Student loan debt is at a record high at about $1.8 trillion. In a January 2023 report, the analysis showed that the average debt per borrower was over $37,000 for federal student loans and nearly $55,000 for private loans. But is it really a big deal when incomes are at record highs and the unemployment rate is at a record low? Probably not.

During my New York trip, I stopped by Princeton, New Jersey to attend a college friend's wedding. We were Spanish House housemates who used to flip on CNBC before class and dream of one day making it on Wall Street. This was back in 1998 when working in finance was all the rage.

Although he never made it into finance, he did something better. He became a cardiologist and married an opthalmologist. In terms of finances, their household is set for life. After all those years of training, I wouldn't expect anything less.

According to the Association of American Medical Colleges, 84% of all 2014 medical students graduate with debt, and the median debt level is $180,000. That is a ton of money to be paying back. Or is it? Let's look at why the “student loan crisis” the media harps on and on about is overblown.

Student Loan Debt Is Relative To Income

Let's say my friend the cardiologist graduated with $180,000 in student loans. Is that really so bad if the median salary for a non-invasive cardiologist is $250,000, and $400,000 for an invasive cardiologist? I don't think so, especially given the high certainty for lifetime employment for doctors. There just aren't enough.

After a 30% effective tax rate, $250K and $400K equals roughly $175K and $280K. Breaking the numbers down even further, $175K is about $14,583 a month, while $280K is about $23,333 a month in income. Let's say my friend goes through an aggressive 10 year student loan repayment plan at a conservatively high 5% interest rate, his monthly payments would be $1,909.18 or just 8-13% of his after tax salary.

If he were to refinance his student loan with Credible, I'm sure he could get lower than 5% because he went to William & Mary, Columbia for his Master's in Public Health, Yale for Medical School, and Cornell for his residency!

Fintech firms are addressing the vastly underserved demographic of recent graduates with a tremendous amount of earnings potential, but not a lot of money just yet.

OK, I understand not everybody has the intelligence or grit to become medical doctors. I certainly don't. I just used the highest student loan debt figures cited by the media and match it with a common example to show how affordable student loan debt may actually be.

Average Student Loan Debt In America

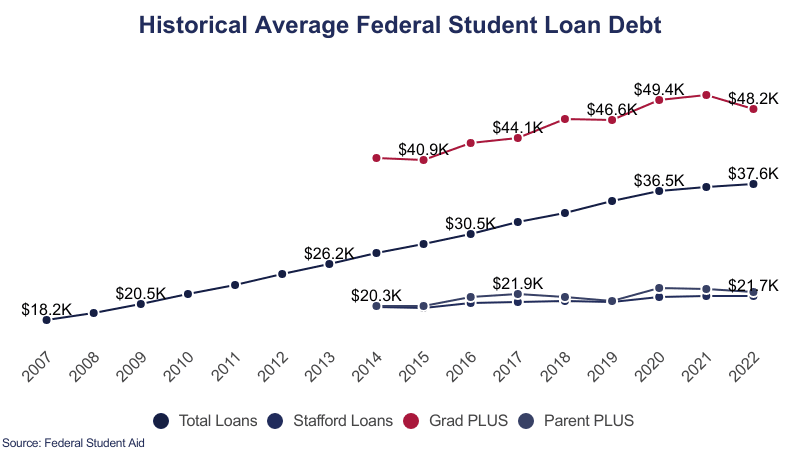

Now let's talk about people who go to college and don't go on to get a graduate degree. The following chart shows the average student loan debt per borrower. We're at record highs at ~$40,500 for the latest class of college graduates of 2022.

Although graduating with $35,000 in student debt sounds like a lot, to gain some perspective, let's compare this debt to median income.

According to the Labor Department, the median weekly salary for those with at least a bachelor’s degree is around $1,193. Let's say the median person works 49 weeks a year. That's an annual salary of $58,457. To be more conservative, let's round down the figure to $55,000.

If we plug $35,000 of median debt into a student loan repayment calculator using a 10-year payoff term and a 5% interest rate, we get a monthly principal and interest payment of $371.23. Let's continue to stay conservative and use a 30% effective tax rate on a $55,000 income. We get $38,500 a year net, and $3,208 net a month.

A $371.23 monthly student loan payment is only 11.5% of a graduate's monthly net income. With over $2,800 a month to live life and save for retirement, unless the person is completely fiscally irresponsible, is his/her student debt really so burdensome? I don't think so.

What About Private School Tuition?

While I was at Princeton, I spoke to some Princeton students and Princeton employees at the admissions office about the cost to attend. Here is the official breakdown of Princeton's tuition and expenses for 2024-2025:

The cost of attendance for 2024-25 is $79,540 and includes:

- Tuition: $57,410.

- Room charge: $10,960.

- Board rate: $7,670.

- Estimated miscellaneous expenses: $3,500.

Damn, Gina! That's a ridiculous amount of money for college. $79,540 means one has to spend 100% of a $100,000 gross income after tax. With the median household income around $75,000, who can afford that?

RICH PEOPLE Are Paying Full Tuition

Private schools have a disproportionate amount of higher income earning households than state schools. That's common sense. I have literally talked to thousands of private school students and now parents during my time working in finance and through this website.

Not everybody can be as rich as Democratic Socialist AOC and attend expensive private universities like Boston University. Most people are not rich enough to pay so much in tuition to encourage socialism.

But let's not assume private schools only consist of kids whose parents make six figures or more. If your child is smart enough to get in, but comes from a middle class-to-lower income household, then attending college might be free or at least highly subsidized!

Private University Tuition Subsidies By School

Check out the subsidies given by the following 10 private schools assembled by Bloomberg. Tuition rates are about 20% higher for 2023-2024.

1. Princeton

Tuition for 2015-16: $43,450

Acceptance rate for the Class of 2019: 6.99 percent

Policy: Families making less than $54,000 a year don't pay tuition, room, or board, and families making less than $120,000 a year don't pay tuition.

2. Brown

Tuition for 2015-16: $48,272

Acceptance rate for the Class of 2019: 8.5 percent

Policy: Families making less than $60,000 don't pay tuition, room, or board.

3. Cornell

Tuition for 2015-16: $48,880

Acceptance rate for the Class of 2019: 14.9 percent

Policy: Families making less than $60,000 don't pay tuition, room, or board.

4. Columbia

Tuition for 2014-15: $51,108

Acceptance rate for the Class of 2019: 6.1 percent

Policy: Families making less than $60,000 don't pay tuition, room, or board.

5. Duke

Tuition for 2015-16: $47,650

Acceptance rate for the Class of 2019: 11.3 percent

Policy: Families making less than $60,000 don't pay tuition, room, or board.

6. Harvard

Tuition for 2015-16: $45,278

Acceptance rate for the Class of 2019: 5.3 percent

Policy: Families making less than $65,000 a year don't pay tuition, room, or board.

7. Yale

Tuition for 2015-16: $47,600

Acceptance rate for the Class of 2019: 6.5 percent

Policy: Families making less than $65,000 a year don't pay tuition, room, or board.

8. Stanford

Tuition for 2015-16: $45,729

Acceptance rate for the Class of 2019: 5.05 percent

Policy: Families making less than $65,000 a year don't pay tuition, room, or board, and families making between $65,000 and $125,000 a year don't pay tuition.

9. MIT

Tuition for 2015-16: $46,704 (includes mandatory fees)

Acceptance rate for the Class of 2019: 8 percent

Policy: Families making less than $75,000 a year don't pay tuition.

10. Dartmouth

Tuition for 2015-16: $48,120

Acceptance rate for the Class of 2019: 10.3 percent

Policy: Families making less than $100,000 don't pay tuition.

Middle Class And Lower Households Don't Pay Full Tuition

As you can see from the data, a lot of middle class to lower income students don't pay the rack rate and that's a GOOD thing. Those students who make above the policy cutoffs will get prorated assistance as well.

There's this big uproar against soaring private school tuition costs. People feel it's unfair that only the rich can afford to send their kids to elite private schools.

Here's a post that shares how much certain rich folks would be willing to pay extra to get their kids in. We already know that rich people have advantages over the rest of us. And coming from a public school like William & Mary, I couldn't help but feel the same way as most.

But after speaking to people at Princeton and highlighting the subsidies in this post, we should actually want listed tuition prices to rise as high as possible!

With high tuition prices, colleges have more flexibility to smartly charge their richest students the highest prices to help subsidize those students with lower household incomes. Ah-ha! A silver lining.

For those curious, here's the median income earned by Ivy League graduates.

Student Loan Debt Is Manageable

So far I've demonstrated that student debt can be manageable for those who've taken out the most debt (doctors). I've also shown that student debt should be manageable for the median person who graduates from college.

I've even shown that the rack rate for private school tuition is not necessarily the amount a student actually pays. We haven't even touched upon how many people can save a ton of money going to a public school like I did or attend community college for two years and then transfer to a public school for even more savings.

The cost to attend college is directly proportional to a student's ability to pay. That a person is able to take on $100,000 in credit card debt is due to the fact that that person has a high enough income to afford it. No credit card company just gives that much credit to anybody just like how nobody pays $60,000 a year for college if they can't afford it.

Rational people research the graduation rates, job placement rates, the median salaries of graduates, the school's rankings in the various polls, internship opportunities, the most popular employers, and so forth because college is expensive and takes years to complete.

The same goes for how plenty of rational investors who want to maximize returns develop a system to allocate capital.

Only Few Students Get Snowed Under By Student Loans

Although every student hopes the perfect job is waiting upon graduation, few students are so delusional as to think employment is guaranteed. Few people would not run a cost/benefit analysis of college or graduate school before spending years of their lives and tens of thousands of dollars. There is no sure thing except for how hard one can work.

Even with the national unemployment rate at ~5%, and the unemployment rate for college graduates at ~2.7%, there will always be students who graduate with debt, and because they haven't found a job or the ideal job, some will have difficulty meeting their loan repayment obligations. Many might even have to move back in with mom and dad, the wealthiest generation in the history of the world.

However, if college graduates want to work, it's not like they'll stay unemployed forever. While searching for an opportunity, there are plenty of low wage jobs to take. You can also apply to work for the state, federal, local or tribal governments, nonprofit organizations with a 501(c)(3) tax-exempt status, AmeriCorps or the Peace Corps to take advantage of the Public Service Loan Forgiveness program as well. Nobody is too proud to work.

So for all those people who think the $1.8 trillion student loan bubble is the next to burst, relax. We've got fintech lending companies making student loan repayment much more manageable since big banks are too inflexible to change.

The rack rate tuition highlighted by colleges is only paid by those families who can afford to pay. And the sharing economy has created a plethora of freelance opportunities to help people make ends meet. Where's the crisis folks?

The problem is, there is a war on meritocracy now. This is leading to a lot more angst and anxiety from parents and students alike. It's hard to get free money through grants and scholarships, even if you are brilliant.

Summary For Student Debt Sufferers

1) Refinance your debt. Check out Credible, a student loan marketplace that has qualified lenders competing for your business. Credible provides real rates for you to compare so you can lower your interest rate and save. Getting a quote is easy and free. Take advantage of our low interest rate environment today!

2) Side hustle. Do not be too proud to take on a minimum wage job, or non ideal job while you search for your ideal job. Getting your ideal job is like winning the lottery. Often times, it takes a lot of paying your dues and a couple job hops before you get there. There's a massive sharing economy that lets you contract your services at $10 – $30/hour. Do that 40 hours extra a month, and you've got an extra $400 – $1,200 right there.

3) Cut expenses to the max. News flash. You are poor! Do not be too proud to live at home with your parents, share an apartment, share a room, take the bus, ride a bike, walk, and wear old clothes. If you are poor, don't act rich. Act poor! The biggest problem is folks expecting to get rich immediately.

4) Do not drop out. The worst thing you can do is go to college, incur a ton of student debt, and then drop out without getting your degree. If you are unsure of college, go to Community College for a year or two and test the waters. CC is an inexpensive option that allows you to transfer credits over to a four year school if you so choose.

Wealth Planning Recommendation

College tuition is now prohibitively expensive if your child doesn't get any grants or scholarships. Therefore, it's important to save and plan for your child's future. Check out Empower's new Planning feature, a free financial tool that allows you to run various financial scenarios to make sure your retirement and child's college savings is on track. They use your real income and expenses to help ensure the scenarios are as realistic as possible.

Once you're done inputting your planned saving and timeline, Empower with run thousands of algorithms to suggest what's the best financial path for you. You can then compare two financial scenarios (old one vs. new one) to get a clearer picture. Just link up your accounts.

There's no rewind button in life. Therefore, it's best to plan for your financial future as meticulously as possible. End up with a little too much, than too little! I've been using their free tools since 2012 to analyze my investments and I've seen my net worth skyrocket since.

More Recommendations

Buy This, Not That is an instant Wall Street Journal bestseller. The book helps you make more optimal investing decisions using a risk-appropriate framework by age and work experience. Arm yourself with the knowledge you need so your money will work harder for you.

Join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

I read your blog often with my morning coffee, and I really enjoy your input. Although, looking at this post I feel that it should be relevant to me. But at the same time I almost laugh because it seems like such a small amount of debt for a student. I am currently a veterinary medical student and am going to be graduating with a lot more than $135k. The average vet school is around $50-60k per year, and government loans are at 6.7% interest rate. At this rate, on top of the cost of living and assuming I can pay off my loan in ten years post-grad, I am looking at a final tally of $427k. That means I will have to pay a little less than $4000/month for the next ten years on a salary of around $100k. I have been wracking my brains to try to figure out how I am going to pay it off and still afford to buy a home (hopefully before I turn 30). If you have any insight, I would be enlightened.

I have been sitting and reading your blog posts for a few hours now, as it is snowing and I can’t leave my apartment…

You, as a Princeton graduate, I am assuming have a very high level of intelligence. YOU are not taking into consideration at all the number of people who are dealing with these issues who do not have the same level of intellect, problem solving abilities, emotional strength, so on. This IS a big deal. Maybe just not for you.

How many people graduate from engineering+medical school+plus law school in comparison to EVERY OTHER PROFESSION? Again, we are talking about people that have an above average IQ that will make enough money to pay it off in a reasonable amount of time, if they are responsible enough.

What about the impact it has on people delaying marriage, buying homes, and starting a family? Not only psychological, but on the economy?

How can you say that it is so easy to pay off significant amounts of debt just starting out in life. Many people are not able to work throughout school enough to put a dent in costs. Through half of undergrad and ALL through my two years of graduate school (summers included). I worked 40+ hours a week, required by my program, for free at externships (not only did I work for free but I paid credits for these rotations) and attended night class everyday. Not to mention the service learning class I had to take for two semesters where again, I PAID to volunteer my time. That left me Saturday and Sunday to work (oh yeah, and study?).

Which brings me to another issue…

How many business students I knew who got paid 20+ dollars an hour for externships, and in the health field as well as many others you have to pay for credits to WORK BILLABLE HOURS. Nurses, occupational therapists, speech therapists, physical therapists, physicians assistants, and teachers as well (the people really making the big bucks ;) ). I PAID TO WORK IN COLLEGE.

I feel like the majority of your posts are extremely ignorant, pompous and insensitive. Have you ever worked with the general public for an extended period of time?

Try not to fall off your soapbox, it seems quite tall.

Several things:

1) I went to William & Mary, a public school because I wanted to pay for my own tuition and I didn’t want to to be a financial burden on my middle class parents whom I knew didn’t make that much as government employees. Me going to W&M is in the post but I will make it more clear by bolding the sentence. Read Public School Or Private School? Depends On Your Fear And Guilt Tolerance.

2) I’ve had craptastic jobs growing up making $3.65 an hour. Read Three Craptastic Jobs That Will One Day Make You Rich

3) I’ve driven for Uber for the past seven months. Read What’s It Like Driving For Uber? Mixed Feelings Of Hope And Sadness

4) To gain perspective, and to encourage others to gain perspective I wrote, Spoiled Or Clueless? Try Working A Minimum Wage Job As An Adult

5) I grew up in emerging markets such as Malaysia and Taiwan in the 80s and was born in Zambia. I’ve gone back to India and China many times in the 90s and early 2000s. I’ve seen tremendous amount of poverty and feel we are truly blessed to live in America.

I’m sorry if you are going through rough times. I don’t mind if you want to take it out on me. Unfortunately, I won’t be the one paying your student loans. Everybody must own up to the responsibility of paying back debt they incurred. Otherwise, another financial crisis will result.

Just know that hard work takes no skill. Stick at something long enough, and I believe you will find the progress you are looking for. Let me go and clarify in this post that I was in Princeton for my friend’s wedding and happened to visit the campus.

Sam

– Parents sent me to boarding school at 15. Graduated at 17. Was told I had to go to college and I had to get a scholarship to pay for it because I wasn’t going to get any help myself. Was told I wasn’t allowed to take a year off to figure it out because “if I didn’t go now, I never would go.” Couldn’t go to CC and transfer because then I would lose my scholarship. Parents terrible with money. One BK, one just financed a gigantic piece of useless property, so now will die in debt. Even with grants, scholarship, and financial aid, still came up short. Went to an out of state private tech school because ignorance. Didn’t have enough money, lost scholarship anyway, resorted to borrowing. Well into six figure territory. Good news is I at least picked something lucrative (Engineering) over something I actually enjoy or find interesting, so I can service the debt that I accrued getting the degree I never wanted in the first place.

This problem affects people of all kinds.

I think the crisis is three-fold

1) 50% of students drop out of college so those students have similar payments without the commiserate increase in compensation.

2) In prior generations, the same increase in compensation came without massive student loan baggage. This means the 10% of income going towards student loans for 10-20 years after school will massively reduce discretionary spending for 20-40 year olds compared to prior generations. This will have a lot of ramifications for the overall economy – and none very good (except probably rental units).

The ironic thing is that information is cheaper today than ever in the history of man (your website is proof) yet higher education has never been more expensive. Obviously something is not right.

3) The big money shot though is that over 1 in 4 student loans currently in repayment are behind at least 30 days or more. This is a HUGE amount compared to other loan types, especially when you consider all of the available forbearance options and extended monthly payment options available. Considering these loans have fees rise substantially upon default and follow you to the grave, that’s not a good thing.

Rob, those are all good points. On point 1, hopefully those who drop out aren’t dropping out in the 4th year, but in their 1st or 2nd year, thereby having less loans than if one went through 4+ years.

I’ve been writing about free education via the internet for years. And it’s not just my website, but MOOCS, Kahn Academy, and the millions of other sites out there. It makes no sense to pay up for free education.

Few comments

1) You are absolutely right about the doctors ability to pay their debt although I’d probably use closer to 40% tax rate for them and closer to 20% for the other example of $55k (remember personal exemption and standard deduction are disproportionate to lower incomes)

2) A bit less than half of college students drop out so you’d want to probably take the $55k income * 55% + $30k * 45% to get an average entering college student’s expected median salary in 6 years.

3) The cost of school should always be compared with its costs (including foregone income / work experience) and not just if you can afford it. An MBA from a T10 program or the doctors in your example will absolutely pay for themselves. A sociology degree at $40k/year in expense and a median salary of $35-40k/year post graduation (vs $30k with no degree) will never pay for themselves – especially if you have to rack up debt.

4) The default rate for student loans is 12% – which is crazy high considering all of the deferment, graduated income payment plans, and general willingness to work with you

5) Even without the higher defaults, that debt load means less spending in other areas of the economy. For example, 25 year olds will probably defer housing purchases or buy much smaller than they would have in the past.

Dropping out after incurring debt is the biggest problem for sure. I’m not sure how to help solve this problem. CC for the first two years sounds like a great idea to test out in as cheap a way possible to see if college is right for the individual first.

This is a topic that has absorbed a great portion of the last couple years for me. I graduated in December of 2011 (supposed to be 2010) at 23.

After the interest accumulated my out of pocket cost was $110,000 for a Biomedical Science Degree at a Texas public university (meaning student loans galore). I was dumb, dumb, more dumb……did I mention I was dumb?

Coming from a family where education has the most importance regardless of how to obtain the degree I lacked the financial sense and intelligence to realize the impact it would have in my life.

It took me 4 months to get a job after applying for about 120 jobs (I was unable to even secure a job working at retails stores, banks, and the list can go on).

My goal was to move back in with a single parent in order to 1) focus one paying back the massive debt 2) being home to help make sure my aging parent was no longer by herself.

I found a job with a healthcare staffing company 500 miles away from home starting at 35K in May of 2012. While I was working I would take very inexpensive community college courses for about a 1 year in order to help defer paying all the loans at one time. This meant on top of typically working 10-12 hour days I would be study late night at the office.

This allowed me to focus the amount I was paying toward a specific loan so I was not just paying interest.

Fast forward 3 years: 12 hour days are the norm, my salary has increased a little bit more than double with no PTO during this time period (salary plus commission).

Having paid down 40,000 dollars in student loans thus far, I could only imagine how my life would be different because I would be able to save and invest.

Nevertheless,

I count down the days, hours, minutes, and seconds I will be free of my student loans (and I WILL BE FREE SOON!).

The lesson I have learned will with no doubt impact the result of my life in terms of how I want to live.

For the folks that read this blog the debt may not be an issue. There are a lot of students that will have issues. When 30%-60% don’t graduate they don’t the $50+ median salary. Plus salaries from the bottom half of colleges are well below those averages. All driven by the all students must go to college b.s.

I am somewhat on the disagreement train with this article.

Sure everyone should pay back what they borrow, but that does not mean everyone can afford to.

Some people (like me) get lucky and get scholarships based on merit for a few years, finish community college for free, start working for a semi-decent salary that’s more than minimum wage (due to connections some people don’t have) and finish school part time without needing loans and then are able to line up a real job because they racked up 3+ years experience while working the semi-decent entry job. But honestly it’s all about luck and who you know.

My sister got lucky like that and was able to work summers in retail to pay off some of her loans as she took them out, but she had merit scholarships to cover much of her tuition, and once fasfa stopped counting my parent’s income she was able to get grants to cover 100% of her last semester. She also was able to get an internship and a job lined up for the day she graduations. She will graduate with 10k in student loans but a 55k per year job and easily pay back her loans.

Other people aren’t so lucky. Especially if only certain schools offer your desired major.

My BF went to engineering school out of state, got some measly 5k per year for 2 years scholarship help (for tuition that was at least 25k per year, not including the room and board because he couldn’t live home and attend this school due to distance). The curriculum was so intense he couldn’t work during school, and he wasn’t home long enough on breaks to work even retail on breaks (can’t interview in person when you’re 4 hours away). So he racked up almost 200k in student debt.

Engineering jobs seems to require 5yrs+ experience. So with 2 years in internship and college, he’s SOL finding a real job, and stuck using a government program to reduce payment amounts on his loans, living with his parents while he works for 10 dollars an hour doing data entry because no one is hiring entry level materials engineers.

Move to an area that is hiring? Sure he could move out to cali for a 55k per year salary job, and somehow also pay 2k in loans per month? Sorry he’d barely survive anywhere on that after loan payments. So he’s trapped at home in an area that isn’t hiring entry level and he can’t move to where the jobs are because the loans are too high to repay even on a decent salary (which he isn’t making).

All these companies want experience that college grads dont have. It seems like a “its who you know not what you know” scenario all over, unless you get lucky that your state school offers your particular major (and is reputable in that major) that you can line up a job right after college.

I have too many friends in debt working minimum wage because no one wants the just out of school college grads. They want free slave interns (which college grads can’t apply for because they wouldn’t be able to pay their loans on “experience opportunities”) but not entry level employees. So they are all trapped in this space of minimum wage jobs and unable to apply many places because they are tied to their parents’ homes just to make ends meet.

There really is a college debt crisis, its causing 20somethings to be late bloomers, buy houses later, start families later and slow down the housing market for it.

College prices need to get under control because right now only the rich, extremely poor, or well connected lucky people have a chance to succeed.

Great comment CH and a very compelling real-world example of how excessive college debt can create massive problems post-graduation. I feel a lot of sympathy for recent college grads entering a job market where you need experience to get more experience. The truism of “It’s not what you know, it’s who you know” is incredibly true – connections can open doors that will otherwise stay closed. Networking events, social media networking, and volunteering all help put you in a place where getting to know the right people can help open doors. I sincerely hope your BF can find a job in his field!

With you and your sister lucky, do you think most people are not as lucky? Most people I know are like you guys with some scholarship help and jobs after college. Ever wonder why everybody here is commenting they are lucky, while others are not?

Isn’t your boyfriend lucky to have you to help pay for his debt if he gets in trouble? You wouldn’t abandon him right? Of course not! Therefore, he is lucky too.

He can’t get into $200,000 in debt without having the financial means or the basic understanding of what he’s doing. Look into his family’s wealth to find out more. Would you lend $200,000 to someone doesn’t have the financial means? No. And I don’t think you are saying your boyfriend is dumb either, otherwise, you wouldn’t go out with him.

There is more to your bf’s family’s financial background. Let us know once you do some deeper digging!

I *almost* completely agree with you on this. I can’t find the article, but the NYT ran an article that showed that even the whole $35k average is really misleading: 68% of students who attend college wind up with $10k in debt or less (partly because 43% wind up with no debt). https://www.nytimes.com/2015/06/12/upshot/student-loans-the-facts.html Moreover, it’s the people with the smallest amount in loans (1-5k or 5k-10k) that are most likely to default! Why? Because the people with small loans tend to be people who started college but did not finish. That’s the real crisis–not the fact that some people borrow or even that a small percentage are borrowing a big chunk but that lots of students aren’t graduating so they then have to try to pay back even small loans with nothing in the way of the increased earnings that a diploma allows.

Obviously I did find the one article. Here’s the other: https://www.nytimes.com/2015/09/01/upshot/why-students-with-smallest-debts-need-the-greatest-help.html?_r=0

Great call highlighting the debt people take on who don’t finish college and therefore don’t get that post college job bump.

That makes a ton of sense. Read a NYU student who left junior or senior year after 100k in debt bc she couldn’t afford it anymore. This is a tragedy!

My situation is a little different, though I would preface it that I am not struggling or denied anything necessary due to my student loans. This was not true for the first two years in practice where I had difficulty sleeping and was constantly stressed after the realization of the enormity of my debt burden. That led to a deep learning expedition in finance, which has been awesome, only wish I did it sooner.

I grew up very poor, put myself through college and med school. Unfortunately growing up poor (aka, welfare, food stamps, food banks and lots of boys and girls club time), doesnt make one the smartest financially, and my choice of careers didnt help either. “dont worry”, etc..etc…take out loans, was just pushed to no end, not to mention your residency programs encouraging home buying, another terrible idea.

I went to a private med school, and there was no gifting of tuition just because of my income level (if there was and I missed it, that would suck). I think my total debt was around 300k all told after graduation. However, due to limits on residency pay (started at 40, end at 52) and the time 6 years, 7 with fellowship, this sum was 496 at the end. Unfortunately, working 80-100 hours a week and the natural aversion of attention from such a scary large number meant I had a mess on my hands…hence the stress when starting out. My only real issue is that americans seem financially less savvy overall, and this is taken advantage of by the system. The other two big gripes for medical folks is the government enforced low level of pay where you cannot reasonably pay on your loans during training, yet they are allowed to compound during that time, seems overly onerous. It seems strange to limit the amount one can make and simultaneously compound interest when they cant pay due to the first issue. The last thing is they should be tax deductible so that people can pay them off without the penalty of a high effective rate (nice problem of course). They would be debt free and consuming faster, which in the end would work out for all involved since the point of student loans is an educated work force that makes more, pays more, and can consume more.

No, I am not suffering, but it is definitely scary to have a million dollar mansion loan payment every month at first, and you certainly must pay attention to finances, which is a good thing. I have refinanced half with SoFi and now Earnest to where I will get a lot paid off shortly now, which is awesome. I pay more than 10% of my gross income in student loans, but this is not forever, and Im still contributing to my retirement fully. Just takes planning and learning of what honestly should have been known decades beforehand.

I could pay much more than 10%/year btw. However, after running the calculations and thinking about it in a net worth, tax benefits, FV perspective I decided to just invest heavily instead. The net worth ends up the same at the same period of time I just end up keeping a lot more of the money.

My main concern was the way debt is structurally handled in the US. Theres no reason it couldnt be tax deductible 100%, this would encourage pay offs and decrease defaults and would not be permanent. The psychological boost would be huge but pale in comparison to economical effect of having confident well paid consumers forming households and supporting the economy.

We have to remember the point of student loans in this conversation and ask if the government is achieving their goals with the current regime. I am going to assume they did not want to create a generation of uber frugal, low consuming early retirees that abhor higher education. They should do everything in their power to get people out there working, paying taxes, and consuming. The overall macro benefit to the economy is huge compared to just thinking of dollars of debt to be repaid, thats missing the point.

I do think that colleges have reached a point where they need to be able to justify their costs and they cannot have so much inflation forever, and thats a good thing, the last thing we need in america is more anti education zeitgeist.

A million dollar mansion payment every month is like having a $1,000,000 student loan debt. That’s not happening. Even doctors who don’t pay/defer for years have at max $500,000 in student loan debt I’ve ever heard of. The median is much lower than that.

There’s doctors coming out of school with $250,000 in student loans at 6.8% ($17k/yr interest). Compare that to a $400,000 mortgage at 3.5% ($14k/yr interest). You’d be paying more in student loan interest than mortgage interest. And that’s not even taking into account the mortgage interest deduction.

pound#math

Good thing is that if you’re smart enough to be a doctor, you’re smart enough to realize that paying 6.8% in student interest is a ripoff and you would refinance that immediately to 4% or less.

My student loans are at 7.0% and refinancing is not an option.

I haven’t seen anyone discuss the real source of the problem. We make these student loans readily available to anyone which in itself isn’t a bad thing. However, this provides colleges with a worry free perpetual influx of money. This has led to systemic glut (e.g. sky high salaries for professors, tenure, students financing majors that are notoriously difficult to repay). Until we turn off the tap for theses colleges, they will have little to no incentive to dial down costs, and students are the ones who will be saddled with the bill.

The bigger issue is what else people are walking away with: minimal work ethic, an anti-intellectual disposition (ironic, eh), and a short-sighted understanding of how to apply their education to their life… or, in other words, a lack of creativity.

It’s sad, but you can often graduate with a very small amount of effort. A really interesting book on the subject: Academically Adrift.

From the description:

“… are undergraduates really learning anything once they get there?

For a large proportion of students, Richard Arum and Josipa Roksa’s answer to that question is a definitive no. Their extensive research draws on survey responses, transcript data, and, for the first time, the state-of-the-art Collegiate Learning Assessment, a standardized test administered to students in their first semester and then again at the end of their second year. According to their analysis of more than 2,300 undergraduates at 24 institutions, 45 percent of these students demonstrate no significant improvement in a range of skills—including critical thinking, complex reasoning, and writing—during their first two years of college. As troubling as their findings are, Arum and Roksa argue that for many faculty and administrators they will come as no surprise—instead, they are the expected result of a student body distracted by socializing or working and an institutional culture that puts undergraduate learning close to the bottom of the priority list.”

The “working” part of the last line makes it a bit more complicated, but I think the “socializing” is the major problem (I worked around 30 hours a week for my undergraduate years, in addition to school). If you are focused on partying every weekend instead of developing your intellect and your self, what the hell should any of us expect? The authors document, to the extent that they can, how this is different from decades past.

And this is far too often reflected in most media representations and popular figures of my Millennial peers.

There is a entitlement crisis, as you say. People can pay of the loans they knowing took out. They are just complaining why they should.

Stop whining everybody!

I normally agree with your articles Sam, but you’re way off the mark on this one. There’s been some great comments posted here, and I don’t have time to write a novel, but my basic point is this: your financial discipline, and particular situation, is *very* rare. You know that, right? So when you shrug your shoulders and say “Why can’t someone save 11.5% of every paycheque to pay off their debt? I saved 50% of mine, so what’s the big deal?”, it’s like a 7 foot tall basketball player asking why a five year old kid can’t dunk like he can. :-)

You’re not putting yourself in the shoes of an average college student: financially clueless because their parents didn’t teach them anything about money (and they didn’t make the choice to learn themselves) stumbling through college racking up debt and 4-5 years later (if they’re lucky) emerging out the other side and coming to the realization they may have ruined the next decade or two of their life with debt. Financial success is 80% behaviour and 20% numbers.

I’ve lost track of the number of people I work with and know – grown adults with kids and 10+ years our of college – that still have their student loans. COULD they have paid them off sooner? Yes, if they had the financial skills and mentality to make the necessary sacrifices. But they don’t. They’re not in the same place where you and others here are.

It’s like having an eight-pack set of abs and asking the rest of the country why they aren’t in similar shape: unless you “get it”, you don’t “get it”. Sure, we can all agree that everyone should eat right and get exercise, but does our agreement change that most of the country is slowly getting diabetes? Student loans are no different. It’s become hideously expensive to go to school; tuition is out of control. Sam, have you watched the documentary Ivory Tower? Please do – you’ll find it very interesting.

Many of the comments here are in the same vein – the people reading this blog have a financial mentality outside the norm. Looks at the stats: most people in the USA have very little saved for retirement, and many people live paycheque to paycheque. These are not financially healthy people who will quickly pay off $35K in debt. And let’s not forget odds are high they’ll have another $10-$20K in credit card debt, plus a car payment…

I personally never had any student debt because my parents had saved for my college education, and I also worked while going to school. But when I went to school it was vastly cheaper; today the rates for college can be so expensive there’s no way I’d be able to duplicate what I did back then (even adjusting for inflation).

I didn’t intend to write a novel, but looking at the poll, 70% of so of people are in agreement that there is a serious student debt problem.

I like your analogies, but I don’t think they are correct. For one thing, no matter how hard one tries they will never be able to grow taller once they stop growing. But for knowledge, or gaining knowledge, that quest is endless.

I have talked to thousands of private school graduates and parents over the years. I kid you not. And I just visited Princeton University for this post and talk to students and admissions counselors. The rack rate is only paid for those who can afford to pay. It does not get that much more complicated than that. If the person who can afford to pay messes up their life for whatever reason, they are OK because they can still afford to pay.

Of course there are exceptions where people are really unlucky, feel really entitled, or just had some type of accident. But math is not lie, nor do the thousands and thousands of people who are paying their debt as they should.

Isn’t it funny that everybody here who say is there is a student debt crisis have no problems paying their student debts them cells? Why do you think this is? Could it be that there really is no crisis?

Respectfully Sam, I think you’re missing the point a bit – regardless of “rack rate”, a few trends seem very clear regardless of any anecdotal stories you or I can tell:

1) Large student loans are crazy easy to get for many

2) Most students lack the financial understanding to grasp what they’re doing to their future selves by maxing out their student loans

3) Colleges know both points #1 and #2, and have both dramatically increased tuition and lavish school benefits (free laundry, free food, $100 million stadiums, etc.) to lure in these artificially flush students

4) Not all students graduating are able to start paying back their loans

As of July 2015, there’s been a 6% increase in delinquency on loan repayment, which is 400,000 more people not paying their loans compared to a year ago:

https://www.wsj.com/articles/about-7-million-americans-havent-paid-federal-student-loans-in-at-least-a-year-1440175645

That’s really not a good sign.

Please, please, please watch Ivory Tower and let’s talk about it in another blog post. :-)

Are you suffering from student loans? If so, in what way?

I’ll check out Ivory Tower! Maybe I can watch it in between rides when I’m hustling from 11pm – 1am every Saturday night. I’m sure everybody else with student loan debt is equally hustling extra hours a week or taking on second jobs to earn money since they are the ones who need it most!

No, I am not suffering from student loans. I went to school back when it was much less expensive, and my parents had education savings that helped me out – I had to pay very little out of pocket. My perspective comes from the many adults I know who still have student loans, and based on the many comments I’m reading here, the common sentiment of “Wow, I took out way too much in student loans!” seems pretty common.

I can’t tell if you’re being sarcastic about the side hustles…it would be interesting to know how many people with student loan debt are doing side hustles to pay it off faster. I’d guess it would be a single-digit number. It takes a very motivated, energetic person to do side hustles. I don’t know a single person in real life that has a side job! For the rest of us, our jobs/marriage/kids take up a lot of extra time and energy…

Not being sarcastic at all. Because I believe in the human spirit, I also believe that people with debt are doing everything possible to get out of debt e.g. driving for Uber, serving at a bar after hours, etc.

The reason why you don’t know a single person in real life with a side job is because you probably have well to do friends who don’t need the money and have very manageable debt.

Look at what people DO, not what people say.

There is NOBODY who is suffering financially who isn’t willing to work to reduce their suffering. That would be illogical.

I too believe in the power of the human spirit, and debt can be overcome if people truly want to do it, but saying “There is NOBODY who is suffering financially who isn’t willing to work to reduce their suffering. That would be illogical” is an naive statement. Since when are human beings all logical? That’s never been the default human condition.

Take any one of these:

…our health: the US is the #11th fattest country in the world and diabetes is a rising epidemic, but how healthy is the average person? I’m personally not very healthy. Logically I know I should eat better, work out, etc. but I don’t. Completely illogical, right?

…our environment: global warming is changing the planet for the worse, but the vast majority of us still consume resources the same way we did 10 years ago. I didn’t buy an electric car because they’re too expensive and there are a lack of attractive options. But if I truly was being logical, I’d buy an electric car regardless, or take the bus, bike, etc. But I don’t.

…our money: consumers are $11.85 trillion in debt (an increase of 1.7% from last year), $890.9 billion in credit card debt, $1.19 trillion in student loans (an increase of 7.1% from last year). The only way debt can be logical is if it leads to a repayment of that debt + more income. Someone buying a 70″ TV isn’t going to make money with it.

Sam, the majority of people wallow in their debt because they’re paralyzed psychologically by it. They’re overwhelmed by it, and most people don’t know where to start. Most people aren’t out hustling a second job (or if they are it’s because they can’t scrape by on the first job); they instead accept that debt is living paycheck to paycheck is “normal”. 26% of adults have ZERO savings set aside for emergencies, 36% have zero retirement savings, adults under 35 years old have a -2% savings rate (student loan debt plays a big part here). There’s NOTHING logical about those numbers.

I really admire what you’ve built here, and like I said I agree with most of what you write, but I’m really surprised that you have a perspective like this about the reality of human psychology and their finances. The rare breed of people who read your site, or, hell, even THINK about their finances on a regular basis in a proactive way, is vanishingly small…

I believe you could help even more people with this site if you understood most people are not like you. :-)

Jason,

I don’t think you are giving the American people, or ever day folks credit. Let’s just look at your one example:

“our health: the US is the #11th fattest country in the world and diabetes is a rising epidemic, but how healthy is the average person? I’m personally not very healthy. Logically I know I should eat better, work out, etc. but I don’t. Completely illogical, right?”

WRONG! Totally logical. It is much easier to not work out and to eat incredible yummy, but unhealthy food than to work out for an hour a day, run several miles a day, and just eat salads and other bland food.

Many people would much rather be out of shape and lead a more relaxing lifestyle, than be extremely fit, but really cut down on the joy of eating and doing sedentary things. And for those who would rather look amazing, they logically sacrifice the cheeseburgers and TV marathons to work out and eat right.

To your second point. You didn’t buy an EV b/c you really don’t care about global warming. If you knew your EV could actually make a difference, and not kill a relatively from radiation or poisoning, you would. But as of now, you don’t believe you can make a difference, so why bother. Totally logical.

Nobody purposefully pokes their eyes with needles unless they are a masochist. Believe in rationality. People might make mistakes with taking out too much debt, but they will do things to make their debt better.

Great post. It would be ideal if most college and grad students run a financial analysis before making a career choice but obvious it doesn’t happen.

Even in the healthcare profession or any high income profession people still run into the same problems, albeit with just bigger numbers. The range of income even within a given specialty can be huge–it really is up to where in the country you decide to work and how much you decide/are able to save. I know of procedural cardiologists in the Bay Area still making the low $200,000’s and eye doctors in the low-mid $100,000’s. Ouch indeed.

Here’s the thing though, even if you never crunched any numbers at all, based on the graduation rates, employment rates, and income levels, everybody will be fine. OK, not everybody but most people.

Of course there is a crisis. Its a system exploiting the financial illiteracy of kids by selling them on the necessity of a undergrad degree at all costs. I don’t recall at any time the school or FAFSA saying, you know, make sure you stay to degrees like Engineering/Acct/Finance and away from Drama/English/Art. Loads of students end up in debt with little to no job prospects that has any correlation to their studies.

The readers of this site are not the ones getting crushed- its the millions of other people out there with no financial IQ. Is it possible to get out from thousands of debt? Yes. But that doesn’t justify being in the position to begin with. I had no idea what I was doing through college coming from a lower, middle class family with no financial education. I will take responsibility for blindly maxing loans, however, it’s unfair to expect financially illiterate 17/18 year old kids to understand the financial impact of their decisions.

I don’t think you give the American people much credit if you are saying millions of people out there have no financial IQ. People are much smarter and much more rational than that. Furthermore, the unemployment rate for people with college degrees is at 2.5% with the latest reading. That is practically full employment.

Coming from a lower/middle class family w/ no financial education, I’d love to know how YOU are doing with your student loan situation. Thanks!

Saying no financial IQ may sound harsh, but I would argue that most people have no idea how to manage money. I had no idea until I met my now wife and she slapped me silly and talked some sense into me. Not a single person in my peer group, prior to meeting my wife, had a semblance of a financial education. So in a way, this is where I lay blame- college is just taking advantage of this situation.

As for me, graduated 12 years ago with $55k of debt and now down to $11k. I worked throughout undergrad to help pay, however, I know in hindsight I could have spent way less by trimming frivolous spending and/or going to a cheaper school. It sounds like a weak excuse, but I seriously had no idea what I was doing.

Here’s the thing. Even though you had no idea what you were doing, you are doing OK now right? The reason is that the math is in your favor. You had debt, but you got a job that more than covers your ability to pay off your debt.

The mass media has gone way to the extreme here.

I don’t recall the schools or FAFSA ever helping to guide students. I thought that was the high school counselor’s job, as well as the students parents? Plus, I think the “crisis” is being perpetuated by the media and not really a crisis. Students, just like the rest of the country, should try living within their means. Then there really wouldn’t be a “crisis”. IMO.

This whole things reminds me of the housing crisis- before I bought a house, I was in the mindset that people were idiotic for taking the loans they did. But after going through the process, you realize how easy it is for mortgage lenders / realtors / appraisers to get people into houses they shouldn’t be in. People got sold.

With student loans it’s the same: they now say just borrow and you’ll be ok! Per Sam above, median loan debt is totally doable with the median salary and you’ll get a job no problem! Well like the housing crisis, student loans are trending into scary waters.

I still think the housing crisis is the same as this….people don’t want to take responsibility for their loans. If you can’t afford it, don’t buy it. And I am sorry, but if you don’t know that you can’t afford a house, then you should not be buying one then either. This is the same thing. My parents, lower income, tried talking me into going to a school in the mid 1990’s that cost $25,000 a year. I knew that there was no way I wanted to come out of college with that much in loans. I am so happy I didn’t listen to my parents who never taught me anything about finances. I graduated from a state school with $16,000 in debt instead of $100,000. So much better off.

I thought the same as you- responsibility falls squarely in the buyer. After buying a house and working in Sales, I no longer hold this belief. Sure, there are/were some reckless borrowers. But there is/was definitely a high degree of predatory lending. Lenders will make the numbers look attractive- that’s their job! College is now following suit.

I’m an appraiser and while I agree that the lender’s job is to make the numbers look great, I think it is the responsibility of the borrower to ultimately make sure the numbers work for them. I have seen really terrible lenders, but I think those are few and far between.

I agree that the media is perpetuating this crisis. Yes, FASA doesn’t help enough middle class folks, but people are getting jobs that can more than afford to pay back their loans. It seems like there is a crisis of not WANTING to pay back loans.

I’m not sure why this is a problem. If you are stupid enough to pay absurd amounts of money for what is usually a trivial education and a piece of paper, then sleep in the bed you make.

Tuition will eventually have to reach a price where a lot more people stop attending. And then a degree will actually be worth something, again.

I mean, seriously, unless you’re a doctor or lawyer or a few other things, why the hell are you wasting a quarter of a million dollars and decades of debt on a college education? Plenty of us out here skipped the college degree and do very well for ourselves, because we cared about something and pursued it on our own (in many of our cases, college would have been a hurdle that only slowed us down).

Aside from a few special fields, college tuition is just a “lazy and unambitious tax”. A tax you have to pay if you don’t care about anything enough to have already pursued it before college time. A tax you have to pay if you can’t pursue knowledge and resources on your own. A tax to pay if you just point to a top ten list of most popular/well-paying careers, randomly pick one, and then sit in classes for four years letting someone else info-dump into your brain so you can go partake in a career you give no shits about for the rest of your life, because you heard it was a top career to have.

Interesting thoughts there. Kinda harsh, but probably some truths. How would you suggest people go about getting ahead then? Skipping college?

I would disagree with the sentiment that “Few people would not run a cost/benefit analysis of college or graduate school before spending years of their lives and tens of thousands of dollars.” All I can go by is my friends and acquaintances, but from my experience this thought process was unfortunately not routine in families that are firmly middle class (the group that sometimes is caught in the middle between massive family wealth and generous tuition assistance). Definitely not 10 years ago, maybe a bit 5 years ago, and probably starting to creep into people’s thought processes in the last few years.

I firmly believe, like most others here, that education is the key to opening new doors, and there should be systems in place to help the less fortunate with tuition assistance. But I am also adamant that the federal backing of student loans is compounding the problem. Unsecured debt to an 18 year old, no questions asked. Who thinks this is a good idea?

So, of course, what do the banks do? They want to join in on the fun and get a piece of that student loan action with their private loan sharking ways. And, of course, what do universities & colleges do? They raise the price at astronomical rates to increase revenues. The government is backing it – so why not???

Student loan debt is one of the biggest issues facing this country in the coming decades and I’m very interested to see how it will continue to affect demographic trends. We can already see the short-term impacts of so many millennials living at home, at least primarily due to student loans. But as one of my friends says, “people want nice things”. The idea of many people going into debt up to their eyeballs isn’t going to change in the consumer driven USA.

I have to say, usually I’m a glass half-full kind of guy…

But let me ask you, are you suffering from student debt? If so, in what way?

No, my wife and I are blessed that we have good paying jobs, both had minimal student debt and eliminated it as quickly as possible. It’s just frustrating to see friends and family affected and have stunted financial growth. But I get your point that it’s not necessarily solely due to the student loan payments. It’s more likely a string of repeated questionable financial decisions (one of which may have been taking on boat loads of debt and not considering their likely earnings potential). It amazes me to have friends that literally live paycheck-to-paycheck, despite their greater than average income…

I’m glad you guys are doing well in the student loan crisis! And with your help of spreading the word about fiscal responsibility and due diligence before spending so much time and money, less students will suffer.

just to give some perspective:

Prior to college I was a top HS student.. 4.0, captain of sports teams, etc. No one encouraged me to think about debt. Choosing a college was based on what school “felt right” and where you think you’d “fit in”. Choosing a major was about your “passion”. And you took out whatever loans were necessary. I didn’t have the life perspective to think about expected income vs debt load.

Solution? Require a finance class in hs.

Talk all you want about the info being available for free online, but like I said I was a “smart” kid and didn’t even think to look.

But are you suffering from your student debt now? And if so, in what ways? Thx

I’m doing quite fine, but my concern is for others.

The point I bring up is that the K-12 education system is failing its purpose of creating well-functioning members of society by not teaching basic personal finance. It is naive to think 17/18 year olds have the perspective to learn about finance on their own.

But that’s the point. WE ARE OTHERS. Everybody says they are fine, and that there’s this crisis out there. Yet, how can it be if we are all doing fine?

There’s no need to worry about others because people are rational, and lenders are rational if they want to stay in business.

The cost to attend college is directly proportional to a student’s ability to pay.

Anecdotal evidence from this site (and many of you relationships being that you’re well-off) doesn’t provide much… This site is going to attract higher income and money motivated individuals. This blog doesn’t cater to anyone that isn’t “above average” in regards to socioeconomics. You MUST realize this.

I do understand that a site about money attracts people interested in money.

I would say NOT to sell the American people short. We are much better off than the schafenfreude media and others make us out to be.

I agree with this. There is a huge selection bias with the group of commenters on any financial website like this. The readers are people who understand finances, and typically are rather well off. The media probably does exaggerate the severity of the student loan problem to an extent; however, I think the number of people struggling to manage their student loan debt is sizable.

While most people probably can find ways to handle it for now, I think it might pose greater challenges down the road when many people reach age 40 or 50 without a dollar in savings. Naturally this wouldn’t have been such an issue if the common man had any reasonable amount of financial literacy, but people don’t.

Given there are over 7 million people defaulting on their student loans:

https://www.wsj.com/articles/about-7-million-americans-havent-paid-federal-student-loans-in-at-least-a-year-1440175645

And that there’s over 1 trillion in student debt – up from around 400 billion in 2006 – so in less than a decade it’s increased almost 300%.

It sure seems to me there’s a big problem!

Two things: 1) FS noted that people might be confusing inflation with growing debt figures. The column chart by year shows nominal dollars, and the 2015 figure of $35,000 backs out inflation to $21,000 in 1993 dollars. 2) Taking on big debt and not getting it handled is a big character issue. Every statistic is made up of real people, with real stories. In my own experience, I’ve seen people under age 30 go on about their lives, get a job, get into a serious relationship, and when the subject of marriage comes up, WOW! The person with the debt (in one case, over $100,000 for a professional degree and license) expected the marriage partner to embrace it as a part of the “total package” and was surprised it wasn’t embraced like a longtime pet. It can be a deal-killer, and rightly so. In another case, a pal of mine married a recent graduate of dental school, paid off her $80,000 debt, and she divorced him two years later to go on with her debt-free and high-paying career.

Smart dentist woman!

She is Asian, so that goes without saying. Slim tiny fingers makes her good at her job, too.

Is that why there are so many Asian female dentists?

Yes. It is a genetic advantage in the dental profession. Same concept as Mohawk high-steel workers, because for them every day is a good day to die. Russians make the best hit men because they are born without souls or the capacity for empathy. Etc.

Oh man, as someone currently paying off $13,000 of student loans in 11 months, I have so many student loan thoughts! So firstly, I don’t think student loans are “bad” or “good.” I do think that there isn’t enough education about them and that’s the biggest problem. Way bigger than the actual math or income or interest rate. People do not know what they are getting themselves into. And for some people, that’s entirely their fault. HOWEVER, at 17 or 18, you’re not necessarily ready or equipped to make decisions that cost $10,000’s (and years of your life).

My loan situation was unique because the loan system that you talked about, totally failed me. My biological father earns a six-figure salary and filled out my FAFSA (and claimed me as a dependent) but in reality, he didn’t give me a single penny. I was completely on my own financially, and despite working three part-time jobs and living on less than $14,000/year in West Los Angeles, I still had to take loans and didn’t receive a financial aid package that reflected my situation because of my father’s high income that had been reported. There was nothing I could do about it for the first year he did this. The system is not equipped to handle parents who choose not to support their children or parents who suck and are selfish. There are so many other factors that come into play besides simply the math or mentality.

I love your alma mater, UCLA! Favorite campus and lifestyle in the states.

Here’s the thing, you are paying it off in 11 months! And you write you are saving half your paycheck. Therefore, you’re doing just fine. What’s the problem? You got a great education in return.

Yeah, UCLA is the best of the best :)

It’s true, life is pretty good now. But the journey of getting to this point was BRUTAL And I honestly wouldn’t wish it upon anyone else. Looking at just the end result is only part of the equation. Love your approach and your advice for student debt sufferers though. (and your Bruin love ;) )

So I had no help from my parents due to a similar situation but how can you call your parents selfish and say they suck for not helping?

Mine gave me nothing and make 6 figures which screwed me over on FAFSA but here’s the deal… it’s THEIR money not MINE. It never was mine and it’s up to them if it ever will be mine. By them choosing how they want to spend it isn’t necessarily a bad thing… you learned financial responsibility from it.

Sure, I wish my parents helped me out and gave me some money but at the end of the day I got it worked out and am doing just fine as it appears you are too. So your parents to choose how they want to spend their money should be no concern of yours… just be grateful if they did help. Sure FAFSA calculators sucks and have expected contributions from the parentals (I lost 20k+ in scholarships from them making too much after I had received the funds – very upsetting) but I will never be bitter for them keeping what they make and using it on themselves. That’s just my 2 cents though.

Hi Jon,

I’m sorry to hear about the 20k. That’s a lot of money. The situation with my biological father is more complex than I could explain in a blog post. I don’t think parents owe it to their kids to fork over $10,000’s. But I do believe that parents owe it to their kids to communicate and not change course midstream with no explanation. I’m glad that you’re happy with your financial situation and the journey you had through college though :)

I have a feeling there’s more to your relationship with your bio father than the issue with paying back student debt. Maybe not!

Haha, good detective skills Financial Samurai ;) definitely more to the story than merely finances. But the point I was trying to make is that the system is not perfect (as shown through my situation) and extensive loans can be a rough/stressful way to start your working life.

But like I said, love the sentiment of the article and I definitely think that for the most part, people can bust through loans in no time if they set their mind to and make the necessary lifestyle “sacrifices” for a short period of time.

If universities offer rebates to low-income families, that’s good news but it’s the job situation that makes student debt difficult to pay off. You showed us the math and it all looks good on paper, yet I wonder if $2,800 is enough for each month, considering that many of these debtors will carry the debt after they get married and start families – if they choose to delay these life choices, then they are missing out on life.

But maybe that all is manageable, as you said. Let’s not forget that many of these citizens carry consumer debt at the same time too, so all of a sudden your salary (even if it is around $50,000 per annum) is insufficient to pay back the monthly installments of debt and once it starts accumulating thanks to the magic of compound interest rates, you’re in for a ride!

I have a friend that took out loans for undergrad (psychology), grad (international business), and then law school. After a couple/few years of law school never finished. Finances wrecked.

Good thing he has you as a friend to help him out!

Are his finances really wrecked though? Does he not have a job and family money?

That’s the bad part. I’ve loaned him a lot of money over the years that I don’t ever expect to see back.

Yes, they are wrecked. Though he is employed now. He spent a lot of years unemployed. We went to undergrad together and by my calculations at least 50 percent of the time he’s been unemployed.

I am so happy to read this post. I went to a private college and got a BS and MS in engineering that left me in $88K of student loan debt upon graduating. This would have been more, but I was working multiple jobs throughout college to afford the $40K/yr price tag. Like some others have said, the FASFA really screwed over my family because it valued their house at an insane amount even though they had a substantial mortgage. I’m pretty sure it also looked at my parent’s retirement accounts as assets that could be liquidated, but that was not an option.

Anyway, after graduating with $88K in debt, I continued to work 2, 3, 4, and even 5 jobs at a time to make as much money as possible. My first real job started at 50K but has risen to just over 100K in 6 years. Even though I am making this money now, I am still working side hustles to make extra money, and can easily make an extra $2-300 a week with minimal work from home, mostly through websites like fiverr, crowdsource, and other freelancing platforms. Sometimes I still help out at a friend’s restaurant waiting tables and can make $2-300 in a night!

On top of this, I also went back to school while doing all this work and got a professional degree in an unrelated field that is going to allow me to open up my own business on the side. I’m hoping that this will net me around $10,000 extra each year.

The thing that really resonates with me, though, is how few people are willing to put in the time, and to make smart life choices so that they can reach financial independence. With all this work, I was able to pay off my $88k in loans and finance a professional degree without taking out any new ones. I also bought a house and have a very reasonable / manageable mortgage payment. I save roughly 20% of my income for retirement when you count the employer match. AND, I still can go out for nice dinners, go to sporting events, go on a week or two of vacation each year, go to shows, have nice clothes for work and casual events, drive a decent car, and afford home improvement projects on my house.

Every time I hear some sob story about people who are stuck in debt from student loans, I also hear stories about how they waste money on useless wants, go on extravagant vacations they cannot afford, eat out at fancy restaurants for every meal, and sleep-in every chance they get. They never tell as part of their story how they are working a second job, or how they are trying to save up for something. Instead, they are racking up credit card debt on top of student loan debt, complaining about it, and not thinking about the future at all.

We really need people in college and recent graduates to be more responsible for their own decisions. I think that is where the solution begins.

Love the hustle! But what if a student with debt just needs a fancy new car or their 6th pair of designer jeans? Shouldn’t they get some debt forgiveness from the government or their parents?

a cardiologist has 6 years of residency making 50k a year working 80 hours a week before they see 250k+. how much can they pay off in those 6 years?

$10k a year?

And during those years of residency the loans are negatively amortized. Over a 3 year residency my husbands student loans went from 240k (20k undergrad + 200k med school + accrued interest) to 310k.

FYI for anyone interested DRB will allow residents to refinance to a lower interest rate. Wish that was available 4 years ago! (And First Republic Bank has refinancing available as low as 1.9% for five year fixed once you graduate – we have that now for the 175k balance of the loan).

Sorry if I sound like an ad for refinancing, but it’s saving us thousands!

And how much is your husband and you making now? That is a lot of student loans, but sounds like you can afford it!