Want to learn how to get out of massive credit card debt? You'll learn how in this step-by-step post.

I don't discuss too much about credit cards on Financial Samurai because I've only got two (a cash back rewards card, and a cash back business card) and nothing much happens except for racking up rewards points. Definitely use a credit card for convenience, safety, rewards points, and insurance protection if you can control yourself. But if you're not careful, thanks to the ease of use and absurdly high interest rates, problems may ensue.

The following is a guest post by Financial Samurai reader, Debs, a middle income earning new grandmother who was able to amass over $140,000 in credit card debt! She was eventually able to get out of her massive credit card debt. I asked her to share her story on how she did it, and how she is getting herself out of debt. Kudos to Debs for having the courage to share her story.

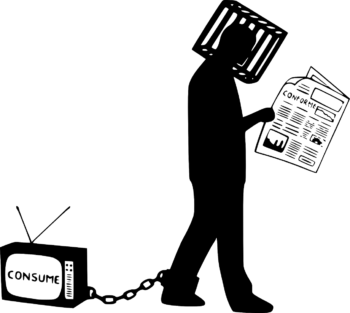

It’s embarrassing to admit, but I tell this tale as a warning to all people like me who are on the bandwagon of lifestyle inflation, “I deserve” and family struggles that may cause you to take your eyes off the ball and wake up one day to say “How did I get here?”.

We weren’t addicted gamblers or smokers. We didn’t have a lot of fancy toys. We drank moderately and yes, we had four kids and a large home to boot (purchased in 1991).

Maybe a few travels thrown in here and there, but not excessive. There was some shopping for work clothes and things for our home. Maybe a bit of stress relief shopping, but nothing extravagant. That is my first message.

Our massive credit card debt crept up on us without even realizing it. At least I didn’t realize the size it had grown to. I wasn’t watching the finances. I was only working hard to contribute to the family income. That was enough, or so I thought.

Why We Got Into Massive Credit Card Debt

In retrospect, I can see how we made some mistakes that didn’t help us. We financed a swimming pool in 1995 because we wanted to have a backyard oasis while the kids were young enough to enjoy it. That (a) was not a smart idea and (b) increased our mortgage payments, which we thought we could afford. Apparently not, because our home equity line of credit (HELOC) started to grow after that.

We never budgeted, we didn’t track spending. We just figured that as long as we weren’t going overboard, things would look after themselves. If we didn’t have all the funds to pay our credit cards, the balance was paid with the HELOC. Then my husband lost his job. Income came down so we did a refinancing and rolled the LoC into the mortgage and off we went again, changing nothing about our spending habits, still not tracking, just living. Strike 1.

My husband went for training in a different career (real estate sales) but this was a lot of work compared to the return, especially at the beginning. A number of years went by, and we came back to the trough again. Strike 2. This was the “do or die” refinancing. We were never going to do this again. Yet, we did not change anything except to say we never wanted to be in that position. As if it would just magically occur because that’s what we wanted.

Again still no regular analysis or tracking of spending was performed, and certainly no targets set either. We were free falling. We didn’t take any second jobs or sideline work, the only thing we did do to bring in some extra income was rent out a room in our basement.

After a few years, we had a freak storm and major flooding in our basement. This stopped the student renters for a period of time and once we had stopped we never got around to starting again.

Generally, it felt like we were too stressed out from the day-to-day hustle to even realize what our problem was. Ignoring things, saying “I deserve”, people pleasing were all part of our psyche. I left all the family financing to my husband, and in retrospect that was a big mistake. It seems that he is “penny wise and pound foolish” but I am actually the frugal one in the family.

Repeating the same events is the definition of insanity, and I plead guilty.

Strike 3 gave me the shock of my life like I had the wind knocked out of me. It happened in March 2012 when I discovered that our family debt consisted of the following:

- $26,000 of original mortgage debt including the refinancing for the swimming pool (not bad)

- $71,700 of a second step mortgage (Strike 1) which probably started at around $100K in 2005

- $100,000 in home equity Line of Credit

- $100,000 in credit card debt that started from low interest rate balance transfers but eventually grew, especially when the interest rates increased to normal prevailing credit card rates

- $47,500 of normal credit card charges

- $27,700 remaining on a truck loan

- $20,000 remaining on a car loan

The grand total was $393,500. I was 52 years old and my husband was 59. It was a personal debt disaster story.

The First Steps To Solving Our Debt Problem

It was the shock I needed to take action and take things into my own hands. I considered divorce. I didn’t consider bankruptcy. I don’t know if that could have been a prudent option for us or not. It wasn’t a word in my vocabulary, given I was earning six figures.

But first, I had to stem the bleeding, so we initially took the following steps to get out of massive credit card debt.

Arrange alternative financing at lower interest rates

We marched into our bank to figure out the options. I needed to get that debt off the credit cards A.S.A.P. to avoid the continued high interest rates. We took out a $235,600 mortgage with the equity in our home at 2.79% for 3 years, which would wipe out our HELOC and the large credit card and most of the other credit card. The bank could not advance us enough equity to wipe out all existing lines of credit, so we were left with a LoC for $11,900 at 7.9%, which was too high a rate for my liking.

Create a detailed budget and track spending

I created a budget and tracked every penny of spending in an excel file. Eventually I moved to doing this in Empower as well, but did not abandon my excel file.

I need my excel for cash flow forecasting and it gives me a second check on what is going on. Before our debt crisis day, I used the excuse that I did not have the time to do this. Now that we know how important it is, I do not mind doing it twice. ;-)

Renegotiate service plans

We renegotiated phone, TV and internet plans. It is amazing how willing the providers are to reduce your rates when you tell them you are considering moving to the competition because the costs are too high. We reduced our cable by $80 / month initially. We have since reduced costs further in these areas (see below).

Conduct a detailed analysis of your massive credit card debt

With some initial steps taken to reduce costs, I was still recovering from shock and trying to figure out if we could repair our marriage and rebuild trust. I needed to go back into history to figure out how the two credit card debts of $100K and $47K came about.

How these amounts grew so large seemed unfathomable to me, since it certainly didn’t seem like we were living beyond our means. What I was able to piece together was that it these amounts grew just on a few hundred here or thousand there that could not be paid off based on monthly cash inflows.

Why wasn’t our cash inflow enough even with a six figure income? We were servicing a HELOC of $100K for most of those years, so were paying $6K – $8K of interest charges annually. Since this money was going to interest, there was no extra cash flow for home maintenance and other incidentals.

Enter the cycle of robbing Peter to pay Paul. When I went back to re-tabulate, I arrived close to $100K in interest charges over about 18 years. Most of it was from the $100K HELOC , but towards the end, credit card interest started compounding as well. After that, I stopped following the money trail. I was sick of looking back and as bad as I felt, it wasn’t enough to throw away 22 years of marriage, so it seemed.

So I am here to say, this is how easily it can happen if you do not manage your money. Our combined income has ranged from $100K – $150K annually during this period of debt accumulation. At the start of our debt recovery in March 2012, our financial net worth excluding the value of our home was less than $100K. Our home is valued at about $500K.

How Did We Reduce Our Debt?

I can attribute this to tracking our spending against a budget and living reasonably frugally. In addition, we have deployed the following strategies to help reduce interest costs, reduce expenses , increase income or help with cash flow management.

- We increased our amortization periods on our older two mortgages, to allow for some breathing room on cash flow. We didn't pay less overall on our debt, we just paid higher interest debt first. We have deployed all available debt prepayment options on our mortgages with available cash including:

- annual prepayments (which don't have to be done all at once with our bank, but can be done in pieces anytime up to a maximum annual amount per mortgage year)

- payment increases by 15% once per year (which means original mortgages that were lowered are now being increased again as we wipe out other debt and have increased available cash flow)

- match a payment (doubling of our payment which means the second payment goes entirely to principal and we can stop any time.) This feature, available at our bank, also acts as a type of insurance for lost income since we can miss payments in future if needed in the event of a job loss, and not be considered in default of our mortgage.

- I have transferred vehicle debt or mortgage debt to a low rate credit card twice since beginning our debt repayment journey. Once to pay off our truck which was at 5.1% and once to make a large prepayment on our mortgage. I may continue to deploy this strategy, but only under the following conditions, because you need to take care of the low rate cash advance credit card pitfalls:

- when I’m sure I can pay off the balance in the time required before the interest rate hike. (Last one was an eleven month period at the low rate).

- I don't pay a transfer fee and only consider 0.99% interest rate. The transfer eats up too much of the interest savings to make this worthwhile, even if only 1%. Since I pay off the balance over time, I see the interest costs decline over the term.

- I will not do this any time near a mortgage renewal date, which would require a credit check. Our credit utilization rate would be raised after doing the balance transfer and this could inhibit our ability to get the lowest possible interest rate for the mortgage renewal.

- We use cash back rewards credit cards that pay 4% on gas and groceries. Our credit cards are paid off monthly by the due date. There is no carrying of credit card balance except in item 2 above.

- We rent a room in our house for $460 / month.

- We switched to a more reliable and cheaper internet provider and have replaced our home phone with a internet based system – savings $50 / month.

- We have just recently cut cable and will save $83 / month.

- We negotiated a better cell phone plan, saving at least $27 / month.

- We limit our entertainment spending and travel, but have managed to take one trip using accumulated business travel points and some planned savings to attend a family wedding.

- We’re currently focusing on ways to reduce our grocery/miscellaneous budget, which may involve simple tactics like keeping my husband out of the store and other fun games. :-)

The longer we live like this, the more we see opportunities to reduce our spending even further. It’s definitely a journey, putting one foot in front of the other on our march towards debt freedom. This year we have paid on average 61% of our net income.

Today we have paid off almost $147K in 2 ¼ years. We still have 4 years to go to reach debt freedom.

Many people with lower incomes may scoff at our ability to pay off $65K annually but I want to stress that it is all relative considering the size of our debt. Sure, I earn a good salary, but it is 64% of the $200K, Financial Samurai deems the right amount to be ‘happy’. In addition, my husband earns only 60% of the average Canadian wage of $48,250. Thankfully, his income is supplemented a little with a $321/month survivor benefits from his first wife who passed away.

Now, after more than two years of debt payment and good retirement portfolio equity market returns, 50% of our net worth is from our home, which we will renovate and sell after we are debt free. Some may say, why not sell now and wipe out the debt instantaneously and start fresh?

It has been considered and is still a point of discussion from time to time. We delay because we would need to do substantial kitchen and bathroom renovations in order to get the best return for our home which is in a good location. We do not want to increase our debt load in order to make that happen.

I’m not going to say it’s easy with a long term debt cloud hanging over your head, but I am going to say it’s possible. We are taking twice as long than what is normally recommended as the maximum to get out from under it – six years versus three.

I hope that when we are done, we do not have any regrets about not downsizing our home during this period. I also think that the habits and skills we are developing now will serve us well in retirement, continuing to live frugally, and appreciating what we have and how far we’ve come.

The Best Cash Back Credit Cards

If you're mature enough to utilize credit cards for your benefit by paying off the balance in full each month, then credit cards are a wonderful financial tool to improve your life. Not only do you get an interest free loan for a month, you get buyer's protection, and rewards points. I think everybody should have at least one cash back rewards credit card. Here are the best credit cards today.

And here are some other helpful articles about credit cards for further reading.

- Financial Samurai's Top Financial Products Recommendations

Pay off Your Debt Faster

If you don’t have enough cash, getting a personal loan from Credible is a good place to start.

Personal loan rates have come down significantly in comparison to the average credit card interest rate. Thus, if you have expensive credit card debt, consider consolidating your debt into a lower interest-rate personal loan.

Credible has the most comprehensive marketplace for personal loans. Up to 11 lenders compete for your business to get you the best rate. Get real personal loan quotes in just two minutes after you fill out an application. Check out Credible today and see how much you could save.

In addition, if you enjoyed this article and want to get more personal finance insights and tips, please sign up for the free Financial Samurai newsletter. You’ll get access to exclusive content only available to subscribers.

I hope everybody has at least one cash back credit card in their wallet. Just make sure never to carry a revolving balance. Use credit cards to your advantage for the rewards points, insurance protection, and one-month interest-free balance. Never let credit cards take advantage of you.

About the author:

debtdebs is a fifty-something wife, mother and new grandmother, who admits to having her “head in the sand” about their financial situation until amassing $247,500 of consumer debt for a total debt of $393,500. She shares her story with all those coping with poor money management decisions.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

[…] so long as he knows what he wants and has a plan to get there. Not all PF bloggers are big ballers. Some have tons of debt. But what every PF blogger has is the will and the direction to get better. That’s what […]

[…] important to align desires with responsibility. The reason why we get into mega-debt is due to entitlement and lifestyle inflation. Do not get into debt to pay for your amazing wedding. Figure out a way to make your wedding fit […]

Thank you debt debs for this terrific post and Sam for hosting it. As someone who has also struggled with HELOC’s, I can tell you that they have the absorption rate of quicksand. You just keep adding your short term credit card debt on to the pile, and then rinse and repeat, without ever dealing with the ever growing HELOC debt or the fact that your are living beyond your means. Much like gaining weight, it doesn’t happen all at once. It’s the extra pizza here or burger there, that you consume without ever working out that sneaks up on you. Keep up the good work debt debs, there are a lot of us out here working off these big debts and you are an inspiration.

Thanks for letting me share my story with your readers, Sam.

You have to be your own steward (obviously, guilty as charged), because there’s not enough checks and balances in the system to prevent someone making a good wage but not monitoring their spending to not fall into this trap. It can happen with a larged sized HELOC and credit card companies willing to give you cards all the time. It’s not a matter of spending $50K all at once, it’s the $500 here and the $1000 car repairs there that give you a $7K credit card bill some months that you can’t pay so it goes on the HELOC. If you’re not monitoring it well or always have an excuse as to why your are over, the cycle continues.

About $100K over 18 years was due to interest on the HELOC, with some interest from credit cards towards the end as well. We weren’t too big on reward programs during that time, basically, because looking at finances was not on our radar then.

Thanks for helping me to look at the bright side. We’re on the right track now. It’s all good.

Hi Debs,

Thanks for sharing your story. Before this post, I honestly did not realize a middle income earning household could amass this much credit card debt.

For example, I’ve got a TOTAL line of credit for my three credit cards of $50,000. I guess I could increase it, but I will never spend $50,000 a month, unless I’m buying a car or something crazy.

What percentage of your CC debt accumulation do you think was due to interest and penalties, as opposed to just charges?

Also, surely you got some good reward out of your credit card consumption too and not all is for nothing right? Just trying to look on the bright side!

thanks,

Sam

I hope others in debt stumble on this post and see that it isn’t impossible to get out of debt – it just takes planning and discipline, which you’ve shown in spades!

I thought my student loan debt after college was high :P :D

Awesome, detailed post Debs. I had no idea that you went through such an ordeal with your debt. You’ve shown amazing persistence to get to where you are now. I could never previously understand how people could get into that consumer debt, but your story sheds some light on just how easily this can sneak up on you when your not paying attention.

Your combined gross annual income is 64% of 200,000 + 60% of $48,250 = $157,000 (rounding off) + $321/month survivor benefits. Your gross monthly income is $13,400. Assuming 30% taxes, that equates to after tax gross income of $9,380/month.

You have paid off $65,000/year (rounded), which equates to $5,400/month. This leaves you with basically $4,000/month for everything else not related to debt relief. Is that correct?

We spend out $4,300 / mth on housing & utilities (incl property taxes), groceries, entertainment, insurances, transportation and business costs. Transportation is quite high at $1K for 1 car payment + maintenance/repairs and gas (my husband drives a lot for his job).

This post frightens me a bit because I just bought a house and am considering financing a pool in the backyard. I met with a contractor who told me the cost could be as much as $60k which I would have to pay for with a business line of credit at 6% interest. Yes, I can afford monthly payments that would pay off this debt within 3 years, but just the thought of financing using consumer debt just feels wrong. All the while I keep going to the community pool every weekend during the summer and wish I could invite my friends and family to barbecue in my backyard instead!

Don’t get the pool if you can’t pay $60,000 in cash.

Simplify your life and keep your finances healthy.

Let me ask you this – if you had the $60000 cash – would you get a pool?

You have an incredible story, Deb, and it seriously is motivating. We have a lot of debt, but it’s all student loans and a mortgage. I like the idea of getting lower interest rate on your debt. I was going to pay cash for my wife’s grad school classes this school year but I realized I could take out the maximum (federal) loan allowed and use that to pay off some higher-interest student loans. I can even take the money I was going to use to pay for the grad school classes and knock off more higher-interest debt. That alone should save us quite a bit in interest.

One of the main reasons why I didn’t get buried in credit card debt is because I watched it happen to my parents. Their debt got way out of control and they still struggle with debt. It’s hard with income limitations, families to raise, and continually rising costs. But as you’ve demonstrated there are always ways to reduce spending and get onto a healthier financial path with motivation and effort. Way to stick things through!

You have made great progress – where I think a lot of people would have thrown up their hands and gave up or buried their head in sand until things imploded and no further decisions would be required.

It amazes me how quickly and easily the spending death spiral sneaks up. Death by a thousand cuts it seems. Not champagne, caviar and yachts – just a slow steady outflow that is greater than inflow and before you know it …

Sorry Deb for being a latecomer! I blog from my iPhone and iPad and Safari will.not.load Financial Samurai for me :-( Finally at a good old Windows netbook :-) This is an amazing post – the fact that you laid it all bare is going to help someone else. Someone else out there is feeling totally hopeless and covered up in debt and they are going to see you fought through it, and now they will have some solid steps to help them. Way to go, working so hard, and encouraging others!

Weird Safari will not load for you. First feedback I’ve got. What version is your Safari? I’ve tested FS on my 2010 MacBook safari and 2013 work Safari and it works.

Jason, what did you buy with that type of debt?

Unfortunately, I think the majority of people are living this way and not realizing how easy it is to get in debt. Money is much easier to borrow then to save. The banks and credit card companies make it way to easy for people to get in over their heads. Great job on getting your life back on track. Thanks for sharing!

I’ve always managed to save more than I spend, but even so, getting on a budget was one of the best things I ever did to track my finances. It really is like an instant pay raise, because you immediately know where every dollar is going, and can make them work that much harder for you. This post is a great lesson in self-discipline and goal setting, thanks for sharing!

Interesting story. I can’t imagine the stress that it caused but I found it odd that your first thought was divorce. Maybe I missed something. Was he responsible for the debt or bring it into the marriage? You said try to rebuild the trust so I assume it was mostly his debt or he was in charge of the finances and kept you in the dark. Though if that’s the case I find it hard to imagine being able to hide that much debt.

Also I was a little confused by:

“At the start of our debt recovery in March 2012, our financial net worth excluding the value of our home was less than $100K. Our home is valued at about $500K.”

So including your house you have a net worth of a little under $600k with debt of $393K. Doesn’t seem that bad. Maybe I am miss reading it. So couldn’t you just sell your home and pay off debt and have ~$200K to put towards a smaller home?

Hi Brian

Yes, my husband was in charge of the finances. I never looked at the bank account online (except when I went to the ATM but there was always a few thousand in the account) or bills (he paid them). It is that easy to transfer money from credit cards to LoC, and from new credit cards to old credit cards, so I found out. This is how easy it can happen if you are both not accountable and responsible for the finances. I definitely advise to not abscond from this responsibility in any relationship. Nothing against my husband, he’s not a bad person at all, he just got in over his head trying to keep everything a float with four children and me likewise with a busy job in a high tech and struggling economy.

At that time we had net worth of $600K including our home but we are nearing retirement. Where I live $200K would not buy much in terms of home value (Canada). If we didn’t have the $247K of consumer debt, we would be mortgage free by December this year. So basically our retirement is delayed 3 – 4 years. I’ve yet to meet someone with that level of credit card / LoC debt from my travels throughout the PF blogosphere. If you know someone, please send them my way. ;-)

I know that this road has been a tough one for you Deb, but that goodness you got your head out of the sand and started tackling your issues head on. It’s scary and you have a long road ahead, but as you have shared, you are making progress not only with paying down your debts, but you are developing practices and skills that will become second nature and will help you as you head into retirement.

Wow, that’s kind of crazy. I guess that’s how a lot of household get themselves in trouble. The debts just keep building. Luckily, we are pretty frugal and never spent more than we can afford. Also, you might want to try getting your home ready sooner. The housing market is really good now and you never know how it’s going to be in a few years.

Thanks for sharing and great job with your progress so far.

If the housing market is not great for selling then we will use the equity in our home to buy a property at a good price and rent it out. Then when the market rebounds we will downsize. Thanks for your comment, Joe and kudos for being frugal. I like frugal.

If the price of the homes go down it is likely that interest rates have gone up. So servicing the debt of the equity pulled out will be more expensive! Keep that in mind! However if your home value goes down, it is likely other home values go down as well when you search for a new home.

Thanks for the post. Glad you are turning things around, I think you’ll be fine. It is amazing how small amounts every month, compounded (one way or the other) can add up over time. (This is a lesson for saving as well)

I think your post also really highlights the importance of home ownership, without it you would be far, far worse off today.

So, save every month and buy a home! (or two or more….)

JM

Thank you JM. I think it’s not wise to expect to use your home equity or mortgage for consumer debt. My purpose is to warn people that it can get this bad if you are not tracking your spending. However, if you did not have this advice previously, and are now in a pickle, there is a way to dig yourself out. Just don’t get into the robbing Peter to pay Paul as we did previously.

Also, please see my comment to Kipp above about the time frame I recommend you should pay off your home in (15 years). If you are paying for two or three at the same time, then maybe you could relax that.

Deb, your story is proof that despite a huge number ($393K) at the outset that if you really want to become debt free – you can. You didn’t take the easy way out like a lot of people would in your situation!

How is your relationship with your husband now that you’re in debt payment phase?

It’s really no different from before, except that we have both grown to see each others points of view better. Plus we’ve carved out roles for ourselves based on our skills and we play our positions better, like in a baseball game. We communicate about finances now too. We’ve both taken ownership for our part in the demise, and we love each other too much to let this tear us and our family apart.

Congrats on taking the hard path of working to pay the debt off as well as keeping the marriage in tact.

You’ve come such an incredibly long way on this journey so far! Like others have said, I admire your determination to go through this versus declaring bankruptcy. It can be tempting to take the easy way out, but at the end of the day, I think it’s sometimes more valuable to learn from your mistakes. I think you’re taking great strides in making this easier with all the negotiating and bill cutting. Not everyone is willing to make those sacrifices, and I think they’ll pay off big time in retirement!

As for your home, who knows, maybe a time will come when you feel it’s right to sell before your debt is paid off. It’s okay to be focused on other things right now. Renovations are a huge undertaking, and prepping a house to sell isn’t fun. When my parents sold their old house, my dad had renovated both of our bathrooms and part of the kitchen, and we painted every single room. Thankfully it paid off, but it took about 2-3 months.

I’ll be first to admit I’m not looking forward to our renovations, I’d almost be tempted to sell the house as is. My husband insists we will get the benefit out of it and he’s more qualified to make this call. I’m hoping with the debt behind us, we will be much more motivated to do the house upgrades as part of the home stretch before retirement.

Great job on reducing the debt Deb. The first part in any journey is realization, I am glad that you were able to find a way to start digging yourself out of that hole! I am not nearly in debt as you are, but 120k (including mortgage) can still seem daunting at times. Just chipping away one month at a time while still trying to plug into retirement accounts. Keep up the good work Deb!

With that attitude you’ll be fine, Kipp. What is your target debt repayment date for everything including your mortgage?

After our experience, I recommend that mortgage debt be paid within 15 years of house acquisition. Still take out a 25 year mortgage, but make sure you have lots of prepayment options so that you can get it paid within 15 years (less if possible, 15 is max). That way you won’t stress yourself out if unexpected expenses come up and it sure feels good paying extra each month and watching your amortization period fall. Usually after 15 years, people have kids going to university so the lack of the mortgage payment helps to even things out. That’s my philosophy anyways.

Total timeline is about 12 years, I actually pushed it back from 7 because I need to invest more in the ROTHs for an IRA ladder to work effectively. Basically I should have all debt KOed before I reach 40, so if other finances go better than planned I can hopefully move up my early retirement date! Right now target range I except between 46-50, last time I did the numbers at least. Alot of guesstimates, or EWAG’s (educated wild-ass guess) as one of my college professor’s would say.

Thanks for sharing your story, Debs. Very inspiring! I admire the fact that you decided to clean up your own mess and pay off your debt instead of running away and filing for bankruptcy.

Hopefully more people get their head out of the sand and tackle their finances and especially debt head on.

NMW – I don’t even know if bankruptcy would have been an option for us. It just didn’t feel right so I didn’t even bother investigating. We weren’t looking for handouts, even if the stress level was quite high. We had a fair bit of equity in our house, obviously, or we wouldn’t be able to take out the additional $235K mortgage. If we declared bankruptcy, would we be required to sell our home to pay creditors? I don’t know but maybe not. I’m hoping a reader may be able to comment on this further. In any case, it’s just not me so I’m happy that I didn’t even try to go there and fight to save our finances and our marriage.