In order to comfortably raise a family in an expensive coastal city like San Francisco or New York, you've probably got to make at least $300,000 a year. Thanks to elevated inflation post pandemic, the middle-class lifestyle is getting harder to obtain due to rising costs of gasoline, food, housing, travel, tuition, and healthcare.

You can certainly raise a family earning less. Statistically, most do. However, it won't be easy if your goal is to save for retirement, save for your child's education, own your own home instead of rent, and actually retire by a reasonable age.

Although $300,000 is a lot compared to the median household income in the United States of ~$80,000, it's not an outrageous sum of money. Once you pay taxes and look at the realistic income statement I've put together for this article you'll see the income is reasonable.

After all, the cost of living is quite different across the United States. Almost half of the United States population lives in expensive coastal cities.

A Middle Class Lifestyle Is All We Really Want

All expenses in my example use current prices. I've also cross-checked the expenses with my family's monthly expenses now that we have a son to make sure they are within reason. I've also cross-checked the expenses with over a dozen other households who make around $300,000 a year.

I use $300,000 in this post because I also believe it is close to the ideal income for up to a family of four to experience maximum happiness.

At $300,000, you aren't paying an egregious amount in taxes (24% marginal federal income tax bracket). You probably aren't killing yourself at work if both parents are working. At the same time, you're still earning enough to live a comfortable lifestyle anywhere in the world. A middle-class lifestyle is all we really want.

About half the US population lives on the coasts. Therefore, this post is directly targeted at folks who need to live on the coasts because of their jobs, schools, or families. If you don't live on the coasts, you might live in a city like Denver or Austin, where the cost of living is rising rapidly as well.

Finally, this post should also provide insights to non-coastal city residents on how good you've got it if you enjoy living where you are. $100,000 – $150,000 is a rough non-coastal city household income equivalent to $300,000.

Who Makes $300,000 A Year?

Before we look at the income statement, let's go through a list of various $300,000 income households. To no surprise, many of these $300,000+ household income earners live in more expensive areas around the country.

- A Bay Area Rapid Transit janitor who makes $234,000 + $36,000 in benefits who gets together with a Bay Area Rapid Transit elevator technician who makes $235,814 + $48,429 in benefits.

- Starting total compensation packages for 22 year old employees at Facebook, Google, Airnbnb and Apple range from $150,000 – $180,000. By the time they are 30 years old, they are making $300,000+ a year.

- 30-year-old first-year Associate in banking earns $150,000 in base salary + ($0 – $120,000) in bonus. In a couple years, she is making over $300,000 a year.

- A 26-year-old first year law associate at a big law firm like Cravath makes $190,000 base + $30,000 sign on bonus. By the end of his 6th year his is making over $330,000.

- A 29-year-old Director of Marketing at a startup makes between $150,000 – $180,000. She's married to a pro blogger who makes $350,000.

- A 42-year-old college professor at Berkeley makes $235,000 and $279,000 at Columbia and NYU.

- The average specialist doctor finishing his or her fellowship at 32 makes $300,000. The average salary for a primary care physician is $200,000.

- A 26-year-old middle school teacher making $60,000 a year plus her $250,000 a year VP of Marketing wife.

- My 60 year old high school athletic director colleague makes about $180,000 a year plus his wife who makes about $200,000 working for the city.

- Thousands of employees at tech companies like Google, Apple, Facebook, Google, Slack, Zoom and more.

The permutations of people making $300,000 goes on and on. If they aren't there now, they will get to such a level of income eventually.

Related post: The Top 1% Income Levels By Age

Living A Middle Class Lifestyle On $300,000 A Year (One Child)

Please study the middle class lifestyle budget chart of a $300,000 earning household below closely. Every expense has been carefully vetted by hundreds of people who live in expensive metropolitan areas like NYC, LA, and SF and who diligently track their cash flow to give you the most realistic budget possible.

I've tracked every line item with my own budget when I had only one kid. All figures are pretty spot on.

Today, with two children, I'm thinking $350,000 a year might be more apt. In fact, based on the 2024 income tax rates, a couple can now earn up to $383,900 in taxable income and stay at the the 24% federal marginal income tax rate. For 2025, that income is a little higher for the same amount of taxes paid.

Gross Income Review

With a $300,000 household income, this dual income household of three puts away $38,000 a year in their 401(k)s. The maximum 401(k) contribution is now $23,000 in 2024. Not bad.

With the passage of the Tax Cuts And Jobs Act, they've lost their ability to deduct more than $10,000 worth of state income, sales, and property taxes. As a result, I've used the $24,000 standard deduction for married couples to keep things simple. The standard deduction for married couples increases to $25,900 for 2022 or $12,950 per individual.

For 2024, the FICA tax rate for employers is 7.65% — 6.2% for OASDI and 1.45% for Medicare tax. For example, an employee will pay a 6.2% Social Security tax on the first $168,600 of wages plus 1.45% of all income earned. Since both parents work, both parents pay the tax. At least both parents eventually gain when they collect Social Security, if it's still around.

For 2025, the income to pay maximum FICA tax is now $176,100. Expect the income limit to go up several thousand every year to account for inflation.

High Effective Tax Rate With A $300,000 Income

They have a marginal federal income tax rate of 24% and a marginal California income tax rate of 9%. Most of their income also faces a 7.65% FICA tax since both work.

Their combined effective tax rate is roughly 32%, for a tax bill of ~$76,160. In other words, their total tax bill is ~$12,000 more a year than today's median household income. Therefore, hopefully folks who earn less can give them some slack. The effective tax rate could be 1-4% lower with some adjustments.

The family also gets a $2,000 child tax credit to help support their middle class lifestyle.

In the past, the credit began to disappear for married couples who earned more than $110,000 and for single filers with AGI above $75,000. Now, singles and married couples can earn up to $200,000 and $400,000 respectively, before their child tax credit begins to disappear.

Bottom line: their $300,000 gross income gets reduced by roughly 38% after taxes and retirement contributions to $187,840. With an aggressive account, the family could probably pay a 2-5% lower effective tax rate. But I'm trying to be conservative here.

Expenses Review Of A $300,000 Household Income

Childcare ($24,000):

A middle class lifestyle often includes kids. There's no getting around this expense if both parents are working. Babysitting and childcare for $20/hour is the standard rate I've found in San Francisco. Some prices go up to $35/hour.

If the parents decide to send their child to private school, this $24,000 annual expense will increase to $35,000 a year for K-8. Come high school, the cost will increase to $45,000 – $55,000 a year. I coached varsity tennis at a boy's private high school for three years. Its annual tuition is now $49,000 a year. It's a shame that so many expensive coastal cities have troubled public school systems.

One interesting thing I've realized is that not all private school families are rich. After meeting 100+ families at my sons school over three years, I realized many are spending a lot more of their income on private school than I recommend in my bestseller, Buy This, Not That. I don't recommend spending more than 20% of one's gross income per child on private school tuition. If you do, then it could put your family's financial health at risk.

In San Francisco, there's a lottery system for the sake of social engineering. In other words, even if you buy a $1.5M median home and pay $20,000 a year in property tax, you are not guaranteed to have your kid get into the public school down the street.

Of course, if you have a second kid, childcare expenses will increase, but probably not double due to synergies. That is unless you want find some 4th trimester childcare relief. Then we're talking $40,000 and up for three months.

Food ($25,200):

When you are a dual job household with a baby, there's little time to cook. Further, given the family is living in a city like New York or San Francisco, food is world class, and on demand food delivery is ubiquitous.

It makes little sense to spend hours cooking when you're already tired. You want to reserve your remaining energy for taking care of your baby. However, food is where this family can cut expenses if they start feeling a little tight.

Mortgage ($46,800):

A middle class lifestyle should include owning you own median-priced home. Although the payment is $3,900 a month for a $900,000 mortgage at 3.25%, $2,000 of it goes towards paying down principal and building net worth. Therefore, you can add $24,000 a year in forced savings to their $37,000 a year in 401(k) savings.

Their $1.5M assessed house is a standard 1,750 sqft, three bedroom, two bathroom home on a 2,500 sqft lot. For new homebuyers, only interest on up to a $750,000 is taxable.

Here's an example of a typical $1.855M home in Golden Gate Heights, one of San Francisco's best kept secret neighborhoods. As you can see from the picture, the house only has 1,288 square feet of living space. It is a simple two bedroom and one bathroom home. At least it has ocean views from the living room.

This buyer needs to spend another $50,000 – $80,000 remodeling the house because everything is about 25 years old. Thankfully, bidding wars are back due to a strong economy.

The $10,000 SALT cap deduction for individuals and married couples really hurts homeowners in expensive real estate markets. Property tax on a $1.5M assessed house alone is roughly $19,200. Then the couple is paying ~$18,000 in state income taxes.

Now if we look at home prices in 2024+, prices are still elevated in big cities. I've been keeping track of a number of home sales during the pandemic, and I'm impressed at the strength.

Bought Their Home Earlier

Further, this couple is lucky because they bought their home several years ago for $1.2M. Now imagine renting a house for $6,000 a month and trying to save up $300,000 for a downpayment on a median priced home. Difficult to do with less than a $300,000 household income. Probably impossible without living in a one bedroom for “only” $3,200 a month or getting help from their parents.

Today, this Golden Gate Heights home is likely worth over $2,300,000. With the tech boom and the growth of artificial intelligence, buying a single-family home on the west side of San Francisco will prove to be a good investment.

I recommend checking out mortgage rates online. Qualified lenders compete for your business so you can get the lowest rate possible.

I was able to refinance my loan for free to a 7/1 jumbo ARM at 2.625%. But I've seen rates that are even lower. Everybody needs to take advantage of record-low mortgage rates to refinance and maybe buy if you are ready to settle down.

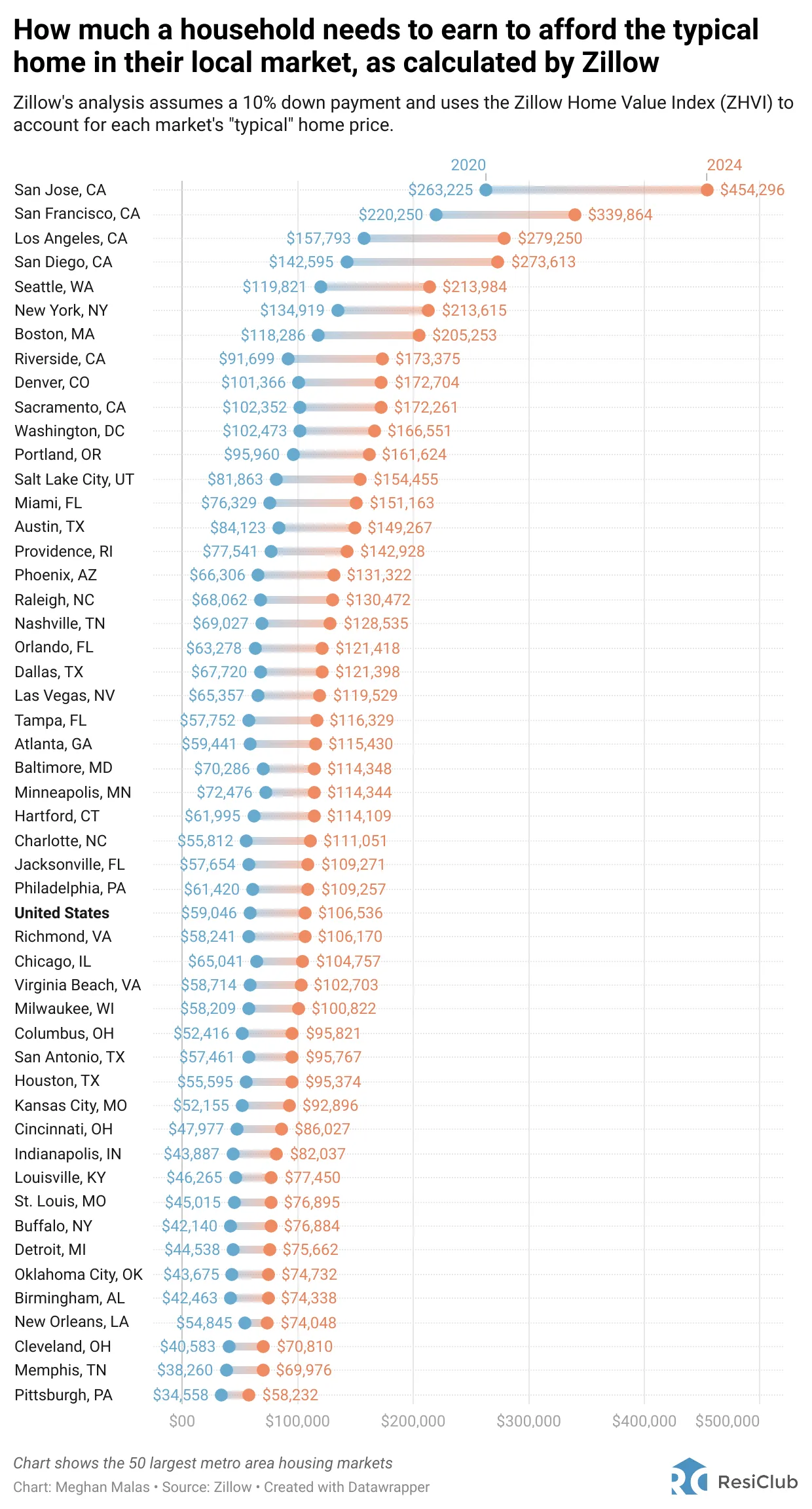

If buying a home is important to you, as it should be, below shows the income required to afford a median-priced home in the top 50 American cities. As you can see from the graph, San Jose, San Francisco, Los Angeles, San Diego, Seattle, New York, and Boston all require over a $200,000 household income to afford a median-priced home.

Vacation ($7,800):

A middle class lifestyle includes vacationing several weeks a year. Some will say that spending three weeks of vacation is a luxury. However, I say spending three weeks of vacation is normal for two working parents who want to keep their sanity.

By law, every country in the EU has at least four weeks of paid vacation days. Meanwhile, Brazil gets 41 paid vacations days a year. Yes, their respective economies might be a mess compared to ours, but at least they are enjoying life!

Car Payment ($7,400):

When you have a baby, all you want to do is protect him or her from harm. Even if you are the best driver in the world, one reckless drunk driver might t-bone you one evening.

No longer do you feel comfortable driving a compact city car while transporting your family. Instead, you want a larger vehicle that has the highest safety rating.

Baby/Toddler Things ($6,000):

You can spend as little or as much as you want on your baby. But this family buys disposable diapers, not washable diapers. They buy tons of baby proofing material. They paid up for the best car seat and have two strollers. It's funny, but one of the best toys for our son is a tissue box.

Entertainment ($7,200):

A middle class lifestyle includes general entertainment and nothing lavish. During the good old days pre-pandemic, date night could easily cost $200+ an outing for two once you include tickets to a ball game or a show and transportation.

Entertainment also includes the cost of sporting equipment, memberships, Netflix, cable, internet, and more. If your friends invite you to a weekend getaway, a bachelor or bachelorette party, or a function or two, your entertainment budget will be blown to smithereens.

What's Missing From The Budget? This couple is lucky in that they have no student loans. They paid their loans off by the time they were 35. They are 39 years old today.

Another important concept to think about is treating investments as expenses. Investment expenses include retirement savings and 529 plans. After all, spending money to take care of your retirement or your children’s education is an expense. Just like spending money on insurance to protect your family is an expense.

Ending Cash Flow Analysis

To live this middle class lifestyle, the end result is annual cash flow of only ~$2,920. $2,920 is not a great buffer because something always pops up.

But overall, this middle class family is building roughly $54,000 in net worth each year through principal pay down and 401(k) savings. Plus, they growth wealth with any appreciation in their investments and primary residence.

After 22 years of work with no change in income or expenses, this household will likely amass a net worth of over $2,000,000. They will have the ability for at least one spouse to retire since their son will have graduated college.

However, based on my recommended net worth goal for financial freedom equal to 20X annual gross income, this couple needs to accumulate closer to $3,500,000 to really feel comfortable for both to retire.

A Middle Class Lifestyle On $300,000 A Year With Two Children

To be comprehensive, here is another budget I put together for a $300,000 household with two children from one child. I've updated the 401(k) contribution amounts to $45,000 given the higher 401(k) contribution limits for 2024. Further, you'll see more childcare expenses and fewer leisure expenses.

One both kids turn five or six, they can both go to public grade school. If they do, that will be a $3,200 a month after-tax savings right there. Kids truly are expensive. But if you can get through the first six years and not be tempted by private grade school, they become more affordable.

With inflation so strong, families may now need to earn $350,000 a year in a big city to live a middle-class lifestyle!

Earn Just A Little More

After analyzing all the numbers above, the ideal household income to raise a family is around a MAGI of $364,200 (after deductions). Any income over $364,200 is taxed at a 32% marginal income tax rate, or an 8% increase. This marginal federal income tax jump is large compared to the 2% jump from 22% to 24%. The ideal income should go up every year by 2-3% to account for inflation.

Below is a chart that shows the marginal income tax rates and the long-term capital gains tax rates for married couples, filing jointly. Know the tax brackets every year to earn the most tax-efficient income possible!

Based on 2023 tax brackets, for individuals, a Modified Adjusted Gross Income of $182,100 is likely ideal, from a tax optimization and lifestyle situation. See 2024 tax brackets and 2025 tax brackets for more on the ideal income to earn.

For married couples, the best income to earn is around $364,200. This way, both incomes faces at most a 24% marginal federal income tax rate. Every year, hopefully, the income thresholds for various tax rates will go up to at least account for inflation.

Based on my experience, happiness did not increase for me when I began making over $200,000 as an individual. Happiness did not increase for us when we began making over $300,000 either.

Therefore, due to the increase taxes and increase stress, it seems pointless to put yourself through the ringer simply to try and make more from a day job. What more households should aim for is to become middle-class income multi-millionaires. By saving and investing aggressively over the years, they can build a to net worth while paying reasonable income taxes.

Save Aggressively Then Move

In order for this household to achieve financial independence, they've got to either up their 17% gross savings rate, figure out a way to reduce expenses, or boost income. Their middle class lifestyle might have to take a hit for a while.

Since boosting income probably hurts their quality of life due to more work and stress, the best way is to reduce expenses and diligently keep track of their finances online for free with Empower in order to continuously optimize their net worth.

If you still don't believe $300,000 for a family with two kids is required to live a middle class lifestyle, take a look at this chart below.

For San Mateo County, which is equally as expensive as San Francisco County, a family of 4 with a $146,350 is consider low income. With rising home prices, it simply takes a lot more income for families to live comfortable lifestyles in big cities.

There are some families scraping by on $500,000 a year in expensive cities. Good financial planning is a must!

Relocating To A Lower Cost Area Of The Country Works

If you feel the cost of living is too high, then consider moving to a lower cost area. In this new decade, it has become much more acceptable to work from home thanks to the pandemic and technology.

The trend is towards relocating to the heartland, where valuations are cheaper and net rental yields are much higher.

Invest In Real Estate strategically

Take advantage of long-term trends and invest in heartland real estate. Technology and work from home have made relocating to lower-cost areas of the country permanently feasible for millions of people

The best way to invest in heartland real estate is through Fundrise, my preferred rivate real estate platform. Fundrise offers diversified private real estate funds, which is likely most appropriate for most investors looking for real estate exposure. Fundrise manages around $3 billion for over 350,000 investors. Its investments are mostly in the Sunbelt, where valuations are lower and net rental yields are higher.

I've personally invested over $300,000 in Fundrise to diversify my expensive San Francisco real estate portfolio and invest more in venture capital. Fundrise's venture capital product invests in some of the top artificial intelligence companies such as OpenAI, Databricks, and Anthropic. AI is going to revolutionize the labor market and I want to invest near the beginning.

Fundrise is a long-time sponsor of Financial Samurai as our investing philosophies are aligned. With an investment minimum of only $10, it's easy to dollar-cost average into Fundrise funds.

Buy The Best Personal Finance Book: Millionaire Milestones

If you’re ready to build more wealth than 90% of the population, grab a copy of my new USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today on Amazon and take the first step toward the financial future you deserve!

With the bull market in everything post-pandemic, costs are likely going to continue to rise. Therefore, earning a household income of $300,000 to live a middle-class lifestyle is not far-fetched at all.

For more nuances personal finance content, join 65,000+ others and sign up for my free weekly newsletter. I've been helping folks achieve financial freedom sooner since 2009.

If you think a family of 3 needs a 300K salary, today, to just get by then you must have been born with a sterling silver spoon in your gem studded mouth. Your breakdown is misleading and quite frankly is rich coddling. Real people don’t spend 400 per month on clothes and budget much better because, you know, weekly date night is as optional as the 1.5M house.

To live a middle class lifestyle in an expensive city like SF, San Jose, Seattle, etc. The median home price here is about $1.7 million.

Not sure how you are misled with all the charts, data, and expense breakdown in the post. I’d spend more time studying the data.

So share your budget maybe?

I got a remote job based in CA and live in the suburbs of an east coast city. Median housing here is probably $400k and my TC is roughly $300k. Even when I think I’m spending too much my account grows. This year we went to Europe and a few ski trips and I could have sworn it was going to be a bad year but I still made out $40k or so ahead in my checking account. I max my 401k of course and I haven’t sold a single share from my RSU’s yet. But really that’s because my mortgage is only $2k and I have no car or student loan debt. Problem is I’m 37 and didn’t start putting money away until my early 30’s, so I still have a ways to catch up. My wife is really the one who wants to take a lot of these vacations but I want to stop that so we can invest faster for our immediate future.

But I did get to see the alps which I always wanted to do, bad financial decisions and all :D

Get kids,

Get older and start paying medical bills

300k will vanish even on east coast

All of these “expenses” are completely low balled unrealistic and completely invalidate the rest of the statistics…if you are paying that little for insurance and utilities please tell me where you live mine are double and triple what you’re listing…average Midwest middle class homes utilities are way more than these examples.

Gotcha. Let me know how much I should pay for utilities and insurance. San Francisco and the Midwest have different temperatures. For example, we don’t have AC in San Francisco. We just open or close our windows.

I live in the Bay Area(Sonoma) and totally have trouble with your premises. If the median household income in Sf is $140k(give or take) then middle class is between $95 k and $280K so in the Bay Area $300k is upper class. I went through your cash flow statement. Your taxes are too high. You should not be taking a standard deduction when you can itemize your mortgage interest, property tax and charity to achieve a larger deduction. Your fed tax rate on total income is not 24%(you are using the highest marginal rate for your entire income). Bottom line is you have more after tax income. You are also putting over 15% of your income into savings and college education.Not something the average middle class family can do. You also fail to mention that your employers probably match some of your 401ks so you have large amounts going to wealth building. Also your mortgage payment is a cash flow but not an expense(it is a balance sheet item which increases your net equity by reducing your mortgage liability). You could have an interest only mortgage which would increase cash flow. You also are not including your annual wealth building that comes from appreciation of your assets. All these things are upper middle class or upper class numbers. Why not create your expenses with 2 school age children which dramatically reduces your child care expenses.? Obviously millions of Bay Area people live a very comfortable life on much less than 300 hundred k a year. The truth is your 300k income allows enough wealth building to live an upper class life so that is what you are. Do not characterize yourself as middle class. Totally misleading and an insult to the 90% of people that make less than you do.

I think you’ll enjoy this post: A Middle Class Lifestyle Is All Anybody Has Every Wanted

One of the super powers to cultivate is not being easily offended regarding the things you read on the internet.

The problem in America is not that people don’t make enough money any more to get ahead, it’s that people’s expectations have grown out of control. Why are you eating out so much, buying $5k a year of clothes, and going on three vacations a year when you have car payment and student loans? You’re right, this is a very middle of the road attitude to finances, but in no way is this lifestyle middle class. Definitely upper middle class, and entitled too.

My husband and I are a single income family, which we much prefer to when we were both working. Husband makes a little over $80k a year. We own our cars, no student loans, and we are planning to pay off our house in about 5 years. We should be millionaires by the time we are 30. Wake up people.

Can you share your budget?

I seriously don’t think a million is enough. My homeowners and auto insurance are 1k a month (one car is 15 years old) and my healthcare on some months is almost 1k in addition to the premiums; college tuition is 30k a year. Property taxes are 14k and thankfully I have a 3% mortgage. When you earn 300k, you are heavily taxed (over 100k in fed alone), especially if you are a W2 employee vs self employed. Yes, you should live as though you are earning 100k, but what is the motivation to push yourself to earn? I envy the social system I am contributing to; the stimulus checks, the free healthcare, and all the assistance (heat, tuition, etc), but I understand that those earning a lot less don’t have as many options. But being able to enjoy those luxuries and contribute should not tick anyone off.

The same I rip my buts to get extra 10k and after that realized that I am not stimulus eligible.

And I’d I did not do anything, I would still get 10k.

What is the motivation then?

Hi Sam, My single mother is a Western European diplomat/FSO, and even though I led a very privileged life in Australia, Switzerland and Italy (something like this), it’s only now while entering the workforce for the first time (in London big 4 audit, though hopefully ER soon) that I’ve realised just how much work its going to take to get my lifestyle back! This is the first resource I’ve ever found that would articulate what I would expect to be ‘normal’ so articulately! It’s been so hard to pin it down given the uniqueness of my upbringing, but thank you for making this post and bringing it to light.

You are welcome and good luck! Consider subscribing to my free weekly newsletter so you never miss a thing.

Great chart. My takes comes down to can you do your HCOL job from a LCOL area? I don’t know if you reside in HCOL California Sam, or if you are writing you blog from a LCOL area. Point is my team leader in his early 40s makes your $300,000, claims to be a millionaire before 30 and yet is bothered to death non cessant complaining about paying his ex-wife $3000 a month alimony and a child support. He pays 3000 monthly, so $36000 yearly in alimony and child support. How a millionaire puts so much energy being bothered by paying $3000 a month I cannot understand.

Here’s how he solved it. He sold his Porsche, moved out of Cali, WFH instead of the office and everything was solved. He lives in an enormous place in a LCOL area and drives a beater car compared to a $135,000 Porsche.

Sounds good to me! I’m based in San Francisco and worked in Manhattan beforehand.

This is a great resource for those looking to build a clean consolidated budget, regardless of the income level. I grew up in a working middle class family with both parents working with 3 kids in a DC suburb. We never had a lot of money and that stuck with me, but it also took me some time to transition my thought process to be fiscally responsible with my own money. I still remember buying my first new car with with my parents (I was 16) and just seeing how far we could extend the payments to make the car affordable, and it was just a Nissan Sentra. The me of today still wants to kick the *** of the me of back then for making that stupid decision. But that was the first bit of financial education I received back then. Focus of the payments… ugh.

Fast forward and now I’m 44 and married with no (0) children. That was a choice we made. We are a single income family, where I am now at that $300k annually mark including bonus and annual vesting of RSUs. This isn’t uncommon in my field. I have a PhD in engineering and been working for about 14 years post-graduate school. All of my education was based on student loans as my parents fell into the goldilocks income bracket of making too much for grants or other quality financial help and too little to actually pay anything, so I went it alone. I did work close to 40 hrs a week all year during school to reduce those loans, while also commuting to school as I couldn’t afford to live on or near campus.

As for locations, we started out in the Boston area for 10 years and now live in New Jersey, relatively close to NYC. Positions in my field don’t seem to be anywhere besides these HCOL cities, so have to suck it up for the time being. I will say that with children our budget and savings rate would be vastly different. As of today we have a net worth just under $1M with a home that has appreciated nicely these past few years. We keep ~14 months of cash in emergency funds (again one income) and save close to 25% of my gross (not net) between maxing my 401k, both IRAs and continuing to contribute after-tax money to the 401k plus another $25k or so in a brokerage account. My biggest regret of all of this was not learning these lessons on finance and compound interest 10 to 15 years sooner.

In all, most would consider us upper middle class, and honestly I don’t know what I would say we are (so subjective). We enjoy going to Europe, but most often I try to couple those trips with business trips so the airfare for me is covered and sometimes the hotel. We hope to retire early but since we started saving so late we don’t know how early that will truly be. We do know that for retirement we are looking to relocate to lower cost areas to make our savings go farther.

Hi Sam,

I just want to say how much I enjoy your articles (first time commenting). As a CPA living in LA, I can attest firsthand that your numbers aren’t outrageous. I am a Controller at a non-profit organization (funded by LA County) and my wife is an elementary school teacher. We have two young daughters and together bring in about 170k per year (We are in our early 30s).

It’s amazing how much income it takes to just live a middle-class life here. My wife has been able to stay home (she was doing substitute teaching on and off) as my daughters grew old enough to start school. So we were living off maybe 120k for a while. There is always give and take. If you have more time with your kids you might sacrifice income. If you work at a higher-paying job you might sacrifice time with the kids.

I think ideally the goal should be to make the most amount of money, with the least amount of stress possible. I wish I had a way to target those positions, but I think I’ve done well so far. Currently, I never work over 40 hours a week, work close to home, and have about 25 days of vacation a year (including a one-week Christmas week closure). But, with the rising inflation, I am now getting the itch to seek a higher-paying job, but I fear losing out on my great work-life balance. It’s been great getting perspective from your posts and others, they motivate me to do better.

Some additional details. I grew up in a low-income family, so 100k was making it in our mind. But as you grow up and understand how expensive coastal cities are and everything you’re responsible for (saving for retirement, kid’s college, home repair, etc). You realize really quickly how much income you need to just be middle class in LA.

The way we’ve survived on 100k-150k living in LA is we were fortunate to buy a 1350 ft 3 bedroom 2 bath house (7,800 sq ft lot) in 2018 (our mortgage is $2,450 a month (including property tax and insurance), the interest rate is 2.5% 30-year fixed), we were fortunate to buy in an ok neighborhood with a decent public elementary school (after all, I went to public school why can’t they). Why drive 2 paid for 10-year-old cars, and currently save about 6% for our retirement in addition to a 3 percent match. Again, we probably aren’t on par for a stress-free retirement according to your metrics, but is the best we can do at this time.

One thing my wife and I do wonder though is, for those of you with children and working high-paying stressful jobs, how do you manage? We find it hard enough, with relatively decent schedules. Would love to hear people’s thoughts on this.

Also, how do we raise our children? Do we encourage them to focus on earnings or work-life balance? Tough choice since work-life balance doesn’t always pay the bills.

Hi Mark!

I really appreciate you sharing your background. “I think ideally the goal should be to make the most amount of money, with the least amount of stress possible.” Absolutely. This is the dream goal for all of us. But of course, it’s easier said than done.

The irony of me having to work 60-80 hours a week for the first few years out of college was that it was miserable. It forced me to save and invest as much as possible to get out! It also made me try to make as much money as possible. If I had worked 40 hours a week or less, I wouldn’t have had that same sense of urgency.

$170K is a nice household income, especially if you like your job and are not stressed. But I will say that working harder in your 20s and 30 to maximize income and wealth is worth it b/c your energy and interest for your job will likely fade in you 40s.

I’m trying to figure out how to raise our children as well. Ideally, they always work hard doing what they enjoy that gives them purpose.

Best,

Sam

Appreciate the response. I’ll be buying your book just for the reply (haha) and of course for the awesome content.

Its funny you say that. I do kind of feel a sense of FOMO of not having worked at the big 4 accounting firms which is suppose to be your badge of honor and set you up for higher income jobs. At least you have that 60-80 hour work week experience to pass down to your kids.

I do respect the work ethic that these type of jobs demand and I do agree with you when you say we should take advantage of our 20s and 30s to increase our income and wealth. Of course all that depends on when you get married and have kids. Ah, so many moving pieces in life.

But yes, definitely teaching our children to work hard and pursue work they love (that can generate good income of course) is a must.

How does your work week running FS compare to those 60-80 hour work weeks?

Mark

Thanks Mark. I’m sure you will love the book. But of course I’m biased. I literally read 10 other nonfiction finance books as research on what makes a great book. BTNT is gonna be it!

I try to limit my work to 20 to 25 hours a week on Financial samurai. And I try to spend about four hours a day with the kids. So that’s a full week right there.

Example, today I took my daughter to the zoo for two hours and then I took my son to the beach for two hours after picking him up from school. Then we spend some time together for bedtime.

It’s a simple, but nice life. All I really want is for us to be healthy and my children to be happy.

The trouble is 98.9% of US households make less than $300k…80% make less than $100k!

So with only 1.1% of American households making over $300k…

How do the ~98% survive?!

300k is upper middle, but agree it’s not what I’d call “wealthy” in a HCOL city. We had to game the system to get ahead. Moved from NY 15 years ago (earning ~60k as a couple and racking up a ton of debt) to the Philly suburbs and eventually worked our way up to ~250k. We bought a 4br home in the low 300’s, but that took 10 years to scrape together a down payment of 5% in our mid 30’s. We eventually paid off both cars, and are now just about to finish paying off a 20+ year old student loan. So we know how to live on a budget because most of the journey to where we are now involved paying down debt — 30k credit card debt, 45k in student loans, and 40k in car loans. Did the $1200/mo daycare, $5k+ summer camps, etc. We are still not quite maxing the 401k’s but did take advantage of ESPP and contributing to 529.

I say we gamed the system because we DIDN’T buy the 600k house the mortgage broker said we should buy and we left the HCOL city, but we are still close enough to Philly and NY to get there when we want. We picked a town (and a state) with a low property tax rate (~4k/yr). And we’d probably be labelled as living in the lower-end part of our town, which has plenty of multi-million dollar estates.

The scary part of all of this is that it wasn’t until we started to get over $150k that we were REALLY able to start to feel comfortable with our ability to pay for emergencies (like a new washing machine, or a random car repair) without panicking. America has become a place where you need to have higher than a six-figure income to feel like you can even survive. The system is designed to keep 90% of the population from ever getting ahead. Many who are brought up lower middle class may never get out of that tier and the same is true of someone who came right out of school and got a $100k job in Finance — it’s hard to relate without having been in the other person’s shoes. I’m grateful to have had the journey I’ve had — where I can remember needing to fish for change to pay for a meal and my wardrobe consisted of a few 3-packs of Hanes White T-shirts. Makes me appreciate what I have now so much more.

Well, If You are not in the major cities like San Francisco, LA or New York/ New Jersey for that matter. hundred thousand would be a fair number if your love by your means. I am a stay at home mom and we are comfortably living in Upstate New York with my two little ones aged 5 and 9 year old.

Yes indeed. One’s budget depends on where one lives. Trade offs for sure. However, The income required to live a middle class lifestyle is going up giving inflation is running about 7% for the past couple of years.

The numbers for housing and utilities look correct for a middle class lifestyle in San Francisco (3 bd house). Cell Phone service could be cheaper, but your numbers are within reason.

I don’t think maxing out 401k (38k total) for both people counts as “middle class” though… Reduce that to $8k to $12k each and I think you’re closer to what normal middle class can save as compared to their expenses.

These people are living extravagant lives though because they’re paychecks allow them to waste money and apparently feel good about themselves.

$400 per month on clothes? This can easily be reduced to $200 / month and still be living a life of excessive consumption. Get a few pairs of good jeans, a few dress pants, a couple nice suits, a few to several nice evening dresses , shoes, 2 or 3 purses/handbags. Take care of them and your wardrobe is mostly (or completely) provisioned with one year of $4800. Then no more than $100 to $200 per month to maintain / make small additions…. justifying spending any more than that on clothes is NOT middle class. Middle class is making some sacrifices, but having reasonable good quality goods.

$1200+ per month for food is also not middle class. This is again the “screw it, we can afford it attitude”…and they clearly can’t afford it. This could easily be reduced to $800 per month even with restaurants / “date night”…..Date night doesn’t imply every meal is $200….Even still, $800 / mo with lots of eating out is not corr “middle class” behavior. Hardcore cooking at home can be done with decent quality food (some organic choices in the mix) for $400 to $500 per month (I did exactly this for YEARS in SF)…This leaves $300 to $400 for restaurants.

Childcare too expensive? Make actual friends with at least one other family with kids..take turns babysitting…Save money, create a sense of community.

Car:. $600 per month for a car payment? Just because advertising tells us to consume, consume, CONSUME, doesn’t mean we should. Same car, drive it for 8 to 10 years and you can halve your effective car payment. Buy a lightly used car of the same model and you can quarter your equivalent car payment and reduce your insurance. I’ve had my car for 7 years, paid it off 3 years ago, and hopefully will drive it for at least 3 more.

I was making $73k per year when I bought a 2 bed, 1.5 bath 1100 sq ft home on 4000 sq ft lot in SF for just over $500k at the end of 2009 (good timing, I know). My daughter started going to preschool when she was 2 1/2, part time, ramping up until she was 3…Full time was about $1000 per month…but this was for about 2 1/2 years until she entered Kindergarten. After school care was only $300 or so per month after that… sometimes less. We made friends with our neighbors and traded playdates instead of paying babysitters.

At this point I was making almost twice as much and my mortgage went up 25% because I refinanced to a 15 year mortgage… I’ve since nearly doubled my earnings again…..I haven’t doubled my spending…I don’t “keep up with the Joneses”… I’m saving closer to $50k to $60k per year (including maxing one 401k)….I have middle class roots. Well, lower class really, was born to teenage parents, but they managed to work hard and be financially responsible get to middle class. However, I don’t delude myself into thinking that I’m still only middle class.

You’re right in that they’re middle class in terms of spending like the upper class when they can’t afford it..that is TRULY one of the hallmarks of the American middle class. If they cannot manage their spending and finances better at 300k per year, they cannot become “upper class” even if they doubled their income because they would clearly just double their spending as well .

Also, I’m aiming to save for 2 to 3 years of my daughter’s college.. hopefully my ex-wife will save another year’s worth…. But I don’t consider “painless college experience” to be middle class….Some help from parents, some working during the summer or the school year to pay the difference….THAT is middle class.

I guess I can thank the people who spend like this for driving up wage inflation that I can benefit from via increased savings.

Also, just for the record, I’m not living like a tightwad either. When I was married ,we did 7 to 14 days of “nice vacation” per year (Hawaii, New York, Miami, often Europe because my ex has family there)..another week or so was more modest (week in Tahoe hanging out at the pool / hiking for example). We did go out for dinner, we did go to the symphony, opera, etc. But in moderation.

Look, I’ve read these types of articles about the SF Bay Area in the past .. There is little to be done about exorbitant housing costs. Everything else is much more under your control. The people who “can’t make it” even with high paying jobs aren’t failing because of housing costs … they’re failing because of their spending.

Also, the 401k maximum is now $20,500 for 2022. So a working couple can now contribute $41,000. Not bad!

I think it’s safe to say we can all judge other people’s spending habits and make improvements. It’s why we should never tell anybody how much we really make or spend. Stealth Wealth!

I live in the bay area. It has always been an expensive area to live, mainly due to the cost of housing. Housing costs have always been ridiculous but people pay it. Maybe, they shouldn’t. The longer they own their homes, as salaries rise, the less of a burden it is to pay. I agree with Bill, what you are describing is an upper middle class lifestyle. Only the very wealthy would use a private jet. 300k wouldn’t be in that category.

I question how can a Bart janitor make a salary like that? The train conductors don’t make that much.There is something seriously wrong and needs to be reviewed.

Programmers making 300k are senior level & would be a little older, even if it’s Apple. A lot of the tech industry workers make money from the stock options they receive.

A couple with a mortage, property taxes, charities, etc would be not be taking the standard deduction, besides they would adjust their W-4 to bring home more pay if possible. Those working for a company would most likely get their life insurance thru their company, paying a lot less. I checked with some friends about the company health insurance. They said it was high for a family of 3. These friends make around that salary. They own a Tesla & newer Lexus, their daughter goes to a private school. They aren’t living paycheck to paycheck. Not only do they have savings but investments.

As for your suggestion of moving to the midwest, etc. They wouldn’t be making the salary they are now. The companies that are allowing full time telecommuting are adjusting salaries to the location they are moving to. The company I worked for was doing this over 20 yrs ago. It is only fair. That is why it is more expensive to live in a coastal urban area, demand. Otherwise, a lot of people would live in the midwest, living the lifestyle of the rich & famous making coastal urban salaries.

Food is about 600 per person if you dont eat junk food daily

There are many things about this post that just seem so out of touch with reality.

First off, the professions listed:the janitor and the elevator technician…if there isn’t a better example of the rampant abuses and insanity of some of these state and local governments I don’t know what is. A guy making $235k to mop floors, or if he is a supervisor, to sign the time cards of people who mop floors? This just truly makes me sick…in the America of yesteryear, this was a working class job.

The other examples of surgeons, big law attorneys, Apple programmers, senior tenured academics…in what world are these middle class professions? The salaries these folks are pulling in are in the stratosphere for 95% of Americans, and by nature these folks have always been considered “upper class”.

Middle class folks are K-12 teachers, cops, firefighters, engineers, accountants, insurance salesmen etc. Are we just saying that all of these regular folks are just broke and scraping by?

What on earth happened to this country?

Perhaps your reality is simply different from many other people’s reality? It’s like only speaking English and not recognizing the world has hundreds of other languages.

About 45% of America’s population lives in expensive coastal city or big cities.

How much do you make, what is your budget, and where do you live? We should keep our perspectives open.

Related: Achieving Financial Freedom On A Modest Salary: $40,000 In Manhattan

I own a home in one of these “expensive” coastal cities. I’m a mid-level federal government employee and reservist and my wife is a CPA. We both have graduate degrees and collectively bring in about $200-220k a year depending on her bonuses each year. I just turned 30 and she is 29, we do not have kids yet but will start trying soon.

I’m the first to say that we spend extravagantly—currently we are living overseas and have been since the pandemic started so we travel internationally often-usually once every other month. Before we moved to Europe we would average about 3-4 international trips a year, luxury goods, etc etc.

To think that we would maintain this lifestyle once we have kids is insane. Middle class families don’t go on vacation to Europe every year, they pack the kids in a van and go camping or go to the beach. Middle class families do not eat out multiple times a week, spend thousands on entertainment and drive luxury vehicles that would necessitate a car note of nearly $700 a month (especially when living in an expensive coastal city with accessible public transportation)—they drive a used car until the wheels fall off. The nearly $50k in vacation, entertainment, food and car expenses is exorbitant. $50k in alot of cases is your truly Middle class, college educated individual’s after tax income, especially if they are in public service such as teaching, social work, the military etc.

The expenses listed and Middle class “salary requirement” are disingenuous and unattainable for truly Middle class individuals.

This article should actually be titled “Why Households Need to Make $300k to Live an Upper Class Lifestyle”.

Hi Josh – Is there a tax benefit of living overseas where the first $95K is tax free? That may help.

One of the biggest things people without kids will realize is how expensive kids can really be. Most of the big costs go way up. It is very hard to understand until you actually have kids.

If you do have kids and end up living in an expensive coastal city in America, please come back to this post again. You might have a different POV.

thanks

There are not any tax benefits in my situation—actually the opposite as my wife is subject to German income tax on her gross salary and it’s exceptionally steep. The extra benefits I do get here (housing) are a wash since we are in the red on the rent we are bringing in vs. our monthly mortgage back in Boston.

We have plenty of friends with kids in expensive east coast cities who make far less than $300k and are doing just fine (Boston and DC).

In fact I know of only one individual that fits the bill for earning over $300k (1 income household), and that is my friend who is a big law attorney. Again, though this is not a “middle class” individual. Middle class folks don’t finish in the top 5% of their graduating class and land that kind of job.

All of the couples you discuss in your original post highlight exceptional situations and high earners (doctors, big law attorneys, Apple programmers, tenured track professors, VPs, investment bankers, and the 2 scam artists of the century in the janitor and the elevator tech).

If this is the new middle class, what about the remaining 95% of the American population?

Cool. The good thing is, not everyone lives in places like SF and Manhattan.

If you’re happy with your net worth at your age, and that’s all that matters.

Related: Ideal Income For Maximum Happiness

Whoa. DINKS. I used to take offense at being called that. Just wait! Your kid is going to need a car, insurance, tuition, clothing they deem is “cool,” that PC for school projects, cell phone and plan. It’s like having a non working spouse. Hopefully you’ll have a compliant kid and it won’t matter.

Brazil does not get 41 paid vacation days per year. In Brazil we get 30 days, but they are different from the us in a sense you need to take them in blocks of days, which means you take vacation days during weekends. 30 brazilian days approximately equal to 22 US days of vacation, removing the weekends in a month.

There are several issues with their budget. Here are the biggies..

Their 401 K contribution is huge — most people can’t afford to put down 12% into their 401k. I suspect the average is more like 6%. So if they reduce their contribution to say 8% which is still decent they now have an extra $1000 per month.

Their childcare cost is huge — we live one of the most expensive cities in the country (Wash DC) and we found a decent daycare/preschool for $1200 / month. So lets say they move their kid out of Gucci daycare and get something more mainstream for $2000/month they now have another $500 / month extra.

Their mortgage is huge — They must have a big house in an expensive neighborhood. A $3900 mortgage would be about a $900,000 house with 20% down payment. We live in an expensive housing market but we choose to live in less expensive neighborhood and in a moderate sized house and our mortgage is $2300 / month. Lets say they downsized a bit and moved into a less expensive neighborhood and settled for around a $750,000 house their mortgage could be reduced by about $500 / month.

So just those reasonable changes they now have $2000 month spare money. Who has that??

FYI, I’m basically the person he is talking about here in nice part of bay area and can basically confirm the expenses. (did someone hack my Mint?). My daycare was cheapest we could find at $1750 per month. Tag a few babysitting hours and were are close. For mortgage, I bought early so am LUCKY to have a house 1600 sqft with leaking roof and rotting bathrooms for almost the exact amount mentioned. Just did the renovations and remodeling, that part is much higher than what was budgeted in the article. I just did review of last 3 years, and am about 5-10% below the expenses listed here (depending on error bars of my records)so its pretty spot on (

Thanks for sharing and confirming your expenses with us. The budget truly is as real as I’ve said it is. Expenses are not cheap in big cities with kids!

Sorry but no, the lifestyle described here IS a wealthy lifestyle. The majority of expenses are way above what a middle class family would spend. 15k a year for vacations and entertainment? $300 a month for charity?

And maybe childcare cost that much in some areas but that’s not a fixed cost for 18yrs, by school age the expense is cut in half to cover just after school and summers, and by 10 it disappears entirely… unless you go to private (rich people) school.

Look at 401k contributions…. 20%? Every year of your working life? For 35years? Assuming 9% returns that would give them 9-12million at retirement, even with inflation that’s rich

And probably the biggest flaw here is the assumed tax rate is double actual effective tax. A family of 3 is not going to pay $75k in EFFECTIVE taxes. It would be closer to $35k.

So basically I’ve just found about $90k in expenses that could be cut, that’s $7,500 a month in cash they could cut from their budget. Ya, if you can cut that much you’re rich!

No idea why he calculated with marginal. That’s completely pointless and misleading. The effective is what they pay, not marginal. We have a progressive fed inc tax. 350k may be in 24% tax bracket, but their effective will probably be somewhere around 17%. 240k AGI. Somewhere around 39k. All his other tax percentages were accurate though.

Typo…300k

Of the tax description in the chart that says Effective Tax Rate isn’t clear I will make the font bigger and bolder. I’ll also write it bigger in my post. Thanks for the feedback.

Interesting point.

Bur imagine an immigrant who started earning 300k at the age of 365 once moved to US.

There is no millions on 401k

Actually, I live in the Bay Area and this is almost exactly our budget. Even down to the “lucky to have bought an old fixer for 1.2M 4 years ago.” The renovations costs are under like the other commentator mentions. I actually found this article searching for budgets because I’m so frustrated that we make what feels like a lot of money but we don’t have much saved. Also, preschools are $2200-2500, and we have two kids. It’s crazy!

I live in the Bay Area. We bought a 1700 sq ft fixer upper for 1 million. Our mortgage is $5500. We could not put 20 percent down but we had looked for a house for over 2 years. We started out with a 750k budget. After multiple rejected offers, we raised our budget to 850k…followed by more rejected offers. We finally got lucky with this fixer, which we put an offer on 4 days before Christmas at 250k above our initial budget. Also, there is no daycare less than 2k where we are. I actually think the most unbelievable thing about the article is $4,000 for a mortgage-I don’t know anyone whose mortgage is that low, and that includes people who bought their houses 5 years ago. The cost of housing in the Bay Area is simply ridiculous.

To punctuate this, our first house is 1100 square feet in a starter neighborhood purchased in a city quite far from SFO-which means one of the cheaper cities in the Bay Area. Last I checked, due to COVID, that house is worth 1 million; we purchased it for 260k in 2010. Our current house ballooned from 1 million to 1.7 million. The cheapest house in our city is 1200 square feet for 1.5 million.

I just want to add, the rest of this budget is incredibly accurate and it is refreshing to FINALLY see a budget posted online that reflects the cost of living in the Bay Area with children.

Thanks for sharing. With inflation, people are finally coming around to the reality that the cost to raise children in an expensive city does cost as much.

We’ve got to continue to invest for our future. Wage inflation is not keeping up for middle to higher income earners. But at least it is increasing faster than lower income earners.

Yeah,

Even in a cheaper location,

The correction would be on mortgage and you can save on vacation.

But the rest is the same. You cannot just stop eat

I have counseled and training many in personal finances. Personal finances are very personal and unique to our preferences in life. Many I have worked with have been in significant debt, a few close to bankruptcy. My observation on this budget is from assisting people to live better and avoiding the debt trap.

1. Doing a standard deduction is a very poor choice especially with $22,800 in interest and $19,200 ($10,000 permitted) property tax needs to be considered for itemization. You note “I’ve used the new $24,000 standard deduction for married couples to keep things simple.” This costs these people thousands of dollars especially in their tax bracket.

2. A possible Health Savings Account could also help reduce taxes.

3. Charitable giving reflects our life values. This low level of giving could be improved and itemization will help make this productive.

4. To protect against debt there needs to be a savings line for future needs (car purchases, home repairs, etc.).

5. The clothing line seems very large and there are other options to keep this lower.

6. The 529 plan seems too high, especially since 529’s are designed to grow over time. There are many resources for college expenses.

7. There are cheaper vacations possible – for example pair up with other family members for a vacation home which would be cheaper than a hotel.

There are other possibilities to reduce expenses and still live a “middle class” life style.

1. what kind of deduction can you take if you don’t own property? Even the itemization seems to get minimal savings with interest deduction, but it’s something–not a lot. What else can one deduct?

2. HSA is good in some cases. I opt for HMO but my healthcare is basically free so I put remaining savings in after tax deferral account. When I was single HSA was the best, wish I had more years I could have maxed that out.

3. I’m torn on charity. I believe in it, yet I don’t think it makes sense to give until I am fully financially stable. My plan is to invest and give a chunk to charity when I die. I may do a donor-advised fun sooner given tax deductions. I will be able to give more if I invest wisely now vs give a small amount now.

6. there are few resources for college expenses if you make too much to qualify for FAFSA. Loans are not a good option. I feel if you have kids you should plan to pay for four years of public school for them. That’s about 150k saved per kid today if kids are babies. That’s what I’m trying to do.

7. pairing up with other families for a vacation home does not = “middle class lifestyle.” When I was a kid, my dad worked FT and my mom was a SAHM. We had a very typical middle class lifestyle. We did not have to pair up with other families to go on trips. We did if we wanted to, but it wasn’t a requirement. This is not to say it’s a bad idea, but I don’t think a typical middle class family would “have” to do this.

Sam, I really I enjoy the detail you put into this article. However, I do think there are some goods ways to save on this budget and was able to cut off almost $3600/month without sacrificing. Per your rules I won’t post the link to my article about this, but if you want a good read check out milliondollarbum

I was taught that your goals should be inline with your life style, which leads to the amount of income you need. Seems most that post here, make and income and then chose to live on less.

Boston Proper. Dual Incomes, One infant. 31/30 yo. Own 3br/1ba 900sf condo. This is almost identical to our budget (minus the car payments/clothes/vacations/entertainment). We also househack to reduce our mortgage by 70%. Great analysis for an HCOL city.

This is kinda hilarious to me. It should really be titled, “How to live an upper middle class lifestyle in one of 4 specific metro areas” (those being NYC, Seattle, SF, and SoCal).

I live in Philly, yes, it’s not as expensive as the above, no, it’s still urban and more expensive than a lot of places. I don’t know anyone here who makes anything near 300k per couple (*maybe* a few that are 200k as a team, most are well below 100k together), let alone anyone doing it solo. Not saying those people don’t exist, but they are the exception, not the rule. Exceptions to me belong in the upper class. None of the examples you described seem to me like the middle class occupations of friends and clients I know- really they seem more like upper middle class to upper class.

I know that you write what you know but it would be awesome to see more content in 2020 geared towards the 99%…er, maybe like 80ish%? Something like that.

Philadelphia is pretty darn cheap in comparison. Feel free to share your budget and your net worth figures by age and tell us how you made it happen. It’s all about sharing to build wealth.

Sure.

I was making $10-20k/yr until this year, 3 to 4 years into a career change. Was piecing together a couple part time gigs until one of them gave me enough opportunity to quit the others this summer (it’s still part time, which I prefer, although full-time is not an available option anyway, 40 hrs guaranteed is rare in that career). This is something very typical with most of my friends/colleagues btw. I just recently looked over income, it was $37k before any biz deductions (~$3k) but not other stuff like trad ira. I’m considered self-employed in both of my careers.

I don’t recall having any classes in school on financials, I grew up in a somewhat poor, somewhat rural area. So financial planning is very new to me. I’m 38, my net worth is $7.5k, although all of that is as of October this year when I paid off the last of biz startup expenses (70% of income is from acupuncture, which requires a bit of licensing, inventory, and insurance up front, though could be worse). 30% of income is from music and October had a lot of big checks from all the fall weddings and Octoberfest gigs so that helped me catch up bigtime. I used to be a musician full-time, definitely making more now. The friends I know anything about their retirement have very little- it’s either from a job they had once with a 401k they no longer work (or benefits got cut), or they are saving would-be retirement money to buy a house or more reliable car, etc. Or, it gets wiped out by emergencies (one friend had to replace roof earlier this year, another had dishwasher and washing machine break the same month. Another had windshield/car windows replaced 3 times this year). I’m known as very frugal among my friends, who also are generally quite frugal.

I rent a VERY cheap tiny studio in Fishtown (skyrocketing real estate there) @$640 including all utilities, except phone/internet (too much, right now it’s $80). It took me a good 6 months to find something like that, and only because I could read between the lines and understand it was an illegal apartment (super not to code, also no kitchen- they rent it as a “room”, it took a few tries to convince them I was cool). I was looking all over neighborhoods that were bikeable and got really lucky and also was right on it when I found it. Rentcafe describes the median 20% of apartments being $1000-1500, though doesn’t specify size. For my neighborhood it’s $1730. Many of my friends rent rooms in houses, including couples who try for a suite-type situation (example- a floor in an apartment). One friend owns, but he lucked out (um, sorta?) in his first marriage where his ex’s parents bought them a condo in SD, and when they broke up, he got half. Another’s grandma bought a house for them. Another’s husband bought a house in a bad neighborhood 15 years ago (his mom was a real estate agent) that now is considered hip. Another married a doctor. My boyfriend owns, but he lived at home until he was 30 to save up. I don’t know any others in my group who own a house. Most of us have bachelors if not master’s degrees.

Most of my group value good food, and the occasional hang. I looked last month and my groceries were $250, but I did more entertaining than usual. But going out and gifts were $400. That sucks. November was less than half these #’s.

Seasonal expenses hit the lower and middle classes hard and I was thrifty even. My boyfriend and I have been tracking budgets lately and are planning to eat out less since I cook better than most restaurants anyway :P

Transport is much lower- you live in the city, no need for a car. I average $150 between public transit and uber/lyft pools. Many friends do have cars to get to work, they tend to spend a lot of money repairing them, but it’s a cycle that’s hard to get out of, since where do you come up with the chunk of change to buy something better? Or qualify with lower income?

Many of my friends don’t pay for health care any more since the penalty is gone unless they have kids. Many of us can’t afford to/don’t want to have kids so it’s a moot issue. Often one person in the partnership is the one who takes a junky job to have benefits for the family if there are kids. Friends sit for kids a lot, so hiring a babysitter is minimal for most people I know, people try to set up play dates instead. It’s hard to afford it. Any spare money goes towards stuff for the kids. Philly schools suck mostly so it’s important to live in a good area or try to get a job at a private or Friends’ school.

Vacation is a must even if it’s camping for most of my peers, gotta escape the grind. I think I save more than friends here because I use miles and points. I also go to cheaper places- went to Colombia last time. I got dental work done there since I couldn’t afford it in the US ($300 vs $2k)

That being said, when you are used to living on so low of income, it’s easier to save if you make more, as long as you don’t get too stressed. Just have to prevent the lifestyle creep. It helps to have like-minded individuals to support you and I think that’s one of the biggest things honestly. I can read all I want online, but it really helps me that I can talk about these things with my boyfriend, or best friend, and come up with solutions. Right now I’m researching grants for first time homeowners, who are low-income. I never thought homeownership would even be possible, I think it could be a good step for me if the price is right and now my income is steady to building and I have a plan (airbnb, which I have experience with). Quality of life is important too, and often it’s easy to say- just make more! when the job opportunities are simply not there. One can only hustle so much, I’d rather put my efforts where they are giving fruit (with financial education, it’s seeming).

Dizzy,

So, I’m not sure why or how I ended up on this post/reply yesterday but it caught my eye for some reason. The exhange stuck with me into the night as well. There are a couple things in this reply that I do not understand. Maybe I am naive… but I can’t seem to understand the situation you have found yourself (along with friends) in.

Looking quickly at the average income in philadelphia, and it shows $65,090.00, looking at the median for a better accuracy I suppose, and you see $43,744.

The post said you were making between $10-20k for the first couple years?

I’m confused on this situation, I made more money than that in highschool working for a grocery store. I had a second job as well that I worked off hours at. Each of them paid between $8.50 and $9.50/hour and both part time. I think in the summers I would get up to 38 or 39 hours at one job, and work 78 hours over two weeks with off hours.

The basic calculation considering a flat wage, is hourly wage x hours worked x 52 weeks. Assuming you were working 37.5 hours (since you said not full employment) to make only $10k, you are talking about working for $5.12 (roughly) an hour.

I’m glad you made the life change to increase that. $5.12 is a hard pill to swallow considering that in some places they are paying $15 for minimum wage. So looking at the case again with say a grocery bagging job you could potentially make $15/hr or roughly $29,250 gross as a part time employee. This seem to only be about $8k less than what you claim as your current gross salary of $37k, and it takes zero “skill” and minor training.

Anyway, looking at your scenario gave me pause last night. Why would you choose to live this way? I sort of understand the “starving artist” mentality but at somepoint you need to shift pipe dreams into action. The music ability once earned will always be there, but if its not putting food on the table, perhaps its a hobby and not a job/career.

It seems like you have taken this step with potentially opening an acupuncture business of sorts, and supplimenting with your music gigs. however, I again don’t understand this. Looking simply at average for acupuncturist online, and you see something like $20-74/hour and/or $43-$110k per year. So if you are certified as an acupuncturist, why are you “selling yourself short”? Looking at PA in general the average acupuncturist salary is $71,042/year. looking at the bottom 25% and you still see $50k. I see the goal in owning your own place, but maybe working for another establishment for a couple of years might help you a bit more. At a minimum you could grow a client base on someone else’s dollar, and then try and sway them to your new operation.

So what is it exactly that you are doing, or choosing not to do that only brings in $37k with skills/talents that you have?

It seems to me that you (and potentially some friends) are choosing to live a more restricted life than necessary. Have you considered moving to a new area? The skills that you have, acupuncture, and music ability seem highly transferable. The state around PA (and including) are all in the $35/hour range for full time acupuncture.

Surely there are other options than $37k per year in part time work? Since you are looking at a financial blog, perhaps you should review some of the suggestions again and consider implimenting them.

I would suggest finding new employement for one. Looking at a location change for two. and finally I would only take a job that provides full time work with benefits. Doing less than these is only stacking the deck against you.

The last comment I have is associated with your friends and people arround you. Everyone (I believe) has a choice to stay the course or make a change. You note that your friends already consider you the frugal one. Maybe now is the time to show them you are more than just frugal, by going out and making a life change. Put those skills of yours to good use and pull down a salary that is more aligned with your ability.

Time is short, in a sense. Why keep yourself in neutral when you have limitless opportunities out there.

Good Luck.

So I definitely wasn’t working anywhere near 40 hrs/week, just not possible. My first year I had worked on a cruise ship (ok, so that was actually 52 hrs/week). I made 20k over a 7 month contract, I needed the rest of the time that year to recover mentally from it. Unfortunately I was so stressed I blew through a lot of it recovering/paying prior debt/moving to new city and starting up biz expenses). Was told I should be getting 50-100k there but really it seems like few get that, you have to get very lucky with your placements.

Then when I moved back to Philly, there are not a lot of acu jobs there. I honestly have never wanted to start my own biz but I was approached by a local yoga studio to do so, figured since nothing else was going on, sure. They of course made it seem like I would have tons of patients and would help more with marketing (they didn’t, naive me).

I literally have applied for every job I’ve seen since I moved there and have not been not hired for any of them (tho, the jobs I did get I actually did not apply for, so there’s that). There are very very few FT jobs in acu let alone with benefits. Most “jobs” are compensation based and you are 1099. 1st biz, was myself, I barely profited over 6 months (learned a lot tho, and have what I need should I start another biz again) and decided to call it when offered another job @ $20/hr. It was 11 hrs/week, was promised more hours eventually, but never manifested. Eventually got another job that gave me another couple hours a week in addition to some rando other one off acu-gigs at other places. The two main jobs started to conflict and I left other job since I made a bit more than staying at the other job and working more hours, by just working the one job.

I’m still only 20 hrs/week tho (now down to 5 hrs/week reopening after COVID this week. We will see what happens, my boss expressed real concerns we will survive. He already let go 2 of the other 3 acu’s there so I’m grateful for anything). Yes, I was also applying for other non- acu jobs but having already gone thru this years ago (I’d applied for close to 2k jobs in 8 months in the aftermath of 2008 nonsense without getting anything that lasted more than couple weeks) maybe you can see why it’s hard to keep banging my head against the wall. I did finally figure out the delivery hustle tho it’s been difficult since I was reliant on my partner for a ride to the city where I could do it (I have just bought a car tho so probs will start again this weekend; last week was shut down mostly w/protests).

That $70k salary you mentioned, as I’ve learned eventually, is from an average. There are a few people who are making tons of money. Everyone else is in the $20-50k range generally. I don’t know anyone here making anything near 75k excepting one practitioner who’s been in practice 20 years and 2 people who own multiple clinics (one of which is my boss). Most people I know are in the 30-40k range. Still a step up for me tho, better than when I was a FT musician!

Some of your numbers seem wild. $15/hr working grocery? Where can you find that. I know $13.50 is Trader Joe’s rate in the city (not burbs, my bf applied last month and it was $11/hr, not bad tho) which is the only place anywhere near that; I’ve applied for them many times over the years without getting hired, it’s very competitive. Everything else minimum wage. And of course, you have to get hired.

All in all I’m doing light years better than some others I graduated with who continue to live in a HCOL area. I saw classmates at a wedding last year, half of them had given up on acu completely and either were panicking, or had children/able to be full-time stay at home bc their partner made $$$. I at least moved to a lower COL area (Philly) where I had some contacts and made it easier. I cannot move now (nor would want to) since I am in a relationship with someone who owns a house in the burbs (have since moved into) and he does not want to move.

I do play music for a profession too make few grand a year. I *need* to do this. This, as well as my other side interest (long distance hiking, which yeah, I even get paid for this on occasion) are really critical for my mental state. Quality of life also beats money, I’m having enough of a hard time adjusting to suburbs life where I’ve recently moved.

Honestly tho, my expenses are v low. I’m now down to $650/mo fixed expenses including for car, if I include money for fun/vacation/etc it’s maybe $1k/mo. I’m self employed so I can have solo401k to dump savings into. I don’t have to work full time, I can do things like my job treating refugees (tho cancelled until fall, it’s only couple hrs a month); play music gigs, have time to develop other side projects, maybe take chance on a new $$ job if I got one (and then feel free to leave if it sucked) and most importantly for myself and now my partner. Most of my friends who don’t have kids are in the same boat. Not having tons of $$$ can be tough in some ways but also is good in others.