Zillow recently released an intriguing study that outlines the income needed to afford a “typical home” in different cities. The study considers a 10% down payment and utilizes the Zillow Home Value Index to determine the median home price in each city.

A 10% down payment is lower than my recommended 20% down payment based on my 30/30/3 home-buying rule, but it's Zillow’s exercise. Let's compare the income required to purchase the median home in each city between 2020 and 2024. These are the top 50 city metros in America.

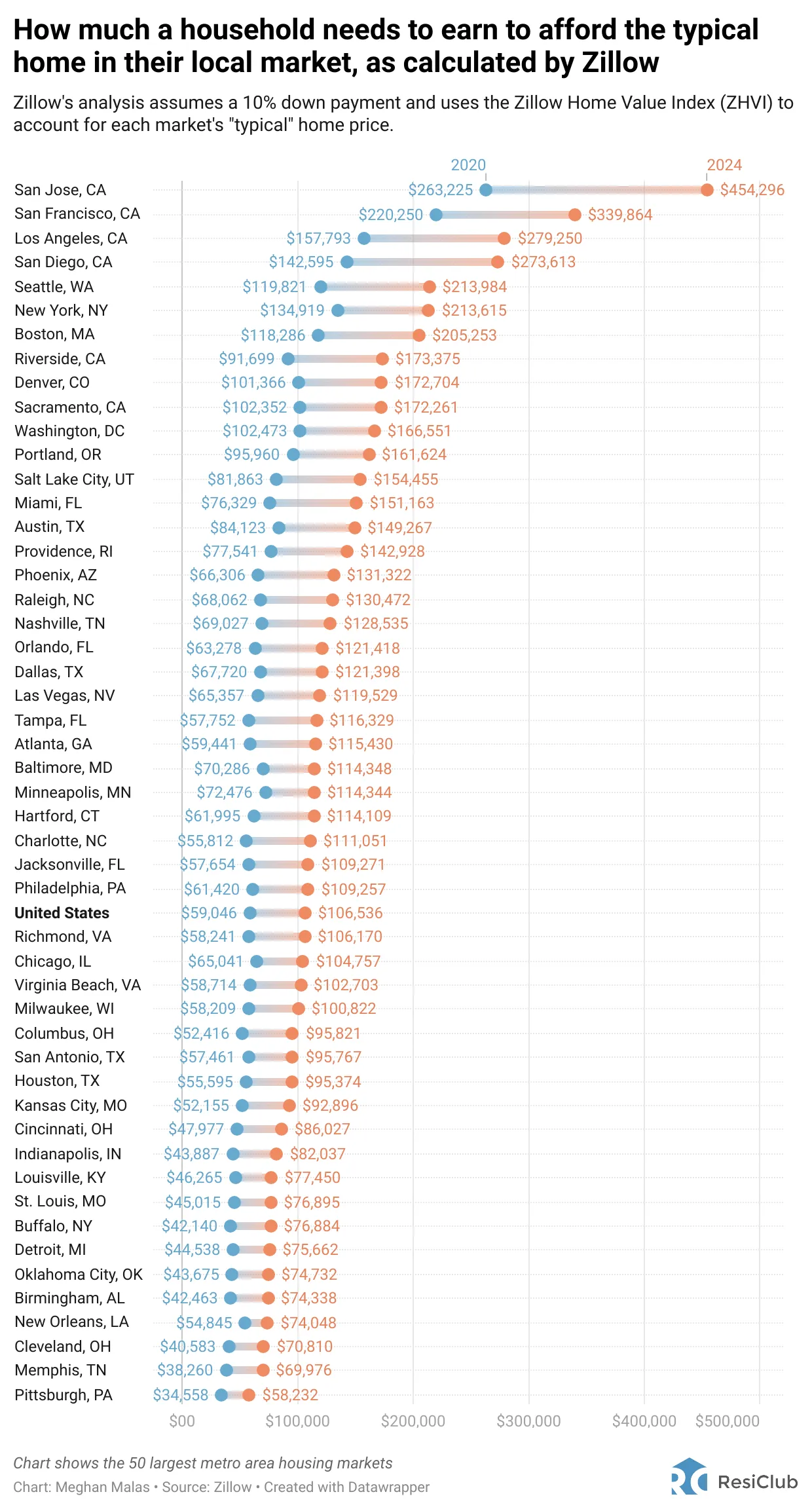

Income Required To Purchase A Median Home

San Jose commands the highest income requirement to afford a median home at $454,296, while Pittsburg boasts the lowest income needed at just $58,232. If homeownership is a priority and budget constraints are a concern, perhaps a move to Pittsburgh, Pennsylvania, is worth considering!

As a San Francisco resident, I find it reassuring that the cost of living here is only $339,864. This represents a substantial $114,432 reduction in the required annual income, or 25%, compared to the income needed for homeownership in San Jose.

Furthermore, when it comes to lifestyle considerations, San Francisco offers a more picturesque, lively, and enjoyable environment compared to San Jose. It's not San Jose that draws world travelers to the U.S., but rather the allure of San Francisco!

Boost your wealth through real estate: Invest in real estate without the burden of a mortgage or maintenance with Fundrise. With over $3.2 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $150,000 with Fundrise to generate more passive income. The investment minimum is only $10.

Expensive Cities Might Actually Be The Cheapest Cities To Live In

You've read my post titled “Why Households Need To Earn $300,000 A Year To Live A Middle-Class Lifestyle Today.” While you might have strongly disagreed with my analysis concerning families residing in expensive coastal cities, it's reassuring to find external validation from Zillow supporting it.

The United States is vast, with varying cost-of-living levels across the country. Fortunately, we all possess the freedom to choose where we want to live.

If the cost of living becomes too burdensome for our income, we have the option to relocate, trim expenses, or seek additional work, as we are all rational decision-makers.

Despite cities such as Boston, New York, Seattle, San Diego, Los Angeles, San Francisco, and San Jose necessitating over $200,000 in household income to afford a typical home, I argue that these cities are more affordable than commonly perceived.

Here are two reasons why.

1) Expensive cities are cheaper to have fun and live healthier

As I wrote in my post about private sports clubs, I pay $180 a month to be a part of a network of clubs in the Bay Area. I think $180 a month is great value, which is why I'm unwilling to cut the expense despite no longer being financially independent.

Then Nate, a reader from Pittsburgh, PA chimed in and wrote,

“Very weird a private sports club with indoor pickleball and tennis would only cost $180/m. Obviously you wouldn’t cancel this. There is no such thing as private indoor sports club for $180/month in Pittsburgh. Only country clubs with outdoor tennis or pickleball and golf for $1,500/m and up. Other option is public park for tennis or pickleball which involves waiting/no reservations/no availability.”

Holy moly! $1,500 a month and up to be able to play tennis and pickleball indoors? No thank you! Who can afford that?

$18,000 a year for sports club membership dues while it only takes $58,232 in income to afford a typical house is an absurd ratio.

Nicer Weather Matters For Quality Of Life

Here in San Francisco, the weather remains moderate throughout the year, providing ample free public courts for tennis and pickleball. In this example, private sports club memberships are at least 88% more affordable.

For those seeking cost-effective outdoor enjoyment almost year-round, cities like San Jose, San Francisco, Los Angeles, and San Diego offer favorable conditions. However, in areas where the required income is less than the overall U.S. income of $106,536 to afford a home, maintaining a year-round outdoor lifestyle is more challenging.

Improved weather stands out as one of the crucial reasons why living on the West Coast surpasses living on the East Coast. Having experienced both coasts for over a decade each, I can attest to the significantly higher quality of life.

Life is already brief, and enduring three to four months of extreme winter conditions annually is suboptimal for many Americans. Consequently, a substantial number of Americans opt to relocate out west or south to Florida.

For those prioritizing favorable weather and homeownership, cities like New York City ($213,615) and Boston ($205,253) might not be the best choices.

Given their high-income requirements for housing and challenging weather conditions, a strategic move could involve geoarbitrage to more affordable and warmer cities on the east coast like Miami ($151,163), Raleigh ($130,472), Baltimore ($114,348), or even Pittsburgh, PA ($58,232).

2) Expensive cities are easier to make more money and thereby increase affordability

I've been contemplating a move to Honolulu, Hawaii since 2014.

After retiring in 2012, I thought, “Why not relocate to my favorite state in America?” The wonderful weather, delicious food, and laid-back vibe all seemed like factors that could contribute to a longer and more fulfilling life.

With enough passive income to sustain a simple lifestyle and the opportunity to generate supplemental retirement income through writing on Financial Samurai, the idea seemed appealing.

Back then, with no kids, retiring to Hawaii appeared to be a straightforward decision. However, my passion for real estate made me feel that if I were to move, I needed to own a home in Honolulu.

Just as shorting the S&P 500 long-term is considered a suboptimal decision, I believed that renting long-term and not owning real estate in Honolulu might also be less than ideal.

For three years, I diligently attended open houses in Honolulu during every visit to see my parents. Despite leaving each time excited about the potential of relocating, I couldn't shake the fear that I might not comfortably afford to live in Honolulu.

Honolulu Housing Is ~30% Cheaper Than San Francisco Housing

It might seem strange to express concern about retiring in Honolulu, where comparable housing is about 30% cheaper than in San Francisco. Or is it?

My worry stemmed from the fear that if I purchased a home in Honolulu and encountered unexpected financial difficulties, I would find myself in a tight spot. In 2014, my passive income was around $110,000, which was already insufficient to qualify for a conventional mortgage for a median-priced home in SF or Honolulu.

Given my lack of W2 income, I would need to come up with a down payment of 50% or more to buy a home priced between $700,000 and $1 million. For context, the median home price in Honolulu is approximately $780,000, according to Zillow, but $1,075,000 according to Locations Hawaii, which seems more accurate.

And just like all median home price estimates, they seem way lower than the cost of the home you want to buy!

Pay Is Much Less In Honolulu Too

Upon exploring the job market in Honolulu, I discovered that the pay was 40% – 60% less than what I could earn in San Francisco. Moreover, I wasn't aware of any attractive part-time consulting jobs in Honolulu.

In contrast, San Francisco boasted a plethora of consulting and full-time jobs paying $100,000 or more. Today, even 23-year-old college graduates working in tech, consulting, or finance can start earning $150,000 or more annually. It is only logical the highest-paying cities also have the highest cost of living.

According to Numbeo, you would need around $7,701 in Honolulu, HI to maintain the same standard of life that you can have with $8,900 in San Francisco, CA (assuming you rent in both cities). This calculation uses their Cost of Living Plus Rent Index to compare the cost of living and assume after income tax.

Buying Real Estate In San Francisco Felt Safer Due To Higher Income

Although San Francisco home prices are approximately 42% higher than Honolulu home prices, I felt more at ease purchasing a fixer-upper in San Francisco for $1,230,000 than buying a house in Honolulu for $700,000 – $1.1 million. I managed to buy the fixer in 2014 because a couple of large CDs matured, and my wife was in her final year of work.

I was confident that if I faced financial difficulties after buying the fixer in San Francisco, I could always secure a six-figure job as a consultant or full-time employee. San Francisco boasts a massive tech ecosystem, along with biotech, medical, aerospace, and tourism industries.

In contrast, Honolulu heavily relies on tourism as its main source of income. Therefore, economic challenges in Japan and China could adversely affect Honolulu. Making money in Hawaii is simply harder than making money in San Francisco.

Buying a home in San Francisco felt more secure due to the diversity of industries and the availability of higher-paying jobs. The ongoing artificial intelligence boom may also enhance the returns of my venture capital funds.

Additionally, if I didn't live in San Francisco, I probably wouldn't have had access to a couple of these private funds. All the top tier venture capital funds are invite only for retail investors because there is so much demand from institutional investors. Retail investors can only gain access to the “friends and family” round of employees.

Easier To Invest In Private Growth Companies Today

Thankfully, today, everybody who has $10 to invest can invest in Fundrise Venture. It invests in private growth companies in the AI space and more. I'm bullish on AI and I don't want my kids asking me 20 years from now why I didn’t invest in the AI revolution near the beginning.

Here's a conversation I had with Ben Miller, CEO of Fundrise about investing in private growth companies, which were once only accessible to ultra-high net worth individuals and institutions, until now.

More Examples Of How Costs Are Higher In Cheaper Cities

Cost of Cars: The price of a Honda Accord remains consistent regardless of location. For instance, purchasing a $34,000 Honda Accord Sport would account for 58% of an $58,000 salary but only 23% of a job-equivalent salary of $150,000.

Cost of Materials for Home Remodel: Lumber, sheetrock, wiring, and fixtures generally cost the same across the country. Whether you're remodeling a $500,000 house or a $1,200,000 house, the costs might differ (10% versus 5.8% of the home value, respectively). However, the higher-priced home yields a greater return on the remodel, considering the 120% higher price per square foot.

Cost of College: College tuition prices are consistent nationwide. However, the affordability of college has become challenging for middle-class families, particularly in cheaper cities, where only the rich or the poor can comfortably afford higher education.

Consider any product that maintains a consistent price regardless of your location, and you'll understand why living in a more affordable city with a lower income can be more costly.

Living In An Expensive City Is Like Playing Offense To Build Wealth

On your journey to financial independence, you have the option to play offense, striving to maximize your income, or play defense, aiming to save as much money as possible. Most individuals pursuing FIRE (Financial Independence, Retire Early), the movement I helped pioneer in 2009, adopt a combination of both strategies.

Personally, I favor playing offense in wealth-building, driven by the unlimited potential for income and investment returns. Since 2009, I have chosen to reside in New York City and San Francisco, recognizing the abundant opportunities for higher earnings. This approach is akin to investing in growth stocks in the first half of your life.

Not only was I able to make more money living in NYC and SF, I was also able to build connections that granted me private investment opportunities, some of which have turned out well. Private company investments in names such as Figma and Ripple have blown past any stock index return over the past 10-20 years.

While the cost of living in these cities is undoubtedly high, it's a reflection of the opportunities they offer. Owning real estate in such high-opportunity cities, once achieved, makes building more wealth much easier.

Relocate Once You've Made Your Fortune

After accumulating sufficient wealth, one can contemplate relocating to a more budget-friendly city that aligns better with lifestyle goals and income levels. It's easier to move from New York City to New Orleans versus the other way around.

The income potential in an expensive city can be so substantial that the perceived drawbacks, primarily the high cost of living, become less significant.

If you live in an affordable city, all the more reason to capitalize on online income and work from home opportunities. Fortunately, an increasing number of jobs now offer comparable wages regardless of your location. Therefore, you might as well take advantage!

Reader Questions And Suggestions

Is living in an expensive city truly more cost-effective? Are people overlooking the fact that these cities are expensive because of the income opportunities they offer? Which cities do you think strike the best balance between affordability and income potential?

I plan to continue investing in the heartland of America, where the cost of living is lower and rental yields are higher. Technological advancements will drive more Americans to relocate to more affordable cities over the next several decades.

If you share this long-term demographic change perspective, take a look at Fundrise. Managing over $3.2 billion in assets, Fundrise primarily invests in residential and industrial properties in the Sunbelt region. If you choose to remain in an expensive city, all the more reason to diversify across less expensive parts of the country.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise funds. Since 2016, I've invested $954,000 in a variety of private real estate funds and individual deals to diversify away from my expensive San Francisco holdings and earn more passive income.

About Financial Samurai

Financial Samurai is one of the largest and most trusted independently-owned personal finance sites with roughly 1 million organic visitors a month. The site was started in 2009 with everything written based off firsthand experience.

Sam worked in finance for 13 years, got his MBA from Berkeley, and has written over5 personal finance articles. He is the WSJ bestselling author of Buy This Not That and one of the pioneers of the modern-day FIRE movement. Join his free weekly newsletter if you want to accelerate your path to financial freedom.

Four years ago I bought my first home in Sacramento, California instead of a new car. No regrets as I would not be able to afford the same home today.

Sam,

I live in Boston and have a summer home in Provincetown, MA on Cape Cod which is great in the summer – great shopping tons of great restaurants, the beach, boating, etc. I also have been spending a lot of time in the winter in Palm Beach, Florida and Miami. Just over the bridge from Palm Beach is West Palm Beach which is absolutely exploding in recent years – amazing restaurant scene in both PB and WPB, great job market and the ocean is that crystal clear warm Caribbean water and fantastic weather all winter long. A friend recently showed me all around nearby Delray Beach, FL – there are high end condo buildings being built everywhere there, new high end restaurants, great hotels with rooftop pools and lounges. South Florida in certain areas/cities in winter is a GREAT high end lifestyle in the winter. Also 70 miles North, Brickel, which is a neighborhood in the city of Miami blew me away. So much development and expansion there since the pandemic it is absolutely popping there – very high end and futuristic. It reminds me of Dubai. I 100% agreee that sunny weather and being near the ocean makes a HUGE difference in mental and overall physical health. I notice a drastic difference in people’s general demeanor in Boston vs Florida. People in Florida, even the people serving in restaurants, are SO much happier. They smile often, engage, etc.

Good opportunity to buy San Francisco real estate today. San Francisco is such a more beautiful, fun and vibrant city. I would be by in San Francisco all day long.

San Francisco real estate should surpass San Jose real estate, especially with the tech and artificial intelligence boom, along with a Change in new leadership.

People from all over the world, someday San Francisco to visit for a reason and not San Jose.

I agree, but I’m biased :)

Requiring $110,000 less a year in income to afford a home in San Francisco versus San Jose is incredible! What a fantastic arbitrage opportunity for a better lifestyle and higher real estate returns.

I’m 26 years old and have a $175,000 base salary with about $60,000 in RSUs working at Apple for the last three years.

I pay $2,300 a month for rent with three other roommates in a magnificent house in Golden Gate Heights with panoramic ocean views. It’s been a great time and I’ve been able to build a much higher net worth than my peers who work in lower cost cities.

San Francisco is one of the most picturesque and beautiful cities in the world. I love how the climate is temperate, and we can be outdoors all year.

I expect to make at least $400,000 by the time I’m 32 years old. Making more money is a much better path to wealth creation than saving.

Take risks and study hard people!

SF isn’t a great place to live anymore post pandemic.

Look at the housing trends,

SF has lower than prices in 2019. Places like San Diego, places in orange County, Irvine, and SD suburbs like Carlsbad, Encinitas, have doubled. Prices in all of these places exceed the mean in SF and San Jose.

I believe Irvine prices are now higher than Mountain View (home of google)

I’m not sure where you are looking, but the bidding wars for median homes are on fire in San Francisco. You can click the link to see a number of recent sales.

It’s nuts due to the performance of big tech companies and all the artificial intelligence growth and funding. JustThe ability to make a lot of money in San Francisco is ridiculous right now.

I totally understand if SF is no longer desirable for you due to the cost. A lot of people have moved out to try to save. Totally rational. But to deny that the Formans tech companies and artificial intelligence and the beauty of the city is denial.

Where did you move to? And what do you do for a living?

Sam,

I love you man, but you have got to put the San Francisco/California cool-aid down and take two steps back. Your constant justifications of the ridiculous CA costs of living are really just too much at this point. CA is officially making Manhattan, Paris, London, Tokyo, and Singapore all ridiculously affordable, and everywhere else a huge bargain, that is a clue my friend! This is an intervention, you have a problem, we are all your friends here, and we want you to get some help today.

The only thing this Zillow Analysis does (in addition to validating your long standing $300k Family Budget, which I have never had any problems with) is that it proves that CA as a state is totally warped and totally out of touch with the ENTIRE rest of the world. The top 4 US cities all being in CA is only a hint of the actual problem, but the proof is that Sacramento is in the top 10. Sacramento, as the state capitol of all things, is simply a terrible place to be, and the idea that anyone would ever spend ~60%+ more money to live there vs the US National average is unfathomable, and proof of the false CA economies. I have lived full time in CA (Los Angeles (& Windsor briefly)), PA, FL, & TX in my 50yrs on Earth. I have traveled the world more than most. I am financially wealthy by any measure. I am telling you, with certainty, that the only redeeming thing about living in CA is the weather, period. In fact, I think you would find nice weather is all over the place, especially based on seasonality, which also offers an even better quality of life. With a summer home in one city and a winter home in another, available in literally dozens of various non-CA worldwide city pairs, and for less money than simply living in CA. I will also argue, with far better cultures and kinder human beings more often than not.

CA, an OK place to visit, and a terrible place to live. Built entirely on made up economics around whatever the latest bubble du jour is….be it gold mines, housing, or the latest tech sector craze, CA has been in a constant boom & bust cycle of existence since the beginning, and while the rest of the world has clearly had its ups and downs, CA takes the cake for unsustainable, short sighted fiscal policies and a horrific have vs have nots culture that it has always had and always will. I (we, your friends) hope that someday you will follow your own advice, and go experience the geo arbitrage opportunities that the entire rest of the planet has to offer everyone who currently resides full time in CA.

Thanks to living in San Francisco, I was able to cash out about $5 million by age 31 working at Uber for seven years. I have literally dozens of friends with made millions of dollars at horse so far ahead of people who didn’t come to places like San Francisco for their career.

My other friend worked at Tesla for five years as an engineer and his $250,000 in RSUs turned into $10 million.

The crazy thing is, San Francisco is a much nicer city than pretty much every single city in America as well. Sign me up for getting rich and living in a nice city. The main people who complain about San Francisco for those who cannot afford it. But don’t worry, there are plenty of other cities in America.

To me, San Francisco is one of the cheapest international cities in the world because the income opportunities are so great and ubiquitous.

Great stuff, and congrats! I had another wonderful weekend in San Francisco playing pickleball, swimming, and going on a hike with my family both days.

Being able to make millions in stock options by 31 is also a nice bonus. I’m hoping my Ripple, Figma, and AI investments pan out in the future! So far so good, but you never know.

It’s totally understand to no like a city if it’s unaffordable to a particular person.

This article is making far too many assumptions to even be remotely viewed as legitimate. Many of those expenses aren’t what the average person has and many are way off. $300 car payments don’t exist unless you are buying a 4yr old car. We have gyms in my area that are incredibly nice, with all those things for under $100/mo. The yacht club at then edge of my subdivision is about $350/mo after and offers all of that and much more, granted its $4k to join sonyou need to dividethat in based on however long you plan to be a member. The article also doesn’t take into account when your household income is close to enough to live in Los Angeles but you live in Cleveland. Having the ability to purchase a beautiful 5000sqft home on a 1/2 acre in a nice suburb 500ft from the lake for well under $1m is a giant benefit to living here. To argue more expensive cities are cheaper is absolutely insane. I travel a lot and have friends all over, food at restaurants and groceries, entertainment, a taxi/Uber, utilities, all far more expensive in more “desirable” places. The beauty of a place like Cleveland is there’s surprisingly a lot to do, some of the best food in the country but no one knows it so everyone stays away, keeping it more affordable for those of us that call it home.

Yeah, but you’re stuck in Cleveland, where the weather is horrible during the winter and summers, high-paying jobs are few and far between, and there’s less fun things to do.

There’s a reason why nobody with any means or dreams chooses Cleveland as a vacation destination or retirement destination.

And once you’re in Cleveland, it’s hard to leave Cleveland for better opportunities given almost everywhere is more expensive.

Spoken like somebody who has never lived in Cleveland.

Feel free to share the fun things to do in Cleveland during the winter and other seasons. Is Cleveland your to place to live? How are the job opportunities there? Thanks

I happen to think professional sports is a reflection of where athletes want to live when money isn’t an issue.

If you grew up in rural areas or in suburbia far, far from mega cities like Chicago. A slower pace of life might appeal to you in cities like Cleveland.

But don’t pretend that Cleveland can be cross shopped with Los Angeles.

As I said the success of sports teams are aligned with the local economy.

High priced difference makers seldom choose the mid west or northeast.

Miami doesn’t work because northeasterners bring their sports alliances with them.

Mathew Tuchuk during Florida Panthers run in to the Stanley Cup was asked about the fair weather nature of it’s fan base. He just shrugged his shoulders, not willing to throw Boston Bruins, NY Islanders, etc fans that now call Florida home under the bus.

I will…

While I struggle to live in Los Angeles, I have been to all the lower 48. I can’t imagine living elsewhere.

I rather move to Sao Paulo, Brazil. The new middle class is coming from the global south.

Plenty of opportunities.

You let us know when California stops bleeding in population of citizens, and companies as they flock to our part of the country. This discussion is nothing more than agent(s) provocateur(s) in fantasy land.

Good luck with the illegals and drugs and the Liberal government that has been an abomination to California.

There are some careers where one makes more money away from the high competition of large markets.

You’re right. Working with the cartels and or being a Liberal in California’s State Government.

In my chosen profession, I make more money and have better QoL away from the traffic and competition of large metros. I’m not involved in the cartels. I live in a red state.

Jeremy,

I meant no disrespect to you. California (so much of it) is a dump. It is. There are no perks to living there. I live in a Conservative Province, Ontario. Doug Ford is our Premier, and he’s referred to as The Trump of The North. Like you, I despise what’s become of Canada and The States because of the Liberals. In November Trump must win. In October 2025, Poilievre must win. This is essential for North America. We cannot survive any more of the leftist agenda.

SouthernOntario,

I wasn’t aware Ontario voted for the Conservative Party. However, I am not meaning to get dragged into a political conversation. I merely wanted to put out a counterpoint to the argument that it’s more beneficial financially to live in the larger (and more expensive) cities.

Never been to Hawaii, but I think I would choose to live there over S.F. regardless of how much money I could make in S.F. I think you used to talk about a family property where you grew fruit and would sell it at the local market. That sounds like a great life in such a special place.

You need to update your mortgage rate assumptions my friend. $1.8mm house with $4000 mortgage? $4000 30 yr mortgage at current 6.5% rates is only getting you a $633k loan. A far cry from what’s needed for a $1.8mm house.

The other variables are when the house was purchased and the down payment. When would you like the home to be purchased and how much down would make the figure more appropriate to you? Thanks

Quality of life in California being higher than the SE is only true for top 15% and bottom 15% of both. Having lived in VA, NC, FL, and CA (San Diego) I would rate quality of life lowest in CA. And the weather is so over-rated. Anybody who thinks SF weather is great obviously doesn’t like wearing shorts and a T-shirt.

But have you lived in San Francisco before? Being able to snowboard in 2-feet of powder on a Saturday and then play tennis in 68° and sunny weather on a Sunday in winter as what did it for me.

Do you rate California the lowest quality of life because you are not in the top 15% or bottom 15%?

Where do you live now?

Lived in California from 79 to 88 when Deukmejian was Governor. It truly was the Golden State. The General Assembly was business friendly, taxes were reasonable and there was none of the apocalyptic craziness of Liberal decay in the streets (drug use, homelessness, etc.). Newsom is a wreck. The only thing a person could pray is that his kids, and the Liberals in the Gen Assy’s kids all pass from cancer to end this cycle of decline. They’re mental. Absolutely mental. Being in Tahoe Saturday and in the city on Sunday is as irrelevant as Joe Biden trying to utter a complete sentence with or without a teleprompter. Sorry, bro… You’re in the bottom, you just don’t know it – yet. Good luck, you need it.

No problem. I guess ignorance is bliss then because the powder up in Tahoe last week was epic! But instead of playing tennis when I returned, it was pickleball. The lifestyle is really great, if you can afford it. And many people I know can do to their jobs. Have you seen how AI stocks are doing too? Nuts!

Feel free to share where you live now and why it’s so great. If it’s Southern Ontario, let me know how you deal with the cold weather for so many months a year. Most people I know who are retirement age move to warmer places, not colder.

We lived in SJ for 5 years, SD for 3. If Calif was run now like it was then, would be no issue. Liberals destroy everything they touch. I genuinely wish that every Bolshevik would keel over (fill in the blank for whatever malady) and that be that. The World would be a much better place. The fact the Calif is losing population based on politics is amusing. You will continue to bleed population… well, you’ll gain illegals, but when has that ever bothered traitors, eh? Ontario is world class ❤️❤️ I’ll take cold snowy winters and tornadoes over illegals and quakes anyday. Unfortunately California lost its class when Wilson left the Governor’s mansion. The weather’s fine, bro. As a dual citizen Canadian American, I have the opportunity to vote for Trump in The States, and vote our own traitor named Trudeau out next year. Haha, you do realise Trump will manhandle your state government next year. Newsom, most of your General Assembly… all of them will be whistling a different tune very very soon. So whilst you ignore the problem your lack of vision created – the drug crisis, homelessness, the open border, inflation, the corruption… be ready to face some very somber music next year. It’s coming sooner than you think

And how in God’s name do you re-elect a clown like Jerry Brown?? Once was enough. SMH…

Got it, it’s crazy how expensive San Jose is now right? $100,000+ more in required income to afford a home that San Francisco is nuts!

I’m curious if you spend a lot of time watching TV and politics? It might not be good for your mental health as we age. I would try to not let politics overly affect your life.

And if you are hurting due to the politics, I’m sorry. I’m sure you can find positive people in your area to lift your spirits. Stay warm!

I think you’ll enjoy this post: How Americans can take advantage of Canadians

Right now, with Trudeau, illegals are indeed taking advantage of us. Politics doesn’t bother me one bit. I want to see Trump and Poilievre pull a few pages out of Stalin’s playbook as retribution for what these scumbag Liberals have done to North America.

The weather’s perfect here all year. It’s mid March and 11 degrees, sunny. Flowers popping up. I love our 4 seasons. That’s why Ontario has had explosive population growth, both people and businesses.

Good luck on the population bleed. I don’t believe in DEI. It’s racist. It’s despicable. It’s going away

Oh yeah, forgot about Trudeau. Isn’t he even more left than Gavin Newsom? I’m glad politics doesn’t bother you. With the way you mention politics in every comment, I that that it did.

You may enjoy this post too: The Diversity Hire Dilemma

Ouch! Sorry you had to retire in your golden years to Western Ontario. It is freezing for four months a year and I’m guessing you don’t live in Toronto, otherwise, you would say so.

If you could afford to live in California, we all know you would. But due to life choices or unlucky events, you’re stuck in Canada.

At the end of the day, you have nobody to blame for your poor life choices but you. It causes a generation of suffering as well because if you have children, then will also be set behind because of where you live.

Oh Jules… you soddy little pinscher, how mislead you are lol. We’re quite fine here in Ont. We have a Conservative Premier, Doug Ford, who is business friendly, and regulation free. He’s lowered hydro bills, but Trudeau and this sham carbon tax we have (which Poilievre will ax when elected) has caused great financial pain across Canada. See, Trudeau should have been the brother who drowned in 97. Well, maybe in his reincarnation, eh?

I’m in the GTA, yes. St. Catharines (hence the 905 area code).

Tell us, how are those open drug and homeless encampments across Calif.? Man, stepping in human excitement… Oy vey! Nasty. We’ll stick with walking in the snow. We’re dealing with the Pakis one at a time. You know, the terrorist supporters. Gives us great target practice

You people really don’t know what’s about to become of you next year, eh? Probably better off. You don’t see it coming, better off, I suppose. Again, Bonne chance. Le jeux sont faits.

Perchik, it’s sad that you continue to deflect the problems California suffers at the hand of these little fleebe Bolsheviks that are the cause of every one of the problems you face. Trump and Poilievre will clamp down the border and send in the Military to do this with or without Newsom’s approval. It’d be even funnier to see Trump send in MP’s to arrest Newsom and his little gang of traitors, never to be seen again. I’m sure they’ll be more than comfortable in Siberia.

I’m gay, Jewish, married 20 years. My husband and I are straight by today’s “standards.” DEI is indeed racist, and like the woke folk, it’s ending soon. Whether it be by flight to Siberia, it’ll be nice to get rid of the trash that has destroyed Canada and The States.

I live for politics. You people are the cancer… we are the chemotherapy. Trump and Poilievre will set things right next year. There will be no blocking roads, no chaos. The military will be sent out this time to – take care of those issues. The time is nigh. Your responses are proof of your fear. Your little Marxist agenda fell on its arse

This article is ridiculous. The study is valuable, seeing how unaffordable housing has become in the major metro areas. But the author is tone deaf as to housing unaffordability for the middle and lower economic classes. The average income, for example in LA is not over 250k. It’s not even 100k a year. Thus obviously ” average ” housing is completely unaffordable for the working class. As a working class worker, i will die renting as long as i can work enough hours and dont have any more serious health issues. If that happens I become homeless, with the lack of social safety net here in the U.S. affordable housing policy needs to change here in the U.S., with the federal government and local entities working together to create more affordable housing, denser housing in partnership with developers. This article, by focusing on ” upscale” big city amenities completely misses the point, showing blindness to the overall housing affordability crises that is outlined in the zillow study. Time to get in the real world and stop being obsessed with big city ” amenities” that are increasingly unaffordable as rent takes up an ever larger share of average incomes…

Thanks for the comment. Feel free to contact Zillow to share your feedback why their income requirements and median home price estimates for these cities are wrong.

I’m sure they will appreciate your feedback. If you have any data to include in your feedback, that would probably help too.

Maybe Zillow can focus on cheaper cities or the exact city where you live if you’d like to share.

You might also want to contact the Federal Reserve and ask them to lower interest rates to make housing more affordable. High interest rates are doing a lot to shut out less wealthy home buyers.

How are you able to pay for a 2M life insurance policy for only $150 a month?

If you haven’t shopped around for life insurance in one or two years, check out Policygenius. My wife and I got matching 20-year term policies during the pandemic and it was a huge relief.

Other factors on price include your age, health, and carrier. The best time to get life insurance is around age 30. The premium rate is the lowest because your health is generally great, but life tends to get MUCH more complicated after 30.

Great summary of housing costs the last 4 years across the country. I have a east, west, and central market tale.

I am a widow losing my husband unexpectedly in my early 50’s. I had 2 daughters graduate in 2020 from UT in Austin. Both were fortunate to land jobs in their respective fields.

One moved to Denver and the other was already in DC for a fellowship. Both rented the 1st year to see if it was a fit. In spring of 2021 I helped my daughter, her husband and new grandaughter(!) buy a brand new home in Denver area with a 2.7% rate. In fall 2021 DC was a great buyers market as the pandemic had emptied out the city. My daughter there offered 60K less at 3% rate for a brand new 700 sq ft condo a mile from the White House by her employer and they accepted and again I provided a 25% down payment.

I started planning when they were younger to gift them with housing down payments. It is not just the biggest wealth builder but also your home. Their house payments are about half of what nearby rentals lease for.

They both are very responsible, built credit and worked during college. Denver one will soon have a CS Masters degree and they earn nice salaries having already doubled them since 2020. So you are right about salaries in large cities. The one in DC gets pay adjustments as costs go up in the city. She also has a side hustle that she loves.

I feel fortunate I was able to help but they know now we always lived beneath our means and invested heavily so we could make this happen. We still had a very nice house. It was also an example to them there is more to life then housing. They save and have “fun” money to enjoy their cities offerings.

I am so thankful they bought as they love their cities and their homes and it would be very hard to repeat this good fortune.

As for me I had the luck of the Irish buying my home in central Austin in the last housing market crash with no mortgage. The housing prices for central Austin are so far off it must be a shock when people come here looking for a 550K home. Tear downs built in the 40’s to 60’s on my street go for 1.6M+ and new homes start at 4M for a 2500sq ft house on a small lot. Most homes sell off market and go quickly to developers who have a waiting list. I do not plan to leave anytime soon as I love my hood and the value keeps going up. Like you said fight for your city. With that said my daughters will not live in Texas anytime soon for their own safety.

Why is there such a big jump for everywhere from 2020 to 2024!?

A rise in both home prices and mortgage rates across the nation since 2020.

But some cities have appreciated faster than others. Here in SF, real estate prices are cheaper, yet tech stocks are surging to all-time highs + the growth of private AI companies. So thankfully, affordability is higher.

NorCal (outside of the Bay Area). Placer County….Roseville, Rocklin, Granite Bay, Loomis. More home and land for the money in relation to income potential in comparison to the overcrowded Bay Area. Each time I drive through the Bay, I ask, what here justifies putting up with this traffic and radical left political environment? It’s seems a little easier to justify putting up with traffic and crowds it in SoCal where at least there is superior weather, beaches, etc.

What is it that you do? And is the pay OK?

I drive by there all the time on the way to Tahoe. But I can’t find any consulting jobs I can do from there. I’m probably not looking hard enough.

Do politics really affect your day-to-day life? For some reason, I am not bothered by local politics or national politics. I just tried to adapt accordingly.

No issue with pay. That was my point. I was just responding to the question:

“Which cities do you think strike the best balance between affordability and income potential?”

Using San Francisco as a benchmark since it’s frequently used as a gold standard here to justify high cost of living. I agree, you probably aren’t looking hard enough in Placer County considering all the Bay transplants moving in that are working remotely. Must you do most of your consulting in person?

Yes, local politics can have a direct impact on life as it relates to taxes, homelessness, crime, etc. You are fortunate that you can be oblivious to it.

Per Census data, the best balance between income and housing:

Median household income (in 2022 dollars), 2018-2022

Granite Bay: $177,803

SF: $136,689

Roseville: $112,265

Median value of owner-occupied housing units, 2018-2022

Granite Bay: $1,012,100

SF: $1,348,700

Roseville: $596,700

Got it. If you’re happy with living in your city, that’s all the matters. I just haven’t found the same opportunities.

For example, I’m not sure I’d be able to get a $150,000 part-time consulting job, or have met someone who invited me to invest in a venture capital fund that invested in Figma or Ripple years ago. I just had a fellow dad invite me to invest in Anthropic, the LLM AI company last month, but I didn’t have enough funds to meet the $100K minimumm.

What is it that you do there? What are some of the things, politics wise, that you really enjoy about your city?

And BTW, I totally get it. We are all biased for where we live. We also have a responsibility to defend our cities and think they are the best cities. So which city do you live in? I’ll check it out next time I drive by.

I think you’ll enjoy this post: the unhappiness cities in America determined by a new wealth ratio

I hear you. In your line of work you might be stuck where you are at until you don’t need to hustle anymore. I’m in education. The top-end compensation is the same in either place. 160K-ish for 185 days of work, leaving ample time for private practice/side hustle. In terms of politics, if you are not aware, you are not aware. Like I mentioned, you are better for it in consideration of where you live. We are getting a little off topic though. Getting back to the question, I would argue that the better balance between affordability and income potential is where I mentioned. Check out the following which is on your way to Tahoe if traveling 80. Rutherford Canyon Rd in Loomis.

This take on cost is pretty much hilarious. a middle income family house in Orlando would be at a minimum of 250k these days because you can’t find them, that is in the edge of the city. 180/mo for a gym is ridiculous. I’m not sure what rock you are living under but it must be quite nice living in an alternate dimension than reality of the rest of the world.

Definitely send feedback to Zillow.

I’m not sure whether you’re criticizing my $300,000 budget or not. But $300,000 is more than $250,000.

But sorry if you’re struggling in Orlando with a multiple six-figure income. Life is more expensive nowadays, but I wouldn’t tell anybody in real life about your difficulties on that incomd.

See: why households need to earn $300,000 to live a middle class lifestyle today

Reading is essential, what I’m saying is that a 250k “middle income” house doesn’t exactly exist anymore.

You need at least the ability to pay 400k for the same house. And hope that the house passes inspection. If your roof is more than 5 years old then the bank won’t offer you a mortgage unless it is fixed first, same in case if it happens to have polyurethane pipe. Have you actually owned a home?

Sorry, English is my second language. I’m a homeowner.

To clarify your point, what is the income needed to “pay $400,000 for the same house?” And how did you come up with it?

What’s your background? I’m looking to learn as much as possible for other people who live in different cities for this article. More perspectives the better given how vast and diverse America is.

This is a bot btw. Beware others.

How do you know it’s a bot?

Jason, are you representative of the typical male living in Florida? If so, no wonder why Florida has such a bad reputation for unintelligent people.

You’re like a toddler who closes his eyes and thinks the world can’t see you. Wake up, your perspective is not the only one in the world.

You think you need to earn $250,000 to afford the median price home in Orlando? The median Orlando home price is $375,000. Even if you increase it to $500,000, a $125,000 – $150,000 income is enough after putting 10-20% down.

It’s so easy to get ahead thanks to people like you. So thank you!

Sam,

You said: “I was also able to build connections that granted me private investment opportunities, some of which have turned out well. ”

Overall, would you say that your private investments have done as well as your public ones, or are they about the same?

Sam , where are you finding $2M in umbrella insurance in California for $600/yr?

Check USAA. But my rate is probably outdated as I haven’t checked in years.

I agree with you that geo arbitrage is a much more difficult calculation than it appears on the surface because I’ve been wrestling with this myself. If you’re younger, the best job opportunities are on the coastal cities, in the Bay area specifically, and it’s the reason I’m here. These job opportunities simply do not exist in Cleveland Ohio in the same number. 18 months or so ago my friends in Cleveland Ohio got laid off by the major tech company there, and many still don’t have jobs. I heard some moved to California in order to get jobs and of course they had to downsize dramatically with respect to their housing.

On the other hand, people who no longer need their jobs and move to Cleveland Ohio, are elated at the quality of life they experience.

I recently went back to visit my mom who lives in a town south of Cleveland. The quality of life is outstanding. We went to fancy restaurants which are as good as the ones in California and half the price. She has 37 acres of land and a 5000 square foot house with an outbuilding. To exercise, I can take strolls down our half mile driveway and even do hills and walk all around. I can just walk out my door there’s no need to go to any park or anything I live in a park basically that we own. If the weather is bad, pretty much everyone has a gym in their basement including us. There is was only a dusting of snow for one day out of the 10 when I was there and it didn’t stick. Thank you global warming.

We still don’t lock our doors when we leave the house. There’s no traffic. There’s no waiting in line. The pace of life is relaxingly slow while at the same time, everyone arrives at the restaurant or other venue at exactly the appointed time. There is zero hustle culture and percentage of socializing time versus work time is much much much higher in Ohio.

Even so, when I landed Oakland, I thought how good it was to be back in my second home. However, that feeling dissipated when it took me 15 minutes to try to exit the parking lot because the stupid app wouldn’t work, and while driving up 880 and 80. Really tired of being guinea pigs for all the stupid apps that don’t work.

For all that the Bay area pisses me off, I’m still a bit on the fence about moving back to Ohio! The pace of life might be a bit too slow lol.

I’d be fascinated to hear your feedback if you do move back to Cleveland. Such good value!

One thing in Cleveland’s favor that’s worth mentioning for people who want to move there after they retire is proximity to the Cleveland Clinic. It’s consistently ranked number one in cardiology and is certainly one of the top hospitals overall.

Even if you live in the burbs, Cleveland Clinic basically bought up the surrounding hospitals so it’s easy to go to the main hospital if you need a specialist.

There are a lot of cheap places in the US but good luck if you want or need top health care. I lived in Albany New York for a while, and was appalled at the terrible quality of hospitals because I had been used to the Cleveland Clinic hospital system. I never needed to go to any hospital myself but I assisted friends and relatives and have spent lots of time in various hospitals and can attest to how extremely important a good hospital system and top doctors are when you are really sick. The top hospital system will have standard protocols that everyone will follow to ensure the best outcome possible. The crappy hospitals don’t have these cutting edge and thorough protocols.

If you’re okay with rolling over and dyiing then this factor might not be as important to you.

Couldn’t disagree with you more on this one. The reason I left Ventura California 8 years ago with my 6 kids is the expensive cost of buying a house, and living in general. Although I think all my kids are exceptional, the reality of buying a normal house (eight years ago )would require $700k . That means they would have to have top jobs or married to spouses that could contribute big $$.

No one that is single living in Ventura California who’s job is a baristas, school teacher, policeman, fireman etc…are buying homes in Ventura.

So we decided to move to Knoxville Tennessee where (8 years ago) you could ( and still) purchase a home with a good income…(cost 200-300k)

As for higher income makers, I moved my Internet business from California to Tennessee. Immediately made 70 k raise from no state income tax. In addition having to compete against Amazon, as they offer Free Freight, Shipping from Tennessee saved in additional 50 k in freight being closer to more of my customers.

I will give you one win for living in a big city… airfare is exceptional expensive from here. Flying from Knoxville to Los Angeles typically $600-$800. It is much cheaper to fly from big cities. You win there!

A rational move to leave California if the cost is too much. That is the logical thing to do.

Internet business is mobile and can be done anywhere. I’m talking about more higher-paying job opportunities in more expensive cities.

But if I had an internet business, which I do, I would choose San Francisco or Honolulu. I enjoy the water, food, business buzz, and activities too much.

Btw, I fully expect everybody to be biased for where they live, including myself.

It’s important to enjoy where you live. It’s also important to feel accomplished. I didn’t want to have to buy my kids a home. I’d rather have them earn it for themselves. I didn’t want to take that accomplishment away from them. Aren’t you a bit concerned with your children being able to purchase a home in San Francisco or Hawaii? Are you going to pay for their homes?

Bummer your kids weren’t enjoying where they lived and weren’t feeling accomplished. That’s good you moved for them.

I’m not concerned yet. Maybe it’s because they’re young and happy. I’m also an optimist because if a public school grad like me can own a place in SF/Honolulu I believe they can too.

If life becomes too hard for them, they can always relocate to a lower cost area of the country. That’s one of the beauties of America!

I never said that my” kids weren’t enjoying where they lived and weren’t feeling accomplished”..

Glad to see you still have that West Coast superiority mindset.

As I recall, you grow up very humble house. Not a $3 million house like your kids are currently. They’re gonna have completely different expectations. You’ll see…you’ll get to buy them each a house.

My bad. I assumed that when you said it’s important to enjoy where you live that you moved because you and the kids didn’t enjoy California, besides the cost.

I think your kids will do fine. Unless you are speaking from experience and have one who has graduated college and is finding it difficult to launch?

I am concerned this will happen to my kids as well. But it’s such a long time from now that I’m hopeful there will be solutions beforehand.

If the kids value owning a home, there are plenty of places in America to go to buy one. One of the main points of this post.

You made a logical assumption. JJ seems so defensive about him having to move to Knoxville, TN to better provide for his family. I’ve never heard of a family leaving a nice place just so their kids can grow up in a poorer place so they can feel more “accomplished” to buy their own home.

I think it’s better to challenge our kids and believe in our kids instead of lower the bar so they can feel accomplished.

You can always relocate to TN to save money, but you can’t always relocate to CA.

Difference between growth mindset and fixed mindset.

Tell me more about why you’d have to pay 50% down with no W2 income. This solopreneur is curious.

Sure, with no W2 income, you become dead to banks. You need at least 2 years of freelance or entrepreneur income to qualify for a mortgage. And banks will discount this income as well given it’s deemed more risky.

See: Refinance before quitting your job

TY! I’d heard about the two years but not discounting income. Great. I thought I was doing so well.

I just relocated to Pittsburgh from San Diego. I can’t agree with your argument here. I kept my tech salary and there are tons of opportunities a could grab up at a moments notice. I bought a nice house and my mortgage payment is 1/4 what I would have paid in San Diego. Meanwhile I’m making the same money. Taxes are lower, healthcare is cheaper, & transportation is cheaper.

That’s great you were able to keep your same salary. This is one of the main reasons why I’m investing in real estate in the Sunbelt region and places like Pittsburgh.

Are you happier, the same, or less happy from a lifestyle perspective?

It’s a great place to invest. I’m hearing a lot of people talk about moving here right now due to the ultra low cost of living. We’ve met quite a few people at dog parks that moved here from CA & NY. The positive: Buying a house that costs us less than 10% of our HHI. It’s a big step up from our 600 sq ft apartment. It also has a huge yard for our golden retrievers which was a huge life improvement. We’re a 3 minute walk to a train that goes downtown. We can walk to Trader Joes, Whole foods, a few other health food stores within 10 minutes. Lot’s of great restaurants and bakeries.

The negative: It’s much rainier and the temperatures have been all over the place we’ve had days where it’s 70 and then days where it’s 30.

Overall: We’re slightly happier. We would have preferred to stay in San Diego, but we couldn’t afford much with interest rates being sky high. We were looking at $5-6K payments vs. $1600 a month.

Cool. If you’re net happier, then your move is a win!

I would stay at this boutique hotel called La Valencia in La Jolla whenever I’d go down for a meeting. It was magical to eat an eggs benedict with bacon on the balcony overlooking the water. And then go for a walk on the beach. Loved it!

Thanks Sam! And oh yes, I loved La Jolla. That’s a great hotel and you have an amazing view of children’s pool & (usually) the seals. We took a few weekend trips up your way though SF to Mendocino. Some of the views in NorCal we’re simply incredible.

Thanks, as always, for the quality articles! I’ve for years followed your guides and it’s made a big difference in my life.

When our friends from San Francisco decide to leave their bubble and travel the entire 50 miles to visit us in San José, they comment on how nice and warm the weather is :-)

We plan to geoarbitrage “someday” and we gripe about the taxes here, but moving from California feels like it would involve compromise.

Honolulu here…that $780K median house number is wrong. If you are looking for a median SFH on Oahu, forget what you’d consider “Honolulu” you best come to the table with at least $1.2M, it would be better if you had $1.5M, but $1.2M could get you something decent in like Pearl City. If you are cool with townhouse/condo living I’d say you need closer to $650K+, still a good chunk of change and the HOA fees here are ridiculous. You hit the nail on the head with regards to the professional pay and consulting opportunities.

Yes, I am talking about the median price to single-family home in Honolulu according to Zillow. However, Locations Hawaii has $1.075 million as the median home price in Honolulu, which sounds much more realistic.

But, of course, you’ll probably have to spend much more than that to buy something decent. It’s funny how things work that way.

How much did your home cost, if you bought one?

I live in a condo in Kaneohe. I bought in the 2010s and paid ~$300K. We were thinking of stepping up to a SFH, but with the interest rates going up the last year(ish) and the price on SFH staying the same, the affordability is broken for now. So we will just ride out our very affordable mortgage for now and invest the balance in retirement assets, etc.

Nice! $300,000 is super affordable. If you don’t need more space, then no need.

East coast numbers are completely false, I grew up in NYC. If by NY they are including the Bronx, etc sure, but no one making $200k would live there. For Manahattan, $200k gets you nothing. Anyone on the West Coast seeing the same?

Totally agree, if for NYC they mean NY metro area, there might be areas where $200K allow you to buy a home but the schools are probably not good. I live in Westchester, outside NYC, and property taxes for a not-too-fancy home are $40k. Other towns with similarly good schools have lower taxes but the price per sqft is higher, so there is no escape for the high cost of living. Long Island is the same story and, if you want to live in the City (Manhattan or nice parts of Brooklyn), you need a $1MM or more for a two-bedroom apartment or need to be prepared to pay $5,000 or more in rent per month.

Do you like Westchester? With recents events in the city, deployment of national guard, etc, they are looking at places like Tarrytown, Irvington, etc

100% agree, any city on the coast is $1MM nowadays unless going south, hence Sam’s $300k remarks

The so called river towns (Tarrytown, Irvington, Hastings, etc) are nice and we almost bought there but we were outbid. Every town has its own vibe so you need to find your own tribe. In Scarsdale, where I am, there is nothing less than probably $1.3-1.5MM that’s comfortable enough for a young family unless you want to buy/rent an apartment in the Village which could be an alternative that allows you to benefit from the good school and pay less taxes.