The Health Savings Account, or HSA for short, is touted as one of the best ways to pay for medical expenses and save for retirement due to its tax benefits.

You get triple tax benefits: 1) you contribute to your HSA with pre-tax dollars, 2) pay medical expenses with pre-tax dollars, and 3) get to earn compound profits tax-free.

Not bad. No wonder why so many people are positive on the HSA. But as we all no in life, there is no free lunch. When the government makes the rules, some benefit while others get left behind.

Let's go over the pros and cons of the Health Savings Account.

The Pros Of Having An HSA

In order to qualify for an HSA, you must be covered by a High Deductible Health Plan (HDHP). An HDHP generally costs less than what traditional healthcare coverage costs, so the money that you save on insurance, can therefore, be put into the Health Savings Account.

If you are eligible you can contribute up to $3,550 pre-tax to an HSA if you have single coverage or up to $7,100 pre-tax for family coverage in 2020. If you’re 55 or older anytime in 2020, you’ll continue to be able to contribute an extra $1,000. Again, these figures go up every year usually by the rate of inflation, which generally equals about 2%.

HSA funds can pay for any “qualified medical expense,” even if the expense is not covered by your HDHP. If the money from the HSA is used for qualified medical expenses, including dental and vision, then the money spent is tax-free.

If the money is used for other than qualified medical expenses, the expenditure will be taxed and, for individuals who are not disabled or over age 65, subject to a 10% tax penalty.

The unused balance in a Health Savings Account automatically rolls over year after year. You won’t lose your money if you don’t spend it within the year.

Finally, the money in your HSA can be invested and earn compound gains tax-free. This benefit is one of the best benefit touted by financial advisors and financial pundits.

The Cons Of Having An HSA

The biggest con of having a HSA is that you need to have a High Deductible Health Plan (HDHP) to be eligible. The HDHP needs to have a deductible of at least $1,350 for single coverage or $2,700 for family coverage. These deductible figures go up every year at roughly the rate of inflation.

When you have at least a $1,350/$2,700 deductible, there is a tendency for people to NOT seek medical help when they should. Over time, the medical condition could get worse and cause much more serious issues.

Think about the case of a leaky roof. The leak might not look like a big deal, hence why you don't patch it. But over a 10 year period, the leak will rot the internal support beams in your house, cause black mold, and will cause structural weakness. To fix everything 10 years later might literally cost 1000!

If you happen to have a Gold or Platinum healthcare plan with a lower deductible or no-deductible, you are not eligible.

The only reasons I can think of for people to get a High Deductible Health Plan are the following:

- You rarely get sick or injured. Folks in their 20s and 30s may be prime targets.

- You can afford to pay your deductible without having to go into debt.

- You're willing to pay your deductible to get medical treatment.

- You have enough money to fund an HSA each month.

- You don't have little ones or sick dependents.

- You want another financial way to support your retirement.

- The Out Of Pocket Maximum is affordable.

If you have a HDHP to be eligible for an HSA, and one of the following or more happen, then having an HDHP to have an HSA is a suboptimal move.

- You are pregnant, planning to become pregnant, or have small children.

- You have a chronic condition or need to see a doctor frequently.

- You’re considering or anticipating a big surgery.

- You take several expensive prescription medications.

- You or your children like to partake in high-risk activities such as mountain climbing, scuba diving, sky diving, skiing/snowboarding, and the like.

- You put a premium on peace of mind and want to minimize the stress of dealing with health insurance providers who may refuse payments.

In such instances, you want to have a low-or-no deductible health plan, which carry higher premiums.

Related: How To Healthcare Subsidies No Matter Your Wealth

Example Of Why One Person Wants A Low Deductible Plan And No HSA

We pay for the top tier PPO for my husband and my son because I am worried about my son’s medical needs. (I’m on my own top tier PPO at my job). For my son and me, we would always have a PPO. If my job subsidized dependents, I would get him on my insurance and then encourage my husband to do the high-deductible plan because he is in excellent health and rarely gets sick.

But since my job only subsidizes my health insurance, my husband must cover my son on his health insurance plan and they both go for the good PPO. Kids get sick with random stuff, they fall and break bones, the get serious cuts that require stitches, etc. etc. Plus, if your child becomes diagnosed with a lifelong condition (like my boss’s son was diagnosed with Chrohn’s Disease and I have plenty of friends who developed Type 1 diabetes as children), good luck with a high deductible plan!

Although I haven’t had to experience too many expensive medical visits yet with my 3-year-old, I know the moment we switch to an HSA plan, I’d eat through the family deductible within months.

The only time I recommend high deductible plans is for young people first getting a job. If they can start maxing out their HSA with their first job and they rarely use that money, maybe then, and only then, if they have kids in their 30s, they can keep with the high deductible plan because they’d have 10+ years of money in the bank to cover any health needs that may arise. But if you’re not in that type of situation and you’re having kiddos, I’d stay far far away from any high deductible plan.

Fun fact– my son was in the NICU for 2.5 weeks (born at 34 weeks after I was in the hospital for 5 weeks with leaking amniotic fluid (high infection risk)). After 13 months of arguing, the health insurance agreed to pay $55,000. I know for a FACT, that my health insurance was BILLED initially nearly $500,000 for that 2.5 week NICU stay. A NICU stay can happen to any child without rhyme or reason! (there was no explanation for my problem).

Unless you are prepared to pay your max deductible on your child’s birth (because anything can happen), consider upping your health insurance when you have children. And unless you can guarantee that EVERYTHING is in the network (the freaking anesthesiologist tried to bill me separately for the birth!!!), stick with the quality health plan.

Example Of Why One Prefers A HDHP And HSA

I have an HDHP for our family of four (kids age 4 and 7), and I think it’s a good option for us. I don’t think you are considering and comparing the costs in a complete manner. First thing to remember is that under all health plans (including HDHPs), preventive care is free, including all kids’ scheduled visits and vaccines. So most of the kids’ health cost is free to us.

Second, yes we pay for doctor visits and other stuff, but it’s at the insurance company’s negotiated rate. (With HDHPs the insurer wants to keep your costs low so you don’t reach the deductible and they don’t have to pay anything.)

Mostly I pay out of pocket and fully fund he HSA, but if there were a big cost (like maybe braces) I will use this tax advantaged money to pay for it.

Finally, the right way to compare health plans is to look at the monthly premium and deductible, yes, but also look at the catastrophic maximum payout, after which the health plan pays 100%. For most plans including HDHPs this is in the range of $25k, but a really serious situation or chronic disease will easily surpass this amount and in the case of chronic disease you’d have to pay it every year going forward.

Since everyone eventually gets sick or hurt, health insurance is really bankruptcy insurance, and this catastrophic max is really where the most important protection appears. In the meantime we are saving money every year, building a non-taxable asset for use in medical emergency situations or for retirement, and still getting the kids’ medical checkups for free.

Quality Of Care From A Doctor's Point Of View

If we believe there is a correlation with price and quality, which there most certainly is in all service and products, then we must also believe that lower priced health plans have lower quality care and doctors versus higher priced health plans.

I have friends who are doctors and they tell me straight up the worst part about their job is dealing with insurance companies followed by increasing bureaucracy.

A couple of doctors have admitted to me that if their patient has a “more difficult” health insurance plan, they are more reluctant to return calls or e-mails or fit them into their schedules.

Doctors, too, are economically motivated, particularly given the amount of time and money required to become a doctor. If they can join a healthcare network whose patients have higher quality health plans, they will.

It's not hard to believe more money attracts better doctors. Some doctors offer concierge service where a patient has access to their private number and e-mail to ask them questions and get consultations any time they want. Such concierge services often cost an extra $5,000 – $20,000 a year.

When it comes to your health, you want to pay for the best possible health care that you can.

An HSA Shouldn't Be A Retirement Vehicle

If you end up depending on your Health Savings Account in retirement, then you have failed at saving enough in your pre-tax and post-tax retirement accounts.

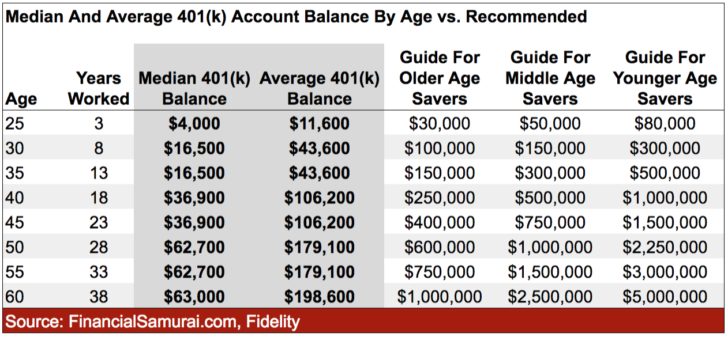

Contributing the maximum $3,550 / $7,100 a year in your HSA to grow tax free is great. At a 6% rate of return, if you contribute $7,000 a year for 20 years, your HSA will grow to $272,900.

But I expect all financially savvy people to have millions in their pre-tax and post-tax retirement accounts by the time they reach retirement age. Therefore, having several hundred thousand in your HSA isn't going to make a big difference. Further, don't forget all the deductibles you had to pay along the way to be eligible for the HSA.

Max out your 401(k) and aggressively save an additional 20% in after-tax money for retirement. After 20 years or more years, there's a high chance you will have multi-millions of dollars while receiving the best health care money can buy.

A health savings account is one way to more efficiently cover your health expenses and save for retirement. If you have the opportunity to contribute to a HSA, please do. Not everybody can.

Recommendation For A Healthier Retirement

Utilize the internet's best free financial tool by Personal Capital. They allow you to track your cash flow, analyze your net worth, reduce investment fees, and help you plan for retirement.

Use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Your goal is get get your percentage chance of a great retirement to over 95% because your future cash flow will cover your future expenses.

There is no rewind button in life. You want to end up with a little too much money in retirement, not too little. Make sure you are on top of your finances.

About the Author: Sam worked in investment banking at Goldman Sachs and Credit Suisse for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too. The Pros And Cons of a Health Savings Account is a FS original post.