The latest average 401(k) and IRA contribution is $7,000 and $4,500 for 2020. The data comes from Fidelity, one of the largest administers of 401(k) and IRA plans in the country with roughly 30 million retirement accounts.

The average 401(k) contribution of $7,000 is pretty low given the maximum one could have contributed was $19,500. In other words, the average person only maxed out their 401(k) by 37%.

The average IRA contribution of $5,000 is pretty good given the maximum one could have contributed was $6,000 in 2020.. In other words, the average contribution accounted for 76% of the maximum potential contribution.

For 2021, the maximum 401(k) contribution rises to $19,500 and the maximum IRA contribution rises to $6,000. We should expected the maximum contribution amounts to rise by $500 every couple of years to keep up with inflation.

Overall, the average 401(k) balance is around $110,000 at the end of 2020.

Average 401(k) And IRA Contributions Are Not Enough

If you're only contribution $7,000 and $4,500 to your 401(k) and IRA, respectively, that's not enough to live a comfortable retirement. Now, if you contributed a combined $11,050 to your pre-tax retirement accounts, that's not bad. But more than likely, the average contributor only contributes to the 401(k) or the IRA.

Instead, it's important to max out your 401(k) and IRA if possible for a total contribution potential of $25,000 from the employee side. If not possible due to funds or income limits, then at least max out your 401(k) each year.

Below is a chart of how much you would have in you 401(k) if you simply maxed it outed your 401k every year.

Now let's look more closely at what everywhere should have in their 401(k) by age with average returns and company matches over time.

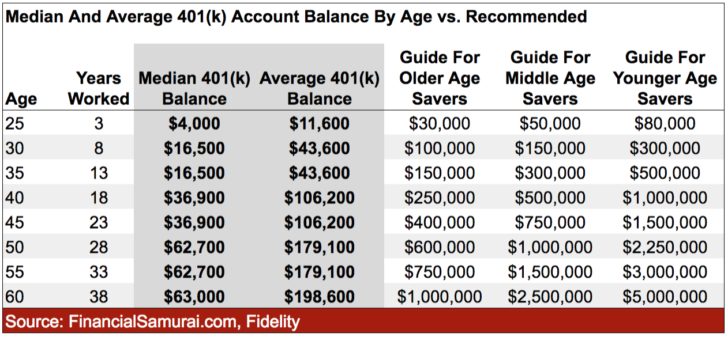

The below chart compares the median 401(k) balance by age, the average 401(k) balance by age, a recommended 401(k) balance by age for older savers, middle age savers, and younger savers.

As you can see from the chart, everyone is expected to be a 401(k) millionaire by the time they turn 60. This is the power of consistent investing and compound returns over time.

By maxing out their 401(k) each year after their third year of work, while receiving the typical 0% – 10% company match and 3% – 10% annual returns stocks and bonds have shown over history, good things happen over time.

Remember, your pre-tax retirement accounts are only one leg of the new three-legged retirement stool. The other leg are your after-tax retirement accounts and your personal hustle.

You don't want to rely on Social Security being there for you in your 60s and 70s because it is currently underfunded by roughly 25%. If it's there for you in retirement, then great. If not, then fine too because you did everything possible to sure up your retirement without expecting Social Security help.

Increase Your 401(k) And IRA Contribution

Adopt my mantra, “If the amount of money I'm not saving each month doesn't hurt, I'm not saving enough.“

Just like working out, if you aren't sore the next day, you're not pushing your body hard enough to develop new muscles.

The very least everyone should do is max out both their 401(k) and their IRA. If you can't do both, max out your 401(k). After 10 years of maximum contribution, you will be surprised at how much you will be able to accumulate.

The key is to grow your financial nut large enough so that it starts building real momentum. Eventually, you hope that your investments start making more than you make from your day job. When that time comes, that's when you'll be able to retire early or pivot to a more satisfying career with ease.

Manage Your Finances Wisely

The second thing everyone must do is diligent track their finances and cut down on investment costs. The easiest way I've found to do this is to sign up with Personal Capital, the web's #1 free financial app. I've used them since 2012 to track my net worth and it feels fantastic to be on top of my finances.

I was paying $1,700 a year in 401(k) fees I had no idea I was paying until running my 401(k) through Personal Capital's Investment Checkup tool. Once I found I, I quickly optimized my 401(k) by selling my expensive funds and buying ETFs instead.

The more you stay on top of your finances, the better you can optimize your finances. In this day and age, there's no excuse to leverage technology for your benefit. You don't want to reach retirement age and realize you don't have enough.

Be better than average. Be great with your one and only financial life!