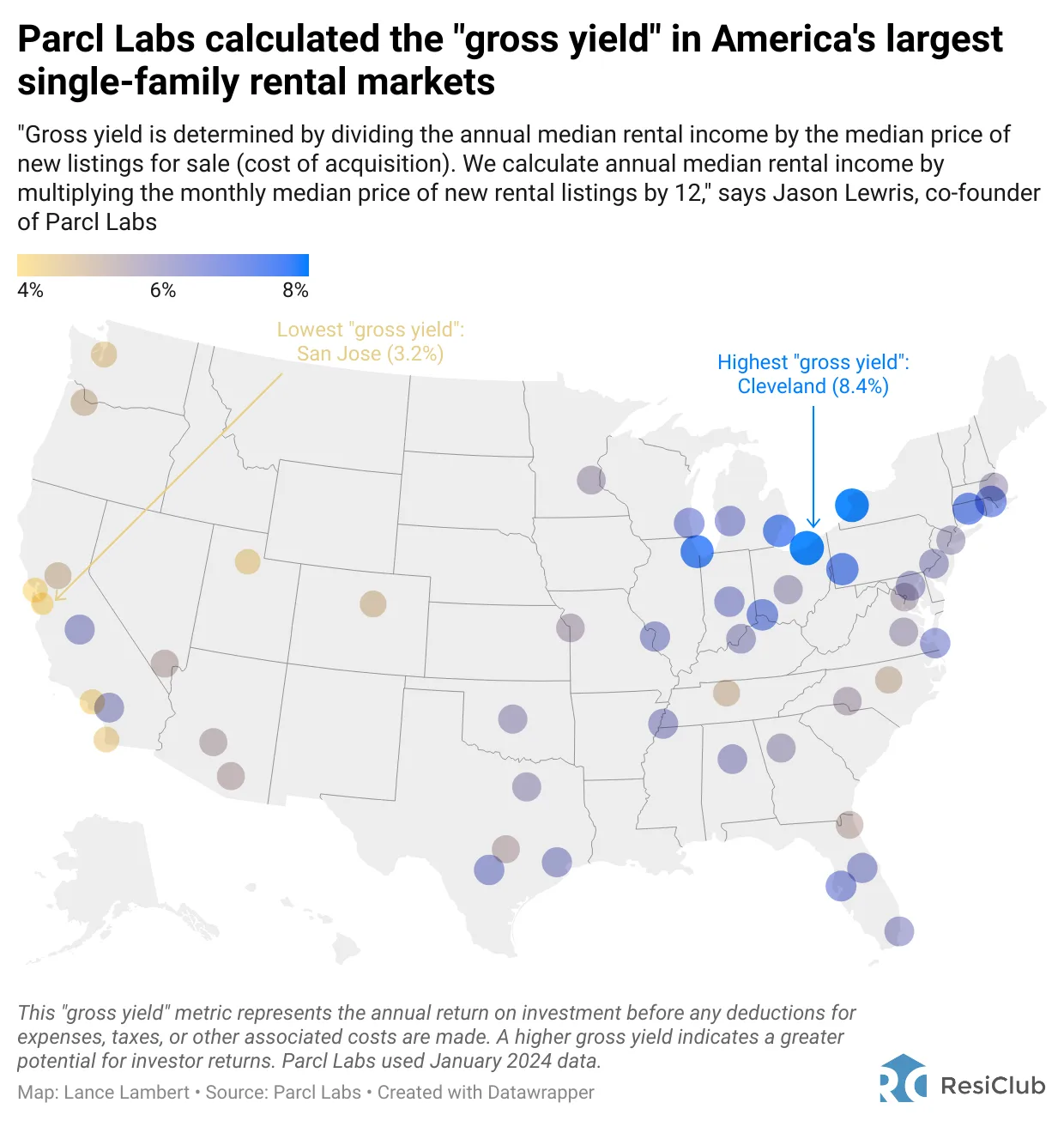

Here's a look at the single-family rental markets with the highest and lowest rental yields. The data is according to Parcl Labs, a real estate analytics firm and Lance Lambert.

According to Jason Lewis, the co-founder of Parc Labs, “Gross yield is determined by dividing the annual median rental income by the median price of new listings for sale (cost of acquisition). We calculate annual median rental income by multiplying the monthly median price of new rental listings by 12. This metric represents the annual return on investment before any deductions for expenses, taxes, or other associated costs are made. A higher gross yield indicates a greater potential for investor returns.'

In other words, gross yield does not equal the cap rate. The cap rate is after all expenses, taxes, and other associated costs.

Top 5 City Metros With The Highest Gross Rental Yields

1) Cleveland: 8.4%

2) Buffalo-Cheektowaga: 8.1%

3) Chicago-Naperville-Elgin: 7.8%

4) Detroit-Warren-Dearborn: 7.5%

5) Pittsburgh: 7.4%

The common factors among all these cities are cold weather and lower median household incomes needed to afford the typical median home in each locality.

Chicago, despite being a large city with abundant job opportunities, faces challenges due to its frigid weather for approximately four months of the year. Consequently, individuals are less inclined to invest significantly in real estate in the Chicago-Naperville-Elgin area.

Bottom 5 City Metros With The Lowest Gross Rental Yields

1) San Jose-Sunnyvale-Santa Clara: 3.2%

2) San Francisco-Oakland-Fremont: 4.1%

3) Los Angeles-Long Beach-Anaheim: 4.2%

4) Salt Lake City-Murray: 4.3%

5) San Diego-Chula Vista-Carlsbad: 4.4%

Apart from Salt Lake City-Murray, the prevailing pattern among metro areas with the lowest gross yields is their association with California, favorable weather, and strong job markets offering high wages.

If you aspire to reside in a city boasting pleasant weather and lucrative employment opportunities, expect to incur higher costs for both renting and purchasing property. This correlation is intuitive; elevated home prices stem from the abundance of well-paying jobs and appealing climate and lifestyle. Conversely, cities like Fargo, North Dakota, and Pittsburgh, Pennsylvania, offer more affordable housing due to classic principles of supply and demand.

However, it's worth noting that the demand for living in various cities can fluctuate over time.

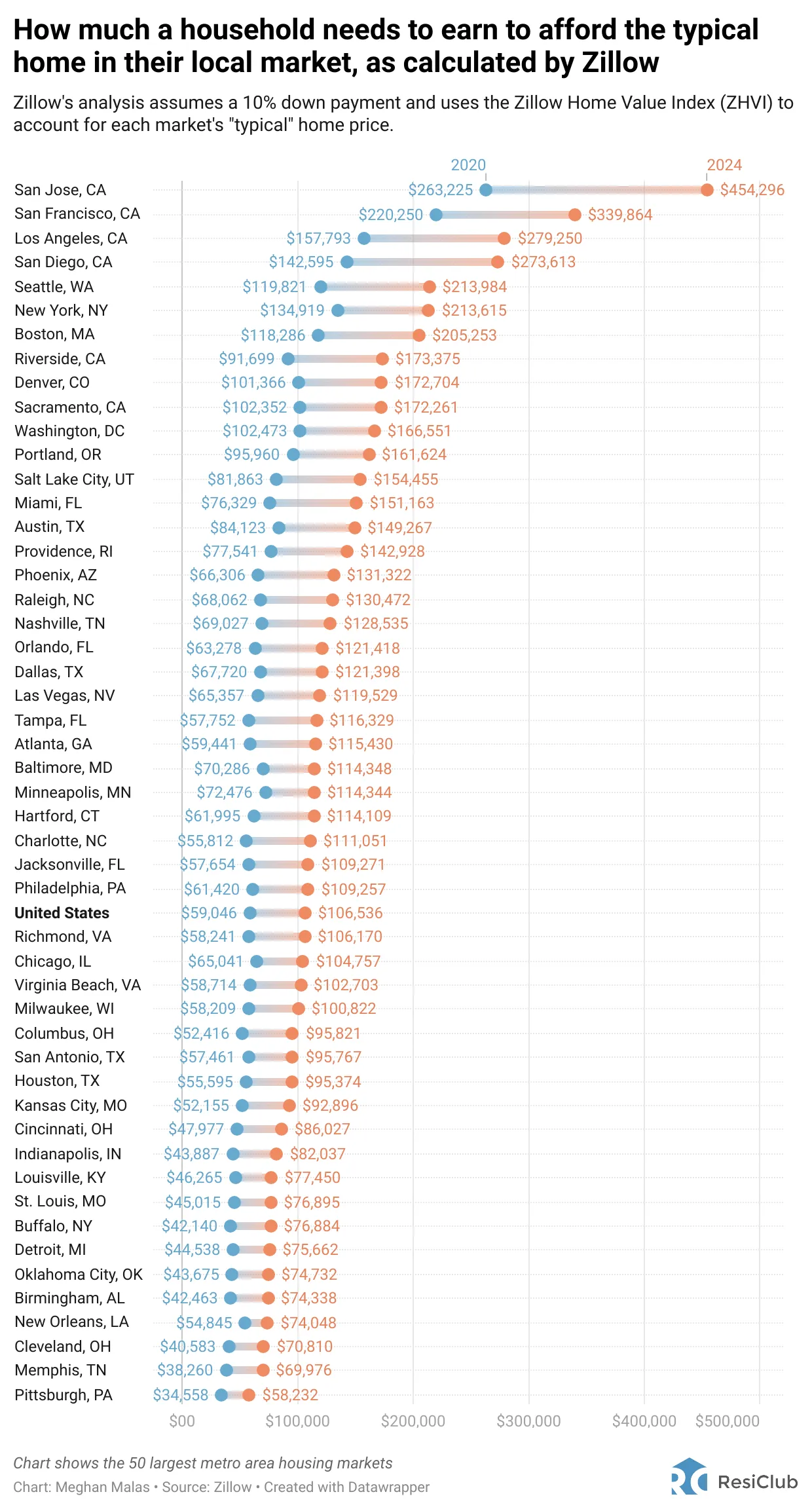

Compare Gross Rental Yields With Median Income Required To Afford A Typical Home

If you want to be a landlord or live in one of these top or bottom metros with the highest gross rental yields, below is a great chart that shows how much household income is required to buy a median-priced home in each city.

Real Estate Investors Follow My BURL Investing Guide

If you want to be a successful real estate investor, you should focus on buying real estate at a low price with a high gross rental yield that also has price upside.

Follow my BURL real estate investing rule, which stands for Buy Utility, Rent Luxury. In other words, buy single-family and multi-family homes in low-price cities with high gross rental yields. Then rent in cities with high home prices and low gross rental yields because it's much cheaper to rent.

You can easily do this if you live in an expensive city by renting, then buying real estate in low-cost cities through platforms like Fundrise and CrowdStreet.

Fundrise manages over $3.3 billion and primarily invests in residential and industrial real estate in the heartland. Its investment minimum is only $10 and is the pioneer in offering private real estate funds for retail investors.

CrowdStreet is similar and focuses on what they call 18-hour cities where valuations are lower, but upside could be greater due to strong demographic trends and job growth. You need to be an accredited investor with CrowdStreet and have the time and interest to analyze deals and build your own real estate portfolio.

Since 2016, I've personally invested $954,000 in various private real estate funds and individual deals to diversify my expensive San Francisco physical real estate holdings. Demographic shifts towards lower-costs areas is a multi-decade trend I want to take advantage of.