Goldman Sachs is the premier investment bank in the world. With an acceptance rate of roughly 4%, it's harder to get into Goldman than it is to get into Harvard or Yale. Let me share how to get a job at Goldman Sachs from someone who did.

I worked at Goldman Sachs from 1999 to 2001 in the International Equities department at 1 New York Plaza, Manhattan. My specific role was Emerging Markets / Asian Equity Institutional sales, a front-end, revenue generator job that paid well.

1999 may be the toughest time to ever get a job at GS because the company was still private up until the summer of 1999. Further, there wasn't massive competition from big tech companies like Google and Facebook.

How To Get A Job At Goldman Sachs

To be very frank, I think luck plays a huge part in getting a job at Goldman Sachs or any of the other bulge bracket firms. It has to when acceptance rates are in the single digits. In fact, I think luck plays a majority part in any outsized wealth you receive in your life.

Plenty of people are qualified. It’s only the lucky ones who get the offer, which is why you need to do things to stand out, or use your connections. Many of my first year analyst classmates had parents who either worked at Goldman or were actually private clients.

I went to The College of William and Mary, a public school and not a target university but ended up getting a front end job at their world headquarters. How? I sent in a resume at a career fair in Washington DC where Goldman was one of the many banks interviewing candidates. The recruiter chose mine, and I ended up flying to their headquarters for seven rounds and 55 interviews. Clearly, they had some doubts on whether to hire me!

But what I did do right was get on the bus to the career fair at 6 AM. I was the only student on the bus, so after waiting for 30 minutes, the driver drove me to his company headquarters and we switched to a Lincoln Towncar instead. Therefore, I would say half the battle is just showing up.

Whatever job you get, it’s like winning the lottery because many other people want that job as well. It’s what you do after Goldman or after any job you get that counts the most.

I ended up parlaying my job for a pay raise and an Associate title at another bulge bracket in San Francisco at 25 years old. At age 28, I was promoted to VP and then at age 31 I was promoted to Executive Director.

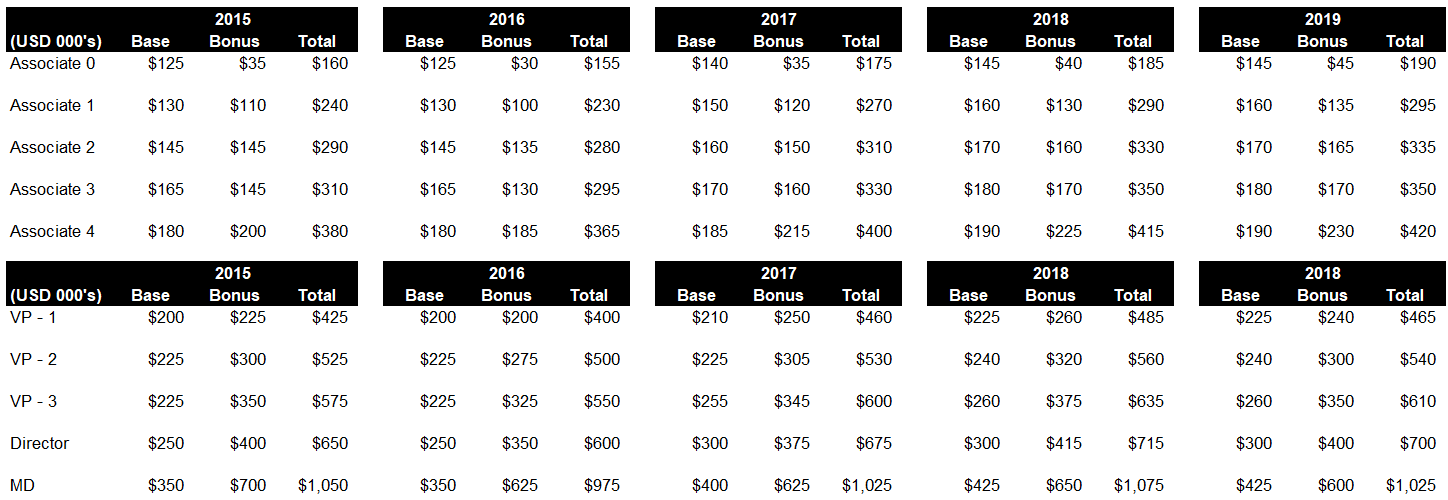

I worked at my new firm for 11 years before negotiating a severance to be free from work for the rest of my life. Below is an idea of how much you can make on Wall Street by level.

As of 2022, first-year analyst base salaries at Goldman Sachs is now $110,000. That is a 30% increase from $85,000 up to 1H2021. Then you get a year-end bonus.

Save and invest aggressively if you work in investment banking. After 10 years, I’m pretty certain you can coast for the rest of your life if you want to.

After leaving Wall Street in 2012, I've worked on building my own online lifestyle business. By 2017, I was making as much as the average Managing Director on Wall Street. The main difference is I spend 20 hours a week doing something I enjoy.

Starting your own online business is the best thing ever!

Other Tips For Getting Into Goldman Sachs

- Make sure you are well-dressed

- Greet with confidence and a smile

- When you don't know the answer, say, “I don't know but I'll get back to you.” Don't bullshit your interview.

- Be humble, but unique.

- Always follow up each interview with a thank you e-mail and a particular point of emphasis from the interview. Hand written cards work well.

- Hint that you have offers from other banks or other firms are interested if they ask

- Leverage the alumni network and existing relationships

- Have a view on the Federal Reserve and whether you think they are right in terms of their interest rate policy and why

- Have a view on the S&P 500 earnings for the year and next year and why

- Know how to lay out a bear case scenario and a bull case scenario

For example, here is my post on How To Predict A Stock Market Bottom Like Nostradamus. I wrote this post on March 18, 2020 when the stock market was tanking. If you can share your investment thought process with the interview in such a way, I think they will be vey impressed. Nobody knows the future. But Goldman Sachs employees will appreciate your thought process.

Here is another post highlight my 2022 stocks and real estate predictions. Study both posts carefully. This is the way you want to write and communicate when laying out your investment thesis.

Take The Job At Goldman Sachs

Although getting a job at Goldman Sachs is hard, because of the strong allure to join tech startups in Silicon Valley, getting a job has gotten a little bit easier nowadays. Many tech companies are allowing workers to permanently work from home, which has bad working in tech even more attractive for some.

The war on talent is real. Take advantage. At the end of the day, people just want to work with people they like. Be likable and know your stuff.

If you are fortunate enough to get a job off at Goldman Sachs, take it! Once you have Goldman Sachs on your resume, you will always be taken seriously wherever your career and financial journey takes you. Just note that your work hours will likely be quite brutal.

Once you get your well-paying finance job, it's important to save and invest diligently and wisely. After 13 years in finance, I was able to retire at age 34 to live the life of freedom. I highly recommend it!

Once you get your well-paying finance job, it's important to save and invest diligently and wisely. After 13 years in finance, I was able to retire at age 34 to live the life of freedom.

With the money I made at Goldman Sachs and Credit Suisse, I reinvested most of it in various investments to generate passive income.

Insights From An Ex-Managing Director At Goldman Sachs

For more on the inside scoop on how to get a job at Goldman Sachs and how much you can make at Goldman Sachs, I interviewed Jamie Fiore Higgins.

Jamie worked at Goldman for 18 years and made Managing Director on the securities lending desk. She then left four years later and wrote a scintillating book entitled, Bully Markets: My Story Of Money And Misogyny At Goldman Sachs. I highly recommend picking it up, especially if you are a woman interested in working on Wall Street.

Listen to the podcast on Apple or Spotify. If you enjoyed the episode, I'd appreciate a review and a share!

Achieve Financial Freedom Through Real Estate

If you end up working at Goldman Sachs or another Wall Street firm, it is vital to save aggressively and invest wisely. It's hard to last for decades in such a cutthroat industry.

My favorite way to reinvest my salary and bonus is in real estate. Because unlike stocks and a career on Wall Street, real estate is less volatile and has staying power. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe thanks to investment banking income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Read The Best Book On Becoming Rich, Happy, And Free

If you want to read the best book on achieving financial freedom sooner, check out Buy This, Not That: How to Spend Your Way To Wealth And Freedom. BTNT is jam-packed with all my insights after spending 30 years working in, studying, and writing about personal finance.

Building wealth is only a part of the equation. Consistently making optimal decisions on some of life's biggest dilemmas is the other. My book helps you minimize regret and live a more purposeful life as you build more passive income.

BTNT will be the best personal finance book you will ever read. You can buy a copy of my Wall Street Journal bestseller on Amazon today. The richest people from Goldman Sachs or wherever are always reading. Learn from those who are already where you want to go.

About the Author

Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at Goldman Sachs and Credit Suisse During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. He also became Series 7 and Series 63 registered.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends time playing tennis, hanging out with family, consulting for leading fintech companies and writing online to help others achieve financial freedom.

FinancialSamurai.com was started in 2009 and is one of the most trusted personal finance sites today with over 1.5 million organic pageviews a month. Financial Samurai has been featured in top publications such as the LA Times, The Chicago Tribune, Bloomberg and The Wall Street Journal.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. I help people get rich and live the lifestyles they want. How To Get A Job At Goldman Sachs is a FS original post.

Related: Should I Work On Wall Street? The Pros And Cons Of Working In Banking