This is a free Financial Samurai newsletter that was published on May 19, 2024. Every week, I come out with a free weekly newsletter to help readers achieve financial freedom sooner rather than later. Join 65,000 other readers and subscribe here. This way, you'll never miss a thing.

Financial Samurai began in July 2009 and is the leading personal finance website today with over 1 million organic pageviews a month. Everything is written based off firsthand experience because money is too important to be left up to pontification.

Sam is the pioneer of the modern-day FIRE movement. He attended The College of William & Mary for undergrad, got his MBA from UC Berkeley, and worked at Goldman Sachs and Credit Suisse for 13 years until he retired in 2012 at age 34. Sam is one of the rare personal finance writers who actually has the background and experience in finance.

You can learn more about Sam Dogen by clicking his About page. You can also visit his Top Financial Products page to help you save, invest, and organize your finances better.

Financial Samurai Newsletter May 19, 2024: Melt-Up Potential

The decision to invest during the stock market pullback in April has proven fruitful, as the markets have rebounded to new all-time highs. April's Consumer Price Index (CPI) came in at 3.4%, slightly below expectations, reigniting Wall Street's enthusiasm for potential Federal Reserve rate cuts.

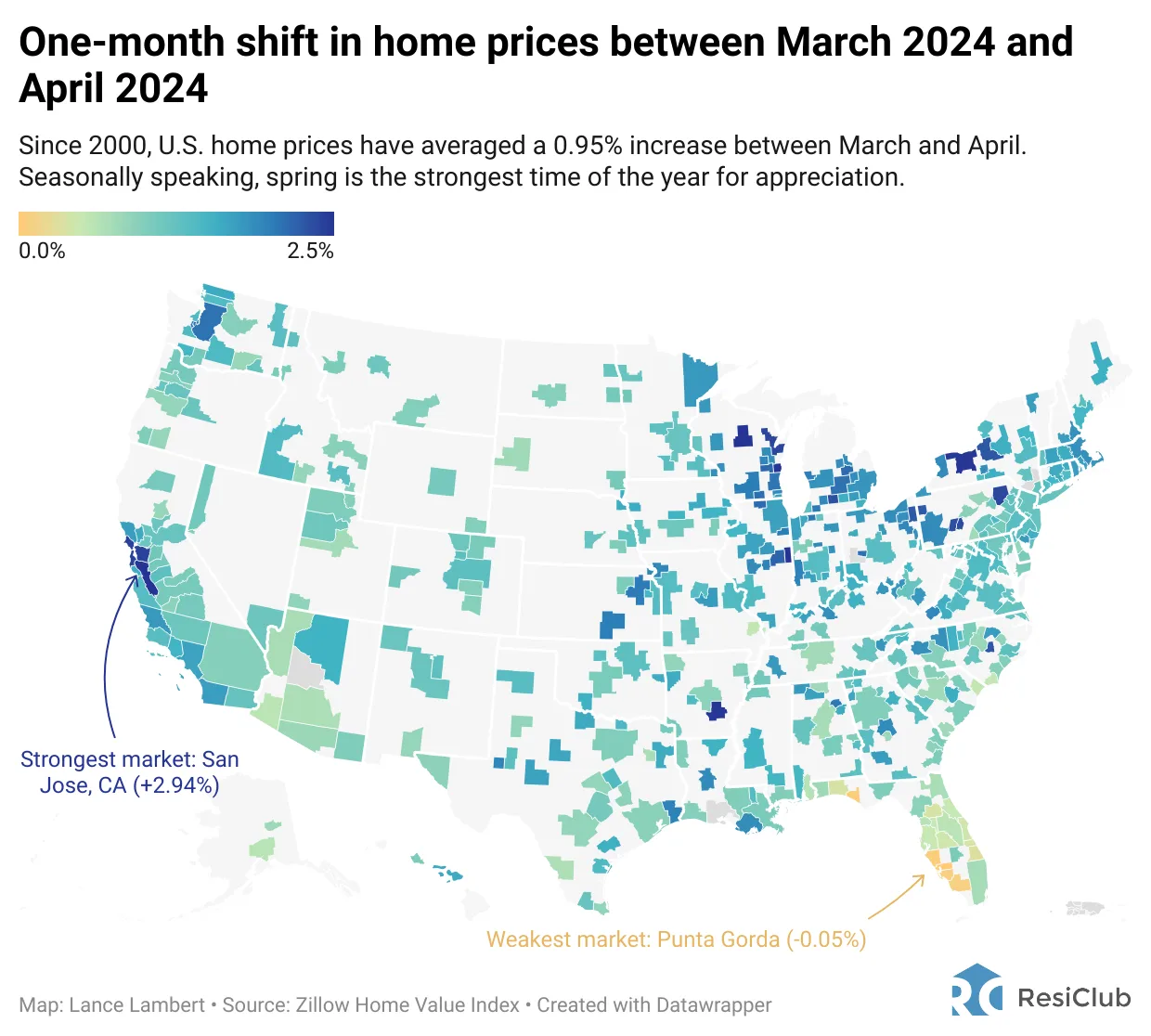

Now, according to the Zillow Home Value Index, U.S. home prices rose by 1.15% between March 2024 and April 2024, outpacing the average 0.95% increase for the same period since 2000.

To provide a more detailed view, it would be helpful if you could share the map illustrating the one-month home price shifts per area across the U.S.

These 10 housing markets saw the strongest month-over-month appreciation:

- San Jose (+2.94%)

- Rochester, NY (+2.48%)

- San Francisco, CA (+2.41%)

- Scranton, PA (+2.37%)

- Green Bay, WI (+2.37%)

- Syracuse, NY (+2.26%)

- Youngstown, OH (+2.24%)

- Champaign, IL (+2.18%)

- Saginaw, MI (+2.14%)

- Rockford, IL (+2.13%)

No wonder there are bidding wars emerging in San Francisco, San Jose, and other leading cities with the highest incomes. Meanwhile, the 10 housing markets that saw the weakest month-over-month appreciation are all in Florida:

- Punta Gorda, FL (-0.05%)

- Panama City, FL (+0.04%)

- North Port, FL (+0.05%)

- Cape Coral, FL (+0.07%)

- Naples, FL (+0.09%)

- Port St. Lucie, FL (+0.31%)

- Crestview, FL (+0.38%)

- Ocala, FL (0.39%)

- Lakeland, FL (+0.44%)

- Deltona, FL (+0.51%)

The robust performance of both the stock market and the real estate sector has fueled an extremely bullish sentiment. A thriving housing market tends to boost consumer sentiment more significantly than a strong stock market, as more Americans own homes, and a greater portion of their net worth is tied to real estate.

See: Real Estate: My Favorite Asset Class To Build Wealth

Melt Up Potential Like 1999?

Despite the ongoing burden of high prices for essentials like food, gas, healthcare, tuition, and insurance, the investment gains thus far have more than compensated for the increased costs.

As a result, I feel as optimistic today as I did in 1999, sitting at my desk on the 49th floor of One New York Plaza. The mood on the trading floor at Goldman Sachs was extremely bullish. We experienced a melt-up until the end of Spring 2000, then everything came crashing down.

If the Federal Reserve indeed starts cutting rates in the second half of the year, which I anticipate, we could witness that magical melt-up once again.

However, it's essential to remember that stocks trade on forward expectations, even more so than real estate. Hence, don't forget to periodically sell some stocks to acquire the goods or services you want or need. Otherwise, there's no tangible utility in investing in stocks.

The Good Times Will Eventually End

Amid the bull market in both stocks and real estate, I've been reflecting more on how fortunate we are. The years 2000 and 2022 were precarious times, but look how far we've come.

Did we build wealth since the pandemic began due to skill or luck? It has to be a combination of both, because 2024 is turning out better than most strategists, economists, and myself had anticipated, once again.

99.99% of the population doesn't read financial newsletters or personal finance websites. As a result, I doubt they are benefiting as much as we are, given that we save and invest a much higher proportion of our earnings than average.

I used to feel guilty if friends, family, or peers missed out while I gained. This guilt fueled me to write as much as possible on Financial Samurai. But after writing online regularly since 2009, I've done what I can to help without any cost. If people want to read and take action, great. If not, there's nothing I can do. As I've gotten to know more people who've become wealthy, partially thanks to luck, my guilt has faded further.

As a result, I penned a new post, Getting Rich By Getting Lucky Actually Feels Better Over Time. Let me know if you agree! I also talk about the bad socioeconomic repercussions of thinking this way.

The Freedom To Move Around The Country To Save

One of my long-term investment theses is investing in heartland/sunbelt real estate due to demographic shifts towards lower-cost areas of the country, facilitated by technology. The pandemic accelerated my investment call made in 2016 by probably 10 years.

Now I realize there could be another catalyst for buying real estate in lower-cost states: taxes. With potential tax increases on the horizon, investing in states with lower tax burdens could become even more attractive.

There are nine states that don't have state income taxes. They are:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

This isn't a new thing. However, if tax rates do eventually go up under our existing or new president, surely, these states should see a greater influx of residents. In turn, more residents should drive up real estate prices further.

We couldn't easily capture such gains before. But now, with private real estate investing, we can. Hence, I'm targeting new private real estate investments in these states. Will this turn out to be a lucky move 10 years from now? Let's hope so!

I do a deep-dive analysis with my new post, The Best No Income Tax States To Work And Live. My logic is sound, as I take into consideration negative factors as well. But of course, if you disagree, feel free to let me know why.

Make Your Kids Lucky Too

Finally, we might as well share our good fortune with our kids by explaining personal finance to them. Make discussions about inflation, margins, returns, asset allocation, debt, interest, passive income, and more, a part of day-to-day conversations.

When I was growing up, I had no idea that only about 35% of Americans went to college. I just expected to go, not thinking I had any other choice.

My thinking is that if we mix in the discussion on the importance of sharing toys with their siblings while practicing delaying gratification, surely, our kids will be better off financially than if we didn't.

If you're interested in talking to your kids about personal finance, check out my wife's post: Raising Money-Smart Kids: A Guide To Teaching Them Personal Finance.

I don't want them still living at home with us at age 35!

Invest Wisely To Grow Your Wealth

The best way to get rich over the long term is to invest in real estate. Real estate is the best asset class to build wealth because it is tangible, generates income, and has steadily outperformed inflation over the past 100 years.

Check out Fundrise, my favorite private real estate platform. Fundrise runs private real estate funds that predominantly invests in the Sunbelt region where valuations are lower and yields are higher. Its focus is on residential and industrial commercial real estate to help investors diversify and earn passive returns.

Fundrise currently manages over $3.5 billion for over 500,000 investors. I've invested $954,000 in private real estate funds since 2016 to diversify my investments and make more money passively. After I had children, I no longer wanted to manage as many rental properties.

Fundrise is a Financial Samurai sponsor and Financial Samurai is a six-figure investor in Fundrise funds.

Invest In AI And Private Growth Companies

Today, one of the things I stress about is whether artificial intelligence will take away my kids' future jobs. The world is already ultra competitive thanks to globalization and technological advancements. Now AI has the potential to wipe away millions of jobs in 20 years.

Because I care for my kids, I've come up with a solution. I am actively investing in private and public AI-related companies as a hedge. If AI does revolutionize the world over the next 20 years, then my AI investments have a high likelihood of making a positive return. If not, then my kids will at least have decent jobs after so many years of education.

I recommend checking out the Innovation Fund, an open-ended venture capital fund that invests in AI companies and only has a $10 minimum. Roughly 90% of the fund has investments or exposure to artificial intelligence. It owns top AI companies such as OpenAI, Anthropic, and Databrick.

Free Retirement Planning Tool

Plan better for retirement by utilizing Empower's free retirement planning tool. It will help you estimate your future retirement needs and retirement cash flow. Your goal is to get your probability of success rate to 99%. The success rate is another great target to incorporate for retirement success.

Subscribe To The Financial Samurai Newsletter

Sign up here for my free newsletter. You can also get my posts in your inbox as soon as they are published by signing up here. My goal is to share pertinent financial news and information to help. you achieve financial freedom sooner.

Listen to the Financial Samurai podcast on Apple or Spotify. Your reviews and shares are appreciated. The May 19, 2024 Financial Samurai newsletter is an original post.