Real estate syndication is a way for investors to pool their financial and intellectual resources to invest in properties and projects much bigger than they could afford or manage on their own.

In the past, only the wealthiest and most connected individuals could participate in real estate syndications. After all, these syndications would usually invest multi-millions in commercial real estate properties around the country.

The emergence of real estate crowdfunding since the JOBS Act passed in 2012 has accelerated an individual's access to real estate syndication.

Personally, I've invested $954,000 in real estate syndication since 2016. As a multi-property owner in San Francisco, I wanted to diversify into the heartland of America. So far, I've received over $630,000 in distributions and have written about my private real estate experience after seven years.

Let's look into the basics of real estate syndication and how it works in more detail

Real Estate Syndication Basics

Real estate syndication is a transaction between a Sponsor and a group of Investors.

As the manager and operator of the deal, the Sponsor invests the sweat equity. This includes scouting out the property and raising funds. In addition, the Sponsor acquires and manages the investment property’s day-to-day operations. Meanwhile, the Investors provide most of the financial equity.

The Sponsor is usually responsible for investing anywhere from 5-20% of the total required equity capital. Then investors put in between 80-95% of the total. The more the Sponsor invests in the deal, the better for the investor. Always investigate the capital stack before investing in a deal.

Most importantly, the more the Sponsor invests in the deal, the better for the Investor. You want the Sponsor to have as much skin in the game as possible. You also want to see the Sponsor have a long track record of performance with a strong management team.

Remember, every piece of marketing material makes a new deal look great. However, not all deals work out. Therefore, having an honest Sponsor talk about its past failures or lower-than-expected returns is attractive.

If you plan to invest in a real estate syndication deal from the likes of CrowdStreet or RealtyMogul, it is vital you do as much due diligence about the sponsor as possible. Then you need to build a diversified portfolio of individual deals.

Real Estate Syndication Legal Structure

Syndications are usually structured as a Limited Liability Company or a Limited Partnership. The Sponsor participates as the General Partner or Manager. And the investors participate as limited partners or passive members.

Further, the LLC Operating Agreement or LP Partnership Agreement are vital documents. They set forth the rights of the Sponsor and Investors. This includes rights to distributions, voting rights, and the Sponsor’s rights to fees for managing the investment.

The LLC or Limited Partnership structure is very similar to the set ups of other private funds in the Venture Capital, Private Equity, and Venture Debt space. Such legal entities are there to protect both the Sponsor and the Limited Partners if the deal goes south.

Real Estate Syndication Profits

Property appreciation and rental income are the two main ways the Sponsor and the Limited Partners make money from real estate syndication.

Rental income from a syndicated property is distributed to investors from the Sponsor. This typically occurs on a monthly or quarterly basis according to preset terms. A property’s value usually appreciates over time. Thus, investors can net higher rents and earn larger profits when the property is sold.

Payment of rental income or profits depends upon the time the investment needs to mature; some types of syndications are over within 6-12 months while others can take 7-10 years. Everyone who invests receives some share of the profits.

Sponsor's often take an upfront profit at the beginning of the deal for sourcing and acquiring the property. This is call and acquisition fee. An average acquisition fee of 1% (although it can be anywhere from .5 to 2% depending upon the transaction).

Before a Sponsor shares in the profits for their work as manager and promoter, all investors receive what is called a ‘preferred return.’ The preferred return is a benchmark payment distributed to all investors. That is usually about 5-10% annually of the initial money invested.

A Real Estate Syndication Example

Real estate syndications are structured so that the Sponsor is motivated to ensure the investment performs well for everyone. The more the Sponsor invests in the deal, the more aligned the sponsor is with Investors.

Let’s look at an example of a preferred return.

Let's say you’re a passive investor who invests $50k in a deal with a 10% preferred return. You could take home $5k each year once the property earns enough money to make payouts possible.

After each investor receives a preferred return, the remaining money is distributed between the Sponsor and the investors based on the syndication’s profit split structure.

If the profit split structure is 70/30 — investors net 70% of the profits after receiving their preferred returns and the sponsor nets 30% after the preferred return.

For example, after everyone receives their preferred return in a 70/30 deal, and there is 1 million remaining, the investors would receive 700k and the Sponsor would receive 300k.

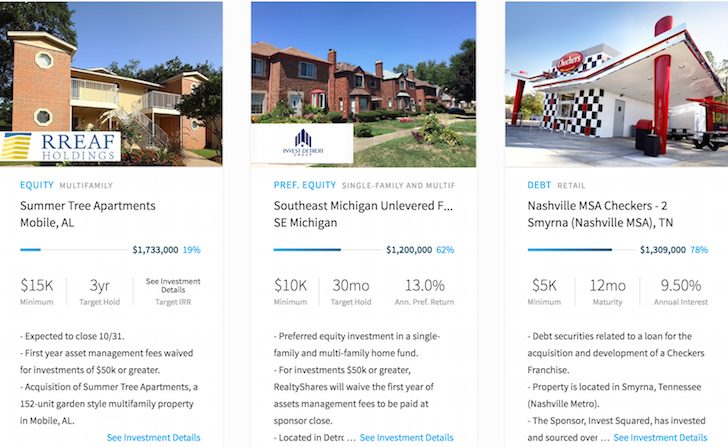

Below are some examples of various real estate syndication deals that used to be on the Fundrise platform. Today, Fundrise mostly focuses on private real estate funds. This way, non-accredited investors can invest in long-term, diversified real estate portfolios.

For most people, I believe investing in a diversified real estate fund is the way to go for most investors looking to gain exposure and earn income 100% passively. Most people don't have the time or patience to research individual deals.

Real Estate Syndication Statistics

- In 2023, over 500,000 investors participated in syndications.

- The average size of a real estate offering was $3 million.

- Passive investors came up with 80-95% of the initial capital investment

- Sponsors came up with 5-20% of the initial capital investment

- Investors received a preferred return ranging from 5-10%.

- The average preferred return was 8%.

- Sponsors netted an acquisition fee of .5 to 2%. The average acquisition fee was 1%.

- Sponsors netted a property management fee between 2 and 9%.

As time goes on, investors should expect Sponsor fees to go down and the number of deals to go up. However, as more capital chases more deals, this will put pressure on returns. Sponsors may also get sloppy with their due diligence as well.

Therefore, it is imperative that investors only invest with the best real estate syndication platforms. After reviewing over 20 real estate syndication platforms, I like Fundrise the best. Fundrise started in 2012 and is a vertically integrated real estate investment platform.

Fundrise managed over $3.3 billion and has over 400,000 clients as of 2023. Again, for most people, investing in a diversified fund is probably the best way to go.

Real Estate Syndication and Crowdfunding

Before the JOBS Act passed in 2012, you had to be rich and connected to invest in real estate syndication. Even if you were rich, you had to know someone who invested in private real estate deals. Otherwise, you were out of luck.

Today, there are several major real estate crowdfunding platforms. They carefully analyze deals before they are allowed on their platform. The REC provides the research and documentation for investors to review. In addition, they help make sure the investments move along as planned once funded.

Real estate crowdfunding is a way to raise money through the internet for a big project with the help of a ‘crowd’ of investors; if a project gets enough funding, it’s a “go”, and if not, the money is returned to investors.

Crowdfunded real estate syndications are more accessible, have lower investment minimums and offer a wealth of online project information available to potential investors.

Invest On The Best Real Estate Syndication Platforms

With real estate crowdfunding, you don’t need to risk hundreds of thousands, if not millions to invest in commercial real estate around the country. Instead, you can invest as little as $1,000 and be much better diversified.

The two best real estate syndication platforms today are:

1) Fundrise, founded in 2012 and available for accredited investors and non-accredited investors. I’ve worked with Fundrise since the beginning, and they’ve consistently impressed me with their innovation. They are pioneers of the eREIT product, which allows for real estate investors to gain a diversified exposure into various regions and types of real estate. Fundrise offers diversified funds that invest in the Sunbelt region.

2) CrowdStreet, founded in 2014 and primarily for accredited investors. CrowdStreet is focused on investing in 18-hour cities (secondary cities) that have lower valuations, higher job growth, and higher cap rates. CrowdStreet is unique in that it allows investors to invest directly with the sponsors it screens.

CrowdStreet is a real estate investing marketplace, hence, investors must pick and choose their deals. Although CrowdStreet carefully screens which sponsors and deals it shows on its platform, investors must do their due diligence as well. Investing in the right sponsor is paramount.

I've personally invested $810,000 in real estate syndication to take advantage of lower real estate valuations in the heartland of America. Thanks to technology and the pandemic, there should be a continued spreading out of America. Cap rates are much higher too.

Big Companies Are Investing In The Heartland

Google in 1H2019 announced they will be buying $13 billion worth of heartland real estate in Nebraska, Nevada, Ohio, Texas, Oklahoma, South Carolina and Virginia. Other big companies, like Tesla Motors, have followed suit.

“With this new investment, Google will now have a home in 24 total states, including data centers in 13 communities. 2019 marks the second year in a row we’ll be growing faster outside of the Bay Area than in it,” writes CEO Pichai.

With the work from home trend here to stay, I see so much opportunity investing across America. Mortgage rates will likely stay low and corporate earnings and employment will continue to rebound post pandemic. Real estate syndication is one of the best ways to invest in real estate today.

About the Author:

Sam started Financial Samurai in 2009 as a way to make sense of the financial crisis. He proceeded to spend the next 13 years after attending The College of William & Mary and UC Berkeley for b-school working at Goldman Sachs and Credit Suisse. He owns properties in San Francisco, Lake Tahoe, and Honolulu. Further, he has a total of $810,000 invested in real estate crowdfunding.