Are you wondering whether to buy Tesla stock after its parabolic move in 2020. Now that Tesla stock went through a 5:1 stock split, it now “looks cheaper” starting on August 31, 2020. But please don't be fooled. A stock split is just financial accounting and does nothing for valuations or fundamentals of the company.

As a shareholder of Tesla since 2018, let me share my thoughts on whether you should buy the stock or not. Tesla has since come off in 2022 as interest rates and energy prices have increased. I'm a buyer of Tesla stock under $800/share.

Thoughts On Tesla Stock

I bought Tesla stock in 2H2018 after I met Elon Musk at a wedding. At the time, there was all type of media hoopla about him being unstable, smoking marijuana on Joe Rogan, sending out missive Tweets, and so forth.

I wanted to see for myself whether Elon was indeed unstable or a stable genius. I decided after observing him for a couple hours and meeting him briefly that he was the latter. The media was blowing things way out of proportion. I bought 300 shares in multiple tranches between $280 – $310.

The stock did well and then started to plummet in 2019. When it recovered to the $400 – $420 level, I decided to sell half my shares and lock in a 30% gain. At the time, I felt good because I was down about 30% at one point. In retrospect, selling was a mistake.

Below was home much I held up until the shares rose to $888 in early 2020. I got shaken out and sold 75% of my shares because it was back to ~$340 at one point in March 2020. Today, I've only got a measly 35 shares, which I plan to hold on for the long-term.

Should You Buy Tesla Stock

Tesla is not a profitable company. In fact, Tesla lost almost a billion dollars in 2019 and in 2020. The great concern with Tesla is whether it can survive long enough to be profitable. Many analysts in 2018-2019 questions its viability, figuring it would need to raise new capital to fund operations.

Because Tesla is unprofitable, you can't value the company based on earnings or operating profits. Instead, you have to base Tesla on its future revenue and earnings.

In comparison to the other global automakers, Tesla's output is tiny. Yet Tesla is valued at more than almost all other automakers today due to its potential.

What investors fail to realize is that Tesla is not just an electric vehicle company. Tesla is positioning itself to be a transportation and power conglomerate.

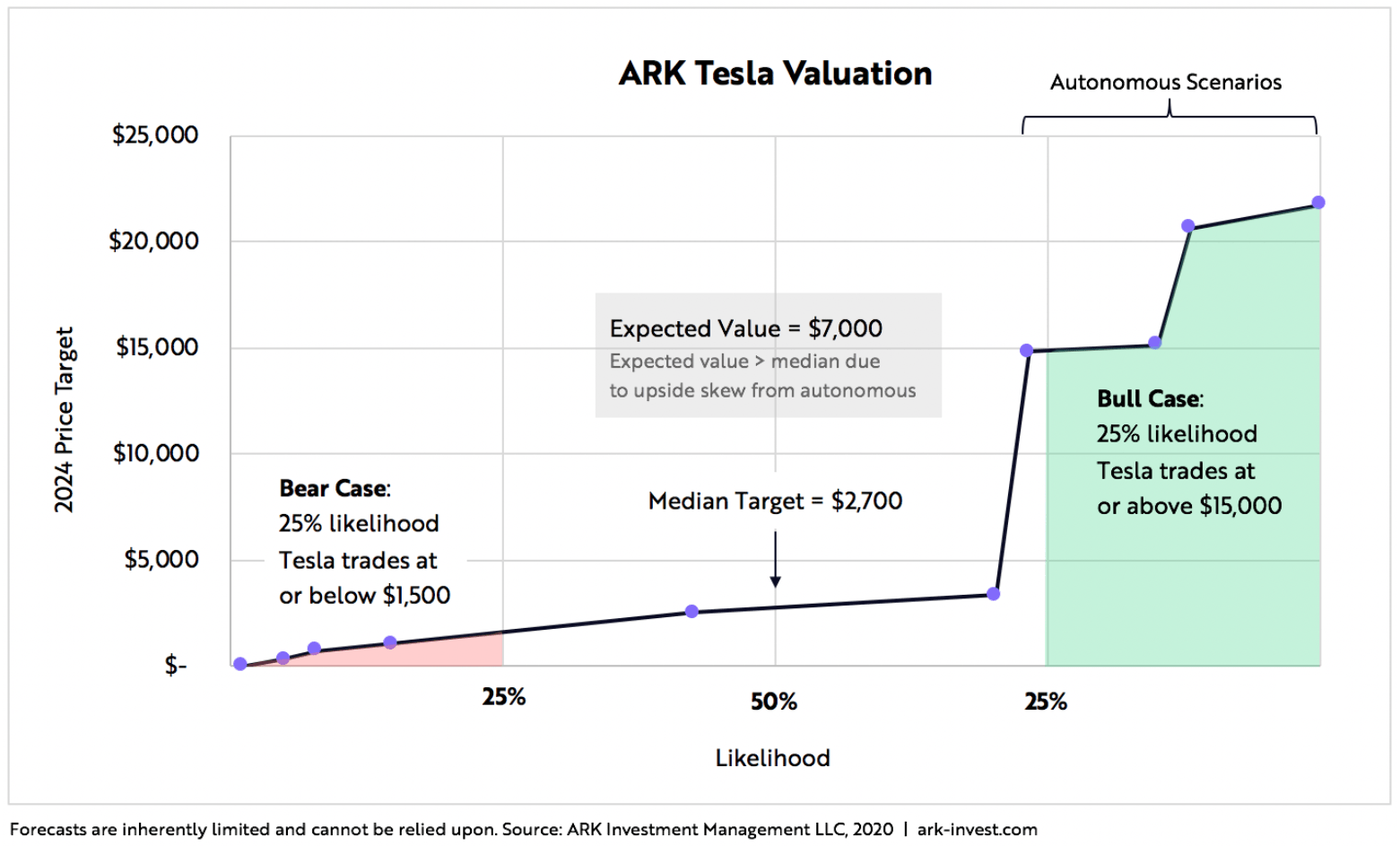

Below is some probability analysis from Ark Investment Group, who is bullish on Tesla. The right-most column also has its various share price targets by 2024.

Missing The Boat On Tesla Stock

Do you really want to miss the electric bus if Tesla becomes the next $1 trillion market capitalization company like Microsoft, Amazon, Google, and Apple? I don't think so. Therefore, if you are asking, “Should I buy Tesla stock?” still, the answer is probably yes.

You don't have to buy a lot of Tesla stock. If you're wary, you can just buy 1 share.

Clearly, Tesla stock is priced to perfection. Any execution missteps or earnings misses will cause the stock to tumble. Heck, the stock could easily correct 30% on no news one day given how quickly the share price has risen.

But as a long-term investor, you need to ride out the volatility and buy the dips.

Specific Reasons Why Investors Are Buying Tesla Stock

- Three-year head start on battery costs: With a three-year head start on battery technology and longevity, it's hard for competitors to ever catch up. By the time competitors figure out what Tesla knows today, Tesla will be even father ahead with other technology.

- The Supercharger network: One of the biggest fears of owning an electric vehicle is getting stranded with no charging station. Tesla has a 10+-year head start in building out their charging network.

- No cannibalization of existing business. Tesla has built an EV business from the ground up, therefore, it doesn't have to cannibalize an existing internal combustion engine business that cost billions to produce. Its competitors, however, have. Each EV vehicle they produce hurts their existing business.

- Off Grid Homes: With Tesla solar and powerwalls, going off grid has never been easier. Alternatively for grids tied systems the Tesla powerwall takes advantage of Time of Day billing. It buys power at night for a much lower rate and sells power back to the grid during the day for a higher amount. For many customers this arbitrage paired with solar can result in a net $0 electric bill, even with charging electric cars.

- Autonomous transportation: Tesla may be the Uber killer in the future as it builds its AI for autonomous transportation.

- Great model lineup: Tesla's Model Y, a mid-size SUV, is estimated to outsell all it's other vehicles combined. They of course you have the Cybertruck, and the long-haul truck. The Tesla Semi in mass production and with full self driving will completely transform the trucking industry.

- Self-sufficient: Before 2020, investors feared Tesla would go bankrupt because it was burning too much cash. However, 2020 is expected to be a year of profitability. As a result, the fear of dilution by always tapping the equity market is no more. There's no need to take on new debt as well.

When To Buy Tesla Stock

Tesla's share price is scary. Its price performance mirrors that of Bitcoin's parabolic 2017 price performance. Then Bitcoin came crashing down because of many hiccups and lack of expected hopes.

I never recommend chasing a stock that has gone up 100% in a matter of months. Instead, I would wait for any 5% – 10% to start legging into a stock.

I'm a buyer of Tesla stock if it corrects $750/share in 2021. I strongly believe in the future of the company. I just wouldn't invest more than 5% – 10% of your stock asset allocation in one stock. It's good to hunt for unicorns, but after such a massive move, let's be prudent.

Below are some further model assumptions from ARK Investment Group on Tesla stock. Even in a Bear Case scenario, Tesla could return 100%+ in 4-5 years time. Price targets below are pre-split.

When investing, it's important to invest in an entrepreneur and leader who is brilliant and constantly looking into the future. I think Elon Musk is one of the best people to look and plan ahead.

Tesla stock has a lot to live up to. I have no doubt Tesla's share price will exhibit tremendous volatility over the next several years. However, I'm bullish Tesla will continue to grow and revolutionize the transportation and power industry.

About the Author: Sam worked in investment banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income, most recently helped by real estate crowdfunding.

He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.