Age 30 is one of the most crucial ages in your life. You will have either made it or know you are on the path to making it by 30, or you will be somewhat lost for whatever reason. This post will address your question: How much savings should I have by age 30.

If you want to achieve financial independence, you've got to implement an aggressive savings routine. If you are serious about living life on your own terms, study my recommended savings chart carefully.

Your saving rate should increase the more you make. To do this, you've got to spend at a slower rate than the rate of your income increase. Don't let lifestyle inflation get in the way.

By age 30, you should have saved at least 1.5X your annual expenses. In other words, if you spend $50,000 a year, you should have about $75,000 in savings. Your ultimate goal is to achieve a 25X expense coverage ratio or 20X your annual gross income in order to retire comfortably or be financially free.

Let's look at the methodology!

How Much Savings Should I Have By 30?

Below is why saving rate guide based on how much you make. The more you make, the higher your saving rate should be.

I recommend everybody start off with 10% and raise their savings amount by 1% each month until it hurts. If you've ever had braces, you get the idea. Keep that savings rate constant until it no longer hurts, and start raising the rate by 1% a month again. If you make more than $200,000, certainly shoot to save more if you can. You can theoretically achieve a 35%+ savings rate in two short years with this method!

Please note that I am making 401K and IRA contributions a priority over post-tax savings. The reasons are: 1) we have a tendency to raid our post tax savings, 2) tax free growth, 3) untouchable assets in case of litigation or bankruptcy, and 4) company match. Obviously you need some post-tax savings to account for true emergencies. Ideally, my goal for everyone is to contribute as much in their pre-tax savings plans as possible and then save another 10-35% after tax.

401k Savings Is Crucial Today

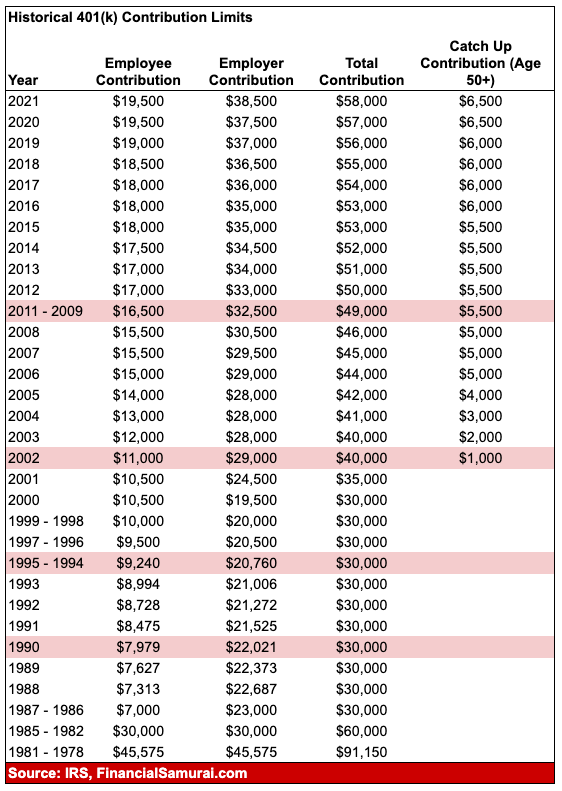

The maximum 401k contribution for 2021 is $19,500. It will likely continue increasing by $500 increments every 2-4 years if history is any guidance. By 25, you should be maxing out your 401(k) every year, no questions. By age 30, you should have saved over $100,000 in your 401k.

I remember when I was living like a pauper in NYC, sharing a studio with a friend, I still maxed out my 401(k). You can do it too.

Recommended Expense Coverage Ratio By Age 30

The below chart is an expense coverage ratio chart that follows someone along a normal path of post college graduation until the typical retirement age of 62-67. I assume a 20-35% consistent after tax savings rate for 40+ years with a 0-2% yearly increase in principal due to inflation.

The other assumption is that the saver never loses money given the FDIC insures singles for $250,000 and couples for $500,000. Once you breach those amounts, it's only logical to open up another savings account to get another $250,000-$500,000 FDIC guarantee.

Expense Coverage Ratio = Savings / Annual Expenses

As interest rates have come down, the reality is that your expense coverage ratio should go up. The reason is because it takes a lot more capital to generate the same amount of risk-adjusted income. Therefore, you really want to have a minimum expensive coverage ratio of 20X before you decide to retire. 20X annual income is a more appropriate net worth goal.

Note: Focus on the ratios, not the absolute dollar amount based on a $65,000 annual income. Take the expense coverage ratio and multiply by your current gross income to get an idea of how much you should have saved.

Your 20s: You're in the accumulation phase of your life. You're looking for a good job that will hopefully pay you a reasonable salary. Not everybody is going to find their dream job right away. In fact, most of you will likely switch jobs several times before settling on something more meaningful.

Maybe you are in debt from student loans or a fancy car. Whatever the case, never forget to save at least 10-25% of your after tax income while working and paying off your debt. If you have the ability to save 10-25% after tax, after 401K and IRA contribution up to company match, even better.

Savings By 30

Your 30s: You're still in the accumulation phase, but hopefully you've found what you want to do for a living. Perhaps grad school took you out of the workforce for 1-2 years, or perhaps you got married and want to stay at home. Whatever the case may be, by the time you are 31, you need to have at least 1.5 years worth of living expenses covered. If you've saved 25% of your after tax income for four years, you will reach one year of coverage. If you saved 50% of your after tax income a year for five years, you will have reached five years of coverage and so forth.

Your ultimate goal by 30 is to be on the right career track. If you are, your savings by 30 will naturally come. Your 30s is when you start earning a lot more money. With potentially 10 years of work experience under your belt, you will be up for more promotions and pay raises. Further, you'll find that other companies will start trying to poach you if you are any good.

Once you've established solid savings habits, your goal to accumulating a net worth equal to 20X your annual income is an inevitability.

Savings During Middle Age

Your 40s: You're beginning to tire of doing the same old thing. Your soul is itching to take a leap of faith. But wait, you've got dependents counting on you to bring home the bacon! What are you going to do? The fact that you've accumulated 3-10X worth of living expenses in your 40's means that you are coming ever close to being financially free. You've hopefully built up some passive income streams a long the way, and your capital accumulation of 3-10X your annual expenses is also spitting out some income.

Your 50s: You've accumulated 7-13X your annual living expenses as you can see the light at the end of the traditional retirement tunnel! After going through your mid-life crisis of buying a Porsche 911 or 100 pairs of Manolo's, you're back on track to save more than ever before! You are 100% in tune with your spending habits, therefore, you raise your savings rate by another 10% to supercharge your final lap.

Savings Once You Reach Traditional Retirement Age

Your 60s: Congrats! You've accumulated 10-20X+ your annual living expenses and no longer have to work! Maybe your knees don't work either, but that's another matter! Your nut has grown large enough where it's providing you hundreds, if not thousands of dollars of income from interest or dividends.

Full Social Security benefits kick in at age 70 now (from 67), but that's OK, since you never expected it to be there when you retired. You're also living debt free since you no longer have a mortgage. Social Security is a bonus of an extra $1,500 a month. You're budgeting a couple thousand a month for health care as you plan to live until 100.

Here are my thoughts on the best time to take Social Security. It all depends on your health, marital status, and financial situation.

Your 70s and beyond: Sure, you've been spending 65-80% of your annual income every year since you started working. But now it's time to spend 90-100% of all your income to enjoy life! They say the median life expectancy is about 79 for men and 82 for women. Let's just bake in living to 100 just to be safe by taking your nut, and dividing it by 30. For example, let's say you live off $50,000 on average a year and have accumulated 20X that = $1,000,000. Take $1,000,000 divided by 30 = $33,300. You're getting another $18,000 a year in Social Security, while the $1 million should be throwing off at least $10,000 a year in interest at 1%.

Important Note: Obviously no one ever knows what might happen to provide a boost or a drag to their finances. Maybe you get lucky with a great new job offer or invest in the next Apple Computer. Or maybe you get laid off at 40 and can't find work for two years. My chart above merely serves as a savings guideline. Work to build alternative income streams in the meantime.

Save Aggressively In Your 20s To Be On Your Way At 30

Don't party away your 20s. Use your 20s to earn, save, and build your investing habits. By the time you are 30, you will develop tremendous financial habits to get you to financial independence.

I was able to retire early at age 34 in 2020 because I consistently saved over 50% of my after-tax income. I also aggressively invested in stocks and real state during this time period.

For the money you are comfortable risking, actively invest the rest of your after-tax savings in real estate, the stock market, bonds, real estate crowdfunding, and basically anything else that matches your risk tolerance.

The point is to gradually expand your savings into investments where you feel most comfortable. Many people, including myself, love real estate because we can see what we are buying.

Having a good amount of savings by 30 is great. However, you need to also invest your savings diligently as well. Personally, I like real estate because it is a tangible asset that generates income. Real estate is also less volatile than stocks.

Favorite Real Estate Investing Platforms

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Diligently Track Your Net Worth

Finally, it's important to then track your investments and net worth. I highly recommend signing up for Personal Capital, a free online wealth management tool that let's you easily monitor your finances.

Before Personal Capital, I had to log into eight different systems to track 28 different accounts to manage my finances. Now, I can just log into one place to see how my stock accounts and net worth is progressing.

One of their best features is their 401K Fee Analyzer which is now saving me more than $1,700 in portfolio fees I had no idea I was paying. They also have a fantastic Investment Checkup feature that screens your portfolios for risk.

Finally, they came out with their incredible Retirement Planning Calculator that uses your linked accounts to run a Monte Carlo simulation to figure out your financial future. You can input various income and expense variables to see the outcomes. Definitely check to see how your finances are shaping up as it's free.

Don't waste your 20s or 30s. In fact, never waste a day of your life!