time to move on when your internal morality clock starts ticking loudly enough. The danger lies in ignoring that sound—like brushing off a nagging chronic pain—until it’s too late to make a change.

If you’re seeking a rational way to leave your job—one that ensures you feel good about your life while minimizing the risk of financial ruin—check out: Wealth vs. Morality: The Dilemma of Profiting From Sin.

The Future Of The Housing Market

After compiling various 2025 S&P 500 forecasts, I’ve now put together a list of 2025 housing price predictions from different institutions. The consensus? Another strong year is ahead, following what appears to be a 4% national increase in the median home price for 2024.

With significant wealth gains from the stock market, it’s likely some of that money will flow into real estate. After all, the best way to enjoy stock market profits is to sell some shares and buy tangible assets. Additionally, after two years of adjusting, buyers seem more comfortable with mortgage rates in the 6% range. As a result, many are choosing to “get on with their lives” by purchasing homes they need or want.

See: 2025 Housing Price Forecasts

However, there are some concerns. November saw the largest monthly inflation increase (0.3%) since April. On a year-over-year basis, inflation rose to 2.7%, up from 2.6% in October and 2.4% in September. This contributed to the 10-year bond yield climbing to approximately 4.3%.

Interestingly, the odds of another Fed rate cut on December 18 have risen to 97%, signaling the market’s lack of concern and positive response to the latest inflation data. That said, expectations for rate cuts in 2025 have been scaled back to just two, down from four initially anticipated.

Regional Strength In The Housing Market

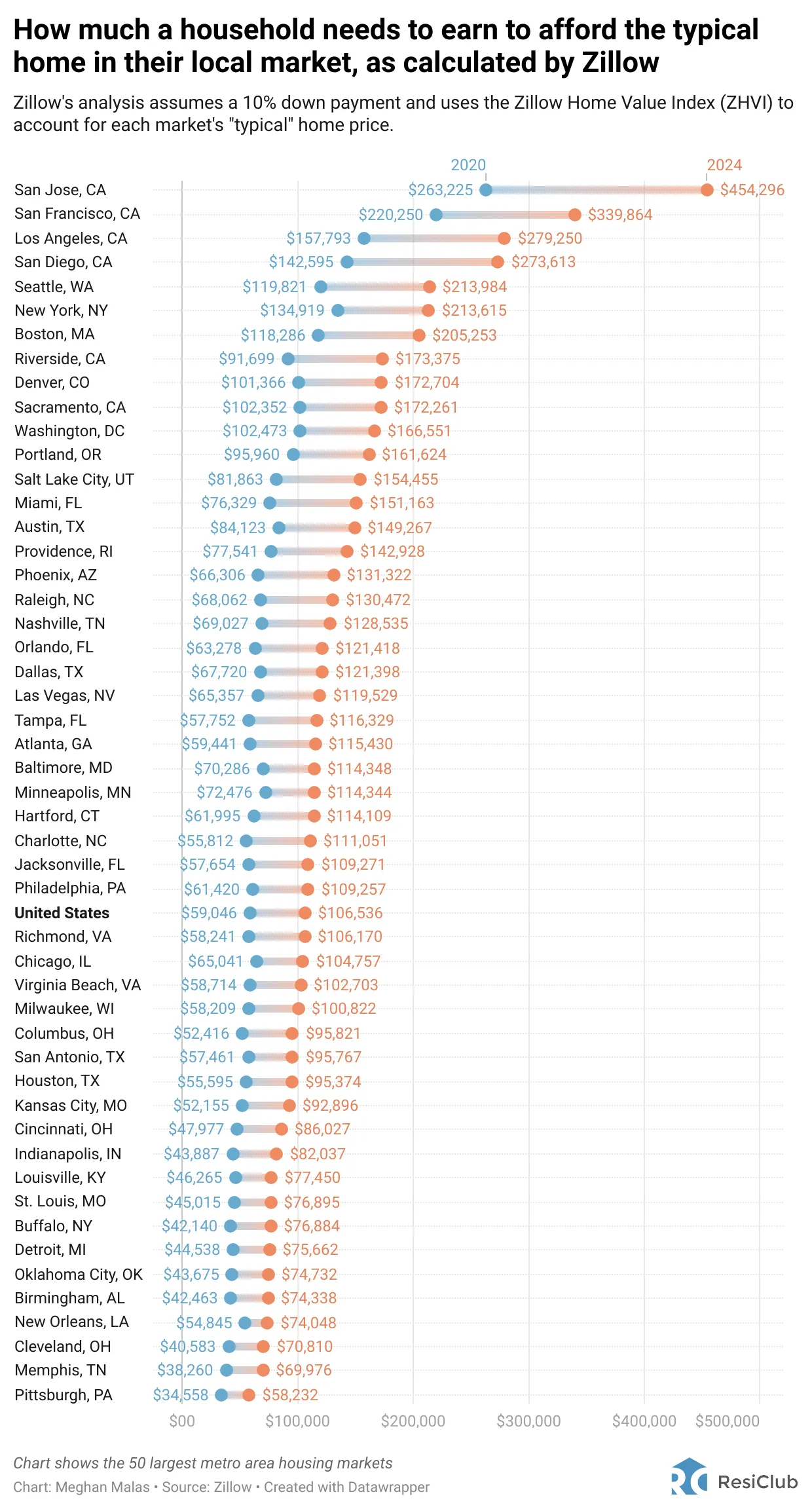

What’s most fascinating about the 2025 housing market forecasts are the areas of relative strength. Goldman expects robust price growth in California, with cities like San Jose potentially seeing up to 10% appreciation over the next year. Such a jump is remarkable, considering San Jose already appears to have the most expensive housing market in America.

By one calculation, a household income of $454,296 is required to afford a typical home in San Jose in 2024. That level of income makes San Francisco, with similar job opportunities, seem downright affordable by comparison.

On the other hand, Goldman remains cautious about the Southeast, particularly Florida, citing slower real income growth, affordability challenges, and rising insurance costs.

As investors, it's our job to identify trends and connect the dots. My latest dot-connecting involves focusing on cities experiencing the largest percentage increase in employees returning to the office. The idea is that, just as “Zoom towns” thrived during the work-from-home boom, major cities with strict land-use policies stand to benefit from the return-to-office movement.

See: Capitalizing On The Return To Office Trend

For Fun, Calculate What Your Net Worth Could Be

It’s always risky to count your chickens before they hatch. However, if the stock market is projected to rise another 7% and the housing market another 3%, take a moment to calculate what your net worth could look like under these scenarios. Then, compare that figure to your financial freedom target.

If your projected net worth by the end of 2025 is nearing your goal, it might be time to seriously consider transitioning out of a job where you feel morally conflicted. After all, if you’re not feeling good about the work you’re doing, you’re ultimately wasting your life. For a more precise financial calculation, revise my Minimum Investment Threshold post where work becomes optional.

For retirees, these forecasts suggest a 3%–5% withdrawal rate is not only safe but may even be too conservative if you want to decumulate wealth. If the stock market and real estate projections hold true, you might find yourself even wealthier a year from now, despite withdrawing funds.

Join 60,000+ others and sign up for my free weekly newsletter here.

To your financial freedom,

Sam

Diversify Your Retirement Investments Into Real Estate

Investing in stocks and bonds in your 401(k) or IRA are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

There is a multi-decade demographic shift towards lower-cost areas of the country thanks to remote work. Technology has enabled more people to work from home or anywhere in the world. Post-pandemic, this trend has only accelerated.

I’ve personally invested over $290,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.