A no-cost refinance mortgage is a loan transaction in which the lender pays all the refinance costs.

Doing a no-cost refinance is a great way to save on costs in the short-run, especially if you're stretching to buy a new home or need liquidity for other things. But over the long-run, a no-cost refinance might cost you much more.

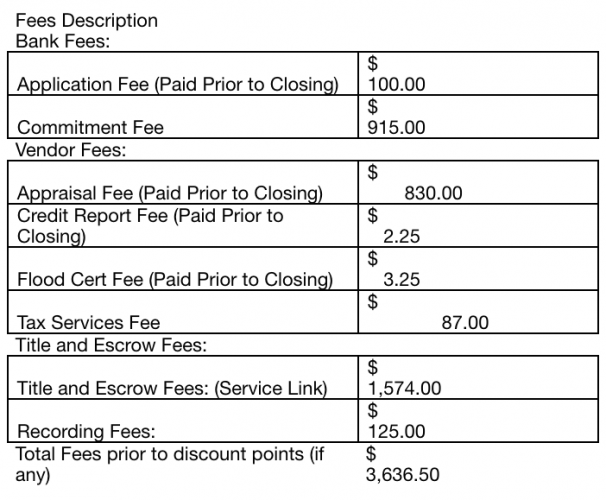

Refinance costs includes: processing and underwriting fees, the appraisal fee, loan origination fees, title and escrow fees, notary fees, and courier fees. Some refinance fees can be negotiated.

The average refinance or new mortgage origination cost is between $3,500 – $5,000. As a result, many borrowers might not be so included to refinance or take out a new loan, despite a low rate environment.

Below are some typical refinance costs a borrower has to pay if the lender does not.

No-Cost Refinance = Higher Mortgage Rate

The way banks make up for covering all refinancing costs is by simply charging a higher monthly mortgage interest rate. The higher the mortgage rate, the more the bank will make if they can keep their cost of capital the same.

It's the same thing as the employer making you, the employee, feel great about their generous 401(k) matching and free or highly subsidized healthcare benefits. You might be getting great benefits, but it's costing you in terms of a lower salary.

Banks are smart. They have huge market capitalizations and make a ton of money. By offering a no-cost loan, they are meeting consumer demand and can therefore refinance more existing mortgages and originate more new mortgages.

The longer you take to pay off your mortgage, the more interest income the bank will make. Banks know that on average homeowners own their homes for ~8.3 years.

Therefore, banks are counting on borrowers to either pay refinance fees up front and get rid of their loan early since the potential rate they charge will be lower or pay a higher mortgage rate and keep the loan for much longer than 8.3 years.

See the average U.S. homeownership duration chart below. It's been steadily going up since the financial crisis, which means doing more no-cost refinance loans or new loans may be more profitable to banks due to the higher mortgage interest rate.

Related reading: Why It’s Better To Pay A Small Mortgage Fee Than Get A Large Credit

Example Of A No Cost Mortgage Refinance

Option A) No cost refinance: 3.5% mortgage rate, NO fees.

Option B) Standard refinance: 3% mortgage rate, $4,000 in fees.

Which refinance option do you choose?

The decision depends on the size of your loan and how long you plan to keep the loan until it is paid off. How long you plan to keep your loan depends on many life variables and your view on future interest rates.

Let's say the loan size you want to refinance is $1 million and you plan to keep the loan for 15 years before paying it off. You plan to turn your home into a rental and build your passive income portfolio so you can retire before 50 and live the dream.

A 0.5% difference in interest rate is $5,000 a year in interest savings on a $1 million loan. From the bank's point of view, if they charge the higher rate, they'll get to make up to $5,000 more in interest income a year, depending on their cost of capital, for the life of the loan.

Over a 10 year period, if you choose Option B with the lower 3.5% rate, you will save $50,000 in interest expense. Therefore, it's clear Option B is the right financial choice despite paying $4,000 in fees.

In a different example, let's say you only plan to borrow only $200,000. It's your first home in a city you plan to live in for four years after which you plan to sell it and go to graduate school.

A 0.5% difference in mortgage rate is a savings of $1,000 a year on a $200,000 loan. Over the four year period, you will have saved $4,000 in interest expense by selecting the 3.5% mortgage that cost you $4,000 in fees.

Four years is now your break even point. If you keep the home and the mortgage for longer than four years, you start benefitting from paying fees up front for a 0.5% lower mortgage rate. But if you get rid of the mortgage by selling or paying off the mortgage before four years, you spent more than you should.

Who Should Do A No-Cost Refinance

A no-cost refinance or no-cost new mortgage is great for the following scenarios:

1) You’re planning on moving, upgrading, or downgrading homes within a few years

2) You believe rates will move lower during the duration of your homeownership, given you the potential to refinance at a lower rate.

3) You are getting a lower rate on your refinance already.

4) Your ARM is set to adjust shortly and the rate is similar or lower than your existing ARM rate.

5) You plan to pay down the mortgage rate much sooner than the 30-year typical amortization period, thereby paying less in interest expense.

Never be afraid to negotiate your mortgage interest rate and your mortgage fees. The first quote is seldom ever the best quote a lender can give.

The key to getting the lowest mortgage rate possible is to get at least one written offer by a lender and then using that written offer to ask your existing bank to match or beat the rate and terms.

Easily Check Mortgage Refinance Rates

Shop around for a lower mortgage rate: Check the latest mortgage rates online. Access one of the largest networks of lenders that compete for your business. Your goal should be to get as many written offers as possible and then use the offers as leverage to get the lowest interest rate possible from them or your existing bank. Compare multiple real quotes, all in one place for free. When banks compete, you win.

A no-cost refinance is a psychologically great way to help you go through with a refinance or new loan. Take advantage when lower mortgage rates are available.

About the Author: Sam worked in investment banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income, most recently helped by real estate crowdfunding. He spends most of his time playing tennis and taking care of his family.

Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.