On the latest episode of the Financial Samurai podcast, I sat down with Ben Miller, cofounder and CEO of Fundrise, for a deep dive into artificial intelligence, venture capital, and what it really takes to get into the best private company deals.

Ben was in San Francisco this summer visiting various portfolio companies and trying to make new investments. We also caught up over lunch in Cole Valley.

As someone with over $350,000 invested in Fundrise Venture, I’m thrilled to speak with Ben about what he’s seeing in the AI and private company space. Since Fundrise has long been a sponsor of Financial Samurai, I’m fortunate to get regular one-on-one time with him. When you invest a significant amount of capital, it’s always wise to conduct due diligence directly with the person in charge.

I strongly believe AI is the next major long-term investment growth trend. Since I won't be joining a fast-growing AI startup, I want as much exposure to the space as I can comfortably take on. My private AI investments span from Series Seed to late stage (Series E and beyond), and I also own individual positions in all of the Magnificent 7 companies.

As always, do your own due diligence and allocate assets appropriately due to the risk involved. Investing in private companies is often riskier than investing in older, publicly traded companies. I currently have about 15% of my overall investments in venture capital and venture debt, with a target range of 10%–20%.

Here’s a brief recap of our discussion, but the full episode has all the nuance you won’t want to miss.

The State of AI: Multiple Winners Accelerating

We started with AI’s growth trajectory. The biggest players—like Anthropic—aren’t just expanding, they’re accelerating their revenue growth.

I floated the idea that AI might eventually become commoditized. Ben disagreed, arguing that the leaders are continuing to differentiate, pulling further ahead with better products, stronger talent, and deeper moats.

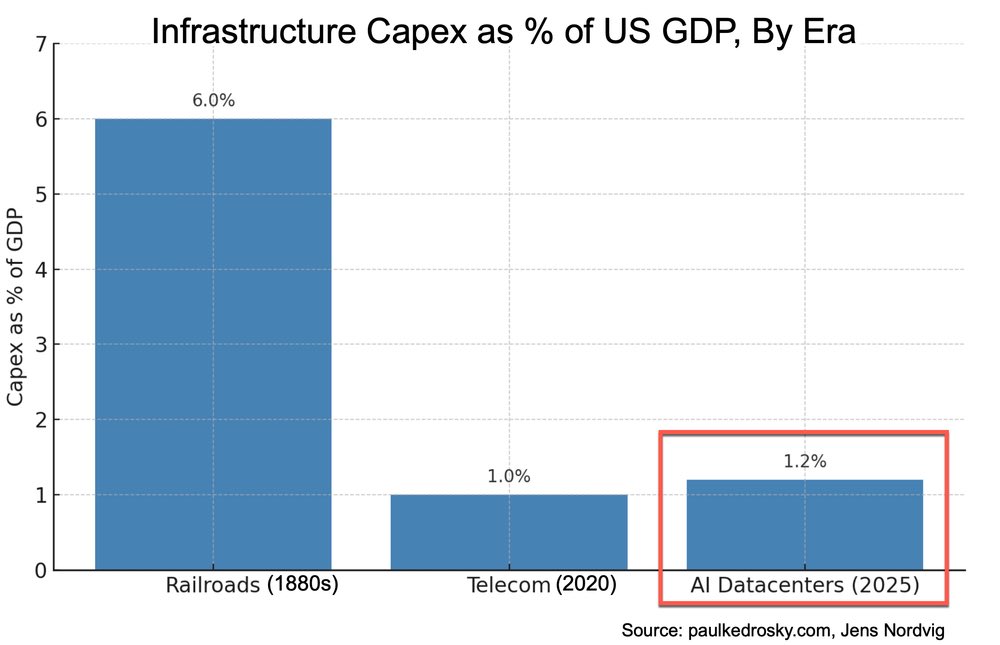

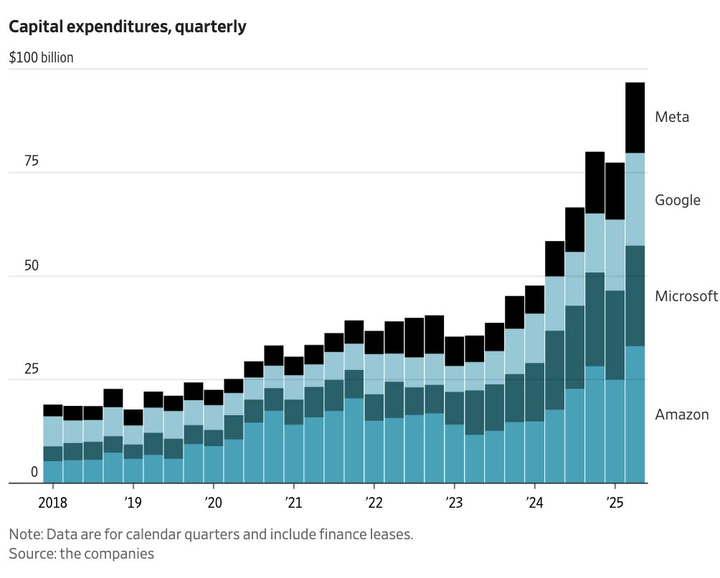

It seems like with all the tremendous AI CAPEX spend, the market is big enough for multiple winners.

Venture Fund Concentration and the Power of Big Bets

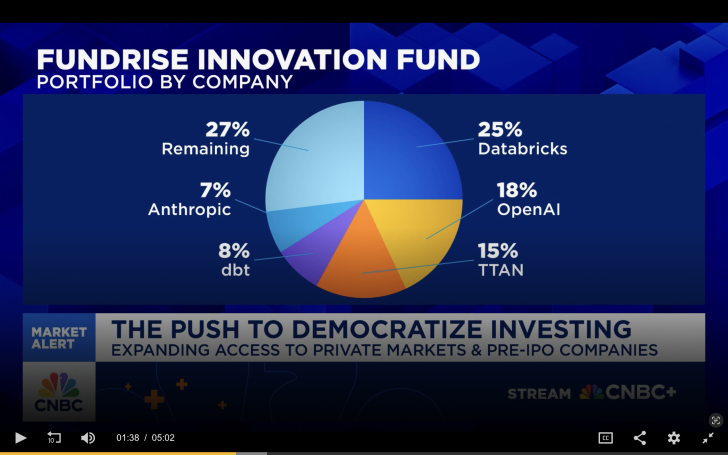

We discussed how much concentration is both healthy and required in a venture fund. Regulations state that 50% of the fund must be spread across at least two companies, and the other 50% must be invested in at least 10 companies for a total of 12 companies minimum.

Currently, about half of the Fundrise Innovation Fund is invested in just three companies: OpenAI, Anthropic, and Databricks. This kind of focus is higher risk, but when you pick the right horses in a transformative sector like AI, the rewards can be enormous.

As the great hedge fund investor Stanley Drukenmiller said, “If you look at all the great investors that are as different as Warren Buffett, Carl Icahn, Ken Lagoon, they tend to take very, very, concentrated bets. They see something, they see it, and they bet the ranch on it. The mistake I’d say 98% of money managers and individuals make is they feel like they got to be playing in a bunch of stuff. And if you really see it, put all your eggs in one basket and then watch the basket very carefully.”

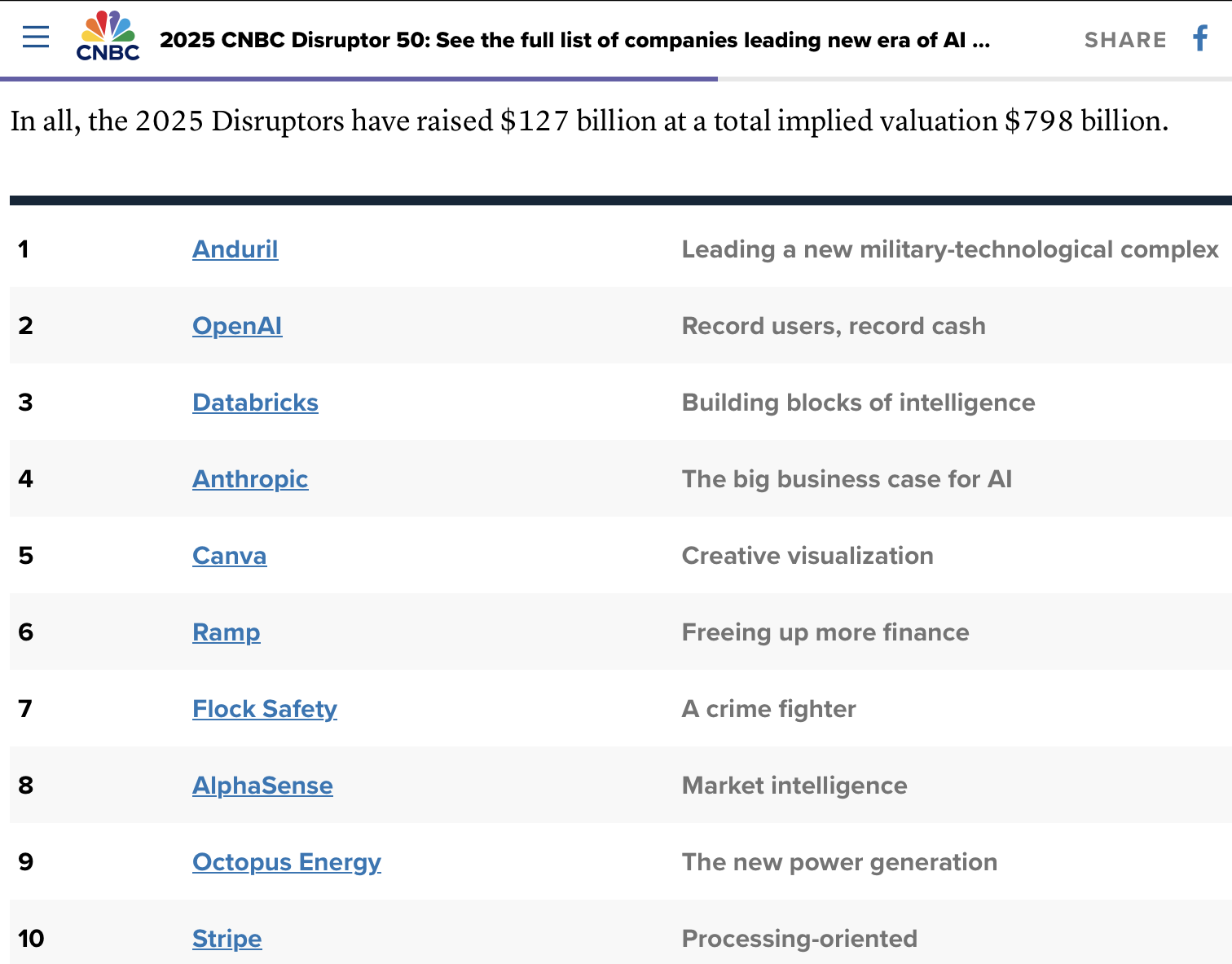

We talked about the planned evolution of the Innovation Fund's holding composition going forward, the holding periods of these companies, and strategies for finding the next winners. The Innovation Fund also owns Canva, Vanta, dbt Labs, Ramp, Anyscale, Inspectify, and more.

Rethinking Valuation: Growth-Adjusted Metrics

Valuation came next. Ben introduced the Growth-Adjusted Revenue Multiple as a better lens for assessing fast-growing companies—similar to the price/earnings-to-growth (PEG) ratio for public stocks.

If we’re truly still in the early innings of AI, it makes more sense to value companies based on both their revenue growth and scale, rather than traditional multiples alone.

It seems like investors may be underestimating how fast AI is actually growing, based on a discussion Ben had with an investment banker at Goldman Sacs who suggested modeling a 30% growth rate instead.

We also touched on the Baumol Effect—how rising labor costs in low-productivity sectors can accelerate technology adoption. In other words, when wages rise faster than productivity, businesses have more incentive to adopt AI to close that gap.

Competing for the Best Private Growth Deals

From there, we moved to one of the toughest challenges in investing: access. In my view, trying to secure a meaningful IPO allocation in a hot deal is an exercise in futility. I’d much rather invest in promising companies before they go public.

Using the Figma IPO as an example, Ben illustrated just how difficult it is to get a substantial allocation—even for well-connected investors. Figma was a name Fundrise didn't invest in, despite being a customer.

The Innovation Fund’s ability to invest in the top six of CNBC’s top 50 Disruptor companies is no accident. It’s the result of deliberately reverse-engineering the process to identify winners early, then finding a way in.

Fundrise's Significant Value Proposition To Private Companies

One unique competitive advantage Fundrise has is its ability to mobilize over a million of its users to spread awareness about a portfolio company’s product. Beyond visibility, Fundrise can actively drive growth—such as promoting Ramp, a corporate card company recently valued at $22 billion. This creates a powerful loop of adoption, growth, and valuation gains that goes far beyond simply writing a check or making introductions.

Of course, having top venture capitalists on the cap table still matters. Their connections and expertise are valuable. But I especially like that Fundrise is a private company itself, often using the very products it invests in (Ramp, Inspectify, Anthropic, dbt Labs, etc). This hands-on involvement can result in deeper due diligence than traditional VCs typically perform. And when Fundrise can also help drive business to those portfolio companies, that’s an enormous value add any private company CEO would want.

For these reasons, I’m bullish on Fundrise’s ability to keep backing some of the most promising companies in the years ahead.

The Global AI Race: China vs. the U.S.

We wrapped by discussing the difference in global attitudes toward AI. China is moving forward aggressively and optimistically, while the U.S. often takes a more cautious, regulatory-heavy approach.

For me, this only reinforces the need to maintain exposure. I don’t want to look back in 20 years and wonder why I sat on the sidelines during the biggest technological shift of our lifetimes.

If you want to hear the full conversation—including deeper dives into valuation metrics, venture fund strategies, and the practical realities of competing for elite deals—you can listen to the episode below.

You can also listen by subscribing to my Apple or Spotify podcast channels. If you're a venture capital investor, I'd love to hear from you. What are you seeing and what are some of your favorite investments?

Invest in Private Growth Companies

Companies are staying private longer, which means more gains go to early private investors rather than the public. As a result, it's only logical to allocate a greater portion of your investment capital to private companies. If you don’t want to fight in the IPO “Hunger Games” for scraps, consider Fundrise Venture.

About 80% of the Fundrise venture portfolio is in artificial intelligence, an area I’m extremely bullish on. In 20 years, I don’t want my kids asking why I ignored AI when it was still early.

The investment minimum is just $10, compared with $100,000+ for most traditional venture funds (if you can even get in). You can also see exactly what the fund holds before you invest, and you don’t need to be an accredited investor.

Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population—and break free sooner.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

To Your Financial Freedom,

Sam

As a 60-year old, not incredibly tech savvy individual, I get very confused on this subject and particularly where AI is currently impacting our lives directly. I am a partner in a land engineering firm and have not seen AI make any discernable effect on our company (ie. eliminate jobs, replace processes) other than all our computers have Copilot installed, which possibly marginally helps efficiency. Are there any recommended podcasts or articles that help me understand where AI is currently impacting our daily lives? I don’t mean computers, but AI. To me that is different. Tesla runs on computers – not until it is fully automated and knows what I want without me saying anything is it AI. Is Siri AI? IS just talking to a computer that has a voice considered AI?

I hear you. AI can feel abstract until you see it directly affecting your industry or day-to-day life. In many sectors, especially specialized ones like land engineering, the impact is still subtle—mostly in the form of efficiency tools like Copilot rather than full-on job replacement. But in other areas, it’s already deeply embedded: fraud detection in banking, supply chain optimization, medical imaging analysis, and, yes, virtual assistants like Siri and Alexa (which use narrow AI to understand and respond to voice commands).

If you’re looking to get up to speed, I recommend the “Hard Fork” podcast by the NYT for current AI news in plain English, and “Eye on AI” for a deeper dive into applications. For articles, the MIT Technology Review often does an excellent job breaking down where AI is actually being used versus where it’s just hype.

Enjoy not being impacted by AI, yet!

Thanks alot! You are such a great resource! I just really am pretty sanguine about it all. It doesn’t freak me out that in 5-10 years I will likely have a robot in my house that talks to me and does what I ask it to do. To me that isn’t AI, that is just a computer with movable parts. I will get freaked out if that same robot tells me to “go f**K yourself” when I tell it to do the dishes. That is AI to me. The former scenario is just moving toward a life like the Jetsons. The latter is the Terminator.

Great interview. I noticed Ben, CEO of Fundrise, when talking about the fear Americans have of AI – he just dismissively said that they are “emotional” vs how Chinese view AI. I thought that was so troubling given the many warnings from the leading AI experts (Hinton, Hassabis, Altman, Musk to name a few) sounding the enormous challenge of alignment. That was just glossed over so casually all in the pursuit of chasing profits. Once AGI arrives (many say by 2027), ASI will quickly follow and there is no going back to putting the genie back in the bottle. The odds of aligning with ASI are abysmally low and safety is marginalized all in the pursuit of winning the arms race. Don’t you think it’s a bit irresponsible to not even broach this topic? I hope you guys are both right … I truly I have yet to hear a cogent argument that says otherwise. Would love to hear your thoughts on this. Thanks!

Only so much can be addressed in a 50 min podcast, and we recorded 15min longer than we normally do.

What are your thoughts on AGI from the investor’s point of view? I’d welcome a guest from you on a deeper dive on the pros and cons of AGI given your concern about the topic. What is your background so we can get some context? Cheers

Thanks for your response. I understand the ethical considerations of AI weren’t the focus of the interview, but I was still alarmed at how quickly Ben dismissed the idea that Americans — or anyone — might have legitimate concerns about AI. Even a quick acknowledgment of those fears before pivoting to the Innovation Fund’s performance would have felt more balanced.

From an investment perspective, I agree AI is going to keep crushing it and is still in the early innings. Personally, your blog pushed me to take investing more seriously — I moved beyond just index funds and started making targeted bets on NVDA, META, PLTR, and AMZN a few years ago while also balancing with a healthy dose of 2023-2024 T-bills (thanks to your articles) which have all outperformed. That shift helped me retire at 49 (my only dependent is an 18-lb dog), so I’m very grateful!

What worries me is the breakneck pace companies like OpenAI, Google, and Grok are moving to win the AI arms race, often with minimal attention to the existential risks once AGI — and eventually ASI — arrives. Many experts see AGI by 2027, and alignment odds with ASI are vanishingly tiny.

Do you think the fears of human extinction from AI are overblown, or are we just collectively looking away?

Sounds like I’ve helped make you a lot of money and achieve freedom earlier! Nice. Do you mind picking up a copy and leaving a review of my latest book, Millionaire Milestones, on Amazon? Every review counts! A review of my podcast would be great too.

End of humanity due to AI? I don’t think so in our lifetimes. But just in case, I would think it would be wise to hedge and Invest. Because if it is in a humanity, then we make money or nothing matters. But if it isn’t the end of humanity, then millions of people still have jobs, including all the children today.

Life really is a game of hedging your risks.

And given you retired, I do welcome a guest post about the risks of AI. It is extremely gratifying to construct an article based on an idea and make cogent arguments for why and why not. Give it a go! Be the change you want to see in the world.

Cheers

Yes, I really do have to thank you — your “Net Worth by Age” and “401(k) balances” posts were huge in helping me pull the trigger and check out of corporate earlier than I thought I could. I don’t really read books anymore (my eyes are shot), but I did leave a 5-star review for your podcast and bought Buy This, Not That a few years back.

I appreciate your optimism, and I honestly hope you’re right. I try to live like things will turn out okay, even though some of this stuff is way out of our control. It’s made me value time more and be a little pickier about who I spend it with. Yeah — life’s definitely about hedging risks or at least managing them the best you can.

Even though I’m “retired,” I’ve actually been grinding 40+ hours a week trying to get a content creation project off the ground (side note: I think you’d crush it on YouTube — you’ve already got the blog, the podcast, and the name recognition. Way more people watch podcasts on YouTube than anywhere else.)

On the AI thing — the reason I’m not so chill about it is because agentic AI is here now, and that’s a legit step toward fully autonomous AI. If we hit a point where it can outperform humans across the board and rewrite its own code (e.g., AlphaGo played itself millions of times and then smoked the world champion without ever playing a human) — things get wild, fast.

The odds of that kind of system aligning perfectly with human goals? I think they’re near zero, especially when we humans can’t even agree on our own goals. And because it’s a race between companies and countries — a total prisoner’s dilemma — no one’s slowing down. Even if we dodge full-on doomsday, the job losses, social unrest, and insane power consolidation could make for a seriously dystopian future

.

I’d love to hear your take, and maybe your readers’ too. I just think this needs to be talked about way more in the mainstream.

Sam – what do you see as the potential ROI upside in the Innovation fund specifically? And the downside risk? Yes. An open ended question by intent. I have about 10-15% of my investable assets in various private investments including Fundrise.

Just looking at the holdings, the potential could be 25% – 35% a year IRR for 5 years (3X). Databricks may be next up, and I think that IPO will be in even more demand than Figma.

I hope I’m being conservative too, as I could also see a 40-50% IRR for 5 years (6X>. I cannot imagine the type of demand companies like Anduril, Ramp, Anthropic, and Canva will have when they IPO. Not sure about OpenAI now since it’s so big already.

ServiceTitan could drag down the portfolio as its fastest growth period seems over. Not sure what’s going on with dbt Labs either, as it hasn’t raised since 2022 and it was a down round. But they crossed $100 million in ARR this year, so it could be a positive dark horse. I need to ask about dbt.

What I do know is that the more I invest, the less FOMO I have. Being in SF and not working in tech or AI is rough, since it’s ubiquitous.

If three companies in the portfolio make up 50%, and each grow by 50% a year, and the rest of the 50% of portfolio grow at just 5% a year, how much will the overall portfolio grow in 5 years and 10 years? The answer from ChatGPT:

Initial setup

• High-growth group: 50% of portfolio, grows at 50% per year (i.e., × 1.5 each year)

• Low-growth group: 50% of portfolio, grows at 5% per year (i.e., × 1.05 each year)

We’ll track each portion separately and then combine.

⸻

Yearly growth factors:

• High-growth: 1.5^n after n years

• Low-growth: 1.05^n after n years

Initial value = 1.0 (representing 100% of portfolio)

• High-growth initial: 0.5

• Low-growth initial: 0.5

⸻

After 5 years

High-growth portion:

0.5 \times 1.5^5

= 0.5 \times 7.59375

= 3.796875

Low-growth portion:

0.5 \times 1.05^5

= 0.5 \times 1.2762815625

= 0.63814078125

Total portfolio value after 5 years:

3.796875 + 0.63814078125 = 4.43501578125

Growth multiple:

4.43501578125 \div 1.0 = 4.435

Growth rate over 5 years:

(4.435)^{1/5} – 1 \approx 0.345 \ (\text{34.5% annualized})

⸻

After 10 years

High-growth portion:

0.5 \times 1.5^{10}

= 0.5 \times 57.6650390625

= 28.83251953125

Low-growth portion:

0.5 \times 1.05^{10}

= 0.5 \times 1.6288946267

= 0.81444731335

Total portfolio value after 10 years:

28.83251953125 + 0.81444731335 = 29.6469668446

Growth multiple:

29.647 \div 1.0 = 29.647

Growth rate over 10 years:

(29.647)^{1/10} – 1 \approx 0.395 \ (\text{39.5% annualized})

⸻

✅ Final results:

• After 5 years: Portfolio ≈ 4.44× bigger (34.5% annualized)

• After 10 years: Portfolio ≈ 29.65× bigger (39.5% annualized)

It’s a great exercise to think about. 5X in 5 years is something I’d gladly take!

Of course, easier said than done.

I am in awe, almost shock, at how much is happening in AI and how much more is going to change. I really related to the part of the podcast episode where you and Ben are talking about the differences in perception of AI in China vs the US. I definitely fall into the fear zone but as I have slowly adopted some AI tools to help with my day to day, I am less fearful and pessimistic. From an investment perspective I totally agree that AI is a huge opportunity and think it’s so fortunate to be able to gain exposure through Fundrise’s offerings. I increased my investments three times this year. There’s lots more to come in AI that’s for sure.

I’ve been reading Financial Samurai for a while and It’s pretty cool that Fundrise is letting regular folks invest in some big-name AI startups like OpenAI and Anthropic without needing a huge amount of money. Getting access to these kinds of companies usually feels impossible unless you’re an insider or big institution.

I also like how the fund mixes AI with real estate tech and data infrastructure. Seems like a smart way to spread out risk but still ride the AI wave. That said, I know AI investing isn’t a sure thing. There’s always going to be ups and downs, especially with new tech and potential regulations coming.

Thanks for sharing the interview!

Hey Sam,

Love your content and I’ve leaned a lot from your blog. I couldn’t t help but notice that off late you have been aggressively pushing Fundrise to your readers. Based on my experience and several others on the internet, the return on Fundrise real estate funds has been very disappointing. Will AI innovation fund be any different?

Nobody knows the future. But from everything I’m seeing, the momentum continues in AI and I want to seize the opportunity.

OpenAI, for example, is in talks to do a secondary at a $500 billion evaluation. I can’t believe it because they just finished doing a round of fundraising mainly from SoftBank for $40 billion at a $300 billion evaluation.

I just opened up a new Innovation Fund account earmarked for my children with an initial $26,000 investment. I’m going to contribute between $1,000-$5,000/month autodebit and build up the account over the next 5-10 years from my rental income. I should’ve done this back in 2023 as it’s hard to stay consistent.

I’m writing about what I think is most promising at the moment. Things could definitely change, as interest rates come down, the under supply of building over the past 2-3 years starts taking effect on upward pressure in rent income. CRE was a great run from when I started writing about it in 2016 until the Fed started aggressively hiking in 2022. But I think finally, rates are starting to come down and the demand for CRE will rebound. We already seeing a big rebound in commercial real estate demand here in San Francisco and rents are rising double digits.

How are you invested in real estate venture?

Definitely don’t invest in things you are not comfortable with. And if you listen to my podcast episode, you can hear me mentioning how I don’t wanna push anything on anybody. People should I be est in what they know and understand. I’m just sharing what I’m most interested in, as assets ebb and flow over time.

I’m gonna be writing more about real estate next week as I experience something pretty positive that I think people should be aware of. And then all ties into the tech and AI ecosystem.

Is there something you would prefer me write or record about? If so, feel free to let me know!

Fascinating insights—thanks for sharing. I hadn’t realized just how competitive it is to get on the cap table of these hot startups.

It’s wild that one private company wanted to allocate shares only to friends of Sam Altman. It really shows how much access and wealth come down to your network—and how the rich and their friends tend to get richer.

When the financial return metrics are clear, the growth slope is steep, and you’re raising capital, it’s almost like handing out free money to those in the know.

Ben also makes a great point that identifying great companies is actually easier than many people think. You’d think it’s the opposite, but it makes sense that once a company has hit momentum, it’s all about trying to get in.

Not so much Seed stage companies.

I’ve invested about 10% of my capital in venture as well. I’m excited to see more exits!