Don't buy stuff you cannot afford. It's a simple mantra to help you get rich. It's baffling to me why people keep spending when they know they shouldn't.

For some reason, some continue to not pay off their credit card bills every month. Can you believe this nonsense? Who willingly buys something they cannot afford, and then pays massive interest on something for months, if not years? That's just silly. Let's get that 30 pound dumbbell and drop it on your toes.

After your metatarsals are broken, get a really long needle and start ramming them into your eyeballs. Maybe after a while, you'll realize how stupid it is to live beyond your means.

We have proposed creating government restrictions on what you can and cannot buy, and how much credit you can get based on your high school and college transcripts. If you're stubborn enough not to see the value of doing well in school, then you are likely stubborn enough to buy things you can't afford.

The government can be a helpful big brother to save consumers from over-consumption. Listen here, this is only one solution to help protect people from themselves. You are welcome to offer up another novel solution too.

Manage Your Money In One Place

Sign up for Empower, the web's #1 free wealth management tool to get a better handle on your finances. You can use Personal Capital to help monitor illegal use of your credit cards and other accounts with their tracking software.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely check to see how your financial life is shaping up since it's free.

I've been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management. Don't buy stuff you cannot afford!

Related: Things To Buy With Your Enormous Investment Gains

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Diversify Your Retirement Investments

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

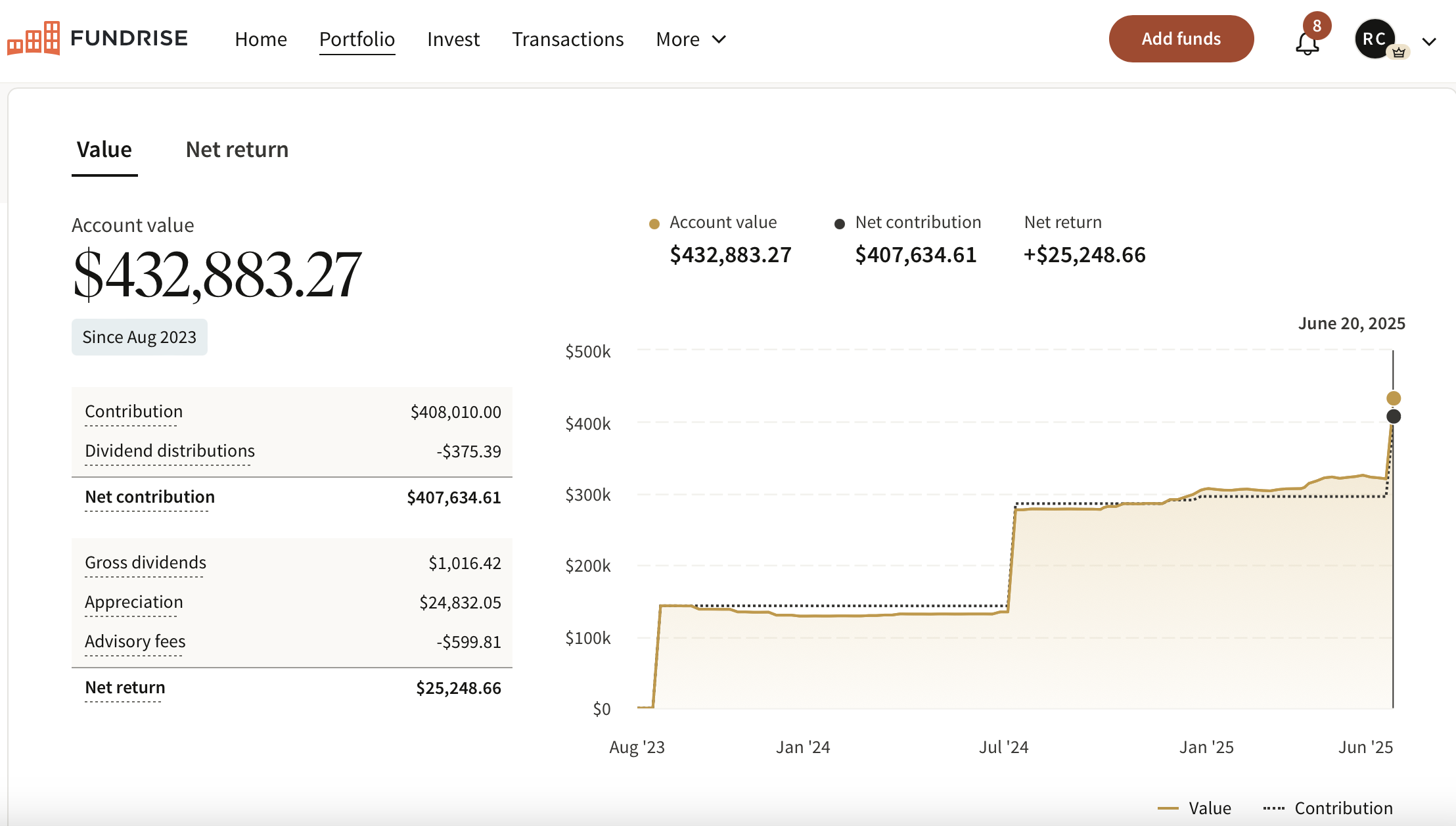

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher. As the Federal Reserve embarks on a multi-year interest rate cut cycle, real estate demand is poised to grow in the coming years.

In addition, you can invest in Fundrise Venture if you want exposure to private AI companies like OpenAI, Anthropic, Anduril, and Databricks. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We're still in the early stages of the AI revolution, and I want to ensure I have enough exposure—not just for myself, but for my children’s future as well.

I’ve personally invested over $400,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

To subscribe to my free newsletter, click here. Check out my Top Financial Products page to help you achieve financial freedom sooner as well.

Great video, but I have to wonder, what if I want to buy something and someone else has the money to pay for it, but I don’t… should I buy it then? (lol)

Lol. Go for it! It’s what millions of people do who live off the government and pay no taxes! Go USA!

LOL, I loved the video. Thanks for the article!

When people look around all they see are others with new or nicer things, and in turn, they want to keep up or surpass them. However, what you can’t see is their savings account, credit card debt or state of financial security. Just because someone looks richer than you, doesn’t mean they are. Lots of people need to learn to not try to look more well off, but actually be more well off.

hhaa, this is a great skit, this is needed advice, that’s the funny part.

Such a simple message, but it ignored daily by millions of people! There are alternatives for the things you actually need such as shelter and food. There are many programs through the government, religious and other organizations to help people with basic needs.

That’s a hilarious video! Thanks for the mention Sam :). I learned so much trying a vegan diet for a week. I found some great chocolate “ice cream” sandwiches made with soy milk last week that have been a yummy substitute for dairy ones. I’m doing pretty good at keeping to my post challenge goal of one day a week vegan and 4 days vegetarian. Have a great weekend everybody! -Sydney

Wow, 5 days a week no meet is very impressive for a carnivore! Good job! And, no wonder……. Hmmmmmmmmmm :)

I think that people just dont seem to understand where they are headed if they continue to spend. A lot of stories you read in the papers about people going through bankrupcy have a whole crapload of things wrong with them – lost job, health, etc and many people think that if they dont let that stuff happen to them, they are ok. NEWS FLASH – everyone starts somewhere, and most start with the credit cards.

Jon also has a good point – many people my age (and older) are still bailed out by their parents all the time.

Unfortunately, we live in a society where we are all “ENTITLED.” Parents treat their kids like best friends and they give them whatever their littles hearts desire. In turn, kids lack the skills needed to enter the workforce and function as an adult. Consequently, they rack up credit card debt they cannot afford while incurring even more debt due to the high interest rates. Parents do not understand that they are raising adults and not children. Need and want are synonymous in this day and age. It will take apparently a larger catastrophe to make people wake up and smell the roses (as if the foreclosures and this recession wasn’t a wake-up call enough).

Thanks for including us Sam! We prefer to use our own personal mobile devices – our legs – to get around. To and from work every day by foot or bicycle wheel.

I remember that SNL video! I hope people get the message behind the few minutes of entertainment!

Was wondering what the name of the video was, it is not available to be streamed in Canada, was going to try and look it up on Youtube

Thanks

I think you’re mistaken – were you not aware of the credit card booths set up at a every major university in the country?

I assure you, the vast majority of those students given a credit line had no business receiving it.

The best kind of customer for the big CC companies is exactly the kind of person you’re saying doesn’t exist.

They love to tether someone to their past purchases.

“Only $15 a month for the rest of my life! Wow!”

I was aware, and walked on by because I didn’t make enough money to spend! Also, I didn’t need no stinking t-shirt either.

Unfortunately there is an insane amount of people I know who do this. My husband and I bought doors last year on an interest free card, as it was better to keep our money earning interest and because we knew we would not spend anymore on the card. I normally loathe the things.

When we got it we had a $14,000 limit!! We could not believe we had that much ‘spare’ on the card. We rang up and had it reduced of course. I mentioned this to a few friends and 90% responded with “I would have gone on a shopping spree!” And they were serious. They have done it before.

So sad, yet so true.

I think you two got a $14,000 limit b/c you guys have good credit and make enough to afford it. Whatcha think?

Hey, it’s Dr. Spaceman. That’s hilarious man.

I should write a one page Ebook on that topic and give it away for free. ;)

Thanks for the mention!!

If it wasn’t a problem then Congress wouldn’t have passed the Credit Card Accountability, Responsibility and Disclosure (CARD) Act signed by President Obama.

Unlike you the vast majority of American’s don’t even make $35,000 a year, let alone have that much in savings. So if you make $20,000 a year you may qualify for anywhere from $2-$7,000 in credit card limit. This doesn’t mean they are financially equipped to pay off that debt if they use it, but the credit card companies aren’t ready to have you pay a small amount each money for that privilege.

I think credit card companies make far more money off people who make less than $50,000 a year than they do from people who make $150,000 a year. You should never underestimate the poor decisions of the material “poor”.

The $35,000 credit limit is an illustration and can’t be arbitrarily compared to someone else’s income. Like you said, if you only make $20,000, you probably will qualify for very little. There is no way someone only making $20,000 will qualify for a $7,000 line btw. And even if they do, they wouldn’t max it out.

I strongly believe in the intelligence of people. The poor aren’t stupid, they just don’t have as much money as others.

I can’t watch the video from Canada, but “Don’t buy stuff you can’t afford” seems like obvious – but sadly very necessary – advice.

The problem, though, is that many people have a skewed idea about what they can “afford” or even what the word means. If there’s room on the plastic, if the bank will approve it, if the money is in the account long enough to spend, then they can “afford” it.

Sorry, Sam. Look into most ‘poor people’ and you’ll find bad decisions about starting

families, poor educational performance, and in the US, way too many ways to

stay this way. Just look at the folks that are poor and win the lotto – boom! money gone.

It’s a liberal myth that by just giving out gobs of $$ to ‘the poor’ (however those are

defined), they’ll magically become un-poor, stronger contributors to society, yadda yadda.

Other than those folks that were disabled their way into poverty, most what you see

are due to the preceding problems.

Give the poor more money, and they’ll just spend it.

And, as we’ve discussed on other threads here, a college education is just another

commercialized product in the US of low quality like so many. Look at all the law school grads

who are in debt up to their kiesters, and aren’t earning minimum wage. Law grads! Who’ve

passed the bar! Earning less than min wage!

Until we gain control of the burgeoning population in the US, the only westernized country

with a birth rate over 2 per woman, we’ll continue down the path to the 3d worldification

of the US. Sad, really, but not unexpected esp. when Reagan was elected. Fell off

the cliff then and we won’t recover.