In the financial technology (Fintech) industry, two applications continue to stand as the powerhouses: Personal Capital and Wealthfront. Both aim to install simplicity into wealth management. Both are accessible from anywhere in the world that has an Internet connection. This post compares Personal Capital vs Wealthfront for your retirement needs.

Personal Capital vs Wealthfront

In my opinion, both tools offer incredible value. If you like pure digital wealth advisory with no human involvement, Wealthfront is your best choice.

However, if you like a hybrid model of digital wealth advisory plus registered investment advisors to help you on your financial journey, Personal Capital is the best choice. You can set up a free consultation first to see if Personal Capital is right for you.

What's great about Personal Capital that Wealthfront doesn't have is free financial tools. I've been using Personal Capital's free financial tools to keep track of my wealth since 2012. You should do the same.

Personal Capital's overall capabilities of bringing together your money from a wide variety of different accounts, consolidating your income and expenses as well as offering a hugely influential retirement calculator, has the advantage.

And if you're looking for financial advise, Personal Capital has advisors standing by.

But, don't just take my word for it. Let's take a look at each application to get a better feel for their primary set of features.

Personal Capital Overview

Personal Capital brings all your money together into a single repository. It's never been easier to take in a full picture of your financial lifestyle.

To do a thorough Personal Capital vs Wealthfront review, let's go deep into Personal Capital first. Here are the four most useful features of Personal Capital.

1) Simplicity to money management.

Before Personal Capital, I had to log into eight different financial institutions to track over 30 different financial accounts ranging from brokerage accounts, money market accounts, CD accounts, checking accounts, IRA, and my 401K. My finances were a mess, and I’m sure your finances could use some organization as well.

Now I can just log into Personal Capital to see how everything is doing in one place. It’s important to have a holistic view of your overall financial health so you know where to allocate resources.

2) Cash flow visibility.

Keeping track of both your expenses and income is personal finance 101.

By tracking your income and expenses, you will be able to save a lot more money than if you simply tried to guess everything.

Think about all the times you withdrew cash from the ATM machine and had no idea where all the money went a couple days later. Aggregating all your accounts allows you to see where all your money is going.

3) Personal Capital helps balance investment risk.

With so many accounts, it’s often hard to see exactly what’s going where.

For example, so many people were too overweight stocks before the financial crash in 2009. With Personal Capital, you can easily see where the imbalances are in your net worth so you can make smart adjustments.

Now that it’s a bull market, investors are probably too overweight equities and way underweight bonds once again.

The Investment Checkup tool analyzes your portfolio’s holdings based on size, style, and sector. Personal Capital excels for those who have assets in the stock market.

Personally, I like to maintain a 35%, 35%, 30% split between stocks, real estate, and CDs/bonds.

4) The Best Retirement Planning Calculator.

The award winning product team came up with what I think is the best retirement calculator on the market because it uses real data and Monte Carlo simulations to come up with the most realistic financial scenarios for your future.

Other calculators simply ask you to guess input values to then come up with your financial future. The problem with this method is that we often underestimate how much we are saving and spending! You can input different life events such as a wedding or home purchase in your cash flow statement and recalculate your financial future to see how you’ll do.

Everybody should give it a try. It is the best retirement calculator today.

Wealthfront Review

For this Personal Capital vs Wealthfront review, let's now do a deep dive on Wealthfront.

Launched in 2011, Wealthfront is the only robo-advisor solely focused on young people in their late 20s to early 40s who prefer to do everything online. They are the founders of this space and technology is in their DNA.

It was one of the first companies in the industry to bring online investing mainstream, and they clearly have their finger on the pulse of, well, everything related to investing your money.

What are Wealthfront’s most unique features?

- Free software based financial planning powered by its automated advice engine, Path, that instantly gives answers to over 10,00 financial questions

- PassivePlus® investment features that are not offered by other automated advisors including Stock-Level Tax-Loss Harvesting, Smart Beta and Risk Parity

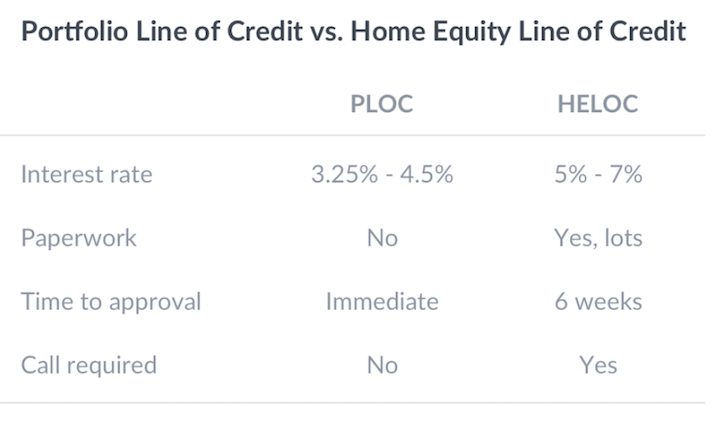

- Portfolio Line of Credit that allows clients to borrow faster, easier and less expensively than from other providers

- Easy transfers that allow you to transfer cash or stock into and out of Wealthfront quickly and for free

Here's what I like about Wealthfront.

Free Financial Planning

In 2018, Wealthfront became the first

For example, here’s what you can expect from using their mobile app:

This is very different from other services that only offer planning to clients who open an investment account first, charge a premium for it and deliver it through a call with a CFP.

Automated Investment Management

Wealthfront offers more than just a personalized investment experience through diversified and balanced index funds. It also offers the broadest suite among all robo-advisors of tax efficient passive investment products.

These strategies known as PassivePlus®, which traditionally have only been available to the very wealthy, are grounded in academic research and made possible through implementation in software.

Wealthfront offers its investment services through a range of account types, like:

- Individual, and joint and Trust non-retirement accounts

- Roth, traditional, SEP and rollover IRAs

- 529 College Savings Plan accounts

Wealthfront Path

Wealthfront Path is a free automated financial planning experience for all clients to better plan for their financial future.

WF built something more personal, connected and instant than any financial advisor could ever be. Path takes advantage of their team of PhDs to analyze your past behavior from connecting to your financial accounts, showing you what’s possible for your future.

As your financial advisor, it’s Wealthfront’s job to sometimes be the bad guy and tell you that you can’t necessarily afford the lifestyle you want. So Wealthfront designed Path to first assess your basic financial health, before we let you imagine what’s possible. They start with your needs before they get to your wants and wishes for one simple reason: If the foundation is shaky, then the rest is irrelevant.

Wealthfront Path let’s you:

- Financially plan for your future

- Explore “what if” scenarios

- Highlight how much you need to save to reach your goal by a certain date

- Highlight how much you can spend to still be on track

- Model your investment forecasts

- Home Planning

Lending

If you have $100,000 invested, then you’re automatically enrolled in Wealthfront’s Portfolio Line of Credit (PLOC). For those looking for lower interest rates and a much smoother approval process, a PLOC is perfect.

In most cases clients can get their money in less than 24 hours.

While both Personal Capital and Wealthfront are worthy web-based applications, it is wise to use them both. Use Wealthfront to actively manage your investments online, but also use Personal Capital as a tool to gain visibility into your entire financial life.

Sign Up With Personal Capital

Once you are financially secure, you free to do whatever you truly want. Get a handle on your finances by signing up with Personal Capital for free and aggregating all your accounts.

The financial management tools are free and

About the Author: Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. Personal Capital vs. Wealthfront is a FS original post.