Let's look at what percentage of income do people donate to charity. The percentage of income donated is in the low single digits across all income levels.

Being able to give your time and money away to worthy causes is one of the best benefits of being financially independent. No longer will you always feel conflicted about whether you should save and invest your next dollar versus helping someone in need. You just tend to give more because you can.

Just keep in mind there are guidelines you have to meet in order to claim deductions on charitable donations. Here are several things to keep in mind.

Conditions If You Donate To Charity

- You'll need to itemize deductions and file Form 1040.

- The charity organization must be qualified with the IRS and be actively tax exempt. This excludes political candidates and organizations, as well as individuals.

- Used items such as housewares and clothing must be in good condition or better for them to be deductible.

- Donated vehicles can be deducted at fair market value if you meet certain requirements. For example, the charity must sell your car well below market price to a person in need, or the organization must make major repairs to increase the car's value. Alternatively, you could qualify if the charity will use the car for purposes such as delivering meals to needy individuals.

- If the total of your non-cash contributions is greater than $500, you'll need to file Form 8283.

- You'll need a written record of all cash donations with the date, amount, and charity name. So keep your cell phone bills for text donations and any relevant bank statements.

- If you donate $250 or more in property or cash, you'll need a statement from the charitable organization detailing your gift and if any services or goods were given to you in exchange.

- And if you receive goods or services for a donation, you can't deduct your entire contribution. The value of what you received must be less than your donation, and you can only deduct the difference.

- If you are volunteering and performing services for a charity using your car, you can deduct mileage.

- Travel expenses can be deducted if you go on a trip with a qualified charitable organization and you're “on duty in a genuine and substantial sense throughout the trip” per the IRS.

- Donations of property are generally deducted at fair market value based on what they would sell for on the open market.

- You can avoid capital gains on appreciated stocks held over a year if you donate them to a charitable organization. The amount you can deduct is determined by the stock's fair market value on the contribution date.

Please definitely try and give away useable items, not your throwaways because the shirt has a big hole in it. You want to donate something that someone in need can use with pride.

The Percent Of Income People Donate To Charity

There is not set rule for how much one should donate to charity. The Church encourages a tithe of 10%, but what if you are barely making ends meet? Or what if you're working 70 hours a week trying to provide for your two kids in an expensive city like New York?

Everybody's charitable contribution to charity is different. You can go to a school fundraiser and donate by just buying a ticket. Just donating to charity is a great move. Don't let anybody make you feel bad for not donating enough.

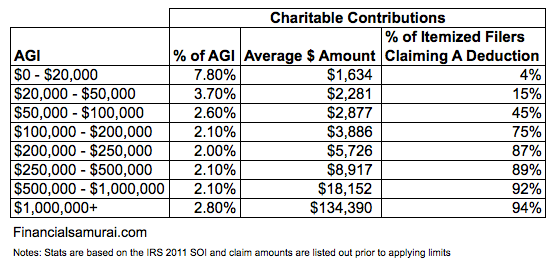

Below is the average percentage of adjustable gross income being donated to charity by income group. The data is from the IRS.

It is great to see the sub-$20,000 group give away such a high percentage of their income. At lower income levels, it's all about giving and helping each other survive. They know how hard it is to make a living at this wage.

Giving By Income Chart

Below is another giving by income chart from the National Center For Charitable Statistics. It's interesting to see the income groups that give the least earns between $200,000 – $1,000,000 at 2.4% – 2.5%.

Perhaps the main reason is due to the higher taxes paid through regular W-2 income. After all, paying taxes is a form of charity since your tax dollars get redistributed to help others.

I've written a lot in the past about how households making $300,000 and $500,000 a year in expensive cities are just living regular middle-class lifestyles. Part of the reason why is because a huge percentage of their income is going towards taxes.

Once you get over $1 million a year in income, a greater percentage of income tends to come from investments, which are taxed at a lower rate. This income group gives roughly 5.9% of their AGI to charity.

Give What You Can To Charity

The best way to help the world is to make sure your finances are solid so that you are self-sufficient. The more people are financially self-sufficient, the stronger our society.

Do everything you can to first max out your 401(k) and build taxable income streams. At the same time, focus on giving your money and time on things that matter most to you. Every little bit helps.

Finally, if you're feeling guilty about not donating to charity or not donating enough, know that paying taxes is a form of charity as well. Taxes are used to pay for healthcare subsidies, food programs, defense, and more.

Manage Your Finances Carefully

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

I’ve been using Empower since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

Diversify Into Private Growth Companies

Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10 while most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much.

What Percentage Of Income Do People Donate To Charity? is a Financial Samurai original post.