Dear Financial Samurai,

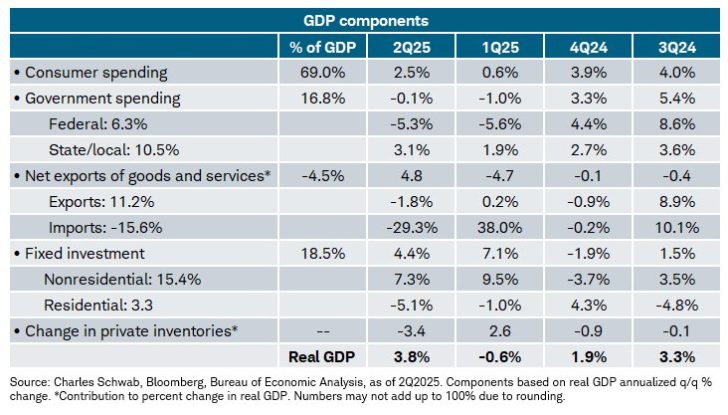

The biggest economic news is that 2Q GDP was revised upward by 50 bps, from 3.3% to 3.8%. The revision reflects much stronger than expected consumer spending, rising incomes, and lower imports. Therefore, the economy is running stronger than expected and hopes of another rate cut this year declined.

What's also interesting is that about 50% of all spending is conducted by the top 10% income earners – a record high. Given income is correlated with investment amounts, I assume the bull market in almost everything is encouraging higher income earners to spend more. Is that you? Let me know.

What I do know is that I feel lucky that the S&P 500 is up over 10% YTD after being down about 20% in early April. So I finally did some YOLO spending on myself, which I'll share in an upcoming post. When you can convert funny money profits into something you can enjoy, it feels wonderful!

AI Super Spending

Nvidia announced a $100 billion investment to help OpenAI build massive data centers powered by its chips. The next day, OpenAI revealed deals with SoftBank and Oracle to construct five new data centers as part of the Stargate Project, a $500 billion plan for AI infrastructure first introduced at the White House in January.

These moves are part of a global race to build AI data centers. OpenAI, Amazon, Google, Meta, and Microsoft together plan to spend over $325 billion on them by year-end. To stay on the bleeding edge, they’re pouring money into the newest processors, advanced cooling systems, and facilities that run 24/7 on staggering amounts of electricity.

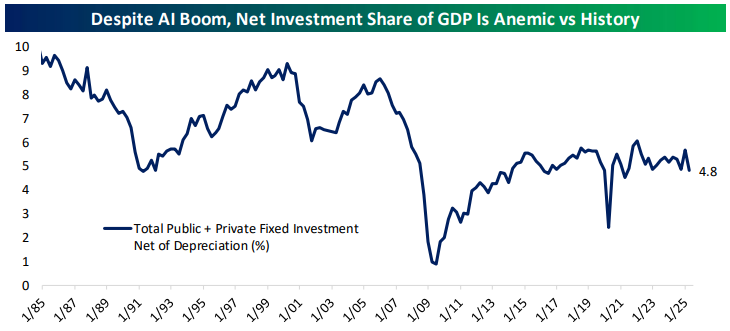

Here’s the kicker: despite this AI spending boom, total U.S. investment net of depreciation is only 4.8% of gross domestic income, a multi-year low. Historically, it has been closer to 10% or more, which means there’s still plenty of room to grow.

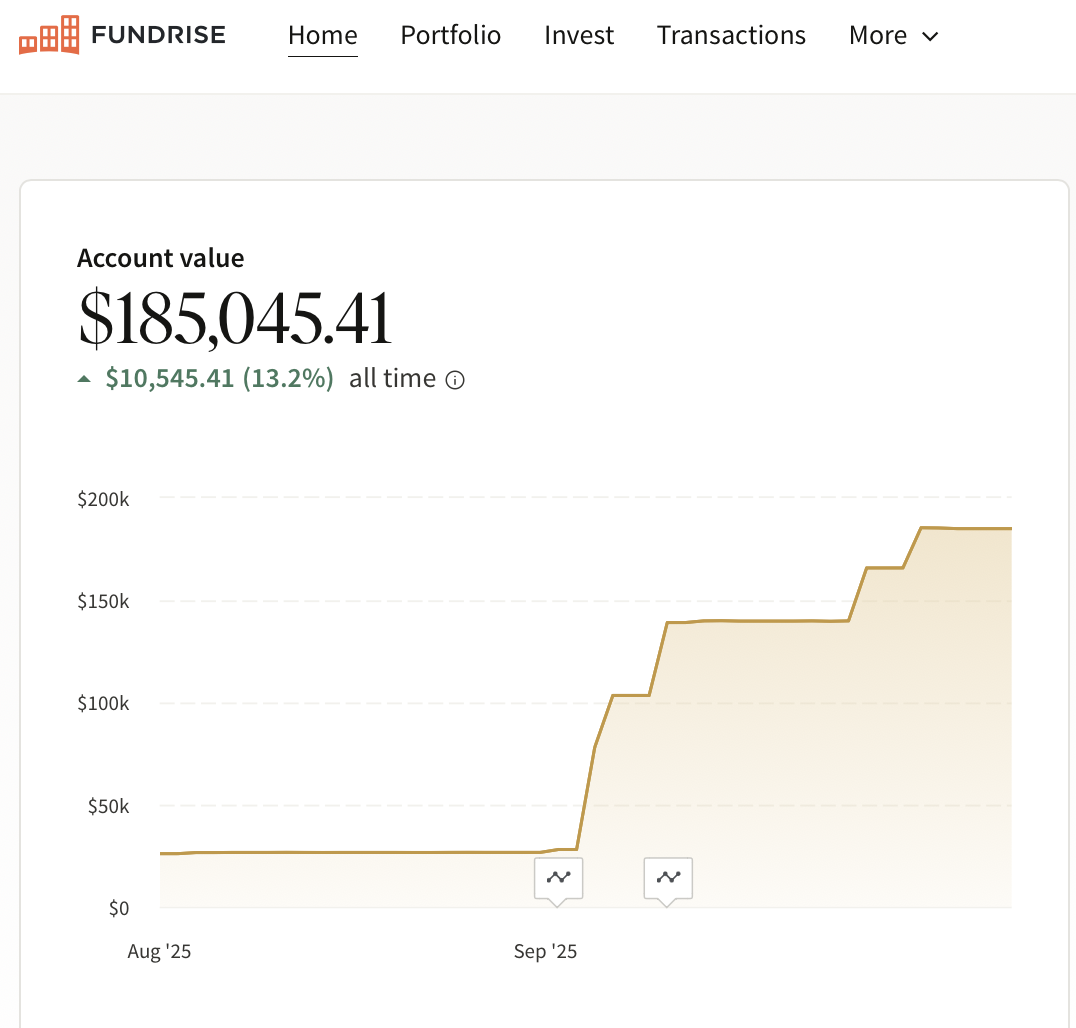

Seeing this kind of circular AI investment support alongside stronger-than-expected consumer demand, the logical move for me was clear. I invested another $20,000 in OpenAI and other private AI companies through Fundrise Venture after the news broke. With the pace of investment and revenue growth, I don't see why OpenAI can't be the next trillion dollar company. It's currently worth about ~$500 billion today.

The only good thing about being old enough to remember and invest in the first Dotcom boom was having perspective. And based on my experience (and fading memory), we are about at 30% – 40% of the level of hype we experienced in late 1999 / early 2000, when the bubble finally popped.

But this time around, company balance sheets are much larger and income statements are much stronger. Companies just might be able to grow into their heightened valuations and expectations.

Ripple Effects With The San Francisco Rental Market

What’s happening in San Francisco feels like déjà vu, just like when Google and Facebook went public in 2004 and 2012. Billions of dollars poured into those companies, billions more in profits were generated, and Bay Area real estate became a prime beneficiary.

Owning Bay Area rentals over the next 10–20 years should again be a smart financial move. But 10–20 years is a long time to wait, which is why more property owners are considering something new: keeping their rentals empty. Sounds crazy, right? Yet if you’ve already made a fortune from private growth investments and public markets, you can afford it.

If the carrying cost is roughly 1.5% a year while the property appreciates by 3.5% and your other investments are compounding even faster, why bother with tenants and maintenance headaches?

I understand some people will be upset by this move. But if renting weren’t such a hassle to some landlords, these landlords wouldn’t even consider leaving their properties empty. In the long run, everything is rational.

Check out: Purposefully Leaving A Rental Property Empty As A Luxury Move

No Innovation, No Worries

On the other side of the AI frenzy are quasi-monopolies that barely need to innovate. With massive moats and entrenched ecosystems, they can earn super-normal profits without introducing anything groundbreaking.

My favorite example is Apple, where I’ve been a shareholder for over 15 years. Even though Warren Buffett sold roughly 67% of his holdings from late 2023 through 3Q 2024, I stayed put. Getting a large seller out actually relieves pressure and makes room for new investors.

The iPhone 17 isn’t revolutionary—unless you count a camera tweak as innovation—but Apple still raised the price by $100 (about 10%). Apple TV+ isn’t bad either, and they hiked prices by 30%. Then in September, a judge ruled Apple can continue receiving $20+ billion from Google to remain the default browser in Safari. Huge.

Given it’s nearly impossible to beat a monopoly, I’d rather invest in them. Check out: Resistance Is Futile: Invest In Monopolies To Win. The logic is similar to the top 10% or 1% of earners who capture the biggest gains in a bull market. It's hard for the person with a negative net worth to ever catch up.

People Would Far Rather Make Money Than Give It Away

Finally, with strong investment gains, I’ve been thinking more about giving. When you make money doing almost nothing, it can feel like winning the lottery.

Part of you thinks you deserve it for taking risks; another part wonders if you really earned it. One way to ease that tension is to give.The more time and money you share, the better you’ll feel and the luckier you’ll get. Spread the luck to as many people as possible!

Unfortunately, the data says otherwise. Articles about making money draw roughly three times the traffic of articles about giving it away. My latest post, The Difficulty Of Donating Money When You're Unemployed Or FIRE, is no exception. I tried to make it interesting by framing it as a battle of opposing forces. Still, most of us focus on what we can get, not what we can give.

Based on the feedback, I’ve lined up some upcoming posts on how we can feel at peace taking far more than we give. In the meantime, I hope you enjoyed this week’s free newsletter. It’s been running for well over 10 years now.

To Your Financial Freedom,

Sam

Suggestions

If you want to participate in the AI boom, check out Fundrise Venture. It invests in leading private AI companies such as OpenAI, Anthropic, Databricks, and Anduril. I’ve personally invested over $500,000, and Fundrise has long sponsored Financial Samurai because our investment philosophies align. Please only invest in what you can afford to lose. There are no guarantees when investing in risk assets.

If you’d like my posts delivered to your inbox as soon as they’re published, subscribe here. I share three posts a week on real-life personal finance topics you may be facing now or will encounter someday. If someone forwarded you this newsletter, you can subscribe here too.