I'm always looking for a buy signal for stocks. In my opinion, one of the best buy signals for stocks is when the S&P 500 yield is greater than the 10-year Treasury bond yield. At the time of this update, this buy signal is flashing green.

The reason why I prefer owning real estate and starting a business is that I can do things to help improve my chances that the assets will perform.

With Financial Samurai, there's a strong correlation between the number of articles written and the amount of traffic the site receives. I can spend more time building rapport with readers. I can also write guest posts on other sites to widen Financial Samurai's reach.

With a real estate investment, I can paint the interior and exterior, refinish the floors, change the fixtures, landscape the front and back yards, expand the livable space, keep up with market rents, find higher-paying tenants and so forth. Then when rates get low enough, I can refinance my mortgage to improve my cash flow.

But with stocks, you and I are minority investors with no say. We are at the mercy of exogenous and endogenous variables. Maybe a CEO will be found guilty of embezzlement. Maybe there will be some type of data breach. Or maybe Amazon or Google will announce they are entering your space.

Who knows!

Yet, investing in the S&P 500 over the long term has proven to be one of the best ways to build a fortune as well. Therefore, all of us should have some exposure to the S&P 500. It's the amount of exposure that is up to all of us to decide.

A Buy Signal For Stocks

We've discussed the importance of taking advantage of arbitrage opportunities in a previous post. There are kinks in the system that can be exploited every day.

If you've got cash lying around, it's a no-brainer to take advantage of online savings rates that are way higher than the current 10-year bond yield. I'm not going to leave any cash in my main transaction bank, Citibank, because they are only paying me a savings rate of 0.04%. Pathetic!

But what if you want to take more risk because you're willing to lose money in order to potentially gain more money? The S&P 500 is one of the easiest risk asset for anyone to buy. We know that the S&P 500 has provided a 5.6% compound annual return between 1999 – 2018, and close to a 10% compound annual return from 1926 – 2016.

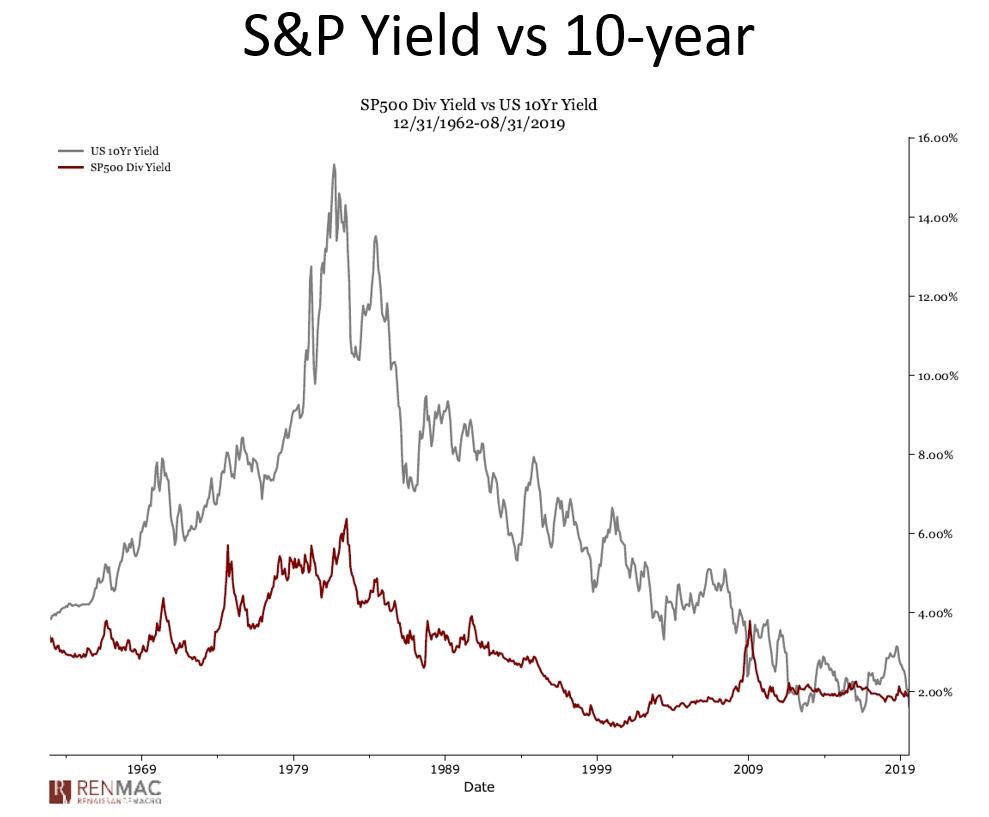

There is one indicator that has historically shown to be a buy signal for S&P 500 bulls: when the S&P 500 yield is higher than the 10-year bond yield. This unusual occurrence happened recently.

Given the S&P 500 has historically outperformed the 10-year Treasury bond in terms of principal appreciation, investors start to get interested when the S&P 500 yield alone is higher than the 10-year Treasury bond.

When The S&P 500 Yield Is Higher

An S&P 500 investor can view the yield as either a bonus or a buffer. For example, if the S&P 500 appreciates by 10% and you also get a 1.5% yield for an 11.5% total return, you can view the yield as a bonus.

If the S&P 500 declines by 10% and you get a 1.5% yield for a total negative return of 8.5%, you can view the yield as a buffer. Your view depends on the direction of the market, your general disposition, and your risk tolerance.

Right now is tricky because the S&P 500 is close to an all-time high, the yield curve has inverted, yet the S&P 500 yield was recently higher than the 10-year yield as of September 2019.

Do you view the yield as a bonus or as a buffer? Given I'm a conservative investor who doesn't want to go back to full-time work, I view the S&P 500 yield more like a buffer in case of a pullback.

What Happened With The Buy Signal During The Last Crisis?

During the 2009 financial crisis, the 10-year bond yield collapsed as investors sought the safety of bonds. But notice how the S&P 500 dividend yield soared as the S&P 500 crashed because companies were late to cutting their dividend payouts.

If a rise in the S&P 500 yield is seen as an ominous sign for equities, then S&P 500 bulls should find solace in today's S&P 500 yield data that shows a steady 1.5% – 2.1% yield since 2010. The hope is that companies this time around are more proactive with their cash reserves instead of reactive.

At the same time, a 10-year bond yield below the S&P 500 yield makes the S&P 500 incrementally more attractive. What is an S&P 500 investor supposed to do? An investor would have done spectacularly well if they had bought in 2009.

Based on the analysis by Renaissance Macro Research (RenMac), the Sharpe Ratio is 100% higher and the annualized return is 68% higher when using yields as a buy/sell signal for stocks versus bonds.

In other words, the data is showing that when the S&P 500 yield is higher than the 10-year bond yield, one should be an incremental buyer of the S&P 500 index.

Do You Believe In The Buy Signal?

As you can tell from the S&P 500 / 10-year bond yield analysis, it's not as straight forward as saying, “Buy panoramic ocean view properties in San Francisco because they are irrationally trading at a discount to the median-priced property, whereas panoramic ocean view properties in other major cities trade at tremendous premiums.“

Real estate is so much easier to understand, which is why for most people, I think real estate is the better want to build long-term wealth.

The argument to buy the S&P 500 at all-time highs, despite its yield being higher than the 10-year bond yield, is much more nuanced because there are so many more tea leaves to read.

The very next day, the 10-year bond yield could be way higher than the S&P 500 yield. Then what? Sell all stocks and build a bunker, especially since the S&P 500 is way above trend?

To finalize the arbitrage trade, some investors would say one should short the 10-year Treasury bond given there could be a reversion to the mean. Based on the first chart, very rarely does the 10-year bond yield stay below the S&P 500 yield for very long.

Stocks Usually Go Up Over The Long Run

Despite the murkiness of the S&P 500 yield versus 10-year bond yield indicator, it is comforting for stock investors to know that rational money will start slowly shifting out of bonds and into stocks due to the relative value the S&P 500 now provides.

All we really know for certain is that the S&P 500 has provided investors a positive return over the long run. Therefore, we should all have some type of exposure and continue to dollar-cost-average over the long run.

Finally, as an investor, please be aware of your biases. You will ultimately find evidence to support your bullish or bearish stance. It's important to always see the other side of the trade.

The buy signal for stocks is currently indicating investors should get long. With the Fed committing to keep interest rates low, investors have “no choice” but to invest in riskier assets like stocks and real state going forward.

The Yield Curve Today

Post pandemic, the yield curve is now upward sloping and relatively steep. The Fed slashed rates to 0% – 0.25% and long-bond yields have risen from their 2020 pandemic lows. As a result, there is a very bullish feeling in the air.

I'm personally very positive on the housing market and am investing as much as possible in the space. I believe the mortgage rates will stay low for a long time, even though they are up from 2020. The economy is recovering, wages are growing, and corporate earnings are rebounding aggressively.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Can you please share your thoughts about s&p 500 etf and s&p 500 index funds.

I want to explore on these also and I found your research easy to understand for me.

Hi Ed,

Thanks for the reply! I’ll happily take the other side of that bet. Since my post, long treasuries are down 3% and stocks are up 1%.

Stocks aren’t overvalued simply because they’re at highs. A lower discount rate means 18x-19x P/Es aren’t unreasonable. On the other hand, bonds have never been more expensive in history. 17 trillion is negative-yielding.

You say “rates WILL go lower,” but the Fed only controls the front end of the curve. Lower short term rates drive inflation expectations and steepening on the long end. Long bonds can easily suffer even if short term rates go down.

Let’s follow up in three years :)

I seldom invest directly in stocks. I don’t do bonds because my wife and I both have pretty decent pensions.

I try to avoid real estate as I’ve been a landlord and I really don’t care for it. Unless you can do it on a large scale there is too much concentrated risk in suddenly having to spend thousands to do totally unpredictable things, like fix cracks in the driveway before the insurance company will reissue renter’s insurance. You may still be able to make more money but you also work for it. I thought we were about retiring and not having to do work we don’t want to have to do.

What I invest in mostly is mutual fund managers. They are NOT all created equal and some, by working in teams, seem to pretty much immortal. They are certainly far less volatile than the market overall and, believe it or not, some do exceed the market, decade after decade and still maintain a low expense ratio.

Your problem there is that many of the best ones are typically closed funds (word gets around and they have to stay at least a little nimble to keep up their performance). A good 401k will have the clout to get you into them anyway and, as a bonus, they don’t waste your money advertising.

Sam, reading this article about exposure to the S&P500 reminded me of passive investing and the so called “Index fund/passive investing bubble” recently brought up by Michael Burry. Would you consider writing an article expressing your opinion regarding this topic? would love to hear your thoughts,

regards.

TINA Its that simple

Invest money in the S&P or VTSAX, when you have the money to invest, period. Trying to time the market, is in exercise in futility.

A simple path to wealth by Jim Collins really helped me ignore the noise and accept that over the long term the stock market trends up and to the right.

Passive index funds are an excellent choice for most people in my opinion. Real estate investing isn’t as passive and even with a management company you still need to oversee them. No one will care more about your assets then the person in the mirror.

Sure, you can invest in crowdfunding or REITS, or I can just buy VTSAX and know i’ll do fine over the long term without having to do my homework on which crowfunding company to use, analyze fees etc etc.

Tenants are a whole other issue and depending where you live, taxes and property prices make good properties hard to find. For every Paula Pant or Rich on Money, there are way many more examples of other folks who are losing money or breaking even for properties that are a life suck.

My experience comes from being a police officer. I have responded to numerous landlord tenant disputes, or tenants having domestic disturbances. Most of our calls arise out of the apartment complexes.

Granted, not all tenants are like this, but it’s a reality that I see and it’s not pretty. Apartments that are ruined, tenants living like animals, dishes piled up in the sink, mattresses on the floor, holes in the wall! The list goes on.

With VTSAX I have none of the issues I mentioned. We all have our preferences, some in real estate others in Index Funds. I just happen to believe most people can build wealth long term in Index Funds.

I’ve looked into real estate but have been discouraged by two things in the Chicagoland area where I’m located, prices/taxes and tenants.

And I know my job gives me a somewhat unique and biased perspective but it’s one I can’t ignore and think- it’ll be different for me. It may or may not.

I’ll continue to plough my capital into VTSAX and use Jack Bogle’s holding period of forever. I think most people could benefit from the same advice and not worry about trying to predict the future. Because the only thing we do now with certainty is that the market goes up and it goes down. That’s all.

Brian,

Greetings from Afghanistan and thank you for an insightful perspective. I’ve been on both ends of the spectrum on real estate – nightmare tenants that took advantage when I got previously deployed to AFG to wonderful tenants. After making significant changes, I now have a great real estate position. Again, great perspective.

Please be safe out there on patrol.

Semper FI

I’m in the Chicago Metro and have seen mentions of rent control in the Trib. I have a small interest in an apartment building in OH. I’m not a real estate investor, but wouldn’t bother with IL at all.

I’ve been waiting for a buying opportunity because I have some cash to deploy. I like to leg into positions little by little so I’ll definitely consider deploying some thanks to these insights. I love how I learn something new every time I read one of your articles. Thanks!

I keep coming back to this site because I learn something new in almost every post. I also think it’s really helpful when you compare analyzing stock/bond investing to real estate investing. It’s true – real estate investing just makes more intuitive sense for the average person!

I have no idea what the market will do. This is why I have a Boglehead inspired 3-fund portfolio and a specific asset allocation that will adjust as I near retirement. When my asset allocation if off (either direction) by 5% I rebalance and “stay the course.” No market timing. No emotions.

+1. I use a 5 fund portfolio- but same idea. No market timing just buying or selling once a year to rebalance. Been so much better for my psyche (and long term returns) than trying to read the tea leaves and time the market.

10 year yield aside, once the S&P dividend yield topped the 30 year (which hasn’t happened in two decades), I started buying equities hand over fist. It’s not that I’m bullish; it’s just that bonds look so much worse on a relative basis.

Nate – Have you checked the total return on 10 year bonds over the past year? They are up about 15%! The S&P is up about 3%. Interest rates WILL go lower therefore long term bonds could still be a very good short term investment.

Stocks are overvalued sitting at all time highs with an inverted yield curve. Stocks generally fall in value when interest rates are cut and bonds go UP in value. Bonds will likely outperform stocks over the next 1-3 years in this environment.

But notice how the S&P 500 dividend yield irrationally soared before collapsing as companies decided to conserve cash by cutting their dividend payouts.

Why wouldn’t we see the same this time? The dividend cut will lag a recession, right? I don’t think this is a good buy signal. It seems like a warning to me, but what do I know.

Hopefully because companies have learned their lesson and are planning ahead.

Yields temporarily soared is probably due to the stock market crashing and then companies acting post mortem. My hope is that companies are more forward-thinking nowadays.

Companies don’t learn. Top management team turnover or folks who were promoted into senior management roles likely won’t have had the experience gleaned from the last downturn. While you have some stability in certain companies or industries, Warren Buffet, Jamie Dimon, etc. these are the exceptions rather than the rule. https://www.kornferry.com/press/age-and-tenure-in-the-c-suite-korn-ferry-institute-study-reveals-trends-by-title-and-industry

I’d like to retire in 6 years or so. The more you know, the better you can make decisions. Maybe they’ll be correct, or maybe they’ll be wrong, but you do the best you can. Thank you for providing yet another (unknown to me) way of assessing the market. :)

We can’t easily predict what the stock market will do next (especially since QE may play a part in our historic stock market highs), but we can pretty easily predict what the Fed will do next: lower interest rates, or at least not change them.

I have plowed almost my entire cash portfolio into I-bonds and CDs to lock-in rates while I can. I have a bunch of cash (26K at 20yo is a lot of cash for me at least) because of a computer reselling business I ran during the summer, and will need the money for something like a down payment on a house when I graduate college in 2022.

Let’s just say for any other financial samurai readers out there who have mommy and daddy paying you living expenses (you either live with your parents or they are paying your tuition): there is no excuse for you to not save every penny you make. You should be turbocharging you savings rate while you have very few to no living expenses. I personally save almost 90% of my income, because I refuse to be the classic spoiled child who never learns how money works in college.

Way to go, I guess you could consider yourself an “Above Average Person” as Sam defines it!

Dylan, great job and great perspective toward saving and investing. I hope to convince my 21-year-old daughter to adopt a similar mindset!

This is why I love visiting this site because I pickup tidbits like this. I never knew of this indicator before.

My caution with chasing S&P yield is that in a recession, the dividends that are providing this yield are at risk and can be cut as in the past. Then you are sitting on an asset that lost its appeal with the initial yield AND get penalized with the value of this asset plummeting in a recession.

Based on your previous advice I have actually gone more conservative (ie moved towards more bonds) as I feel like I am in my 5 year pre-retirement window and don’t want to gamble with a drop in equities during this time that could force me to extend that time.

Xray – Did the same last summer and man did it pay off. My 10 year treasuries went up 15% in value over the past year as yields plunged. Stocks barely are keeping pace with inflation with massive risk. I won’t buy stocks unless the market goes down at least 20%.

It’s such a tough decisions making asset allocation decisions off of recessionary indicators.For example when 2s/10s inverts on the yield curve it usually predicts a recession in 18-24 months – but you still have no idea when the stock market will correct. All most people can really do is decrease risk a bit, especially is stocks are “funding” their retirement.