Happy New Year 2026 everyone! With another year wrapped up, I thought I’d do a 2025 year in review so I can one day look back fondly as an old man. Overall, I give the year an A for effort, which is all I can really control. Unfortunately, the result didn’t match the effort, as I give it a B minus, maybe even a C plus.

The main reason for the B minus is ongoing family issues that negatively affected my spirits. I am naturally a happy and joyful person – a steady-state 8 out of 10. But for much of the entire year, I felt a lot of gray clouds and rainy days hanging overhead.

The thing is, even if you are happy, when someone in your family is under duress, your happiness will inevitably decline. From everything from aging to taking care of children and sick parents, the happiness dip for the sandwich generation is real.

Entering The Trough Of The Happiness Curve

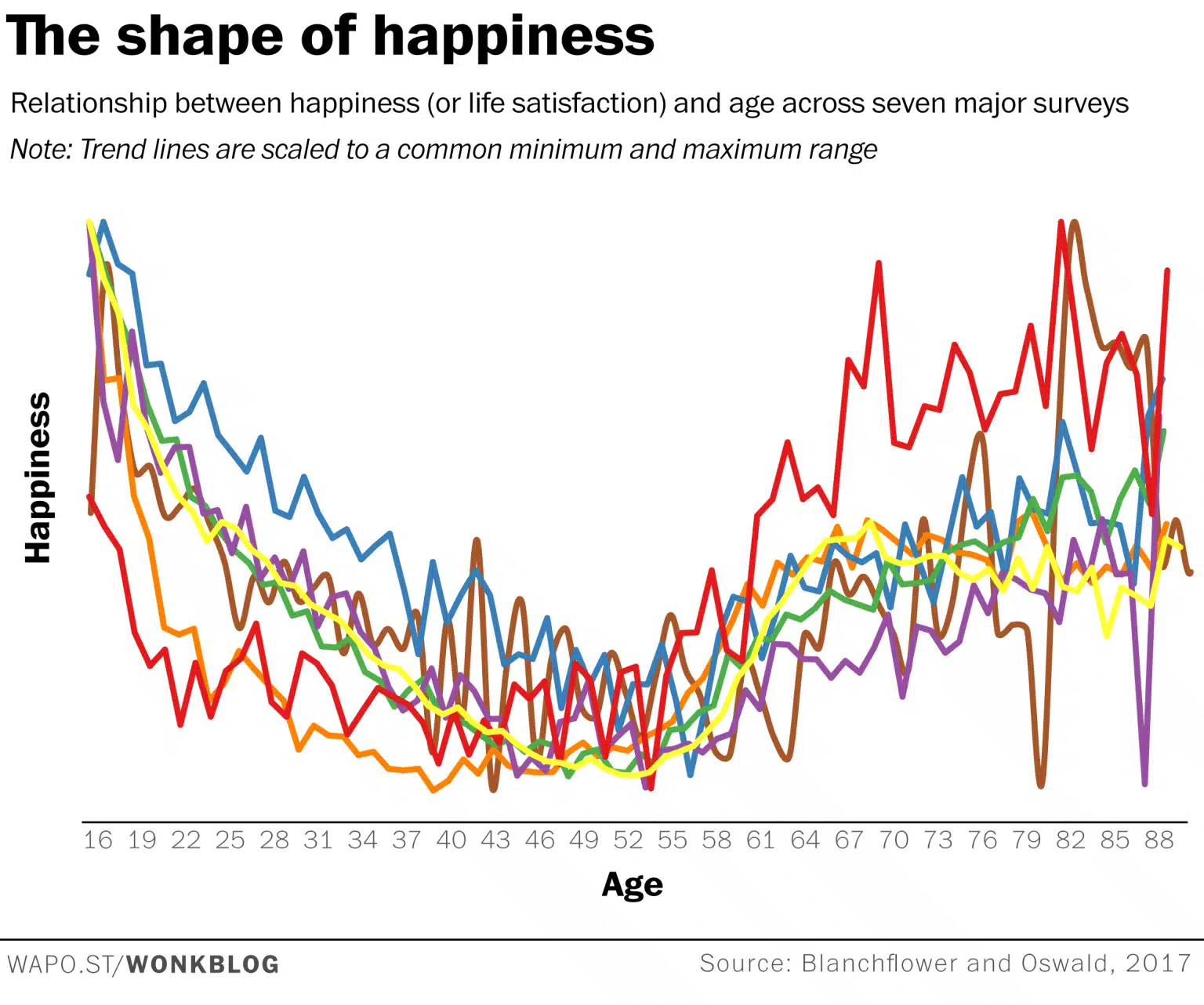

Just look at this great chart summarizing seven major surveys of 1.3 million randomly sampled people across 51 countries. Between ages 45 and 55 is where happiness is lowest – and my wife and I are 45 and 48.

I wrote this post first before looking for happiness curves to see where we stand. It’s comforting that we're not alone.

But gosh, I thought I would be able to avoid this trough by retiring earlier. In fact, I wrote a post stating the best reason to retire early is greater happiness sooner and for longer. That phase lasted about 11-12 years, but it has now faded.

2025 really made me appreciate, once again, how money can’t buy happiness after your basic needs are met. I was frustrated this year that, no matter how hard I tried, the melancholy still lingered.

It’s sad to realize that even if you live in a nice house, have minimal debt, have your health, don’t feel stuck at work, and have happy kids, you can still feel down sometimes. This disconnect also feels embarrassing, especially if you've grown up in a developing country with a tremendous amount of poverty and inequality.

We all know the solutions: practice gratitude daily, take steps to eliminate regrets, walk and exercise daily, reduce desire, and lower expectations However, besides constantly showing up, there’s sometimes nothing you can do when uncontrollable circumstances take place.

Now on to my 2025 review, categorized by Investments, Family, and Ikigai (reason for being).

Public Investments – Grade A

Overall, 2025 was a solid year financially thanks to another bull market. My combined public equity portfolio rose by about 22%. The reason for its 5% outperformance compared to the S&P 500 was due to my overweight positioning in Google, Tesla, and Nvidia. On the downside, my shares in Apple, Amazon, Netflix, and Nike underperformed the S&P 500.

This is now three years in a row of 20%+ returns, which feels like a lottery win after a difficult 2022 (-24% for my tech-heavy equities). The after-tax gains alone are able to pay for about four years of normal living expenses for my family of four here in San Francisco.

The problem with a 22% return is that it took a lot of effort to get there as an active investor. And frankly, I thought I had returned even more before crunching the numbers. In my mind, I thought I was up closer to 28% after buying the dip in March and April. However, that was only with my taxable brokerage account, which at least, is my most important portfolio.

If I had just invested all my money in an S&P 500 index and done nothing, I would have made about 17%. I’m not sure if the effort to make an extra 5% is worth it, especially since I could have easily underperformed like I did in 2022. But I stay active because a lot of money is at stake as DUPs with no steady active income.

Going through the whipsaw of the April tariff tantrums, followed by trying to constantly figure out whether the economy would really be OK amid stagflation fears, took a toll on my mental energy. But I need to recognize that a 5% outperformance has bought us a little over one year of normal living expenses. I just need to be careful not losing too much this year.

Private Investments – Grade A Minus

As for my private investments in venture debt and venture capital, it’s harder to gauge returns since so much is illiquid. I know one 2018 vintage venture fund holds Rippling, which is doing great. But the rest of the closed-end funds remain unclear as many investments are still in the early stage.

Fundrise Venture was a standout performer. It rose 43.5%, making it my top-performing fund investment of the year. I had about $150,000 invested at the start of 2025, and invested $100,000 on June 20.

Then in early August 2025, I also decided to reinvest $192,000 worth of expiring Treasury bills and open a new personal account earmarked for my children’s future. I figured, if I'm willing to invest over $200,000 in a 529 plan, then I might as well invest in the very technology that might make their college educations obsolete.

My main regret is not investing more at the beginning of the year when I had a windfall from selling a property. But out of discipline, I keep private investment allocation to at most 20% of my investable capital. I plan to let this ~$600,000 combined position ride for the next 10 years as I believe AI growth will continue.

The reason I don’t give my private investments an A is that one venture debt fund (out of three) closed out at a 12% IRR, underperforming the S&P 500. Meanwhile, my private commercial real estate investments saw another flat year, although there are positive signs of life.

Physical Real Estate – Way Too Much Effort

2025 was the most difficult year I’ve ever had as a real estate investor.

The main reason is that I had three tenant turnovers out of four properties, which required my wife and me to prepare each property either for sale or for rent. Then I did another remodeling job. The time, coordination, and emotional energy involved were significant.

Property #1: Most Recent Primary Residence Turned Rental

The first property required about two months of preparation and ultimately sold via a preemptive offer. I hit my realistic target sales price and felt extraordinarily relieved that we sold it, especially after the devastating January fires in Southern California. It was a great property with ocean views, but the rental yield was low due to the high price point and the need to manage four tenants each year was annoying.

After this sale, which only had a 13-day close, I thought the rest of the year would be easy street with regard to property management. Oh, how wrong I was!

Property #2: Summer Remodel Job

Given we decided to go to Hawaii for five weeks for summer school and see my parents, I figured it was time to remodel the neglected two-bedroom in-law unit connected to my parents’ house. It was my aunt’s old living space, and it hadn’t been inhabited for over 13 years. The place was piled with stuff, crawling with insects, and had broken faucets and faulty wiring everywhere.

I thought the remodel would take two or three weeks and cost maybe $25,000. But it ended up taking four weeks while I was there and another week after I returned to make the place fully livable, with furniture, a refrigerator, and appliances.

After gut-remodeling a property from 2019–2022, I swore I’d never remodel another property again. It’s a terrible process, and I would happily pay a premium for a fully remodeled home. However, I felt my summer in Hawaii was a now-or-never moment to get to work because nobody else would after my aunt passed several years ago.

The silver lining is that I got the place done and fully furnished, providing my wife and children with a more comfortable living arrangement during our 10-day winter holiday trip. That said, I did almost burn down my parents’ house twice in one week due to faulty wiring for the dryer. Ah, more stress.

Property #3: Partial Rental Turned Full Rental

After getting back from Hawaii in July, I needed to rest because the trip was also hard on my wife. I also felt unsettled since the dining room furniture, refrigerator, and washer and dryer weren’t going to arrive until early September, and then were pushed back until the end of November.

Unfortunately, during our time away, our long-time tenants since 2019 at another property found another place to live. They were solid renters who occupied the upstairs portion of a house with two bedrooms and one bathroom. They wanted an entire single-family home due to having a baby.

To accommodate, before we went to Hawaii, I offered to rent them the downstairs portion as well, giving them three bedrooms, two bathrooms, and an office. Even after offering a discount to comparable market rents, they decided to rent a smaller house farther south for less. No problem, but not ideal for me.

The process took about five weeks to find new tenants. Once again, we had to clean, paint, garden, and fix some random things in preparation for new tenants. I also hosted multiple private showings for parties. Fortunately, we found a great family who is respectful and had previously owned property in the area. They relocated back to San Francisco due to greater business demand after moving away during COVID.

The positive of our tenants moving out was our semi-passive income increased by $3,500 a month. This was thanks to charging market rent after several years of undercharging by ~$1,000/month and renting the entire house instead of just the upstairs for an extra ~$2,500 / month.

Property #4: The Largest Rental That Was Hardest To Rent Out

Finally, I thought I was done after three property turnovers! But no, the real estate gods had more work for me to do. Only a month after finding new tenants, I received another email from another set of tenants giving their 45-day notice. Apparently, they had already relocated to Colorado and were only returning occasionally. This was a surprise, especially since their kids attended a school just blocks away and they had moved in only 15 months earlier.

Once again, I spent about six weeks coordinating cleaning, repairs, and the tenant search. This time it was harder. The rent was a 35% higher price point than my other rental, which reduced the rental pool. Further, I was searching during the off-peak months of October and November, part of the worst time of the year to find renters.

Fortunately, five weeks after I published my first ad on Craigslist, a woman reached out saying she and her husband were relocating to San Francisco for work. One worked at a Series C private tech startup, and the other at one of the most popular AI LLM companies today, which I’m a shareholder in through the Fundrise.

To my surprise, the couple was willing to pay $10,000 a month for a five-bedroom, four-bathroom home. Given their salaries and equity compensation, the rent was actually quite affordable. They wanted two home offices and space for a home gym.

Due to these new tenants, rent for this remodeled home went from $9,000 a month for 12 months in 2024-2025, to $9,200 a month for three months in 2025, and now $10,000 a month from November 2025 onwards.

Solid Total Rental Income Growth

Overall, I boosted my semi-passive income by about $4,300 a month, provided there are no unforeseen expenses. I sold a property purchased in 2020 for roughly a 20% net profit after taxes and fees and reinvested most of the proceeds into public and private equity. Then I made made a two-bedroom in-law unit really nice for all family members to stay.

As a result, I give the real estate returns an A, but the effort required an F. I feel like I did four years worth of regular real estate management in one year.

As a result, I’m determined to sell another property after 2027 when I can take advantage of the tax-free exclusion rule. In the meantime, I hope my tenants enjoy the properties and remain self-sufficient. Real estate was my greatest source of financial stress in 2025.

The commercial real estate market also seems to be waking up from its long slumber. It’s been a tough slog since inflation surged and the Fed began hiking interest rates aggressively in 2022. But valuations are now extremely compelling compared to the stock market, and I’m starting to invest more in private real estate again.

Family Dynamics – Grade B Minus

Due to some complex issues affecting one beloved family member especially hard, a gray cloud hung over my wife and me throughout the year. I tried to be a rock by keeping our finances solid, running Daddy Day Camp every weekend, dropping off and picking up the kids 95% of the time, and always being around in the evenings.

My days would generally run from about 5:15 a.m. until 11:30 p.m. because I wanted to write before the family woke up and after the family had gone to bed. Unfortunately, my effort to be a full-time dad didn’t seem to be enough. My wife has a lot on her plate, is doing the best she can, and is genuinely adored by our children. I’m also learning how to be more empathetic to matters and biological changes outside our control.

The good news is that we have the financial resources to provide the best treatment and care possible. Another bright spot is that our children continue to grow and thrive. They love their school, have friends, and receive an enormous amount of quality time from both parents.

In particularly, I spent a lot of time teaching both kids tennis and swimming. They now have decent-looking forehands and backhands, along with improved freestyle strokes. In total, I gave each child at least 35 one-on-one lessons, each lasting one to one-and-a-half hours.

Teaching your own kids requires patience, internal prayers for patience, and sheer determination. But seeing visible progress has been incredibly rewarding.

It is deeply satisfying to be able to support my family and enable my wife to be 10 years free from full-time work after helping her negotiate a severance package back in 2015. However, the weight is getting heavier thanks to persistent elevated inflation, unnecessary desires, and hedonic adaptation. I need to make adjustments in order to last.

Ikigai (Reason For Being) – Grade A Plus

Once you leave your day job, you’ll most likely need to find something creative or purposeful to do – your ikigai. I highly doubt you’d be happy only watching eight hours of TV a day and playing pickleball. Personally, I have a need to feel useful. It also feels great to help people feel better and gain confidence in their finances.

In 2025, I published another 156 articles, 52 newsletters, and roughly 30 podcast episodes. Here’s a recap of the best articles on Financial Samurai for 2025. What made this particularly gratifying were two things.

First was the success of my second national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. It took two years to write and countless hours to market. One of the highlights was narrating the audiobook myself. It was one of the most challenging professional experiences I’ve had.

The difficulty of the process made me realize how a disability or health issue could take away your ability to earn, so please take nothing for granted. If you are healthy, take advantage of your ability to produce before it's gone.

Second was maintaining my publishing streak despite Google and AI negatively impacting site traffic. As organic traffic declined, so did revenue. But because I genuinely love writing, I kept going anyway. I’ve been expecting this day for five years, and now the existential crisis from AI is here. I don't think I'll ever fully quit.

Surprise Video Interview

Finally, Business Insider released a fun video interview featuring my family and two others discussing money lessons for raising children. The inquiry came out of the blue and felt like a perfect way to close out the year.

Instead of paying to take pictures and send out holiday cards, I had an Emmy-winning producer reach out and produce a video for us instead.It was a great way to finish the year and commemorate my parents and grandparents.

Money Is Nice, A Happy Family Is Far Better

2025 reinforced a truth I’ve known for decades: the window to live your best life doesn’t stay open forever. This is the main reason I quit the desire to make maximum money at age 34 and left my finance job behind. Once your basic needs are met, money no longer brings incremental happiness.

Family and friends matter far more. They are also the people who can hurt us or help us the most. To this day, I’m still trying to better understand my parents’ personalities. Specifically, I’m trying to differentiate how much of the way they are is due to their personalities versus their ages. They operate so differently than I do that I find myself searching for clues when I’m with them.

I’m also living life for the first time and am fascinated to see how our perspectives change over time. You’d think we’d always be able to steadily increase our joy the more we achieve, but I’m not seeing this correlation after age 45. Instead, the more we have, the heavier we tend to feel and the more we suffer. Having ever-higher expectations is a recipe for unhappiness.

Genetically, we’re all built differently. Based on twin studies, roughly half of our happiness is influenced by genetics, setting a “set point,” while the other half comes from our intentional actions and life circumstances. So I need to remain mindful that we are all unique in our own ways.

Glad 2025 Is Over, But Also Miss The Time We No Longer Have

I’m proud of my effort and my attitude this year. I called my parents regularly and made time to see them more than I have since I was 19. The highlight was surprising my dad for his 80th birthday on November 17 by simply appearing in the kitchen one afternoon as he came downstairs.

Health-wise, I continued to play tennis and pickleball three times a week and even started going to Sunday night basketball at my children’s school. I just need to be careful not to overdo it to avoid injuries.

In the end, I grew our household finances, spent tremendous quality time with our children, helped many people with their finances, and survived a year of persistent gray clouds. On the flip side, the time spent actively managing our finances during a volatile stock market, finding new tenants and buyers, and dealing with significant car problems at the end of the year really beat me up.

A B minus grade feels about right. But I hope the rays of sunshine will burn off the clouds more regularly again. Here are my New Year’s resolutions for 2026.

How was your 2025? What were some of your hits and misses?

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

If you’re looking for a way out of a soul-sucking job, consider learning how to negotiate a severance package like my wife and I did. Check out my bestselling ebook, How To Engineer Your Layoff, to learn how. Use the code “saveten” to save $10. The book has been refined over the past 14 years. If you quit, you get nothing. But if you negotiate a severance package, you can secure a nice financial runway to do whatever you want with far less financial anxiety.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Financial Samurai was established in 2009. Everything is written based on firsthand experience and expertise.

Hi Sam, Great post. read that the u shaped curve of happiness is now being debunked?https://www.psychologytoday.com/ca/blog/fulfillment-at-any-age/202601/what-shape-does-happiness-really-take-over-the-lifespan

Fascinating! If you live long enough, everything people say a while ago gets debunked, and then the cycle renews again.

I guess I’m no longer in the trough of despair, hooray! :)

I had my kids watch your BI interview and remind them who you are. I discovered other BI interviews. They are all quite good.

I don’t want put a grade on my 2025 but life definitely has its stresses and challenges regardless of wealth. Wait until your kids start applying to college. I have one applying now and another flaming out in Junior year. It’s difficult to see in real-time one’s kids’ futures diminish in possibilities, but that is life. With each life (and with each year), we start with unlimited potential and through our choices and fate, we see opportunities created, wasted or eliminated. As a type A personality with strong long-term planning skills, I am quite content with the choices I’ve made in life, but I only have so much control over other people’s choices, abilities and outcomes.

Best of luck with the college application and hope your junior finds their North Star eventually. Some folks just take a longer time to mature or find their interest than others. Keep the faith my friend! And thank you for this perspective. I am sure there’s going to be a lot of worry then for me as well.

3 posts a week for ~15 years is an inspiration, Sam!

Congrats! What a cool way to end the year–an interview with BI.

Looking forward to 2026 and beyond.

Thank you Sam. I always enjoy your letters. It seems to me you wife might be hitting menopause. If that is true, I can understand the clouds on your horizon. If you want help and insight, I may have something to offer, being 60 and surviving the worst of it with 6 kids, a remodel and an eventual move from 41 to 56 yrs old. Please reach out, or better yet =, have your wife reach out. Trust me it is good to know you are not alone during this time.

Thank you Sam for writing your newsletter. You have made our family’s finances stronger and are directly helping us care for our son who will need our support into adulthood. I am so grateful for your wisdom and advice. Thank you thank you thank you.

Thank you for reading Jill. And bless your son and your great care of him!

Thank you for sharing your 2026 start with some honesty in your newsletter. Last year was a tough one for my family. I don’t share challenges with others because their lives seem fine, especially with spouses and parents. Two years ago my husband and I gut remodeled our first home for my parents to live in. I understand, intimately, you statement about negative comments. I appreciate your emails and the market analysis you provide. Keep up the good work. – Laura

Congrats on your prolific output in 2025 while juggling so many balls. Your content is much appreciated and game-changing. Keep up the good work. We must do everything we can to try to invert that u-shaped happiness curve! It’s not easy at all. By any objective metric, I had a successful 2025, but yet I’m now experiencing anxiety about sustaining this level or exceeding it in 2026. So annoying! I’ll keep reading the fisherman’s parable to keep this in check. Godspeed in dealing with those grey clouds.

Could you please share your “results” expectations by grade?

Sure. I always expect an A for effort, which is the main thing I can control.

And with A effort, I excited A results. So 2025 was a disappointment, and I’m thinking of adjusting my effort down.

How about you? What were some of your hits and misses for 2025?

Hi Sam,

Although this is a financial site, you talk about your pursuit of happiness quite a bit, which is a good thing. Have you ever looked into the Science of Happiness or the Greater Good out of a UC Berkeley research group? I’m not associated with it.

https://greatergood.berkeley.edu/podcasts/series/the_science_of_happiness

One item I think is missing from your analysis on increasing happiness is financially giving back to your community. I get so much joy from giving. It is a line item in my budget I take seriously and it always makes me happy.

I wish you a healthy, joyful, prosperous 2026! I hope the clouds lift in the family area.

Thanks for sharing. I’ll take a look as a Berkeley alum.

One of the reasons I’ve been able to publish three times a week for 16 years straight without charging a subscription fee is that I’m able to help a lot of people improve their personal finances. The emails and comments I receive each week—thanking me for an insight or for helping solve a specific problem—are one of the greatest rewards.

It honestly feels even more fulfilling than donating money to causes, which I also do, because I get direct feedback and can see the tangible difference I’m making in people’s lives. Some readers have been with me since they were in college or just graduating. Sixteen years later, many have started families, built tremendous wealth, and gained far more agency over their lives. Watching that growth has been incredibly rewarding.

I’ve also been doing more volunteer work at my children’s school, which has been equally meaningful. At the end of the day, feeling productive and helping others is a core purpose in my life—my ikigai.

Have a great 2026!

Love your site . Why are you so resistant to hiring property management ? Thank you for all your content and books!!

Thanks. It’ll eat up margins by 8 to 10% and then I have to manage the property manager. So by selling one property in 2025, I reduce my probable property management time by 25%, which is meaningful. And now that I have two new tenants, there should be no turnover this year and hopefully minimal problems. But you never know.

Do you have a property manager? If so, how much do you pay them and how has it been?

Hard to believe a new year has started. Congrats on a very full year. Sounds like you got so much done and did an excellent job providing for your family. Best wishes into the new year!