Dear Readers,

What a chaotic week it's been for the stock market. There was more flip-flopping on tariffs by President Trump than a fish out of water! Although it's too soon to feel the impact of trade policy changes, the fear is that consumer spending could slow down due to all the uncertainty. And if we stop spending like it's 1999, we risk driving ourselves into a recession.

Following the muted February jobs report, the market is now pricing in a ~52% chance of a Fed rate cut in May and an 86% chance of a cut in June. On Friday, Fed Chair Jerome Powell stated, “We do not need to be in a hurry and are well positioned to wait for greater clarity on trade, immigration, fiscal policy, and regulation.”

With the S&P 500 down about 7% from its peak and the NASDAQ at one point off 11% from its peak, I'm reminded why I prefer real estate over stocks. The slow, steady Eddy nature of real estate is comforting. Even when prices decline, there's no flashing ticker reminding you by how much. This ignorance often results in a more peaceful and longer holding period.

All this uncertainty is terrible for stocks, but ironically fantastic for real estate. When it's hard to forecast corporate earnings, people tend to gravitate toward hard assets with greater earnings certainty. Could 2025 finally be real estate's year to outperform stocks? I think so. Check out Fundrise if you want to take advantage of the recover in the commercial real estate market.

See: Chaos, Fear, And Uncertainty: A Real Estate Investor's Best Friends

It's Too Hard To Time The Market, Easier To Control Your Life

Whether you're timing the bottom of the stock or real estate market, consistency is incredibly difficult. That's why dollar-cost averaging and investing for the long term remain the best strategies. If prices fall faster than expected, increase your investment size. If prices are at unsustainable highs, reduce your investment exposure.

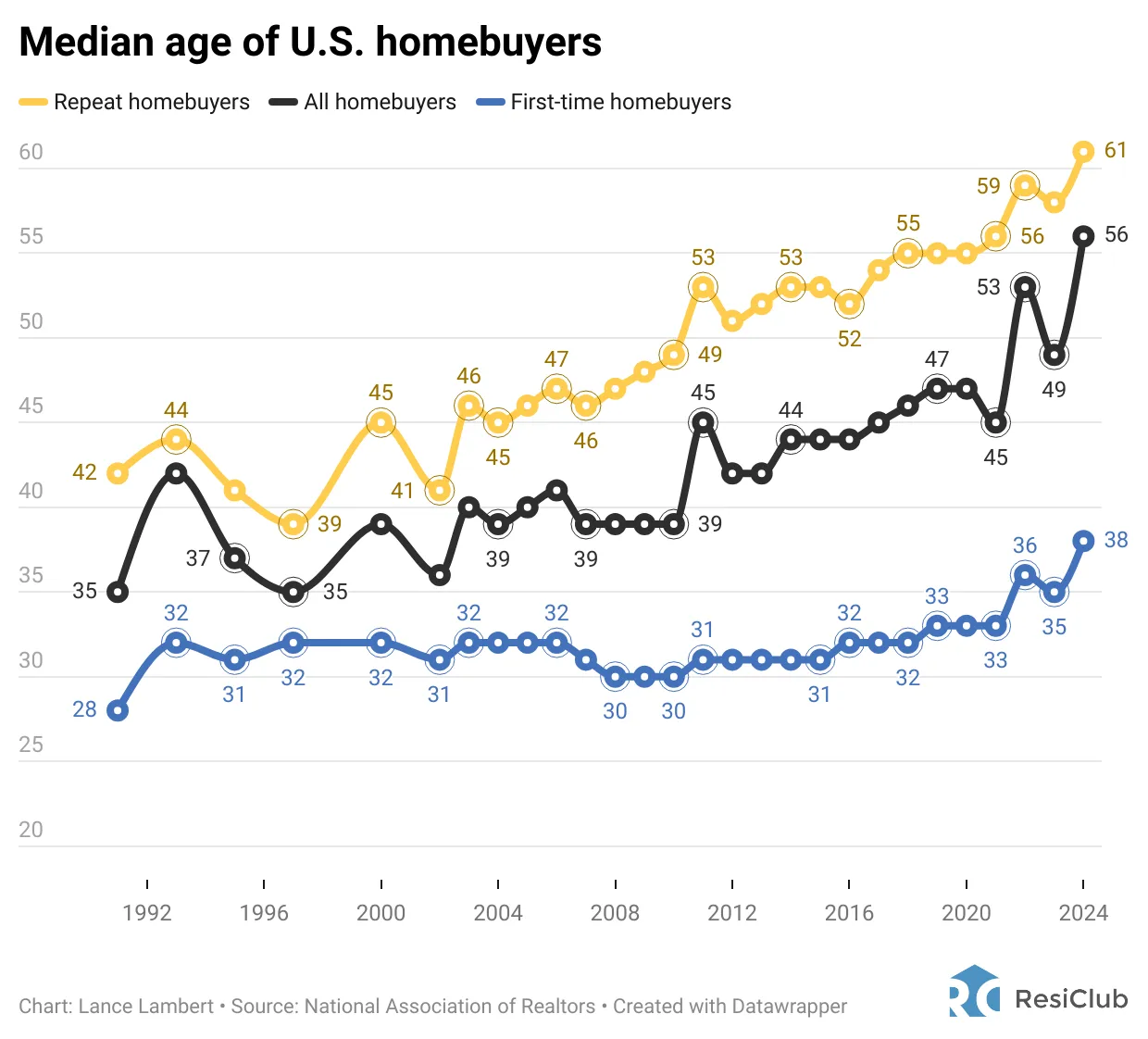

I recently came across a surprising stat: the median age for first-time homebuyers is now about 38 years old. Rising home prices are partly to blame, but this is concerning for those waiting to buy at a lower price and are now pushing 40.

Many people delay buying a home until they've found a life partner. However, Americans aren't living longer to accommodate these delays. In fact, life expectancy has been declining since COVID.

One of my biggest regrets was waiting longer than necessary to propose and start a family. Despite buying my first property at 26, I delayed proposing for five years because I thought I needed a certain net worth and career success first. Looking back, this hyper-focus on money and career delayed family formation by 3-5 years.

If someone had told me to STOP waiting for the perfect financial scenario and start building a family sooner, I'd be better off today. Now, I'm eating fewer cheeseburgers and having to exercise an hour more a day than I'd like to just to increase my chances of maximizing my potential lifespan!

So please, don't neglect your relationships in pursuit of wealth. Be as intentional about building love and family as you are about building a large net worth. And if you're already in a relationship, don't take it for granted. Show your partner they are appreciated, today!

See: Waiting For The Perfect Price Could Hurt Your Lifestyle And Happiness

Let's Get Through March

I'll leave you with a couple of hopeful charts for the stock market. One chart shows how the S&P 500 and Russell 2000 have performed during Trump's second term versus his first. Optimists may see this and think, “It can't get much worse,” and start buying the dip. These buyers may believe the President doesn't want to trigger higher prices, mass layoffs, or a decline in retirement portfolios. Additionally, the Fed will likely step in to cut rates or restart quantitative easing if growth slows too much.

Another chart reveals that March is traditionally the most volatile month of the year. Remember March 2020 when the S&P 500 cratered 32%? If we survive March, volatility typically fades for a few months before ramping back up in October (e.g. crashes of 1929 and 1987).

Since nothing fundamental has changed about the economy yet, and peace agreements can be made quickly, I'm buying this dip more aggressively than normal. A 10% pullback from the S&P 500's recent all-time high is 5,530 — we're about 4% away. With a risk/reward ratio of -4% to +10%, I'm a buyer.

Valuations remain elevated at around 21X forward earnings, which is a risk. There isn't “blood in the streets” yet, but my vulture investor instincts are awake and ready to identify opportunities if more self-inflicted wounds occur this year. Identify sources of cash or low-risk assets you can easily liquidate to take advantage of potential opportunities in 2025.

As always, please conduct your own due diligence before investing. I'm simply sharing what I'm doing with my money, not what you should do with yours. Everyone's financial situation, goals, and risk tolerance are different. We are responsible for our own decisions.

See: It's Time To Awaken The Vulture Investor Within

To Your Financial Freedom,

Sam

P.S. Does anyone have a furnished two-bedroom rental or larger in Kaimuki, Honolulu, for 4-6 weeks this summer? It'll be for my mom and dad. Ideally, it's within walking distance of 11th Avenue and Harding Avenue, where my dad exercises. We're planning to send our kids to summer school in Honolulu for five weeks, testing the waters for a potential move in 2032 for high school. Let me know!

If you were forwarded this newsletter, you can join 60,000+ others and sign up here. My goal is to help you achieve financial freedom sooner rather than later. Everything is written based on firsthand experience and knowledge.

If you enjoy listening to podcasts, I recorded a new one last week and have several more in the pipeline. Your reviews and ratings are appreciated as every one takes hours to produce. Listen on Apple or Spotify.