Real estate is one of my favorite asset classes to build wealth. I've been buying real estate in San Francisco and Lake Tahoe since 2003 and have seen my net worth skyrocket by several million as a result.

It's important to own at least your primary residence or one property because you want to get neutral inflation. If you are a renter, you are short inflation, which is too powerful a force to combat.

Shorting the real estate market long-term by renting is just as bad as shorting the stock market long-term. You want to at least ride the inflation wave.

To really make money in real estate, you need to own more than one property. After all, you need some place to live. Even if your primary residence appreciate in value, it's hard to capitalize its value.

But owning multiple properties can be a hassle due to tenant and maintenance issues. When I became a first-time father in 2017, I wanted to simplify my life so I sold a SF rental property for $2.74 million and reinvested $550,000 of the $1.8 million in proceeds in stocks, municipal bonds, and real estate crowdfunding.

One real estate platform that helps you invest in real estate is Roofstock. Let's take a look.

Roofstock Review: Single Family Real Estate Investing

Roofstock is a real estate platform that helps investors buy single-family homes as rental properties. You can log on and browse various rental properties for sale and filter them on a variety of factors.

The great thing about Roofstock is that it vets each property before it reaches its platform for investor consideration. Often times, the single family homes already have tenants paying rent.

Below are some examples of Roofstock single family rental properties for your review.

Roofstock certifies each house that is listed on their platform. They do this by inspecting the property using a professional investment property inspection service. This is huge because you don't want to do this work yourself, especially if the property is in a different city and state.

If there are repairs or maintenance needs, those are estimated and included in the property's valuation.

Here's the information listed on each property report:

- Market, neighborhood, and local school insights

- Photos, floor plans

- Title report (property report card)

- Interior & exterior inspection reports

- Property valuation & comparables

- Tenant payment history & lease details

- Preliminary title report

- Major repair cost estimates, if applicable

- Visualizations of appreciation, income & total returns

- Detailed financial pro forma & return estimates

If you want to buy a property, Roofstock will provide financing recommendations for the required 20% downpayment as well as provide contacts for properly vetted property management companies after the sale.

All purchases come with a 30-day money back guarantee as well as guaranteed rent (and no property management fees until it is leased) on any properties that don't have tenants.

Please note that Roofstock is only a marketplace, matching buyers and sellers. Roofstock smartly does not own the individual single family homes for sale. Their job is to find great properties with great tenants and valuation upside potential for buyers. Their also trying to help sellers sell their properties for a profit or to simplify life.

When I sold my SF rental property, I was receiving $65,000 a year after all expenses. It was a nice income, but it was just too much of a hassle to manage. Roofstock could have acted as my broker for someone who wanted SF single family real estate exposure.

But instead, I found a local real estate agent to sell my property off listing.

Roofstock's 30-Day Satisfaction Guarantee

The Roofstock 30-day satisfaction guarantee is the first I've ever heard of such a guarantee. In general, there are no return policies when you buy big ticket items like a car or a house.

I'm thoroughly impressed that if you buy a house on Roofstock and you are not satisfied, you can get your money back. Of course, there's no absolute free lunch.

What they do is re-list the property on the platform and not charge you their seller's fee. You don't get your money back immediately, you have to wait until it sells, and Roofstock may repurchase it from you after 90 days.

Roofstock Has Low Fees

Roofstock is free to join and explore. Further, you don't have to be an accredited investor with over $1 million investable assets or a $250,000 income to invest like some other platforms.

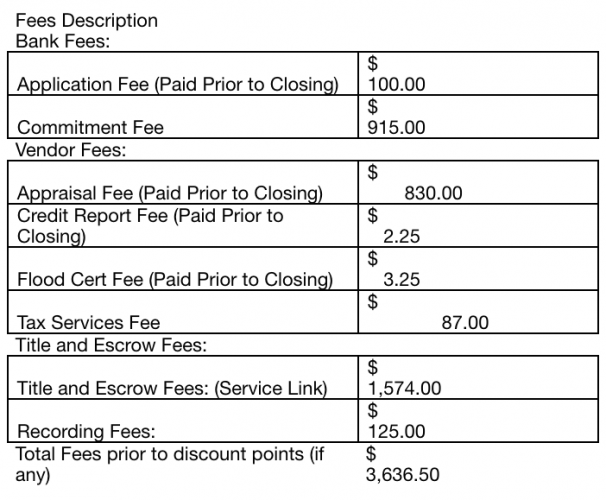

When you buy a property, below are the typical kind of fees associated with a purchase. These fees all get rolled up into the final sales price of the property.

Roofstock collects a Marketplace Fee of 0.5% of the Contract Price and payable when you agree to buy the property. That's what secures the property.

If you decide you want to sell your property, they charge 2.5%. These fees are comparable to when you sell a property with a real estate agent. Most real estate agents will charge between 5% – 6% in commission to sell your home.

Roofstock As A Single Family Rental Investment Solution

If you're interested in investing in single family rentals across the country, Roofstock is a good solution, especially if you want to diversify your real estate holdings.

If you live in an expensive coastal city, it's very hard to go long more than one property. After all, San Francisco and NYC have a median home price of over $1.5 million. Coming up with two ore more $300,000+ down payments is a tough task.

It's much easier to diversify your real estate investments with Roofstock in lower cost areas of the country. I've personally invested $810,000 in real estate crowdfunding in the heartland of America because I believe there is a demographic shift away from expensive coastal cities like NYC, Boston, SF, and LA due to technology and mobile work.

I really like Roofstock's 30-day satisfaction guarantee because every every large real estate purchase I've made, I've always experienced some type of buyer's remorse. Over time, I get over it as prices have tended to rise. But it's always good to have an out if you change your mind.

Good luck with you real estate investing journey. Make sure you run the numbers, create various return scenarios, and invest in a risk-appropriate manner.

About the Author: Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income, most recently helped by real estate crowdfunding. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.