Reaching the maximum limit for 401(k) contributions of $19,500 for 2021 and contributing an additional $6,000 for those 50 and older is no easy task. Let's look at what percentage of people max out their 401(k).

Only 13% of participants maxed out their 401(k) in 2017 (when the limit was $18,000), according to a 2018 Vanguard report about its investors. The percentage of investors who maxed out their 401(k) in 2020 hovered around 13%. It's too early to tell what percentage of people max out their 401(k) today given we're still coming out of a pandemic.

What’s more, these investors had higher incomes, were older and had longer tenure at their employers.

Comparatively, 9.1% of workers whose 401(k) plans are managed by Fidelity Investments reached the cap, up slightly from 9% at the end of 2017 and 8.1% at the end of 2013.

The older you were, the more likely you were to max out your 401(k) given the presumed higher median incomes. Millennials were dead last in their 401(k) contribution amounts.

Given the rebound in the S&P 500 in 2020 from its -32% decline from peak in March 2020, one can presume the average 401(k) balance is back over $100,000 once again.

What Percentage Of People Max Out Their 401(k)

Below is a chart highlighting the average 401(k) contributions by age from Fidelity's database.

As you can see from the chart, no age range maxes out their 401(k). It's actually kind of sad to see that the 60-64 age range maxes out the most at $9,440 given they are so close to the traditional retirement age of 65.

Further, one can start withdrawing from their 401(k) penalty free at 59.5, so it is strange they are still contributing. After the age of 60 we should be enjoying life more instead of trying to aggressively save for the future.

Then again, the average life expectancy continues to grow. It's always better to end up with too much money than too little.

Try To Max Out Your 401(k) ASAP

If you want to achieve financial freedom by the time you're in your 60s, you should max out your 401(k) every year for as long as possible. Given contributions are in pre-tax dollars, the retirement contributions shouldn't hurt as much.

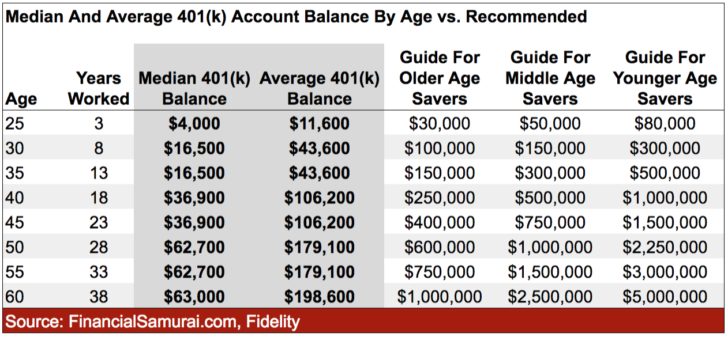

Here is my guide for how much you should have in your 401(k) by age to ensure a healthy retirement. The gray area shows what the median and average 401(k) balance by age is for the typical American. The right three columns show my recommended amounts.

You will be able to achieve my recommended 401(k) balances by age if you consistently max out your 401(k) and allocate your cash properly. Add on company matching and everyone should be a 401(k) millionaire by the time they hit 60.

Although less than 15% of Americans who have 401(k)'s max out their 401(k)'s, don't be like most Americans who are struggling to come up with $1,000 for an emergency and need to rely on Social Security to survive in retirement.

Not only should you max out your 401(k), you should save an additional 20% or more after tax and building your after-tax investment accounts. It is your after-tax investment accounts that will generate passive income for you to live a comfortable retirement life.

Now that you know what percentage of Americans max out their 401k, it's up to you to join the movement. You only have one life to live, make the most of it!

Achieve Financial Freedom Through Real Estate

In addition to maxing out your 401(k), consider also investing in real estate. Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income.

By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Recommendation To Build Wealth

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your 401(k) through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

I’ve been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

What Percentage Of People Max Out Their 401(k) Is A FS original post.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience because our finances are too important to be left up to pontification.