Wealthfront was launched in 2011 and is the original online financial advisor (robo-advisor) in the industry. Based in Silicon Valley, Wealthfront was the first to reach $1 billion in assets under management (AUM), and now has over $28 billion in assets under management as of 1Q2022.

Wealthfront has experienced explosive growth over the years largely due to their sophisticated investing automation along with their low-cost fees.

For example, the first $5,000 under management that you invest is free with my promotional link, and they only charge 0.25% of your assets under management each year vs. 1.5% – 2.5% charged by traditional wealth advisors.

Wealthfront continues to innovate and offer its users the best experience and product offerings possible.

Wealthfront Cash Account Review

After multiple Fed Rate hikes since late 2015, one can now earn a healthy interest rate in their money market funds and short-term CD funds.

To keep up with the rise in interest rates, Wealthfront started their new Wealthfront Cash Account.

With much higher rates today, investors demand their cash reserves also earn a higher rate as well to minimize ‘cash drag.”

Now, investors can not only continue to efficiently invest in the market with Wealthfront, but also come closer to earning the highest rate possible online.

The thing is, the Fed slashed interest rates back down to 0% – 0.25% in 2020. As a result, Wealthfront's Cash Account isn't paying much anymore.

Details About Wealthfront's Cash Account

Wealthfront’s Cash Account has the following key features:

- FDIC insured up to $1 million: Wealthfront uses what they call Program Banks to multiply the traditional FDIC insurance you’d typically get. Traditional FDIC insurance is $250K/$500K for individuals and couples.

- No market risk: The money isn't subject to the same risk as stocks and bonds.

- Unlimited, free transfers: Unlike a standard savings account, you can move money both in and out as much as you’d like with no fees.

- No fees: No fees, which includes no advisory fees and management fees.

- $1 minimum: Every last dollar you have with Wealthfront gets maximized.

- Easy to set up: Easy to sign up with your phone or laptop in under a couple minutes.

Higher Interest Rates

The Wealthfront Cash Account paid 2.51% APY as of 2H2019, which was very healthy compared to the national average of 0.1% APY. It was also higher than a 3-month Treasury bond and the 10-year Treasury bond. Interest will accrue daily and it’s credited to your account monthly. However, in 1Q2022 Wealthfront is only paying 0.1%.

If the Federal Reserve raises rates further, however, the Wealthfront Cash Account should follow suit and vice versa.

It takes only $1 to open a cash account and get started, and you must have a Wealthfront investment account to be eligible.

At the end of the day, Wealthfront wants to try and manage as much money as possible. Launching the Wealthfront Cash Account is a very smart way to go.

No Advisory Fee To The Cash Account

There are no fees for the Wealthfront cash account. They charge no advisory, withdrawal, or other fees for this account.

The standard Wealthfront investment advisory fee of 0.25% doesn’t apply to the cash account, unlike at Betterment.

But if you compare Wealthfront's Cash Account APY to an online bank's APY, it's slightly lower. That spread is how Wealthfront can still earn a marginal fee.

But since Wealthfront uses so much automation already, their overhead costs are low and, like their investment platform, they can pass the savings on to their customers.

FDIC Insured

To give you FDIC insurance, the money that sits in your cash account is automatically moved into what Wealthfront calls “unaffiliated banks” to provide you the standard $250,000 insurance coverage through the FDIC.

But since Wealthfront uses a multitude of affiliated banks, you get FDIC coverage of up to $1 million on your cash deposits in this account.

You don’t do or see anything happening behind the scenes–Wealthfront handles this with what they call Program Banks. You just need to log in and access your money.

Wealthfront will move cash between these banks to ensure you’re covered.

I've never heard of this smart strategy before, so it's worth looking into further if you're interested. However, I wouldn't recommend holding more than $250,000 per person in your Wealthfront Cash Account anyway.

Wealthfront should be used primarily for investing. But having up to $100,000 in the Wealthfront Cash Account makes sense.

Negative Of The Cash Account

What’s odd about the Wealthfront Cash Account is that you can’t transfer money from your Wealthfront Cash Account to your Wealthfront investment account. This should be a no-brainer, but for some reason it's not possible yet.

Wealthfront says they’re working on the ability to do internal transfers, but it’s not ready yet. So for now, the cash account and investment account operate like separate entities–which is strange.

For the time being, you must withdraw money back to your checking account and re-deposit that into an investment account. Withdrawing money takes between one and three business days.

At least there aren’t any restrictions on the number of times you can withdraw per month.

Wealthfront Cash Account Final Verdict

Wealthfront is smart to offer their Wealthfront Cash Account to pay higher interest rates on savings. Although Wealthfront's bread-and-butter product is their sophisticated, low-cost digital investing business, offering an attractive cash savings account ensures they stay competitive.

Every digital wealth advisor's goal is to try and gather as much assets under management as possible. Eventually, Wealthfront should be able to allow Wealthfront Cash Account holders to easily transfer money to their Wealthfront investment account.

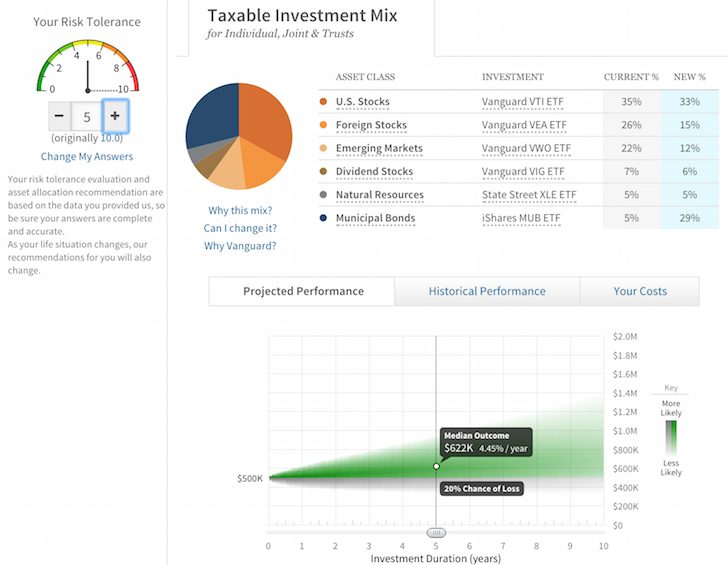

For a low-cost investing solution, sign up for Wealthfront for free. Have them construct a customized model portfolio for you to get an idea of how your money will be invested.

The way to build great wealth is to invest for the long-term. Too many people don't invest because they either don't know what they are doing or are scared. Wealthfront has helped investors overcome these issues and simplify their investments.

About the Author: Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. I help people get rich and live the lifestyles they want.